California Dreaming—State Metaphor for a Failing Nation

Below we consider the State of California as the metaphor of a failed state as well as the failing state of the American Union, which is anything but a dream.

Metaphors

For those already familiar with my articles, interviews or even daily banter, I have an admitted affinity for metaphors and analogies, as they help draw the simple from the complex.

Toward that end, I’ve 1) compared policy makers to failed generals, 2) debt and currency bubbles to Titanics, 3) macro investing to polo matches, 4) monetary policy to drug addiction and 5) the love of bloated bond markets to toxic romances.

As for politicians and political issues, there is always the risk of partisan bias and offending those who cling to only one perspective.

Fortunately, my take on the left or the right of current politics is fairly agnostic, as I view nearly all politicos as crooked as a dog’s hind leg.

Thus, as I turn my lens toward the state of California and its failed governor, I hope readers of the left or right can dispense with politics and just stick to math so that we can all get past the swamp of red vs. blue opinions and respect the objective facts of red vs. black balance sheets.

And when it comes to the State of California, she’s deeply in the red, and serves, ironically, as yet another broader yet applicable metaphor of the world economy in general and the United States in particular.

So, let’s dig in.

California Dreaming?

Oh, how I have loved California. It is home to some wonderful personal memories as well as personal wipeouts—and not just the surfing kind.

Its sunny appeal, however, is universally seductive, and like that famous Eagles song, one indeed feels like you can check in any time you’d like, but you can never really leave California’s tempting horizons and mythical spell where dreams come true.

Nevertheless, folks are leaving California, and have been doing so to the tune of over 500,000 exits in the last 2 years alone.

Why?

For those on the political right, California’s big-headed Gavin Newsom is an easy target.

His over-the-top COVID hysteria (similar to other failed experiments in Seattle, Chicago or Portland…) and unsustainable tax policies coupled with San Francisco’s soft-on-crime nightmare (car-jacking capital) and L.A.’s recent fall from City of Dreams to Tent City are all classic symbols of a failed state.

I once lived on this beach…

But let’s leave that issue, debate and fall to the woke, the left, the right, the angry and the smug.

For me, the math of California (whose nominal GDP ranked as the 5th largest in the world) makes the discussion far easier to sift through.

The Hard Reality of Simple Math

Like nearly all cornered politicians, Newsom is driven by obfuscating the obvious and trivializing the momentous (Chicago’s recently failed mayor of the nation’s “murder capital” comes to mind…).

For example, his January projected budget deficit of $22.5B (an already embarrassing figure which he nevertheless tried to downplay) was in fact off.

Way off.

It turns out that even Newsom’s “sunny” forecast and optimistic math had overlooked a few pesky facts.

First, the state’s monthly tax revenue for January was almost $14B less than the revenue for the month prior.

Secondly, California’s fiscal year, which started last July, is moving at a pace of $23B in less income than the previous year.

In short: California’s income stream is running toward an emptiness equivalent to Newsom’s IQ, despite sunsets as consistent as his immaculate wardrobe and “Hollywood” smile (smear?).

But as many Californian’s know—it’s not how things feel, but how they look which counts.

For the top income bracket, however, California’s tax bills (and revenues) aren’t looking good.

Even those wealthy and beautiful (from Topanga to Belvedere Island) are starting to squirm under a state tax structure that feels and looks anything but “dreamy.”

State tax for Californians earning over $1M is 13.3%, and the top 0.5% of California’s tax payers are responsible for over 40% of the state’s total tax income.

Many, of course, are getting sick of paying taxes for increasingly expensive sunsets, even from Orange County’s row of waterfront mic-mansions.

Furthermore, for those wealthy left-coasters who’ve lost their jobs or capital gains at Google, Amazon, Facebook and countless other Silicon Valley enterprises of late, that tax income is openly drying up, which means so are the state’s revenues.

Fantasy Land

California, of course, is home to Hollywood and fantasy-like conversations of making dreams come true over cocktails at Shutters on the Beach or an overpriced vegetarian meal at The Ivy.

Fantasy, of course, is fun, and even necessary at times. (I always loved Shutters…)

It was fantasy, for example, that made an Austrian body-builder into a former Governor of California. How’s that for the American/Californian dream?

Unfortunately, that same Austrian never studied Austrian economics in between barbell sessions, and the last time I heard him speak, he was saying “screw your freedom,” suggesting that the unvaccinated were all anti-science “schmuks… “

What a guy. What a dream.

But had some of Cali’s former leaders indeed studied any form of economics, they’d likely understand that rising deficits and falling revenues is the opposite of a dream—it’s the historically-confirmed prelude to a nightmare.

Even the once-reliable WSJ has confessed that California’s budget has imploded and that January revenues are poised to be down by 40% y/y.

Uh-oh?

One wonders how long the top 0.5% of California will want (or be able) to pay that ever-increasing bill as profits in their tech-heavy portfolios creep ever closer toward a cliff steeper than Malibu’s Point Dume.

Fantasy Politics—Lipstick on a Pig

In the interim, Californian leadership sure knows how to put lipstick on a pig.

They’d tell us, for example, that despite revenues falling from prior peaks, that the state expects revenues for 2023-24 to “remain about 20% higher than before the pandemic.”

In other words, nothing to worry about.

Really?

First, those “projections” already have a ring of good ol’ Californian fantasy to them.

But even if we assume they are accurate and that California’s “revenue problems” are solved, those same budget wizards are ignoring the spending (i.e., the aforementioned budget deficit) problem which is mounting.

California as Metaphor

Unfortunately, California’s embarrassing combination of tanking revenues, increased spending and expanding deficits is not happening in a vacuum.

In fact, California serves as a mirror to a broader problem within the United States as whole (or debt hole) …

Like the failed state of California, the equally failed state of the US government has a problem with incoming tax revenues, an issue I’ve been tracing throughout 2022.

Like the Californian wealthy 0.5%, the wealthy 1% of the United States taken collectively are the ones paying 40% of the national taxes.

And like California’s wealthy in general, the nation’s wealthy in particular get a lot of that wealth from a bubbling risk asset market whose best days are largely behind us and whose worst days (and hence weaker capital gain receipts) are still ahead.

In short, and like California, the United States is facing less tax revenues combined with greater deficits and increased spending, making the Cali crisis a leading indicator of a national crisis.

The Math of Recessions

Recessions, even the kind the DC crowd seeks to redefine, deny, postpone or ignore, have patterns and facts which we can use to foresee coming trends, weaknesses and even opportunities.

For example, recessions mean less tax receipts and higher deficits.

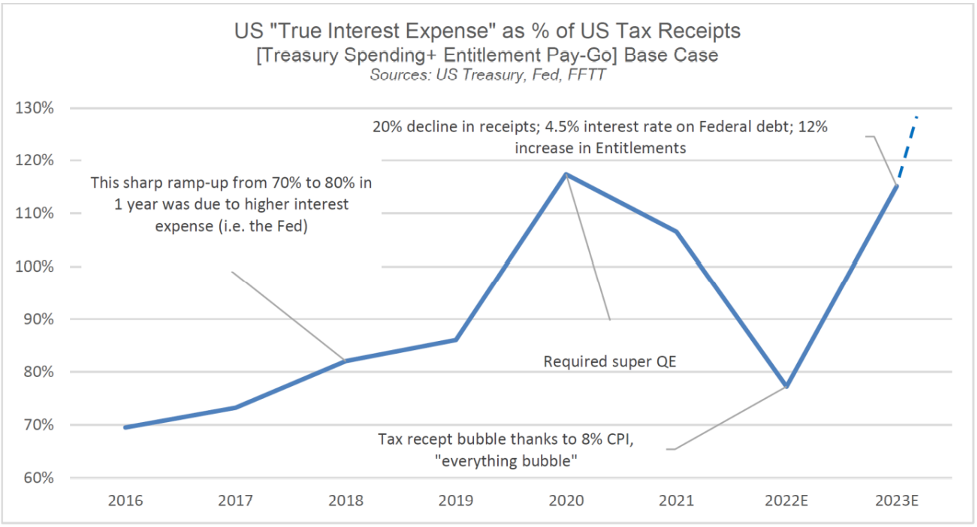

If we assume even a 20% decline in tax receipts (conservative), tagged on to rising deficits estimated at a 12% increase in Entitlement Pay-Go’s (also conservative) in the backdrop Powell’s current rate hike policy, Uncle Sam’s bar tab (i.e., True Interest Expense) returns to Covid crisis/pain levels reminiscent of a seemingly forgotten yesterday:

In other words, the United States (along with California…) are mathematically heading toward a bar-tab (i.e., interest expense bill) as painful as the one we saw in March of 2020, when markets tanked and the Fed was required to print trillions in less than 8 months just to keep Uncle Sam’s nose (and Treasury market) above water.

For now, however, the Fed is not printing trillions via QE, but tightening ala QT.

Or stated more simply, US debt obligations are sailing toward yet another debt iceberg, only now the issue is not about too few lifeboats, but no life boats at all.

As I see it, and have said many times prior, the US is trapped with no easy solutions as debt levels are rising and revenues falling.

The end result is obvious, even if the precise timing of the iceberg is not.

Whether Powell’s Fed continues to tighten into a debt iceberg, or eventually seeks to temporary melt (monetize) that iceberg with more QE, the nation is doomed either way in a Hobbesian choice between tanking markets (QT-driven) or skyrocketing inflation (QE-driven).

No One Likes Bears, and Even Fewer Understand Gold

Unless you are a talented short-trader or volatility option jock, no one likes bears or bear markets, and hence very few like to hear data-driven bears (mathematical realists) like myself constantly reminding us of the debt elephant in the room–and all that this toxic debt inevitably implies.

Once debt levels become fatal, the direction of credit, stock, property and finally currency markets are easy to diagnosis, though the time of death is not.

Gold, of course, loves dying currencies.

The price of gold today, or the strength or weakness of the USD tomorrow, are frankly silly questions in the short term for any who understand the broader context of the long-term.

Currencies are always the last bubble to pop, and given that gold is a store of value rather than an instrument of speculation, gold investors (i.e., those whose aim is wealth preservation not asset speculation) recognize that gold never rises, currencies just fall.

Investors in physical gold therefore measure their wealth in ounces, grams and kilos, not highly toxic, increasing debased and (forever debated) fiat currencies whose race to the bottom is literally happening right before our eyes in real time.

To dismiss such simple deductions from admittedly complex market forces as just “gold bug” thinking ignores math, history and gold cycles.

But again, no one likes to see bears, even when they’re staring at them from the Californian state Capital.

Based on all the debt destruction (and coming consequences) I see in California, the United States and the world in general, I suppose I’ll still just be a “bear” and a “bug” to most.

But both are better than a sitting duck.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD