GOLD: The Global Financial System’s Lie Detector?

Is gold calling out a broken global financial system?

One Big…Lie?

Earlier this year, I was asked to give my most “heretic” opinion about the global financial system.

This was an unusual yet bold question, and after a brief pause, I answered that the entire system was…, well:

“A lie.”

This may seem like a sensational response in an industry sometimes prone to the sensational; however, if we look at stubborn facts, the answer is truer than it is extreme.

When it comes to a financial system rotting from within, the Botox-like beauty of our ballooning S&P and centralized credit market hides an aging and decrepit disease.

That is, policy lies, like Botox, can’t hide reality forever, and the evidence of a fatally debt-sick system hiding financial truths behind forked tongues and euphemistic lingo is literally all around us.

A Long List of Truth-Stretching…

From the very era of my birth, the list of lies is almost comical.

Nixon:

In 1971, for example, when Nixon decoupled the dollar from gold [thereby allowing his own and future administrations the unfettered luxury (and sickness) of expanding (debasing) the money supply], he promised the measure would be “temporary” and that “our dollar would be worth just as much tomorrow as it is today.”

Both statements, of course, were open lies.

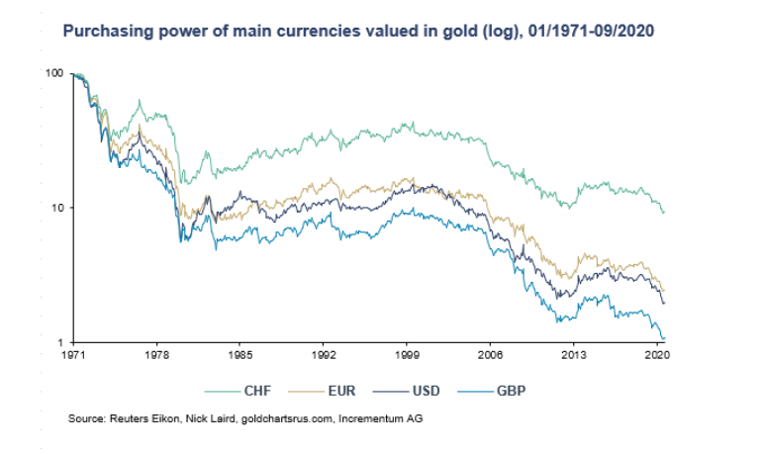

54 years later, the dollar remains un-chaperoned to gold, and when measured against a milligram of that same precious metal, the USD (and other major Fiat currencies) has lost 99% of its purchasing power.

Meanwhile, gold is rising faster against the USD and other world currencies as their purchasing power is diluted by desperate policies to inflate away their debt with debased currencies.

Lying to Our Founding Fathers:

It’s also worth noting that our fiat paper Dollar, un-backed by gold, is a direct contradiction to our Constitution, and in my mind, is itself just another, well…Lie.

Wilson’s Fed:

But long before the lies of 1971, let us not forget the lie of 1913, when Wilson signed an equally unconstitutional Federal Reserve into law, a so-called “independent” bank which is anything but independent (it’s effectively a fourth branch of government) and is neither “Federal” nor a “Reserve.”

Larry Summers:

Fast forward to the great financial crisis of 2008, which was effectively a mortgage—backed-security credit implosion driven by an unregulated derivatives market, and we see even more staggering dishonesty.

A decade before this levered credit implosion, Assistant Treasury Secretary Larry Summers was called to Congress to answer Brooksley Born’s concerns (as head of the CFTC) that these derivative instruments, if left unregulated, would destabilize markets.

Summers publicly embarrassed Born and then told the world that the bankers in charge of these OTC instruments of levered destruction were more than sophisticated enough to manage the risks.

Of course, by the 2008 market implosion, we all knew that assertion was a lie.

Bernanke, Yellen & Powell:

We also know that when the markets tanked in 2008 (thanks largely to Mr. Summers’ deregulation fiasco), Bernanke’s subsequent promise that the money printing which followed (counterfeiting euphemistically called “Quantitative Easing”) would only be a “temporary” measure was just another lie.

QE1 was soon followed by QE 2,3,4 “Operation Twist” and then “Unlimited QE” by 2020.

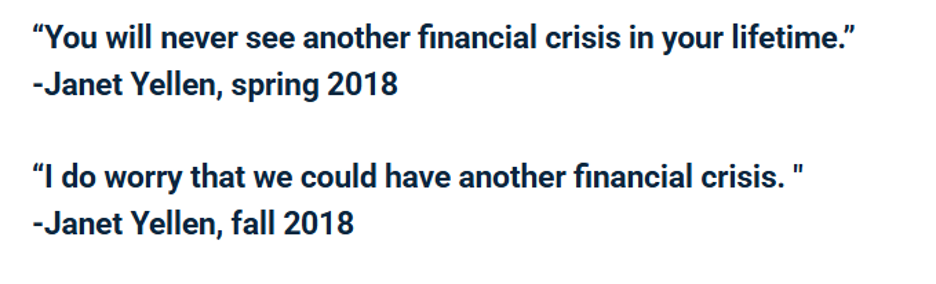

But such lies are nothing new to central bankers. Remember Yellen?

And let us not forget Powell’s 2021 promise that the inflation (a direct result of the very money printing Bernanke promised would be “temporary” in 2010) facing the USA would only be “transitory.”

We knew then, as we still know today, that transitory inflation, like the very scale which measures CPI, were just more lies.

In fact, lies, like the euphemisms from on top, are almost standard policy from our so-called policy makers.

MMT:

“Modern Monetary Theory,” or “MMT,” for example, is neither modern, nor monetary, nor a theory.

The fantasy of believing a nation can solve a debt crisis via more debt, which is then monetized by creating fake money, has been tried from ancient Rome and 1789 France to 1990’s Yugoslavia.

But as history confirms, it has failed EVERY time.

Other Lies…

Other such lying euphemisms, from the “Patriot Act” and the “Department of Homeland Security” to the “safe and effective” of our now-pardoned “trust the science” leadership may be less economic, but they are no less dishonest—being far more about centralization than anything “patriotic” or “security” driven…

In sum, so many lies, so many examples.

And the fact that 99% of our nation’s now openly distrusted (by greater than 40% of the US population) media outlets are owned by just five mega-corporations, is it any wonder that such lies, as Mark Twain quipped, “can travel half way around the world while the truth is putting on its shoes”?

But as introduced above, eventually the lies can no longer hide what our eyes, intuition, and wallets can see, touch or feel.

Gold: The Ultimate Lie Detector

Toward this end, we clearly know we are reaching an inflection point in the global financial system when even the liars have started to confess the truth, and much of this truth is golden.

As I noted elsewhere, a group of European Central Bank economists have just said the quiet part out loud.

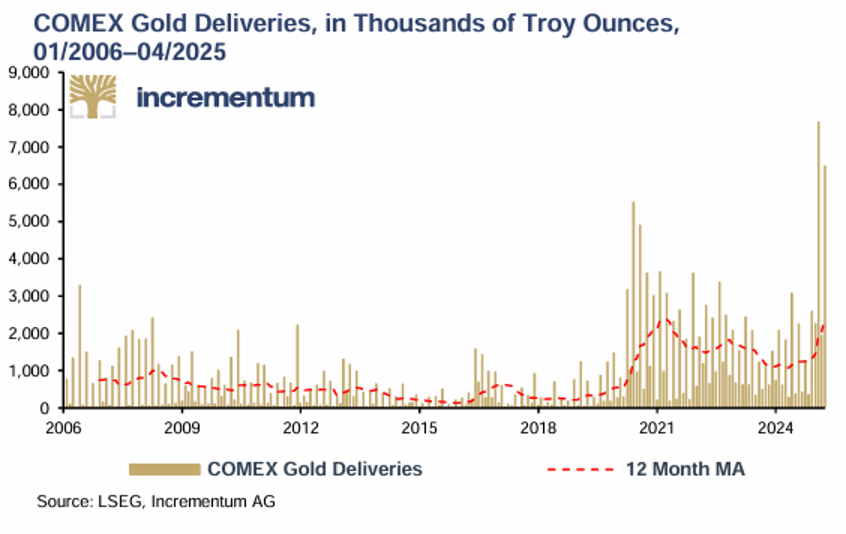

In a recent report, they warned that rising demand for physical gold (over 2000 tons from London to NYC in 2025) could send the European Union into collapse.

Why?

Because the Eurozone, already teetering on skyrocketing debts and rising bond yields (and hence interest rates), doesn’t have the money nor the gold to meet their 100:1 levered gold derivative contracts hitherto floating on the London and NY Gold Exchanges with a gross exposure of over $1T.

Yes, One TRILLION.

Sadly, we’ve been warning of this derivative time bomb and Comex insanity for years, yet only now the ECB is confessing its trillion-dollar problem out loud.

These metals exchanges, which rolled over and extended paper gold contracts since the 1970s to artificially short (i.e., price control) the gold price, were basically credit exchanges, not gold storage providers…

But now they are seeing counterparties wanting the physical gold itself rather than just their extended paper contracts.

Unfortunately, the Eurozone doesn’t have the gold their contracts promised.

In short, they are caught in a lie.

The other lie is trying to “blame” this leverage trap on gold while failing to confess that counterparties are seeking actual gold delivery to cover their own past sins.

That is, they need the gold because they trust this hitherto “pet rock” analog asset as a far, far superior store of value and reserve asset than the sovereign bonds and paper currencies they’ve been destroying for decades—something we have also been forewarning for years.

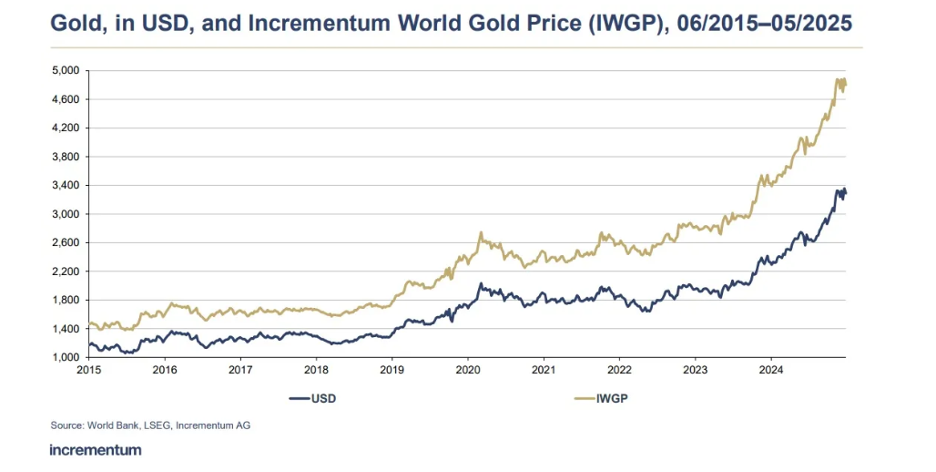

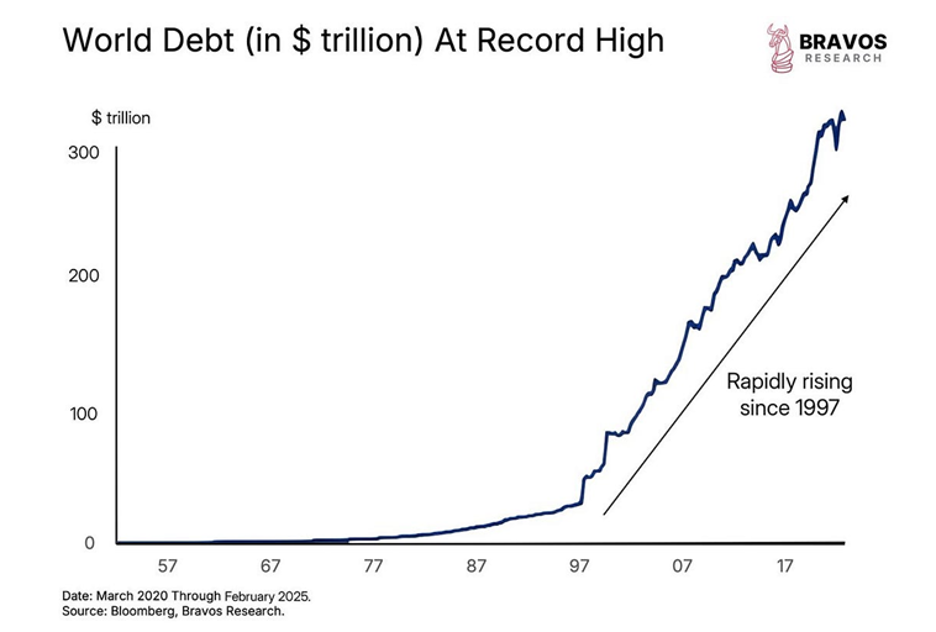

In other words, gold is no longer just a hedge or matter of speculation, it’s THE emerging global Tier-1 asset which even those folks at the BIS and IMF (notorious for “bending” truths) now openly recognize as THE reserve asset in a world openly losing confidence in the debased paper money and distrusted IOUs from a world falling off a $300T global debt cliff.

In short: Gold is calling BS on an entire global financial system whose dishonest fantasy policies of thinking they could take sovereign debt levels to unprecedented/historical and drunken levels to buy time, votes and wealth inequality without a hangover.

Or stated more simply, gold is unmasking the lie of deficits without tears, money printing without currency debasement and debt without destruction.

When I think of such “leaders” and financial policies, I am again reminded of Mark Twain, who observed: “I sometimes wonder if the world is being run by smart people who are putting us on, or by imbeciles who really mean it.”

No Surprise at All

But such imbecility (or dishonesty) is no surprise to those who understand math, history and sound money—i.e. those who understand gold.

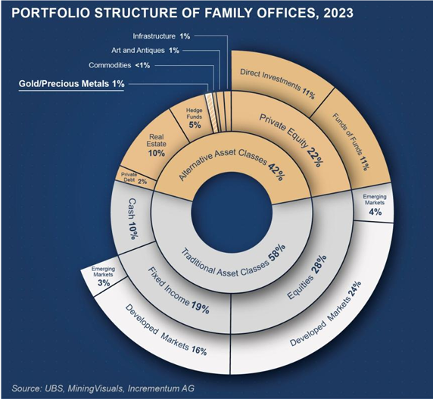

For years, family offices, private wealth advisors at lofty bank X, Y&Z and even RIA A, B&C have been telling themselves (and you) that gold is just too “volatile.”

Gold has been less than a 1% allocation for most family offices and an even lesser allocation for all other investors for years and years.

But gold has outperformed the S&P (at even a total return basis) for TWENTY years, and is the highest performing asset of 2025.

Under NO stretch of the imagination (or even objective math) is this asset even close to being “too volatile” of late.

Far more importantly, gold’s real secular move has yet to even begin, despite over two (largely ignored) decades of outperforming traditional risk assets.

Meanwhile, the so-called “smart money” – from the Harvard Endowment to Family Office A, B&C–are stuck in private credit pools (what Jeffrey Gundlach described as the new “weapons of mass destruction”) and other non-marked-to-market PE timebombs whose hey days are about to become dark days in the illiquidity that defines all credit cycle implosions, toward which we are marching at top speed.

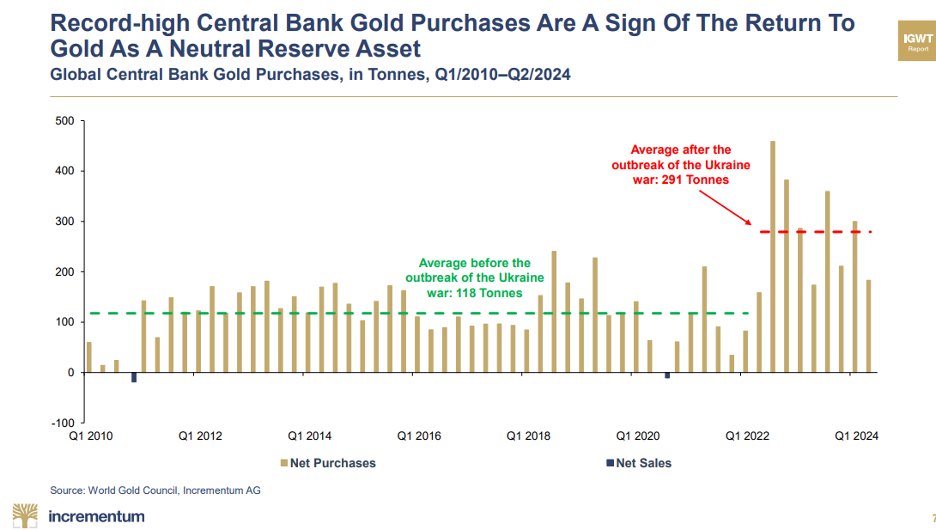

And in this very strange backdrop, the very central bankers who have downplayed, ignored, and intentionally misrepresented gold, are now buying it at record levels.

In short, even the liars are now stacking the hidden truth.

The ironies. They do abound.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD