Gold Shines as Private Equity Goes Dark

Is private equity (PE) going dark?

And what does this have to do with gold?

In fact, the answers are becoming harder to ignore.

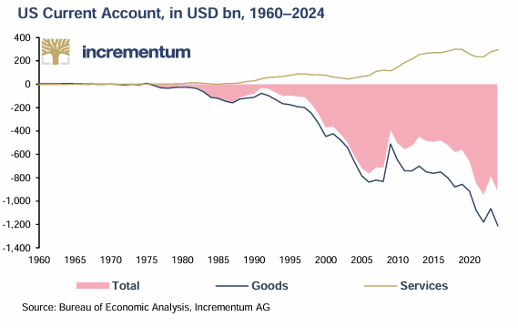

Understanding gold’s rise in the context of macro-economic forces—i.e., historically unprecedented debt levels, oversupplied and under-demanded USTs and the consequent rise in yields/credit costs – helps us place a range of other asset classes, including private equity, into sober perspective.

Private Equity Going Dark?

As in all financial niches, there are the good, the bad and the ugly.

Many PE firms across the nation have been rightfully lauded for buying decent companies at fair to unfair (or even bloated) valuations, providing business owners (from shoe stores to biotech) with profitable exits, and PE investors with solid returns.

When rates were low and money was free and liquid, the PE space boomed with good and bad intentions yet undeniably solid returns.

The Cambridge Associates US Private Equity Index has pooled an annualized net return of 12.77% in the last 25 years.

But the boom era for private equity is now coming to an objective yet largely ignored turning point as credit tightens, yields rise, and liquidity (i.e., PE exit strategies/sales) dry up in a nation objectively entering a credit/liquidity crisis.

And remember, EVERY financial crisis is at root just that: A liquidity crisis.

This turning point in the credit cycle matters in a financial landscape where PE valuations had risen by 24% just a year ago and where the aggregate manpower behind the largest PE firms (Carlyle, KKR, Blackstone, etc.) also served as the largest US employers behind Walmart and Amazon.

Despite such numbers, and even during the boom years of private equity, there was a darker side to PE practices and an even darker horizon ahead for its profits as the PE boom era marches toward bust.

Let’s dig in…

Private Equity: A “Disturbance in the Force”?

American cinema and culture have forever found fascination with the iconic struggle for justice in the same manner investors have forever found fascination with a return on investment.

As to cinema, I’m thinking of those John Ford Westerns where the white-hatted Henry Fondas or John Waynes were pitted against black-hatted scoundrels like a Jack Palance or Charles Bronson.

Let’s also not forget the small-town hero genre of the simple good guy against the greedy, heartless loan shark, embodied by the 1947 classic film, “It’s a Wonderful Life.”

And as for sci-fi fans, this Hollywood theme of white hats and black hats can be equally summed up within the good-v-evil struggle of “The Force” against “The Dark Side.”

But when it comes to the increasingly toxic real world of private equity, there is a “disturbance in the force” which has been quietly getting darker for years despite its boom times.

PE: A Barn Full of Black Hats

When it comes to modern Private Equity firms and their off-the-radar pillaging of the retail sector, the list of bad actors is factually worse than many of the fictional dynamics Jimmy Stewart faced in 1947 Pottersville.

Stated simply, this space has some dark stories.

It’s Not a Wonderful Life

The all-too-real plot in so many ignored Private Equity deals of the last two decades are easy to see for those familiar with their five-act script.

It boils down to PE partners 1) forcing their retail co-parties into debt, 2) squeezing them at MBA knifepoint for payouts (nicely described as “dividends”) and then 3) sending those coerced borrowers into bankruptcy, after which, 4) the retailers (and the bonds you bought from them) get clobbered while 5) their PE lenders (“sponsors”) walk away from the bankruptcy court with a nicely (and legally) re-structured payout (i.e. fat profit).

Really?

Yes. Really.

The PE Death Star

All bad guys come from some version of a thieves’ den, horse-gang or Death Star.

In this evolving PE/Retail plot, the modern Death Star begins (where else?) at the Federal Reserve.

For years, we have revealed how central bank policies are directly responsible for distorting and corrupting stock prices, UST yields and almost every other aspect of natural (rather than artificially stimulated) market dynamics.

Not surprisingly, this same Federal Reserve, with its past practice of effectively taking over the sovereign bond market in one fat perma bid (i.e., QE to the post-2008 moon), had single-handedly destroyed yield in the credit space for years.

And this is precisely where the evil (and boom years) began in our now openly unwinding Private Equity tale.

Enter the Stormtroopers

What would Darth Vader’s Death Star be without its stormtroopers? And what would this private equity plot be without the help of those little rogue private equity shops and their many eager, bonus-hungry, yield-makers?

Most got their “force” from the Fed…

That is, beginning in 2009, from a galaxy far, far away…, Darth Bernanke flipped a switch on the mega money printer, creating trillions of dollars out of thin air while simultaneously compressing interest rates and bond yields to zero.

That is, the Dark Side had begun its opening act and salvo, destroying yield in the bond market in one grand, laser-like gesture.

Thereafter, nervous investors looking at 0% yields began to scatter throughout the investment galaxy, looking for a way to get something more.

But where could they find yield?

Enter a dark niche of Private Equity stormtroopers who quickly emerged to make a near-term profit for themselves and a long-term mess for the rest of us…

But what dastardly little plan did they come up with?

Squeezing Yield in a World Without Yield—the Retail Pawns

As per above, it was actually a pretty simple scheme.

The PE stormtroopers found a wounded animal—the retail space—and then used uber-leverage [i.e. easy money thanks to Darth Greenspan’s (and later, Darth Bernanke and Darth Yellen’s) low-rate Fed Death Star] to buy majority control of weakening businesses (the fancy term for this was called a “Retail LBO”).

Thereafter, these PE “partners” forced many of those businesses to take on more debt to pay their PE loan sharks a series of painful “dividends,” which was good for private equity investors but a fatal blow to many business owners.

As expected, most of those trapped retailers were forced into taking on more and more debt by issuing more and more “high yield” junk bonds (which more and more investors, pension funds, endowments and mutual funds bought recklessly).

Back in 2010, for example, retailers under the knife of their PE owners issued $90+B in junk bonds and levered loans just to pay “special dividends” to their PE masters.

More than 20% of that figure went straight to the balance sheets (and wallets) of their PE lords as a “carried interest.”

Un-Happy Endings

In the end, many of those businesses were forced into bankruptcy, where their black-hatted PE “sponsors” (from Bain to Golden Gate Capital) stepped in to “restructure” deals in which the PE shops made even more money as their retail partners (from J-Crew and Gymboree to Payless Shoes, Safeway etc.) were carried out on their shields.

And that, in a nutshell, is how the revered PE model worked in so many dark corners of so-called “free market” opportunism, which the Fed’s hitherto zero-bound policies made so, well… opportunistic for a niche PE class.

Stated simply: Many PE shops took no risk, offered no guidance, and assumed no legal responsibility while making painful loans to their retail victims, who were then forced into ever-cascading levels of greater debt to repay those loans along with contractually added dividends to their PE sponsors.

Ultimately, these cornered businesses issued layer after layer of bogus retail bonds before going broke or living half-dead on the S&P as zombie companies.

For many such businesses, their movie ended with retail stores closing all over the country, retail bondholders (i.e. investors) and credit markets seeing lots of red, and PE shops sneaking off with all the profits.

In short, no one thrived except the loan sharks (aka PE guys) who took no risk and added no value to the “deals” they papered and the yield they sucked out of retail’s woes.

Bad Guys and Bad Bonds

But this is what happens when a market was desperately seeking yield in a world where the Fed had all but eradicated it.

The good guys (i.e. retail borrowers) had no chance against the much more clever and capitalized PE shops, who found perfectly legal ways to strip mine struggling enterprises, plunder their cash flows and then send them into chapter 11, where the sponsors profited even more.

What Happened to the Good Guys?

When I was a younger and greener finance guy, we once thought that the PE side of the street was about building businesses, not poaching and then gutting them.

But desperate markets bring out the best and the worst in human nature. Most will say it’s not personal, it’s just business, rate arbitrage and the struggle for yield.

Hmmm…

In any case, that same bond market, increasingly loaded with junk paper, was just one more symptom of an artificially sustained credit market and PE bubble inflating faster by the day yet poised to fall further tomorrow than most investors were then (or now) aware.

The Culminating PE Moment of “Uh-Oh”

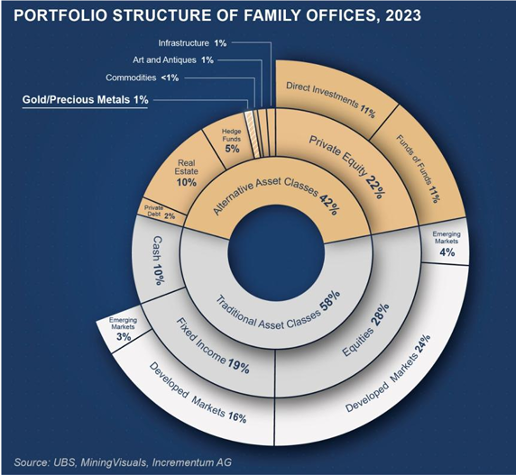

Which brings us to the present moment of just undeniable “uh-oh” in the otherwise falsely acclaimed “PE” sector, one in which numerous family offices and other “smart folks” — from the Harvard Endowment to your latest mutual fund managers–now find themselves.

As bond yields creep north and the greatest credit cycle in the history of capital markets creeps toward crisis, the false yet illiquid valuations now inflating increasingly illiquid and grossly over-valued PE balance sheets will soon do what all bubbles do: Pop.

Fund sponsors will then scurry (as they already are) to liquidate their holdings at discounts, at least for those funds lucky enough to even find a buyer at all.

The Inevitable Moment of Golden “Oh Yes”

In short, the private equity sector, which thrived in artificially supported low rates, easy money and exuberant investors, will soon dive into a setting where capital costs are rising, credit is tightening, and investors are sellers rather than buyers.

We are moving toward a macro environment wherein everyone from Warren Buffett and Jamie Dimon to the BRICS+ coalition, the IMF and even the BIS knows that a credit cycle is ending.

Folks, the U.S. is objectively broke.

This means the unloved IOUs from a debt-drunk Uncle Sam can only be sustained by debased dollars and negative real rates.

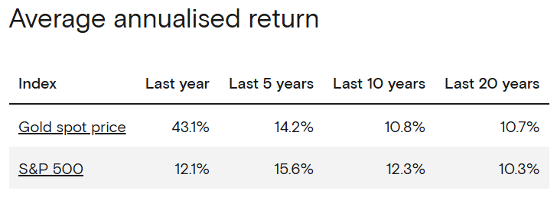

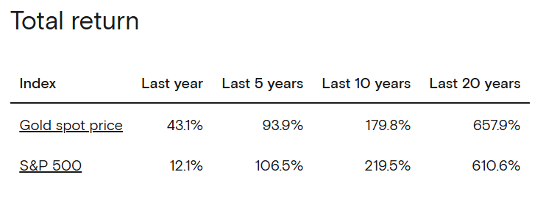

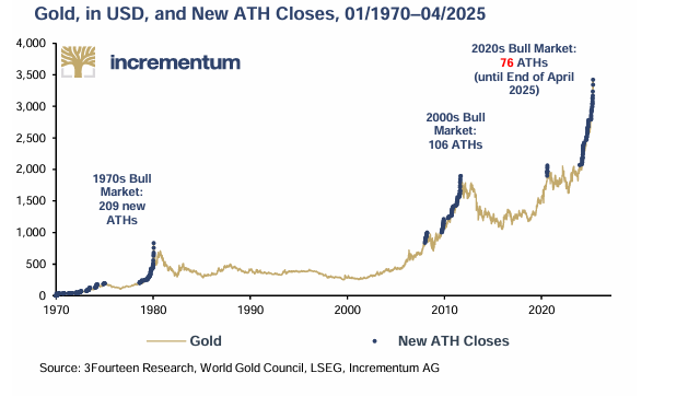

In other words, we are entering the perfect setting for physical gold, an ignored asset which has outperformed USTs (the worst performing asset of the last 5 years)…

…and the S&P 500, which gold (as per curvo.eu) has outperformed for the last 20 years at both an annualized and total return basis:

Yet despite such obvious yet deliberately ignored performance, gold still comprises a mere 1% allocation for the majority of family offices and endowments.

Hmmm…

In sum, these whales are now grossly top-heavy in inflated stocks, PE time bombs and private credit pools, which Jeffrey Gundlach recently described as the new “Weapons of mass destruction.”

The ironies do abound when even the “smart money” is stuck in the consensus-think of the wrong place, such as PE peaks–while a small percentage of so-called “gold bugs” find themselves squarely in the right place, a golden era whose secular price direction is only just beginning.

Sometimes, it pays to be smarter than the smart money.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD