Too Late to Buy Gold? Not Even Close…

Many are wondering if it’s too late to buy gold, that gold has peaked, and they have missed their opportunity.

We hope the below series of facts, figures and common-sense reality-checks will put such fears squarely to rest, as gold’s role, price direction and days are only just beginning.

A Light House in the Fog

In a world of geopolitical tensions, can-kicking monetary fantasies, falling bombs, rising debt, discredited leadership, impotent summits, weaponized trade and a comically discredited media narrative, it’s hard to find a lighthouse in such fog.

Even with the world closest to the brink of nuclear war since the Cuban missile crisis, the markets, forever certain that a lifeboat of mega liquidity is just one crisis away, churned Titanically forward with no ice berg fears.

VON GREYERZ advisor, Ronnie Stoeferle, sarcastically described the recent S&P, NASDAQ and NVIDIA behavior as being almost like that of a Zen monk.

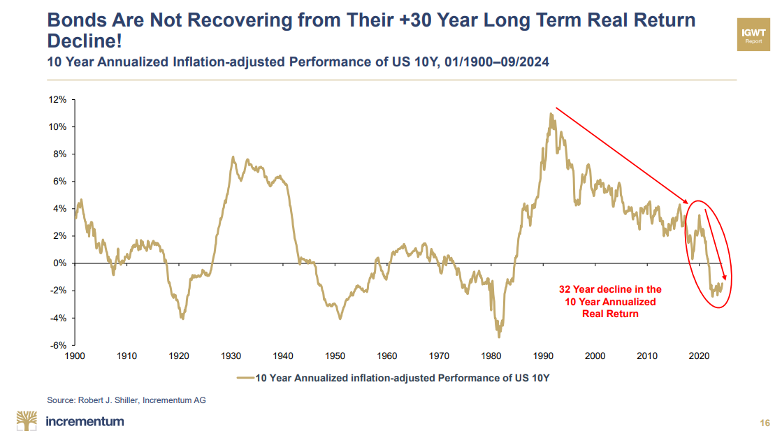

But there’s nothing “Zen” about these markets, times, currencies or financial systems. And there’s certainly nothing “Zen” about the once-sacred 10Y UST…

How do we know this? How have we always known this?

In short, what has been our lighthouse?

The answer is as simple as it timeless, indestructible, and honest: Gold.

The Quiet Accumulation Phase

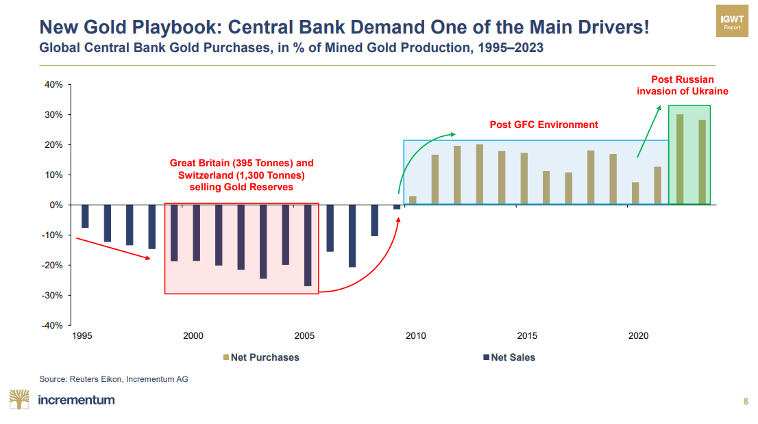

Unlike politicians scrambling for power like donkeys fighting for hay (Chamfort) and squawking threats, promises and miracle solutions for one more X follower, vote or concession, sophisticated gold investors—from generational family offices, portfolio managers and sovereign wealth funds to eastern central banks and even the IMF and BIS—have been quietly accumulating gold at unprecedented levels.

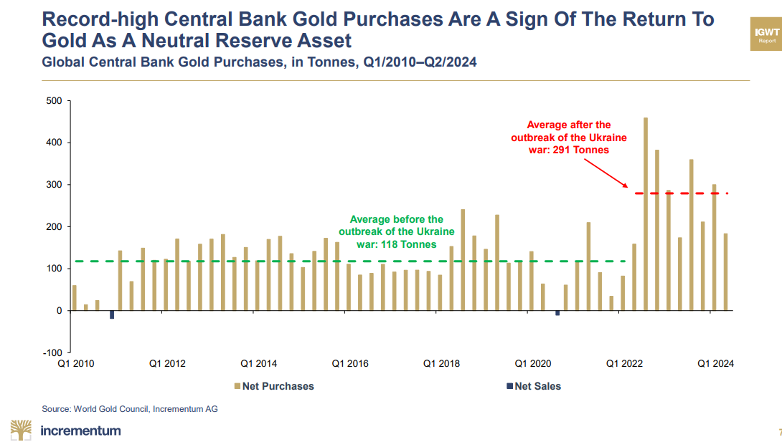

For the last 3 years (since the US foolishly weaponized the world reserve currency), central banks have been annually accumulating over 1000 tons of gold.

Average central bank gold stacking has skyrocketed from 118 tons (pre-2022), to over 290 tons per/bank/year post weaponization.

In short, despite all the fog, squawking, speculating and debating, precious metal investors have been watching what gold does rather than listening to what failed policy makers and systems are saying.

The Unofficial Reserve Currency

Nassim Taleb bluntly said the quiet part out loud in a recent Bloomberg interview, namely that gold is effectively becoming the unofficial global reserve currency.

We have been saying the same for years, not because we fawn on every empty phrase of every empty politico or market pundit, but because we have been watching what gold does.

And let’s look at what gold has been quietly, calmly and historically doing—and SIGNALING—for years.

Signals Rather than Words

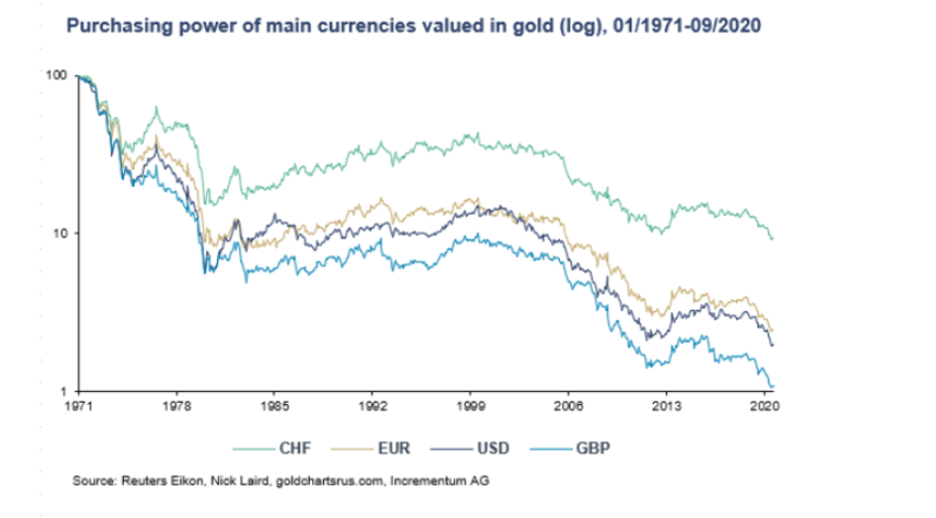

In 1971, when the USD lost its golden chaperone, money supply expansion, inflation and hence a gold price explosion followed, held in check only by Volcker’s aggressive, post-1980 rate hikes.

Even the Great Financial Crisis of 2008, in which gold ultimately out-hedged a perfect market storm, the only thing to “save” that not-so-Zen equity market was Bernanke’s money printing to the moon.

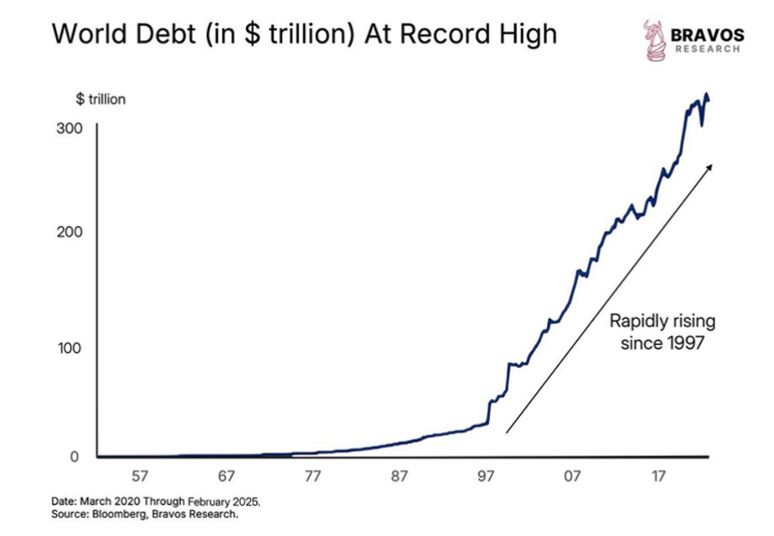

But as US public debt levels crawl toward $37T, we objectively know (and knew from day-one) that raising rates wouldn’t work for Powell as they did for Volcker, and hence Powell’s “higher-for-longer” policies were doomed from the onset by the hard math of fiscal dominance.

Or stated more simply, America was too far in debt to afford its own so-called “inflation killing” rate hikes.

We also know that QE to the moon is another useless option, and that Bernanke’s Nobel Prize for such a “temporary” solution has since devolved into a currency destroying nightmare.

In short, the Fed is Trapped. Cornered. Out of good options.

Period.

More Recent Signs of Golden Power

But there are far more current yet ignored signals from that modest pet rock, which has been quietly getting the last laugh on a global system that is loudly getting more desperate and hence more centralized.

From Day-One of the Putin sanctions, we said that trust in, and hence demand for, the dollar and UST would fall as gold slowly rose to replace this mistrust.

That, of course, is precisely what followed despite polite debates with strong-dollar proponents as the reality of de-dollarization became more than just a headline, but a global and irreversible trend.

We also carefully tracked the critically important move by the BIS to rate physical gold as a Tier-One, global reserve asset.

This was another quiet, yet media-ignored BIS signal, that gold was becoming a far more trusted and objectively superior store of value that an over-issued and increasingly weaponized/unloved UST.

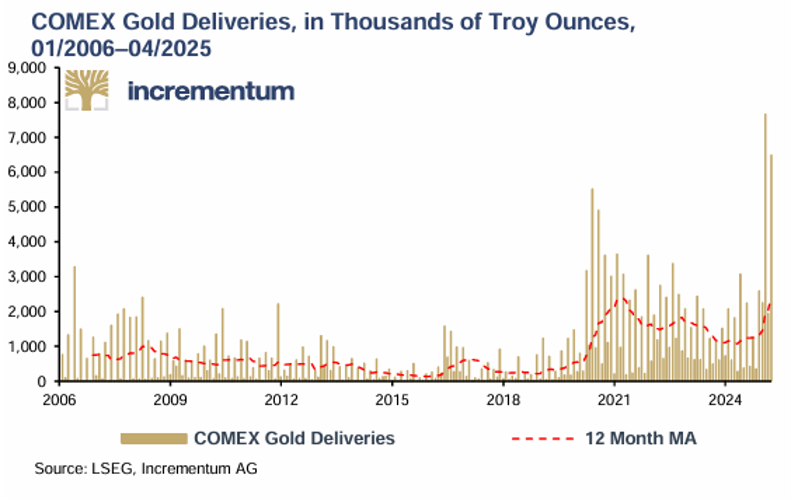

We then tracked yet another obvious, yet again, media-ignored signal from the extraordinary physical gold demand/deliveries in the COMEX exchange.

This was neon-flashing evidence that nations preferred physical gold to paper money or unloved US IOUs.

The Old System Nearing Its Gettysburg Moment

Such signals from the BIS, the COMEX, and the BRICS de-dollarization policies were analogous to armies slowly preparing their financial cannons for a massive shift in a global monetary and financial system.

Sadly, yet objectively, this very system– unknown to most participants and trend speculators—was already reaching a clear Gettysburg Moment in which the fight to save it may continue, but the war is already lost.

The Biggest Casualty? The USD…

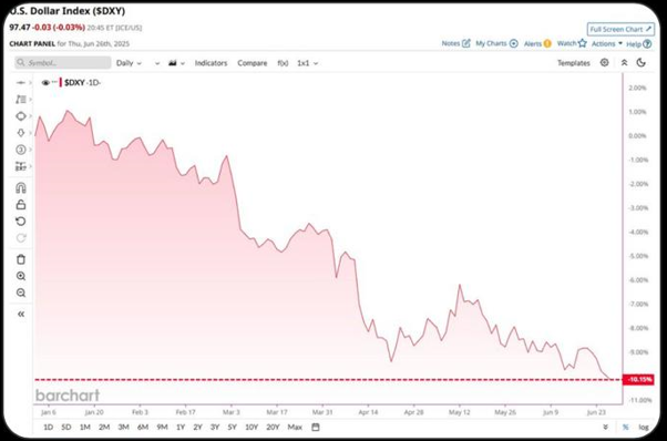

Today we see the desperate signs of this losing war in the desperate measures to give credit to an otherwise discredited and debased world reserve currency which even JP Morgan confesses is 15% over-valued based on long-term real exchange rates.

This year alone, the USD has lost 10% of its power and is seeing its worst first-half performance in nearly 40 years.

Meanwhile, the EUR-USD is nearing 1.17 and gold is consolidating.

Too Late for Gold?

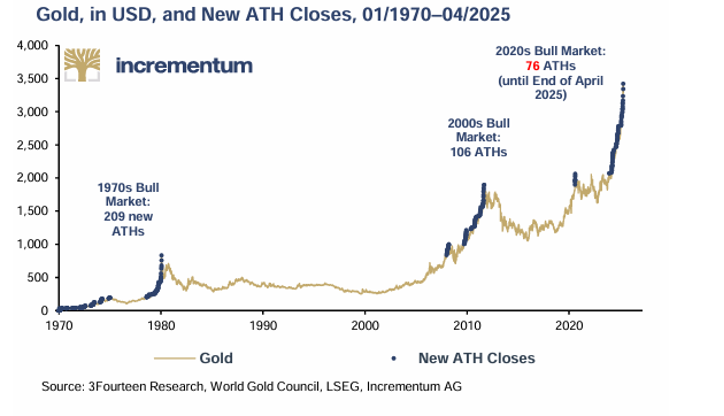

But despite all these signals of gold rising (more than 75 All-Time-Highs in 2025 alone and outperforming the S&P total return for two decades), there are those who would say gold is too volatile or that it peaked at $3500.00.

In other words, there are those who think it’s too late to catch “the gold bubble”?

Oh dear… what a complete misunderstanding of reality, markets, gold and broken financial systems such a view embodies.

Gold: No Mania, just a Sober Culmination

Gold is not in a bubble.

Gold is not to be compared to a tech stock or a speculation craze, and gold is no longer even a volatility “hedge” or “allocation.”

Rather, gold is becoming the base money for a system that is openly denying its own slow death and losing war.

In other words, gold’s exponential growth and role are not peaking; they are only just beginning.

But let’s show rather than say that, as words have become just as cheap as dollars in a system terrified of its own unravelling.

Gold is not spiking because the future of the global financial system and paper currencies is looking brighter.

Instead, and based on the string cite of signals above, gold is rising because that very debt-based, MMT-fantasy pushing addiction to mouse-clicked money and debt-based (currency-destroying) “growth” is failing.

Trust: Hard to Quantify but Easy to Own

The recent and extraordinary (but entirely inevitable) “rally” in the gold price had nothing to with its yields or earnings (it offers none), but everything to do with its trust.

But as we’ve said for years, trust is hard to quantify for those who don’t understand gold.

Or stated otherwise, Gold is not changing, but trust in the global financial and currency system is.

Gold is doing nothing other than what it has done for millennia when debt levels unmask the sins and addictions of its fiat money comptrollers: It is signaling a slow reset toward real money from paper currencies.

In such moments of dramatic global change, looming resets and embarrassing policy failures, the old correlations break down.

Strong dollar or weak dollar, low inflation or high inflation, positive real yields (2023,24 & 25) or negative real yields—gold is rising in all scenarios because gold is breaking away from a broken system that has printed, borrowed, taxed and even traded itself into debt trap.

Who Is Afraid?

Yes, gold loves chaos, but today it’s not Main Street that is running to gold, it is the very central bankers who are terrified of the chaotic system they alone created and broke, which are running to this metal.

In short, it’s not the people who are scared—it’s their governments.

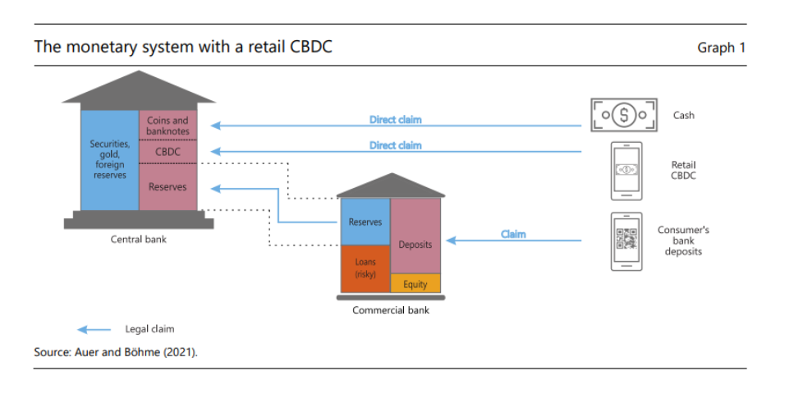

Even the IMF, which has recently admitted that it doesn’t fully know what is coming, at least knows that whatever (even horrific CBDC) reset arises, it will have gold (the last truly politically neutral asset in a global financial war) as its anchor rather than a hitherto chastised “pet rock.”

And so, in this backdrop of reality rather than spin, we ask again, is it too late to buy gold?

Silver Speaks

In addition to the foregoing reality checks and answers, let us not forget what silver is saying to us.

Those familiar with long-term, sophisticated precious metal investing are well aware that rising silver (and mining stocks) confirm a bull market in gold, which we argue has not yet even begun despite gold’s recent record highs.

As of this writing, the gold/silver ratio still hovers in the 100:1 area, and silver ETF inflows are yawning.

In short, silver, despite its steady movements North, is still greatly lagging the gold moves of late, suggesting that gold has yet to make its true move in price, role and use.

Today silver lags, but when it moves, its move will be explosive.

For us, the current silver lag is a sign that gold is still early rather than too late in its secular direction.

Peak Distrust, Not Peak Gold

The recent gold price tops at $3500 were not a sign of mania or peak gold, but simply an early indicator (and reflection) of the rotten debt foundations beneath a global credit and currency system slowly teetering toward a massive shift.

In such a setting/shift, gold’s value today is merely a fraction of what is to come.

For those thinking beyond the next equity trend or miracle stock toward protecting and growing their wealth, they are not even close to “too late,” but rather right on time.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD