Whales AND Minnows Swimming to Gold

Many, from Elliott Wave experts to the dollar-hugging faithful, are asking if we are now reaching a moment of “peak gold”?

The evidence, and answer, is: No.

Our Currency, Our Problem

Gold has made massive price moves in 2025, touching $3500 just days ago and finally making headlines in a politicized world, media and financial system that has otherwise deliberately attempted to ignore and downplay gold for decades.

But can we really blame those silly little “experts” with political incapacities for honesty?

After all, rising gold is proof positive that a debt-soaked nation is in deep trouble, as its currency is no longer trusted, loved, used or wanted.

When the USA abandoned its golden chaperone in 1971 and began spending like a drunken sailor, its Treasury Secretary, John Connally, didn’t seem to care at all that the US had just welched on the rest of the world—a world which once trusted the gold-backed dollar promised to them in the Bretton Woods moment of 1944.

For Connally (as well as Nixon, Kissinger and countless other DC forked-tongues), the new mantra was “our currency your problem” as Uncle Sam enjoyed the “exorbitant privilege” of spending beyond its means, inflating its dollar and then exporting that inflation to the rest of the world via its world reserve currency powers.

But powers can weaken…

Too Broke to Bully

As Uncle Sam now reaches $37T in public debt, the rest of the world, having seen that same bully of a fiat dollar weaponized and indebted beyond rational levels, is no longer as interested as it once was.

In short, for America, it’s now “our dollar, our problem” as the world slowly turns its back on the once hegemonic USA, UST and USD– the distrust and evidence of which is literally everywhere.

Equally evident are the desperate policy reactions from DC to make the dollar hegemonic again—from DOGE headlines and tariff distructions to even the tragic irony of a so-called BTC Strategic Reserve Fund…

In this era of a less trusted and demanded dollar and UST, the backdrop for gold couldn’t be stronger, and the argument for “peak gold” couldn’t be weaker.

Show & Tell

But rather than just tell you this, let us show you this.

Just over a year ago, in March of 2024, gold broke the 13-year baseline of a deep cup and handle formation and then promptly met (and surpassed) its first $3000 statistical target price.

Over the next 6-12 months, the technicals suggest gold hitting its next percentage target of $4000.

Naturally, this does not mean gold only goes in one permanent direction (technically, for example, it could pull-back to a 200-day moving average), but its secular direction North is now obvious at both technical and fundamental levels.

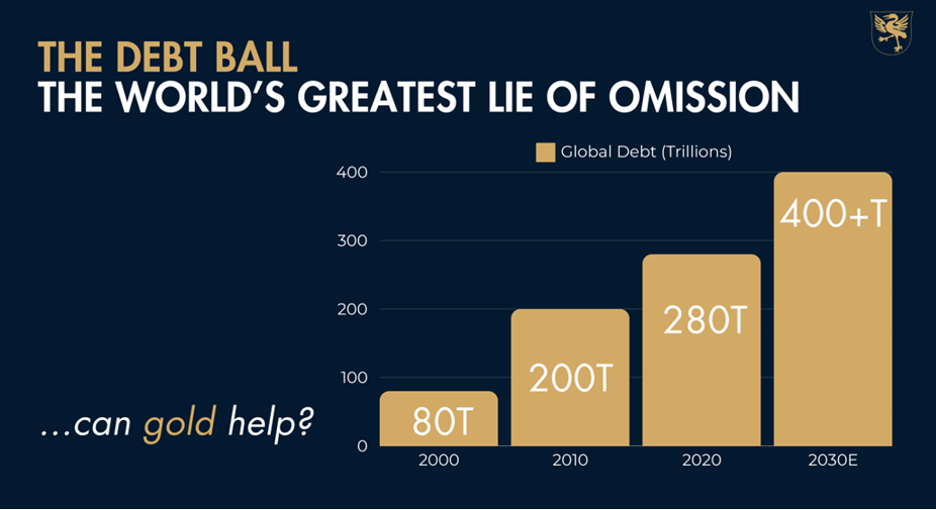

As to those pesky (and far more telling) fundementals, gold will rise for the singular reason that fiat money will continue to fall in the backdrop of the greatest global debt backdrop in the history of capital markets.

When one just looks at gold’s rising direction…

…it is literally nothing more than an inverse image of the fiat dollar’s falling direction:

But to any who understand a bit of history and math, this is no surprise.

After all, when a nation gets too in debt, the only real tool left is to inflate that debt away via deliberate currency debasement. Hence the chart above.

And as to this debt reality…

…it is THE key driver of every discussion in play today—from inflation/deflation debates, DXY direction, recession denial and stock market risk to precious metal price direction.

The Whales Are Stacking

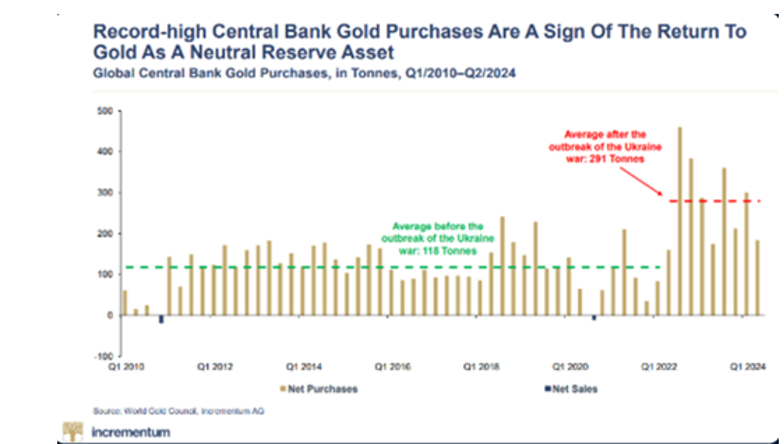

Such debt and currency dynamics are now fully understood by the global financial whales, which is why central banks have been net stacking gold over USTs since 2014 and nearly tripling their physical gold purchasing since the weaponization of the USD in 2022:

This is also why whales like the BIS declared gold a Tier-1 strategic reserve asset in 2023 and it further explains why the whales have been taking physical delivery of gold OFF the COMEX at record levels since November of 2024.

And when it comes to the BRICS turning their backs on the USD while net-settling trades in gold at the same historical moment that the oil trade is slowly moving away from the petrodollar, the golden writing on the wall could not be clearer.

In short: The whales know that gold is far superior to a bankrupt Uncle Sam’s UST/USD as a future reserve asset.

Such whale purchasing of gold explains gold’s historic price moves of late and further explains why we are years (and thousands of dollars) away from anything at all resembling “peak gold.”

And Now the Minnows Are Catching On

Another key, yet largely ignored factor in confirming the longer-term direction (rather than current “peak”) of gold is that the minnows (i.e. retail markets) have only just begun to see the same writing on the wall of gold’s real use and future price direction.

That is, just as gold made a major technical breakout in March of last year, in March of THIS year, we saw another major breakout which, of course, the media is not covering at all…

Specifically, we just saw gold breaking away from a 10-year base in the classic/traditional 60/40 stock bond portfolio, which is the very bread & butter of consensus-think retail investment (mal) advisory narratives.

Stated otherwise, retail investors are catching on that inflated stocks and bonds aren’t what they used to be and that gold is more than just a pet rock.

The New Safe Haven

This rising retail understanding/move, coupled with the aforementioned “whale” moves in gold, bodes very well for its longer-term price and direction.

Much of this evolving awareness among retail investors hinges upon the devolving role of bonds as a once-sacred “safe haven” from stock market risk.

Even Bloomberg’s experts see the S&P’s fair valuation at below 4000.

In other words, stocks are in a massive bubble.

Buffett knows it. He’s hundreds of billions in cash and the last time we saw a stock market cap to GDP ratio (>200%) this high was in the US of 1929 or the Nikkei of 89.

And we all know how that played out…

But where to hide?

As we saw in 2020, and then again just weeks ago when the VIX surpassed 60 and stocks were falling, bonds were falling as well—which is a major warning of uh-oh.

In fact, we are now in a secular bear market for bonds, something not seen since the mid-1960’s to 1980, which means investors—both minnows and whales—need a better store of value than paper promises from broke(n) sovereigns.

In short, and to repeat: Gold is that new asset and that new direction, and is not even close to peaking.

Instead, gold’s climb is just beginning.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD