Gold In 2025: After The Rally Is Before The Rally

2024 was an eventful year in politics. Around half of the world’s population was called to the polls for presidential or parliamentary elections. For the first time in the history of Western democracies, every governing party lost support in the elections. Among all the changes of government, Donald Trump’s return to the White House stands out, especially as the Republicans also hold the majority in the Senate and the House of Representatives. A few weeks ago, the German traffic light coalition collapsed after long squabbles. Germany is now voting prematurely at the end of February.

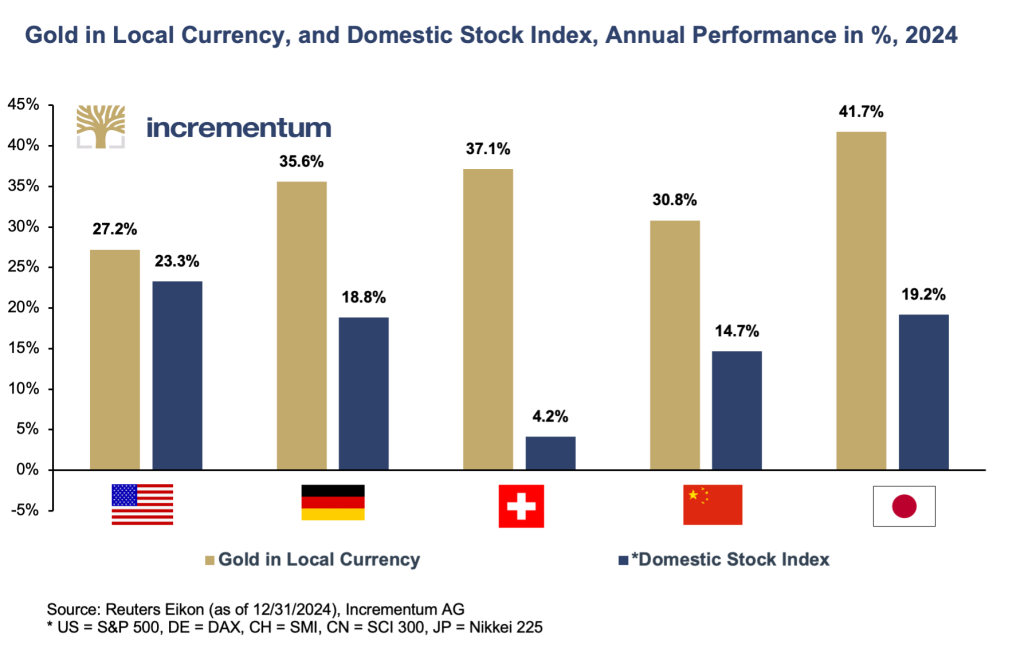

For gold investors, 2024 was truly a golden year. The yellow precious metal gained 27.2% in US dollars, 35.6% in euros and 37.1% in Swiss francs. The marked differences in performance in the various currencies indicate the significant exchange rate shifts between the currencies last year. In US dollars, 2024 was the sixth year with a positive annual performance for gold since 2016; in euro terms, it was the seventh consecutive year with positive returns. In Swiss francs, the rhythm that has existed since 2015 – one year of losses followed by two years of gains – was broken in favour of gains. Gold in Swiss francs has, therefore, closed seven of the past 10 years with positive returns. And in the first days of the new year, gold reached a new all-time high in euro terms, due to continued weakness of the euro weakened.

The astounding rise in the price of gold since the summer was halted by Donald Trump’s re-election as US President at the beginning of November. However, the dip in the final weeks of 2024 was unable to significantly change the far above-average annual performance of gold. In euros and Swiss francs, the marked appreciation of the US dollar since Donald Trump’s re-election prevented a decline in the price of gold in both currencies.

Gold beat most other asset classes in 2024

With a clear double-digit percentage increase, gold outperformed most stock markets, which also performed well to very well. Gold was even ahead of the booming US stock market.

Year-on-year, there was little movement in long-term bonds despite the repeated interest rate cuts. However, 2024 was another year in which bonds ended the year in the red. The 10-year US Treasury fell slightly, marking the third year in the past four in negative territory. This also applies to the 10-year German Bund.

Among the other precious metals, silver also had an outstanding year, gaining 21.5% on a US basis, 29.6% on a EUR basis and 31.0% on a CHF basis, despite the marked weakness following the US elections at the beginning of November. In the wake of the bull market in precious metals, mining stocks also recorded gains. The HUI rose by as much as 13.3%.

Public debt continues to grow skywards

After the impressive gold price rally last year, it would come as no great surprise if the gold price were to continue or even intensify its consolidation phase, which has been ongoing since Donald Trump’s re-election, following the strongest annual rise since 2010. The first trading days of the new year did not confirm this fear. In the medium and long term, the general conditions for gold remain positive to very positive.

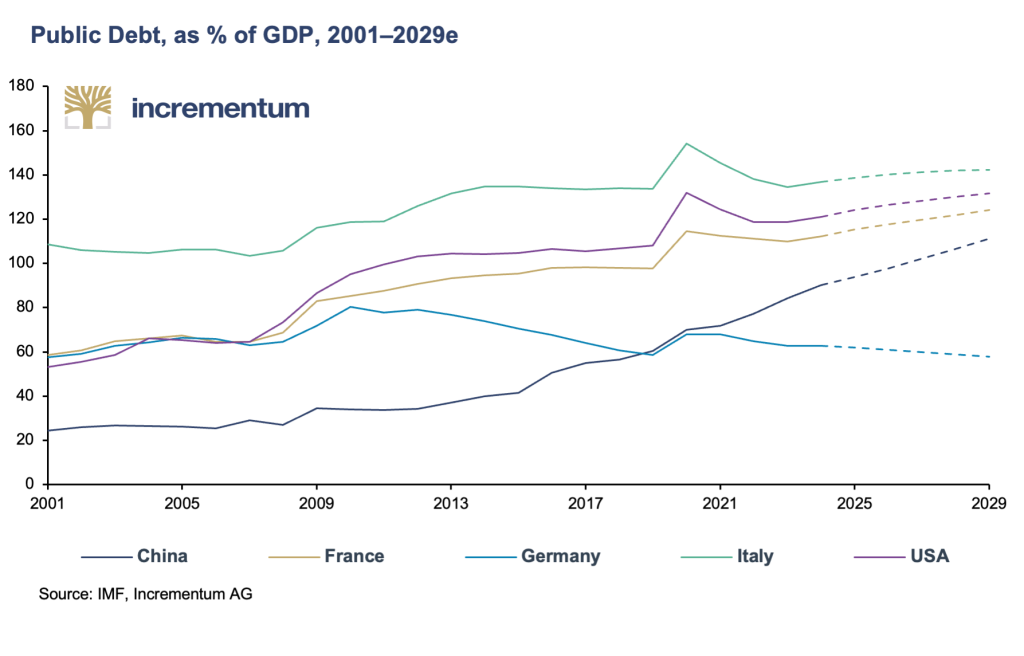

One structural factor supporting gold is the permanent growth of public debt, aggravated by the fact that public debt is reaching a critical level, even in industrialized countries. In April last year, the Director of the International Monetary Fund (IMF), Kristalina Georgiewa, warned with unusual urgency about the development of sovereign debt, particularly in industrialized countries. She said: “Our forecasts point to an unforgiving combination of low growth and high debt – a difficult future.” It is true that the growth prospects for the US are better than for most other industrialized countries precisely because of the high budget deficits. However, an economic slowdown due to an escalation in geopolitical tensions or as a result of the broad use of tariffs announced by Trump would also affect the US.

Donald Trump, the politician who described himself as the “king of debt” during the 2016 election campaign, was re-elected US President. In 2017, he moved into the White House with a US debt of just under USD 20trn; now, it stands at over USD 36trn or 80% more. As a percentage of economic output, the increase is almost 20%!

Trump cannot reject this legacy; on the contrary, it can be assumed that he will continue to increase it – in a negative sense. The Committee for a Responsible Federal Budget (CRFB), a non-partisan organization, has made calculations on the development of the US national debt based on the proposals presented by Trump during the election campaign up to the end of October. The CRFB’’s calculations showed that, based on the legal situation at the time, the US public debt would rise from its current level of around 100%, i.e. excluding intragovernmental debt of around 20% of GDP, to 125% by the end of 2035. The range of proposals presented by Donald Trump during the election campaign would see the US national debt rise to between 128% and 180%, with 142% as the most likely scenario. In his first term in office, Donald Trump widened the deficit from 3.4% in his first year in office to 4.6% in 2019 and then to 14.7% in the first year of the Covid-19 pandemic. Whether the new/old US president will actually implement his announcement to get the structurally high US budget deficit under control through massive spending cuts by establishing the Department of Government Efficiency (DOGE) is doubtful, given the experience of his first term in office, especially as many states governed by Republicans also benefit considerably from the transfers from Washington. In addition, the next federal elections in the US are already just around the corner. The entire US House of Representatives and a third of the Senate will be re-elected in November 2026.

Europe’s number one problem child, France, is also failing to get its budget under control. At around 6%, it is of similar size as the US deficit. Add to that the political instability of France. France is on its way to becoming the new Italy, both politically and economically. However, France has a completely different, heavier political and economic weight in the EU and in the ECB than Italy. Germany is back on the consolidation path due to the constitutionally secured debt brake. And China is supporting its weakening economy with fiscal and monetary policy measures. Accordingly, the Chinese budget deficit is steadily increasing and is likely to exceed the 6% mark. As a result, the deficits are pushing up the government debt ratio. The precarious debt and, in many cases, fiscal situation will put more and more central banks under at least indirect pressure to loosen monetary policy.

Central banks are already cutting interest rates again

The number of over 60 interest rate cuts in the fall of 2024 is the fourth-fastest decline in global interest rates since the turn of the millennium. At the peak of the rate cut cycle during the global financial crisis, the number of rate cuts was only slightly higher at 76. These repeated interest rate cuts and the announcement of further interest rate cuts are surprising in that inflation on both sides of the Atlantic remains stubbornly above the inflation target of 2.0%. Relief for the inflation rate has come primarily from energy prices in recent months. According to the flash estimate, even this trend came to an end in the eurozone in December 2024, particularly due to the sharp depreciation of the euro against the US dollar since Trump’s election victory.

Core inflation, in particular, is proving to be quite stubborn in many countries. Core PCE inflation has been consistently above the 2.5% mark since May 2021, while core CPI inflation has even been above the 3% mark over the same period. The long-lasting disinflationary trend came to an end in summer 2024. In the eurozone, core inflation has been moving sideways, well above the 2% mark for more than half a year

It is, therefore, not surprising that capital market interest rates are developing differently from key interest rates. Since the first interest rate cut in the US by a surprising 50 basis points on 18 September 2024, the yield on the 10-year US Treasury rose significantly by almost 1 percentage point by the end of the year, while the federal funds rate was cut by a total of 1 percentage point.

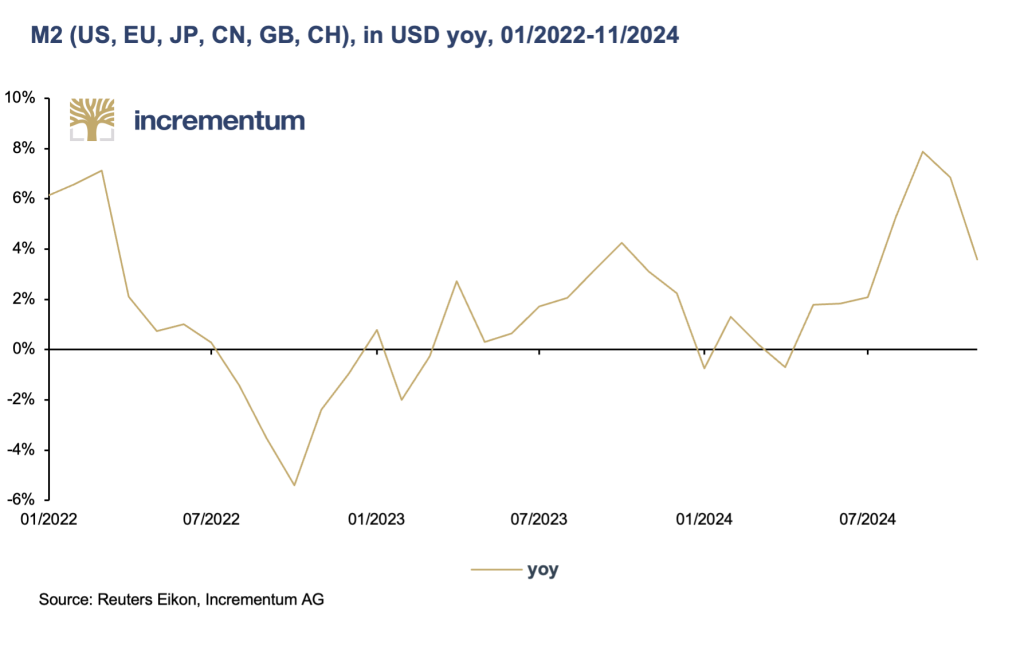

Despite QT: M2 rises again globally

The interest rate cuts are already having an impact on the development of the M2 money supply in the world’s most important currency areas. In the summer of 2024, the global money supply gained momentum, even though the Federal Reserve and the ECB are continuing their respective QT programs, and the Bank of Japan has also been reducing its balance sheet for several months. However, this reduction in the balance sheet total to a “normal” level cannot compensate for the People’s Bank of China’s expansionary course. The significant monetary stimulus measures are driving the global money supply trend, in combination with the numerous fiscal stimulus measures that are now in place.

Demand for gold remains high despite price rally

Despite the soaring price of gold in the calendar year 2024, demand for gold remains high, although there have been notable shifts in demand categories. At 3,761.9 tons, total demand in the first three quarters of 2024 set a record for the first nine months of a calendar year. Compared to 2023, total demand increased by 2.7% in this period.

Central bank demand declined compared to the record year 2022 and the second-best year 2023 but remains at a very high level. After just three quarters, it is already certain that central bank demand for gold in 2024 will be at least the third strongest year since 2010, the year in which central banks became net buyers again. In October 2024, the central banks increased their gold holdings by 60 tons, the highest monthly figure in 2024, and in November by a further 53 tons. In addition, after pausing for several months, the People’s Bank of China also returned as a buyer. There seems to be no end in sight to the current above-average demand for gold from central banks

The development in the category “OTC and other” continues to be striking. In this category, an increase of 61.0% was recorded in the first three quarters compared to the previous year. After 2020, when OTC demand doubled compared to 2019, 2024 is likely to be the second strongest year in this demand category. In times of global tensions and rising mistrust, bilateral settlements are clearly gaining in importance. Gold ETFs recorded a net outflow in 2024 as a whole. While minimal inflows were recorded in the US and significant inflows in Asia, there were strong outflows in Europe. However, December 2024 was the first December 2019 with net inflows. This could signal a trend reversal.

On the supply side, there was an increase of 3.0% in gold mining and 9.1% in gold recycling, which is why the total supply rose by 2.7% year-on-year in the first three quarters. The substantially higher gold price is having an impact on the supply side.

Conclusion

Following Donald Trump’s re-election, the long-awaited consolidation phase in the gold price set in. This breather is a good sign, as this consolidation allowed speculative demand to be reduced. The foundations have thus been laid for a continuation of the upward trend.

There are, however, some downward risks to gold in 2025: A continuation of the rally in cryptocurrencies could have a dampening effect on the price of gold in 2025, as could the increased attractiveness of bonds due to higher yields or a further upswing on the stock markets, as well as a stabilization of the Chinese real estate market and a lasting easing of geopolitical tensions.

All in all, however, it can be assumed that the general economic and (geo)political climate will continue to support the gold price in 2025, even if a repeat of the record year 2024 should not be expected. The following figures show that despite the record run in 2024, gold is not overpriced. Adjusted for inflation, gold only reached a new all-time high in the fall of 2024, replacing the previous all-time high from January 1980. In nominal terms, gold rose more than fourfold during this period, but global GDP increased more than ninefold and the S&P 500 almost tenfold. The risks on the equity and bond markets, as well as a possible weakening of the US dollar following Donald Trump’s inauguration, could give gold an additional boost. There is, therefore, much to suggest that gold will continue to perform well in 2025.

About Ronnie Stoeferle

Ronnie Stoeferle

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD