Gold, Oil & Global Currencies Entering a Watershed Moment

Below we look at the math, history and current oil environment in the backdrop of a global debt crisis to better predict currency and gold market direction without the need of tarot cards.

Seeing the Future: Math vs. Crystal Balls

Those looking forward only need to look at current and backward math to make relatively clear forecasts without risking the mug’s game of deriving crystal ball predictions.

Not surprisingly, the theme and math of simple (as well as appalling) US debt levels makes such forward-thinking almost too simple.

The Oil Issue: Is Anti-Shale Anti-American?

Although not as fluent as others in the oil trade or the green politics of the extreme US left, I’ve argued in prior reports that the current administration’s anti-shale policies make for some good (debatable?) environmental chest-puffing while ignoring the math, history and science of sound national as well as well as global thinking.

(But then again, the entire woke fiasco of current US policy seems to be on a crusade to cancel such things as math, history and science; so, thinking contextually or globally is beyond their sound-bite-driven stump-speeches.)

Oil, however, still matters.

And when understood in the broader context of the macro-economic themes we’ve tracked for years–namely debt, currencies, inflation, gold, a cornered Fed and a weaponized USD–the current and future trends are already in motion.

And as for the endless debate as to global warming, butterfly-friendly energy policies and the simple reality of fossil fuels as a part of, rather than threat to, our planet, I’m certainly not here to answer or solve the same.

Certainly the Germans (and their solar powered ideas in a part of Europe with very little sun) are not getting it… In fact, they are getting much of their (nuclear) energy from France and are now forced to burn coal to get through the winter.

I am here, however, to lay down some objective facts and ask some blunt questions.

Oil Politics

Biden, it seems fairly clear to all, is not in charge of US policy.

That’s a scary fact. Even more scary, however, is determining who is in charge?

Again, not something I can answer.

But if he were in charge, we’d all be amused to ask how he expected Saudi Arabia to welcome him and his embarrassing pleas for Saudi production increases (to ostensibly ease inflated US fuel costs) after previously telling the world he considered Saudi Arabia a pariah state…

We all remember that embarrassing fist-pump with the Crown Prince.

Meanwhile, Saudi is now spending far more time with the Chinese and Iran…

We’d also love to hear the White House explain how it expects increased US shale production to reduce energy inflation when it has been simultaneously seeking to legislate oil off the American page.

Furthermore, it would be worth reminding Americans and politicians tired of inflated fuel prices that the vast majority of those inflated pump costs are due to US taxes per gallon, not Saudi production cuts.

But I digress.

Oil Math

At the current levels of US oil production and exploration, the US (according to its own Dallas Fed) will have to engage in annual energy price inflation levels of 8-10% just to keep the oil industry’s lights on at a breakeven price level.

Such conservative inflation figures for oil/fuel pricing, when seen in the context of over $31T in US Federal debt, basically means that Uncle Sam’s ability to cover his ever-increasing public debt burden will weaken by at least 8-10% per year at a moment in US history where Uncle Sam needs all the help, rather than weakness, he can get.

Fighting Inflation with Inflation, and Debt with Debt?

Needless to say, the only “solution” to these inflated debt burdens will be the monetary mouse-clicker at the Eccles Building, whose doom-loop (yet now ossified) “solution” to addressing inflated oil prices is the even more inflationary policy of printing more fake money to “fakely” cure an inflation crisis.

You really can’t make this stuff up.

Fed monetary policy, ever since patient-zero Greenspan sold his soul (and sound-money, gold-backed academic thesis) to Wall Street and Washington, boils down to this: We can solve a debt crisis with more debt, and an inflation crisis with more, well…inflation.

Does this seem like “sound monetary policy” to you?

Or, Just Export Your Inflation to the Rest of the World?

But as I’ve warned for years, Uncle Sam’s first instinct (as holder of the world reserve currency) whenever handed a hot-potato of self-inflicted inflation, is to hand it off to the rest of the world—i.e., to export his inflation to friends and foes alike.

Global energy importers in Europe, emerging markets, India, China, and Japan, for example, are facing what accountants call a balance of payments crisis, but what I’ll bluntly call by its real name: A currency crisis.

That is, under the current, but potentially dying petrodollar system, these countries will need more USDs to buy oil.

But that’s where the problem lies.

Why?

Simple: Those USDs are drying up (unless more are printed).

How Long Will Global Currencies (& Leaders) Remain Prisoner to the USD?

Regardless of whether you believe in the perpetual hegemony of the USD as a payment system or not, we can all agree that USD liquidity is drying up (whether it be from the milk-shake theory absorption in euro-dollar and derivative markets or from post-sanction de-dollarization).

Nations facing the double whammy of needing more USDs to pay for inflated oil prices and inflated USD-denominated debts around the globe are going to being crying “uncle!” rather than just “Uncle Sam.”

What can these nations do in the face of that bullying hot potato known as the USD? How can they service these increased USD payment (oil and debt) burdens?

How the US Creates a Global Currency Crisis

Well, short of turning their backs on the USD (not yet), the only current option other nations have is to devalue (i.e., inflate and debase) their own currencies at home, which is how Uncle Sam makes his problem just about everybody else’s problem…

As I often say, with friends like the US, who needs enemies?

Something, however, has to give.

How Physical Gold Offers Better Pricing than Fiat Dollars

This clearly broken system of the US exporting its inflation upon a world forced since the 1970’s to import oil under a broken and inflationary Greenback has a genuine potential to implode.

Already, countries like Ghana have realized that it’s better to trade oil in real gold rather than fake fiat dollars.

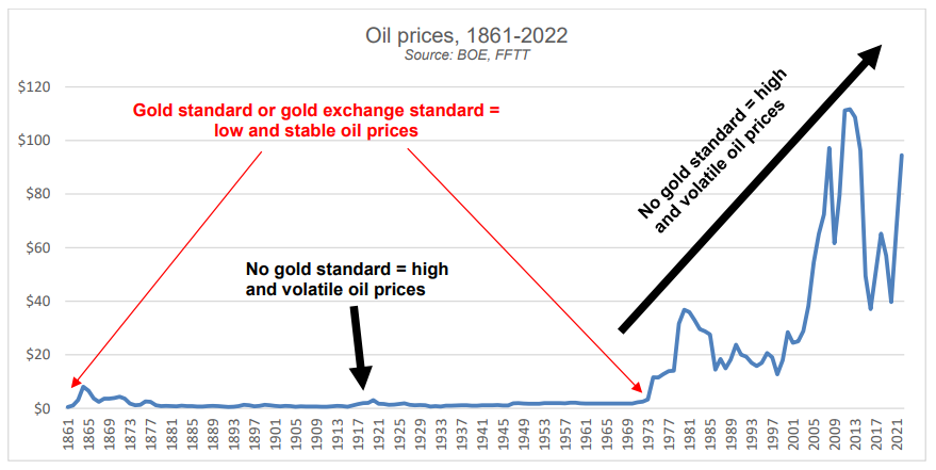

Long before the petrodollar became the mad king, for example, history recognized that physical gold was a far better instrument of payment to settle stable oil pricing.

See for yourself.

As more and more of the world recognizes the currency crisis slowly in play now, and then steadily in greater pain tomorrow, this “Balance of Payments” (i.e., currency) crisis can easily evolve into a “change of payments” reality in which gold re-emerges as a superior payment system for oil.

Think about that.

More Tailwinds for Gold

As of this writing, the physical oil markets are greater than 15X the size of the physical gold markets on an annualized (USD) production basis.

If the world turns slowly (then all at once?) toward settling oil in gold (partially or fully) to avoid a global currency crisis, gold will have to be repriced at levels significantly higher than current pricing.

Hmmm.

Something worth tracking, no?

Well, the Zeitgeist suggests that we are not the only ones tracking these trends…

The Central Banks Are Catching On to (and Stacking) Gold

A recent pole of over 80 central banks holding greater than $7T in FX reserves indicated that 2 out of 3 polled strongly believe that central banks will be making more, not less, purchases of physical gold in 2023.

Again: Are you seeing a trend? Are you seeing the context? Are you seeing why?

As I’ve said countless times and will say countless times more: Debt matters.

Debt matters because debt, once it crosses the Rubicon of insanity and unsustainability, impacts everything we market jocks were supposed to have been taught in school and in the office—namely bonds, currencies, inflation and recessionary cycles follow debt cycles.

In short: It’s all tied together.

Once you understand debt, the policies, reactions, weaknesses, truths, lies, and cycles are far easier to see rather than just “predict.”

The increasing loss of faith in the world reserve currency and its embarrassing IOUs (i.e., USTs) is not merely the domain of “gold bugs” but the simple and historical consequence of the blunt math which always follows broken regimes, of which the US is and will be no exception.

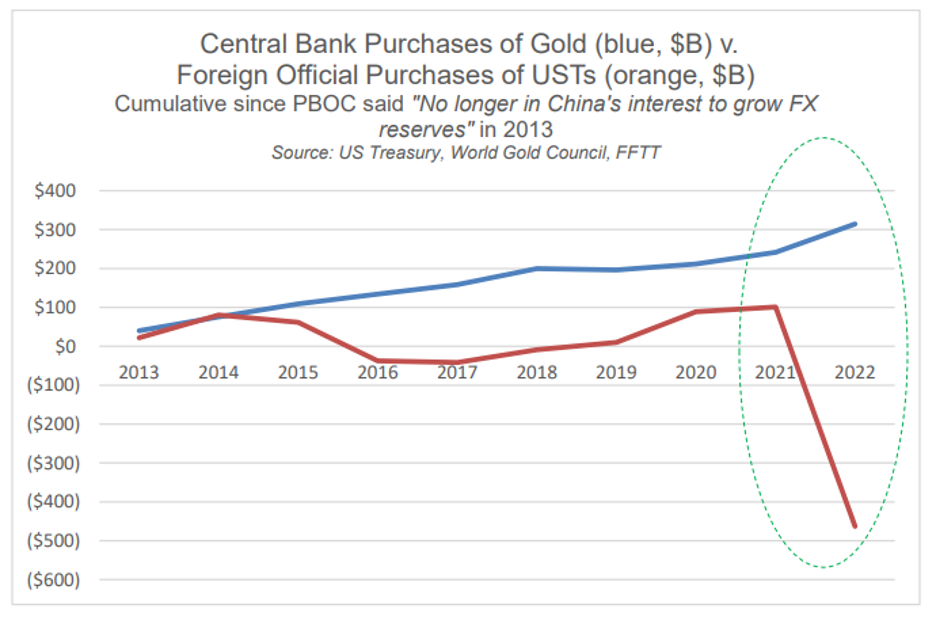

The graph below, is thus worth repeating, as the world is clearly turning away from Uncle Sam’s drunken bar tabof debased dollars and IOUs toward something more finite in supply yet more infinite in duration.

Again: See the trend?

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD