Powell: A Breathing Weapon of Mass Destruction

Below we track how the Powell Fed serves as a contemporary weapon of mass destruction.

Powell’s so-called “war against inflation” will fail, but not before crushing everything from risk asset, precious metal and currency pricing to the USD. As importantly, Powell is accelerating global market shifts while sending a death knell to the ignored middle class.

Let’s dig in.

The Fed: Creators of Their Own Rock & Hard Place

In countless interviews and articles, we have openly declared that after years of drunken monetary driving, the Fed has no good options left and is literally caught between an inflationary rock and a depressionary hard-place.

That is, hawkishly tightening the Fed’s monthly balance sheet (starting in September at $95B) while raising the Fed Funds Rate (FFR) into a recession was, is and will continue to be an open head-shot to the markets and the economy; yet dovishly mouse-clicking more money (i.e., QE) would be fatally inflationary.

Again, rock and a hard place.

What’s remarkable and unknown to most, however, is that the Chicago Fed recently released a white paper during the Jackson Hole meeting which says the very same thing we’ve been warning: Namely, that Powell’s WMD “Volcker 2.0” stance (arrogance/delusion) is only going to make inflation (and stagflation) worse, not better.

To quote the Chicago Fed:

“In this pathological situation, monetary tightening would actually spur higher inflation and would spark a pernicious fiscal stagflation, with the inflation rate drifting away from the monetary authority’s target and with GDP growth slowing down considerably. While in the short run, monetary tightening might succeed in partially reducing the business cycle component of inflation, the trend component of inflation would move in the opposite direction as a result of the higher fiscal burden.”

In short, Powell can’t be Volcker.

Why?

Simple.

America Can’t Afford Powell (or His Rate Hikes)

This hard reality is economic and mathematical, not political or psychological, though Powell suffers from both political delusion and a psychological lack of self/historical awareness…

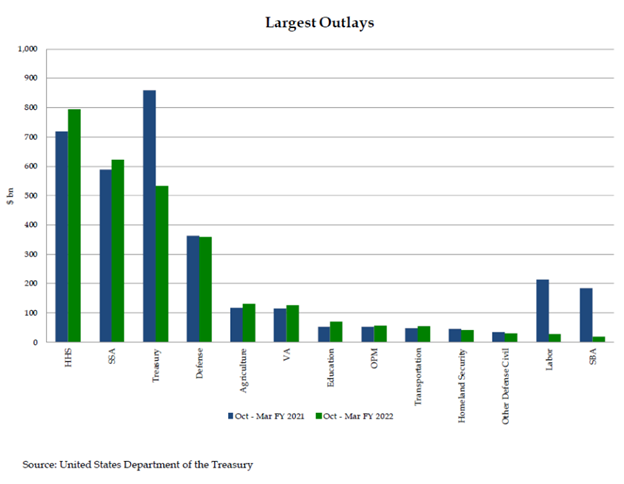

I’d like to ask Powell, for example, how the US plans to pay for its now rate-enhanced (i.e., even more expensive) debts and obligations regarding defense spending, Treasury obligations, social security and health care when just the interest payments alone on Uncle Sam’s current bar tab are unsustainable?

Powell, part of the so-called “independent Fed,”will now have to make a political choice (and trust me, the Fed IS political): Will he A) intentionally seek to crash the economy into the mother of all recessions to “fight” the inflation his own private bank’s balance sheet singularly created, or B) will he help turn America into the Banana Republic that it is already becoming by printing (debasing) trillions more US “dollars”?

The “inflation-fighting” Powell, embarrassed to go down in history as the next Arthur Burns, may just A) continue to hike rates and strengthen the USD (currently bad for gold), which is sending America to its knees, or B) sometime this autumn he’ll cave, pivot and let inflation rip (while the BLS, of course, under-reports inflation (i.e., lies) by at least ½).

In the meantime, we can only watch markets and economic conditions continue to tank as interest rates and the USD climbs toward a peak before the USD makes a record-breaking fall.

And why do I see a fall?

Easy.

The Credit Markets Are Screaming “Oh-Oh!”

To borrow/twist from Shakespeare: “The bond market is the thing.”

Everything, and I mean everything, hinges on credit markets. Even the cancerously expanding US money supply(M0-M4) is at root just 95% bank credit.

Understanding credit markets is fairly simple. When the cost of debt is cheap, things (from real estate to growth stocks) feel good; when the cost of debt is high (as measured by the FFR, but more importantly by the fatally rising yields on the US10Y), things collapse.

We saw the first (and media-ignored) warnings of this collapse in September of 2019 when the oh-so critical (yet media ignored) repo markets imploded, none of which can be blamed on COVID (2020), Putin (2022) or climate change.

As dollar liquidity dries up, so will markets, economies and lifestyles. Remember: All market crises are, at root, just liquidity crises.

A Summer of Credit Drought

As previously warned, signs of this drying liquidity are literally everywhere. The Fed’s own Quarterly Loan Officer Survey confirms that banks are lending less.

And given that 70% of the US bond market is composed of junk, high-yield and levered loans (i.e., the worst students in the class hitherto priced as PhD candidates), the rigged game of debt roll-overs and stock buy-backs is about to end in a stock and bond market near you as rates rise to unpayable levels.

Furthermore, it’s worth noting that US banks (levered 10X) and European banks (levered 20X due to years of negative nominal rates), will now use rising rates as the long-awaited excuse to de-lever their bloated balance sheets, which is fatal to risk asset markets.

Even more alarming, however, is what this de-leverage will mean to that massive, USD-based and expanding (1985 to now) Weapon of Mass Destruction otherwise known as the OTC and COMEX derivative markets.

Rather that expand, this fatal market will contract—all of which will have massive implications for the USD as debt markets slowly turn from a past euphoria to a current nightmare.

The Dangerous USD Powell Ignores

Measured by the DXY, the Dollar is ripping.

But you’ll note that Powell and his “data points” never address the Dollar.

Powell, like most DC-based Faustian deal-makers, lives in a US-centric glass house, which ignores the rest of the world (namely Emerging Markets, oil producers and mislead “allies”) who are de-dollarizing (i.e., repricing the USD) as I type this.

In case Powell never took an econ history class or read a newspaper that was not written in English, it might be worth reminding him that EM nations like Venezuela, Lebanon, Argentina, Turkey, and Sri Lanka, as well as, of course, the BRICS themselves, are tired of importing US inflation and paying trillions and trillions of Dollar-denominated debt or forced dollar-settled oil purchases.

As the Fed artificially strengthens the USD via rate hikes, debt-soaked nations are forced to either: A) debase their currencies to pay their debts (which might explain Argentina’s 69.5% official interest rate) or B) raise rates and look elsewhere for new trading partners or money.

Even “developed” economies are seeing their currencies at record lows vis-à-vis the rising USD (Japanese Yen at 50-year lows, UK’s currency at 37-year lows and the euro now at 20-year lows).

And as for those cornered EM nations, $650B of the IMF’s 2021 usurious (and dollar-based) loans to them have already dried up.

EM Markets Looking East Not West

So, where will EM countries go trade, survival, better energy pricing, and even fairer gold pricing?

The answer and trends are now open and obvious: East not West, and away from (rather than toward) the USD.

Russia and China are making trade and currency deals not only with the BRICS at a rapid pace, but with just about every nation not otherwise “friendly” (i.e., forced to be) with the USA (and which “friends” now face a cold winter on this side of the Atlantic.)

Even the notoriously corrupt LBMA gold market, which spends its every waking hour using forward contracts to artificially crush the paper gold price, is about to see a Moscow-based new gold exchange (the Moscow Gold Standard).

Of course, such a Moscow exchange makes sense given that 57% of the world’s gold comes from Eurasian zip codes where a post-sanction Putin sees yet another golden opportunity to fix what the West has broken.

Furthermore, and as stated above, as the derivatives markets de-lever, demand for the USD (and hence dollar-strength) will equally tank, as OTC settlements are done in USD, not Pesos, Yen, euros or Yuan.

As we warned within weeks of the failed sanctions against Putin, the world is de-dollarizing slowly yet steadily, and once the DXY inevitably slides from 108, to 107 and then below 106, the Greenback’s fall will mirror Hemingway’s description of poverty: “Slowly then all at once.”

For the last 14 months, the Dollar Index has been trading above its quarterly moving average, which as the always-brilliant Michael Oliver reminds, is like a runner who never exhales. At some point the USD’s lungs will collapse.

Gold: Waiting for the USD to Snap

The foregoing and seismic shifts in the derivative and EM markets portend the sick finale of the USD, and hence for the currently repressed gold price. In short: As the former tanks, the latter surges.

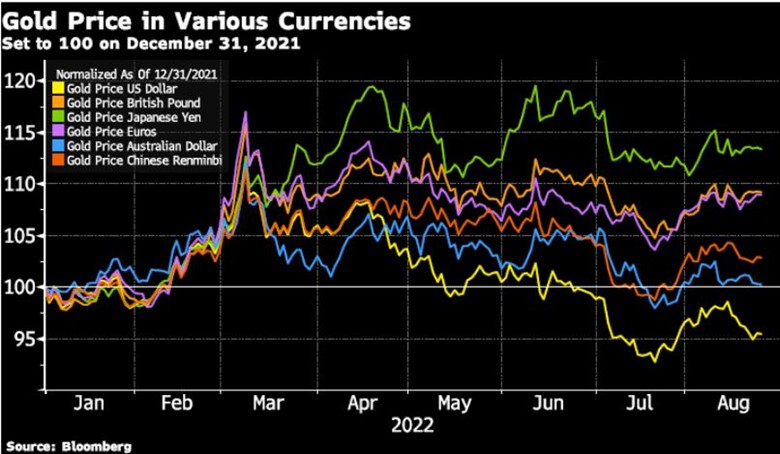

Many are nevertheless angry that gold hasn’t ripped in a world of geopolitical risk and rising/persistent inflation, but that’s because the artificially rigged USD has been their only (and short-lived) measure.

As risk assets in the US and around the world experience double-digit declines, gold in every major currency but the USD has been rising, not falling:

And even gold’s relative decline in US markets remains minimal compared to double-digit losses in traditional US risk-parity (i.e., stock/bond) portfolios for 2022.

A COMEX in Transition

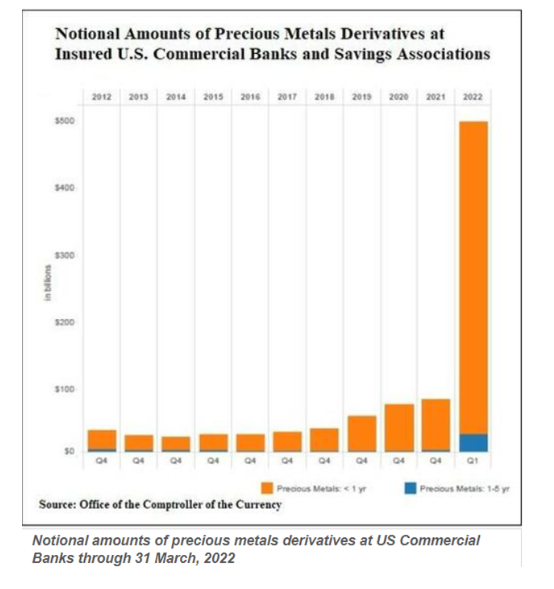

You also may have overlooked that those fat foxes over at the BIS recently unwound 90% of their gold swaps (from 500 to 50 tons) at precisely the same pace that JP Morgan and Citibank (which hold/control 90% of the US commercial banking gold derivatives) just expanded the notional value of their gold derivatives by 520% (!).

Anyone and everyone in the precious metals markets knows that the notional value of those contracts over-shoots the actual supply of the physical metal by 99%.

The COMEX is a nothing more than a legalized fairytale (fraud) whose non-fictional pains (and gold surges) are inevitable.

In the meantime, however, many players in the COMEX markets (the precious metal exchange in NY) are now (and increasingly) looking to take delivery of real rather than paper gold.

Why?

Because they see the writing on the wall.

Gold is a monetary metal not a paper card trick. The COMEX players want to get as much physical metal as they can before false idols like Powel and the global EM currents flowing East take down the USD’s post-Bretton Woods hegemony.

When/as that happens, gold does what it always does when nations and their debased currencies tank: It rises.

And you can be sure that JP Morgan and Citi will keep the paper gold price low until they have enough of the physical gold in hand when gold rips and the USD sinks.

For Now, More Lies, Empty Phrases and Distractions

In the meantime, Powell will act like the nervous captain of a sinking ship and play with rates and the USD as the DC information bureaus (i.e., BLS) spread more open fictions and false distractions on everything from the inflation and unemployment rate to suddenly forgotten viral threats (?), the freedom of Ukraine or the political theme of climate change.

And of this you can also be certain: Powell will continue the Fed’s historical role of crushing the US working class.

Translating Powell’s “Softening Demand”

As Powell wandered Jackson Hole, he warned Americans to prepare for “softening demand,” which is a euphemism for crushing the middle class via rising rates and long-term (rather than “transitory”) inflation ahead.

This rich.

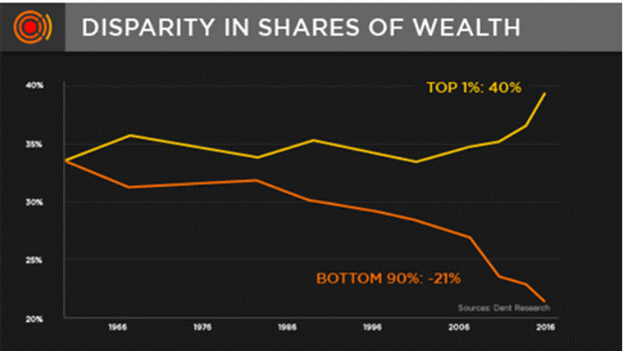

After being the sole tailwind for pushing equity markets up by hundreds of percentage points with mouse-click money since 2009, the Fed has made the top 10% (which owns 85% of the Fed-inflated stock market wealth) extremely rich.

Now, by deliberately cranking rates higher, Powell’s Fed is making the middle class (bottom 90%) even poorer.

Wealth inequality in the US has NEVER been higher, and this never bodes well for the future of an openly fracturing nation.

Indeed, inflation pains and rising rates certainly hurt all Americans.

For the wealthy, such inflationary pains sting; however, for the working class, they cripple.

And as far as this crippling effect of “softening demand” goes, we can blame that squarely on the narrow shoulders of such false idols like Greenspan, Bernanke, Yellen and Powell.

For years, they’ve been saying their mandate was to control inflation and manage employment.

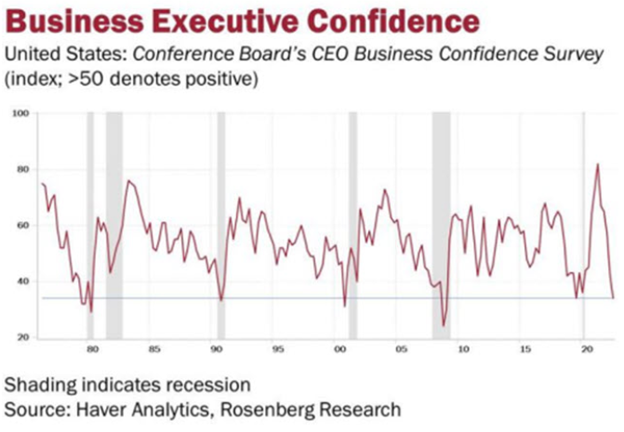

But that employment (as confirmed by PWC, household surveys and our own two eyes) is about to see hiring freezes, downsizing and lay-offs as debt-soaked enterprises with tanking earnings and confidence levels cut costs and jobs.

Again: That’s not “softening,” that’s crippling.

But as I’ve shown in Rigged to Fail and Gold Matters, the Fed’s real mandate is providing (now increasingly scarce) liquidity to credit markets (and hence tailwinds for the equity markets), which benefit a minority, not a majority, of the population.

This easily explains Andrew Jackson’s prescient warning that a central bank simply boils down to the “prostitution of our government for the benefit of the few at the expense of the many.”

Truer words were never spoken, and we are now seeing these warnings playing out in real time, and will see even more pain ahead in this surreal new normal of “softening demand” and a current America of central-bank created serfs and lords.

Powell’s words, of course, do not match his or the Fed’s deeds, a profile flaw that has been hiding in plain site since the Fed’s not-so-immaculate conception in 1913.

The more that investors understand where the decisions are made and why, and the more they track the market signals (bond yields, credit markets and currency debasements), the more they can prepare for what is already here and what lies ahead.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD