Dollar Woes to Debt Denial: The USA Is Screwed

Below, we see why the USA is screwed.

De-Dollarization: Downplaying the Obvious

De-Dollarization is a real, all too real trend, though it is both fascinating and disturbing to see what is otherwise so obvious being deliberately down-played, excused or ignored from the top down.

But then again, the laundry list of ignored facts and open lies from the top down to hide hard truths in everything from inflation data to recessionary debt traps is nothing new.

Instead, such propaganda replacing blunt transparency is the new normal (and classic trick) for all historical endings to debt-soaked (and failing) nations/systems and their fork-tongued (i.e., guilty) policy makers.

Slow & Steady

De-Dollarization, of course, is a gradual rather than over-night process.

Its origins stem from 1) years of exporting USD inflation overseas (to the painful detriment of friend and foe alike) and 2) the insanely stupid decision to weaponize the world reserve currency (i.e., USD) subsequent to a border war between two local tyrants in the Ukraine.

Whether or not you buy into the Western “media’s” narrative which categorizes Putin as Hitler 2.0 and Zelensky as a modern George Washington, the weaponization of the USD (and freezing of FX reserves) has made an already dollar-tired globe even more distrusting of Uncle Sam’s currency and IOUs.

This trend is confirmed by the profound dumping of USTs throughout 2022 and the undeniable trend among the BRICS (and the 36 other nations) to deliberately seek bilateral trade agreements and settlements outside of the USD.

Furthermore, with Saudi talking to China and Iran, and with China talking to Mexico, Russia and just about everyone else, it’s fairly clear that a move away from the once sacred petrodollar (Pakistan now seeking Russian oil in Yuan) is no longer just the fantasy of conveniently eliminated folks like Saddam Hussein or Muammar Gaddafi…

As I discussed here and here, the petrodollar is under threat, which means longer-term demand for the USD is equally so.

But the USD Still Has Legs—For Now…

That said, there’s also no denying that the USD is still very strong, very important and very much in demand.

After all, and despite welching in 1971 on its 1944 promise to be gold-backed, the USD is still the world reserve currency.

With over 40% of global debt instruments denominated in Greenbacks and over 60% of the reservoir of global currencies composed of USDs, this reserve status (and hence forced demand) aint going anywhere too soon.

Furthermore, and as I have written and agreed, the so-called “milk-shake theory” is not altogether wrong.

That is, demand for USDs (and USTs) within the tangled and levered web of US derivative and Euro Dollar markets is baked into a system which will take years (not days) to unravel, monetize or replace, and this sure as heck won’t be orderly, global nor overnight.

Then Comes Change, Pain and Open Denial

But let’s get real: The days of the USD as a trusted payment system or hegemonic power broker are unwinding right before our very eyes.

And the best way to see the truth of this reality is to catalogue the ever-expanding list of lies from the big boys and their complicit, media ja-sagenders (“yes-sayers”) desperately trying to deny the same.

At first, for example, the centralized economists were blaming de-dollarization and CNY energy transactions on the Russian sanctions.

Gee. Go figure?

Thereafter, the economists said de-dollarization is just the result of Emerging Market (EM) countries momentarily running out of (in fact they’re intentionally dumping) USD reserves.

Western “experts” are trying to convince themselves and the rest of the world that EM nations will implode unless they eventually acquire more USTs and USDs to buy energy.

What these experts are failing to see (or say), however, is that many of those countries are already beginning to buy that energy outside of the USD…

Folks, de-dollarization in global commodity markets is happening already, and will accelerate rather than fade away into some fantasy image of how the “West was Won,” for as argued elsewhere, the West is already losing.

Facts Are Stubborn Things

As for the list of nations, both big and small, de-dollarizing right before our watering eyes, just consider, well…China, Russia, India, Pakistan, Ghana, Bolivia…

Even the world’s largest hardwood pulp producer, Suzano SA, is in talks with China to trade its commodity in CNY.

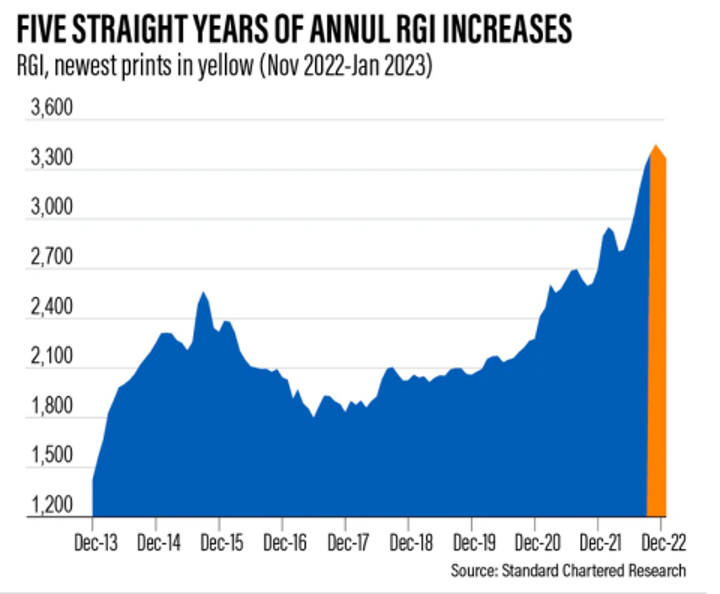

This transition from a weaponized USD to an expanding CNY is not just the sensationalism of fiat-haters but the hard math of real events and data, which the following chart of the Renminbi Globalization Index (up 26% in 2022) makes all too clear…

The undeniable trend and rise (which is not the same as “hegemony”) of the CNY is certainly not good news for the fiat-all-too-fiat USD, who is less and less the prettiest girl at the dance.

As trust/demand in the USD falls, so too does its purchasing power, which may explain why China, at the very same time its trade power increases, is simultaneously growing its gold reserves in anticipation for what it knows is coming but what the West still refuses to see, namely: The slow-drip neutering of Uncle Sam’s fiat currency.

See the trend folks?

We Told You So

See why picking a currency-for-energy war against Russia (the world’s biggest commodity exporter and a nuclear power in bed with China, the world’s biggest factory owner and a nuclear power) may have been a bad idea?

As we warned literally from day-1 of the sanctions, this was obviously not the same as picking a sanction fight with say, Iran or Venezuela…

Nope. This scale of this was far more dangerous, and the avoidable casualties still piling up in the West’s proxy war (on Ukrainian soil/rubble) are not just soldiers and civilians, but Greenbacks too.

This was foreseeable.

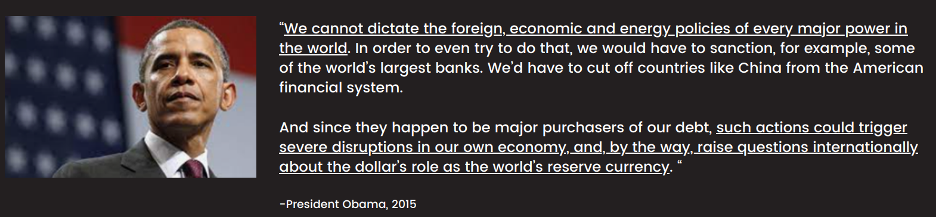

Even Obama foresaw it in 2015:

Clearly, Biden’s handlers, however, didn’t see it in 2022.

They wanted to play war rather than sound economics, and the end result will be a loss of both.

As for the USD: Volatility Before Debasement

As for the fate and price of the USD near-term and long-term, the move will be volatile rather than in a straight line north or south.

The USD can still go higher, much higher, as fewer Greenbacks overseas still face large debt payments.

Ultimately, however, Uncle Sam’s own twin deficits and schoolyard of children masquerading as House Members/”leaders” will deficit spend the USA into a debt spiral whose only “cure” is more mouse-clicked and debased dollars along side more unloved and over-issued USTs (IOUs).

Thereafter, the up and down moves of the USD will eventually just sink, Titanic-like, in one direction as ever-more USD’s collide with a growing debt iceberg.

As argued so many times, but worth repeating: The last bubble to die in a debt-soaked regime is always the currency. Even the increasingly unloved world reserve currency will be no exception to the laws of over-supply and decreasing demand.

Between now and then, all we can expect are more lies from on high and more centralized controls masquerading as efficient payment systems and national emergencies blamed on Eastern bad guys and bat-made (?) virusesrather than the bathroom mirrors of our central planners (happy idiots?).

All Good Until Things Break

We have always warned that Powell’s rate hikes (too much, too fast, too late) would be too expensive for Uncle Sam, and would thus break things here and abroad—from repo markets, gilt markets and Treasury markets to a US fiscal implosion and dying regional banks.

Next to implode are the labor markets.

Six decades of data confirm that rising rates always break things.

But when you place such rising rates into the context of the greatest debt crisis in US (as well as global) history, the “breaking” gets really ugly.

Until the Fed supplies more inflationary liquidity (fiat-fantasy money), the dual forces of a hawkish Powell and a de-dollarizing yet milk-shake world means the USD could rise and squeeze out the dollar short traders nearer term.

Anything but “Softish”

Ultimately, however, and after enough smaller banks have been murdered (more will die) and after the UST market has suffered all it can suffer, too much will break at once, and it won’t be soft, or even “softish.”

This is not fable but fact. The only “tool” the centralizers will have left is more synthetic, fiat (and inflationary) liquidity on demand.

This trend is simple: Uncle Sam is broke and his only solution is a money printer.

In short, a counterfeit answer to a real cancer.

Don’t believe me?

Just ask the US Treasury Dept.

More Ignored Math from DC

The latest TBAC (Treasury Borrowing Advisory Committee) confirms the US has already deficit spent $2.060T in fiscal 1H23, the interest expense alone of which is 101% of tax receipts.

This effectively puts the USA into a red-zone of imbalance reminiscent of the COVID crisis, only this time they don’t have COVID to blame for a debt addiction that was in play long before Fauci stained our screens or Powell printed more money post-March-of-2020 than was produced in the entire compounded history of our nation.

The TBAC report further indicated that projected US Federal deficits for 2023 to 2025 have risen by 30-50% in just the last 90 days…

And folks, the only way to pay for this embarrassing bar tab in DC is either more open QE (mouse-clicked trillions) and/or a much, much, much weaker USD to inflate away this debt as we head simultaneously into the mother of all recessions.

Such a crisis, of course, could be preceded by temporary (relative, rather than inherent) spikes in the USD until more UST supply/liquidity weakens the Greenback and sends gold higher, regardless of the USD’s relative strength and then subsequent weakness.

Meanwhile the Propaganda from On-High Continues

As I’ve said in interview after interview, you know things are getting really bad when comforting words and de-contextualized data increasingly replace simple (but scary) math.

At $95+T in public, household and corporate debt, the US has irreversibly passed the Rubicon of any easy solutions.

As Egon von Greyerz makes abundantly clear week after week, the US in general and the Fed in particular have irrevocably cornered themselves.

Stated otherwise: The USA is screwed.

DC has to chose between saving its “system” (of insider/TBTF banks, self-interested politicos–from the Maoist “woke” to the neocon “dark” and Wall Street Socialism) or destroying its currency.

Needless to say, it’s ultimately the currency that will fall on the sword for this now openly corrupt and pathetic “system.”

But again, rather than confess their own sins, the message is always “be calm and carry on.”

The Latest Fantasy Chart

Take, for example, the latest puff-tweet regarding Bloomberg’s “US Economic Surprise Index” which paints an oh-so rosy picture of the US economy rising at the fastest pace in over a year.

But as far smarter folks than me (i.e., Luke Gromen) will remind, this so-called data is ignoring a few contextual elephants in the room…

Context Helps

First, the above “good news” ignores a US debt/GDP ratio of 125%, a deficits/GDP ratio of 8% and government spending at 25% of GDP.

Secondly, US Government Outlays (i.e., deficit spending) has been growing at 30% for five of the last seven months.

Spending rates like this have only occurred twice in the last four decades, namely: 1) during the height of the COVID hysteria and 2) during the height of the 2008 GFC.

So, despite the “good news” in puff-charts above, the pundits are ignoring the fact that Uncle Sam (and his mis-fit children in the House of [lobbied] “Representatives”) are spending as if the USA is already in the eye of a financial storm.

And yet we haven’t even seen the recession officially hit or labor and risk markets tank, YET.

Imagine the spending when things get officially far worse than today—and they will; it’s now mathematical.

Out of Sight, Out of (Our) Mind

Sadly, however, very few investors are seeing the bigger picture and the wandering elephants.

In the interim: 1) the military industrial complex will create more profits and jobs here and more casualties overseas; and 2) deficit spending will keep unemployment in check (for now) and GDP “stable” until 3) its deficits (and debts) cancerously metastasize within a nation frog-boiling in debt and fractured by manufactured identity politics over transgender beer ads and slavery reparations from the 1860’s.

Such “woke” trends are ironic, given the fact that middleclass Americans of all colors, sexualities, “privileges” or political bends are already unknowing slaves/serfs in a modern feudalism of fake capitalism fighting against the bogus (yet SJW) “equity” euphemism of a woke (but hidden) re-distribution of social “shares” smacking of modern yet genuine Marxism.

Slowly, Then All at Once

And amidst all this distraction, division and in-fighting, the reality of rising rates colliding into historically unprecedented debt levels will just crush all stripes of Americans in the same manner Hemingway described poverty: “Slowly, then all at once.”

As Egon has often told me: Be careful what you wish for or already know.

Gold will inevitably go higher as the rest of the nation/world slides into its foreseeable debt trap and fiat end-game.

This may be obviously good for gold; but it will be at the expense of so much else, as the disorder ahead is neither fun nor pretty.

And it’s only just beginning…

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD