A DISORDERLY RESET WITH GOLD REVALUED BY MULTIPLES

Tectonic shifts lie ahead. These will involve a US and European debt crisis ending in a debt collapse, a precipitous fall of the dollar and the Euro with Gold emerging as a reserve asset but at multiples of the current price.

The next phase of the fall of the West is here and will soon accelerate. It has been both precipitated and aggravated by the absurd sanctions of Russia. These sanctions are hurting Europe badly and affecting the US in a way that they didn’t expect, but was obvious to some of us. The Romans understood that free trade was essential between all the countries that they conquered. But the US administration blocks have both the money and the ability to trade of the countries they don’t like.

But shooting yourself in the foot really hurts and the consequences are in front of our eyes. No foreign country will want to hold US debt or dollars. That is a catastrophic problem for the US as their deficits will grow exponentially in coming years.

So a debt collapse is not just a looming disaster but a bomb hurling towards the US economy at supersonic speed.

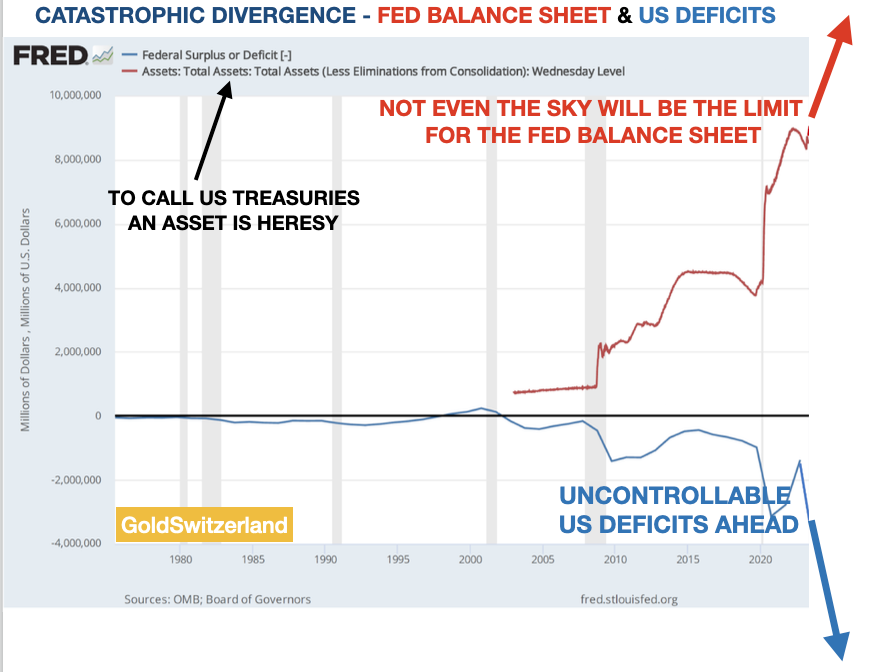

With the imminent death of the petrodollar and explosion of US debt, there is only one solution for the funding requirements of the US Government – the FED which will stand as the sole buyer of US Treasuries.

A CATASTROPHIC DEATH SPIRAL

So the DEBT spiral of higher debt, higher deficits, more Treasuries, higher rates and falling bond prices will soon turn into a DEATH spiral with a collapsing dollar, high inflation and most probably hyperinflation. Sounds like default to me but that word will probably never be used officially. It is hard to admit defeat even when it stares you in the face!

Yes, the US will probably obfuscate the situation with CBDCs (Central Bank Digital Currencies) but since that is just another form of Fiat money, it will at best buy a little time but the end result will be the same.

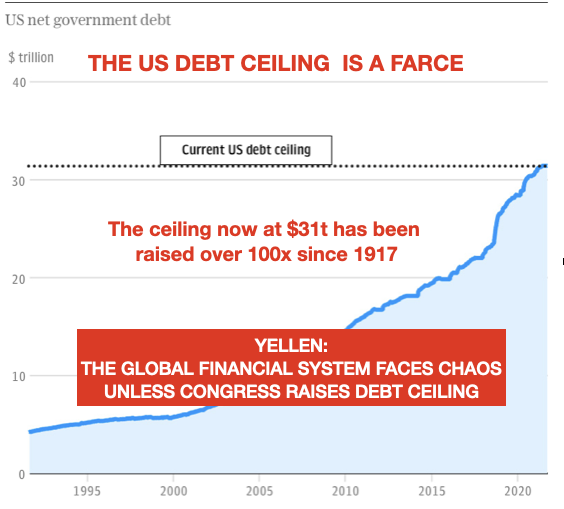

US Debt Ceiling Farce belongs to Broadway rather than Wall Street

The debt ceiling was created in 1917 as a means of restricting reckless spending by the US government. But this travesty has gone on for over 106 years. During that time there has been a total disdain for budget discipline by the ruling Administration and congress.

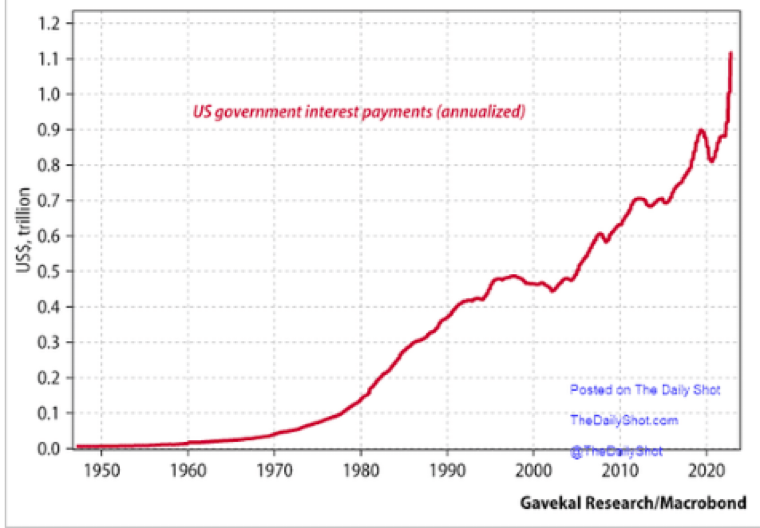

The problem is not just the debt but the cost of financing it.

The annualised cost of financing the Federal debt is currently $1.1 trillion. If we assume conservatively that the debt grows to $40 trillion within 2 years, the interest cost at 5% would be $2 trillion. That would be 43% of current tax revenue. But as the economy deteriorates, interest will easily exceed 50% of tax revenue. And that is at 5% which will probably be much too low as inflation rises and The Fed loses control of rates.

Thus a very dire scenario lies ahead and that is certainly not a worst case scenario.

THE FED IS BETWEEN A ROCK AND A HARD PLACE

The Fed and the thus US government are now between Scylla and Charybdis (Rock and a Hard Place).

As it looks today, the US will bounce between Scylla and Charybdis in coming years until the US financial system and also the economy takes ever harder knocks and goes under just as every monetary system has in history.

Obviously the rest of the West including an extremely weak Europe will follow the US down.

BRICS AND SCO – RISING POWERS

The whole world will suffer but the commodity rich nations as well as the less indebted ones will ride the coming storm far better.

This includes much of South America, Middle East, Russia and Asia. The expanding power blocks of BRICS and SCO (Shanghai Cooperation Organisation) will be the strong powers where a much increasing part of global trade will take place.

Barring major political and geopolitical upheavals, China will be the dominant nation and the main factory of the world. Russia is also likely to be a major economic power. With $85 trillion of natural resource reserves, the potential is clearly there for this to happen. But first the political system of Russia needs to be “modernised” or restructured.

What I outline above is of course structural shifts that will take time, probably decades. But whether we like it or not, the first phase, which is the fall of the West, could happen faster than we like.

A MONETARY SYSTEM ALWAYS ENDS IN A DEBT EXPLOSION

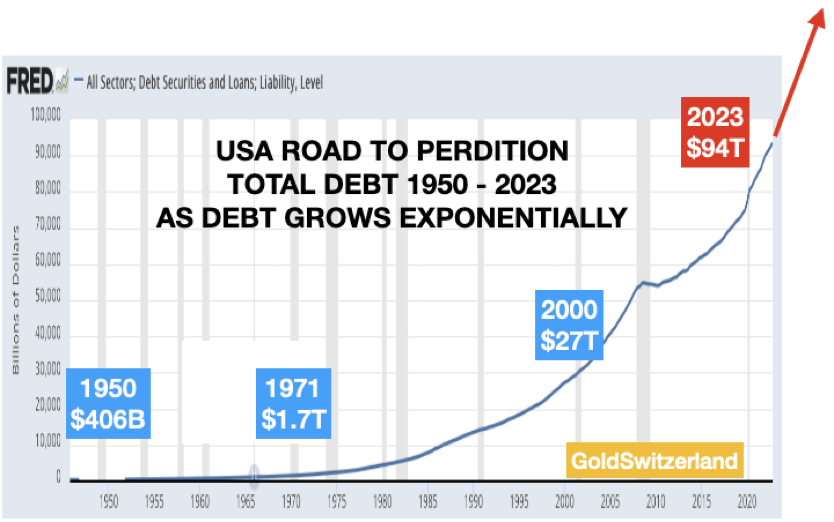

In 1913, total US debt was negligible, and in 1950, it had grown to $406 billion. By the time Nixon closed the gold window in 1971, debt was $1.7 trillion. Thereafter the curve has become ever steeper as the graph below shows. From September 2019 when the US banking system started to crack, the Repo crisis told us that there were real problems although no one wanted to admit it. Conveniently for the US government, the Repo crisis became the Covid crisis which was a much better excuse for the Government to print unlimited amounts of money together with the banks.

Thus, just in this century, total US debt has grown from $27 trillion to $94 trillion!

But that was history and we know we can’t do anything about the past. But now comes the fun.

I have been warning about a coming debt explosion for some time. Well, I believe this is it.

In a recent article about the price of gold I explained that the final stages of hyperinflation are exponential.

We will see a very similar exponential pattern with the coming debt explosion. If we assume that the final 5 minutes of the exponential phase started in September 2019, the stadium was then only 7% full and will in the next few years grow from 7% to 100% full or 14X from here.

This is obviously just a demonstration and no exact science, but it shows that theoretically US debt could now explode.

So let’s take a quick look at a few factors that will cause the debt explosion.

BANK FAILURES

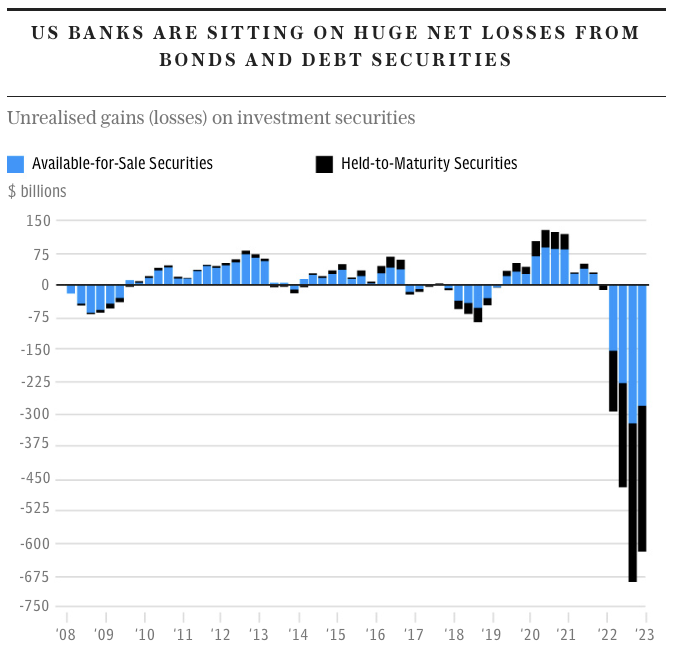

A Hoover Institute report calculates that more than 2,315 US banks currently have assets worth less than their liabilities. The market value of their loan portfolios are $2 trillion lower than the book value. And remember this is before the REAL fall of the asset values which is still to come.

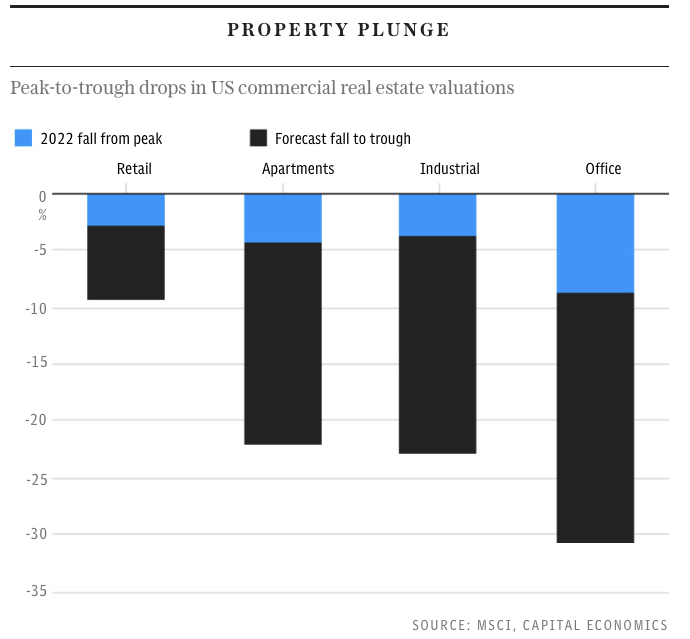

Just take US property values which are greatly overvalued by the lenders:

So the four US banks that have gone under recently are clearly just the beginning. And no one must believe that it is just small banks. Bigger banks will follow the same route.

During the 2006-9 subprime crisis, bailouts were the norm. But at the time, it was said that the next crisis would involve bail-ins.

But as we have seen so far in the US, there were no bail-ins. Clearly the government and the Fed were concerned about a systemic crisis and did not have the guts to bail in the bank customers, not even above the FDIC limit.

As the crisis spreads, I doubt that bank depositors will be treated so leniently. Neither the FDIC, nor the government can afford to rescue everyone. Instead depositors will be given an offer they can’t refuse which is compulsory purchase of US treasuries equal to their credit balance.

The European banking sector is in an even worse state than the US one. European banks are sitting on large losses from bond portfolios acquired when interest rates were negative. No one knows at this stage the magnitude of the losses which are likely to be substantial.

Both in commercial property and housing, the situation is worse in Europe than in the US since the European banks are funding most of these loans directly themselves, including € 4 trillion of home mortgages.

The banks also have a mismatch between low rates received on mortgages against high rates paid to finance them.

The ex-governor of the Bank of France and ex-head of the IMF, Jacques de Larosière accuses the authorities of subverting the private banking system with deranged volumes of QE after it had become toxic:

“Central banks, far from promoting stability, have delivered a Masterclass in how to organise financial crisis”

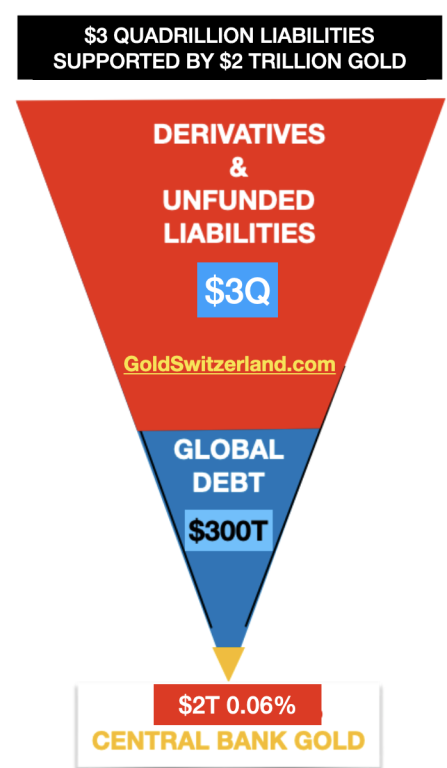

$3 QUADRILLION OF GLOBAL DEBT & LIABILITIES

If we add the unfunded liabilities and the total outstanding derivatives to the global debt, we arrive at around $3 quadrillion as I discussed in this article:

“This is it! The financial system is terminally broken”

Sadly, the Western financial system is now both too big to save and too big to fail.

Still all the king’s horses and all the king’s men cannot save it. So even if the system is too big to fail, it will with very dire consequences.

GOLD TO BE SUBSTANTIALLY REVALUED IN THE DISORDERLY RESET

Just over a century after the creation of the Fed and the beginning of the debt ceiling, the mighty dollar has lost 99% of its value in purchasing power terms.

And measured against the only money which has survived in history – Gold – the dollar has also lost 99%.

This is obviously not an accident. Not only is gold the only money which has survived but also the only money which has kept its purchasing power throughout the millennia.

For example, a Roman Toga cost 1 ounce of gold 2000 years ago, which today is also the price for a high quality man’s suit.

You would have thought that losing 99% of its value for the reserve currency of the world would be a disaster. Well it is of course, but the US, as well as most of the Western world, has adjusted by increasing debt exponentially to make up for the disastrous debasement of the currencies.

What is even more interesting, gold is up 8-10X this century against most currencies.

That is a superior performance to virtually all major asset classes.

And still nobody owns gold which is only 0.5% of global financial assets.

More recently gold is at all-time-highs in all currencies including the dollar.

But in spite of the extremely strong performance of gold or more correctly put, the continued debasement of all currencies, no one talks about gold.

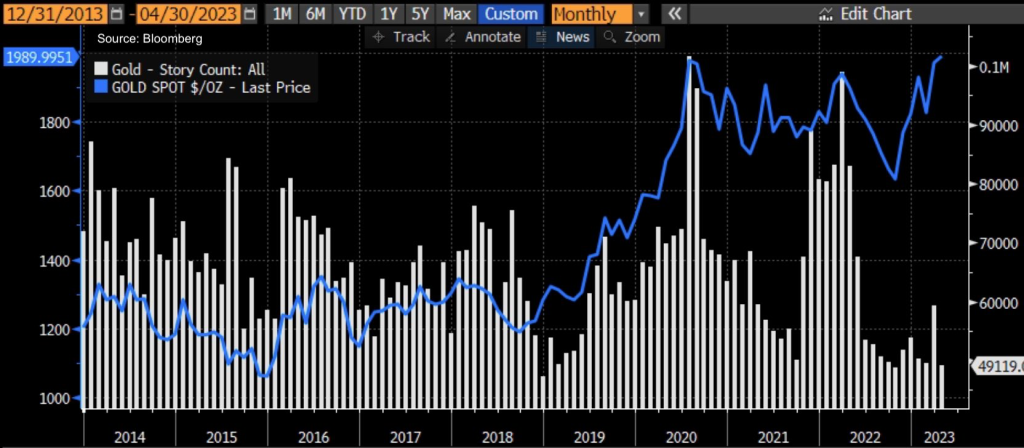

Just looking at the number of articles covering gold in the press in the graph below (white bars), it confirms that the most recent price increase of gold (blue line) is met by a yawn.

This is obviously very bullish. Imagine if all stock markets made new highs. It would be all over the media.

So what this is telling us is that this gold bull market, or currency bear market, has a very long way to go.

As I often point out, no fiat money but only gold has survived throughout history.

Gold’s rise over time is always guaranteed as governments and central banks will without fail destroy their currency by creating virtually unlimited fake money.

Since this has been going on for 1000s of years, history tells us that this trend of constantly debasing fiat money is unbreakable due to the greed and mismanagement of governments.

And now with the debt crisis accelerating, so will the gold price.

Luke Groman makes a very interesting point in his discussion with Grant Williams (grant-williams.com by subscription). Luke suggests that although the dollar will not yet die as a transactional currency, that it is likely to be replaced by gold as the reserve asset currency.

The combination of dedollarisation and liquidation of US treasuries by foreign holders will lead to this development.

Commodity countries will sell for example oil to China, receive yuan and change the yuan to gold on the Shanghai gold Exchange. They will then hold gold instead of dollars. This will avoid the dollar as a trading currency when it comes to commodities.

In order for gold to function as a reserve asset, it will need to be revalued with a zero at the end and a bigger figure at the beginning as Luke says. The whole idea would be that gold will become a neutral reserve asset which floats in all currencies.

The inverse triangle of Global debt resting on only $2 trillion of Central Bank gold shown above makes the revaluation of gold obvious.

A floating gold price as a reserve asset is of course much more sensible than a fixed gold price backing the currencies and would be the nearest to Free Gold.

See my 2018 article, “Free Gold will kill the Paper Gold Casino”.

So the consequence of gold becoming a reserve asset could involve a rise of say 25X or 50X the current level. Certainly not an improbable outcome in today’s money. The debasement of the dollar and other Western currencies is likely to have a similar effect but then we are not talking in today’s money. Time will tell.

As gold is now in an acceleration phase, we are likely to see much higher levels however long it takes and whatever the reason is for the rise.

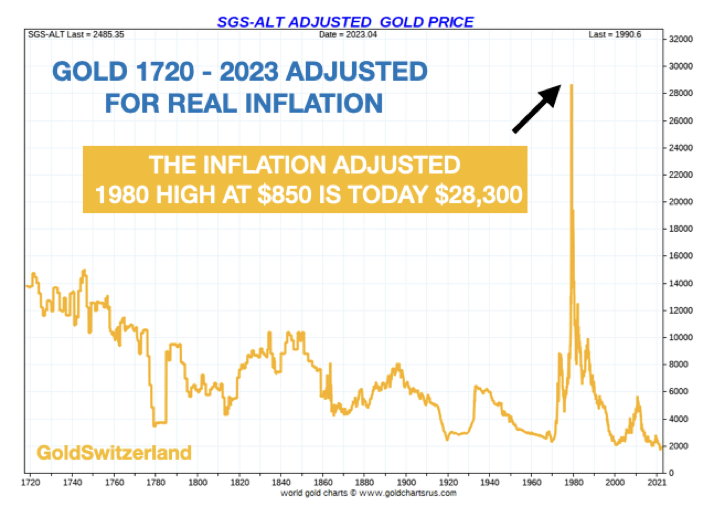

The 1980 gold price of $850, adjusted for real inflation would today be $28,300

As gold is now in an acceleration phase, we are likely to see much higher levels however long it takes.

What is clear is that fiat money, bonds, property and stocks will all decline precipitously against gold.

What is important for investors is to take protection now against the most significant RESET in history which is a disorderly reset.

So if you don’t hold gold yet, please, please protect your family, and your wealth by acquiring physical gold.

Gold repositioning as a Global Reserve Asset could happen gradually or it could happen suddenly. But please be prepared because when it happens you don’t want to hold worthless paper money or assets.

About Egon von Greyerz

Egon von Greyerz

Founder and Chairman

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD