From Biden to Bonds: Unmasking a Template of Lies

Political opinions are almost as vast as financial opinions—from bull to bear, or left to right.

But there are differences, no?

Political opinions, unlike market evaluations, for example, more often lean on emotion, media/partisan influence or even Californian hair styles rather than simple math.

But in the spectrum of negative to euphoric market pundits, even math can be ignored to confirm biases, euphoria and group-think.

Ideally, of course, we’d like our politics, like our investing, to be equally rational; but as history and philosophy confirm, man is not very, well: Rational…

When one supplements human irrationality with open dishonesty and misinformation (think Main Stream/Legacy Media and self-serving rather than pubic-serving “leadership”), an otherwise clear path to rational deliberation can become all the more clouded.

Take Joe Biden…

From literally day-1 of his administration, it was fairly clear to anyone (left or right) that his mental fitness was undeniably declining.

The physical and verbal examples of Biden’s “resting 25th Amendment face” and condition are and were endless.

Equally endless were the efforts of his “concealers in chief” (from his vice president, press secretaries, cabinet and point-of-view “journalists”) to hide, deny or contradict this open fact for years—repeating the lie of Biden’s robust mind long enough to convince the masses of the political equivalence to the sky is green and the grass is blue.

But then came a moment of truth: A single presidential debate in which Biden was all alone without prompts, ear phones, note cards or his wife’s elbow.

Not surprisingly, he imploded for all the world to see.

Not even mental giants like actor George Clooney or “journalist” (actress?) Rachel Maddow could save him from our own two eyes and ears.

Soon thereafter, Biden dropped out of the race.

Shocker?

In short, and with the entire world watching, a lie that was otherwise obvious (and deliberately ignored) for years, was suddenly exposed: The emperor had no clothes (or the President had no clue).

This sad fact should not have been partisan, but moral.

But what does this have to do with markets, portfolios and your currency?

Well, the answer is: Everything.

A Pattern of Lies, Denial and Public Gaslighting

The Biden example, or denial-template above, is literally identical to a similar template of economic lies, denial and public gaslighting as acted out by our central bankers, debt-addicted (economically juvenile) politicians and utterly clueless financial media for years.

The Bankers…

Anyone, and I mean anyone, who hails from Wall Street’s big banks, for example, knows that bears are fired and bulls are promoted.

Why?

Because banks are in the business of levering depositor money for year-end bonuses and an endless stream of risky (rather than fiduciary) “products” that have nothing to do with long-term value but everything to do with short-term fee collecting.

Any honest banker who questions the financial weapons of mass destruction developed in those banks (from MBS derivative schemes to current “private credit pools” and non-performing CRE loans) is shown the door.

The Fed…

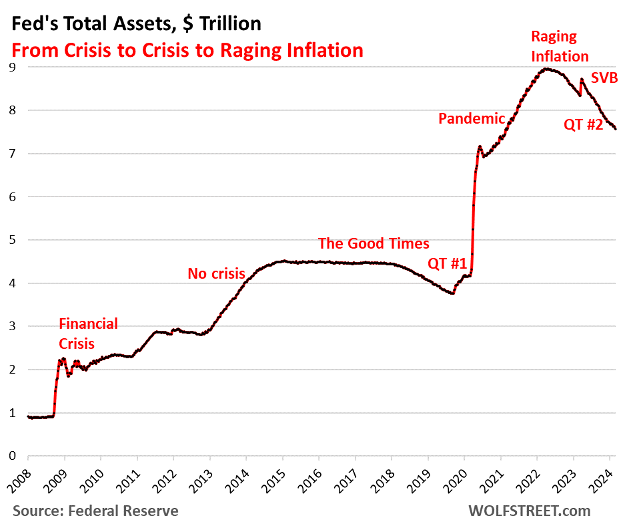

Such financial vanity is equally true of our central bankers.

Near-term power at the expense of longer-term prosperity is the name of their distorted game and the surest path to a Nobel Prize in economics (Bernanke) or a prestigious post at the US Treasury Department (Yellen)…

But as Thomas Hoenig, one of the very few FOMC players (and Kansas City Fed Presidents) with actual integrity, reminds: The Fed, if run properly, “should make policy for the long-term and let the near-term work itself out.”

But the Fed’s actual practice, as Hoenig himself confesses, has been the precise (and sickening) opposite.

As Hoenig (and the few of us who speak what we think rather than what are told) have been warning for years, the Fed (from Greenspan to Powell) is more worried about bailing out the next bank or bond crisis than preventing the next generationfrom suffering permanent inflation/currency ruin in the endless wake of their repulsive “spend and print” policies.

The Politico’s…

Needless to say, this same pattern of near-termism and me-first-ism (nation-be-damned) is most glaringly apparent in the halls of political decision-making.

Congress is where heavily-lobbied and embarrassingly math-challenged Ken, Barbies and stumbling octogenarians deficit spend like crack addicts for near-term re-election while leaving the bill (and twin deficits) to our kids…

In short, even when openly in decline, they cling to power.

This explains why an entire party could stand behind an otherwise zombie-fied Biden for years: So long as their machine (and happy-idiot) was in power, they could scramble for personal promotion, power and wealth at department or agency X, Y or Z.

For this class of politico’s (both red and blue), the cry is not “ask what you can do for your country,” but simply, “what can DC do for me and my CV?” as the U.S. just witnessed the highest level of corporate bankruptcies since early 2020…

Such open selfishness, arrogance and deliberate economic/debt ignorance is a symptom of decadence and decline which precedes the inevitable fall of all once-great nations.

The Great American Debt Lie

Like Biden’s mental health, America’s hidden financial health has been a perfect homage to the smoke and mirrors denial of what were otherwise obvious shark fins circling our economic prosperity for years.

And yet for years, we and others have been warning of these open and irrevocable risks with candor, while Wall Street and anonymous YouTube comment-cowards gaslight us as “gloom and doomers.”

The ironies just abound…

Candor Matters

For over four years, by way of example only, we have been shouting from the electronic rooftops that western sovereign debt in general, and USTs in particular, are racing toward a moment of implosion that can’t be blamed on COVID, global warming, Putin or even little green men from Mars.

For even more years, we have been warning that nations cannot spend or borrow 3-4X more than they earn by monetizing the delta with liquidity literally created out of thin air without eventually destroying their currency and stoking an inflationary fire, which the Fed got 100% wrong.

And by the way, this fire always leads to social unrest and distractive wars followed by democracy-insulting centralization from the extreme political left or right.

Meanwhile, those very forces of currency debasement, inflation, war and social unrest are ALREADY and LITERALLY occurring all around us, to the bemused dismay and denial of our so-called “elites.”

Yet like Biden’s yes-sayers, crony-capitalists, position-grabbing lackies and complicit media mouthpieces, our current financial and political elites are still making a daily effort to ignore the obvious and force-feed us their well-telegraphed counter-narrative of deficits without tears.

Fortunately, and like the Biden template above, at some point even the cleverest lies can no longer hide the most basic math and history of nations free-falling from a debt-cliff of their own design.

Signs of a Broken Narrative

Recently, for example, the mother of all central banks, the Bank of International Settlements (BIS), published its annual report, which the media, DC and Wall Street largely ignored.

Specifically, the BIS finally, in 2024, said out loud what we have been saying for years: When economic growth slows to a level outpaced by debt growth, sovereign IOUs get weaker not stronger.

And when sovereign bonds get weaker (i.e., sell off), their prices fall and hence their yields rise.

And when yields rise (mathematically), so too do interest rates.

BUT herein lies the rub:

Rising rates + historically unprecedented global debt levels = $#!T hitting the fan.

The Bond Market’s “Biden Moment”

This, then, is a kind of “Biden moment” for the $130T global credit market.

Even the BIS is confessing that the bond market, like America’s current emperor, may have no clothes.

And yet the majority still want to believe a fantasy narrative that all is (and will be) fine, recession and inflation facts notwithstanding…

That is, the vast majority of investors and bank salesmen are still trying to convince themselves and the world that a growth slowdown—or even a recession—will lead to a goldilocks scenario of increased buying (rather than selling) of government “safe-haven” bonds, which, in their collective fantasy, means higher bond prices ahead and hence lower bond yields and interest rates ahead.

This, folks, is the economic equivalent of believing Joe Biden will be the next Jeopardy Champion or Olympic Marathon gold medalist…

Natural vs. Un-Natural Forces

In the end, and despite the 800+ PhD’s at the Fed (who completely got inflation wrong) and all the happy idiots in both red and blue in the US House, natural forces (i.e., supply and demand) ultimately humble human forces (i.e., stupidity and vanity).

That is, not even the Fed or other central banks can control rates; instead, the natural forces of the bond markets get the final say.

As demand for over-indebted and unloved sovereign IOUs falls, yields and rates will rise to levels no nation can afford to pay.

This reality (aka moment of fiscal dominance) can only be monetized/paid with fake money, which is by definition inflationary.

Like Biden’s mental decline—it’s just that obvious. It’s also math.

Inflation is killing the purchasing power of the “wealth” by which you measure your savings account, paycheck, portfolio and legacy.

Think about that with eyes that see and ears that hear.

Speaking of Nature…

Nature, unlike most bankers, politicians and artificial market bubbles, has an embedded honesty which, cruel or kind, has a way of self-correcting the un-natural interference of man-made designs.

There’s no hubris or vindictive spite, for example, in an iceberg that challenges a poorly steered and otherwise “unsinkable” Titanic.

Nor is there anything personal when a flood washes away a mansion poorly built on the river’s edge.

And any yachtsman who thinks he or she can tame a hurricane, quickly learns a lesson in humility.

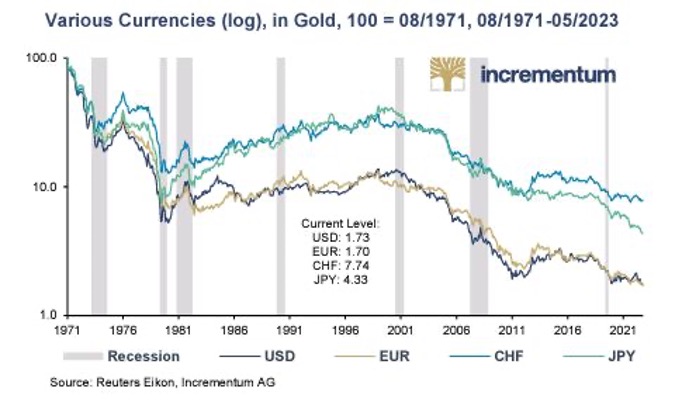

The same, of course, is true of paper or digital money. Man can make, and hence debase, as much of it as he wishes.

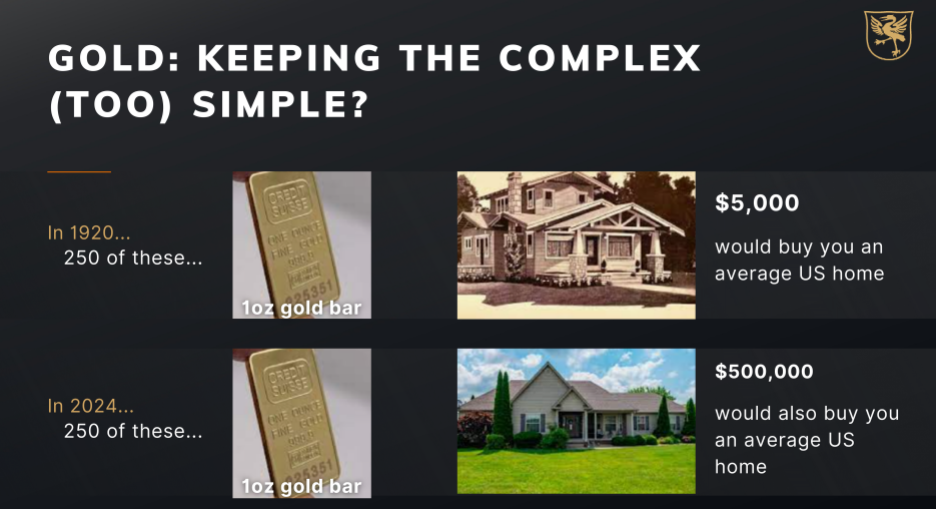

But nature’s money, gold, is far less arrogant and far more honest.

In addition, nature’s money is far more patient.

Gold’s detractors, of course, will say that it merely sits there doing nothing.

But while dollars, yen, pounds, pesos and euros are all very busy swapping, trading, collateralizing and debasing, gold calmly does one thing very well: Retain its value.

The World is Catching On

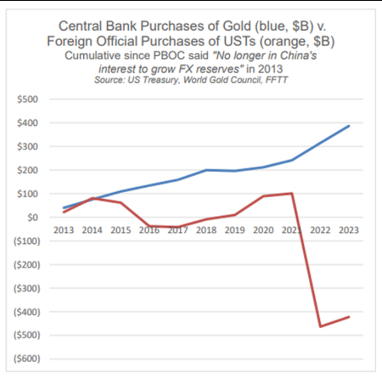

Your private wealth advisors, political representatives or family office CEOs (typically just former bankers) may not wish to see such natural honesty among the teargas of financial group-think and complex market lingo, but many nations and their central banks are catching on.

As outlined in detail many times, these players (i.e., the BRICS+ et al) are, and have been for years, quietly and now openly stacking nature’s money at historical levels while dumping USTs.

Why?

Because after years of enduring a debt-debased world reserve currency and its “return-free-risk” IOUs, the world wants: 1) a neutral Tier-1 asset that can’t be frozen at DC’s will, and 2) which actually retains rather than loses its value.

Imagine that? The world actually prefers natural gold over a man-made sovereign IOU as a reserve asset?

Rather than replace the USD and other fiat currencies (which are critical spending tools), more and more nations are simply going to reprice currencies like the USD while storing their reserves in real money (gold).

This trend is now obvious, from India, China and Russia to Nigeria, Thailand or Saudi Arabia: Gold, a yield-less asset, which is outperforming a dollar bull market and so-called “yielding” 10Y UST, is clearly emerging as the premier inflation-fighting, savings and net trade settlement asset.

Yet despite this otherwise obvious shift, akin to Biden’s obvious mental decline, many would intentionally have you ignore what your eyes see and your ears hear.

“The dollar,” they cry, “is king!”

But as Biden’s fall poetically reminds, a king with no clothes, is a crown (and money) with no value.

As asked elsewhere: Which will you prefer? A crown of paper or a crown of gold?

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD