FAMILY OFFICES PREFER THE PERSONAL TOUCH OF FAMILY BUSINESSES

As a family business ourselves, VON GREYERZ understands the challenges facing many Family Offices today. Whether the goal is to enhance or protect the wealth of future generations or avoiding escalating inflationary or geopolitical risks, every decision ultimately hinges on the trust and values we are committed to preserving.

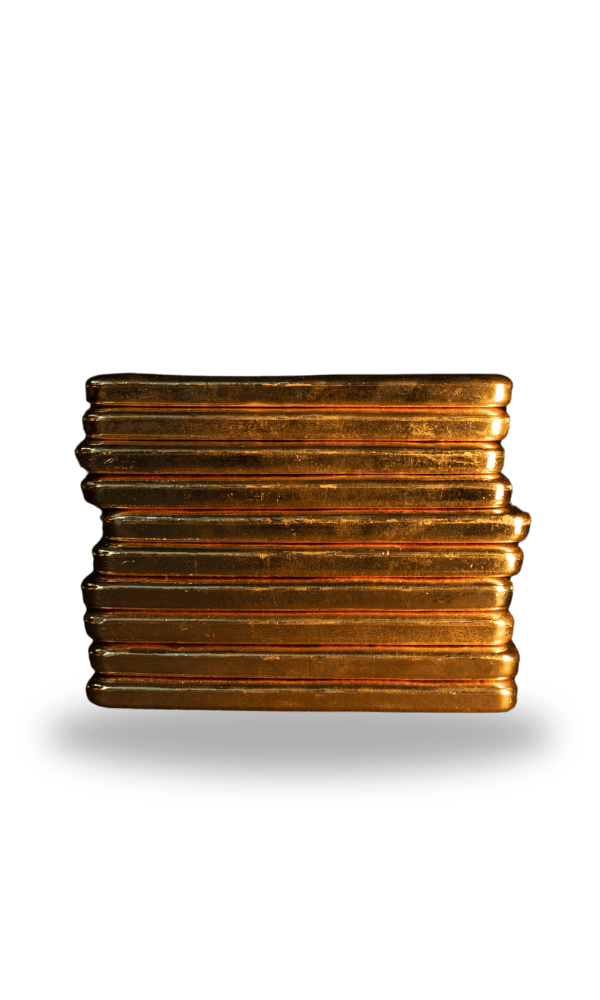

For the past 25 years, we have been dedicated to helping families worldwide, many with billions in assets, safeguard their wealth against current and future challenges by storing their gold in the world’s most secure vaults.

With the great power of inherited wealth comes an equally great responsibility. Through our personal approach, commitment to customer needs, and market expertise, we have eased the burden of wealth preservation, enabling our clients to focus on what truly matters.

We are passionate about analysing risk and advising capital stewards to take advantage of their ability to genuinely invest for the long term. We use gold as an essential diversifying, as well as strategic, reserve asset allocation within a traditional portfolio comprising equities, bonds or real estate and private equity.

The power of our business is rooted in its simplicity and differentiated offering.

Understanding the Geopolitical and Inflationary Risks Facing Family Offices Today

The dramatic shifts we are sadly witnessing in geopolitics, combined with unprecedented debt levels globally, are occurring at a time when inequality between the wealthy and the less fortunate has never been greater. While it is impossible to predict precisely when the debt burden will become critical or when the asset market corrections will occur, preemptive protection is crucial.

Owning Physical Gold In a Secure, Non-bank Location Is Vital Insurance Against Uncertainties

We recognise that each Family Office is unique. However, the exposure to inflationary pressures and weakening FIAT currencies is universal. In fact, since 1971, these FIAT currencies have lost 98% of their value relative to gold due to the relentless debasement of money. So, whilst we appreciate various strategies by which our clients generate multi-generational wealth, our commitment is to advise Family Offices to safeguard and preserve a part of their wealth in physical gold.

PRESERVING GENERATIONAL WEALTH

Learn Why Gold is a Vital Asset for Family Offices

The world is changing rapidly, and the risks to wealth preservation are increasing. Download our complimentary guide to learn why gold remains the ultimate hedge against financial uncertainties and a critical asset for today’s Family Offices.

With The Great Power Of Inherited Wealth Comes An Equally Great Responsibility

Through our personal approach, commitment to customer needs, and market expertise, we have eased the burden of wealth preservation, enabling our clients to focus on what truly matters.

We are passionate about analysing risk and advising capital stewards to take advantage of their ability to invest for the long term. We use gold as an essential diversifying and strategic reserve asset allocation within a traditional portfolio comprising equities, bonds, real estate, and private equity.

The power of our business is rooted in its simplicity and differentiated offering.

The Ripple Effect of Weakening Currencies on Family Offices

In 1920, gold traded at $20 per ounce. At that time, 250 ounces of gold worth $5,000 could buy you an average family home in America. Today, of course, a $5,000 cheque probably wouldn’t be enough even for a house deposit.

If, however, you had held on to those 250 ounces of gold at current valuations, it would still buy you an average home in the US. This is a simple way to illustrate how gold acts as a reliable store of value over time, in contrast to ever-weakening FIAT currencies.

Expertise for Generations

Family offices face significant challenges in securing, growing, and preserving generational wealth. Having served as both a Managing Director and CIO of a family office, I appreciate the tactical and strategic responsibilities involved in diversifying asset exposures, overcoming inflationary pressures, and optimising tax efficiencies – all while striving to maximise returns and minimise risks. These are indeed challenges.

Gold complements these efforts by providing essential, yet often overlooked, protection against the increasingly misunderstood risks to purchasing power posed by FIAT currencies. Additionally, gold serves as a buffer against short-term portfolio volatility while ensuring long-term wealth preservation. For families planning decades into the future rather than focusing on quarterly returns, gold remains a crucial allocation for safeguarding wealth worldwide.

Staying Ahead of the Gold Curve

At VON GREYERZ, we share a common investment philosophy: focus on where the ice hockey puck is going, not where it has been. Our diligence and experience allowed us to observe that it is much easier to follow a trend than fight against it. So, we take note of the fact that Central Banks, especially those in the East, are becoming significant net buyers of gold. These central banks are selling US treasuries to systematically increase their gold holdings. This alignment with the BIS, who declared gold in 2023 a strategic Tier 1 asset, amid an ongoing de-dollarisation, is significant.

Given that gold represented 74% of global central banks’ balance sheets in the 1980s, and today it is only 20%, it is clear that the recent tailwind in buying gold by central banks will very likely continue. And yet, when we look at Family Office allocations to gold, it is only 1% at best, varying by country. What is more alarming is that many Family Offices have zero allocation to the asset class.

Alternatives for Gold Asset Allocation

All our clients understand that once they have decided to allocate part of their wealth to gold, it makes little sense to store it in a bank inside a leveraged financial system. Choosing the solution outside that framework offers you zero counterparty risk and the best protection.

At VON GREYERZ, we fully understand that wealthy Families will have a large percentage of their wealth inextricably embedded in the financial system. Therefore, it is crucial that the insurance allocation to gold within their portfolio is held outside this system, eliminating the counterparty risk.

We also advise against owning gold in the form of ETFs. Not only is it debatable whether these ETFs are backed by physical gold, but also because these ETFs are held within the financial system, increasing counterparty risks for a multi-asset portfolio.

The Golden Opportunity

We estimate that only 0.5% of global financial assets are invested in gold today, compared to circa 5% in the 1960s. Given the rising risk of debt, inflation and geopolitical instability, it is reasonable to assume that gold reverts to its long-term mean of 2% of global financial assets. But that would require a quadrupling of demand, which could only be satisfied by materially higher gold prices.

Understandably, some clients are concerned about buying gold at or near recent high prices. Of course, in absolute terms, evaluating gold can be complex. If, however, you adjust and measure the gold price versus the money supply over the last 90 years, gold is almost as cheap today as it was in 1970 and 2000. That is why we believe the bull market in gold has only just begun.

Meet Jonny Haycock

Jonny, who qualified as a barrister in London, enjoyed a 27-year career in the City before joining VON GREYERZ to run their Family Office department. Starting at Salomon Brothers in 1997, Jonny joined Morgan Stanley in 2001, where he spent 23 years advising Hedge Fund and Institutional clients, as well as sitting on their European Equity Underwriting Committee.

It was at Morgan Stanley that Jonny became a long-term trusted advisor to their UHNW clients. It is this experience over two decades that he brings to serving Family Office clients seeking wealth preservation advice at VON GREYERZ.

Message Jonny below to schedule a call or connect on LinkedIn.

Trusted Advisors to Family Offices for Decades

VON GREYERZ offers over 25 years of unparalleled expertise in gold ownership, alongside significant accomplishments in corporate finance, equity, foreign exchange, and credit markets.

Our deep financial insight empowers us to expertly navigate today’s complex market landscape, analyse key historical and current events that may impact your family office’s wealth, helping you stay ahead of the golden curve.

Please reach out if you're interested in discussing gold ownership, addressing challenges, or transferring your family office's current gold assets.

GOLD’S CRITICAL ROLE WITHIN FAMILY OFFICE ALLOCATIONS

Essential Insights for Strategic Wealth Preservation

Dive into our comprehensive slide deck to understand why gold should be a cornerstone of any Family Office wealth pyramid. This complimentary resource provides valuable data to help enhance your investment approach.