Lorem ipsum dolor sit Lorem ipsum dolor sit amet

Lorem ipsum dolor sit amet

-

| Matthew Piepenburg

Too Late to Buy Gold? Not Even Close…

Many are wondering if it’s too late to buy gold, that gold has peaked, and they have missed their opportunity. We hope the below series of facts, figures and common-sense reality-checks will put such fears squarely to rest, as gold’s role, price direction and days are only just beginning. A Light House in the Fog […]

-

| Matthew Piepenburg

Gold: The Only True Asset in A Broken Global System

Matthew Piepenburg, Partner at VON GREYERZ, joins VRIC Media founder, Jay Martin, in a compelling conversation about the revolutionary shifts happening in the global financial system—the ramifications of which all point toward gold’s increasingly central role as THE strategic reserve asset of the present and future. Piepenburg opens with a simple theme. Namely, the risks […]

-

| Matthew Piepenburg

Revolutionary Change = Revolutionary Mess & Rising Gold

Matthew Piepenburg, partner at VON GREYERZ, joins Thoughtful Money’s Adam Taggart to underscore, in no uncertain terms, that every headline thread—from markets, inflation/deflation and credit risk to social unrest, geopolitical war drums and failed tariff policies-is tied directly to multi-trillion dollar global debt levels. In short, TRILLIONS matter, and both Taggart and Piepenburg try to […]

-

| Matthew Piepenburg

GOLD: The Global Financial System’s Lie Detector?

Is gold calling out a broken global financial system? One Big…Lie? Earlier this year, I was asked to give my most “heretic” opinion about the global financial system. This was an unusual yet bold question, and after a brief pause, I answered that the entire system was…, well: “A lie.” This may seem like a […]

-

| Matthew Piepenburg

Gold Shines as Private Equity Goes Dark

Is private equity (PE) going dark? And what does this have to do with gold? In fact, the answers are becoming harder to ignore. Understanding gold’s rise in the context of macro-economic forces—i.e., historically unprecedented debt levels, oversupplied and under-demanded USTs and the consequent rise in yields/credit costs – helps us place a range of […]

-

| Egon von Greyerz

DIE FÜNF GEBOTE DER ULTIMATIVEN VERMÖGENSSICHERUNG

Physisch vs. Papiergeld. Man kann kaum verstehen, warum es für große Investoren akzeptabel ist, ein Vermögensschutzasset und eine Versicherung gegen ein kaputtes Finanzsystem in Papierform zu halten – wie beispielsweise Anteile an einem Gold-ETF. Im Fall einer Finanzkrise ist es unwahrscheinlich, dass Sie an das physische Gold oder aber den baren Gegenwert des Goldes herankommen werden.

-

| Matthew Piepenburg

Whales AND Minnows Swimming to Gold

Many, from Elliott Wave experts to the dollar-hugging faithful, are asking if we are now reaching a moment of “peak gold”? The evidence, and answer, is: No. Our Currency, Our Problem Gold has made massive price moves in 2025, touching $3500 just days ago and finally making headlines in a politicized world, media and financial […]

-

| Egon von Greyerz

THE BIG SHORT AND THE BIGGER LONG

For at least 35 years, the monetary system has been telling us that the current era is coming to an end. That means a debt collapse, a currency collapse and a collapse of most bubble assets like stocks and property. THUS THE BIG SHORT! As I am writing this on Easter Monday, the Dow is […]

-

| Ronnie Stoeferle

The Rearrangement of the Global Economic Order

It was a tremor that shook the financial markets in the trading days following Liberation Day, when tariffs were imposed on almost every country in the world. One of the big winners was gold. After a brief setback below USD 3,000, the USD 3,200 mark was broken on April 11, the USD 3,300 mark on […]

-

| Matthew Piepenburg

Tariff Needle + Debt Balloon = Era-Ending Liquidity Crisis

Despite the undeniable ripple effects of the recent tariff measures out of DC, the headlines, as usual, are mostly wrong about the causes of the current market volatility and the longer-term ramifications ahead. Navigating such market stress, historical debt realities, the role of gold and the absolutely critical importance – and meaning – of a […]

-

| Matthew Piepenburg

Constitutional Money: Who Killed It, What Follows?

Below, we conduct a necessary autopsy on the death of Constitutional money. The Constitution Matters Most of us, myself included, have a favorite lawyer joke (or two), but law school had its shining moments, including our deep dive into the US Constitution. Written (and signed) by admittedly flawed men, the founding fathers of the United […]

-

| Egon von Greyerz

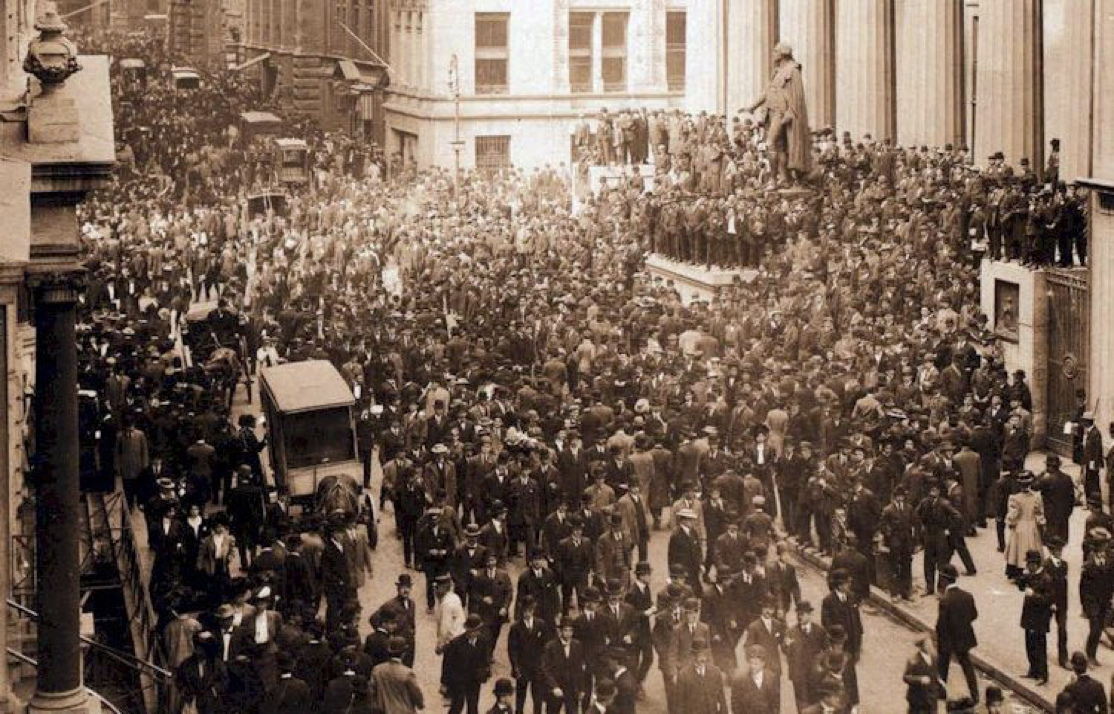

BONFIRE OF THE PAPER ASSET VANITIES & THE REBIRTH OF GOLD

The picture above shows the Bonfire of the Vanities (Falò delle Vanità)in 1497 in Florence. Objects of sin like art, books, cosmetics etc were burnt. Tom Wolfe wrote an excellent book with the same title in 1987. THE WISE, THE UNLUCKY AND THE GREEDY Some time ago, I wrote an article with the title: THE […]

-

| Matthew Piepenburg

Gold vs Toxic Brews of Financial Repression & Capital Controls

As we’ve said and written so many times, and as history confirms century after century, and regime after regime, desperate (i.e., debt-cornered) nations do desperate things. And this, by the way, always results in more centralization from on high and more pain for the man on the street. Every. Time. Theft Aint Funny There’s an […]

-

| Egon von Greyerz

Fort Knox: Ist das Gold wirklich sicher oder verliehen?

Das Interesse an Gold steigt weltweit. In Südkorea werden die Verkäufe der Prägeanstalt ausgesetzt, China ermutigt Versicherungen, einen Teil ihrer Assets in Gold anzulegen. In den USA wird über eine Aufwertung der Goldreserven diskutiert, doch der Effekt wäre vernachlässigbar. Aber ist das Gold überhaupt vorhanden? Eine vollständige Prüfung hat seit Jahrzehnten nicht stattgefunden. Elon Musk […]

-

| Egon von Greyerz

NEXT GOLD MOVE WILL SURPRISE THE WORLD

Trump would not be surprised if there is no gold in Fort Knox. There should be 4,600 tons there, at a value of $430 billion. The U.S. allegedly holds 8,100 tons of gold in Fort Knox, with most remaining reserves stored at the New York Fed. TRUMP: “Elon and I are going to Fort Knox […]

-

| Matthew Piepenburg

Gold Revaluation: Solution or Desperation?

Topics like bond yields, dollar debates, or yield curves can be admittedly, well, boring. And things like politics can be, well… emotional at best or divisive at worst. Shared Concern Among So Much Division? In the current Zeitgeist, it’s hard to get through the fog of market complexity or the self-censorship of political polarization to arrive […]

-

| Matthew Piepenburg

COMEX Flows: Is the Gold Case Almost Too Obvious?

For years, we’ve been warning of gold’s critical role as a buffer against increasingly obvious currency risk, banking risk, geopolitical risk and market risk. And for years, we’ve been warning about the precious metal price fix in the COMEX, the hidden risks of holding physical gold in a commercial bank, and the now irrevocable de-dollarization […]

-

| Egon von Greyerz

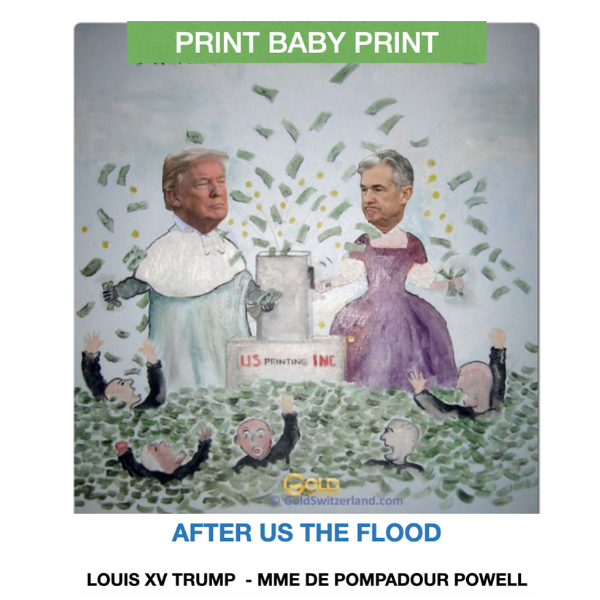

PRINT BABY PRINT (AFTER US THE FLOOD)

When all the euphoria about the election and the Executive Orders is gone, the annoying small problem of the $36 trillion US debt remains – a debt growing exponentially. And also a debt that Trump tactfully avoided to discuss in his election campaign. After us, the flood (après nous le deluge) is what Louis XV’s […]

-

| Matthew Piepenburg

BTC: Desperate Times Require Centralized Measures

Just three years ago, BlackRock’s Larry Fink and the current White House’s Donald Trump openly declared that BTC was a scam. Fast-forward to today, and the Trump administration is promising a BTC “strategic reserve” stockpile while Fink (who has since launched a $50B+ BTC spot ETF) is at Davos front-running a 700,000 price target due […]

-

| Matthew Piepenburg

BTC : Les Temps Désespérés Exigent Des Mesures Centralisées

Il y a trois ans à peine, Larry Fink, de BlackRock, et l’actuel président de la Maison Blanche, Donald Trump, déclaraient ouvertement que le BTC était une escroquerie. Avançons jusqu’à aujourd’hui, l’administration Trump promet un stock de BTC en tant que « réserve stratégique », tandis que M. Fink (qui a depuis lancé un ETF […]

-

| Matthew Piepenburg

BTC: Verzweifelte Zeiten erfordern zentralisierte Maßnahmen

Noch vor drei Jahren erklärten sowohl Larry Fink von BlackRock als auch der damalige US-Präsident Donald Trump offen, dass BTC ein Scam sei. Schnitt zur Gegenwart: Die Trump-Regierung verspricht nun den Aufbau einer „strategischen BTC-Reserve“, während Fink – inzwischen Betreiber eines über 50 Milliarden Dollar schweren BTC-Spot-ETFs – auf dem Weltwirtschaftsforum in Davos eine Kursprognose […]

-

| Ronnie Stoeferle

Gold In 2025: After The Rally Is Before The Rally

2024 was an eventful year in politics. Around half of the world’s population was called to the polls for presidential or parliamentary elections. For the first time in the history of Western democracies, every governing party lost support in the elections. Among all the changes of government, Donald Trump’s return to the White House stands […]

-

| Ronnie Stoeferle

Nach dem Höhenflug ist vor dem Höhenflug

2024 war ein ereignisreiches Jahr. Rund die Hälfte der Weltbevölkerung wurde zu Präsidenten- oder Parlamentswahlen zu den Urnen gerufen. Zum ersten Mal in der Geschichte westlicher Demokratien verlor jede Regierungspartei bei den Wahlen an Zuspruch. Unter all den Regierungswechseln sticht die Rückkehr Donald Trumps ins Weiße Haus heraus, zumal die Republikaner auch im Senat und im Repräsentantenhaus die Mehrheit innehaben. Vor wenigen Wochen zerbrach nach langen Querelen die deutsche Ampelkoalition. Ende Februar wählt etwas verfrüht nun auch Deutschland.

-

| Ronnie Stoeferle

L'Or En 2025 : Après Le Rallye Est Avant Le Rallye

L’année 2024 a été riche en événements politiques. Près de la moitié de la population mondiale a été appelée aux urnes pour des élections présidentielles ou parlementaires. Pour la première fois dans l’histoire des démocraties occidentales, tous les partis au pouvoir ont perdu des soutiens lors des élections. Parmi tous les changements de gouvernement, le […]

-

| Matthew Piepenburg

Gold in 2025? Tragically Predictable

Another year is ending, which means it’s time to look back in order to better look forward. For 2025, I see no other realistic option or scenario ahead other than a weaker dollar and rising gold. This is not “selling my book,” it’s just a common-sense approach to the realities of history, debt markets and […]

-

| Matthew Piepenburg

Facts Matter: How Trump Won the Election

In a pre-election trip to DC and the Big Apple, it was clear to everyone with whom I spoke that, “Trump was never gonna win, period.” A month later, he won. These were pretty clever folks, so why were they wrong? The Current Political Mood: Geniuses vs Fools? As of now, the losing side can’t […]

-

| Matthew Piepenburg

The “Gold vs. BTC” Debate is Pure Fluff

Piepenburg rolls up his sleeves with a blunt assessment of BTC’s so-called “digital gold” slogan, which, based on the very definitional elements of money and the mathematical elements of volatility, clearly makes BTC neither a store of value nor a medium of exchange. Piepenburg makes no direct criticism of BTC as the speculative asset of an era, but the crypto in no real way resembles the characteristics and uses of physical gold nor an anti-fiat money alternative.

-

| Egon von Greyerz

THE EVIL CYCLES OF WAR AND ECONOMIC DESTRUCTION

As we approach what usually should be a blissful holiday period, the treacherous path the world is now on does not bode well for 2025 and beyond.

-

| Matthew Piepenburg

Die 6-Millionen-Dollar-Banane

In New York wird eine Banane für über 6 Millionen Dollar versteigert, der Dow Jones Index läuft auf 45.000 Punkte zu und Bitcoin auf 100.000 Dollar. Sind wir in der Endphase einer nie dagewesenen Spekulationsblase? Dafür spricht einiges, auch die immer stärkere Abkoppelung der Finanzmärkte von der Realität. Der Buffett-Indikator erreicht 200% des BIP, während der Andrang bei "Tafeln" ständig größer wird und immer mehr US-Bürger in teure Kreditkartenverschuldung gezwungen werden. Die Hoffnungen in Trump, die auch BTC und Aktien beflügelten, dürften sich als Luftschlösser erweisen. Gold wird weiterhin von östlichen Zentralbanken gekauft, während im Westen keine Veränderung des Anlegerverhaltens zu sehen ist. Gold ist, trotz nominalen Höchstpreisen, in den Depots weiterhin sehr niedrig gewichtig und bietet große Chancen im unvermeidlichen Finanz-Tsunami.

-

| Egon von Greyerz

GOLD WILL RISE BY MULTIPLES

The combination of Eastern/Southern Central Bank gold buying and all CBS replacing their dollar reserves with gold will lead to unprecedented demand for gold for many years. More gold cannot satisfy this demand since the current gold mine production of around 3,000 tonnes cannot be increased. Thus, the substantial increase in physical gold demand can only be satisfied by much, much higher prices. This is why gold will rise by multiples.

-

| Matthew Piepenburg

Gold In a Trump Era: Rock Still Beats Paper

Needless to say, Donald Trump recently won the US election, and as JFK Jr. said of this “impolitic” figure, a “revolution” is coming. Depending on one’s politics, such a “revolution” is either music to one’s ears or the potential for “fascism American style.” Good grief… Nothing written here or elsewhere will change the polarized opinions of those who have long ago picked their right or left camp (or pejorative), so there will be neither gloating nor hand-wringing here.

-

| Egon von Greyerz

GOLD - BEST ASSET IN 2000s BUT YOU AIN’T SEEN NOTHING YET!

There is a fine line between happiness and misery, as Dickens describes in David Copperfield. Copperfield’s landlord, Mr Micawber, was just on the wrong side of happiness by six pence. In a recent article called THE END OF THE US ECONOMIC AND MILITARY EMPIRE AND THE RISE OF GOLD, I stated: “Unsustainable deficits and galloping […]

-

| Matthew Piepenburg

Who & What Are Killing the USA?

There Are Two Americas… This observation goes beyond the partisan divide of a polarized nation heading toward a polarized election. The deeper, irrevocable rift lies beyond left vs. right. Quite simply, the rising divide of this late-stage empire is marked by haves and have-nots. A clear minority has reaped visible benefits while an ever-expanding majority live paycheck to paycheck amidst job-loss anxiety, record-level credit card/car loan delinquencies and the invisible (grossly misreported) tax of inflation. Oh, and we have over 13M new “asylum seekers” (future bribed voters?) who cost about $68K each to support…

-

| Ronnie Stoeferle

5 Reasons Why The Gold Rally Is Not Over Yet

Has the gold price reached its peak, or is it in a bubble similar to the early 1980s? Is a significant correction on the horizon, or are there strong reasons to believe that gold is not yet extremely overvalued? Find out more.

-

| Egon von Greyerz

THE END OF THE US ECONOMIC & MILITARY EMPIRE + THE RISE OF GOLD

Yet our army is shrinking while the navy is decommissioning warships faster than new ones can be built, our Air Force has stagnated in size, and only a fraction of the force is available for combat on any given day. After decades of neglect, the defence industrial base cannot produce major weapon systems in the numbers we need in a timely way, nor - as we have seen in Ukraine - can it produce the vast quantity of munitions required for a great power conflict. Despite these realities, it is largely business as usual in Washington. Dramatic change is needed to convert rhetoric into ensuring and sustaining long-term "military superiority”.

-

| Matthew Piepenburg

A Global Snapshot: The Stupid, the Broken & the Evil

As a polarized U.S. marches toward a political, financial, and perhaps even military crossroads in the closing months 2024, many feel what George Lukas might otherwise describe as a “disturbance in the force.” From blow-off market tops, empty political platitudes and an openly broken bond market to debased currencies and large swaths of the planet at war or inching toward escalation, it seems we are juggling aspects of the stupid, the broken, the insane and perhaps even…the evil.

-

| Matthew Piepenburg

How to Hedge Anti-Heroes?

Left, right or center, our policy makers - from parliaments and executive branches to central banks and think tanks - have taken the world closer to war, immigration disasters, infrastructure failures, credit traps, wealth inequality, social unrest and currency destruction than any other time in recent memory.

-

| Matthew Piepenburg

Comment Couvrir Les Anti-Héros ?

Comment se prémunir contre des bêtises évidentes ? Qu’ils soient de gauche, de droite ou du centre, nos décideurs politiques – des parlements et des pouvoirs exécutifs aux banques centrales et aux groupes de réflexion – ont rapproché le monde de la guerre, des catastrophes liées à l’immigration, des défaillances des infrastructures, des pièges du […]

-

| Matthew Piepenburg

Wie können wir uns gegen Antihelden absichern?

Wie kann man sich gegen explizite Dummheit absichern? Unsere Entscheidungsträger – ob links, rechts oder Mitte, von den Parlamenten und Exekutiven, von den Zentralbanken zu den Thinktanks – haben die Welt näher an Kriege, Immigrationskatastrophen, Infrastrukturausfälle, Kreditfallen, Vermögensungleichheit, soziale Unruhen und Währungszerstörung gerückt als je zuvor. Viele, auch mich, beschäftigt privat oder öffentlich die folgende […]

-

| Egon von Greyerz

$ 1 MILLION GOLD PRICE & EXCHANGE CONTROLS

It was always inevitable that the GOLD price would reach $ 1 million! So, now we are there. The price for a 400-ounce gold bar has now reached $ 1 million. It reached $ 1 million on August 16, 2024 – 53 years and 1 day after the US (Nixon) permanently said farewell to the […]

-

| Matthew Piepenburg

Golden Question: Is Democracy Dying?

Is democracy dying? Pride Cometh Before the Fall Many years ago, the American political scientist, Francis Fukuyama, prematurely declared the victory both of liberal democracy and free-market capitalism. In a recent article, I argued that Fukuyama was dead wrong. Sadly, I’ve also written that capitalism died long ago, replaced instead by a fact-supported yet disturbing […]

-

| Egon von Greyerz

THIS WILL NOT LAST - DESPERATION

The last few weeks are pointing to clear directional markets in the coming weeks, months and probably years. – Stocks have peaked – Gold and Silver have resumed a secular uptrend. (price targets later in the article) – US 10-year Treasury yields are heading much higher. (even if there is a temporary Fed cut) – […]

-

| Egon von Greyerz

Nowhere to Run - Gold & Family

In this important 20-minute Gold Matters discussion, Matt Piepenburg and Egon von Greyerz cover critical areas which are vital for investors to survive in a tumultuous world. These include: – What triggered the stock market falls this week – Why investors must not buy the dips in stocks – The dangers facing the world due […]

-

| Matthew Piepenburg

From Biden to Bonds: Unmasking a Template of Lies

Political opinions are almost as vast as financial opinions—from bull to bear, or left to right. But there are differences, no? Political opinions, unlike market evaluations, for example, more often lean on emotion, media/partisan influence or even Californian hair styles rather than simple math. But in the spectrum of negative to euphoric market pundits, even […]

-

| Matthew Piepenburg

The New Abnormal: Social Unrest, Market Volatility & Currency Debasement

In his latest conversation with the David Lin, VON GREYERZ partner, Matthew Piepenburg, addresses US political volatility (post-assassination attempt, pre-Biden drop out) and social unrest, with special attention on their near and longer-term implications for US and global markets. Turning to US political headlines, Piepenburg addresses the history of markets under Democratic and Republican administrations […]

-

| Egon von Greyerz

AVOID THE COMING DEBACLE WITH YOUR PERSONAL GOLD BANK

The failure of Western financial structures, including the currency system, is in its final stages. Sadly, no one takes any notice – YET! Global debt has already tripled this century, with the dollar and most currencies having lost 98.5% of their purchasing power since 1971. Experts say the US can never default as they have […]

-

| Matthew Piepenburg

Is the USD Really Too Big to Fail?

Between politics (driven by self rather than public servants), markets (driven by debt rather than profits) and currencies (diluted by over-creation rather than chaperoned by a real asset), it is fair to say we live in not interesting but surreal times. But amidst the surreal, the dollar, as many believe, is our rock, our immortal […]

-

| Ronnie Stoeferle

5 Reasons for a New Gold Playbook

The rise in the gold price this spring 2024 was undoubtedly spectacular. In just a few weeks, the gold price rose by almost 20% in USD terms, with a gain of 21.7% for the first half of the year as a whole. In EUR terms, gold recorded a gain of 16.4% in the first six months of the year.

-

| Egon von Greyerz

AS POLITICAL PARTIES FALL, GOLD AND SILVER WILL RISE

With the collapse of the Western financial and political systems now happening before our eyes, wealth preservation takes on a totally different meaning.

-

| Matthew Piepenburg

Gold vs. “Bad Cocktails” of Staggering Credit, Equity and Currency Risk

In this extensive interview with Adam Taggart of Thoughtful Money, VON GREYERZ partner, Matthew Piepenburg, addresses a wide range of market forces impacting investors in an almost surreal 2024 of rate tensions, credit vulnerabilities, currency (USD) shifts and geopolitical unknowns. The interview includes a “post-script” analysis of Piepenburg’s observations by two independent portfolio managers worthy of careful attention.

-

| Matthew Piepenburg

The Next Generation Deserves an Apology

I spend a lot of time tracking the ripple effects of embarrassing and unsustainable debt levels on our credit markets, rate markets, equity bubbles, inflation metrics and, of course, the daily-debasement of our currency’s inherent purchasing power.

-

| Egon von Greyerz

AS DOMINOES FALL, GOLD WILL STAND STRONGER THAN EVER

At the end of a monetary era a number of dominoes will keep falling, initially gradually and then suddenly as Hemingway explained when asked how you go bankrupt. Some of the important dominoes the world will see falling are: Political, Geopolitical, Currency, Debt and Investment Assets. The consequences will be unthinkable – Social Unrest, War, […]

-

| Matthew Piepenburg

Gold & Oil: Understanding Rather than Fearing Change

There is much legitimate (as well as dramatic) talk about the failing US, its debased currency and its identity-fractured/inflation-taxed middle-class which has been increasingly described more aptly as the working poor. But is America coming to an end? Will the USD lose its world reserve currency status? Will the greenback disappear? Will gold or BTC save us from all that is breaking before our media-clouded eyes and increasingly centralized state?

-

| Egon von Greyerz

Jim Rogers & Egon von Greyerz: Navigating Economic Uncertainty

Financial experts Egon von Greyerz and Jim Rogers explore the complexities of global economics, investment strategies, and the future of currencies.

-

| Matthew Piepenburg

Is America Losing?

Below, we soberly assess the lessons of history and math against the current realities of a debt-defined America to ask and answer a painful yet critical question: Is America losing?

-

| Matthew Piepenburg

Sober Gold vs. The Rate Cut Circus Show

Poor America. Poor Jerome Powell… It is no fun to be openly trapped, and even less fun to be in open decline while meekly declaring all is fine.

-

| Egon von Greyerz

THE REAL MOVE IN GOLD & SILVER IS YET TO START

Since the October 2023 gold low of just over $1,600 gold is up but is anyone buying?

-

| Matthew Piepenburg

The Tragic Ripple Effects of Historically Unsustainable Debt

VON GREYERZ partner, Matthew Piepenburg, joins John Buttler (Southbank Research) and David Lin in a spirited discussion on the omni-present yet undeniably important theme of the USD and its historical implications for rising gold.

-

| Matthew Piepenburg

Why Is Gold Rising Now, Where Is It Headed Tomorrow?

Needless to say, we at VON GREYERZ spend a good deal of time thinking about, well… gold. Year after year, and week after week, there is always a new way to examine gold price moves and decipher the obvious and not-so obvious forces which flow behind, ahead, above and below its monetary and, yes, metallic, move through time. Here I explain why gold is rising now.

-

| Egon von Greyerz

GOLD AND SILVER ENTERING EXPONENTIAL PHASE

The desire of gold is not for gold. It is for the means of freedom and benefit.

-

| Ronnie Stoeferle

The biggest misconception with regard to gold – High stock-to-flow ratio is the most important characteristic of gold

In recent weeks, gold has reached new all-time highs in many currencies, including the US dollar, the euro and the Swiss franc. We want to take the euphoric mood among gold investors as an opportunity to focus on a fundamental topic. From our point of view, the gold sector is riddled with an elementary misunderstanding.

-

| Matthew Piepenburg

Piepenburg: The Soft Landing Farce as Stocks Rip

In this brief, 13-minute compilation of insights from 2023, VON GREYERZ, AG partner, Matthew Piepenburg, reminds us of prior warnings which are truer than ever (and playing out) today as the stock market totally divorces itself from the real (and recessionary) economy.

-

| Jonny Haycock

Smart Gold Ownership: Why Gold ETFs Aren’t the Best Option

The best way to own precious metals is outside of the banking system. Because ETF vehicles used for precious metal ownership are integrally tied to this system, they too are another all-too-common, yet clearly inferior approach, to informed precious metal ownership. For many investors, gold and other metal ETFs are the most convenient instruments for […]

-

| Matthew Piepenburg

The Implications of Fatal Debt? Expect More Lies

If you want to understand the direction of debt, rates, the USD, inflation, risk asset markets, gold and the US endgame, it might be better not to listen to the experts. In fact, Johny Cash is a far better source…

-

| Egon von Greyerz

UNSTOPPABLE DRIVERS WILL REVEAL BEST KEPT INVESTMENT SECRET

The world’s best kept investment secret is GOLD Gold has gone up 7.5X this century Gold Compound annual return since 2000 is 9.2% Dow Jones Compound annual return since 2000 is 7.7% incl. reinvested dividends So why are only 0.6% of global financial assets in gold?

-

| Matthew Piepenburg

The Facts and Math Are Clear: Gold’s Rise is Only Beginning

In this fact-packed, 30-minute conversation, VON GREYERZ partner, Matthew Piepenburg, joins Jesse Day of Commodity Culture to make sense of the growing list of dislocations in debt, currency and financial markets, all of which serve as longer-term tailwinds for gold.

-

| Matthew Piepenburg

Modern “Leadership”: A Perfect Blend of Delusion, Dishonesty & Distraction

As is historically typical of all corrupted and objectively bankrupt nations, the truth is often as hard to find as an honest man in parliament.

-

| Egon von Greyerz

GOLD - WE HAVE LIFTOFF!

All Empires die without fail, so do all Fiat currencies. But Gold has been shining for 5000 years and as I explain in this article, Gold is likely to outshine virtually all assets in the next 5-10 years.

-

| Matthew Piepenburg

What’s Next When Policy Makers Can’t Hide Their Sins?

It’s almost comical to watch policy makers of all stripes and country codes caught in a corner yet pretending we don’t notice. Again: It’s almost comical. But there’s really nothing funny at all about major economies crawling into recession (Germany, Japan, UK, China) or denying recession (USA) while our mental midgets from DC to the EU play with bonds, inflation currency and war like kindergarteners with gas and matches.

-

| Egon von Greyerz

The Worst Time for Yet Another Grotesque Stock Bubble…

In this critically important Gold Matters discussion, VON GREYERZ principals, Egon von Greyerz and Matthew Piepenburg, place the enormous risks of the current U.S. equity bubble within the much-needed context of unprecedented global economic factors.

-

| Egon von Greyerz

WAR + INFLATION = GOLD

All the fundamentals are now in place for the above equation to be true.

-

| Matthew Piepenburg

Gold: How DC Screwed You, and Now Itself

The French poet, Arthur Rimbaud famously wrote that “Nothing is true.” Hmmm. Fairly sensational, no? Deciphering the nuance behind such poetic phrases is almost as difficult as deciphering the meaning behind so many political (and hence central banking) phrases.

-

| Matthew Piepenburg

The US Is Living on Borrowed Time

In late December, I published a final report on the themes of 2023 while looking ahead at their implications for the year to come. I repeated my claim that debt markets and debt levels made the future of Fed policies, currency moves, rate markets and gold’s endgame fairly clear to see. Of course, as facts change, opinions change as well.

-

| Egon von Greyerz

CATCH THE GOLDWAGON OR LOSE YOUR FORTUNE

With the US shooting itself in the foot again, we are now certain that this is the final farewell to the bankrupt dollar based monetary system. More about this follows but in the meantime an extremely important warning:

-

| Ronnie Stoeferle

2024 – A Year in which Social Tensions Will Deepen further: Anecdotal Evidence of Three Worldviews

In Europe, many countries have been seething since 2015, when the first major wave of refugees reached Germany and Austria in particular. In the US, it was the election of Donald Trump as President in November 2016 that brought the deep divide between Republicans and Democrats to everyone's attention. A few months earlier, to the surprise of many, the UK had opted for Brexit, an exit from the EU. Only a few years have passed since then, but the density of crises has increased rather than decreased: Covid-19, the climate crisis, inflation, the war in Ukraine, the energy crisis, and finally Hamas’ terrorist attack on Israel and its response.

-

| Matthew Piepenburg

More Golden (and Black-Gold) Proof: The Dollar is Totally Screwed

Ever since day-one of the predictably disastrous and politically myopic insanity of weaponizing the world reserve currency against a major power like Russia, we warned that the USD had reached an historical turning pointof slow demise and increasing de-dollarization. We also warned that this would be a gradual process rather than over-night headline, much like the slow but steady death of the USD’s purchasing power since Nixon left the gold standard in 1971...

-

| Matthew Piepenburg

2024 Markets: The End of a Crappy Year, The Beginning of a Worse One

As my last report for 2023, I wanted to hit the big issues blunt in the face—from debt and sovereign bond markets to themes on the USD, inflation, risk markets and physical gold. This will not be short, but hopefully simple.

-

| Matthew Piepenburg

Hope Dies, Gold Rises

The primary stages of grief include: Denial, anger, bargaining, depression and finally, acceptance. When it comes to grieving over the slow demise of the American economy, sovereign IOU/USD and the absolute failure of our “re-election-only-focused” policy makers, these stages of grief are easy to see yet easier to ignore.

-

| Egon von Greyerz

THE FINANCIAL SYSTEM HAS REACHED THE END

The world is now witnessing the end of a currency and financial system which the Chinese already forecast in 1971 after Nixon closed the gold window. Again, remember von Mises words: “There is no means of avoiding the final collapse of a boom brought about by credit expansion.”

-

| Matthew Piepenburg

DC Cancelled Common Sense

It doesn’t require decades of financial expertise to balk at the notion of selling retail air conditioning units in Siberia or lemonade stands in the heart of the Arctic. That is, even a high-school freshman would foresee the likely mis-match in supply and demand. After all, unwanted assets, including USTs, can often have more supply than demand. In other words: Common sense matters.

-

| Matthew Piepenburg

It’s Time (and Easy) to be Smarter than Our “Leaders”

Below, we consider just how far America has fallen from its founding vision (and something we can do about it).

-

| Matthew Piepenburg

Debt, Currency Debasement & War—The Timeless Pillars of Failure

Below, we follow the breadcrumbs of simple math and bond market signals toward an oft-repeated pattern of how once-great nations become, well…not so great any more.

-

| Egon von Greyerz

A 1987 CRASH IN STOCKS WITH A GOLDEN DAWN FOR OIL AND GOLD

What a bloody mess! Well, economic collapses and wars always are. But sadly it will become a lot messier! We now have two dangerous wars, maybe we will have a global war. We have a coming collapse of stock markets and debt markets and a banking system which probably will not survive in its present form. But there is always another side of the coin.

-

| Ronnie Stoeferle

5 Signs that Gold Will increasingly Flow to the East

The reshaping of the world economy and the global (political) order is in full swing. It is a long process, the concrete outcome of which is uncertain in advance and associated with numerous imponderables. Nevertheless, there are powerful factors, such as the shift in economic, demographic and military weight, that are driving the readjustment in the (geo)political arena. And this readjustment is also reflected in the change in gold flows. They are increasingly shifting from West to East, since “Gold goes where the money is,” as James Steel pointedly put it.

-

| Matthew Piepenburg

The Economic Future is Sad, Simple & Already Obvious

The foregoing title may seem a bit sensational, no? With all the recent hype about a gold-backed BRICS currency emerging from this summer’s South African meet-and-greet vanishing like oar swirls, one can understand the argument that many gold bugs chase (and create) click-bait like teenage bloggers. And the precious metals space is no stranger to being labeled perma “doom-and-gloomers” to keep the retail trade forever moving. Fine. Understood. Yep. I get it. We are all “just selling our book.”

-

| Egon von Greyerz

A SICK US PATIENT WITH A $100 TRILLION DEBT

The health of the world economy is clearly linked to the health of global leaders. That clearly raises the question if unhealthy leaders create a diseased economy or if an ailing economy creates sick leaders. It doesn’t really matter what came first since the Western world economy is now as close to being terminally ill as it has ever been and its population is continuously getting unhealthier. And weak Western leaders focus on peripheral political issues, whether it is climate, ESG, Covid vaccines, gender and other woke topics.

-

| Matthew Piepenburg

Real BRICS Threat + The Worst Macros I’ve Ever Seen

In many recent articles and interviews, I’ve warned that Powell’s “higher for longer” war against inflation will actually (and ironically) lead to, well… greater inflation. That is, the rising interest expense (nod to Powell) on Uncle Sam’s fatally rising 33T bar tab will inevitably need to be paid with an inflationary mouse-clicker at the Eccles Building. I’ve also consistently maintained that Powell’s war on inflation is mostly just optics, as he secretly seeks inflation to help pay down that bar tab with an increasingly inflated/debased USD. Powell achieves this open lie by publicly declaring a steady decline in inflation by simply misreporting the true CPI number.

-

| Matthew Piepenburg

Rising GDP + Rising Yields = A MAJOR Sign of “Uh-Oh”

Have you heard the good news? The Atlanta Fed GDPNow estimates a 5.9% growth in real GDP for Q3 2023. In nominal terms, we can even boast of an 8.9% surge. What fantastic news! Growth! Productivity! This must mean we can all breath a collective sigh of relief as Powell continues his valiant war against inflation as GDP rises, right?

-

| Matthew Piepenburg

When Baseballs & Guitars Say More Than Pundits

Before I got the invite to a swank prep-school out East, I used to spend my Spring afternoons on a baseball diamond not too far from the home field of Derek Jeter, who was still playing local ball in Kalamazoo while I was harboring high-school fantasies of playing for the Detroit Tigers. Glory Days, Simple Lessons. Those were dreamy days of young fantasy. Alas, the Tigers never called, so I hit the books rather than the minor leagues and never looked back.

-

| Egon von Greyerz

POWELL’S ABRACADABRA INFLATION TARGETING

The Fed has two mandates - Maximum Employment and Price Stability If we look at price stability, the Fed has failed miserably. The Fed employs 3,000 people in Washington DC of which 300 have a Ph.D. degree. Their mission is “to provide our nation with a safer and more flexible and more stable monetary and financial system” with the overall mandate being price stability. In addition to discussing the Fed’s total failure in controlling inflation, in this article I will also stick my neck out in the climate debate before I go on to the likely disastrous effects of debts, deficits and inflation will have on investment markets.

-

| Matthew Piepenburg

Keeping Your Head Amidst Debt-Blind Madness

I recently blew the dust off an old Rudyard Kipling poem, “If,” which many have castigated as a bit overly romantic, despite its high praise from Mark Twain and T.S. Eliot to India’s Khushwant Singh. The fact, moreover, that “If” was written by a Victorian era colonial in 1895 as a father’s advice to a son, could easily put its otherwise timeless insights at risk of being cancelled by the woke elite as potentially misogynistic or regionally insensitive… Notwithstanding such critiques, financial readers might equally be asking what Kipling has to do with global markets, the currency wars, inflation/deflation tensions or the US bond market? Given the fact that each of these financial topics, when examined closely or even broadly, are now signs of open madness, yet still consistently ignored or down-played by our leaders and media midgets, I could not help but consider the following line of advice...

-

| Matthew Piepenburg

The BRICS Won’t Kill the Dollar, US Policy Will

Below we separate the hype from the sad reality of the USD in the face of a new “BRICS currency.” Net conclusion: The real death of the USD will be domestic not foreign.

-

| Egon von Greyerz

A CATASTROPHIC DEBT IMPLOSION CAN BE INCREDIBLY QUICK

Will the world experience a catastrophic debt implosion? Just like the Titanic Submersible that recently imploded, the global debt bubble can implode “within just a fraction of a millisecond”. More later in the article. Are we now in the third circle in Dante’s Inferno?

-

| Matthew Piepenburg

Jerome Powell: Misunderstood Angel or Open Devil?

Becoming Powell’s (and the Devil’s) Advocate? I’ve been thinking, and re-thinking, Powell. It’s no secret that in numerous interviews and articles, Jerome Powell has been on my critical mind. I called him a breathing weapon of mass destruction, and have openly mocked his attempt to be Volcker 2.0 in a USA facing $32T in public debt and climbing. So, what gives? Why and what am I re-thinking?

-

| Ronnie Stoeferle

Recession ante Portas: Which Assets Perform Well in Recessions?

It is considered the most anticipated recession of all time – the one looming in the US. And although countless indicators ranging from the yield curve, the Leading Economic Index (LEI) and PMIs to producer prices and international trade volumes have been pointing to a recession for months, it has not yet materialized in the USA. However, the labor market, which has been more than robust up to now, is now showing the first signs of a slowdown. A labor market which, due to demographic change, is structured completely differently than it was in the 1970s. Initial jobless claims have been on an upward trend since last fall.

-

| Egon von Greyerz

MAJOR REVALUATION OF GOLD & PRECIOUS METALS IS IMMINENT

The time has now come for the 99.5% of financial assets which are not invested in gold silver or precious metals mining stocks to grab both the investment and wealth preservation opportunity of a life time. Making that decision before it is too late is likely to determine your financial and also general wellbeing for the rest of your life!

-

| Matthew Piepenburg

Modern Currency Policy: Nations Compete, Citizens Suffer

Below we consider how modern currency policy may not be so good for, well, the people... This is why gold inevitably enters the conversation, for unlike policy makers, this old pet rock garners more trust.

-

| Matthew Piepenburg

Solid Gold In a Broken World

Below, we look at gold in a broke(n) world of hubris, debt, Realpolitik and a rising east. For well over a year, we’ve openly declared that the Fed is cornered. That is, Powell knows he needs higher rates to allegedly “fight” inflation but also knows that raising rates into an historical debt bubble means one “credit event” (or “crunch”) after the next, from tanking USTs in 2020 to tanking banks in 2023. It seems only now that the WSJ (Mr. Timiraos), along with a former Indian central banker (Mr. Rajan) is confessing the same.

-

| Matthew Piepenburg

Stories for Children: The US Economic Fairytale

When Humpty Dumpty fell off the wall and took a big fall, “all the king’s horses and all the king’s men could not put Humpty-Dumpty together again.” I see a similar fate for the US debt egg, whose cracks are just about, well… everywhere. The first obvious (but media ignored) signs of this breaking egg emerged in September of 2019, when the TBTF banks no longer trusted each other’s collateral and the repo markets spiked overnight, prompting Uncle Fed to be the lender of last resort to its spoiled little banking nephews. This required hundreds and hundreds of billions in mouse-clicked liquidity. But then again, what does a billion or trillion even mean anymore to a mouse-clicker and $31+T (and growing) Public debt?

-

| Matthew Piepenburg

Front-Running the Fed: How Gold & Chess-Players Beat a Rigged Market

We have hardly been the first nor the last to realize that rising rates “break things.” We’ve all seen the disastrous credit events in the repo crisis of late 2019, the UST debacle in March of 2020, the gilt implosion of October 2022 and, of course, the banking crisis of March, 2023. And behind, beneath, above and below each of these debacles lies a bemused central banker.

-

| Matthew Piepenburg

Facts vs. Fed-Speak: A Comical History with Tragic Consequences

Below, we look at simple facts in the context of complex markets to underscore the dangerous direction of Fed-Speak and Fed policy. Keep It Simple, Stupid. The simple facts are clear to almost anyone who wishes to see them.

-

| Matthew Piepenburg

Dollar Woes to Debt Denial: The USA Is Screwed

Below, we see why the USA is screwed. De-Dollarization: Downplaying the Obvious De-Dollarization is a real, all too real trend, though it is both fascinating and disturbing to see what is otherwise so obvious being deliberately down-played, excused or ignored from the top down. But then again, the laundry list of ignored facts and open lies from the top down to hide hard truths in everything from inflation data to recessionary debt traps is nothing new. Instead, such propaganda replacing blunt transparency is the new normal (and classic trick) for all historical endings to debt-soaked (and failing) nations/systems and their fork-tongued (i.e., guilty) policy makers.

-

| Egon von Greyerz

A DISORDERLY RESET WITH GOLD REVALUED BY MULTIPLES

Tectonic shifts lie ahead. These will involve a US and European debt crisis ending in a debt collapse, a precipitous fall of the dollar and the Euro with Gold emerging as a reserve asset but at multiples of the current price. The next phase of the fall of the West is here and will soon accelerate. It has been both precipitated and aggravated by the absurd sanctions of Russia. These sanctions are hurting Europe badly and affecting the US in a way that they didn’t expect but was obvious to some of us. The Romans understood that free trade was essential between all the countries that they conquered. But the US administration blocks both the money and the ability to trade of the countries they don’t like.

-

| Matthew Piepenburg

Gold, Oil & Global Currencies Entering a Watershed Moment

Below we look at the math, history and current oil environment in the backdrop of a global debt crisis to better predict currency and gold market direction without the need of tarot cards.

-

| Egon von Greyerz

FORECASTING THE GOLD PRICE IS A MUG’S GAME

Most investors are totally ignorant of the purpose of gold or its historical significance. After all, Gold is the only money that has survived in history but virtually nobody is aware of this vital information. That’s why only 0.5% of global financial assets are invested in gold. Still most people put their trust in paper money. In spite of the title, in this article I will be a Mug for a day and make some gold and silver projections.

-

| Matthew Piepenburg

So Many Open Signs of Financial Disaster Ahead and Gold Working

From oil markets to treasury stacking, backdoor QE, investor fantasy and hedge fund prepping, it’s becoming more and more clear that the big boys are bracing for disaster as gold stretches its legs for a rapid run north. Recently, I dove into the cracks in the petrodollar as yet another symptom of a world turning its back on USTs and USDs. Gold, of course, has a role in these headlines if one looks deep enough. So, let’s look deeper. Diving Deeper into the Oil Story The headlines of late, for example, are all about “surprise” OPEC production cuts. Why is this happening and what does it say about gold down the road? First, let’s face the politics. As noted many times, it seems US policy, on everything from short-sighted (suicidal?) sanctions to the “green initiative” makes just about zero sense in the real world, which is miles apart from the “keep-me-elected” fantasy-world of DC. After all, energy, matters, which means oil matters. But the current regime in DC has been losing friends in Saudi Arabia and cutting its prior and once admirable shale production outputs (think 2016-2020) in the US despite a world that still runs on black gold fighting against green politics. The DC attack on shale may make the Greta Thunbergs happy, but let’s be blunt: It defies economic common sense. Saudi, by cutting production, is now showing a still very much oil-dependent world it is not afraid of losing market share to the USA in the face of rising oil for the simple reason that the USA just aint got enough oil to fill the gap or flex its energy muscles. In the meantime, Chinese demand for crude is peaking while Russian oil flows to the east (including to Japan) are hitting new highs at prices above the US-led price cap of $60/barrel. If DC has any blunt realists (wrongly castigated as tree-killers) left, it will have to re-think its anti-oil policies and get back toward that recent era when US shale was responsible for 90% of total global oil supply growth. If not, oil prices can and will spike, making Powell’s war on inflation even more of an open charade. Speaking of inflation…

-

| Egon von Greyerz

FIRST GRADUALLY THEN SUDDENLY - THE EVERYTHING COLLAPSE

The inevitable consequence of the current Global Debt Bubble will be the Bankruptcy of the financial system and many of its participants. The one Swiss and three US banks that just went under is just a foretaste of what is to come. As the US and European banking systems come under pressure, The Everything Collapse […]

-

| Ronnie Stoeferle

Showdown on the Markets – in 5 Charts

There is a good reason why the Chinese understand the saying “May you live in exciting times!” as a curse. Economic and (geo)political developments in recent weeks and months have indeed been exciting. In many areas, it looks as if we are heading for a showdown, for a lasting, formative change. The following five charts present the multi-faceted showdowns that are happening right now before our eyes. We cannot choose that the times are currently so exciting. However, we can choose how to deal with these exciting times so that they do not become a curse for us, but rather an advantage for us and as many people as possible.

-

| Matthew Piepenburg

“Lions Led by Donkeys:” The Irrevocable Decline in US Hegemony

In his latest conversation with WTFinance’s Anthony Fatseas, Matterhorn Asset Management principal Matthew Piepenburg answers the question: Is the worst behind us? The short answer is: No. The reasons, and signals, however, are many, which Piepenburg addresses from both a broad and market-specific perspective. Piepenburg’s analysis begins and ends with a string cite of bond-market-driven signals and crises—from the repo disaster of 2019 to the latest US bank failures of 2023. Piepenburg distinguishes the bank failures of 2008 and 2023, but reminds that the Fed has its fingerprints on every crisis and every artificial “recovery.” The simple math of debt, inflation and monetary policy failures (akin to “credit cards and whiskey”) confirm that cornered central banks have no good options or scenarios left. It’s either tighten into economic depression (hangover) or loosen policy into a hyper-inflationary pain (hangover). The latter is most likely.

-

| Matthew Piepenburg

“No Way Out” for Global Markets Trapped in a Doom Loop of Debt

In this compelling conversation with Wealthion founder, Adam Taggart, Matterhorn Asset Management principal, Matthew Piepenburg, addresses the current and vast range of headline market topics, signals and risks. Inflation, deflation, risk assets, bond stress, cryptos, war, bank failures, CBDC’s rise, trapped policy makers and, of course, the topic of precious metals are all carefully and plainly discussed. Piepenburg’s broader views on current and future financial conditions are bluntly yet realistically presented as a “no way out” scenario for global economies distorted by cornered central bankers. The bottom line is as simple as it is incontrovertible: The global economy is stuck in a doom loop of debt.

-

| Matthew Piepenburg

Golden Question? Is the Petrodollar the Next Thing to Break?

As we warned throughout 2022, the Fed’s overly rapid and overly steep rate hikes would only “work” until things began breaking, and, well…things have clearly begun to break, including the petrodollar. Even prior to the recent headlines regarding US regional banks, “credit event” stressors were already tipping like dominoes around the world, from the 2019 repo crisis and the 2020 bond spiral to the 2022 gilt implosion. Then came SVB et al in 2023, and, of course, the forewarned disaster at Credit Suisse… But as we also warned literally from day 1 of the sanctions against Putin, the oh-so-critical petrodollar would be among the next dominoes to tip, and tipping is precisely what we see. As argued below, petrodollar shifts are yet another headwind for USTs and USDs, but an obvious tailwind for gold. But before we dig into this historical tipping point, it’s important to see the forensic cause of all that is breaking…

-

| Matthew Piepenburg

Today & Tomorrow: Volatility Worse Than 1987, September 11th and the 2008 Crisis

In this 30-minute conversation with Elijah Johnson of Liberty Finance, Matthew Piepenburg addresses the escalating ripple effects of the U.S. banking crisis and the growing distrust of gasping bond markets, cornered policy makers and now inevitable as well as potentially unprecedented market instability. Already, Treasury markets and contract prices in the futures market are sending price and volatility signals which surpass the stressors of 1987, 9-11 and the GFC of 2008.

-

| Egon von Greyerz

THE EVERYTHING COLLAPSE

“Don’t wish for gold to go up substantially for when it does, your quality of life will deteriorate remarkably.” Let me be clear, now is the time to protect whatever assets you have in order to avoid the total asset destruction that is coming next. THE FINANCIAL SYSTEM WILL NOT SURVIVE.

-

| Matthew Piepenburg

Bond Destruction, Banking Waste and the Tilt Toward CBDC

In this extensive and now English-translated, interview with Jan Kneist of Investor Talk, Matterhorn Asset Management principal, Matthew Piepenburg, addresses the critical themes of the ongoing banking crisis. In this substantive, 21-minute conversation, Piepenburg squarely addresses the ripple effects and larger implications of the current banking crisis, namely: 1) its bond crisis origins; 2) the ultimate pretext for (and direction toward) political and financial centralization culminating in CBDC; 3) increasing consolidation away from the smaller banks toward larger banks; 4) the nearly inconceivable waste behind the Credit Suisse bailout; 5) the percolating and equally inconceivable dangers within the derivative markets; 6) the collapse of trust in the USD as evidenced by the rise of the BRICS; and, of course, 7) the growing importance and role of gold in a world heading inevitably toward more centralized controls and currencies. As Piepenburg has warned and repeated throughout 2022 and 2023, all debt-soaked systems inevitably resort to desperate measures and greater controls, of which currency debasement and increased centralization, symbolized by the drift toward CBDC, is no surprise or exaggeration.

-

| Matthew Piepenburg

Je T’Accuse: To Bond Killers & Other Villains Destroying Our World

From bond markets to border wars, the world is openly and objectively tilting toward disaster. Many of us already know this, but what can be done? As I look back on just the latest and entirely predictable hours, days and weeks of waste occurring in the global debt markets in general, and the U.S. Treasury markets and banking systems in particular, the billions and trillions sloshing and churning through emergency swap lines, discount windows and broken financial systems almost defies belief.

-

| Egon von Greyerz

THIS IS IT! - THE FINANCIAL SYSTEM IS TERMINALLY BROKEN

Anyone who doesn’t see what it happening will soon lose a major part of their assets either through bank failure, currency debasement or the collapse of all bubble assets like stocks, property and bonds by 75-100%. Many bonds will become worthless. Wealth preservation in physical gold is now absolutely critical. Obviously it must be stored outside a broken financial system. More later in this article.

-

| Matthew Piepenburg

Silicon Valley Bank Collapse: Just how safe is the banking system? Matthew Piepenburg shares his views.

On Wednesday 8th March 2023, Silicon Valley Bank (SVB) announced a loss $1.8B from sale of investment securities. Investors and Depositors got spooked, withdrawing estimated $42B+ in cash within a few hours; approx 25% of total SVB deposits, leaving a negative cash balance of $1B. Matthew Piepenburg, joins Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News, to discuss the collapse of Silicon Valley Bank (SVB) and Signature Bank.

-

| Matthew Piepenburg

Making Common, Golden Sense of the Next Senseless Bank Crisis

Two Failed Banks. The tech-friendly SVB story (i.e. FDIC shutdown) is actually preceded by another failed bank, namely the crypto-friendly Silvergate Capital. Corp, now heading into voluntary liquidation. It boils down to crypto fears, tech stress and bad banking practices.

-

| Matthew Piepenburg

California Dreaming – Staatsmetapher für eine Scheiternde Nation

Im Folgenden betrachten wir den US-Bundesstaat Kalifornien als Metapher für einen gescheiterten Staat aber auch als Metapher für das Scheitern des amerikanischen Staatenverbunds.

-

| Matthew Piepenburg

California Dreaming—State Metaphor for a Failing Nation

We consider the State of California as the metaphor of a failed state as well as the failing state of the American Union, which is anything but a dream.