Gold vs Toxic Brews of Financial Repression & Capital Controls

As we’ve said and written so many times, and as history confirms century after century, and regime after regime, desperate (i.e., debt-cornered) nations do desperate things.

And this, by the way, always results in more centralization from on high and more pain for the man on the street.

Every. Time.

Theft Aint Funny

There’s an old joke/saying in Europe, for example, that’s really not so funny, largely because it’s so tragically accurate.

It basically says that countries start by borrowing from each other. When that trust dies, they borrow from the banks. And when that source for their debt addiction taps out, they end up stealing from the people.

This theft can take a number of obvious and not so obvious forms. Like the ubiquitous rise of automated speed radars designed “for public safety” but are basically motorized theft…

But I digress…

Inflation: From Irksome to Appalling

Inflation for example (and its fatal compounding effect) is an invisible yet insidious form of “frog boil” theft of which many tax payers are unaware when otherwise paying off their percentage of the national debt drug.

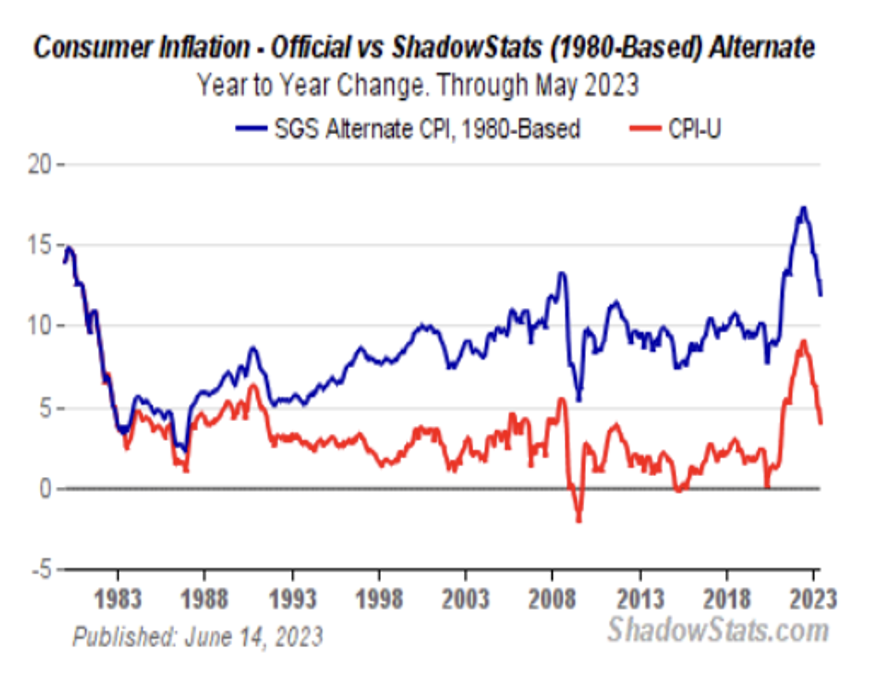

And as we’ve reported with facts rather than drama, the official inflation percentage (i.e., melting ice-cube decline rate of your dollar’s purchasing power) is an open lie.

The annual and compounding effect of the CPI theft may seem irksome at the official 3% range, but when actual rather than reported inflation (as measured by the more honest/accurate scale of the 1980s—See Shadow Stats) is closer to 12-13%, you can quickly see just how much you have been robbed.

In short, inflation goes from irksome to appalling.

In short, inflation is a silent wealth killer, and the higher the inflation percentage, the more fatal the theft-related wound.

Powell’s Word Salad

Powell, of course, said he wanted to beat inflation. In fact, some years ago, he even described the problem as merely “transitory.”

But as we said/showed then, and will repeat today, that whole “transitory” thing was also, well, an open lie…

Powell, after all, never could or did beat inflation. (Only a recession or market mean reversion will.)

Nor did he reach the mythical 2% inflation target.

This was despite his post-2022 (and admittedly dis-inflationary) rate hikes, which were effectively designed to kill consumer demand (through higher debt costs) and engineer a convenient little dis-inflationary recession (which he then called a non-recession after conveniently redefining the definition of recession) on the middle class…

(Oh, and those rate hikes? They caused the greatest single year nominal loss in US stocks and bonds [2022] since the 1870s…)

But as I argued then, and will repeat again now, Powell’s real aim was never to beat inflation.

Oh, to the contrary…

His real aim was and is inflation.

Why?

Enter Financial Repression

Because inflating away debt is the last desperate (but darkly effective) option of debt-soaked nations.

This is because inflation is very good for debtors, and no one or no thing is more in debt than the US of A.

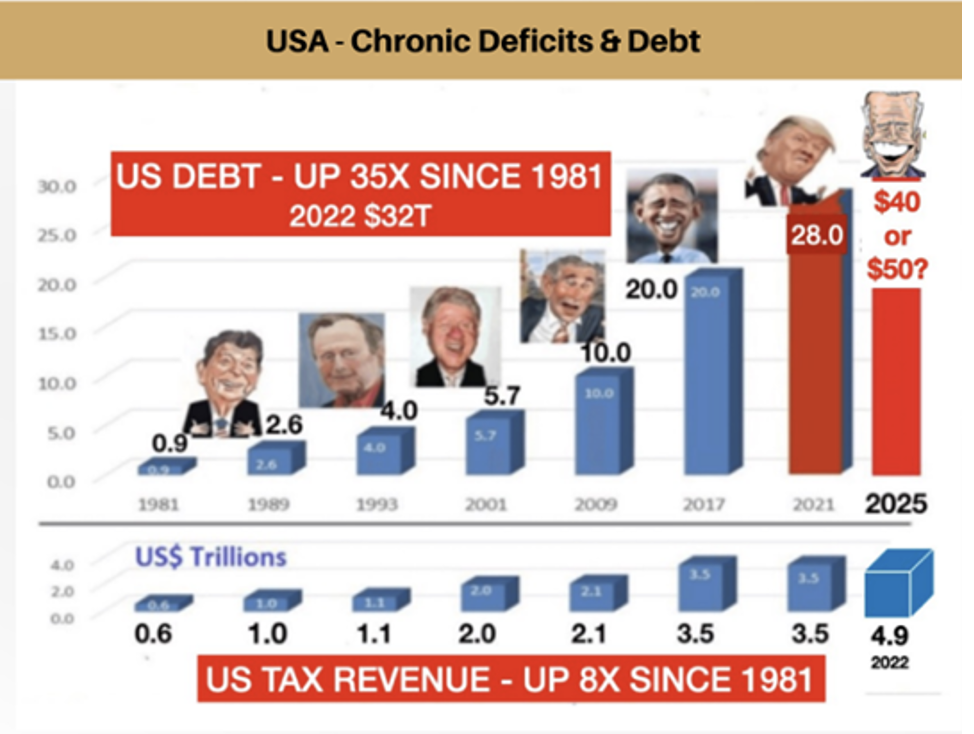

After all, once a nation crosses the 100% to 120% debt to GDP ratio, every dollar borrowed results in far less than a dollar of growth.

Such mathematical debt spirals are siren calls for inflating away debt.

By the way, this act of pursuing a deliberate inflationary policy while simultaneously lying about the inflation rate is a perfect (and oh-so common) little tactic (and example) of what history and market scholars call “financial repression.”

But the fancy lads on Wall Street have a more eloquent term, and it’s called “negative real rates.”

We’ve written at length on this topic and term, but what negative real rates effectively boil down to is a scenario whereby the inflation rate is higher than the interest rate on one’s debt.

And in the case of Uncle Sam, this essentially (and officially) boils down to a scenario whereby the official CPI rate of inflation is higher than the yield on its most sacred-cow bond/IOU: The 10-Year UST.

Negative real rates are such a boon to debtors because it means you get to pay back your IOU with debased money at a negative rather than positive rate.

If, for example, you owe 5% on a $100.00 loan due in one year, the cost of that debt is in fact free if inflation for that year is greater than 5%. That is, if the CPI rate was, say 7%, this means you are paying 2% “negative real rates” on your loan.

Not bad at all.

Who A Lender/Sucker Will Be?

Of course, your next observation would be fairly simple: Why would anyone or any bank want to loan at negative real rates? The lender, after all, is losing money.

Well, every time you purchase a UST bond, you are doing precisely that: Losing money to inflation while Uncle Sam smiles, borrows and spends.

Countries, of course, have been deleveraging their debt at the expense of their citizens for centuries, which means citizens holding sovereign IOUs or saving in fiat/paper money have been suckers for centuries.

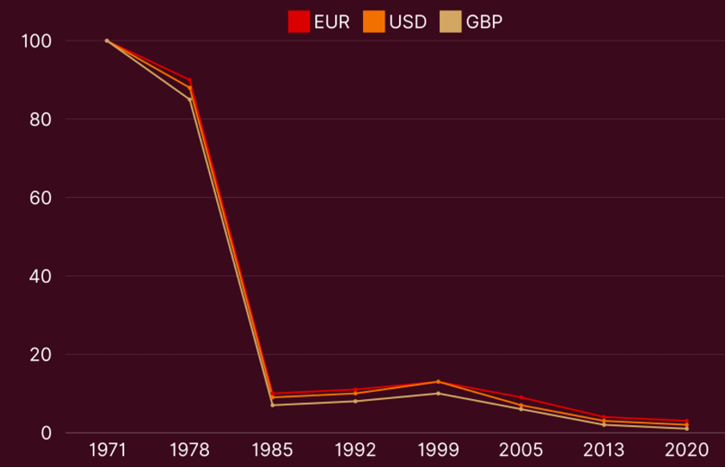

Compared to a milligram of gold, the purchasing power of their currencies has been tanking since 1971:

During the desperate times of the US Civil War, for example, the US government got even more “repressive.”

Under the National Bank Act, DC literally forced US banks to buy more of Uncle Sam’s IOUs or lose their banking rights.

Times & Lenders, They Are A-Changing

As of today, there is a limit to how many USTs banks can hold, but as we’ve forewarned many times, under fancy new rules related to deliberately confusing “Supplementary Leverage Ratio” modifications, that number is about to expand decisively.

Only this time, in a post-Fed America, those TBTF banks will be (and have been) simultaneously supported (i.e., paid out at full, rather discounted, bond prices by the Fed) by the government.

The same “accommodation,” however, will not be true of citizen bond holders.

As usual, Joe Six-Pack WILL be (and is being) fleeced.

Other Clever, One-Sided Tricks

The government has other repressive tricks up its sleeves to reduce their debt pains, including inevitable yield curve controls (YCC) to force the cost of government debt to near zero.

Citizens, of course, won’t have similar benefits, including the now “working poor” US middle class, who pay a criminal 20+% interest on credit card debt, which is now defaulting at record-breaking levels.

Just saying…

More Signs of Desperation

But again, the template is fairly obvious for those paying attention to history, math and current events.

In just the last few months, we’ve tracked other desperate sovereign attempts to gamble, weasel or centralize toxic debt levels.

The carefully propagandized wolf in sheep’s clothing, for example, of a “BTC Strategic Reserve Fund” is neither strategic nor a reserve.

It’s just a deliberately inflated asset bubble designed, like the El Salvador model, to pay down debt with market winnings while simultaneously luring citizens from a BTC bubble into a Tether bubble, which is just CBDC by another name.

And then there’s the recent headlines regarding the auditing and revaluing of the US gold reserves from the $42.22 certificate price to the current market price, which, assuming US gold holdings of 8131 tones are accurate, will provide another $750B to $800B of “gold QE” to tackle Uncle Sam’s embarrassing bar tab.

But such a guppy solution ($800B) to a whale of a debt problem ($37T in public debt) will not move the needle one bit in alleviating America’s meth addiction to debt nor make the reality of simple math or US debt & spend addiction go away.

Folks, today the combined weight/cost of US entitlements, military spending and interest expense on US public debt is 140% of tax receipts.

Ouch…

It’s Inflate or Die

Again, once a debt-addicted nation reaches a now publicly obvious level of debt cancer, the options and scenarios left to it become weaker and worse.

Uncle Sam’s available (bad) options are no exception.

It can:

1) default on the debt (ain’t gonna happen with a money printer at the Fed);

2) play the Yellen card and issue more short-duration debt (won’t make a dent on the 140% ratio above);

3) cut military and entitlement spending by 40%-50% (political suicide) or;

4) get real and say the quiet part out loud, namely: “inflate their way out of debt.”

But here’s the rub. Financial repression via inflating away debt (which even a 2015 IMF white paper soberly accepted as the inevitable game plan) makes the natives restless.

Currency devaluation through inflation has been the source of more than one pitchfork or guillotine in the pages of history.

Nervous governments, of course, know this too. They fear an informed mass.

That is why it’s in their best (survival) interest to lie again about the official inflation rate, while quietly carrying on with a mis-reported but deeply NEGATIVE real rate policy.

Then Comes Capital Controls…

But never underestimate your adversary.

Financial repression works, but as that same IMF warned sovereigns in another 2023 report, debt-soaked nations will do much better if they quicky add capital controls to their toxic brew of financial repression.

That is, before financial repression can really do its nasty work, it’s important to simultaneously control citizens’ ability to flow their money within or outside of the system BEFORE they fully feel the currency pain of negative real rates.

Same Tricks, New Era

Again, we’ve seen how such tricks look before.

FDR’s infamous Executive Order 60-102, which outlawed citizen gold ownership before he later revalued gold higher to allow more inflationary money printing, is a classic example of capital “controls.”

Today, the digitalization and tokenization of all things bodes for even more modern and efficient versions of the same.

This may explain, for example, why BlackRock, which just years ago critiqued BTC as a scam, has since created a $50B BTC ETF.

Such a centralization of this once “de-centralized” altcoin makes it easier for governments (and their proxies) to control your assets on and off ramps.

The same is and will be true of digital stable coins and inevitable CBDCs—direct or hidden.

Yes, “digitalization” is openly hyped as so modern, so innovative, and so efficient – but what those from on high are not telling you is that such digitalization is also so trackable, so programable and so, well: seizable…

In short: CONTROLABLE.

Golden Solution: How to Prepare for Capital Controls

History offers some answers to the toxic template and direction above.

Yep, that boring ole analog “pet rock” which the modern/digital generation calls outdated, yet which central banks are stacking like mad and which the COMEX market can’t get enough of. It once again reminds us that some indestructible assets get the final and patient say in a world growing increasingly mad/centralized.

That is, if you are wondering how to prepare for the looming capital controls, the modern answer lies in what sophisticated investors have known for centuries, and what we have been arguing for decades:

Own PHYSICAL gold in PRIVATE vaults OUTSIDE of your country and fractured BANKING SYSTEM.

For US investors, for example, physical gold held in legally and historically confirmed gold-hub jurisdictions outside the US is not reportable to the US government.

Such reporting rules, however, vary from country to country, and thus what works for US citizens – does not work for all.

This is true only for gold (and not for cash) held in foreign jurisdictions – be that cash held in a bank, a safe-deposit box or other – all of that IS reportable, as are any capital gains at time of sale.

For US citizens, only gold in a private vault outside their country of citizenship provides a truly legal and safe firewall between themselves and their increasingly centralized/controlled financial system and government.

Sophisticated investors, families and institutions have quietly been assessing such reporting options in a country-by-country manner for centuries.

But, again, the foregoing analysis applies specifically in the context – and home – of the world reserve currency, namely the US.

NAVIGATE UNCERTAINTY WITH VON GREYERZ UPDATES

Gain exclusive insights into gold trends, market opportunities & the latest in global finance and politics.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD