GOLD WILL RISE BY MULTIPLES

THE CASE FOR GOLD IS INCONTROVERTIBLE

As Eastern and Southern Central Banks substantially increase their gold holdings, Western Central Banks will most probably have little physical gold in their coffers.

Total global gold reserves allegedly held by central banks (37,000 tonnes) are valued at $3.1 trillion at the current market price of $2,700.

That value is absurd when one US company – Microsoft – has the same valuation. Just think about it: Microsoft is as big as the gold backing of the global financial system.

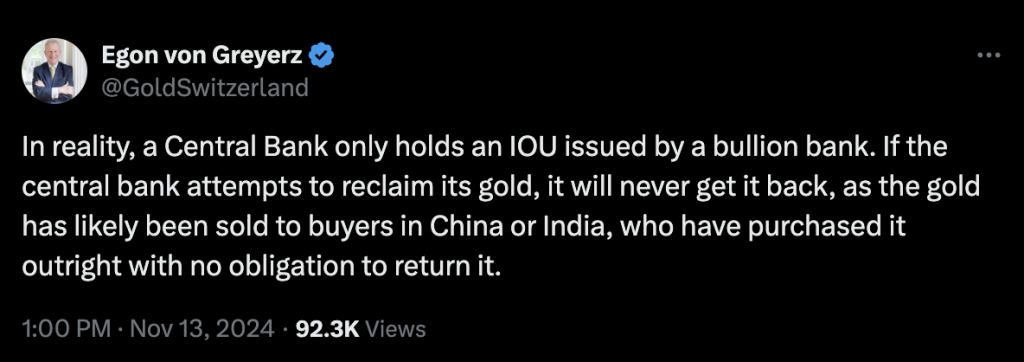

Furthermore, Western central banks have most probably hypothecated and re-hypothecated (lent, leased) their gold several times via bullion banks. That gold will never come back.

Consequently, CBs is heavily short on gold and will be badly squeezed as the gold market becomes disorderly.

The combination of Eastern/Southern Central Bank gold buying and all CBs replacing their dollar reserves with gold will lead to unprecedented demand for gold for many years. More gold cannot satisfy this demand since the current gold mine production of around 3,000 tonnes cannot be increased.

Thus, the substantial increase in physical gold demand can only be satisfied by much, much higher prices.

This is why gold will rise by multiples.

This article could stop here. You must know the above to understand why gold will be significantly revalued. Still, the article contains a lot of interesting material explaining THE INCONTROVERTIBLE CASE FOR GOLD, so I recommend you read on.

Just look at the chart above, which shows the relentless bull market in gold since 1971, going up 78X since Nixon closed the gold window.

As I have stated in many articles, gold is now in its exponential phase.

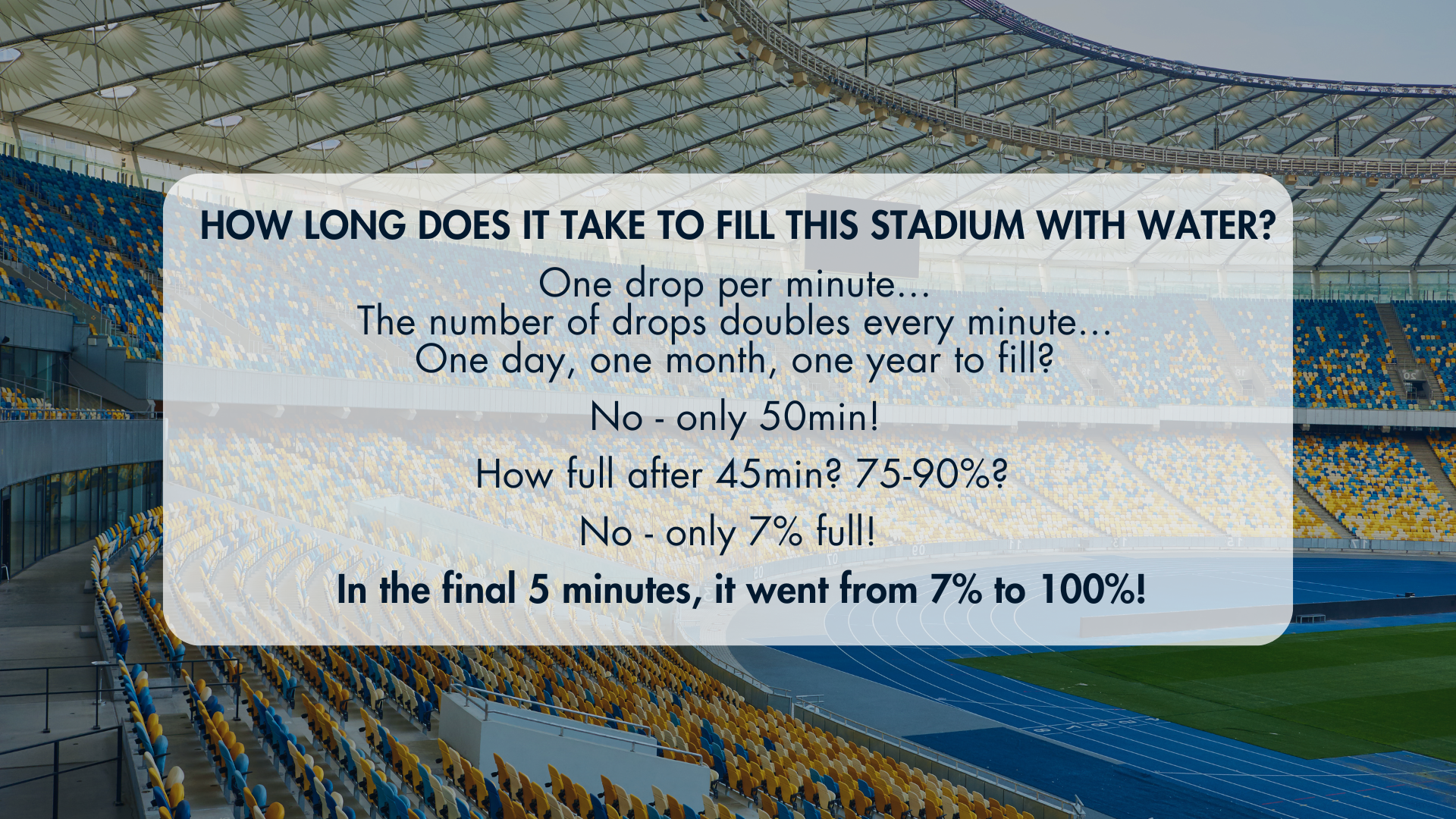

I have shown my illustration of what exponential means with this picture.

They make it clear – gold is now in a phase when the price will go up by MULTIPLES.

Since the mid-1990s, I have been convinced of the importance of gold for wealth preservation and investment.

I started my first job in Swiss banking in 1969 and experienced Nixon’s 1971 closing of the gold window. The consequences of Nixon’s “temporary” action were spectacular, as gold went up 24X between 1971 and 1980.

MAJOR GOLD SELLING BY WESTERN CENTRAL BANKS

A long correction followed after 1980, and gold finally bottomed out at $250 in 1999. In the late 1990s and early 2000s, Many Western central banks liquidated part or all of their gold holdings. Countries like the UK, Switzerland, and Canada halved their holdings in that period, and Norway sold all its gold.

One of the best signals of a gold bottom was the Bank of England and Swiss National Bank selling over half of their gold near the lows.

This central bank selling almost 10,000 tonnes was another sign of their total incompetence. As I have often argued, financial markets would function much better without these politicised bureaucrats. Natural forces of supply and demand are the best regulators on earth.

History tells us that gold should never be sold.

If politicians and central bankers ever studied history, they would know that no paper money has ever survived, ever, ever.

All papers of fiat money have always been destroyed by governments, without exception. Today, this is achieved by credit expansion or “money printing”.

When gold or silver was money, the precious metal would be diluted by other metals like copper or zinc.

Physical gold is for wealth preservation and the protection of purchasing power.

As Ralph Waldo Emerson said:

GOLD IS FOR FREEDOM AND BENEFIT

FORT KNOX HOLDS “NOTHING BUT MOTHS AND HALF-EATEN IOUs”

Vincent Lanci of GoldFix recently wrote the above article:

Vince published the article here. He starts by quoting my Tweet:

He goes on to say:

“Bold claim, right? He’s not wrong.

Bottom line with regard to Ms. Shelton’s call to monetize our Gold by throwing it out on the yield curve (with which we agree) there is no way you can do it honestly if you wanted to.

We’d wager no Gold is there at all. Anyway, there is much less Gold in Fort Knox than people think, which brings us to Pozsar’s predictive analysis.“

He goes on to quote the revered Zoltan Pozsar’s article:

Banks have been managing their paper gold books with one assumption, which is that [Nation] states would ensure gold wouldn’t come back as a settlement medium.”

The above article is really worth reading, and it confirms my initial statement in this article that Central Banks have hypothecated gold to the extent that, if attacked by Russia and China, would collapse the Western Central Bank and LBMA (London Bullion Market Association) cabal.

GOLD UP 11X IN THE 2000s

So here we are 24 years into the 21st century, and gold is up 11X in US dollars and more in many other currencies.

Between 2001 and 2011, gold rose 8X with no single down year.

Then, there was a 3-year proper correction from $1,920 in 2011 down to $1,046 in 2016.

Since 2016, gold has gone up for 9 years, including three sideways years.

The chart speaks for itself.

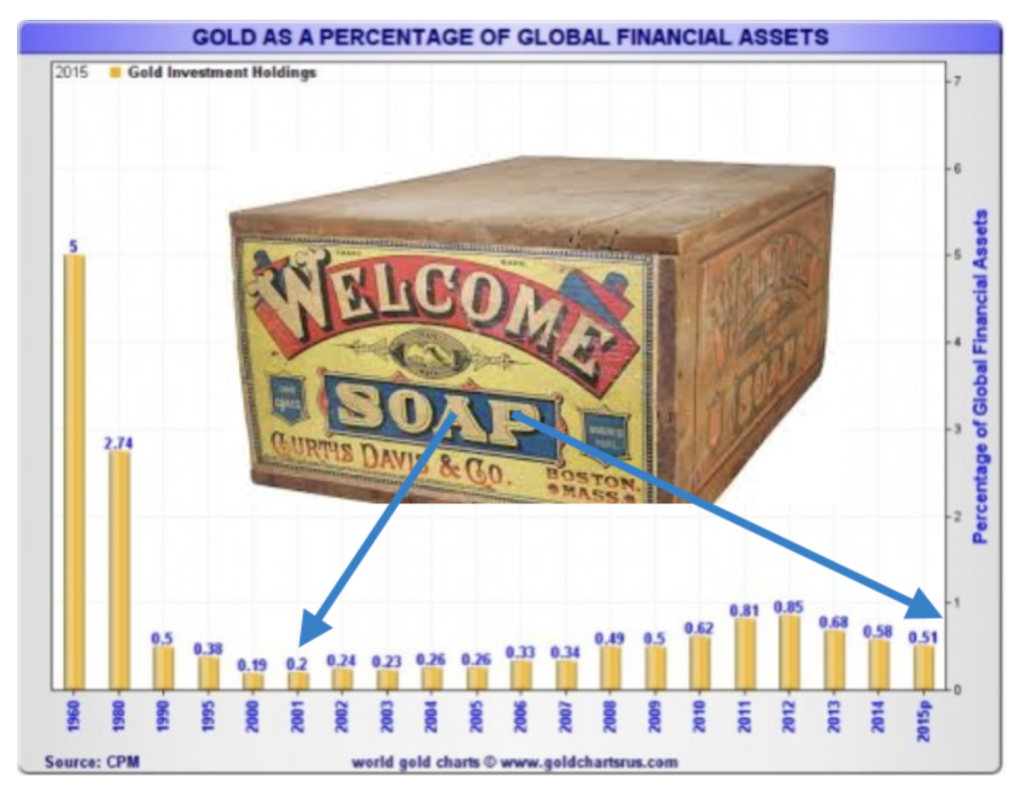

In the last 24 years, we have seen an incredibly strong bull market in gold, with virtually no one participating. Still, only 0.5% of global financial assets are invested in gold, so virtually nobody understands or invests in it.

As the graph below shows, gold has gone from 0.2% of global assets in 2001 to 0.5% today. During that time, I have been standing on a soapbox explaining the importance and virtues of gold, even in my father-of-the-bride speech in 2002. Still, very few own it.

GOLD IS ONLY 0.5% OF GLOBAL FINANCIAL ASSETS

GOLD HAS VASTLY OUTPERFORMED STOCKS IN THE 2000s

With a similar bull market in stocks, which has been the case in most of the 2000s, no investor would have been out of the stock market.

Still, gold has vastly outperformed stocks in this century.

For the last 24 years, the S&P 500, with dividends reinvested, has risen by 572%.

Gold is up 990% for the same period with much less volatility.

Gold ownership is like a hidden, well-guarded secret. Very few, not even professional investors, know that gold has gone up 1,000% or 11X in this century.

Still, very few own gold, and even fewer are aware that gold fulfils the dual function of being both the ultimate protector and ultimate enhancer of your wealth.

If you own gold, you never have to worry about the price. Because on your side stand governments and central banks who will always support gold by creating an endless amount of new money, thus expanding debt and the money supply. This guarantees the continuous debasement of paper money, directly reflected in the gold price.

Only since 2000 has the US dollar lost 92% of its value in real terms – GOLD.

History proves that gold over the medium to long term always reflects the government’s irresponsible and opportunistic management of the country.

Governments always spend money that doesn’t exist in a futile attempt to placate the people and buy votes.

GOLD SUBSTANTIALLY UNDERVALUED

Let’s look at a breakdown of all the gold that has ever been produced in history.

The cube below gives a good picture.

Only 201,000 tonnes of gold have been produced in history. All this gold is assumed to be still around, although some might be at the bottom of the sea and some hidden forever.

Just under half, or 93K tonnes, have been used for jewellery.

But now come the very important figures.

Only 43T tonnes or $3.6 trillion in private investment gold.

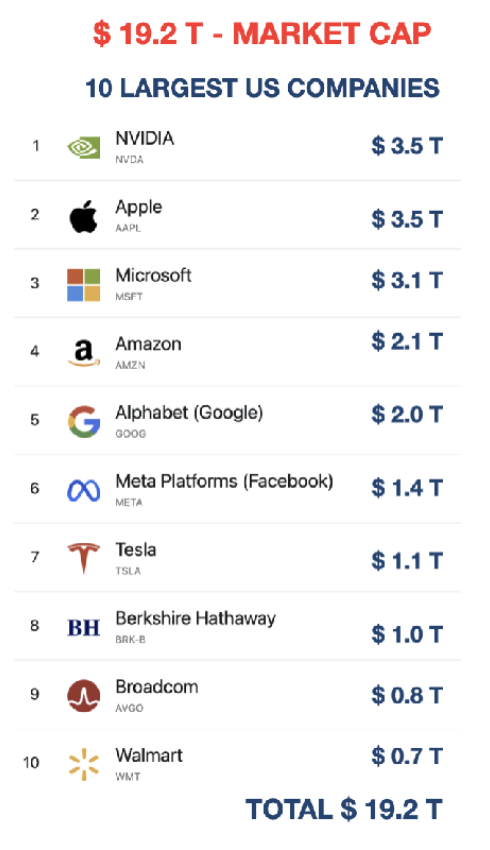

If we compare that to the biggest US companies, only NVIDIA has a market cap of $3.5 trillion, and so does Apple.

Even more astounding is that all the gold held by central banks globally is just $3.1 trillion, which is Microsoft’s market cap.

So, the shareholders of Microsoft could swap their shareholdings against all the Central Bank Gold in the world.

I doubt the central bankers would sell their countries’ gold at the current price, but we shouldn’t put it past them. As mentioned above, they have often sold gold at the bottom and against fiat money.

As all paper money has gone to ZERO throughout history, it clearly can’t be real money.

It is only a claim or an IOU issued by your government. Remember what the banker JP Morgan said:

THE DOLLAR ON ITS WAY TO ZERO

As all government debt always increases over time, we know that this debt will never be repaid. Instead, it is inflated away by the constant printing of new worthless paper money and debt until it becomes worthless, which is a de facto sovereign default.

Remember that this has happened to every currency in history without exception.

Since Nixon closed the gold window in 1971, the dollar and most currencies have lost 99% of their value.

The total market capitalisation of the top 10 US companies is $19.2 trillion.

Let’s look at the cube above again. At today’s price, all the gold ever produced in history is at today’s price worth $17 trillion, $2 T less than the top 10 US stocks.

GOLD UNDERVALUED BY MULTIPLES

When all the central bank gold in the world is valued at the same price as one major US corporation, we know that this is an absurdity.

The stock market is currently overvalued.

As our friend, Bill Bonner recently wrote in his wonderful style:

“Sooner or later, the lava flows of red-hot credit are going to meet up with the cold reality of rising interest rates. When this happens, most likely, stocks, bonds, and real estate will all be buried, like Pompeii.

Some investors will take a Big Loss. Big deal. Markets are correct all the time. But we’re not making predictions. We’re just looking for the worst-case scenario. And it could be far worse than just a market sell-off.”

What Bill states above is inevitable.

And gold’s coming rise by multiples is a “Sine Qua Non” (absolute prerequisite).

In numerous articles, I have stated the reasons for gold’s acceleration in price.

In my article WE HAVE LIFT-OFF in March this year (when gold was $2,000), I said:

“YES, GOLD IS ON THE CUSP OF A MAJOR MOVE AS:

- Wars continue to ravage the world.

- Inflation rises strongly due to ever-increasing debts and deficits.

- Currencies continue their journey to ZERO.

- The world flees from stocks, bonds, and the US dollar.

- The BRICS countries continue to buy ever bigger amounts of gold.

- Central Banks buy major amounts of gold as currency reserves instead of US dollars.

- Investors rush into gold at any price to preserve their wealth”.

And back in August, I said: $1 MILLION GOLD PRICE AND EXCHANGE CONTROLS:

“DOLLAR, GOLD AND EXCHANGE CONTROLS

As I have outlined in this article, a continued and steep dollar decline in the coming years is a virtual certainty.

As there has been no gold window to close since 1971, the US government is almost certain to implement foreign exchange controls as the dollar falls. I wouldn’t be surprised if it comes relatively soon, but the timing is irrelevant. The risk is here today, and now is the time to prepare for it. Thus, for Americans, it would be an advantage to have funds or assets outside of the US as soon as possible. Physical gold and silver are clearly the best assets to hold as they also protect against the dollar debasement. Switzerland and Singapore are obvious places to hold gold. Switzerland has a strong currency and a very sound economy. Exchange controls would be unlikely here. What is extremely important is not to hold your precious metals through a US company or other entity, which the US government can order to return the gold or silver from a foreign vault to the US.”

However, as has been pointed out relentlessly, gold is undervalued by multiples.

I have also warned that we will not have a 2008-type correction in the gold price for quite some time. But some so-called experts have, for most of this year, warned gold investors that this would happen. Thus, virtually no private investor has bought gold this year in the West. But non-Western Central banks, the astute Chinese, and the BRICS countries have. This strong buying will continue to drive the gold price up by multiples in the next few years.

MOST PRECARIOUS GEOPOLITICAL SITUATION IN HISTORY

Finally, the geopolitical situation is more precarious than ever in world history due to both the Middle East and Ukraine crises.

The deep state or neocons who steer Biden are doing everything they can to start WWIII by provoking Russia with US and UK missiles sent from the UK in the remaining 8 weeks before Trump takes over. This is totally ludicrous and irresponsible by an unaccountable and anonymous group of people who cannot stand that the US is losing its hegemony.

Let’s hope that the superiority of the Russian Oreshnik missiles just fired has made the US military and the world realise that this is a conflict that the US, NATO and the world can only lose.

Let’s also hope that the world gets to January 20, 2025, without any serious escalation.

Trump clearly is determined to solve the US problems, as he declared in this video.

About Egon von Greyerz

Egon von Greyerz

Founder and Chairman

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD