PRINT BABY PRINT (AFTER US THE FLOOD)

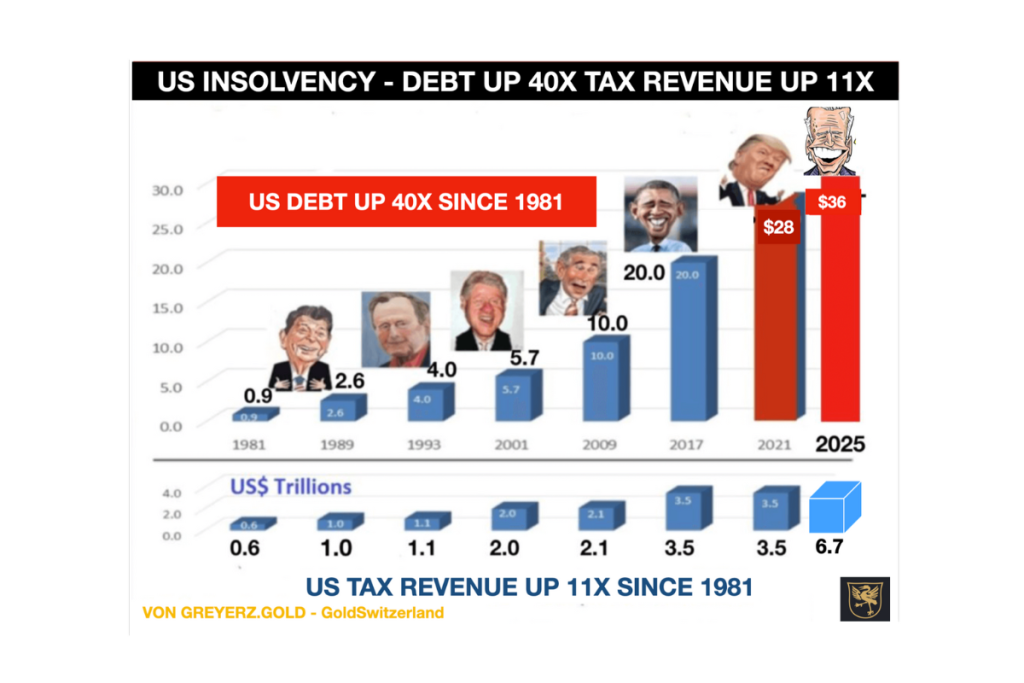

When all the euphoria about the election and the Executive Orders is gone, the annoying small problem of the $36 trillion US debt remains – a debt growing exponentially. And also a debt that Trump tactfully avoided to discuss in his election campaign.

After us, the flood (après nous le deluge) is what Louis XV’s Mistress, Madame Pompadour, said to the French king after losing an important battle against Prussia in 1757, leading to the end of the French monarchy.

Deficits, debts and a devaluing currency have killed every monetary system in history.

So this is next for the US and especially the Western world, as I have expressed in numerous articles.

Although timing is a mug’s game, I believe we are now in the exponential and final phase of the fall of the current Monetary System. The next phase should happen at speed. See my article:

“THE END OF THE US ECONOMIC AND MILITARY EMPIRE & THE RISE OF GOLD”

The image below explains it clearly.

Deficits are likely to increase substantially, especially as the financial system comes under pressure. It wouldn’t surprise me to see a US debt of $50 trillion at the end of Trump’s reign.

BITCOIN OR GOLD

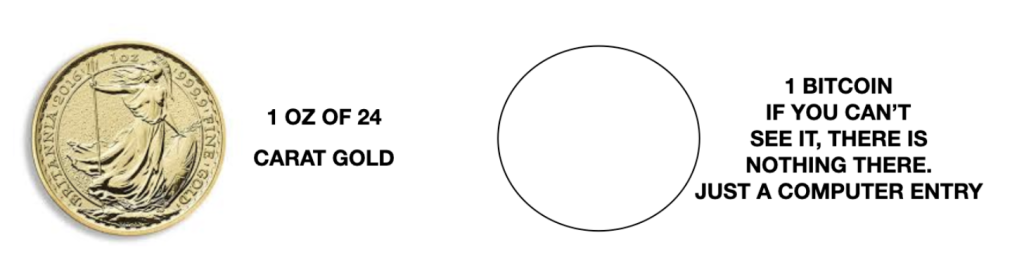

Take 1 Bitcoin (BTC) and 1 Stablecoin like Tether.

Mix them well. What do you get?

A weird electronic entry on a computer or memory stick with no intrinsic value.

So this is what could be the next US currency, at least if the Bitcoiners get their way.

Well, I have always said that BTC will go to $1 million or ZERO – but not necessarily in that order.

If BTC has no intrinsic value and with a Stablecoin doubtfully backed by US Treasuries, I wouldn’t attribute any real value to these coins. Primarily since USTs are issued by an insolvent government.

The plot thickens with the Trump government now in favour of BTC and cryptos.

Was BTC always intended to replace a worthless dollar?

Remember that the dollar has been down 99% since 1971 and that no currency has ever survived.

And with the US/Trump now also declaring that CBDSs (Central Bank Digital Currencies) are banned, a BTC sponsored or backed by the US government could be the Trump way forward to solve the US debt catastrophe.

This will be the blind leading the blind or one Ponzi scheme backing the other.

It seems more like 17th-century Tulipomania to me.

Yes, major speculative gains could still be made in BTC, just like in tulip bulbs 400 years ago. But I will pass. For me, the 86-fold increase in the gold price (or inverse fall of the dollar) since 1971 is enough.

I am quite happy with the 9-fold increase in gold since 2002 when we and the investors we advised went heavily into physical gold, stored outside the baking system.

I was UK pound-based at the time, yielding an 11-fold gain.

I know that the BTC aficionados will say that I understand nothing about cryptos.

They are right, of course. I don’t, but I know enough not to touch it with a bargepole.

I prefer assets with intrinsic value, like physical gold, which is nature’s money. Gold has stood the test of time and been money for 5,000 years.

Gold is certainly superior for wealth preservation purposes to volatile computer money like BTC with a 16 year history.

TRUMP – A BREATH OF FRESH AIR, BUT HOW LONG WILL IT LAST?

Trump ran a good election campaign, focusing on easy issues everyone could understand, like ‘Make America Great Again’ and ‘Stop the Immigrants’.

Many of his executive orders are also sensible like free speech, no wokeism and Drill Baby Drill.

He is also throwing out the fake climate agenda.

I have always been of the firm opinion that climate change is cyclical and not man-made. Thus, we cannot play god and believe that we can limit temperature growth to 1.5 degrees by 2050.

Fossil fuels produce 85% of global energy, and that is not likely to decline substantially for the next 50 years. So not to invest in oil, like Biden did or to stop producing coal, like Germany did, is a quick way to destroy these economies.

Trump’s optimism is what a country needs. It wins elections and makes the electorate (at least half) feel good.

We can just turn to the UK’s Starmer or Germany’s Scholz to see what terrible results a depressive leader can have. Scholz is on his way out, and Starmer, having only been in power for 7 months, would lose if there was an election today.

TRUMP A MASTER MONOPOLY PLAYER?

Trump loves buying property. So, playing Monopoly, he now tries to buy the Panama Canal, Canada and Greenland, which are all on his list.

But I guess that he will pass GO without having bought any of them.

MAGAlomania

Trump clearly has MAGAlomania.

This helps to win an election but not to end wars and, sadly, not to make a bankrupt nation financially sound.

And Trump has already failed with the election promise to end the Ukrainian war on day 1, promising to stop sending weapons and money to Ukraine. But he has done none of that. Instead, the Neocons now seem to be in charge again, and all Trump has done is to threaten Russia with sanctions. He said: “We can do it the easy way or the hard way – and the easy way is always better. It’s time to ‘MAKE A DEAL.’ NO MORE LIVES SHOULD BE LOST!!!”

Russia was never going to lose this war. This was clear to me on day one despite the false Western propaganda about Ukraine winning. And that despite Western money, weapons and personnel. Disastrously, around 800,000 Ukrainians have died and substantially fewer Russians (despite what Western propaganda says.)

The Puppet Zelensky will not agree to freeze the current situation, whilst that is the absolute minimum for Putin. Thus Trump’s first promise is likely not to be fulfilled for a very long time, if ever. The US and NATO can never beat Russia and their allies in China, Korea, and Iran. And everyone knows that using nuclear weapons means the end of the world.

The US has spent $175 billion in total on the Ukraine war. An important part of that has been siphoned off to corrupt middlemen – WHAT A TERRIBLE WASTE OF LIVES AND MONEY!

I sadly see no solution in the short term.

END OF THE US EMPIRE

I have written many times about the end of the US Empire. The latest time was in October 2024:

“THE END OF THE US ECONOMIC AND MILITARY EMPIRE & THE RISE OF GOLD”

We must not forget that the once powerful US Empire has since WWII lost every major war that it started. This includes Korea, Vietnam, Afghanistan, Iraq, Libya, Ukraine and many more.

So, despite advanced weaponry and unlimited printed money, the US has not won a war since 1945. So, to argue that the US is the strongest military power in the world doesn’t stand up to scrutiny when this “mighty power” can’t even win a battle in little Libya.

Trump knows this, of course, so he is just blustering. But Putin will not fall for that.

SOCIAL UNREST

Inflation-adjusted workers’ wages are lower today than in the mid-1940s. An unadjusted minimum wage of $7.25 has not increased since 2010. Who can live on an hourly wage of $7?

Everyone can see it, and middle America is getting poorer by the day.

What most people can also see is that the rich are getting much, much richer.

So, the poor are getting poorer, and the rich are getting richer. What does that remind us of?

REVOLUTION OF COURSE

Just like the French Revolution starting in 1789 or the Russian Revolution of 1917.

The inequality in the West between the rich and poor is currently greater than at any time in history.

It is extremely likely that this will result in a major uprising by ordinary people in the West.

And we should not believe that the Police or Military will protect the people as they are also “People” who are suffering.

GOLD AND WEALTH PRESERVATION

Asset markets like stocks, property and bonds are in a generational bubble phase.

And gold will continue to reflect the destruction of paper money.

Cycles are sometimes useful as a forecasting tool. Looking at our proprietary cycles, I have a very interesting cycle bottom in the Dow/Gold ratio in 2035. If that is correct, it would mean much weaker stocks and much stronger gold for around 10 years.

In any crisis in history, monetary or political, physical gold has always been the best form of wealth preservation. There will be no difference this time. Gold will reach multiples of the current price, and most financial assets will collapse.

So hold as much physical gold as you can afford, plus a bit of silver, and store it outside the banking system.

And please don’t forget to help family and friends or to enjoy all the wonderful free things in life like conversation, nature, music, books, etc.

IT’S NOT TOO LATE TO JUMP ON THE GOLDWAGON

IT HAS JUST STARTED

About Egon von Greyerz

Egon von Greyerz

Founder and Chairman

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD