A Global Snapshot: The Stupid, the Broken & the Evil

As a polarized U.S. marches toward a political, financial, and perhaps even military crossroads in the closing months 2024, many feel what George Lucas might otherwise describe as a “disturbance in the force.”

From blow-off market tops, empty political platitudes and an openly broken bond market to debased currencies and large swaths of the planet at war or inching toward escalation, it seems we are juggling aspects of the stupid, the broken, the insane and perhaps even…the evil.

Let’s start with the stupid.

America’s Bond Market

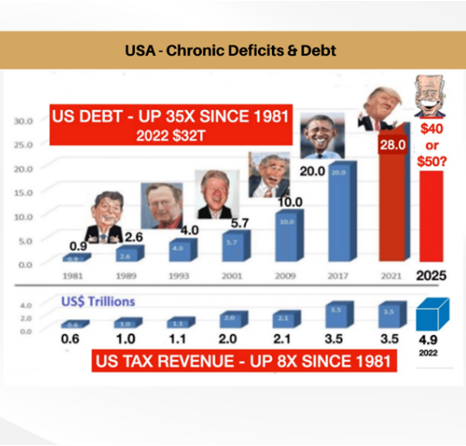

Over the next 3 years, Uncle Sam (or Aunt Yellen) has to re-finance shy of $16T of US debt.

This figure is painful on its face, but the pain gets even worse when one understands what the debt-addicted (and spend-crazy, vote-peddling) clowns in DC have done to our Titanic US debt levels ($35T+) and the ice-berg-bound US bond market.

As I have been repeating for years and will repeat for years to come: The bond market is the thing.

Once one soberly understands debt levels, credit markets and the cost (yields) of that debt, one can soberly foresee the end-game for bonds, stocks, inflation cycles, fiat currency shifts and, of course, the longer-term direction of anti-fiat assets like gold.

Impressive Buildings, Empty Heads

Looking now at the $16T re-fi alluded to above, we get a case study of how a nation becomes a debt-trapped embarrassment hiding behind otherwise impressive financial buildings.

After all, anyone who has stood before the Federal Reserve or US Treasury Department can’t help but admire the impressive architecture.

Unfortunately, the CV-smug and partisan-focused administrators within those walls are little more than a sustained level of mediocrity, most of whom care more about their next political post than the condition of their nation in the next twenty years. See: We Owe the Next Generation an Apology.

Stated simply, this collective of self-servants masquerading as public servants is the heart of the American financial darkness.

Like those before them, our central bankers, Treasury officials, and (s)elected (lobbied) leaders have promulgated the fantasy (policy template) that every debt problem can be solved with more debt, which is, in turn, paid for with debased/inflated fiat money.

Sounds great? No? Who wouldn’t love such a miracle solution?

Selling Fantasy, Postponing Ruin

This is the crux of their much-lauded and euphemistically misleading “new” policy of Modern Monetary Theory (or “MMT”), which, by the way, is neither modern, monetary, nor a theory.

In fact, versions of MMT have been used throughout history – from ancient Rome, the John Law 1720, the French Assembly of 1789, Weimar Germany, Yugoslavia in the 1990s or every banana republic south of Key West. See: How History (and Stupid) Repeats Itself.

But such politically seductive miracles are just time-buying lies; and as we will see below, the US bond market is already (and openly) running out of time.

As most who objectively follow the gameshow in DC already know, debt in the US is color blind.

Every post-Eisenhower president (red or blue) likes to make promises they can’t pay for, which means the deficit (i.e., can) gets kicked down the road to the next administration, who ultimately kicks the can straight into the Main Street gut in the form of recession, inflation and/or war.

Math Is a Stubborn Thing

Current signals from the US debt (and hence bond) market make such otherwise sensational observations an empirical reality.

Again, consider the nearly $16T which Uncle Sam has to re-finance/rollover in the next three years.

The average coupon (sticker price) on the IOUs representing this debt is around 2%, but given global distrust for a U.S. over its skis in debt, the actual yield (i.e. TRUE interest expense) for those T-Bills is over 5%.

Please re-read that last line.

This is an expensive and screaming sign of credit market “uh-oh.”

From Stupid to Broken

How did we get here?

First, because America (and its share-price-paid/margin-obsessed CEOs) outsourced American productivity (and the American dream) to China circa a 2001 WTO “policy.”

Instead of China BUYING American products, the US CEOs allowed them to MAKE our products. The cheaper labor and higher margins made a handful of CEO’s richer and millions of US workers unemployed.

This also meant less productivity (and hence less GDP) to pay for our own debt. Solution? Take on more debt and issue more IOUs to pay the older IOUs.

But the second problem is that there are less buyers for our IOUs.

Why?

Because less and less nations, investors and foreign central banks trust a declining asset (bond) from a debt-soaked issuer (USA) with a weaponized dollar (think sanctions.) See: How the West was Lost.

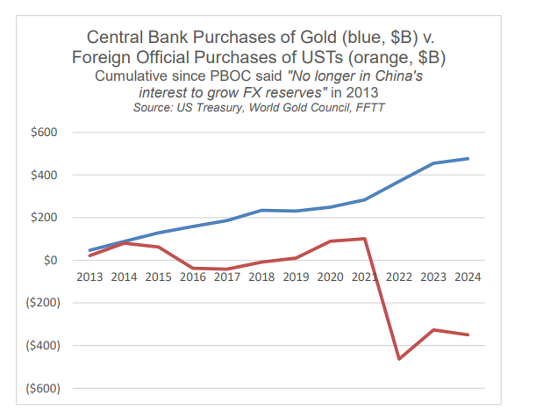

This explains why central banks have been net-dumping USTs and net-stacking physical gold since 2014, a fact openly omitted from the so-called “free press.”

This is how once trusted nations become failing nations.

And if there is less love/trust for US IOU’s, the bond prices sink; and if the bond prices sink, their yields rise.

And if their yields rise, the cost of repaying those IOUs rises.

Again: The bond market may seem boring to the masses, but it matters—far more than Taylor Swift’s searing political acumen or George Clooney’s economic IQ.

And this debt addiction is how the post WW2 USA went from being the world’s greatest producer and creditor to the world’s greatest off-shorer and debtor.

From Broken to Insane: Inflation

As warned by our founding fathers, central bank monopolies and corrupted treasury me-firsters have made the land of the free and home of the brave a feudalistic dystopia which literally lives and breathes on debt. See: The Death of Democracy.

In this opportunistic (yet deliberately mis-understood and media-omitted) backdrop, it should come as no surprise that Yellen issued another $2T in T-Bills (IOU’s) this year to get pressure off bond volatility in an election year (i.e., solving a debt disaster with more debt).

And if you think the Fed isn’t political, think again. See: The Fed: Anything but “Independent.”.

But with yields rising, this $2T, as part of the overall $16T above, now has to be paid or rolled-over at much higher rates than just their original sticker price (i.e., “coupon.”)

Like any banana republic, the US has been living dangerously by extending and pretending away its debt trap by living off (i.e., issuing IOU’s from) the short end of the yield curve (in the form of short-duration T-Bills) to take some of the pressure off the long end of the yield curve (longer duration bonds).

But the net-net of all these musical chair IOUs (from both the short and long end of the IOU duration curve) boils down to this: Uncle Sam’s IOUs (bills, notes to bonds) can never be repaid with actual productivity or tax receipts.

Not ever.

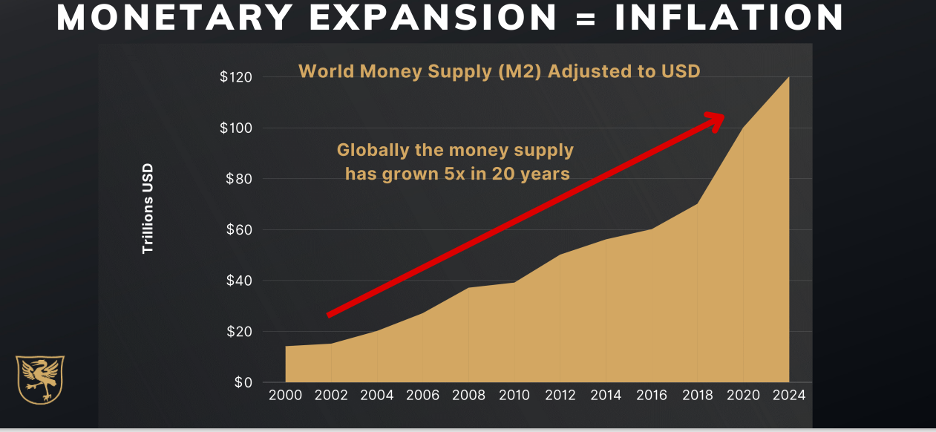

And what that means in simple English is that the only way to pay Uncle Sam’s (or any other G7’s) IOUs is by having its central bank buy them with mouse-clicked and increasingly debased (i.e. diluted) currency.

This is why inflation is not only here to stay (as opposed to “transitory”), but it’s about to get much, much, much worse.

Is Deflation Coming?

But what about recessions and possible market drawdowns/mean-reversions?

Won’t they be dis-inflationary if not deflationary events?

Certainly.

In fact, Powell’s recent (and now failed) “higher-for-longer” rate hike policies “to beat inflation” were designed to kill demand (i.e., the middle class) and create a deflationary recession, which the DC statisticians then conveniently refused to ever admit was a recession. See: We Are Already in a Recession.

But the end game will still be (as it has always been throughout history and without exception) inflationary, as inflation via currency debasement is how all political power brokers (be they in togas, military uniforms or Armani suits) transfer their debt and currency failures onto the backs (and wallets) of their people.

Powell’s Rate Cuts

Powell, as we’ve argued all year, would eventually cut rates in September for the simple reason that not even Uncle Sam could afford Powell’s prior rate hikes.

The $16T in bond re-financing discussed above was simply coming too fast and too high for DC to afford, hence the aggressive rate cuts—which were no shocker to a market that has been pricing them in for months.

Of course, rate cutting is just another way of dollar-weakening, and those holding anti-dollar insurance assets like gold are not surprised to see this precious metal breaking all-time highs.

But that trend is only just beginning.

BTC, the S&P, and Industrials will also continue to outperform Uncle Sam’s IOUs on the tailwind of cheaper debt policies, which explains the widening gold/TLT, BTC/TLT, and SPX/TLT ratios.

When Stupid Turns Evil

Readers know my respect for Hemingway’s all-too prescient yet historically tragic observation that political opportunists will inevitably solve their own self-inflected debt disasters by selling the temporary prosperity of inflated stock prices followed by the permanent ruin of inflation and war.

As for the inflation component, we can already check that box/policy.

But the far more sinister policy option in the current landscape of some the weakest political IQs to ever take the simultaneous global stage remains, namely: War.

The War Option?

No one needs to share my views on the avoidable Ukraine war et al, but we can all agree that the world is getting militarily hotter each day.

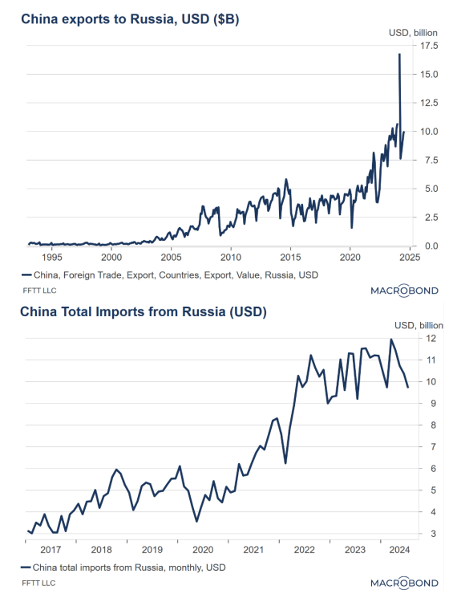

The US is accusing China of providing “very substantial” aid to Russia’s war machine in a current setting of the worst brinksmanship since the Cuban Missile Crisis or the Guns of August.

The US is also considering the absurd option of giving Zelensky long-range missiles to strike deep within Russia, which Putin naturally said would incur a military response against NATO.

Once again, old men with bunker access are setting up younger men to potentially die for their power agenda and sins, all camouflaged in patriotic rhetoric which their media servants propagate word-for-word.

Meanwhile, for those brilliant US “statesmen” (?) who might have hoped that US sanctions against Putin would successfully cripple its trade relations with China, the evidence suggests the precise opposite:

War, of course, is no longer, as von Clausewitz wrote in a pre-nuclear era, “a mere extension of politics by another means.”

Back to Stupid & Evil

In a nuclear era, war is just an extension of stupid by political means.

Or as even the storied warrior, Stonewall Jackson said in the 1860’s, war is the “sum of all evils.”

But concepts like stupid or evil have never prevented policy makers from using war as a political instrument.

And so, here we are, once again risking evil into policy at the expense of the many for the benefit of the embedded few.

To certain politicos with no concept of history nor ounce of conscience, war can be a clever tool rather than defense of ideals.

After all, war is inflationary, and it would give the US and its coerced EU allies all the excuses and scapegoats needed to impose capital controls and rationing upon a post-COVID world already trained in civil obedience and bending a knee to fear, coercion and lies.

And perhaps there are just enough power brokers willing to blame their own financial sins on eastern bad guys rather the DC bathroom mirrors.

In short: Perhaps there are those who still see nuclear war as a viable option?

The Graves Speak

Recently, my daughter and I visited the US World War 1 cemeteries of the Meuse-Argonne and Metz, filled with rows and rows of anonymous heroes from Montana to Michigan, now forever lying in France.

For their sake and ours, I hope Hemingway will be wrong this time. I hope war will not be used by political opportunists as a personal tool despite its universal harm.

Gold can solve many financial and currency disasters – that is the stupid, the broken and the insane outlined above in our foreseeably doomed credit and currency markets.

But no precious metal can preserve or replace the loss of far more precious lives consumed by the evils of unnecessary wars.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD