NEXT GOLD MOVE WILL SURPRISE THE WORLD

Trump would not be surprised if there is no gold in Fort Knox.

There should be 4,600 tons there, at a value of $430 billion.

The U.S. allegedly holds 8,100 tons of gold in Fort Knox, with most remaining reserves stored at the New York Fed.

TRUMP: “Elon and I are going to Fort Knox to see if there is any gold there. If there are only 27 tons, we would be happy. Would not be surprised if there is nothing here – they stole this too!”

So, is Trump preparing the world that there is no gold in Fort Knox?

In a recent Tweet, I said:

So, the time has now arrived for the U.S. to show the world their gold hand.

Will Trump suppress the news, if it is bad? Very likely.

GOLD IN FORT KNOX A SIDESHOW

Whether the gold is or is not in Fort Knox, it could be seen as a sideshow.

After all, it accounts for only 2% of all the gold ever mined in history.

But on the other hand, either little or no gold there, results in no confidence in the U.S. or in the dollar.

GOLD PRICE IS RIDICULOUS

At $2,920, all the gold officially held by Central Banks is $3 trillion.

Just one US stock – Microsoft – has a market cap of $3 trillion.

How can the value of a SINGLE AMERICAN COMPANY equal the total central bank gold holdings?

It tells us, how overvalued stocks are; and that the gold price is ridiculously low.

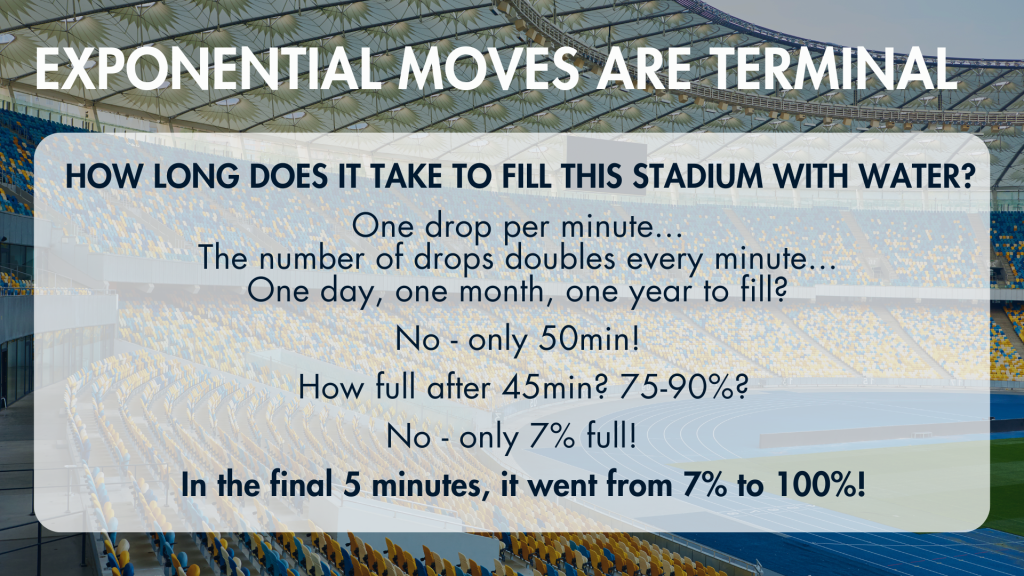

EXPONENTIAL GOLD MOVE IS STARTING

Gold is just starting another massive UP-MOVE. This is the acceleration or exponential phase, as explained below.

This is when gold will again go up by multiples, just as it always has when currencies collapse.

Stocks will also fall rapidly, and a bit later, bonds will fall (interest rates up).

Any major correction in gold is unlikely until it has reached much, much higher prices.

Thus, anyone watching conventional overbought indicators will miss the Gold Wagon.

And don’t forget, the next very big silver move hasn’t started yet. Paper-short positions in silver by bullion banks are temporarily keeping silver down.

When, or even before, the gold-silver ratio falls below 75 (now 91), silver will explode.

Silver will then move 2-3 X as fast as gold.

But remember that silver is very volatile and not for widows and orphans. So if you want to sleep at night, hold no more than 25% in silver and 75% in gold.

And remember, it must only be physical. There is an unlimited supply of paper, gold, and silver. One day, these paper contracts will be worthless.

SO WHY SHOULD ANYONE BUY GOLD?

As a matter of fact, virtually no one does as gold is only 0.5% of global financial assets.

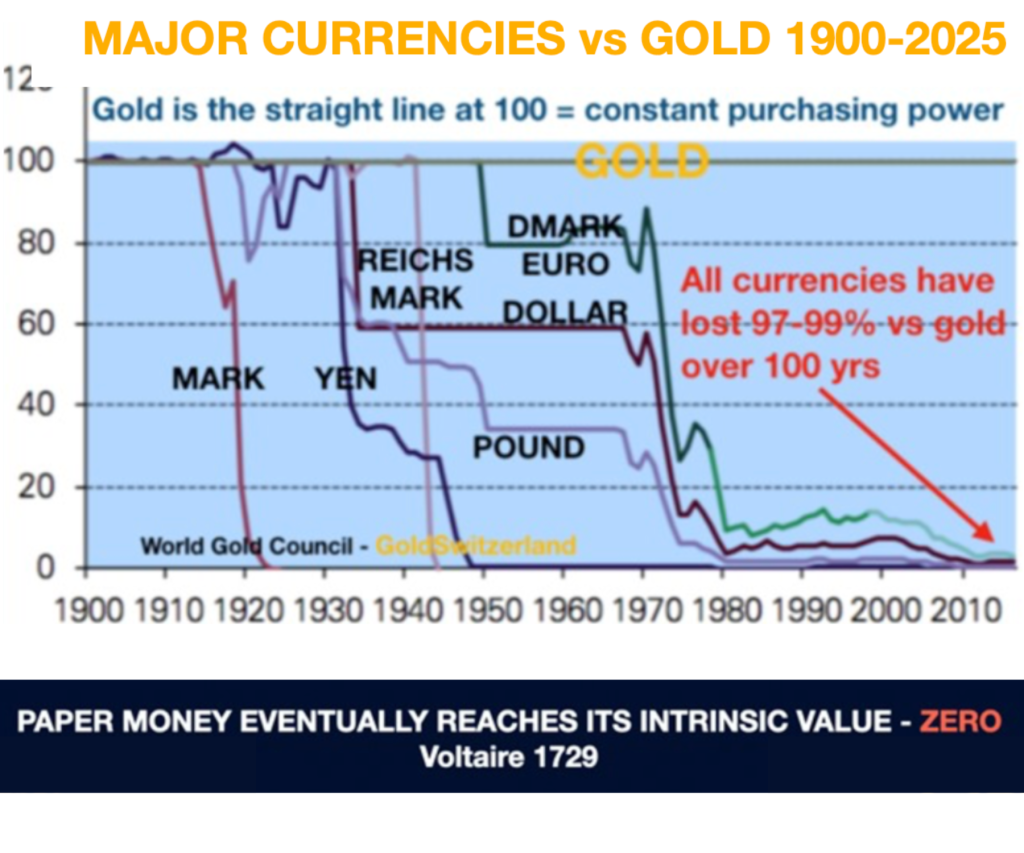

Still, gold is up 10X, or more, in most currencies in this century.

When Nixon went off The Gold Standard in 1971, few understood that this would be the start of the biggest global debt creation in history, leading to gold going up 84 X. More accurately – paper money losing 99%.

This is not meant to be sensational – I am a conservative Swiss born in Sweden.

My message has been consistent for the last 25 years of advising High-Net-Worth Investors to preserve wealth in physical gold and silver stored outside the banking system.

WE HAVE HAD SKIN IN THE GAME SINCE 2002.

That’s when we and our HNW clients put the majority of their liquid assets in physical gold at $300. I had been fortunate to advise some of them in successful corporate deals in 1999, like selling tech businesses at a valuation of multiples of sales (no profits, of course) in 1999. So, these investors trusted me and put major amounts into gold 23 years ago.

Why is physical gold the only money in history that hasn’t gone to ZERO?

Simple – GOLD IS NATURE’S MONEY!

It is the only money not made by man.

So it can’t be printed or manufactured.

It can’t be debased.

It can’t be hacked – North Korea just stole $1.5 billion from the world’s second-largest crypto exchange. 4›

It is not dependent on a computer (like crypto or paper money).

It is unlikely to be confiscated (if you hold it in the right jurisdiction), thus not in the U.S.

It is unlikely to be stolen if you hold it in the safest vaults.

GOLD IS VIRTUALLY INDESTRUCTIBLE.

It is the only money that has maintained its purchasing power for thousands of years.

All other money has gone to ZERO, without fail.

With such a fantastic record, why is only 0.5% of global assets invested in gold?

Why doesn’t anyone buy gold? They have been spoiled by a stock market fuelled by printed money.

That is about to change. When stock markets start falling in earnest and the era of “stocks-always-go-up” is finished, a stock collapse is very likely.

At that time, some investors will realise that they need protection in the form of physical gold. The problem is that gold will not be available at current prices.

So, gold will go up by multiples.

And remember, there will be major bank failures and exponential money printing.

As my previous article stated – PRINT BABY PRINT.

Please, please jump on the Gold (and Silver) Wagon now, before it is too late.

About Egon von Greyerz

Egon von Greyerz

Founder and Chairman

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD