Modern Currency Policy: Nations Compete, Citizens Suffer

Below we consider how modern currency policy may not be so good for, well, the people…

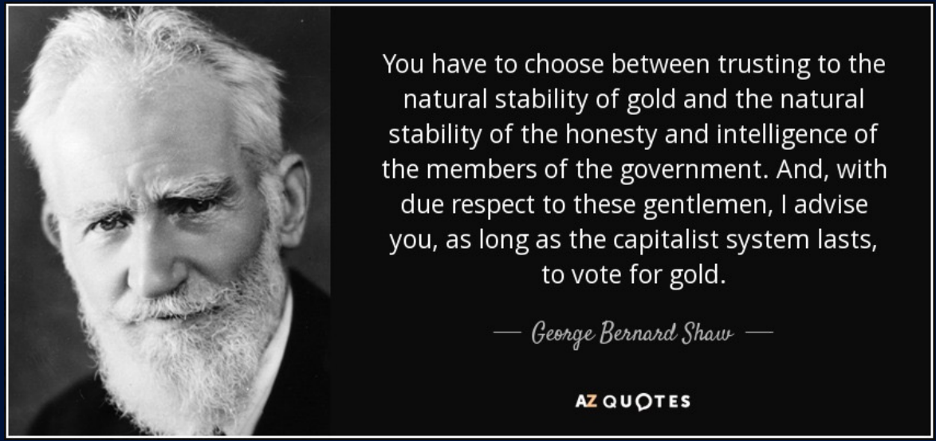

This is why gold inevitably enters the conversation, for unlike policy makers, this old pet rock garners more trust.

Gold, of course, loves chaos, tanking currencies and cornered, debt-soaked nations, the numbers of which rise with each passing day.

We see currency debasement as mathematically and historically inevitable, though we have no clue (no one really does) as to the precise date, trigger or time the already teetering fiat money systems fall over the global debt cliff.

We only know that the $300+T cliff is here, and that nations are racing toward it at historical speed, with equally historical consequences.

Physical gold holders, however, enjoy a certain and calm advantage: They don’t need to be precise timers; simply patient owners.

As for more signs of the move toward weakening currencies in general, and a weakening USD in particular, let’s look at some more history and current facts.

Hot vs. Financial Wars: Today’s Evidence, Tomorrow’s Polices

As headlines change with daily Western biases regarding the military war in Ukraine, America’s financial war with the East (i.e., China) will continue into the next generation.

It’s no secret to me, or many others, moreover, that the war in the Ukraine is a US proxy war against Russia, in which Ukraine (and its citizens) are merely a convenient battering ram against Putin.

That’s just my opinion, but we’ve seen this “freedom” movie before. Many times, and in many countries, none of which ended with much “freedom” …

But as to financial wars, they too are just an extension of politics by another means, and with the growing waves of de-dollarization rising in speed and height following the predictable ripple of effects of the 2022 sanctions against Russia, there is much which can be deduced today about the Realpolitik of the USD and its weakening future.

Is the Fed Watching China? Yep.

DC, of course, may not admit to the rise of China (growth and trade) and the slow decline of USD hegemony, but the facts and trends I’ve recently described are not escaping them.

So how will the USA fight its financial war with Beijing?

If history and math are any guides, much will hinge upon the USD, which means we can expect it to get weaker over time, despite inevitable peaks along the way.

Again, let’s consider the past as prologue.

The Rising Sun

I was playing little league baseball when Japan made its slow and steady rise into the 1980’s. But even I noticed more things, from Michael Douglas films to pop music, were “turning Japanese” in that decade of MTV fashions.

Japan’s rising sun seemed to have no end as Tokyo-based financiers were buying up everything from California real estate to the Rockefeller Center in NYC.

The Setting Sun

But fast-forward to 1989 and the Nikkei implosion, and that same Japanese sun was beginning to set.

By the mid-90’s, I was a young law student in Boston (never made the Red Sox roster) reviewing lease modifications in a Rockefeller Center which the Japanese could no longer afford.

In short: Things can change quite fast in the rise and fall of financial empires.

But it wasn’t just exuberant market bubbles which brought Japan down.

During the 90’s, the US was deliberately weakening the USD to reduce the warp speed of Japanese trade and economic growth.

At the acme of this hidden financial war, the yen had appreciated 46% against an intentionally devalued Greenback.

In short: Uncle Sam squeezed Japan.

The Rising China

China is clearly the next target (or “Japan”) for US financial war-gamers.

And it’s my strong opinion that among the many advantages and realities of a falling USD ahead, the hidden planners in DC are adding the desire to cripple Chinese growth as yet another reason (besides inflating away debt or combatting a denied recession) to weaken the USD.

In the 1980’s, for example, nations like Japan and Germany (whom, ironically, the USA helped defeat in a prior world war) had slowly and steadily emerged from the dust of the 1940’s with current account surpluses and hence rising domestic demand, which meant rising local currencies.

The Fed, at that time, saw an opportunity to end its “war on inflation” narrative and commence weakening the USD in the name of “growth,” but it was no coincidence that such measures (and narratives) also sealed the fate of a rising Japan whose yen was made too strong to compete on the global stage.

Today, I see a similar pattern emerging between the US and China.

Although the Fed has yet to officially abandon its “war” on an inflation disaster which they had previously (i.e., wrongly/dishonestly) described as “transitory,” they know the USD is and was too strong for its own good, and they also know that China and Russia are making deals which threaten US trade and settlement superiority.

In short: The US needs to fight ugly again, and to do, they need an uglier/weaker dollar.

Thus, in the coming months, quarters and years, when the rate hikes of late (paused for now, but promised for later?) keep on breaking things (see below), the inevitable pretext for an otherwise bad habit of debasing, printing and weakening the USD will become too tempting for the mouse-click-money-addicted central planners in Washington to ignore.

Stated even more simply: The pivot to easy money is only a matter of time, for in addition to needing an inflationary money-printer to stay alive (and print-away debt), DC also needs a weaker USD to beat a rising East.

Of course, in such a war, the greatest casualties will come from a Main Street earning weaker dollars…

US Bonds: The First to Fall in a Financial Cold War

On a real basis, that is to say, when measured against inflation (which will rise and fall, but ultimately stick around for years to come), the US reality will thus involve one in which bonds, in an inflation-adjusted context, will be sacrificed (vs. the CNY) if the US intends to engage in any kind of plausible financial war with China and others.

Or stated more simply, US bonds, having enjoyed an artificial, Fed-tailwind for over 40 years, will be the first troops (along with investors, IRAs and 401Ks) sacrificed in the financial combat of nations now firing their cannons on a world stage changing faster than the German Blitzkrieg through France or Ney’s calvary charge at Waterloo…

When one adds weaker bonds to a debased currency, the net result is bad for the average citizen as Uncle Sam plays its financial war games with China.

Hot War?

Of course, there is also the omni-present risk of a financial war turning into a hot war with China.

Though unthinkable in a nuclear era, such risks change the entire argument, and at such points, financial forecasting and planning (or reports like this) will be less of a priority than simply finding drinkable water.

Perhaps I’m naive, but I believe that such worst-case scenarios are too insane and stupid even for the policy makers and neocons in DC.

Besides, and as Michael Mullen said over a decade ago from the Joint Chiefs of Staff: How could America, who borrows money from China, which it then uses to build weapons to potentially fight China, actually go to war with China, where the vast majority of the components necessary for those very same weapons are made?

Ahhhh. We do love in interesting times, don’t we?

Waiting for the Pivot as More Things Break

For now, and assuming no nuclear Armageddon (which I don’t wish to consider), we can only sit back and wait as a totally fork-tongued and cornered Powell plays with markets, currencies and interest rates like a child playing with matches.

As for Capitalism, it died long ago. Instead, the Fed IS the market.

Powell’s far too fast and too-high rate hikes of 2022-23 (made far too late) have done a modest bit to “fight” inflation, but have been far more effective in murdering US bond demand and regional banks—as well as ensuring a recession, which I suppose, is one crazy way to “beat” inflation…

Big Trouble for Little Britain

In addition to prompting the world to turn away from the USD and Uncle Sam’s USTs, Powell’s hikes also forced the UK (BOE) to follow the rate-hike trend, which caused an implosion in their gilt market in October of 2022.

As I’ve said many times, with financial allies like the US, who needs enemies?

But the pain in the UK goes beyond just 2022 gilt markets or a Royal Duchess seeking photo opps at US polo tournamentsin 2023.

The Bank of England, chasing its tale as well as Fed policy, has just been forced to raise rates to 5% in what the BBC and Bloomberg prompt-readers recently described as a 50 bp “surprise move.”

In more honest reporting, or at least more blunt reporting, my view on the “surprise” rate hike is that it is (and was) no “surprise” at all.

In fact, such sudden, frequent and steepening rate hikes are nothing new or “surprising” to over-indebted emerging market nations, of which the UK, and the US, are no exception.

That is, the US and UK are just glorified banana republics once one looks honestly at their national balance sheets.

Thus, the UK is simply raising rates higher and faster to save an otherwise dying currency, and in doing so, are breaking everything else in their current path.

Already, over 1.2 million UK households have been made insolvent this year due to higher mortgage payments.

As BOE rates rise, bond prices fall and hence gilt yields (like mortgage payments) are now rising like shark fins toward scary levels seen last autumn.

In short, and as we warned of the US, you folks in the UK are going to need a bigger boat very soon…

Keep It Simple

The foregoing geopolitical, currency, and policy facts all suggest a world leaning further and further toward deliberate tweaking (strengthening and then debasing) of their fiat currencies to stay alive as well as “competitive” in a race to the fiat finish line in which all the horses are effectively cantering toward a glue factory.

As such trends continue, the question will not be about which currency you hold, but how much of it is backed by gold.

If nations won’t back that paper money in something precious, then investors can do it for themselves by owning physical gold.

It’s just that simple.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD