THE PHILOSOPHY OF DEBT, THE MATH OF PRECIOUS METALS

Market insights often come from unexpected sources.

One of Harvard’s most beloved and popular professors, for example, was not an economist, but the brilliant (and thus controversial) campus philosopher, Cornel West.

Professor West filled Harvard’s auditoriums with hundreds of awe-struck undergrads who marveled at his ability to break down Wittgenstein, Royce, Nietzsche and William James as others might rattle off stats for the Boston Red Sox or Newcastle’s odds in the Premier League.

Professor West took Harvard to intellectual heights not seen since Ralph Waldo Emerson’s infamous Divinity School Address.

These were perhaps the happiest days (and reading lists) of my academic life.

And one book West pushed us to read was “A Treatise of Human Nature,” by David Hume.

This was some pretty heavy stuff, all about Kantian notions of reality, perception, consciousness, and other matters which you might think have nothing to do with your wealth or a critical economic secret.

But philosophy is in fact riddled with names (Plato, Pascal, Hume, Descartes, Whitehead, Russell etc.) who were good at math.

From Philosophy to Economics—Hume’s Market Secret

David Hume, for example, wrote another very short book (essay?) in 1752 that was less about philosophy and more about economics.

It contained a profoundly simple market secret.

Entitled “Of Public Finance,” Hume’s thinking would later inspire Adam Smith’s infamous work, “The Wealth of Nations,” and guide the insights of other geniuses like Voltaire, Franklin and von Mises.

Specifically, Hume looked at the problem of debt, using case studies from the Roman Empire to the far-flung corners of ancient Mesopotamia to make his point (and market secret) sink in.

And what was his market secret?

Very simple: Debt destroys.

David Hume’s Market Secret in 2021—The End of “Luxurious Languor”

Some 269 years after Hume penned this seminal market secret, we now find ourselves in a worse-case “Hume scenario” when it comes to philosophy meeting reality.

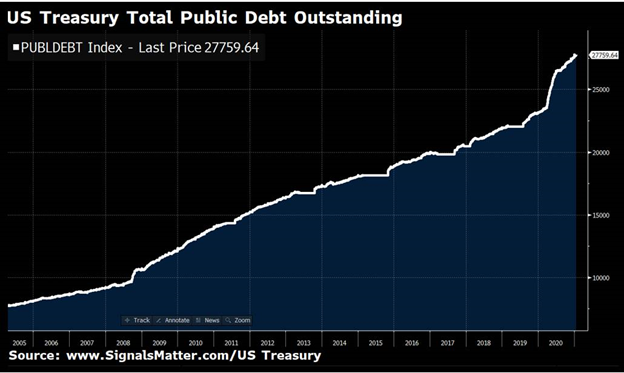

By the end of 2019, just moments before the Coronavirus made the headlines, the global economy in general, and the US economy in particular, were already at record levels of debt—well past the $260T global marker.

That was a problem.

Why?

Because as Hume (and countless other classical economists far brighter than myself) have warned: Whenever debt is used to enjoy a short-term “buzz,” the result is simply a long-term disaster.

The future is effectively mortgaged into pain while the present generation lives in what Hume described as a “luxurious languor.”

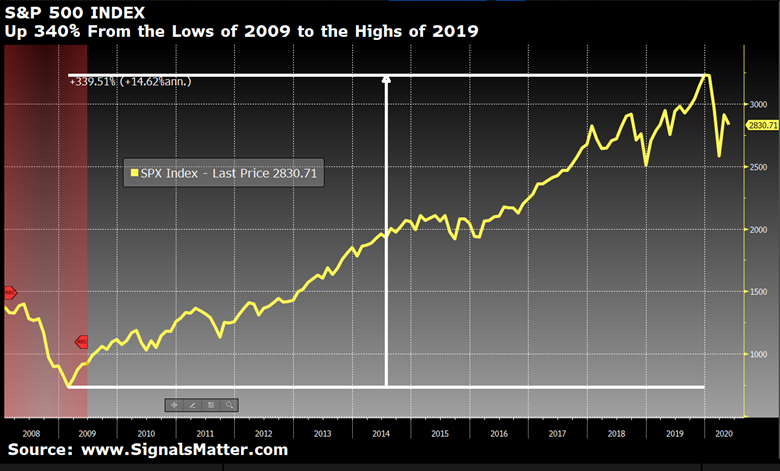

Needless to say, Wall Street in general, and the post 2008 “accommodated markets” in particular, had certainly enjoyed some debt-induced “luxury” as the following post-2008 market bonanza illustrates…

The pre-COVID S&P 500 Index rose by greater than 300% from the lows of 2009 to the highs of 2019 almost exclusively on the tailwind of, you guessed it: DEBT.

But even a global pandemic did nothing to slow down the S&P’s steroid (i.e. debt-driven) post-COVID rise either…

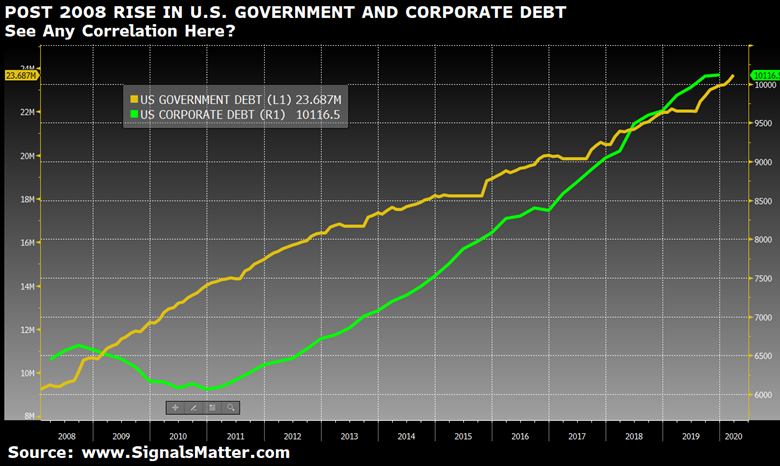

U.S. Government and Corporate Debt simply skyrocketed, as did the stock market.

See the correlation here?

In short: Most of these “luxurious” S&P points were paid for by corporate stock buybacks funded by low-rate debt and extreme government borrowing.

The folks at the big banks, or the various politico’s (red or blue), who never bothered to study economics (or frankly basic history), forgot to tell voters and investors that beneath the last 12+ years of “luxury” and “recovery” lies a market secret (and economic virus) of which Hume warned in 1752…

More is not More

Specifically, Hume said this of debt: “More is not more.”

That is, more debt does not create long-term growth; in fact, it mathematically destroys it.

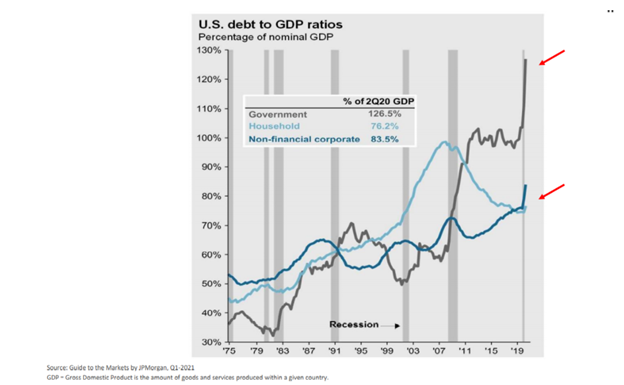

To confirm this market secret, one only needs to look at the history of what happens when government debt exceeds 50% of its income, or GDP. Once that ratio hits 50% of GDP, this is bad.

And when that ratio hits 90%, the economy loses 1/3 of its growth rate.

This is not just true some of the time. It’s true all of the time, because economics, when understood, is not an art; it’s a science.

Debt, when over-extended, always kills growth.

As of today, US government debt to GDP, at 126.5%, is well past the point of no return.

In short, when it comes to growth, the U.S. (and the EU) is simply screwed…

Japan proves this point as well.

It’s debt to GDP ratio has hit and passed the 225% mark and its economy has yet to see any growth worth noting since the Nikkei tanked in 1989.

The US will be no different.

Coming into the COVID disaster of 2020, the US debt to GDP ratio was already at 107%.

In 2019, we added $1 trillion to our deficit, and by the end of 2020, another $4 trillion, with far more debt ahead for 2021.

Crisis: Who to Blame?

Alas, the U.S., like so many “leading economies,” is in an undeniable debt crisis.

And there’s no argument at either an ethical, humane or even political level that emergency measures (all paid for by debt) were needed.

But here’s the rub: At an economic and historical level, we can’t afford these measures.

Hume’s market secret warns us that the next generation will pay for our debt (and questionable COVID policy measures) in ways now unimaginable.

But is it fair to blame policy makers for COVID surprises and COVID debt?

For Hume, the answer is yes.

Why?

Because our leaders, like the leaders of any family, were warned long ago to have what Hume described as “output gap protection,” i.e., what our parents would call a “rainy day fund.”

In fact, the US often kept such a rainy-day fund in place.

Eisenhower certainly did.

But everything went downhill when Nixon famously declared “I guess we’re all Keynesians now,” meaning we all ignored the market secret and became enamored by (addicted to) debt.

Our Love Affair with Debt

Why? Because debt is fun.

It buys a lot of shopping sprees and “luxurious languor,” from Wall Street to Main Street to Pennsylvania Avenue.

But Hume’s market secret reminds us that any nation that doesn’t produce and earn as much as it spends is heading mathematically for a real moment of “uh-oh.”

Hume warned policy makers to prepare for the “Uh-Oh” (rainy day)—which at his time included wars, natural disasters and diseases.

Sadly, our policy makers were not prepared; they were tapped out.

Once the debt to GDP ratio gets too high, every dollar of government debt produces less economic growth.

Going into 2020 and COVID, for example, the US was only getting 40 pennies of growth for every dollar of debt.

Then Came OUR Moment of Uh-Oh

With the COVID disaster (i.e., that inevitable “rainy day”), we were already drowning in debt.

Worse, the new debt we have taken on (and will continue to accrue) will lead to 20 pennies of growth for every dollar of new debt.

Uh-oh.

Needless to say, the US is now facing a massive “output gap.”

Even before the COVID crisis, the volume of world trade, which typically grew at a rate of 5% per year, was only at 0.5% — levels we’ve only seen 3 times in our history.

Global debt, now at an unbelievable $280 trillion, has tripled in just over a decade.

In short, our debt-drunk policy makers had made us weak well before the world got sick…

It’s shameful, though the IMF and others will never admit their own responsibility, pointing instead to COVID like a guilty child with his hand already in a cookie jar of debt.

Deflation to Inflation: Declining Growth & Investment Ahead

Increasing debt levels and pinning interest rates to the zero zone to encourage even more debt can indeed lead to deflation and low growth.

But with an inflationary twist (see below).

For now, the Fed literally has no choice but to keep rates at or near zero for the next 6-7 years, which means yields on longer-term bonds (1%-2% range) will remain anemic (with real yields negative) for a long-time coming, with a Fed-manipulated yield curve now mired (stuck to) the repressed over-night rates.

What About (Hyper) Inflation?

Many are wondering about rising inflation.

This is valid, given all the money printing that has been going on since 2008 in general and in the current COVID backdrop of unlimited QE in particular.

After all, when the Fed prints trillions of dollars out of thin air in a matter of weeks, inflation seems inevitable, right?

Well, that depends.

But inflation is coming. Here’s why.

The Fed: From Lender to Spender

The Fed (as per the Fed Reserve Act of 1913 and the revisions drafted by Carter Glass in the 1930’s) only had the power to provide loans; it did NOT have the power to spend—i.e. print money and directly allocate/spend it as it sees fit.

This is because the drafters of the Fed Reserve Act must have read some Hume back in 1913…

That is, Mr. Glass understood that if the Fed were given the power to print and spend, then, as Hume warned, we’d see snowballing inflation, rising rates and economic death—i.e. we’d become a banana republic much like the France of the 1790’s, Germany of the 1930’s, post-war Yugoslavia or something like 20th century Bolivia…

That would be very, very crazy, no?

Signs of Crazy?

But folks, perhaps you’ve noticed that central banks are slowly turning desperate—i.e. crazy.

Let’s look closer.

Perhaps you’ve already noticed how the Fed’s “power to spend” recently snuck in through the back door of the law and right past the bobble heads of the so-called financial “media.”

By creating a clever little special-purpose entity to act as an intermediary, the Fed in 2020 bailed out private corporate and other junk bond ETF’s—which in my mind is just a form-over-substance way of desperately giving itself the power to spend.

Uh-oh.

As Hume’s market secret warned, and history confirmed from John Law France (1720) to 20th century Weimar, that ends very, very badly.

By the spring of 2020, for example, the Fed was making direct purchases of bond ETF’s, and later of individual bond issuers.

Soon, they are likely to make direct purchases of stock securities, following Japan’s desperate lead.

That kind of spending to support otherwise broken markets increases the velocity of money, and as Hume warned, eventually increases the pace and scope of inflation, which is now off our doomed bow.

The Solution?

As Hume’s market secret (as well as basic math and economic history) confirm, once a nation passes the Rubicon of too much debt to income, more borrowing and money printing will never, not ever, lead to more growth.

Instead, it just buys a stagnate, Japan-like survival mode in which we see and experience increasingly diminishing returns for our debt orgies.

The tragedy of the COVID crisis (and its increasing wealth-disparity policy reactions which border on feudalism) will demand and require even more debt and more aid.

But, again, politicians are not economists, for if they were, they’d admit the truth of this market secret, and the truth is we are heading toward years of stagnation and higher inflation, which is hardly a winning campaign slogan.

The market secret of which David Hume told us in 1752 boils down to this: Debt can only be solved by austerity, namely living within our means.

But as a society, stock market and country, we have been living beyond our means for over a generation, which means our children’s generation will be suffering for the excesses of their predecessors.

Living within our means would mean less spending, less demand, less growth, less artificial bond support, less investment, less staggering market highs and (hopefully) less faith in fantasies.

Which means as we witness the Fed gradually exploiting the open power to spend (pure fantasy solution), don’t fall for it as a “solution”—not even for a second.

A Fed given the open power to spend is simply the first sign and symptom of greater inflation to come, the kind that destroys economies, as all hyper-inflationary policies have done, from Mesopotamia to 18th century Paris.

Precious Metals: Common Sense Preparation & Protection

Informed investors would thus be wise to consult Hume’s warnings as well as the basic laws of math and history.

Such insights serve better (in the long term) than the latest headlines of a financial media or Congress that more often resembles kindergartners at play than wisdom in motion.

More printed currencies and more direct spending (rather than just lending) from desperate central banks points historically toward rising inflation and hence continuing currency debasement.

Those playing the long-game (rather than just the putting green) of wealth preservation understand that commodities in general, and precious metals in particular, are an absolutely essential component of preparing for these slow-moving yet historically confirmed eventualities toward rising inflation and rising yields.

This inflationary trend, of course, might tempt some to shorting longer-dated Treasuries, but that means fighting a powerful (and powerfully dangerous) central bank—something I’d avoid for now, as the Fed still controls (i.e. distorts) the yield curve.

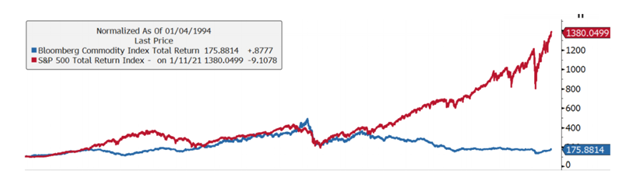

But commodities (blue line), for patient investors, are a far surer long-term bet than manipulated Treasuries, and a far better value than bubbled-stocks (red line).

Of course, physical gold is my favorite commodity in a debt world supported by fiat madness. Regardless of the daily price action, physical gold protects against the currency debasement well in play today.

In sum, and as history unfolds toward rising inflation, the smart money will be protected in the years ahead in the same way it has been protected for thousands of years before: With golden tones.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD