COMEX Flows: Is the Gold Case Almost Too Obvious?

For years, we’ve been warning of gold’s critical role as a buffer against increasingly obvious currency risk, banking risk, geopolitical risk and market risk.

And for years, we’ve been warning about the precious metal price fix in the COMEX, the hidden risks of holding physical gold in a commercial bank, and the now irrevocable de-dollarization trend away from an indebted UST and weaponized greenback.

With each passing day, these risks and forces are rising, so much so that the case for gold has become almost too obvious.

Let’s dig deeper…

The Real COMEX News

Since the November Trump Victory, over 400 Metric tons of physical gold have left London for the NY COMEX warehouses.

This has resulted in a 75% increase of the COMEX gold stockpile (29.8M ounces, or 926 tons).

Why the big move?

As always, the Main Stream Media (MSM) can be counted on to give the wrong but eloquent answers to an otherwise obvious currency breakdown (and gold directional move) hiding in plain sight.

The headlines partially ascribe the massive gold flow to fears of future tariffs on gold imports.

They point as well to a potential arbitrage play between the UK gold spot price and the NY-based futures price (London is known for making the physical gold spot price; NY is known for the futures contracts).

Our view, footnoted by years of tracking, warning and describing the real smoke behind the COMEX fire, is a bit more blunt, a bit more foreseeable and, well, a bit more tragic.

Understanding Legalized Price Fixing

As we wrote in 2021, the post-Basel III banks were going to need more allocated/physical gold to comply with Basel Regs.

This presented a clear and present danger to the ongoing and legalized price fixing of COMEX gold by a handful of bullion and TBTF banks.

These banks maintained a permanent levered short on the gold price via daily (and massively levered) short contracts against gold (these contracts were typically backed by 4% actual gold and 96% paper leverage).

In case you need proof of this spoof, just see our prior reports here, here and here…

For decades, the COMEX could play this short game because gold on the COMEX stayed on the COMEX, as nearly every futures contract was simply rolled over (an institutionally accepted game of extend and pretend) rather than “standing for physical delivery.”

In short, the physical gold (collateral for the perma-short) never left the building but just stuck around for the omnipresent, 8:30 AM price fix.

The COMEX Uh-Oh Moment?

BUT NOW THE GAME HAS CHANGED. Players on the COMEX are no longer rolling over their contracts but asking for PHYSICAL DELIVERY of the gold (this is called “Open Interest”, and it’s up 750%).

But why are traders, nation-states and central banks suddenly seeking physical gold delivery?

We saw De Gaulle do it in 1971. We saw the Germans do it in 2016. India and China have been doing it off the radar as well.

In fact, we’ve been warning of (and answering) this question for years.

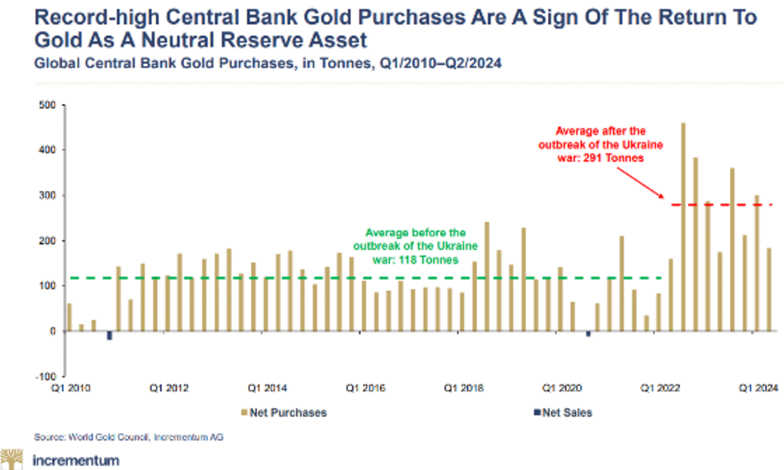

And the answer is simple: In times of crisis, the world trusts physical (indestructible) gold far more than paper money, digital coins or Uncle Sam’s IOUs.

Global actors (including the BIS) are openly preferring real gold (i.e., sound money) as a strategic reserve asset over USTs for all the obvious reasons, namely: Who wants/trusts an IOU (a declining asset) from an over-indebted issuer (Uncle Sam) who is also prone to weaponizing (i.e., stealing) that asset?

Gold In the Near-Term

What does all this mean for gold in the near term?

Well, the COMEX was certainly worrying if it had enough physical gold on tap to continue its perma-short on the precious metal.

Less artificial (but legal) gold shorting via futures contracts on the COMEX means a rising/fairer gold price.

But now the COMEX has re-loaded its stockpile, so will the price fixing continue?

That all depends on how much of this new stockpile will be a stockpile rather than a revolving door for delivery to counterparties who now want their gold in real rather than paper form within their own control rather than sitting in a COMEX warehouse.

Gold Longer-Term

Ultimately, global gold demand is rising, and gold supply (in the banks, COMEX, etc.) is tightening—all of which is extremely good for gold.

Of course, all of these moving parts flows, and figures boil down to a simple bottom line that no one in the halls of any government, bank or financial MSM outlet wants to say out loud: There’s no way out of this historical debt trap.

The global financial system is broken.

Too Broke to Grow

The debt-soaked US (at 125% debt to GD), like so many other nations, is mathematically too broke to grow.

Uncle Sam, caught in this debt trap, has only 3 bad options to select from: 1) default on the debt, 2) discover a productivity miracle, or 3) inflate or die.

Option 1 won’t happen with a money printer in the corner; option 2 can’t happen once debt to GDP crosses 100%, and option 3 now just becomes a matter of time and the right headline event.

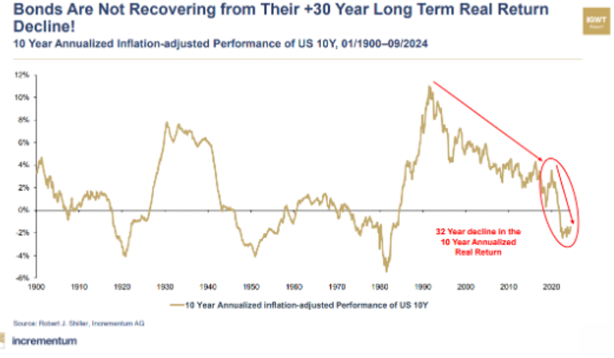

The Fed, like the Treasury Department, knows perfectly well that at some point, the currency will have to be further sacrificed/debased (inflation) to monetize its broken, unloved and increasingly weaponized and distrusted bond market.

As we’ve shown historically, this is what governments have ALWAYS done once their back is against an unsustainable debt wall, and this is why gold is ALWAYS the go-to asset in a financial crisis.

This means get ready for QE to the moon, a global “reset” or a gold-revaluation—any and all of which are quite good for gold…

Global Crisis, Global Gold Rise

Today, this debt crisis is global and unprecedented.

As such, demand for physical gold, as evidenced by the BRICS+ manoeuvres and now clearly demonstrated by the COMEX inflows and outflows above, is equally global and unprecedented.

In a world racing toward $400T in entirely abstract global debt (which is 2/3 higher than global GDP), there is less interest (but greater distrust for) sovereign debt instruments and debased fiat money within a fractured banking and financial system, the open cracks of which we have been tracking/warning for years.

An increasingly fractured world, in short, would rather save in gold and spend in fiat because gold holds its value far better than paper money or unloved IOUs.

Ignoring the Obvious

Although this should be obvious to literally everyone, almost no one understands gold (it accounts for less than .5% of global financial allocations).

But as we’ve warned for years, the broken, centralized DC system (as well as the RIA’s and the PWM teams of the TBTF banks) that controls your money (and media) doesn’t want you to understand this, as rising gold prices are proof of a declining nation, currency system and “safe” banking narrative.

Again, this should be obvious to everyone. The evidence is almost too simple.

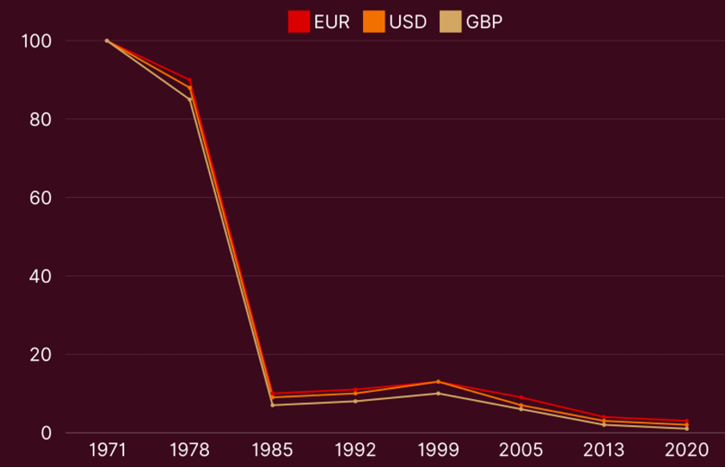

When measured against a milligram of gold, all fiat money has lost greater than 99% of its purchasing power since the USD decoupled from gold in 1971.

A 400-ounce bar of gold sold for $17,000 in 1971; today, the same bar sells for $1.14M.

Hmmm… See a currency problem?

Do you also see why the world’s traders, central bankers, mega-institutions and nations are increasingly seeking physical, allocated gold outside the banking and COMEX system to be held exclusively, physically and fully segregated in their own name—a practice and service we’ve been engaged in for decades in Switzerland?

Pet Rock? Really?

Or do you still think gold is just an outdated, analog pet rock poised to fall before all things modern, digital and “tech-evolutionary”?

Do you still think that BTC, with a triple-digit standard deviation and four maximum drawdowns of 80% since its 2009 birth, is a better store of value than gold, which has been money since 480 BC?

Do you still think crypto currencies are a truly “maverick,” “decentralized” and apolitical/anti-fiat magical bean, when the very BTC/Tether trade is literally a centralized, politicized and highly programable/trackable CBDC wolf in sheep’s clothing?

Such questions are for each to determine individually, but the recent and increasing COMEX gyrations, BTC centralizations and BRICS+ protestations would suggest with objective evidence rather than “gold-bug” drama that the world is stacking physical gold outside the banking system for a reason: Gold is more honest than paper, bytes and politicos…

We and our clients from over 90 countries have known this for decades.

Shouldn’t you?

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD