The Economic Future is Sad, Simple & Already Obvious

The foregoing title may seem a bit sensational, no?

With all the recent hype about a gold-backed BRICS currency emerging from this summer’s South African meet-and-greet vanishing like oar swirls, one can understand the argument that many gold bugs chase (and create) click-bait like teenage bloggers.

And the precious metals space is no stranger to being labeled perma “doom-and-gloomers” to keep the retail trade forever moving.

Fine. Understood. Yep. I get it. We are all “just selling our book.”

The Current Facts are Sensational Enough

But here’s the rub: One doesn’t need to be a doomer or a gloomer to interpret bond signals, basic math, historical lessons, current geopolitics, or openly obvious energy and precious metal flows with common sense.

If so, one sees the writing on the wall of nations going broke, currencies losing faith and sovereign bonds falling like rocks.

In short, one doesn’t need to sensationalize headlines or forecast doom when the current facts and numbers are more than sensational enough.

USTs: Crying Alone in the Corner

Foreigners hold about $18T worth of US assets, of which $7.5T are Uncle Sam’s increasingly embarrassing and unloved IOUs.

But those IOUs are looking a lot less attractive as an increasingly debt-soaked USA ($33T and counting of public debt) seeks to borrow an additional $1.9T (net) into the back-end of 2023 and issue another $5T of USTs into the next year, all of which has even Jamie Dimon pulling at his hair.

But who will buy those IOUs? Be honest.

And if foreigners start simultaneously dumping existing USTs into an already obvious US debt crisis, subsequent pain levels here and abroad, already felt, will only rise exponentially.

This is not fable but fact.

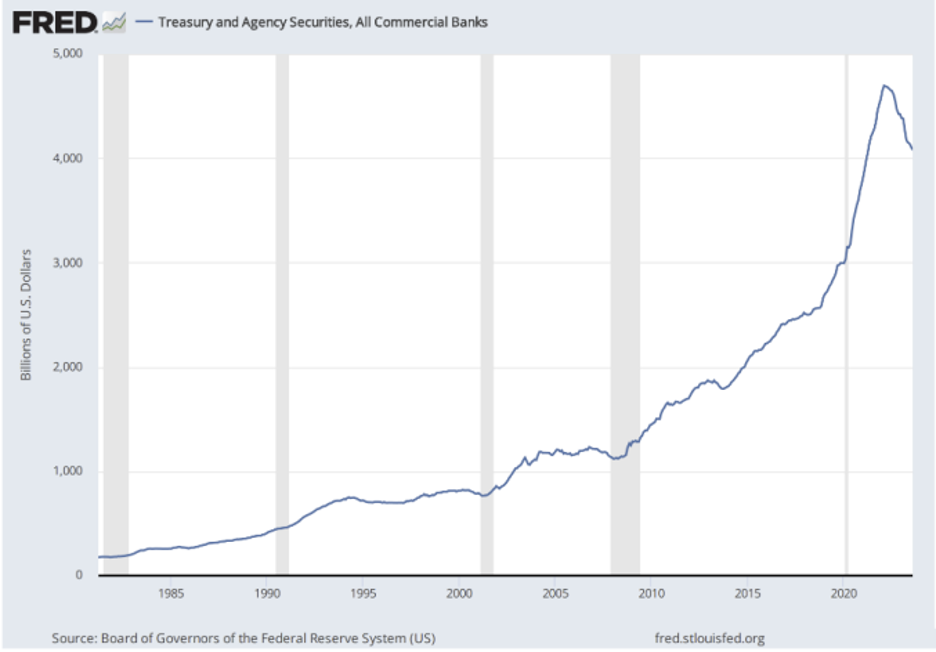

Even American banks, traditionally the biggest buyers of USTs, are now cutting back rather than ramping up their purchases…

And hedge funds, currently marginal buyers of USTs, could easily face liquidity scenarios where they will soon be massive sellers of these unloved IOUs.

Basic Math, Basic Liquidity

Meanwhile, as Powell’s higher-for-longer and (in my opinion) bogus war on inflation pushes the Dollar higher at the same time oil prices are inflating (shale production declining in the Permian, Russia cutting oil exports while US makes deals with Iran?), those foreigners currently holding that $7.5T worth of USTs will need liquidity to buy higher oil and pay-down increasingly more expensive (USD-denominated) debts.

This liquidity crisis mathematically means more dumping (rather than buying) of American sovereign bonds and hence more shark-fin rising yields (as bond prices fall), which, mathematically, will send debt costs fatally higher for companies, individuals, home owners and, yes, governments, already way over their skis in debt.

This is important, because, well… the bond market is important, a theme I’ve been hitting week after week, month after month, and year after year…

Gold Bulls Crying Wolf?

Again, some will still say that such basic math and blunt warnings from boring credit markets are little more than gold bulls crying wolf.

Unfortunately, history confirms that nations spiraling into a debt whirlpool always end with a currency crisis followed by a social crisis followed by increased centralization and less personal and financial freedoms.

Do such centralization trends feel familiar to anyone with their pulse on the current Zeitgeist?

So yeah, desperate bond markets matter, especially when measured in a world reserve currency which, like all currencies marked by unpayable debts, will be the final bubble to pop.

A Broken America Going Broke

The simple, empirical and now increasingly undeniable fact is this: America is writing checks its body can’t cash.

Even the US government is cracking/splitting under the pressure of its debt burdens, as anyone tracking the soap-opera with Kevin McCarthy can attest.

And whatever one thinks of Florida’s Eddie Munster Congressman, Matt Gaetz, it’s hard to disagree with his blunt declaration before a row of cameras outside the nation’s Capital– namely that America, already reeling under de-dollarization and debt woes, is now, as he puts it: “F—ing broke.”

Is he too just crying wolf, or should we consider the foregoing math? You know, basic facts…

No Good Scenarios Left

There are no good scenarios left for a country, currency and sovereign bond which has replaced productivity, balanced budgets, trade surpluses and national income with historically unprecedented debt, twin deficits and a central bank which has become the un-natural and de-facto (yet busted) portfolio manager over our shattered economy and totally centralized markets.

As I’ve been saying/asking for years during this slow and openly-ignored frog-boil toward credit implosion (nod to any lobby-bought politician near you), who will be the final buyer of our fatal debts in a world where no private sector entities have the balance sheets to do so?

The answer is sad, simple and already obvious: The Fed.

And where will the Fed find the money to pay for those increasingly more expensive debts (nod to Powell)?

The answer is sad, simple and already obvious: Out of thin air.

The Inflationary End-Game

Such inevitable monetization (i.e., QE + Yield Curve Controls) of historically unprecedented and drunkenly managed debt levels will, of course, be inherently inflationary despite intermediary disinflationary events (i.e., falling credit and equity markets).

All of this makes me repeat the ironic conclusion (shared by even the St. Louis Fed’s June white paper on Fiscal Dominance) that Powell’s so-called war on inflation (QT + rising rates) will end in historically inevitable inflation in the form of mouse-clicked trillions to “save” our system at the expense of our currency.

Already, the US Treasury Dept (See Josh Frost) is telegraphing its plan to make US bonds more “resilient” (i.e., liquid) via a not-so-clever plan to buy-back its own IOUs.

In other words, the Treasury Dept will be drinking its own (poisoned) Kool Aide with increasingly debased (yet relatively strong) USDs mouse-clicked out of, again…nowhere.

Does this seem like a good plan to any of you already feeling the daily decline of the inherent purchasing power of your greenback?

For Now, The Dumb Gains in Consensus

Yet despite such clear and common-sense signals from the simple math of debt gone wild, consensus still favors the long-duration UST as the relatively safest harbor in an admittedly broken global ocean.

Faith in the TLT today is almost as desperate as faith in Captain John Smith of the unsinkable Titanic.

But if math and history are not altogether ignored, cancelled or forgotten, a 15-point fall in the TLT and subsequent spike in already fatally high rates seems the most probable outcome.

Why? Because there just aren’t enough natural buyers of Uncle Sam’s criminally negligent bar tab other than a magical (and inflationary) money printer.

That’s just how we see it.

Soft Landing? It’s Already Hard

Meanwhile the Pravda-like efforts by policy makers (and the infantry and artillery support from their vertically integrated media platforms) are still pushing the “soft-landing” narrative despite nearly every indicator (bankruptcies, layoffs, yield-curves, YoY M2 growth, Fitch downgrades, Conference Board of Leading Economic Indicators and Oliver Anthony cries) making it painfully obvious that we are ALREADY in a hard-landing.

(And weren’t these the same soft “experts” who told us inflation was “transitory”?)

Folks: Things are already hard, not soft.

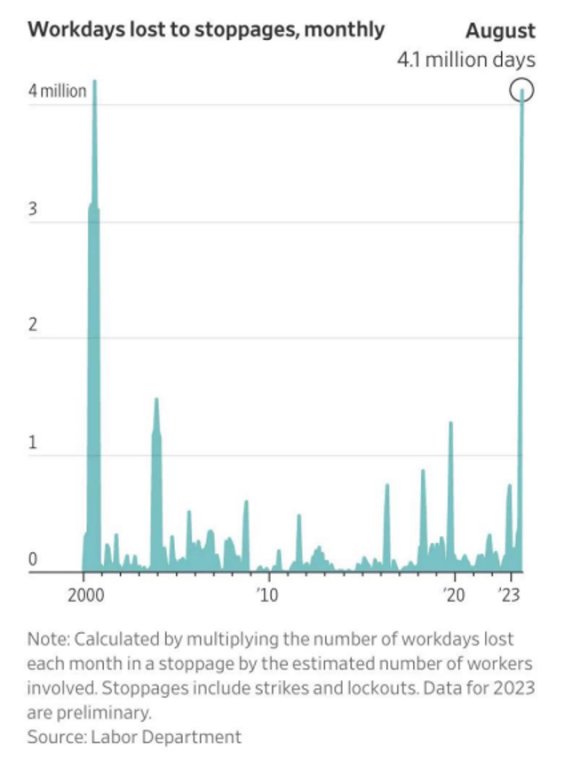

August in America lost 4.1 million days of work due to strikes (think Ford, GM etc.) as the West tries to tell us in one headline after the next that China (with 7 of the world’s 10 largest shipping ports) is the real problem and hence the least investable.

Hmmm.

A Global Problem

If anything, China and the USA suffering together will eventually make 2008 seem like a decent year for capital markets and global economies…

The hard reality is this: All western sovereign bonds are in historically deep trouble at the same time that China is facing real estate and debt bubbles on top of geopolitical shifts and hence supply-chain disruptions which are neon-flashing tailwinds for even greater price inflation in all those American products made in, well: China…

For all of these reasons, we favor assets best positioned to play where the inflationary hockey puck (or polo ball) is heading, not just where it sits today.

China: Changing the Gold Price

One of these assets, of course, is physical gold.

Speaking of China, what it has been doing with this asset is nothing short of extraordinary and foretells a great deal of what we can expect in the months and years ahead in the West when it comes to debt, inflation, rates, currencies and gold.

Or to put it even more simply: China is repricing the gold trade.

Unbeknownst to most who get their market data (and interpretations) from the legacy financial media, China has been quietly evidencing a clear intent (as well as ability) to weaponize gold against a now weaponized USD.

In particular, China’s central bank recently lifted limits on gold imports, whose temporary imposition, according to the Western press, was a failed effort to defend its currency and to curb USD outflows.

But as with most things legacy press-related, the real story is about 180 degrees opposite…

That is, our Google-searching, 30-something “investigative journalists” ignored the fact that: A) gold in China is bought in Yuan not Dollars and B) and that gold premiums in China jumped back to 5%.

In short, it seems that China did not fail to defend their currency but just succeeded in showing the world that their domestic policies can impact gold pricing.

In fact, the import restrictions only caused the gold price to rise within China’s boarders by a spread of over $120 per ounce over London spot.

However, once the import limits ended, the price spread fell to $76/ounce.

Stated more simply, China just proved that it can control gold, and by extension inflation expectations, rates, and even the USD.

This is because there is a clear and obvious correlation between gold flows (West to East) and gold pricing.

In the past, those flows (from London) were greatest when gold was sinking in price. But now, and for the first time in decades, the flow East is happening even as gold is rising.

Why?

The Natural Flow from Worthless Paper to Precious (Monetary) Metals

It was my consistent belief that despite no official gold-backed BRICS currency or explicit arbitrage of gold for oil, gas or other real assets, a more natural and expected trade would be unfolding with nearly the same intent and result, all of which will spur further Chinese gold buying (and Dollar dumping) over time.

Net result? Western gold pricing will be chasing/rising to the levels of domestic Chinese gold.

As the Chairman of the Shanghai Gold Exchange, Xu Luode, said in 2014:

“Shanghai Gold will change the current gold market with its ‘consumed in the East but priced in the West’ arrangement. When China has the right to speak in the international gold market, the true price of gold will be revealed.”

Please read that last line again.

As we warned literally from day-1 of the suicidally myopic sanctionsagainst Russia, the net result would be tighter relations between Russia and China, two countries already openly tired of the USD being the tail that wags the global dog.

If you haven’t noticed, Russia is selling much-needed oil to an openly oil-thirsty China in CNY rather than USD.

As gold, priced in CNY, buys more energy in China than in the west, more of that monetary metal will flow toward Shanghai, whose power over the London pricing of gold is about to ratchet upwards.

This was so easy to foresee, but the Western media likes to hide such foreseeable facts. After all, one of their greatest sins is the sin of omission.

When weaponizing the world reserve currency against Russia, the US-lead West forgot to mention what Luke Gromen described as its “Achilles Heel”—namely, the unallocated gold markets based out of London.

Changing Battle Tactics

By changing the trench lines of the gold-for-energy battlefield, China and Russia are slowly, but predictably, weaponizing gold and energy commodities against a weaponized USD.

In the long run, my bet is on gold and I’m not alone.

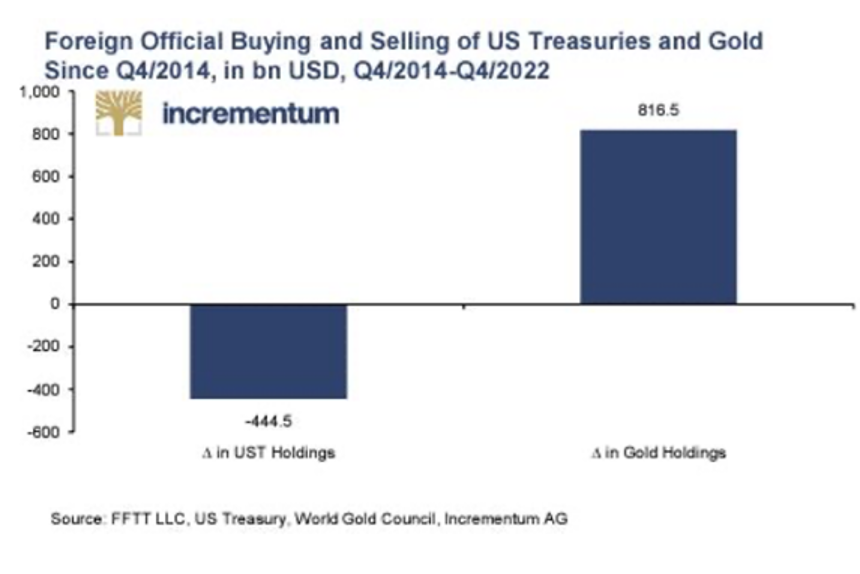

Just ask all those central banks stacking the physical metal and dumping America’s paper debt at record levels.

Like an army amassing troops, cannons, horses and supply wagons at the boarder, these central bank gold movements are obvious signs of a coming battle for a new trading system with less focus on Uncle Sam’s debt-based trading model and debt-soaked currency.

Needless to say, this is bullish for gold, which unlike the US markets and economy, is the true “resilient” asset, holding its price power despite positive (though manipulated) real rates and spiking UST yields.

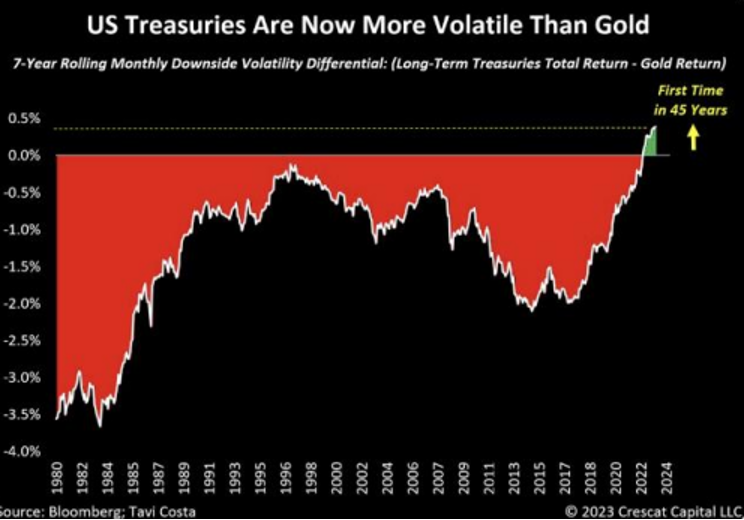

This may further explain why the downside volatility for long-duration USTs is now higher than the downside for physical gold, something not seen in almost half a century.

Just saying…

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD