Tariff Needle + Debt Balloon = Era-Ending Liquidity Crisis

Despite the undeniable ripple effects of the recent tariff measures out of DC, the headlines, as usual, are mostly wrong about the causes of the current market volatility and the longer-term ramifications ahead.

Navigating such market stress, historical debt realities, the role of gold and the absolutely critical importance – and meaning – of a liquidity crisis requires a far more balanced assessment than just “blame it all on the tariffs.”

Carnage

As of this writing, risk-asset reaction to Trump’s tariff “liberation day” has been anything but well-received as the VIX rips well past 50 and intra-day gains following recent sell-offs made record U-turns to the red.

The S&P has lost 11.5% in 3 days, and the yield on the 10Y UST now sits at 4.38%, which suggests Uncle Sam’s IOU is no longer acting like a traditional safe haven.

Blame the Tariffs?

Consensus, along with the financial media, is attributing the current market carnage to tariffs, which, as usual, is missing the bigger picture by miles (as well as trillions) …

The blunter explanation for the aforementioned bloodletting is that US stocks have been a long-lasting, over-valued and entirely fed-created red ballon just looking for a needle.

And all kinds of potential needles were in play, be it a new war, another bank failure, a desperate rate policy, a political black swan or just the simple gravity of mean-reversion in bubble markets.

And yes, of course, the tariffs were a MAJOR trigger – but they were not the deeper cause for what investors are now experiencing and what regular citizens – entirely disconnected from markets – have otherwise been suffering for years.

Markets: Easy to See

In January of 2024, I was openly risk-on due to Pavlovian markets giddy with projected rate cuts from that monstrous market maker, otherwise known as the Fed.

However, exactly a year later, I was openly risk-off for 2025.

Psychic powers?

Hardly.

The smart money was already well into cash, and the markets were too narrowly led by a handful of overvalued names crawling into a changing (and volatile) landscape of de-dollarization, de-globalization and a disrupter in the White House.

Such January projections were not magical predictions, just recognitions of a debt cycle marching toward a painful yet unavoidable turning point.

Debt Told Us So

In fact, for anyone seeking clarity on the trends now impacting risk assets, tariff consequences, currency direction, recessionary forces, precious metal moves and the broader nature of the global new dis-order now and to come, one only needs fluency in a four-letter word, namely: DEBT.

Debt (and the unprecedented size, danger and direction of it), is a theme we’ve addressed with consistent warnings in nearly every article or interview we offer.

But let’s keep it simple.

From Debt Crisis to Market Crisis

A debt crisis = a credit crisis, and a credit crisis = a liquidity crisis, and a liquidity crisis is the cause of EVERY market implosion from time immemorial.

Period.

The math, history and direction of the current credit and liquidity crisis were, therefore, plain to see well before the headlines came up with the tariff trigger.

For years, we’ve been warning about the open and obvious signs that Uncle Sam was broke and that a credit crisis was not just coming but percolating all around us.

Many chose to ignore the signs, but here’s a quick reminder…

Ignored Neon-Flashing Signs

There was the repo crisis of 2019, in which even the big banks didn’t trust each other’s collateral, and the Fed had to re-liquify them, yet again, with billions of mouse-clicked money.

A year later, there was the so-called COVID crisis of March 2020, which was really just, well … another credit/liquidity crisis, followed by, you guessed it–unlimited (i.e., trillions) of mouse-click money.

By 2022, thanks to Powell’s higher-for-longer (and failed) rate-hike war on inflation, US markets saw the worst nominal returns in stocks and bonds since 1871.

Why?

Because rising rates at the Fed had created yet another credit (and hence) liquidity crisis…

By 2023, we then saw three of the four largest US bank failures in our history, which was, again, not really a banking crisis but a crisis in their underlying collateral – namely US sovereign bonds.

In short, yet another CREDIT crisis, which, again, required trillions of backdoor liquidity (i.e., currency-debasing, mouse-clicked money) to “solve.”

See a trend above? See a rising debt, credit and hence liquidity crisis – i.e. a ballon in search of a needle?

Adding Insult to Liquidity Injury

By connecting such a sequence of dots, it becomes easier to understand how a nation with a 125% debt/GDP ratio and $37T bar tab becomes less trusted with less buyers of its IOUs.

This means less “credit” and liquidity to move forward, which means: Uh-oh.

And when that same openly debt-soaked, less-trusted and dis-credited nation then adds insult to its liquidity injury by weaponizing its currency and IOU, is it now any great surprise that there is less love of and demand for US debt instruments?

Stated simply, all of the foregoing forces converge to form a perfect road map to a liquidity crisis, the consequences of which were well in play before our media wanted to blame this most recent market turmoil on tariffs…

Tariff Perspective

As for the tariffs, we and others have spoken ad nauseum about their approach as well as risks, so there’s no need to revisit those details here nor act surprised by their actual arrival, which both the markets and media seem to be acting.

No shocker there…

Certainly, a 10% baseline tariff on all imports, coupled with a 20% tariff on EU goods and a now staggering 104% tariff on Chinese imports, is going to shake things up—from global markets and geopolitics to Joe Six Pack.

And as to Joe Six Pack, have no illusions: These tariffs will be inflationary and painful given the US is now experiencing the worst goods deficit in its history.

Beating Inflation by Beating Down Everyone Else

But here’s the so-called good news – you folks on the ground might get a deflationary break anyway from the near-term price rises to come.

How so?

Well, that’s the bad news…

If tariffs create a recession or worse (nod to the rhyming McKinley era), and broke Americans buy less, the consequent demand-side destruction will send prices lower.

Oh, and a deflationary market implosion and the destruction of your 401K can also help beat inflation, but this, too, will be on your backs.

Just saying…

But in the end, inevitable bazooka money from the Fed will send inflation higher and your dollar lower.

All roads (de-dollarization, Fed desperation, unloved USTs, tariff wars, etc.) lead to ultimate inflation.

Facts Are Stubborn Things

Meanwhile, the media and stock market (as well as 99% of all politicos who know next to nothing about economics or history) have forgotten to mention that YOU are already in a consumer recession and have been for quite some time.

Need evidence?

Aside from boring yield curve data, M2 shifts, 24 straight months of leading indicator data, 13-year peaks in small business bankruptcies, record levels of credit card and car loan delinquencies, the Oliver Anthony indicator and 2024 (post-election) labor data (that was off by 880,000 non-new jobs) and unemployment up 50 basis points in the last 12 months… the US has endured negative retail sales for months, and consumer discretionary spending (ex-Amazon) is near zero.

But apparently, such screaming recessionary indicators meant nothing when the stock market was ripping.

Markets No Longer Hiding Facts

But now the ripping has stopped, and the panicking pundits, politicos and FOMO traders are starting to look confused, worried and even surprised.

Surprised?

With all the foregoing facts, figures and widening bond spreads, how and why is the debt crisis, credit crisis and now market (i.e., LIQUIDITY) crisis any surprise at all?

For those paying attention, it’s absolutely no surprise.

The Future & Liquidity

Given that every debt crisis leads to a credit crisis, liquidity crisis and then market (and economic) crisis, the future – as confused and unknowable as it is – can nevertheless be fairly predictable.

Or stated simply: Broke systems, markets and nations predictably need more liquidity.

But how?

Well, ideally, we’d need more productivity, tax receipts and net trade income than we have debts, liabilities and deficits.

Trump’s spending cut/DOGE initiatives, USAID clean-up, and even tariff policies (good or bad) are not going to accomplish any surplus or productivity miracle anytime soon or even close to soon.

As I’ve said elsewhere, and many times, not even Santa Claus can save the US from the necessary and inevitable constructive destruction ahead.

Instead, and as argued recently, the US will do what all broke nations throughout history have done—namely, inflate their way out of debt via financial repression before introducing eventual capital controls and covert centralization disguised as “good for the nation.”

Equally predictable is more desperation, like creating a speculation bubble in a BTC strategic reserve charade and then applying those gamed winnings toward paying down debt ala El Salvador.

Another little trick will be regulations tying BTC and other so-called “maverick” anti-system assets only to US dollars and UST/USD-backed stablecoins, thereby creating a kind of “new oil” centralized “petrodollar” for so-called decentralized digital assets.

This will be good for creating forced dollar demand and UST demand but very bad for individual civil liberties.

No shocker there.

But even more predictable in the nearer term is an inevitable pivot from QT to QE once/when illiquid markets really tank.

This means more mouse-clicked and inflationary money (“liquidity”) to the moon after a deflationary market implosion and official (rather than denied) recession.

Thereafter, the broken leadership will likely move toward an already IMF-telegraphed reset in which CBDC partially pegged to gold will become the norm in an otherwise new global dis-order.

Gold

And what do all of these so-called solutions to a national and global debt, credit and liquidity crisis have in common?

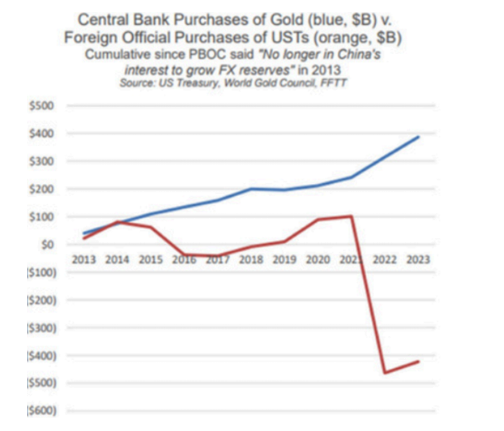

What does the failure of USTs and UST-purchasing say? What happens when former buyers of our debt become sellers? And believe me, China will now be a seller…

What happens when a de-dollarizing world (BRICS and otherwise) is openly net-settling trades in gold and selling oil outside the dollar?

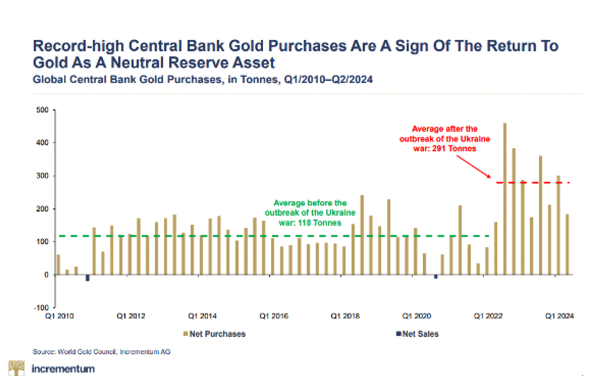

Why have we seen record-high central banking gold buying since the US weaponized the dollar?

What does it mean when even the BIS just designated gold as a Tier-1 reserve asset ahead of the once-sacred UST?

What does it mean when central banks have been net-dumping USTs and net-purchasing physical gold since 2014?

What is implied by the COMEX outflows of physical gold?

It’s simple: Gold is the consequent and new safe haven in a world losing faith in unpayable IOUs, debased currencies, bloated debt levels and market mean reversions driven by an obvious liquidity crisis.

In such a backdrop, is it not time to do what your governments have failed to do – namely, protect your own currency with nature’s, history’s and common sense’s only real money, gold?

Decide for yourselves.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD