Showdown on the Markets – in 5 Charts

There is a good reason why the Chinese understand the saying “May you live in exciting times!” as a curse. Economic and (geo)political developments in recent weeks and months have indeed been exciting. In many areas, it looks as if we are heading for a showdown, for a lasting, formative change. The following five charts present the multi-faceted showdowns that are happening right now before our eyes.

We cannot choose that the times are currently so exciting. However, we can choose how to deal with these exciting times so that they do not become a curse for us, but rather an advantage for us and as many people as possible.

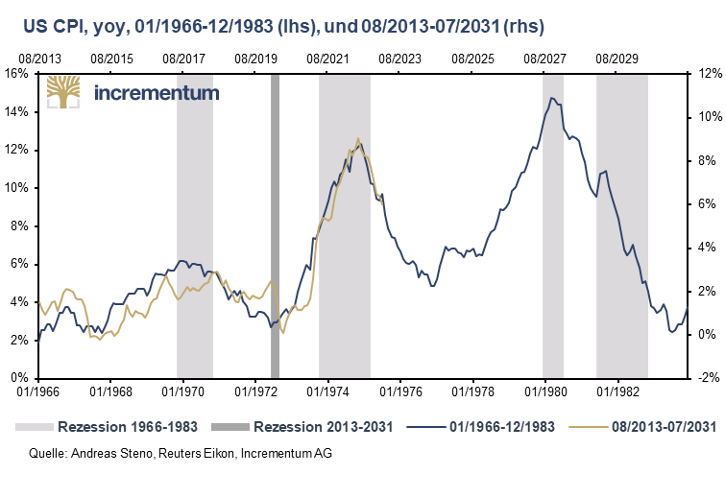

1. Inflation – History (still) rhymes

The parallels between the inflation trend in the 1960s, 1970s and early 1980s and the inflation trend since 2013 is almost frighteningly striking. Only the scaling needs to be slightly reduced by a quarter, loosely based on Mark Twain’s well-known statement: “History doesn’t repeat itself, but it rhymes!”

If the parallelism continues in this way, a disinflationary environment can be expected until early summer 2024, after which the second wave of inflation would set in, breaking only in fall 2027.

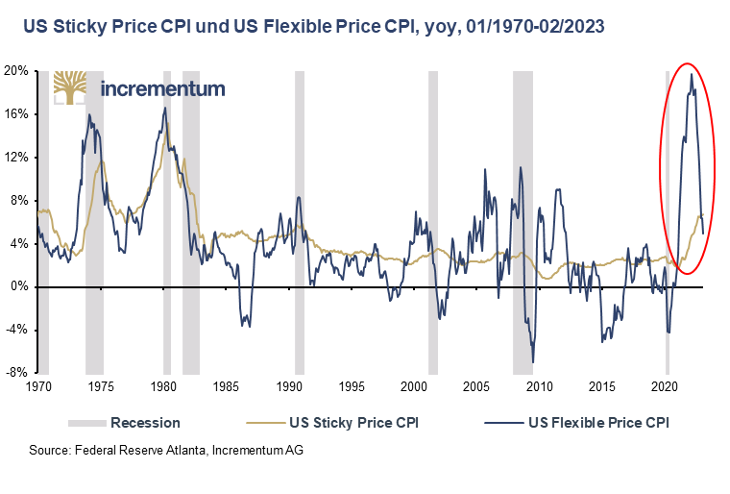

2. Inflation is likely to prove more persistent

Some prices are adjusted quickly to reflect changes in the market situation. These include, for example, gasoline prices, many food prices or car rental prices. Other prices react only with a significant delay, such as garbage charges, the cost of a doctor’s visit, prices in the education sector or rents.

The different price development of these two subgroups is reflected by the Federal Reserve Bank of Atlanta in proprietary indices. After a historical increase to almost 20%, flexible prices are now falling sharply. The sticky prices are behaving quite differently. At just under 7%, they are at a level not seen since the inflation wave of the late 1970s/early 1980s. They are now rising even more strongly than flexible prices and remain at a high level.

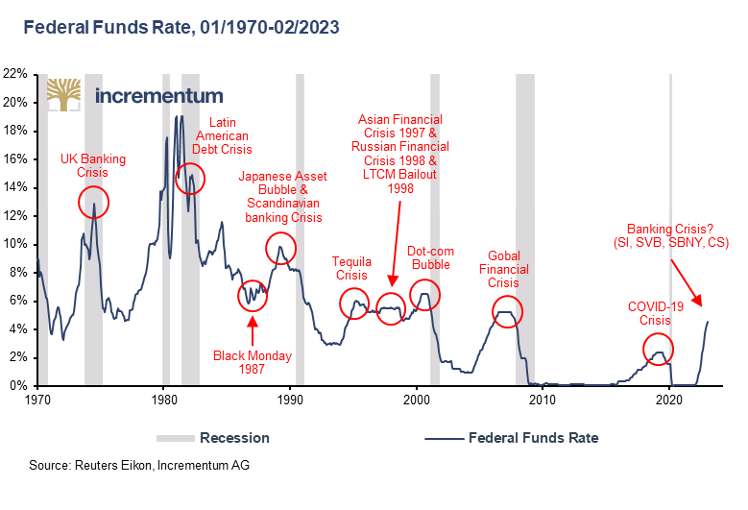

3.Iinterest rate increase cycles

“This time is different” – four words suffice to describe one of the greatest economic illusions. Every generation of investors has yet to succumb to this illusion that a development – in our case interest rate hikes – which in the past have (always) led to one and the same result – in our case severe economic turbulences – -will not happen this time. In everyday life, we would call such behavior stupid.

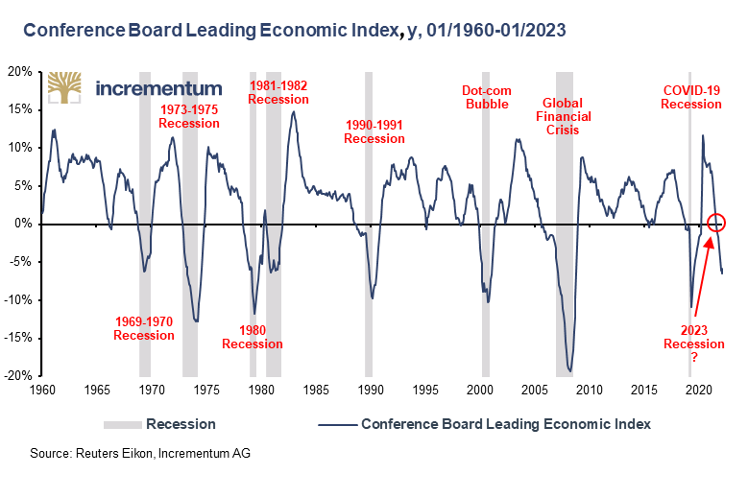

4. A recession seems inevitable

While stock markets give the impression that the worst is already behind us, many leading indicators point to the imminent slide into recession, including the Conference Board Leading Economic Index. This index is composed of 10 economic indicators selected for their ability to predict changes in economic activity. The indicators are selected based on their sensitivity to changes in the economy, their timeliness, and their ability to predict future trends. The 10 components include such diverse economic developments as money supply trends, interest rate spreads, consumer confidence, and initial claims for unemployment insurance. This index has correctly predicted every recession in the past 5 decades as soon as the index slipped significantly into negative territory.

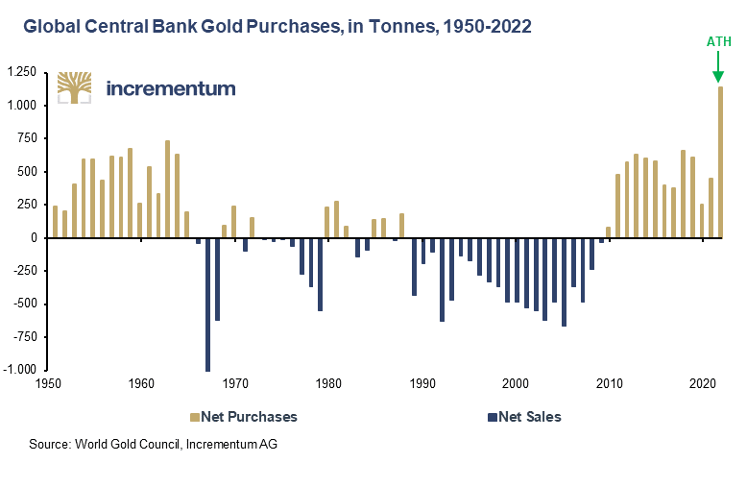

5. Central banks are going for gold

2022 saw record central bank demand for gold. Never since 1950 have central banks increased their gold reserves as much as in 2022, with net purchases totaling 1,136 tons. Three aspects require particular attention. A breakdown of gold purchases by quarter shows that three quarters of gold purchases by central banks in 2022 were made in the second half of the year. Since, as in previous years, it was mainly non-Western central banks that increased their gold holdings, this can be interpreted as a very quick reaction on the part of central banks to the freezing of Russian US dollar and euro currency reserves. Second, China has been making official purchases again since November 2022. And third, about 50% of gold purchases cannot (yet) be attributed to any country.

In this economically and (geo)politically fragile environment with an uncertain outcome, gold has once again proven to be a stable anchor in recent weeks and has made strong gains. Since the interim low at the beginning of November 2022, gold gained 24.0%, since the beginning of the year 10.7%, and since the outbreak of the banking crisis 11.3%. And there is no reason to believe that gold will not continue to excel at this task in the exciting times ahead.

A short message on our own behalf: the In Gold We Trust team is currently working furiously on the In Gold We Trust report 2023, which will be published on ingoldwetrust.report on May 24, 2023. You can already sign up for the mailing list on the website. You will then be informed by us on time about the publication of the In Gold We Trust report 2023.

by Ronald-Peter Stöferle, Incrementum AG

About Ronnie Stoeferle

Ronnie Stoeferle

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD