Gold Revaluation: Solution or Desperation?

Topics like bond yields, dollar debates, or yield curves can be admittedly, well, boring.

And things like politics can be, well… emotional at best or divisive at worst.

Shared Concern Among So Much Division?

In the current Zeitgeist, it’s hard to get through the fog of market complexity or the self-censorship of political polarization to arrive at anything even resembling a shared concern.

But we should all be concerned if we are collectively sinking on a global debt ship with not enough lifeboats to save our fiat current’s absolute purchasing power.

And when it comes to the water over-filling the air-tight compartments of the U.S. debt Titanic, we need to look soberly at what the Trump America is facing.

Toward this end, let’s be blunt.

Can’t We All Agree that America is Broke?

Public debt – $37T, unfunded liabilities at $190T. A debt/GDP ratio above 120%, etc.

The USA is in an unprecedented debt trap/spiral, the math, details, history and consequences of which we have been tracking for years.

And history (ignored) tells us an even darker yet simpler truth: debt destroys nations.

Every time and without exception.

Boring Bond Yields

Given that the USA in particular (and the world in general) is witnessing the greatest debt crisis of human history, should we not be equally concerned rather than politically divided when it comes to such boring things like bond yields (which reflect the very cost of debt)?

As for those boring bond yields, let’s just keep it broad and simple.

Yields on the 10-year U.S. Treasury represent the cost of money/debt for nearly everyone on the globe, in general and Uncle Sam in particular.

This means that when those yields start to climb too high, just about everything and everyone (including the country you reside in) starts to fall deeper into “uh-oh.”

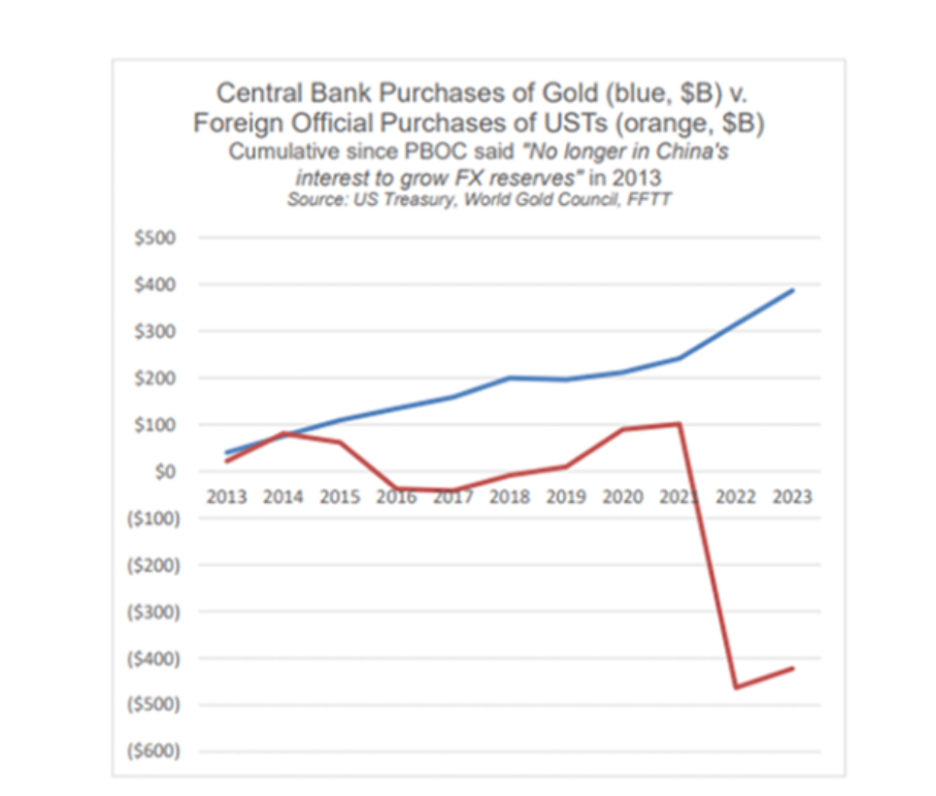

And those yields rise when demand (i.e., purchasing) of those bonds starts to fall.

Read that last line again. Let it sink in.

When trust, love and/or demand and price for UST’s falls, pain for just about everything but the USD (and now gold) spikes.

Boring? Yes.

But relevant?

Absolutely.

From Boring Bonds to Just About Everything

So, what does such boring bond/UST talk have to do with your currency, your wealth or your lives?

And what does such boring bond talk have to do with market risk, gold prices, BTC’s direction or the fate of Trump’s America or even world trade and peace?

A lot.

Trump Change

Trump is a disruptor. A political outsider to a DC setting for which the term “swamp” is probably too kind.

He’s making bold statements and directives on everything from tariffs and immigration to JFK’s assassination (no great mystery there…) and DOGE spending cuts.

Love or hate him – he’s certainly busy making change…

And although he may know far more about real estate capitalism than he does about government debt or US history, his Treasury Secretary, Scott Bessent, knows a heck of a lot about the latter – which means he’s dealing with a lot of contradictions coming out of today’s White House.

No Change Without Consequence or Contradiction

Trump’s administration is making headlines, for example, about a stronger USD, ending inflation, optimizing tariff revenues, saving big oil and getting those boring UST yields down.

But there’s just one catch – no one, not even Trump or Santa Clause, can do all that without radically re-shaping the prior notion of American exceptionalism.

And ironically, no one knows this better than Trump’s own Treasury Secretary.

Why?

It’s simple – and even a bit “boring” – but the forces at play will directly impact YOU, so it’s worth a few reality checks and simple fact-reminders here.

It All Starts (and Ends) with the Dollar

If Trump, for example, pushes for a stronger dollar and aggressive tariffs (love or hate em), such a policy would not only create a drag on the global economy (which owes over $14T in USD-denominated debt), it would also be knife wound to Uncle Sam, oil production and the very yields the Trump White House wants to reduce.

That is, a rising dollar forces foreigners (and nations) to sell/dump USTs to get more liquidity to pay debts.

And if USTs continue to sell off, then prices fall, and yields rise; and when yields rise, even Uncle Sam reaches a point where he can’t afford his own bar tab.

See the paradox? The trap? The boring yet incredibly important relationship between bonds, currencies and economic life itself?

The USD: Weaker By Necessity

This relationship between a strong dollar and UST yields is clear and direct, and although the headlines and consensus still see a strong dollar ahead, I’ve long argued the oppositefor the simple reason that America itself can’t afford a strong dollar.

And deep down, Scott Bessent (a private gold buyer) knows this, too.

He’s openly admitted to the “counterparty” risk of a strong USD, but he won’t publicly confess that one of those counterparties at risk is the U.S. itself.

So, what is to be done?

How can Trump afford short-term tariff costs, cut spending/waste in DC (via DOGE), pay for the needed re-shoring of American jobs, or even win the war on inflation without risking debt issuance to the moon and hence bond yields even higher (which recently rose from 4.3% to 4.65% in just three trading days)?

Well, as even his own Treasury Secretary knows under his breath, the answer is simple: he can’t.

Unless…

Unless …an already openly declining, and hence openly desperate, debt-soaked nation does what all desperate individuals or nations do: resort to desperate measures.

Only Desperate Options Left

Bessent knows that for anything Trump wants to enact to grow the American economy; he must first get Uncle Sam’s debt to GDP levels to a place where growth is even mathematically feasible.

At current debt/GDP levels, for example, such growth is mathematically impossible.

So, what can the US do under Trump?

1) Inflate Away Our Debt?

We could end up inflating away our debt.

For that to happen, we’d need years of inflation and negative real rates at well over 15% to even come close to “inflating away” such debt.

This would not only be fatally painful for U.S. citizens but also political suicide for Trump.

2) Play the Yellen Card?

Bessent could try his predecessor’s playbook of just issuing more UST’s (IOUs) from the short end of the yield curve or emptying the reverse repo market and TGA accounts to buy more time/liquidity and create more debt.

But with the world dumping USTs and bracing itself for more tariff and trade wars, there just isn’t enough love, trust or buyers for those American IOUs anymore…

More importantly, such wimpy measures can no longer save a nation whose bar tab (interest expense on outstanding debt, entitlements and defence) is 140% of its tax receipts.

That, folks, is neon-flashing evidence of desperation, which means we are now at an inflection point where the only measures left are entirely emergency measures – and they come with a cost. A serious cost.

3) Create BTC Bubble?

The U.S. could also help pay down some debt by speculating in a politicized BTC bubble, and then use the speculation proceeds (not actual BTC “currency”) to pay down debt in an emerging-market-desperation play akin to El Salvadore?

This is desperation at its highest, yet masquerading as “tech” nirvana to the rescue…

I’ve written and spoken about this option at greater length here and here.

4) Revaluing Gold?

Finally, and perhaps most importantly, the topic of gold revaluation is also ripping through the precious metal pundit circles at a galvanic pace, and for good reason.

Based upon “reported” U.S. gold holdings, if gold were politically re-priced to just $4000 per ounce, that would create an additional $1.2T of instant liquidity (i.e. inflationary M2), which the Treasury Department could then direct deposit into an ever-drying TGA.

(This direct deposit is made legal under Section 2.10 of the Financial Accounting Manual for Federal Reserve Banks.)

Such a gold revaluation policy would take a lot of pressure off Bessent’s Treasury Department and buy the U.S. more time and money for the aforementioned Trump policies to “Make America Great Again.”

But could a potential series of gold revaluations to inject new money into the TGA piggy bank truly make America, well… great?

Or would it just save the U.S. economy from crumbling to the ground?

Kissinger’s Ghost

In the 1970s, Kissinger was very concerned when Europe, which collectively owned more gold than the U.S., wanted to revalue their gold to similarly cover their own debt disasters at home.

This would mean the U.S. would have to do the same, thereby playing its last Trump card (pun intended) of desperation (reverting to its gold vaults) in 1974.

And why was Kissinger so terrified of having to resort to the ultimate “red button” act of desperation in the form of revaluing its last real form of sound money/wealth?

Because Kissinger knew then what many of us know.

That is, if the USA shows its hand and starts revaluing gold to higher and higher levels to pay down higher and higher levels of debt (to keep politicians in power and the masses free of pitchforks), this would mean the end of American supremacy, hegemony and/or the Pax Americana.

Why?

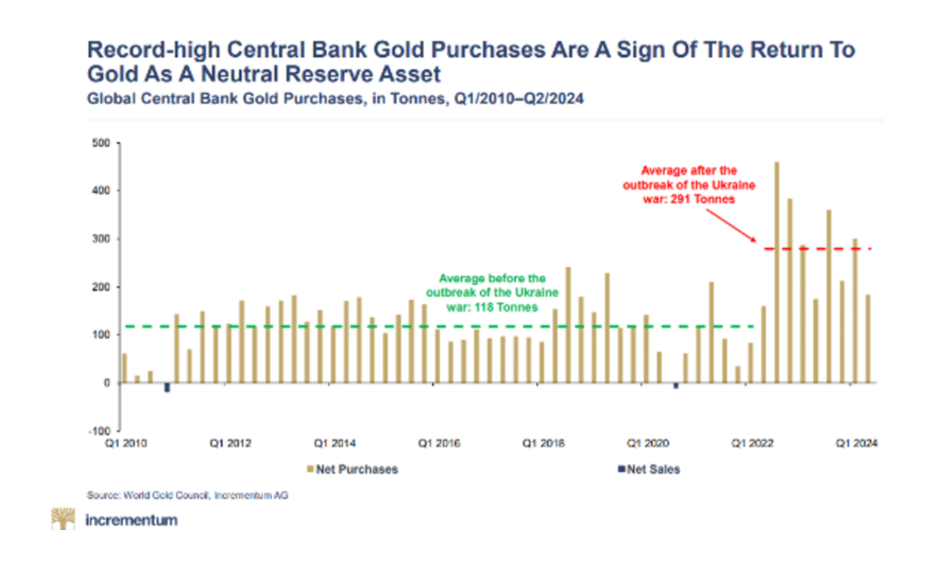

Because he who has the most gold wins, and despite what the World Gold Council reports, it’s an open secret that America does not have the most gold (in a world of central banks stacking gold at record levels and COMEX revolving doors).

The Dilemma: Greatness or Survival?

Trump, Bessent, and the USA itself thus face a debt trap and, hence, a sovereign dilemma of historical import.

Yes, certainly, the U.S. can and may revalue its gold holdings to dig itself partially out of debt and hence spur more growth.

But once/if the U.S. revalues, the rest of the world will naturally follow, and that will make the US just one more economically average nation among many, but certainly not the strongest anymore.

Kissinger knew this.

Do Bessent and Trump?

Either Way, Gold Wins

Regardless of whether such a formal gold revaluation occurs from the top down in DC, the gold price will continue to rise (re-value itself) naturally from the bottom up for the simple reason that debt-soaked nations = debased currencies.

Gold, which only rises because fiat money inevitably suffocates under debt, sits at a different kind of historical moment.

It gets the last laugh because sovereign debt, led by sovereign mismanagement, has killed its sovereign currency in a death by a thousand cuts.

So, yes, gold gets the last laugh – but the circumstances couldn’t be sadder.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD