How Long Can Lies & Control Supplant Reality & Free Markets?

The facts of surreal yet broken (and hence increasingly controlled and desperate) financial markets are becoming harder to deny and ignore. Below, we look at the blunt evidence of control rather than the fork-tongued words of policy makers and ask a simple question: How long can lies & control supplant reality?

The Great Disconnect: Tanking Growth vs. Supported Markets

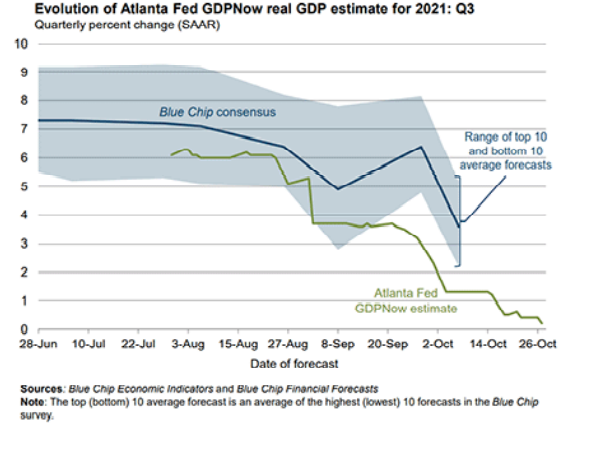

It’s becoming harder to keep up with the increasingly downgraded GDP growth estimations from the Atlanta Fed.

As recently as August, its GDPNow 3q21 estimates for the quarterly percentage change was as high as 6%.

But within a matter of weeks, this otherwise optimistic figure was cut embarrassingly in half.

Last month their GDP forecast sank much further to 0.5%, and as of this writing, it has been downgraded yet again to 0.2%.

Needless to say, 6% estimated growth falling to effectively 0% growth is hardly a bullish indicator for the kind of strengthening economic conditions which one might otherwise associate with risk asset prices reaching all-time highs for the same period.

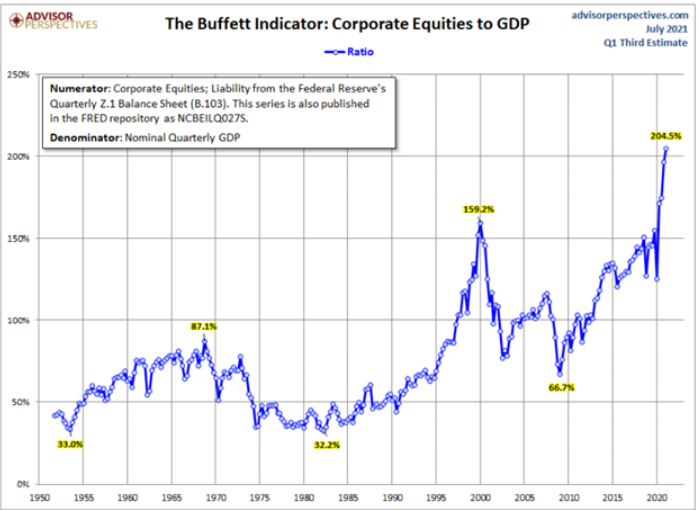

The current ratio of corporate equities to GDP in the U.S. (>200%) is the highest in history.

This growing yet shameful disconnect between market highs and economic lows is getting harder to explain, ignore or deny by the architects of the most artificial, rigged and dishonest market cycle in modern history.

In short, it is no longer even worth pretending that stock markets are correlated to such natural measurements as natural supply & demand or a nation’s economic productivity.

After all, who needs GDP in the New Abnormal?

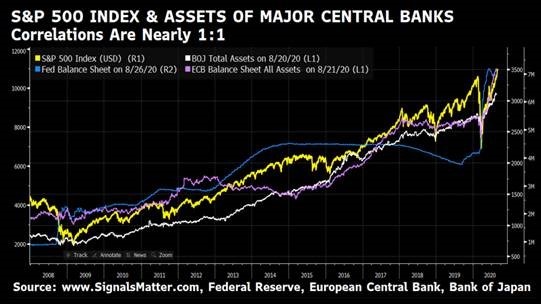

By now, even Fed doublespeak can’t hide the fact that the only market force which the post-08 markets require is an accommodative central bank—i.e., a firehose of multi-trillion liquidity on demand.

But as for this most recent GDP downgrade, it is being blamed on tanking US export data.

More Fantasy: Bogus Taper?

In the meantime, the much-anticipated taper has been announced. As predicted, it’s as bogus as a 42nd Street Rolex.

Taking $15B off a $120B/month QE rate and sending the Fed’s balance sheet to over $9T by year end while keeping rates at zero is hardly the kind of “tightening” that signifies a “healthy” market.

Add to that the liquidity provided by Standing Repo Facility and the FIMA swap lines and you quickly see that the bond market will see more, not less, “support.”

In short: This was a bogus taper and nothing has changed.

Even if central banks allow rates to rise one day, it will only be when inflation is rising faster.

And as discussed in prior reports, gold markets can and will rise if rates rise, so long as inflation rises faster, which for all the reasons we’ve addressed elsewhere, convinces us that a future of negative real rates is the only future these duplicitous central banks can allow.

More Inflationary Tricks (i.e., Fantasy)

Why?

Because short of default, the only and time-tested trick left up the sleeves of debt-soaked policy makers to dig their way out of a nightmarish and historically unprecedented debt hole (which they alone created) is by pursuing policies of deeply negative real rates.

This twisted inflationary playbook, so familiar to rigged insiders yet unknown to the vast majority of retail investors, boils down to a policy play by which our “experts” solve debt with more debt and hide truth behind more complex policy adjectives (i.e., lies.).

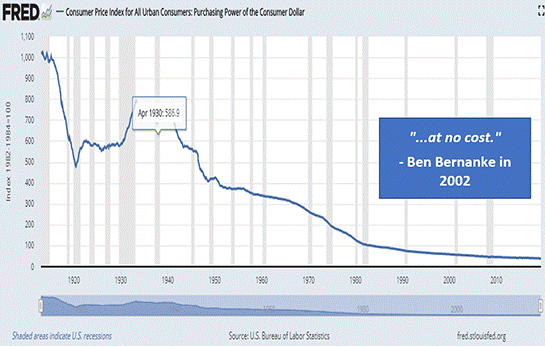

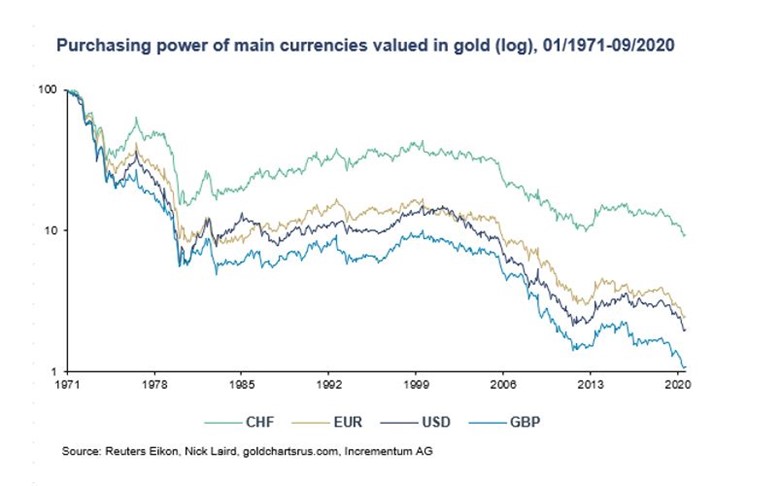

Specifically, this means the “experts” will: 1) deliberately seek more inflation while 2) lying about true inflation levels and then 3) repress interest rates in order to partially inflate their way out of debt with 4) increasingly debased currencies.

Take the U.S. Dollar’s purchasing power, for example…

Keeping the Serfs Down—The Policy of the New Feudalism

Needless to say, more inflation is a direct tax on the increasingly poorer middleclass.

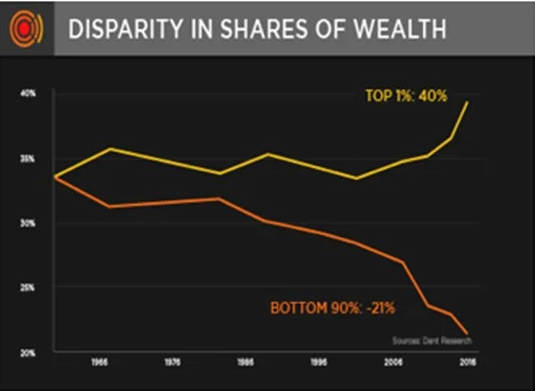

Sadly, too many are too busy trying to make sense of months of lockdowns, illegal vaccine mandates, movement restrictions, crime waves and inflating rent payments to notice that they have been made into serfs in a Brave New World where greater than 80% of the stock market wealth is held by the top 10% of the population.

Let’s be clear: I’m a screaming capitalist, but a pandemic world in which Bezos, Musk and other billionaire wealth has increased by 70% while 89 million Americans have lost their jobs is NOT capitalism, but a symptom of a rigged system in which the anti-trust rules I learned in law school, or the social and economic principles I learned in economics are simply gone.

Then again, when I was in school, we were once taught how to think, not what to think.

With each passing day, we see increased evidence of what I wrote (and described) elsewhere as a new feudalism marked by grotesquely distorted notions of truth, reporting, data, natural market forces and political/financial accountability.

In order to keep this report objective rather than an op-ed, let’s just consider the facts and case studies right before us.

Yellen & Dimon—Two Classic Lords Spinning Familiar Yarns

Take, for example, the aforementioned tanking of GDP, now being attributed to openly tanking export data out of the U.S. and the undeniable supply chain disruptions impacting the global economy.

To address this, none other than two of the most media prolific “lords” of the new feudalism, Fed Chairwoman-turned-Treasury-Secretary Janet Yellen and current JP Morgan CEO and 2008 bailout-beneficiary-turned-Fed-Crony, Jamie Dimon, assure us not to worry.

How nice.

Yellen, for her part, has recently said:

“I don’t think we’re about to lose control of inflation.”

“As we make further progress on the pandemic, I expect these bottlenecks to subside. Americans will return to the labor force as conditions improve.”

Again: How nice.

But let’s not let warm words get in the way of cold facts.

Yellen, like every Fed Chair since Greenspan, has a long history of buying time with comforting words that have nothing to do with hard reality:

“You will never see another financial crisis in your lifetime.”

-Janet Yellen, spring 2018

“I do worry that we could have another financial crisis. ″

-Janet Yellen, fall 2018

Despite a long and well-documented history of outright dishonesty spewing from the mouths of financial media darlings and policymakers like Yellen and Dimon, both are now pushing a bullish “be calm and carry on while we profit and control” meme.

They recently seized upon Biden’s move to run the Ports of Los Angeles and Long Beach on a 24/7 schedule to alleviate bottlenecks, which increased throughput by roughly 15% (3,500 containers/week v. 950,000 containers per month.)

That’s nice, and sure, it helps.

But despite such band-aid measures, supply chains won’t normalize until early 2023, at the earliest…and that assumes no further disruptions, which frankly, is a naive assumption.

Folks, it’s not up to Yellen or Dimon to give us honest guidance as to whether supply chains will normalize in 2021. It is up to China and Biden’s entirely Orwellian vaccine mandate.

Speaking of Yellen, Dimon et al, aren’t we all a bit curious about the now undeniable marriage of the Federal Reserve (an illegal private bank) and the U.S. Treasury Department?

And as for bank CEO’s like Dimon, have we not forgotten other bank CEOs like Goldman’s Hank Paulson, who made a similar “marriage” to the Treasury Department just in time to bail his former bank out of the Great Financial Crisis that it helped create?

Are these the honest brokers we want deciding our economic fates or signaling/controlling our economic future?

Vaccine Passes and Mandates—The Great Smokescreen

And as to the mandate… Note Yellen’s careful yet semantic magic of hiding autocracy behind humanitarian lingo.

Her comment above regarding bottlenecks “subsiding” once “we make further progress on the pandemic” is very comforting, no?

But it’s just another veiled way (i.e., smokescreen) of pushing a vaccine mandate which defies every principle of the social contract our founding fathers achieved in that silly document I revered as a 1L and known otherwise as the U.S. Constitution.

As I’ve said many times before, I’m no source for medical advice, and my circle includes many who are vaccinated and un-vaccinated alike—with equal respect for the choices we’ve made and equal disgust for the notion that such choices should be imposed rather than voluntary.

Simple Questions, Cold Math, Global Control

But should we not at least be asking ourselves if the pandemic discussion is less about global health and more about global control?

Without seeking to offend anyone’s COVID stance, can we nevertheless agree that C.J. Hopkins makes an undeniably clear and common-sensical point by simply asking a few basic questions.

For example, why has so much political, social and economic power been given to a minority of policy makers to scare/distract the world into ignoring a now obvious global power-shift justified by a virus which causes mild-to-moderate symptoms in 95% of the infected and whose case fatality rate is quantifiably somewhere in the range of 0.1% to 0.5%?

Yet despite such simple math, tens of thousands of firemen, police officers, nurses and military personnel—the very heroes who have placed themselves on the front lines of our increasingly criminalized, sick and psychologically damaged population– are now being forced out of work for not agreeing to a forced jab imposed by anti-heroes?

One has to at least wonder why so much effort has been made by a government-influenced/co-conspired media to spend its time criminalizing the unvaccinated rather than making front-page noise pointing out the obvious criminalization of our global financial system?

The Real Criminals

By that, I’m thinking of the years of recently revealed insider trading at the Fed and in Congress, the anti-trust violations of the non-tax-paying Amazon robber-baron (whose warehouse employees are on food stamps) or the open media-censorship and just plain shady that occurs daily at Facebook—an entity so blatantly shameful that it thinks a name-change can hide its dark “face”?

Or how about years of open price manipulation by bullion banks, the BIS and other dark corners of the OTC to deliberately force the natural price of gold and silver to the floor in order to illegally price-fix and protect globally debased currencies from the embarrassment of what a natural gold price would otherwise confirm, namely: Your currency has died, thanks to the white-collar criminals otherwise touted as experts.

In case you think this is mere sensationalism or speculation, I’ve written hundreds of pages and countless reports of graphical/mathematical/objective evidence of the same, and even an entire book on the rigged-to-fail system otherwise passing as normal to make this clear distortion of economic rules and political laws objective rather pejorative.

Nor am I/we alone in pointing out the objective truth. From the honest minority in controlled markets to an honest minority in politics, plain-spoken facts are fighting for free expression.

More Honest Voices

Take, for example, the recent press-conference (ignored, of course, by the main/muddy stream media) held by key members of the European Parliament to openly defy the insanely autocratic notion of a health pass to distinguish the compliant from the free or the “safe” from the “unsafe”.

As one brave parliamentary member from Germany, Christine Anderson, candidly observed, if you think the vaccine pass was made because the government cares about you, you are clearly ignoring its real motive—which is to control you.

And this straight from the European Parliament.

Control, of course, only works if enough people are scared, tired or uninformed enough to be controlled.

As for the financial system, signs of its increasingly obvious attempt at more controls to mask increasingly shameful policies are literally everywhere.

And yet… and yet…the media, the masses and the majority of investors continue to follow their murky and shady “guidance.”

Again, just keep it simple and factual rather than partisan or medically-controversial.

Criminal Evidence

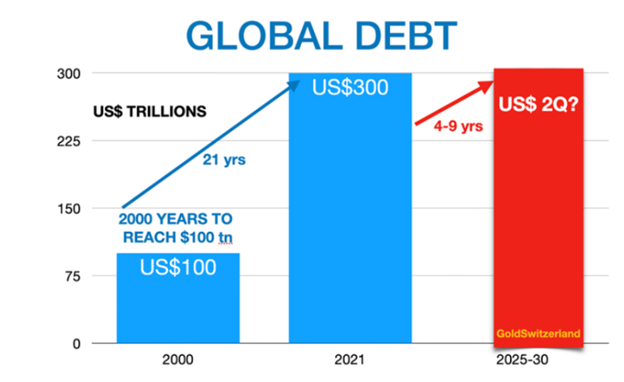

In the last 20 years, for example, policy makers have tripled the global debt levels yet made no commensurate progress with global GDP, which is literally 1/3 of this embarrassing debt pile.

That is shameful. Debt like this always destroys economies. Always.

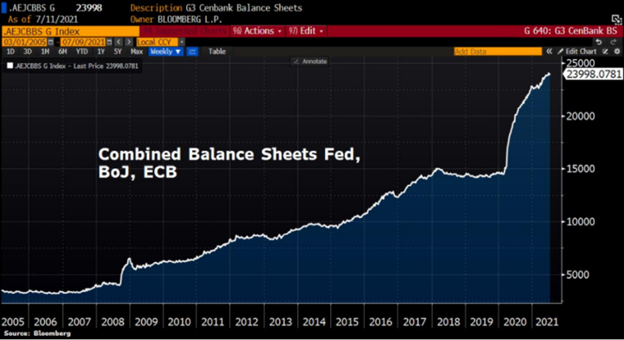

Instead, those same “experts” have mouse-clicked more instant money out of thin air in the last decade than all the money ever created by all the combined central banks since their inception.

They actually want you to believe that a debt crisis can be solved with alas…more debt.

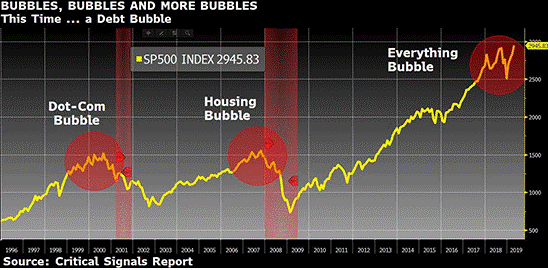

Such staggering money creation has led unequivocally and directly to the greatest and most inflated risk asset bubble in the history of capital markets.

Yet rather than admit to the open failure of such monetary expansion, which has simply crushed the natural purchasing power of fiat currencies…

…the architects of this failed experiment will now try to blame such excessive debt and currency destruction on a severe flu pandemic rather than years of their own pre-COVID policy crimes.

Today, politico’s and their central bank masters are literally comparing the Pandemic’s death toll to the unthinkable disaster which was the +75M killed in World War 2.

They then employ this pandemic narrative to justify another Bretton Woods-like reset.

To any who have studied, or far worse, experienced the second world war, do you think it’s even remotely fair to compare it to the “war on Covid”?

The Carefully Telegraphed “Reset”

And what is this “needed” reset?

In a nutshell, it’s more fake money in the form of CBDC or even digital SDR’s from that shameless control center of failed monetarism otherwise known as the IMF and a central bank near you.

Those Who Control Money & Information

In an open and free system, rather than criminalizing police officers, nurses, or even athletes who refuse a jab, should we not be pointing our headlines, adjectives and subpoenas at the bankers, experts and policy makers who put the global financial system at this horrific, debt-soaked and socially destructive turning point?

Are you waiting for Mark Zuckerberg, Don Lemon, Wolf Blitzer or the censorship boards at YouTube, FaceBook or Google to guide you?

Sadly, those who control money as well as information have immense and undeniable power.

Thus, a media that controls deliberate COVID distraction, supported by the lords who created this financial serfdom, continues.

That is, the feudalists responsible for such grossly mismanaged financial markets are all too aware (and nervous) that they have equally created the greatest wealth transfer and wealth disparity ever witnessed, akin to the pre-revolutionary era of Marie Antoinette France, Romanov Russia, Batista Cuba or Weimar Germany—none of which ended well…

Such otherwise immoral and corrupt wealth disparity, wealth transfer and wealth creation explains why the very architects of the same would rather have the masses fighting about jabs, schoolboards, and “woke” SJW’s gone wild rather than at themselves–the root cause of the fracturing we see all around us.

Why?

Because controlling serfs with lies, fear and division is better than letting those serfs replace you with truths and/or pitch-forks.

Truth Still Matters—Fundamentals Too

For that select yet blunt and independent-thinking minority who thankfully prefer candor over propaganda, reality over fantasy and genuine rather than hyped solutions to the problems and problem-makers all around us, all l/we can do is trust history, facts, natural market forces and each other.

As for us, our candid solution to the foregoing string cite of distortions, controls and historical tipping points remains the same.

Regardless of the tricks, re-sets, and digital new bluffs of the new feudalism, enough free-thinkers, nations, informed investors and wealth managers understand that they hold a better (and golden) hand to combat the dirty hands and dirty currencies unraveling all around us.

If there’s one thing history and free market forces have taught us it’s this: In the end, broken systems die and real money returns.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD