Powell’s Gettysburg Moment, the USD’s Waterloo & Today’s Open Madness

Below we examine the historical interplay of losing wars, cornered egos, tanking currencies, greater controls and gold’s loyalty in times of open madness.

History Matters

Despite the fact that universities even in the Land of Lincoln have had a say in cancelling Abraham Lincoln (good grief…) for apparently not being “woke” enough circa 1861 to be as wise as the neo-liberal faculties of 2023, I’d still make a case that history matters, and by this, I mean all its wonderful and ugly nuances (and lessons), whether they offend modern sensibilities or not.

History, of course, is full of desperate figures and times, many of which involve desperate economies followed by equally desperate (proxy) wars and desperate turning points.

In this light, the more things change, the more they stay the same. Just look around you…

And in the largely forgotten history of war, there is no shortage of desperate generals at desperate turning points.

Wars Doomed from the Start

Napoleon, who having previously won countless battles from Rivoli to Austerlitz, found himself shivering through an 1812 Russia after losing the vast bulk of his army to General Russian Winter and remarking to one of his generals that it’s “only a fine line between the sublime and the ridiculous.”

Three years later, at Waterloo, Napoleon’s “sublime” days (and countless casualty numbers) ended for good.

At Gettysburg, on the 3rd day of July, 1863, an equally talented and grossly outnumbered Confederate States Army under Robert E. Lee, having humbled Union forces at Manassas 1 & 2, Fredericksburg, Gaines Mill and Chancellorsville, looked across an open field from Seminary Ridge to the Emmitsburg Road strewn with the dying and dead of his once bravest divisions as the U.S. Civil War reached a mathematical turning point.

Despite this carnage, the war (post Pickett’s doomed July 3rd charge) dragged on for 2 more horrendous years (and countless casualty numbers), ignoring the hard math of waning troop numbers, supplies, cannons and horses which now rendered Southern “victory” impossible.

Less than a century later, this time near Stalingrad in the winter of 1943, the seemingly invincible German Wehrmacht, having conquered Poland, France, North Africa and large swaths of the East, found itself (and General von Paulus) facing the equally mathematical reality of what once seemed like impossible defeat.

By all metrics the Germans, having engaged in a two-front war, were done, but the war (and countless casualty numbers) would continue for two more senseless years.

But what do any of these examples of doomed and costly wars have to do with current global markets and our financial “generals”?

In fact, quite a bit.

Financial Policies Doomed from the Start

The overlapping interplay of human ego, hard math, and failed strategies doomed from the start have their place in both military and financial history.

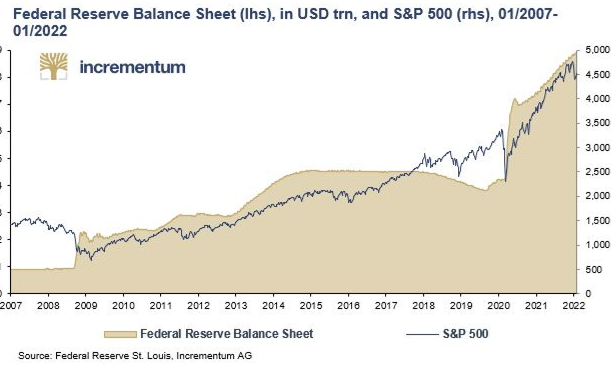

For example, once upon a time (circa 2008), our central bankers in general, and the U.S. Fed in particular, had the insanely bad idea that central banks could use fiat money created out of thin air to save bad banks, defeat recessions, manage inflation, monetize debt, win a Nobel Prize and ensure total employment with a “Pickett’s charge” of mouse-click money.

Such grand plans, like the promises of failed generals and insane wars of Lebensraum, la gloire de l’empire or the “Southern Cause,” were initially followed by a string of early “Austerlitz-like successes” (i.e., market bubbles) which brought near-term euphoria.

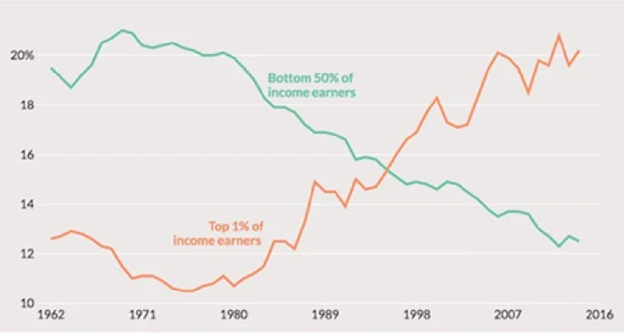

Unfortunately, those early and mouse-clicked victories ignored the longer-term realities/casualties, namely: historically unprecedented wealth inequality, grotesque currency debasement, the death of free-market price discovery and the birth of what amounts to little more than Wall Street socialism and market feudalism masquerading today as MMT “capitalism.”

Such short-term “glory” at the expense of longer-term ruin is a pattern all too familiar for those paying attention…

Emperor Powell, for example, thinks he can “win the war against inflation,” but like Napoleon, Lee and von Paulus, he is still unable to admit to himself (or us lieutenants) that his grand vision is doomed either way.

And so, he continues to desperately fight a losing cause at the expense of countless currencies and investors (casualties) around the world.

How can we know this?

It All Boils Down to Hard Math and Bad Options

As detailed in prior reports, the math speaks for itself.

Global debt levels are past their “Gettysburg moment”—there are no easy victories left once we start dealing in the quadrillions…

Whether Powell continues with QT or pivots to more QE, retail foot-soldiers here and abroad face either economic recession/depression or extreme inflation.

Pick your “victory” or your poison. I see both, namely: Stagflation

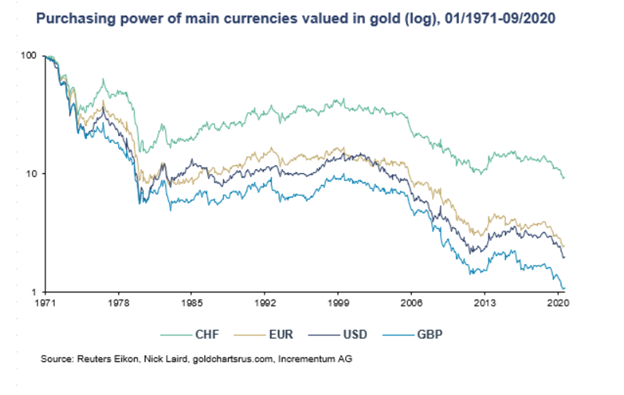

Equally serious is the inevitable demise of the USD’s purchasing power at home and the slowend of its hegemony in the world.

The Sad Fate of the USD

Regardless of whether the USD (DXY) rises or falls in the near-term, the end result is as inevitable and mathematical as Germany’s two-front war, Pickett’s charge or Napoleon’s Waterloo: Disaster.

Once stock and bond bubbles reach their tipping points, the last bubble to die is always the currency, which is precisely where our prize-winning (?) central bankers have placed us.

In short, and as shown below, the global economy and USD, led by Field Marshall Powell, is about to cross that infamously fine line from the sublime to the ridiculous…

The USD’s Sublime Last Moments

As in any losing war, however, there are always those clinging for hope, including those who think the USD will never, well…surrender. (In 2022, the British pound, the yen and the euro already caved…)

Recently, for example, the headlines, politicos, markets and perma-bulls were positively giddy over the stronger than expected US jobs report and non-farm payroll data. The DXY climbed in lock-step.

However, what was equally higher (60% higher…) than expected was the 2023 US Treasury borrowing estimate –aka: Uncle Sam’s increasing bar tab–$930B! –for Q1 alone.

Each of these data points has sent the USD temporarily higher, along with inflation expectations, which now seem to be embedded.

So, the big question today is this: Will the USD get stronger or weaker in 2023 and beyond?

There are two camps in this strategic debate, and two consequences depending on which camp is right. Neither are “victorious.”

Bad Scenario 1: A Rising Dollar’s Consequences

If the USD gets stronger, it kills just about every asset class but the USD…

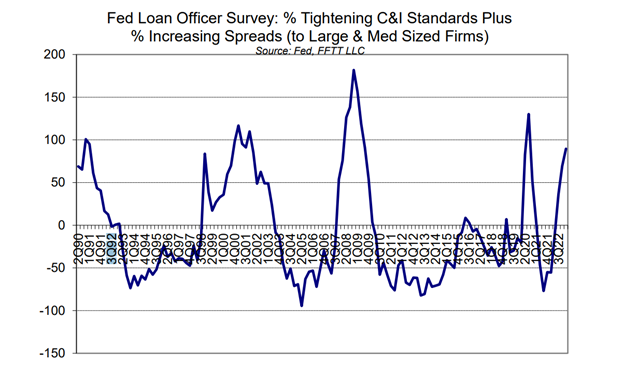

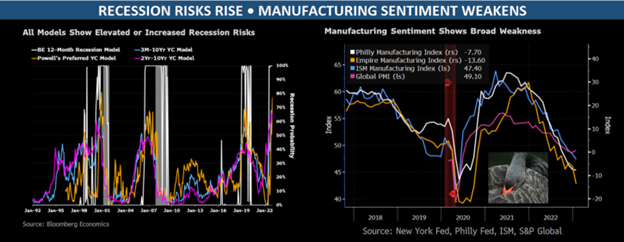

Already, we are seeing this open carnage in credit markets as rising rates and General Powell’s strong-Dollar policies cripple lending and borrowing norms of the past.

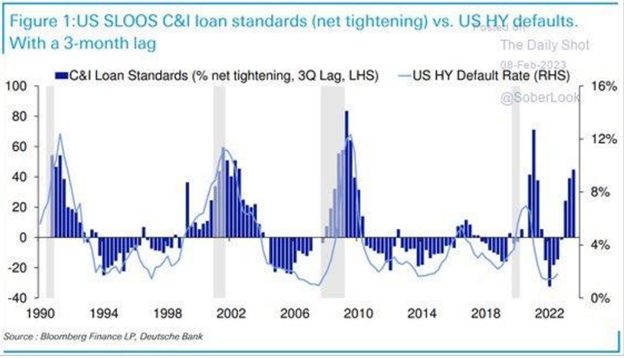

Loan officers are confirming a tightening of credit availability (and a widening of bank lending spreads, above) at levels only seen in prior recessions, adding more weight to my ongoing contention that the US is already in a recession, despite every Göbbels-like attempt in DC to redefine, cancel, ignore or downplay the same.

The equally dismal rise of defaulting High Yield bonds adds further proof of the slow (then steady) death of bleeding bonds in a rising rate and strong USD backdrop/policy.

A strengthening USD will send bonds down and hence yields and rates higher, which will be deflationary as debt-soaked America gets poorer and foreigners are forced to sell more USTs alongside a tightening Fed which is doing exactly the same thing—namely: Bond dumping and yield-spiking.

Bad Scenario 2: A Falling Dollar’s Consequences

However, if the USD gets weaker, the inflation we are already feeling will only get worse as $2T+ deficits make their steady climb North toward $3T, $4T or even $5T+ for 2023.

So, once again: Will the USD get stronger or weaker?

The answer lies in what signals (or desperate generals) you track or trust: Powell’s Fed or the UST market?

Trust What Powell SAYS?—Strong Dollar Ahead

If, for example, you follow the Fed and its bogus yet deadly-serious inflation narrative, then you will be lured into Powell’s “we must beat inflation” war cry, which boils down to a zero-sum battle-plan of “high inflation bad, low inflation good. Must beat inflation.”

Equally part of this bogus battle plan (Powell needs inflation and negative rates…) is the courageous meme that “rising rates kills inflation.”

Well… yes, but at what cost?

If Powell wins the headline battle against inflation, he loses the war for global credit markets, economies and political credibility, which loss will be immediately blamed on a virus and Russian bad guy but never on the mad generals who pushed us over the debt cliff.

However, if we get beyond linear headlines and two-dimensional thinking of central bankers like Powell, we quickly realize that the 3-dimensional UST market is perhaps the real (and superior) indicator of future probabilities.

Or, Trust What Bond Markets DO?—Weaker Dollar Ahead

Thus, rather than watch the Fed, I’m looking at bond markets to get my directional compass-North in a world of policy cannon smoke.

As said more times than I can count: The bond market is the thing.

And as for the sovereign bond market, it has seen 3 periods of complete dysfunction in recent years, namely: 1) the repo rate spike of September 2019; 2) the March 2020 “Covid” crash, and 3) last October’s gilt implosion spawned by the rising USD.

Those who follow the Fed (and this is entirely understandable given that the Fed IS the market in our post-2008 centralized nightmare) can’t be blamed for therefore expecting the USD to rise on more tightening and Powell “inflation-fighting.”

But those who follow the Fed are also ignoring those 3 bond market cracks in the ice above.

It’s my view that this ice is about to break if we have a 4th “uh-oh” moment/crack in sovereign bonds.

Thus, rather than follow the Fed, we might be wiser to look at the UST market, which is heading precisely in that “uh-oh” direction unless someone (i.e., Yellen?) pushes another meme—namely more toxic liquidity and thus a weaker USD.

But as previously argued, either way we are doomed…

Failed Battle Plan 1: Tightening into a Debt Crisis (Stronger Dollar)

Let’s play out the Fed’s current scenario first.

If we look only at what the Fed says, and it tightens, which, for now seems like the plan for Q1 and Q2, the USD will strengthen, yields and rates (5% to 5.25%) will rise further and the UST market will see such a wave a selling (foreign and QT Fed-driven), that a fourth “uh-oh” moment in the sovereign bond market will be inevitable, and likely enough to not only “crack the ice” of global bond markets, but drown everyone skating above it.

Given these realities and risks in the UST market, risks which even a fork-tongued and totally cornered Jerome Powell understands, I see no realistic way forward other than a weaker USD and thus a move from QT to QE.

Why?

Again: Because I’m taking my signals from the bond market not Powell.

To track (and trust) Powell means a tanking US Treasury and fatally rising rates, which is like kryptonite to America’s debt-based “accommodation” model.

Instead, I believe Powell will be forced to strategically consider the fact that this inflation war has killed his army of USTs and hence force him (at Yellen’s direction) to change tactics.

Or stated more simply, just as Napoleon, Robert E. Lee, and even the Wehrmacht learned that no outnumbered army can win an extended war, Powell will discover that no sustained policy of rising rates can end well for the toxic bonds/IOUs which float a bankrupt nation.

In short: Unless Powell weakens the USD and injects more QE liquidity sometime in 2023, his victory over inflation will be at the expense of America’s life-blood—namely the UST market.

Failed Battle Plan 2: Resort to More Mouse-Click “Miracles” (Weaker Dollar)

At the end of the day, and despite all this “beat inflation” rhetoric from Powell, it is my admittedly contrarian and unpopular (don’t say “gold-bug”) view that saving Uncle Sam’s IOU lifeline (i.e., the UST market) will take strategic priority over “beating inflation.”

By the way, this appears to be a view shared by none of other than that Corps Commander of toxic liquidity herself: General Janet Yellen…

In other words, expect an eventual (not immediate) capitulation to more fake money—aka, QE, i.e., “liquidity.”

This means that despite gyrating USD moves and hence DXY flip-flops today, the only direction and choice in the longer term to beat a recession and save Uncle Sam’s IOUs is a weaker not stronger Dollar.

Ultimate End-Game? Blame, Reset and Centralized Control

A weaker USD will buy time (and USTs) until ultimately the developed economies of the world, which in fact have the balance sheets of banana republics, finally realize that there’s still nothing left to save them but a great big “reset”—i.e., a global Chapter 11 or Economic “Versailles Treaty.”

The need for this “re-set” will, of course, be conveniently blamed on Putin and Covid rather than the central bankers (failed generals) who caused this horrific war on real money, sustainable debt and sound fiscal spending years ago.

At that point, history will remind us that lost wars and failed policies always devolve into more centralized controls masquerading as governmental “guidance,” payment efficiency and “democratic” leadership, nicely encapsulated in that toxic new direction of Central Bank Digital Currencies and a more Orwellian new normal…

But I digress…

How to Position Yourself?

Switching from military to equestrian metaphors, I argued in 2022 that investors, like polo players, need to think where the ball is headed, not where it lies currently.

Regardless of what Powell says today, the real play is 3 to 4 moves ahead, which all point toward an inevitably weaker USD and thus an inevitably rising gold price.

Powell, of course, is more politician than economist, and central banks like the Fed are anything but independent.

As such, Powell, DC and the creative math and fiction writers at the BLS will continue to do what all politicians (or losing armies) do when things are going against them: Lie.

Thus, the DC creative writers will continue to fudge, distort and “tweak” the CPI data to mis-report true inflation as nearly “beating expectations,” thereby allowing Powell to save face in a losing “war against inflation” while Lieutenant Yellen quietly pushes a weaker USD narrative to save the UST market (i.e., prevent more foreign UST dumping).

This face-saving policy will then allow the US to do what it does best: Borrow, spend and go deeper into inflationary debt spirals.

The Pesky Human Factor

Based on bond market Realpolitik, the probabilities point toward a liquidity pivot and weaker USD, longer term.

But history also reminds us that power-drunk figures don’t like to admit defeat. Their egos get in the way of rational decisions.

Powell, who desperately wishes to be remembered as a Napoleonic Paul Volcker rather than a comical Arthur Burns, is no exception to such human-all-too-human small-mindedness.

Unwilling to accept a Gettysburg moment that originated with Colonel Greenspan, General J. Powell could indeed push too far and too long with rising rates, a stronger USD and tanking bonds until inflation and everything else is destroyed.

We can only wait and see.

The Gold Factor

Whether on battlefields or economic cycles, man’s history of the absurd and his disloyalty to the many for the benefit of a few is nothing new under the sun.

In short, chaos eventually rears its head.

Powell or Yellen, QT or QE, inflation to deflation, left or right, Davos or DC, the chaotic results are always the same: Currencies and markets die, opportunists, lies and controls increase and the little guy (and common sense) gets trampled, drafted or “cancelled.”

Physical gold, of course, loves chaos and offers far greater loyalty to those who put their trust in this natural metal rather than flimsy paper money and the even flimsier promises from on high.

So which form of money will you trust to preserve your wealth?

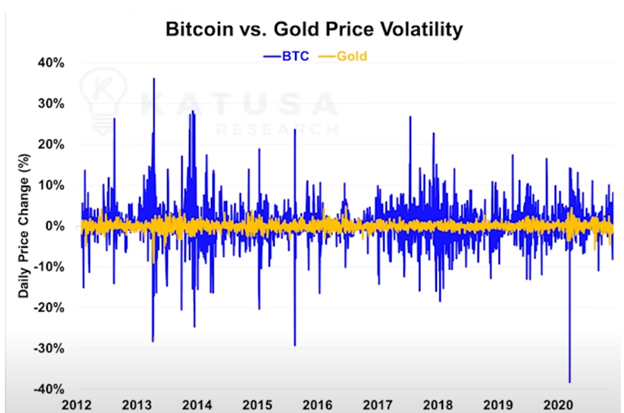

A digital and speculative “coin” promoted by human cons that is anything but stable?

A fiat currency that is losing its purchasing power by the second?

Or a naturally finite monetary metal with infinite duration born from the earth rather than an anonymous code writer or over-heating printer?

The choice, of course, is yours.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD