COVID Bailouts Have Nothing to Do With COVID

Below, we ask a simple question: Is the war on COVID the needed pretext for even more centralized market “performance?”

After all, who needs free markets when central bank liquidity determines price forces via endless COVID bailouts?

The trend toward centralized controls and centralized markets was in play long before COVID, but has the pandemic given the powers-that-be even more power?

As we discuss below, COVID may just be the final nail in the coffin of free market capitalism.

In this murky light, do traditional market indicators and forces even matter anymore?

Consumer Sentiment: Who Cares?

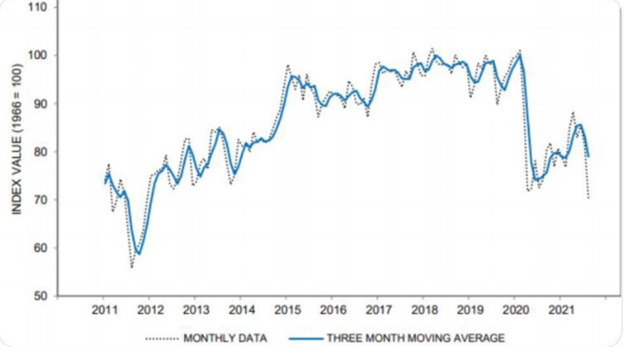

As stocks reached all-time highs in U.S. markets, consumer confidence recently saw its 7th greatest collapse in history.

Needless to say, cadres of Wall Street spin-sellers (propaganda specialists?) are already hard at work explaining why such a disconnect between sentiment and equity valuations (i.e., price bubbles) doesn’t matter.

After all, when buckets of QE liquidity pour daily into the financial system in a COVID-induced era of unlimited-QE, today’s central-bank driven markets don’t need consumer confidence or even healthy balance sheets (from free-cash-flows to profits & earnings) to make their zombie-like climb toward 34.6 PE levels on the S&P.

In short, who needs consumer confidence (or even consumers at all), when a central bank airbag sits permanently beneath the S&P, NASDAQ and DOW?

Words Replacing Math & Facts

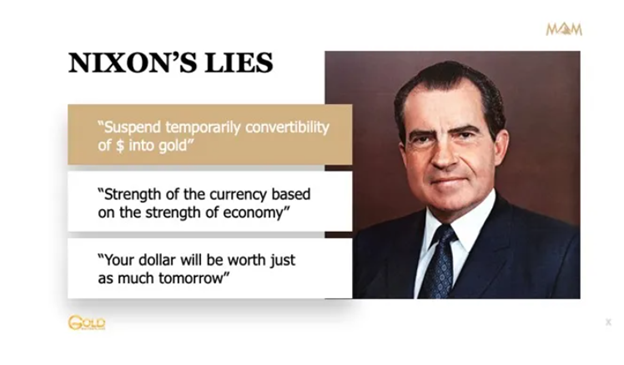

Over a decade ago, when the first controversial bucket of QE1 began, Bernanke promised it would be a “temporary” measure.

But bear or bull, we are fairly clear by now that words like “temporary” and “transitory” coming out of D.C. are as empty as Nixon’s promise in 1971 that decoupling from the gold standard would be equally short-lived:

And when it comes to words vs. reality, it doesn’t take a Sherlock Holmes or even an Inspector Clouseau to see the lighthouse of true motives amidst a fog of false narratives.

Enter COVID—The Ultimate Bailout

Whatever one’s view of the COVID pandemic or its toll on human health and global GDP, one can no longer deny that a virus whose survivability percentage is greater than 99% has been the perfect setting (ruse?) to justify, inter alia, yet another tsunami of Wall-Street bailouts under the guise of a global health crisis.

In short, if Bear Sterns, Lehman Brothers, Morgan Stanley and other TBTF banks playing with MBS fire justified the 2008 bailout, certainly the optics of a “global health crisis” made trillions worth of more market “accommodation” easier to swallow (or sneak in).

Toward this end, as the needed and all-too important debates continue to rage (despite open censorship) about health passports, nation-wide shutdowns, case fatality rates, vaccine safety/efficiency facts and health ministry fictions in a backdrop of dying civil liberties, free-market forces and governmental trust, one thing is becoming clear…

COVID (and more specifically COVID bailouts) saved the global financial markets.

That is, despite the competing fear-porn vs. “we care for you” narratives from NYC to Sydney, COVID has been Wall Street’s greatest ally since the Geithner-Bernanke-Paulson era of 2008.

Stated even more simply, while millions wonder when they can travel, work or save money again, the markets got another bail-out at the expense of the real economy.

And COVID, whether man-made or bat-made, came just in time to bailout a credit market that was near death’s door by late 2019.

Coincidence? Deliberate? We’ll never find those answers in a carefully/privately censored Google search or YouTube video.

Meanwhile, policy makers (like bees buzzing galvanically around a pot of honey) continue exploiting the COVID narrative to justify an unprecedented era of centralized control over public free markets and individual free choice with a sanctimonious carte blanche the likes (and dishonesty?) of which history has never seen before.

Playing along or following along, companies like Amazon, the NY Times, BlackRock and Wells Fargo continue to push back their return-to-office dates as individual states debate whether mask mandates make sense, despite censored science which suggest that masks stop the spread of viral microbes about as well as chain-link fences stop mosquitos…

Has the world gone mad as a gullible herd following fork-tongued shepherds, or does Big Brother just care a lot about your health?

That’s for each of us to decide, but when it comes to what we can expect from central bankers, my view is clear: COVID will continue to be exploited to justify more liquidity and hence more market “support.”

The Taper or No-Taper Debate

This means investors can expect more market bubbles, volatility, and distortion alongside more inflationary tailwinds, currency debasements and policy double-speak as the taper vs no-taper debate takes on a prominence in the public discourse similar to the mask or no-mask comedy de jour.

That is, as Wall Street continues to debate whether the Fed will begin tapering its magical money printing, the growing volume of Delta variant headlines pouring from the global Ministries of Truth leads me to believe that a narrative is already being telegraphed to justify more rather than less monetary expansion in the near-term.

This may explain why BTC and gold, despite bumpy rides of late, have been recovering rather than hiding in a corner, as more and more investors see the currency debasement writing on the wall, despite such realities never making the headlines or FOMC meeting notes.

We’ve also written elsewhere that the “taper debate” is ultimately (and realistically) a non-debate, as any significant form of tapering means less sovereign bond support, and less sovereign bond support means bond-decay followed by immediate yield (and hence interest rate) climbs.

If interest rates climb in a $280T backdrop of global debt, the market party (i.e., artificial “recovery”) enjoyed since 2009 comes to an immediate end. Period, full stop.

Central bankers and politicos, of course, know this, which explains why more rather than less QE is all that keeps the current risk asset bubble (from stocks to real estate) alive.

In this sad yet seductive light, policy makers—and investors—have two choices: 1) keep the QE going and send inflation to the moon, or 2) taper and send the global markets to the basement of time.

At some point, of course, even unlimited QE becomes unsustainable and the entire house of cards collapses under its own grotesque weight.

When that moment (planned or natural) occurs, the very policy makers who caused this inevitable catastrophe will have the convenient excuse to blame the financial rubble on COVID rather than their bathroom mirrors.

Again, COVID is a very convenient narrative, no?

Near term, the cynical yet realist take on the taper ahead is that it will be postponed rather than embraced. That’s our view.

The Case for Tapering—Michael Burry’s Next Big Short

In fairness to open debate, however, it’s worth noting that far smarter folks have taken other views.

For example, Michael Burry of Scion Capital, the misunderstood genius behind the “Big Short” during the Great Financial Crisis of 2008, has been shorting US Treasuries to the tune of $280 million in put options against the iShares 20+ Year Treasury Bond ETF (ticker TLT), which makes him money if bond prices fall rather than rise.

Michael Burry, it seems, is expecting less rather than more FED bond support, and hence rising rather than “repressed” yields on long-term Treasuries.

And Burry, I’ll confess, may be right.

Even the Fed can’t print forever to keep yields and rates artificially suppressed. Hence, they may actually signal actual rather than semantic tapering, which is why all eyes will be on Jackson Hole to look for further signs of Fed tightening by year end.

This brings us back to COVID and the deliberate fear campaign from on high, as Powell has confidence that stoking the COVID narrative will force more investors into buying “safe” bonds, thus taking some of the onus off the Fed to buy the bulk of Uncle Sam’s debt via extreme QE.

If the Fed taper becomes a reality rather than debate, bond prices will fall, which means bond yields could easily and rapidly rise from the current 1.2% range to 1.8% or higher mark.

Rising bond yields, of course, mean rising interest rates, and rising interest rates means a rising cost of debt, which ultimately means that the debt-driven “party” which markets have been enjoying for years will see a genuine “hangover” moment worse in scope to what the rising rate window of late 2018 witnessed.

In short, should the Fed indeed turn naively hawkish and “taper,” this would be a disaster for just about every asset class but the dollar, and would likely be a short-lived and immediately reversed policy, akin to the 2019 reversal after the 2018 Q4 rate hike. We may even get a new variant and COVID bailout to mark the occasion!

Tapering & Gold

As for gold investing, rising rates would send gold lower and the dollar higher if inflation doesn’t rise measurably faster or higher than potentially rising bond yields.

Given the Fed’s primal fear of that anti-dollar known as gold, we can expect more fictionally downplayed bad CPI inflation reporting from DC in the near-term, especially if a dollar-surging taper were to occur.

Longer term, however, the damage created by years of expansionary monetary and fiscal policy will continue to be an inflationary tailwind for precious metals whose patience in the face of drunken fiscal policy is historically confirmed crisis after crisis after crisis…

Real Rates: Deeper Down Seems Inevitable

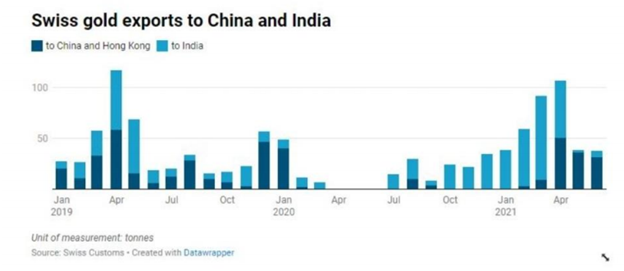

As all precious metal investors know, gold price moves inversely to real (i.e., inflation-adjusted) rates. That is, as real rates plunge, gold prices rise.

This would explain why gold bought from Switzerland is moving to patient gold investors in zip codes like China and India.

Despite genuine arguments in favor of tapering and the genuine intelligence of traders like Michael Burry, the realists play the long-game. They know, in short, that tapering is a self-inflicted bullet wound to risk assets.

Furthermore, they understand that the massive mountains of debt upon which countries in the West now sit would make rising rates impossible for countries like the U.S. to re-pay.

For this reason alone, I see more rather than less QE ahead, as the only real buyers of government debt needed to keep rates repressed come from central banks, not natural market demand.

As U.S. debt to GDP skyrockets past 100% and now 130% for the twin-deficit USA, the only solution/option available to such a debt-soaked nation is lower rather than higher real rates.

In such a light, tapering, again, is a dangerous option.

Since 2014, when the U.S. lost its external finance base (i.e., when global central banks stopped buying Uncle Sam’s debt on net), the Fed has had no choice but to be the buyer of last resort for its own IOUs.

This means Uncle Sam has a vested interest in keeping rates low while inflating away its debt with higher (albeit mis-reported) inflation rates—the perfect backdrop for falling rather than rising real rates—and hence a clear tailwind for gold.

Despite such realism, many are arguing that the negative 1.1 real rate figure seen last August represents a floor.

Hmmm?

A New War, a New Excuse to Print Money

Returning to that all-too-convenient COVID narrative (scapegoat?), I am of the strong opinion that the “war on COVID” will be the dominant and continued narrative moving forward, as wars are historically confirmed (as well as historically convenient) justifications for further rate repression and even lower real rates.

That’s good for gold.

Be reminded, for example, that the U.S. is no stranger to seeing real rates fall as low as -14%, as was seen in the Civil War, as well as World Wars I and II. In the post-Vietnam 70’s, real rates sank to -7%.

My cynical realism suggests therefore that the -1.1% real rates observed last August were anything but a “floor” and that the War on COVID will be deliberately exaggerated, promulgated, extended and alas conveniently exploited to justify even greater negative real rates ahead—all very good conditions for gold and silver.

As hard as it may be for modern investors lulled into thinking the Fed has actual intelligence and choices when it comes to tapering or managing inflation like a home thermostat, the only means they have for keeping the tragi-comical levels of U.S. debt sustainable is to see real rates closer to -15% not -1.1%.

To achieve this, they will need more COVID bailouts and QE, and hence more liquidity, and hence more dollar-debasing policies to pay their debts cheaply. Again, a very nice setting for precious metals.

But -15% real rates? No way? Crazy, right?

Growing Rather Printing Our Way Out of Debt?

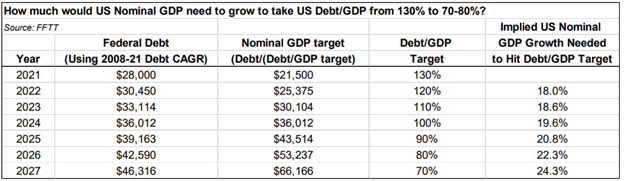

Optimists, of course, will call me crazy, and pundits will say we can “grow our way out of debt.”

Fair enough.

But to “grow” our way out of debt in a normal rather than increasingly more negative real-rate environment would require GDP growth rates of 20% or higher for the next 5 years.

Does anyone actually believe that will happen?

We don’t either.

Taper or no taper, real war or a politically-contrived “COVID war,” pandemic altruism or pandemic scapegoat, the debt reality facing the world in general or the U.S. in particular suggests that COVID will be the politically-correct pretext for more rather than less “accommodation” from the Eccles Building.

Longer term, this means an already grossly debased dollar will become even more so, and that negative real rates can go far lower than expected, thereby ushering in a new yet all-too familiar era for gold.

Let’s wait and see.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD