Gold & Oil: Understanding Rather than Fearing Change

There is much legitimate (as well as dramatic) talk about the failing US, its debased currency and its identity-fractured, inflation-taxed middle class, which has been increasingly described more aptly as the working poor.

The End, or Just Change?

But is America coming to an end? Will the USD lose its world reserve currency status? Will the greenback disappear? Will gold or BTC save us from all that is breaking before our media-clouded eyes and increasingly centralized state?

Nope.

America is slipping, but not ending.

The USD is being repriced not replaced.

The greenback is still a key spending, liquidity and FX currency. But it’s no longer the premier savings asset or store of value.

Gold (now a Tier-1 asset btw…) will continue to store value (i.e., preserve wealth) better than any fiat money; and BTC will certainly make convexity headlines in the future.

And yes, we all know the Fourth Estate died long before Don Lemon or Chris Cuomo stained our screens or insulted our collective IQ.

And as for centralization, it’s not coming, but already here.

Be Prepared Rather than Emotional

So, yes there is tremendous reason for informed and genuine concern, but rather than wait for the end of the world, it would be far more effective to logically prepare for a changing world.

Rather than debate left or right, black or white, straight or trans, safe or effective, smart (Barrington Resolution) or stupid (Fauci), we’d likely serve our individual and collective minds far better by embracing the logical and tabling the emotional.

Toward that end, we’d be equally better off relying on our own judgement rather than that of the children making domestic, monetary or foreign policy decisions from DC to Belgium…

Logically speaking, the USD (and US of A) is changing.

Like its recent swath of weak leadership, the greenback and US IOU are quantifiably less loved, less trusted, less inherently strong and well…far less than they were at Bretton Woods circa 1944.

Change Is Obvious

Since our greatest generation stormed the beaches of Normandy in June of 44, we’ve gone from being the world’s leading creditor and manufacturer to the world’s greatest debtor and labor-off-shorer by June of 2024.

This is not fable but fact. A recent Normandy veteran admitted that he no longer recognizes the country he fought for—and that’s worth a pause rather than “patriotic” critique.

When the post-2001-WTO-daft policy makers weaponized what should have been a neutral world reserve currency in 2022 against a major nuclear power (i.e. stole $400B worth of Russian assets) already in economic bed with a China-driven and now growing BRICS coalition, the “payback” writing was on the wall for the greenback—as many of us understood from day-1 of the Putin of sanctions.

De-Dollarization Is a Reality, not a Headline

In short, many nations of the world, including the oil nations, quickly understood that the world wants a reserve asset that can’t be frozen/stolen at will and that simultaneously retains (rather than loses) its value.

But rather than end the USD as the world reserve currency, most of that world is simply going around (or outside of) it…

Or even more bluntly, the prior hegemony of the UST, and by extension, the USD, irrevocably changed in 2022.

Thank You Ronni & Luke

Thanks to data-focused and credit/currency-savvy thinkers like Ronnie Stoeferle and Luke Gromen, we can plainly see the facts rather than drama of these trends.

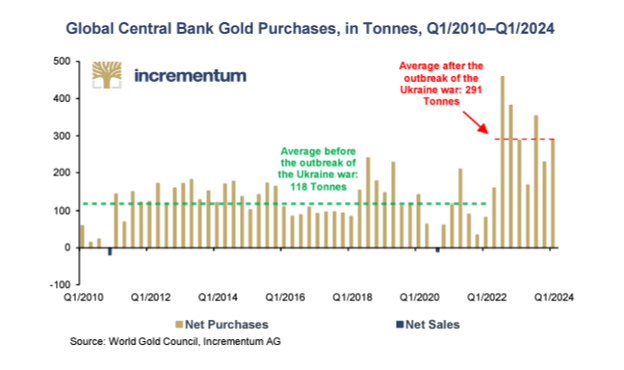

The actions rather than mere words of the BRICS+ nations and global central banks, who prefer to save in physical gold rather than US IOUs, speak loudly for themselves, which Stoeferle’s objective charts remind.

That is, since the US weaponized its Dollar, there has been an undeniable move away from the greenback and its UST in favor of gold as a reserve asset:

The COMEX et al…

The hard facts are in, and dozens of BRICS+ countries are trading outside the USD, purchasing in local currencies for local goods, and then net settling the surpluses in physical gold, which is far better/fairer priced in Shanghai than in London or New York, two critical exchanges that are seeing more physical deliveries out of their exchanges than in.

Immodestly, we saw this coming years ahead of the White House…

This means decades of artificially rigging precious metal pricing on legalized fraud platform like the COMEX are coming to a post-Basel III and post-sanction slow end.

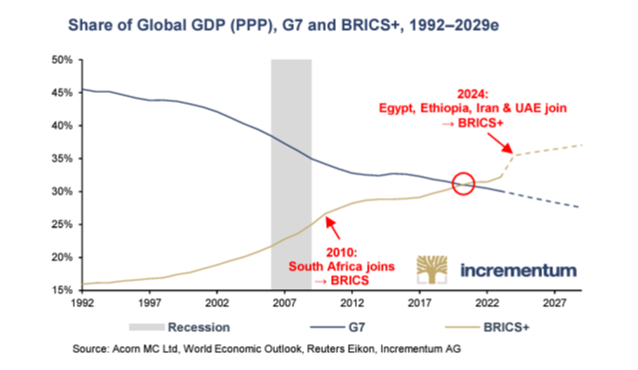

This matters, because like it or not, the rising power of the BRICS+ nations, generationally tired of being the dog wagged by the USD’s inflation-exporting tail, are growing in economic power away from a debt-driven West, which again, the facts (global share of GDP) make clear rather than sensational.

The Chart of the Decade?

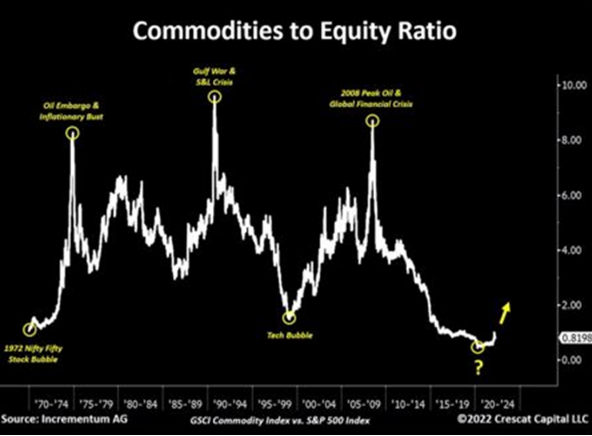

Ronni posted a similarly critical chart over a year ago, asking, somewhat rhetorically, if it was not the chart of the decade?

That is, he asked if the world is moving toward a commodity super-cycle wherein real assets begin their slow rise against falling (yet currently inflated) equity markets and a falling (yet increasingly debased) USD.

As Grant Williams, would say, this should make far-sighted investors all go hmmm.

Commodity Markets: Change is Gonna Come to the Petrodollar

And as for commodities, currencies and hence gold, the changes are all around us, at least for those with eyes to see and ears to hear.

Toward this end, we can’t ignore what has been happening in the global energy markets, topics which I’ve previously (and so-far, correctly) addressed here and here.

But when it comes to understanding oil, the USD and gold, Luke Gromen leads the way in clear thinking and has informed us as well as anyone.

He reminds, for example, that oil, like any other object of international supply and demand (i.e., trade), can be equally net-settled in gold rather than UST-linked petrodollars.

(In 2023, by the way, 20% of global oil sales were outside of the USD, a fact otherwise unthinkable until the Biden White House sanctioned Russia.)

The implications of this simple observation of (as well as its impact on) the USD, commodity pricing and gold are extraordinary.

Oil: The Recent Past, Prior to Sanctions…

Before the US weaponized its USD against Russia (and publicly insulted its key oil partner, Saudi Arabia), the world towed the line of both the UST and the USD-denominated oil trade, which was very, very, very convenient for Uncle Sam and his Modis Operandi of exporting US inflation to everyone else.

For example, in the past, when commodity prices got too high, nations like Saudi Arabia would absorb USTs and effectively go long the USD, which the US pumps out faster than the Saudis do oil…

This, of course, was good for stabilizing and absorbing an otherwise over-produced and debasement-vulnerable USD while simultaneously helping US government bonds stay loved and hence yields compressed/controlled.

In a way, this was even good for global growth, as it kept the USD stable and low enough for nations like China and other EM countries to grow.

These other nations, in turn, would keep buying the “risk-free-returning” UST’s and thus help refund (“reflate”) the US’s own debt-based “growth narrative.”

After all, if every one else is buying his IOUs, Uncle Sam can forever go deeper and deeper into debt-financing the American Dream, right?

Oil: Present Facts, Post the Sanctions…

Well, that is true only if you assume the world never changes, and that reported—i.e. utterly dishonest inflation makes our USTs truly “risk-free” rather than just returning negative real yields.

Fortunately (or unfortunately), the rest of the world is seeing the changes which DC pretends to hide.

Specifically, and as of November of last year, the Saudi’s met with a bunch of BRICS+ nations looking for ways around the USD and UST when it comes to trading among themselves—and this includes the oil trade.

Think about that for a second.

This means that what has been working in favor of the USD and sovereign bond market since the early 70’s (i.e., global demand for the USD via oil) is slowly (but surely) unwinding right before Biden’s barely open eyes…

All those decades of prior support/demand for USDs and USTs is going down not up, which means unloved UST’s will have to be supported by fake (i.e., inflationary) at-home liquidity rather than immortal foreign demand.

This, by the way, leads to currency debasement—the endgame of all debt-soaked nations.

Oil: The Changing Future, Post Sanctions…

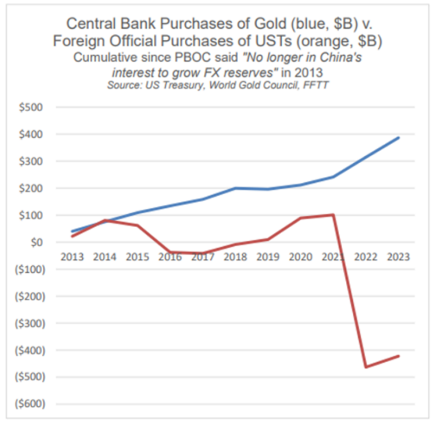

It also means that commodities, from copper to yes, even oil, can and will continue to be purchased outside the Dollar and net settled in gold, which likely explains why central banks have been net stacking gold (top line) and net-dumping USTs (bottom line) since 2014…

Again, watch what the world is actually doing rather than what your politicos (or even bank wealth advisors) are telling you.

Gold & Oil: Impossible to Ignore?

As for gold and oil in the foregoing backdrop of a changing rather than static world, any sane investor has to give serious consideration to the changing petrodollar dynamics which Luke Gromen has been tracking with sober farsightedness.

The compressed but inevitably rising super cycle (Stoeferle chart above) in commodities this time around will differ markedly from past rallies.

As oil, for example, goes up (for any number of reasons), the old system that once recycled those costs in UST purchases can (and has) pivoted/changed to another asset.

You guessed it: GOLD.

Think it through: Russia can sell oil to China, Saudi Arabia can sell oil to China. But now in Yuan not USDs. These trading partners can then take their Yuan payments to buy Chinese “stuff” (once made in America…) and finally net settle any surpluses in gold rather than USTs.

That gold can then be converted into any EM/BRICS+ local currency (from rupees to reals) rather than Dollars to trade among themselves for other raw commodities, of which many BRICS+ nations are resource rich.

This, by the way, is not some distant possibility, but a current and ongoing reality. It can be devastating to USD demand and hence strength.

When copper and other commodities, including, oil starts repricing (and stockpiling) outside the USD with increasing frequency, the Dollar’s so-called “hegemony” becomes increasingly hard to believe, telegraph or sustain.

The Ignored Gold/Oil Ratio

As Luke Gromen observes, but few wish to see…if/when gold becomes the “de facto release valve for non-USD commodity pricing and net settlement,” the impact this will have on the long-term gold price is simply a matter of math rather than debate.

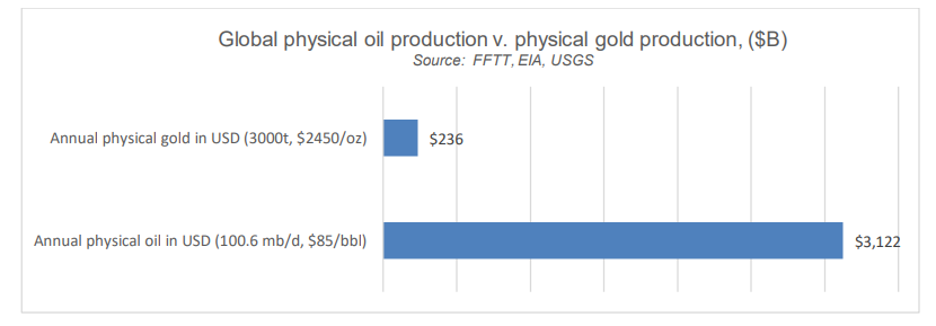

He repeatedly reminds that the global oil market is 12-15x the size of the global gold markets in physical production terms:

We thus can surmise that gold can and will be pushed higher by oil in particular and other commodities in general, a reality already in play as measured by the global gold/oil ratio, which has risen (not so coincidentally) by 4x since Moscow began stacking gold in 2008 while the Fed was preparing to mouse-click trillions of fake Dollars in DC…

The Most (Deliberately) Misunderstood Asset…

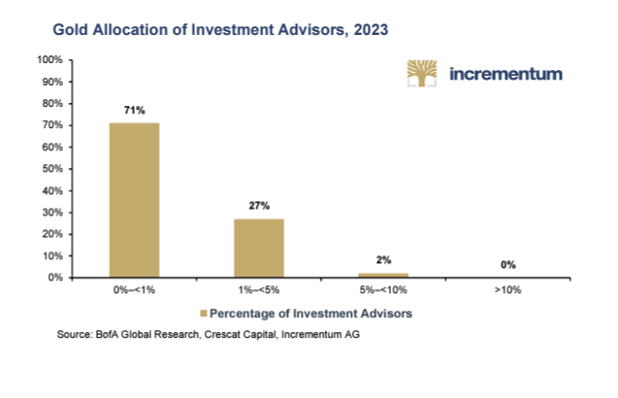

Meanwhile, as we stare in awe at the consensus-think which still places gold at only 0.5% of global asset allocations (the 40Y mean is 2%) and just barely over 1% of all family office allocations (still crawling further and further on the risk branch for yield), we have to wonder if it is human nature (or just political and monetary self-interest) to fear change, even when the evidence of it is all around us.

Yet few see gold’s real role…

For gold investors (rather than speculators) who think generations ahead rather than news cycles per day, and who understand that preserving wealth is the secret to having wealth, this asset (and change) is not feared.

It is understood.

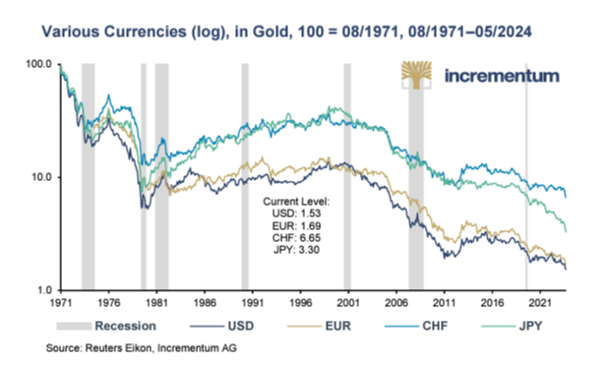

And that is how we understand gold. It preserves wealth while paper currencies destroy it.

That is why despite positive real yields, a relatively strong USD and so-called contained inflation, gold is breaking away from these correlations and making all-time-highs despite their profiles as traditional gold “headwinds.”

It’s so simple.

Gold is trusted far more than broken currencies from broke countries, including the once revered USA in particular and the West and East in general:

As Ronni correctly says: “In gold we trust.”

Makes a lot of (common/historical) sense. Just do the math and read some history…

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD