The Facts and Math Are Clear: Gold’s Rise is Only Beginning

In this fact-packed, 30-minute conversation, VON GREYERZ partner, Matthew Piepenburg, joins Jesse Day of Commodity Culture to make sense of the growing list of dislocations in debt, currency and financial markets, all of which serve as longer-term tailwinds for gold.

Piepenburg begins with a blunt analysis of the broad market, drawing from his own prior experiences on Wall Street in general and within the hedge fund space in particular. Taking both sides of the S&P bull and bear case, Piepenburg concludes, with evidence, that we are in fact seeing a classic “bubble” in equities. Toward this end, he explains how bubbles rise on net-income expansions and then pop on net-income contractions. The current S&P, which is comically narrow and what he describes as little more than a veritable “tech ETF,” offers far greater risk today than in prior bubbles (2001, 2008). This is because we are now seeing an equity melt-up in the backdrop of technical recessions from Germany to China (and ignored in the US…). In short, the timing, and irony, of a Fed-driven bubble in the backdrop of record-high global debt and recessionary trends could not be worse. Piepenburg then provides certain warnings and insights for those chasing the current tops.

Naturally, the core of the conversation turns to gold matters, which equally involves currency matters. In particular, Piepenburg offers his evolving views on de-dollarization themes/realities, but does not foresee a gold-backed BRICS currency. Instead, and equally bullish for gold, he sees more and more nations trading outside of the USD and/or net-settling trades in gold. The evidence of this growing trend is now openly undeniable, and he makes a clear case of this evidence, point by point, event by event—including dramatically important changes in the USD oil trade, which he addresses in detail.

Silver, Piepenburg quotes Egon von Greyerz, is “not for widows and orphans,” but is coiled for an inevitable spring forward based on the hard math of supply constraints and radical (one-way) physical silver deliveries out of the NY and London exchanges.

The conversation further includes key insights on recessionary, currency and inflation forces, all of which foretell a mathematically inevitable rise in the gold price. Piepenburg closes by reminding listeners to not only understand why one should own gold, but as importantly, HOW one should own gold, a theme which VON GREYERZ, AG (and Egon von Greyerz himself) has understood since its inception.

The Facts and Math Are Clear: Gold’s Rise is Only Beginning

As is historically typical of all corrupted and objectively bankrupt nations, the truth is often as hard to find as an honest man in parliament.

Thus, if you want to see what’s most true, and embarrassing (and directly linked) to desperately cornered power-brokers increasingly enamored by the centralizing marriage of corporate influence and government opportunists (currently masquerading as “democracy”), the best evidence of genuine reality often lies in what is deliberately omitted from the headlines and public discussion.

Stated otherwise, the devil doesn’t just lie in the details, it lies in what is deliberately ignored, omitted or censored.

As any serious devotee of history (now increasingly cancelled as “elitist”) already knows, there’s no greater power than the power to control the two key levers of society, namely: 1) information and 2) money.

Unfortunately, even in the land of the free, neither of these forces (from genuine capitalism to the fourth estate) serve its deliberately “tribalized” citizenry. Our so-called free press (aka “legacy media”) is anything but free, and our “independent” Federal Reserve is anything but Federal, a reserve or independent.

The ironies just abound.

Between the corporate media and the central bank, it’s fairly clear that both of these time-honored institutions are now openly in bed with big government.

This is not fable, but fact. It’s also ominous.

How Information is Controlled

Note, for example, how the obvious blunders of the “safe and effective” COVID policies/failures of late (from hysterical and global mandates, lab-leak denials, and excess-death math to the global gaslighting of the un-vaxed) have been curiously absent from the headlines or public debate, when just over a year ago this “crisis” was the center of all our lives.

Attempts by the French legislature were even made to fine or jail those criticizing the vaccine. It seems, for some, at least, that Liberté, Égalité, Fraternité has become a convenient phrase rather than guiding ideal. C’est la vie…

More, however, can be said of the strangely silent headlines on the blatant (and finally confirmed) illegality of Trudeau’s invoking of emergency powers to criminalize truckers’ collective expression of free speech and dissent in Canada, or the demonizing of veterans who question the neocon’s US proxy war in the Ukraine as “unpatriotic” or a threat to “national security.”

In short, if you want to see the truth of what scares the power-brokers whose policies defy the open common sense of the common man (which Walt Whitman described as the true spirit of any nation), just look at what those clinging to power deny, hide from, cancel, censor, confuse or punish.

Or to paraphrase Shakespeare, they “doth protest too much,” for they know they are in the wrong.

How Money is Controlled

Turning from the centralization of information toward the centralization of money, the template is no different.

Obfuscation, devilish little details and outright absence of discussion and headlines are where you find the darker truths behind our entirely rigged-to-fail financial system, which as we’ve shouted from the rooftops with facts rather than fear, is little more than a modern feudalism of insider lords and public serfs.

As we’ve warned for years, solving a debt crisis with more debt, which is then paid for with money mouse-clicked out of thin air, is not policy—it’s fantasy.

We’ve also warned that at some point this fantasy (and debt addiction) will lead to not only more lies, more wars and more centralization by the state (as well as a pretextfor dystopian CBDC), but to an inflationary QE endgame/hangover of currency destruction interrupted by a conveniently deflationary (and openly denied) recession.

This is because a government $34T (and counting) out of debt control will have no choice but to take full control over our markets and money via capital controls, yield curve controls and more currency-killing QE to provide fake liquidity to a fake (Fed-driven/deficit-driven) market and economy.

Memories Are Short, Headlines Are Empty

Remember when Bernanke, for example, said QE would be “temporary”? What followed was QE 2,3,4, Operation Twist and then unlimited QE in 2020.

Remember when he also said such magical money would have no impact on the currency, which is the same thing Nixon said when he decoupled from gold in 1971?

What followed was a 98% decline in the USD’s purchasing power when measured against a milligram of gold.

And now, with Powell (who also said inflation was “transitory”) still toe-dipping into QT and hawkish rates, he seems to think no more QE will be needed, and that even the rate cuts he promised months backed are now being back-stepped.

Why?

Because Powell, like all political figures (and the FED IS POLITICAL) is pathologically incapable of admitting error or offering transparency or accountability for the debt hole his Fed has dug for us since its creepy inception in 1913.

After his “higher-for-longer” fight against inflation (a ruse to re-load his rate gun for the next recession) knee-capped the middle class, regional banks, and small businesses in an economy that is witnessing the highest level of corporate bankruptcies and layoffs in over a decade, Powell is still relying on words rather than math.

In this way, he has tempted an appallingly narrow S&P (which is nothing more than a tech ETF led by five names) to all time highs on just the suggestion (rather than act) of rate cuts.

But as I’ve argued elsewhere, this S&P bubble couldn’t come at a worse time nor in a worse national and global setting.

More Currency-Killing QE Will Come

Despite (and frankly, because of) all this embarrassing (and ignored) disfunction, the inflationary QE will come.

In fact, it has been hiding in plain sight.

Five times in the last four years, the two-heads (Yellen and Powell) of the two-headed financial snake in DC have been quietly providing trillions in back-door QE in various forms yet completely off the public headline/radar.

That is, via emptying of the Treasury General Account, issuing unloved IOUs from different extremes of the yield curve and sucking liquidity from the Reverse Repo Markets, DC has managed to buy more fantasy and time from “back-door” sources of liquidity which are now tapping out.

But math, as well looking beyond the headlines, teaches us that front-door (i.e., direct) QE is only a matter of time—i.e., just one popping and deflationary S&P bubble away.

For now, of course, Powell can’t say the quiet part out loud, and the vast majority of children playing within our Congress can’t even count out it loud.

How Dumb is the CBO?

The Congressional Budget Office (CBO), for example, has already projected another $20T in US Federal Debt to be issued in the next 10 years.

If this number wasn’t so mind-numbingly shocking enough (yet largely ignored from the WSJ or NYT), what is even more comical (and mind-numbing) is that the same CBO also foresees NO recession in that 10-year projection.

Furthermore, the CBO is assuming that 10Y yields (i.e., interest rates) will be 40 basis points lower than they are today.

Wow.

The level of dishonesty, denial and/or outright stupidity in such a projection literally defies belief and hard reality.

Why?

First, the CBO is ignoring the recession we are already in.

Secondly, the only way for yields on the US 10Y to be lower than they are today is if someone (or some “thing”) actually buys Uncle Sam’s IOUs. (Yields move inversely to bond demand.)

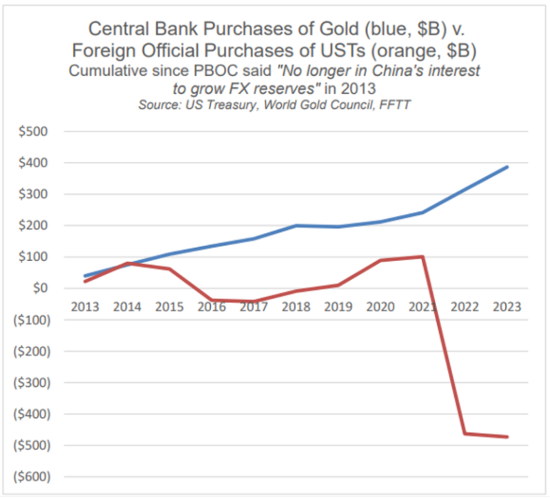

Yet based on not only our last report on the most recent UST auction, and based far more importantly on the unspoken reality that global central banks have been net-sellers rather than buyers of USTs since 2014, one has to wonder from where those mathematical wonder kids at the CBO expect that bond demand to come?

The honest answer, of course, is that there are not enough natural buyers of our unloved IOUs.

This means the actual buying will come from a mouse-clicker at the Eccles Building, where zeros can be added to a balance sheet far easier than say…actual GDP.

Equally clear, is the fact that the trillions of such mouse-clicked dollars are fake dollars, and despite the ongoing debates between “base money” and “reserve notes,” QE IS inherently inflationary.

Powell, for all his faults, knows this.

But his political position (and hence proclivities) means he will continue to well… lie about the inevitability of more QE, more inflation and more currency debasement, which as we (and history) have also warned for years, is THE endgame.

New, Clever Little Lies and More Time-Buying at Your Expense

In the interim, the Fed and its sister little devil, the US Treasury Department, will come up with clever tricks to tell the surface truth while substantively (and simultaneously) lying.

In short, politics 101.

They do this via absolute confusion and brain-numbing details, acronyms and data hiding—i.e. “smoke and mirrors.”

For example, recently, the magicians in DC (namely, the ISDA, or “International Swaps & Derivatives Association) have asked the FED, the FDIC and the OCC (the Office of the Comptroller of the Currency) to reinstitute the UST exclusion for Supplementary Leverage Ratios (SLRs) at Federal Reserve Banks.

Most of you, of course, are saying: “What in the he_ _ does that mean?”

Well, that’s the entire point: You’re not supposed to understand, and you’re not supposed to notice.

Like all other pre-QE and current “backdoor QE” tricks, DC doesn’t want to show its bad poker hand.

That is, it doesn’t want you to know how broke(n) our dollar thirsty (i.e., debt-soaked) nation truly is.

In simple English, by excluding SLRs from calculations at the Fed banks (which was last done when markets tanked in April of 2020), banks are allowed to buy USTs with no reserve requirements (which essentially allows for unlimited leverage).

Or in even simpler English, this is just QE without the Fed having to say the “QE” part out loud.

Shocker?

Hardly. Just more words replacing bad math, which in my opinion, is the perfect description of the current financial cycle (or fourth turning…)

Takeaways?

Given that extreme liquidity, as well as extreme leverage, is THE trigger for extreme debt and then extreme disaster in markets and economies (a theme repeated from David Hume to von Mises, or Reinhart & Rogoff to Jeremy Grantham), those investors playing the long-game (rather than a Taylor Swift S&P) are thinking preparation not FOMO.

Rather than chase tops, the smart money is looking at assets that cannot be “popped” when all that is rosy today turns to blood in the streets tomorrow.

Currencies–for all the myriad reasons discussed elsewhere, from De-dollarization to central bank debasement and petrodollar divergence–will be hit even harder, and yes, the USD too.

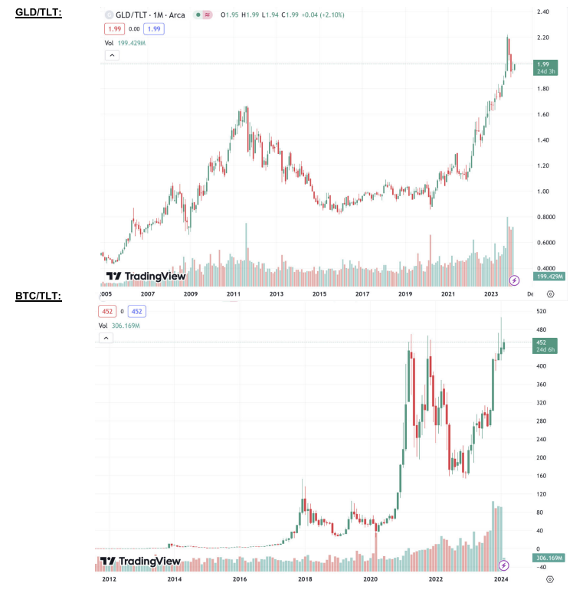

This explains the breakout in anti-fiat assets like BTC and gold.

We are not going to compare “digital” gold and real gold here, but have long argued that they are not the same assets, stores of value or mediums of exchange. Nor are we here to critique fans of the former to highlight investors of the latter.

I love gold. This doesn’t mean I hate BTC. But there’s a difference.

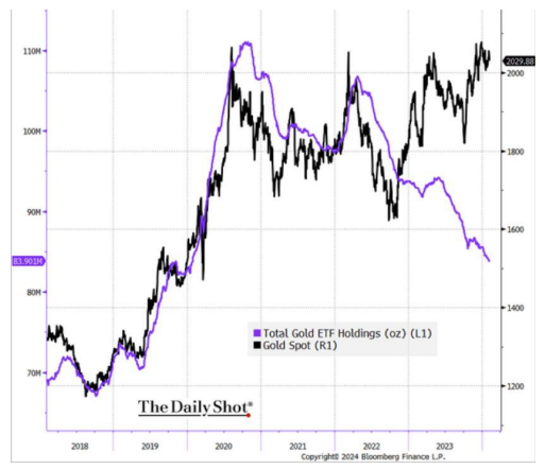

What we do know, and can say, however, is that the world’s central banks are stacking physical gold at unprecedented levels and that the COMEX and London exchanges are seeing historical (and one-way) out-flows from these exchanges for the simple reason that the world wants gold– a tier-1 asset—far more than it wants a UST.

In short, seismic shifts are not coming, they are already happening to the currencies of distrusted and debt-heavy sovereigns.

Many, however, will still try to understand gold’s price moves in connection with (i.e., as a “correlation” to) Fed policies as to rates (up or down), bond yields (up or down), the DXY/USD (up or down) or CPI inflation (up or down).

What we are seeing however, is that gold breaks away from all standard “correlations” when nations tip toward chaos, which is what always follows a debt crisis.

The fact that Germany, the UK, Japan, South Korea and China are technically in recession, while America denies recession at home, suggests to us (gee whiz) that such chaos (financial, military, social, currency and political) is already upon us.

And as trust falls in such a backdrop of objectively neutered currencies, gold simply rises, because it’s real rather than paper money.

The BIS knows this, the world’s central banks know this. Wall Street legends know this.

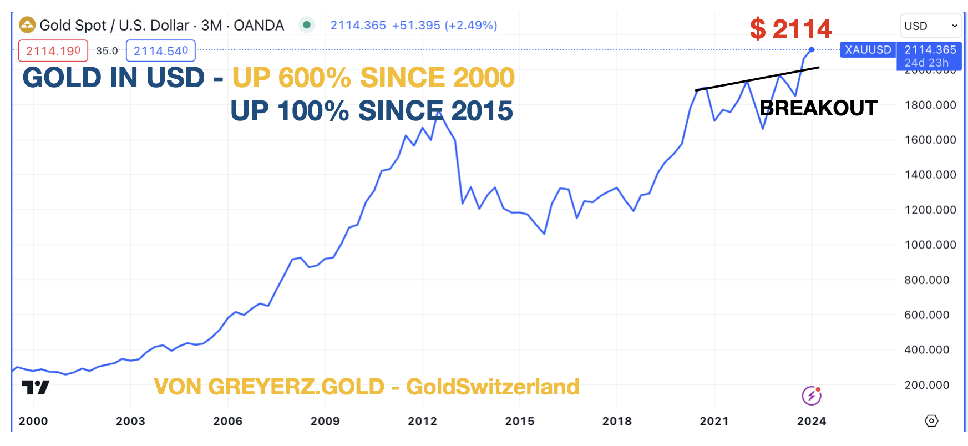

And yes, gold just reached all time highs in USD terms. We all know this.

But there is much, much, more to come for gold, and for no other reason, than that there is sadly much, much more disfunction ahead in the financially upside-down (and debt-trapped) world which our leaders have handed us.

The Facts and Math Are Clear: Gold’s Rise is Only Beginning

In this engaging, 30-minute conversation, VON GREYERZ partner, Matthew Piepenburg, sits down with Liberty Finance’s Elijah Johnson to discuss Gold’s recent surpassing of the 2100 (USD) marker in the backdrop of an S&P totally disconnected from global and national economic warning signs. For Piepenburg, such price action in gold is no surprise, and in fact, is only just beginning as global and US debt levels tip toward the absurd while credit markets, currency markets and central bank policies near their cracking points. In addition to these much-discussed trends, Piepenburg also addresses the historical changes in the London and New York gold and silver exchanges, each of which are seeing massive (and one-way) deliveries OUT of their exchanges and into the waiting arms of central and commercial banks losing faith in the USD/UST. Instead, the bigger names are gathering a far safer Tier-1 asset (gold) in anticipation of seismic shifts in the global economy and financial markets. The implications of these deliveries out of the OTC exchanges are immense, as they strongly curtail the ability of the bullion banks to manipulate honest pricing in precious metals.

Piepenburg turns an equally concerned (yet characteristically blunt) eye toward an S&P breaking all-time highs on the backs of only five, highly over-valued names. For Piepenburg, this so-called “bullish” move in equities could not be further from the truth, as once this bubble “pops,” as all bubbles do (and Piepenburg explains HOW), there is literally no good “narrative” left for the US to cling to in its desperate attempts to confuse a bloated stock market with a “resilient” economy. For Piepenburg, such warnings are not just felt and shared by “gold bulls,” but equally so by a long list of esteemed portfolio managers, from Jeremy Grantham to Paul Singer. In short, the evidence of a dangerously topping and soon-to-be mean-reverting S&P are now undeniable.

The outlook for gold is ultimately so convincing and so strong because the outlook for cornered Fed officials and an openly trapped and bankrupt US economy is so week. As always, Piepenburg addresses these sober realities with facts rather than hyperbole. He closes the conversation reminding viewers that understanding WHY investors need gold is now fairly obvious, but further reminds that it is equally important to understand HOW to own/hold gold outside of the banking system, which of course, includes ETF or “paper” gold.

The Facts and Math Are Clear: Gold’s Rise is Only Beginning

All Empires die without fail, so do all Fiat currencies. But gold has been shining for 5000 years and as I explain in this article, Gold is likely to outshine virtually all assets in the next 5-10 years.

In early 2002 we made major investments in physical gold for our investors and ourselves. At the time gold was around $300. Our primary objective was wealth preservation. The Nasdaq had already crashed 67% but before the bottom was reached, it lost another 50%. The total loss was 80% with many companies going bankrupt.

In 2006, just over 4 years later, the Great Financial Crisis started. In 2008, the financial system was minutes from imploding. Banks like JP Morgan, Morgan Stanley and many others were bankrupt – BANCA ROTTA – (see my article First Gradually then Suddenly, The Everything Collapse)

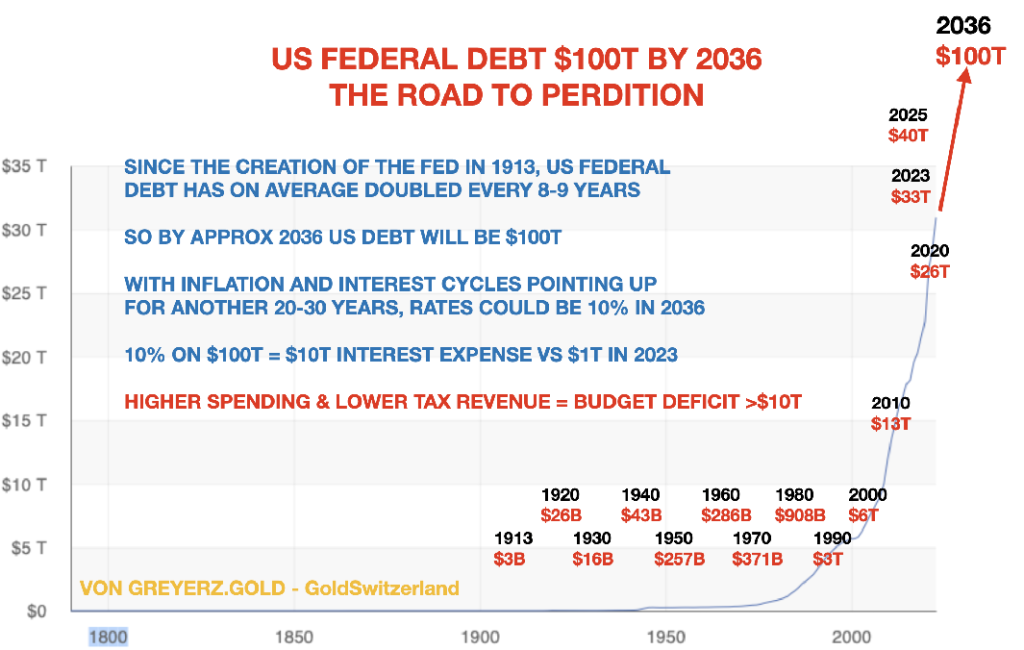

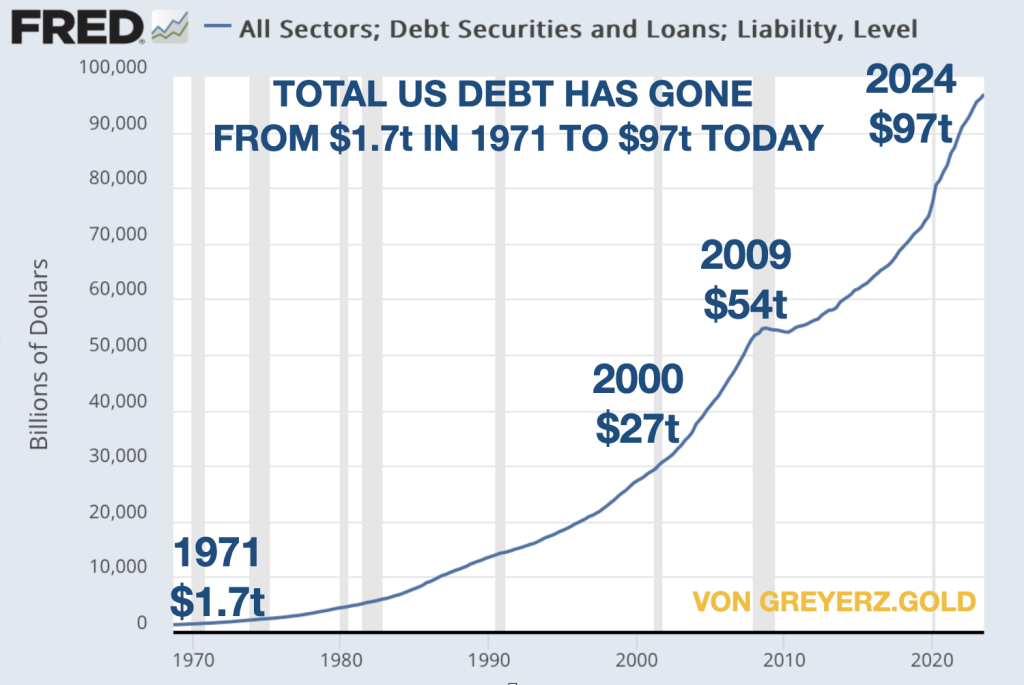

Virtually unlimited money printing postponed the collapse and since 2008 US total debt has almost doubled to $100 trillion.

Gold backing of a currency doesn’t always solve a debt problem but it certainly makes it more difficult for the government to cook the books which they do without fail.

BONFIRE OF THE US BUDGET BOOKS

So tricky Dick (Nixon) couldn’t make ends meet in the late 1960s – early 70s partly due to the Vietnam war.

Thus in 1971 Nixon, by closing the Gold window, started the most spectacular bonfire of the US government budget books. How wonderful, no more accountability, no more shackles and no more gold deliveries to de Gaulle in France who was clever to ask for gold instead of dollars in debt settlement from the US.

So from August 1971, the US embarked on a money printing and credit expansion bonanza never seen before in history.

Total US debt went from $2 trillion in 1971 to $200 trillion today – up 100X!

Since most major currencies were linked to the dollar under the Bretton Woods system, the closing of the gold window started a global free for all with the printing press (including bank credit) replacing REAL MONEY i.e. GOLD.

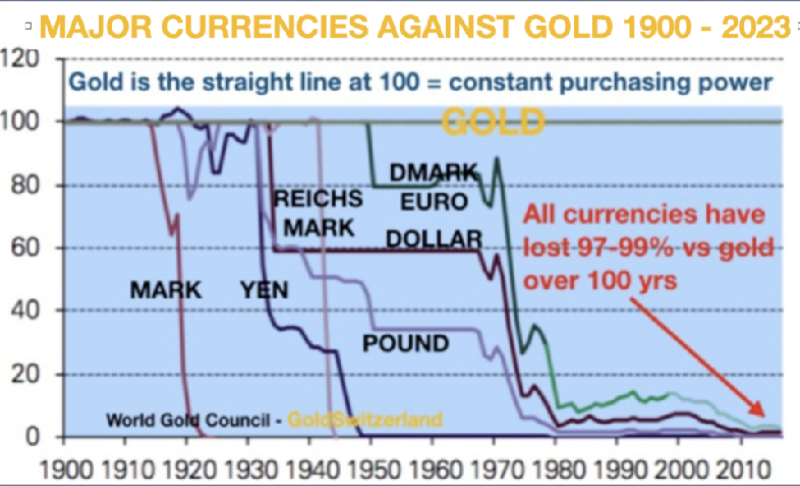

The consequences of this “temporary” move by Nixon is that all Fiat or paper money has declined by 97-99% since 1971.

The price of assets have obviously inflated correspondingly. In 1971 total US financial assets were $2 trillion. Today they are $130 trillion, up 65X.

And if we include off balance sheet assets including the shadow banking system and derivatives, we are looking at assets (which will become liabilities) in excess of $2 quadrillion.

I forecast the derivative bubble and demise of Credit Suisse in this article (Archegos & Credit Suisse – Tip of the Iceberg) and also in this one (The $2.3 Quadrillion Global Debt Time Bomb).

HEADS, GOLD WINS – TAILS, GOLD WINS

Luke Gromen in his Tree Rings report puts forward two options for the world economy which can be summarised as follows:

1. Dedollarisation continues, the Petrodollar dies and gold gradually replaces the dollar as a global commodity trading currency especially in the commodity rich BRICS countries. This would allow commodity prices to stay low as gold rises and drives a virtuous circle of global trade.

If the above option sounds too good to be true especially bearing in mind the bankrupt status of the global financial system, Luke puts forward a much less pleasant outcome.

And in my view, Luke’s alternative outcome is sadly more likely, namely:

2. “China, the US Treasury market, and the global economy implode spectacularly, sending the world into a new Great Depression, political instability, and possibly WW3…in which case, gold probably rises spectacularly all the same, as bonds and then equities scramble for one of the only assets with no counterparty risk – gold. (BTC is another.)”

Yes, Bitcoin could go to $1 million as I have often said but it could also go to Zero if it is banned. Too binary for me and not a good wealth preservation risk in any case.

As Gromen says, there is a virtuous case and there is a vicious case for the world economy.

But above both cases shines GOLD!

So why hold the worthless paper money or bubble assets when you can protect yourself with Gold!

FOR THE CBO BAD TIMES DON’T EXIST

The US Central Budget Office – CBO – has recently made a 10 year forecast.

Obviously, the CBO assumes no depression or even a little recession in the next 10 years!

Isn’t it wonderful to be a government employee and have a mandate to only forecast GOOD NEWS!

And although the CBO forecasts a debt increase of $21 trillion by 2034 to a total of $55 trillion, they expect inflation to stay around 2%!

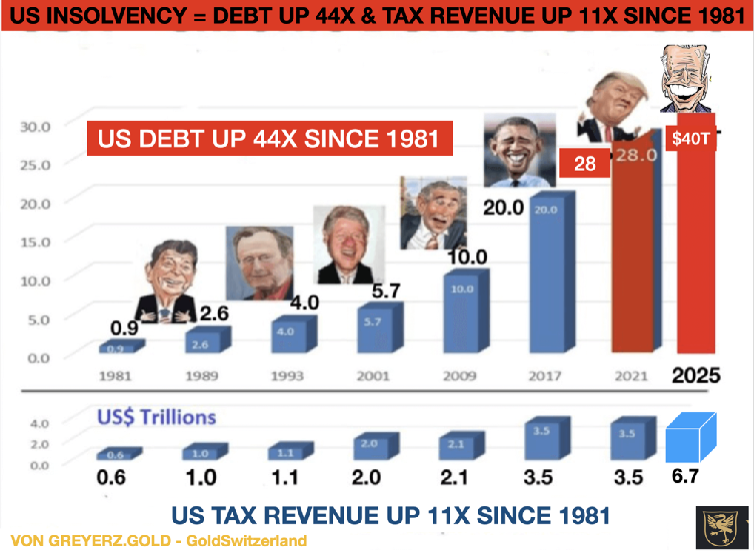

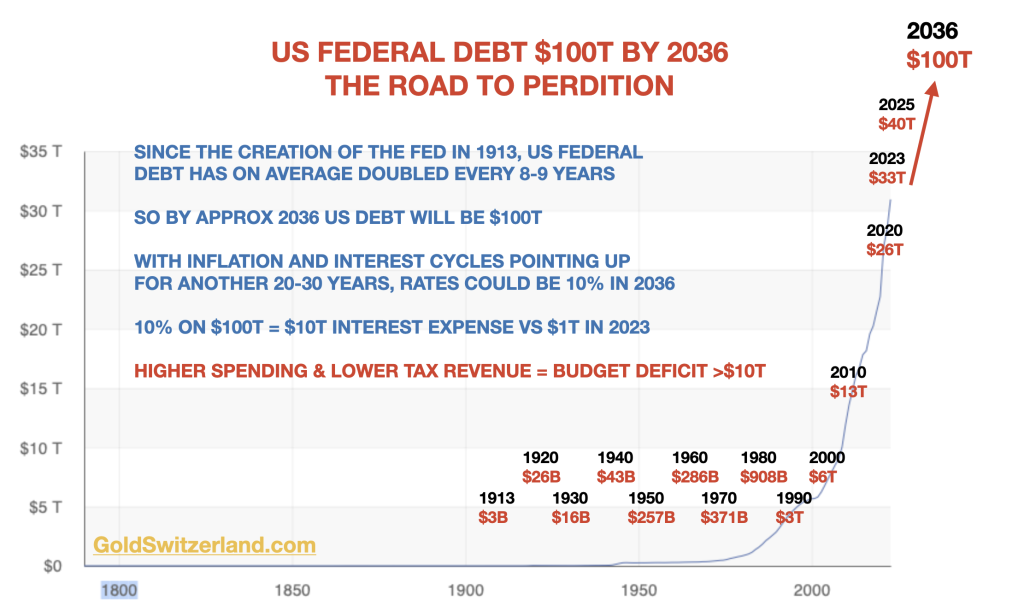

As I have stated in many articles, the US Federal debt has doubled every 8 years on average since Reagan became President in 1981!

I see no reason to deviate from that long term trend although there can be short term deviations. So based on that simple but historically accurate extrapolation, I could forecast the increase from $10 trillion to $20 trillion debt in 2009 when Obama took over from Bush Jr.

Extrapolating this trend, the US Federal Debt will reach $100 trillion in 2036.

With debts and deficits increasing exponentially, it is not unlikely that as inflation catches fire again, $100 trillion Federal Debt will be reached earlier than 2036.

Just think about a big number of bank failures, which is guaranteed, plus major defaults in the $2+ quadrillion derivative market. Against such dire background, it would be surprising if US debt doesn’t go far beyond $100 trillion by the mid 2030s!

STOCK MARKET BUBBLE & LEADERSHIP SWAPS

Investors and many analysts are still bullish about the stock market. As we know, markets will move higher until all investors, especially retail, are sucked in and until most of the shorts have liquidated their positions.

It has been a remarkable bull market based on unlimited debt creation. Nobody worries about the fact that 7 stocks are creating this mania. These stocks are well known to most investors: Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, Nvidia and Tesla.

These Magnificent 7 have a total market cap of $13 trillion. That is the same as the combined GDP of Germany, Japan, India and the UK! Only the US and China are bigger.

When 7 companies are greater than 4 of the biggest industrial economies in the world, it is time to fire the management of these countries and maybe do a swap.

GATES, COOK, MUSK TAKING OVER GERMANY, UK & FRANCE

What about Germany’s Chancellor Scholz running Amazon. Or Rishi Sunak in the UK being in charge of Microsoft? How long would it take them to destroy these companies? Not many years in my view. They would quickly double the benefits for workers and increase debts to unsustainable levels.

But Germany and the UK would most certainly benefit from Bill Gates of Microsoft taking on Germany and Tim Cook of Apple running the UK. They would of course need dictatorial powers in order to take the draconian measures required. Only then could they slash inefficiencies, halve benefits and reduce taxes by at least 50%.

If the entrepreneurs just got a very small percentage of the improvement in the countries’ finances as remuneration, they would make much more money than they are currently.

Even more fascinating would be to see Elon Musk as French President. He would fire at least 80% of state employees and by doing that he might even get the militant French unions on his side and get the country back on its feet.

An interesting thought experiment that of course will never happen.

WHY IS EVERYONE WAITING FOR NEW GOLD HIGHS IN ORDER TO BUY???

For almost 25 years I have been standing on a soapbox to inform investors of the importance of wealth preservation.

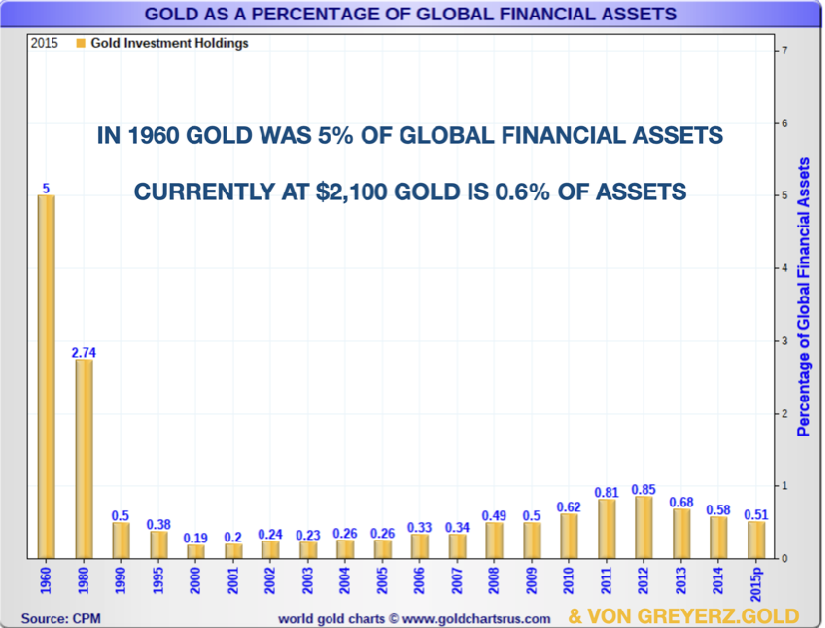

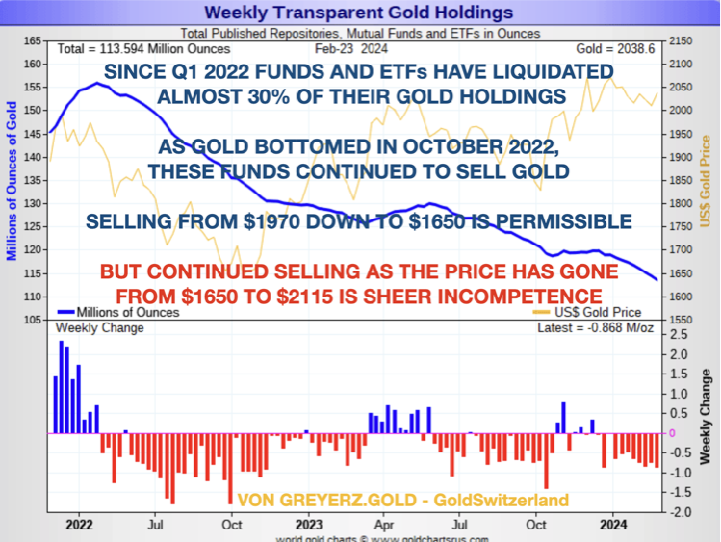

Still only just over 0.5% of global financial assets have been invested in gold. In 1960 it was 5% in gold and in 1980 when gold peaked at $850, it was 2.7%.

For a quarter of a century, gold has gone up 7- 8X in most Western currencies and exponentially more in weak currencies like the Argentine Pesos or Venezuelan Bolivar.

In spite of gold outperforming most asset classes in this century, it remains at less than 1% of Global Financial Assets – GFA. Currently at $2,100 gold is at 0.6% of GFA.

WE HAVE LIFTOFF!

So gold has now broken out and very few investors are participating.

This stealth move that gold has made has left virtually every investor behind as this table shows:

The clever buyers are of course the BRICS central banks. Almost all of their purchases are off market so in the short term it has only a marginal effect on the gold price.

But now the squeeze has started as my good friend Alasdair Macleod explains so well on King World News. The Comex was never meant for physical deliveries but only for cash settlements. But now buyers are standing for physical delivery. We have also seen last month major exports of gold from the US to Switzerland. These are either Comex 400 ounce bars or US government bars sold/leased and sent to the Swiss refiners and broken down to 1 kg bars for onwards export to the BRICS. These bars will never return again even if they are only leased and not sold.

The above process will one day bring panic to the gold market as there will be nowhere near enough physical gold for all the paper claims.

So for any gold investors who don’t hold physical gold in a safe jurisdiction (NOT USA), I suggest that they quickly move their gold to a private vault where they have personal access, preferably in Switzerland or Singapore.

So NO FRACTIONAL GOLD OWNERSHIP, NO GOLD ETFs or FUNDS and NO GOLD IN BANKS!

At least not if you want to be sure to get hold of your gold as the gold squeeze starts.

GOLD IS ON THE CUSP OF A MAJOR MOVE

Having just broken out, gold is now on its way to much, much higher levels.

As I keep on saying, forecasting the gold price is a mug’s game.

What is the purpose of predicting a price level when the unit you measure gold in (USD, EUR, GBP etc) is continually debasing and worth less every month.

All investors need to know is that every single currency in history has without fail gone to ZERO as Voltaire said already in 1727.

Since the early 1700s, over 500 currencies have become extinct, most of them due to hyperinflation.

Only since 1971 all major currencies have lost 97-99% of their purchasing power measured in gold. In the next 5-10 years they will lose the remaining 1-3% which of course is 100% from here.

But gold will not only continue to maintain purchasing power, it will do substantially better. This is due to the coming collapse of all bubble assets – Stocks, Bonds, Property etc. The world will not be able to avoid the Everything Collapse or First Gradually then Suddenly – The Everything Collapse as I wrote about in two articles in 2023.

YES, GOLD IS ON THE CUSP OF A MAJOR MOVE AS:

- Wars continue to ravage the world.

- Inflation rises strongly due to ever increasing debts and deficits.

- Currency continues their journey to ZERO.

- The world flees from stocks, bonds, and the US dollar.

- The BRICS countries continue to buy ever bigger amounts of gold.

- Central Banks buy major amounts of gold as currency reserves instead of US dollars.

- Investors rush into gold at any price to preserve their wealth.

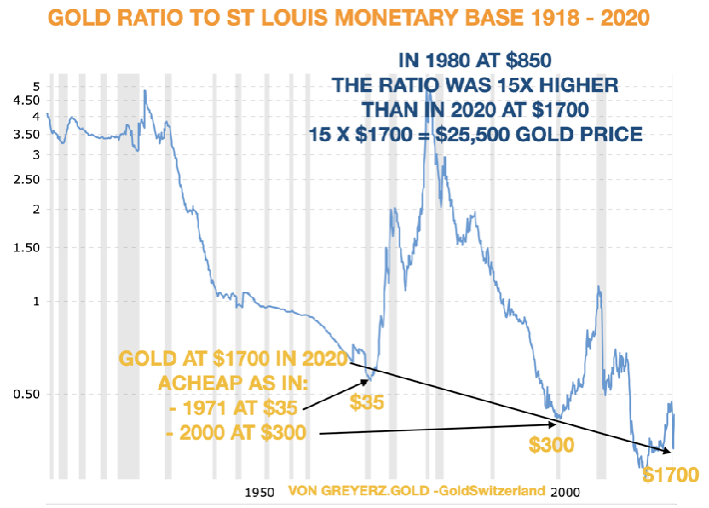

GOLD AS CHEAP AS IN 1971 OR 2000

The chart below indicates that gold in early 2020 at $1700 was as cheap as in 1971 at $35 and in 2000 at $300 in relation to money supply.

At this point we do not have an updated chart but it is our estimate that the monetary base has probably kept pace with the gold price meaning that the level in 2024 is similar to 2020.

So let me repeat my mantra:

Please jump on the Gold Wagon while there is still time to preserve your wealth.

The coming surge in gold demand cannot be met by more gold because more than the current 3000 tonnes of gold per annum cannot be mined.

THUS THE ONLY MEANS TO SATISFY THE COMING GOLD MANIA IS THROUGH MUCH HIGHER PRICES.

The Facts and Math Are Clear: Gold’s Rise is Only Beginning

It’s almost comical to watch policy makers of all stripes and country codes caught in a corner yet pretending we don’t notice.

Children In Charge

I’m reminded of the kid with his hand in the cookie jar while pretending his parents can’t see him—denying his guilt despite the crumbs falling from his face.

Again: It’s almost comical.

But there’s really nothing funny at all about major economies crawling into recession (Germany, Japan, UK, China) or denying recession (USA) while our mental midgets from DC to the EU play with bonds, inflation currency and war like kindergarteners with gas and matches.

Can’t Hide the Debt Cookie Crumbs

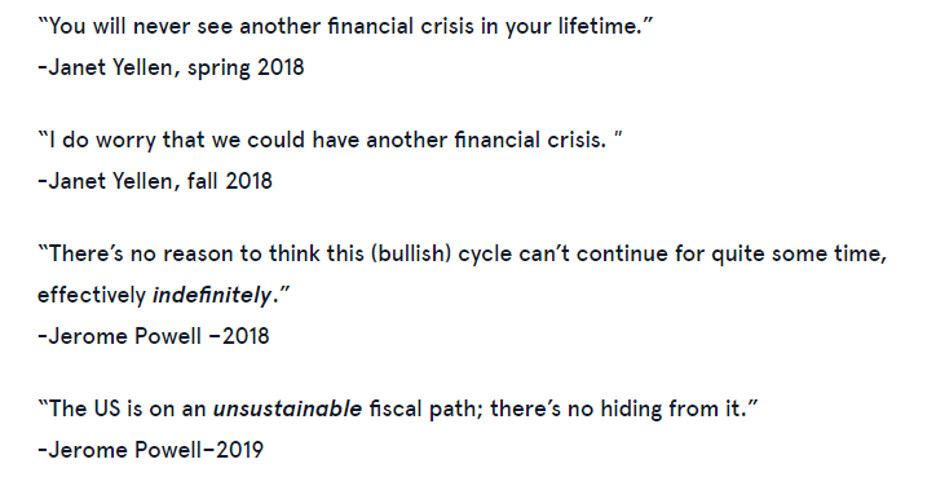

Speaking of kids caught with crumbs on their face while denying responsibility, it seems that even our central bankers can’t keep hiding the facts of now “unsustainable debt” (Powell) with clever lies, such as they had tried to do in the past:

In short, the days of hiding bad math behind empty words are now coming to an end, as most recently evidenced by another comical treasury market auction (below).

Keep It Simple: Debt & Bonds

As we’ve repeated ad nauseum, “the bond market is the thing,” and its survival, like a diesel V8 engine, lives and dies on liquidity/grease—i.e. dollars.

After trillions in outright grotesque QE grease following the bond crisis of 2020 and a hidden TBTF bank bailout (disguised as pandemic relief), the combined efforts of the Fed and Treasury Dept (i.e., the yin and yang of Powell and Yellen) to provide backdoor liquidity to this thirsty market are both tragic and remarkable.

Despite Powell’s headline tightening since 2022, the level of direct Fed liquidity is still tens of billions per month, and the hundreds of billions provisionally drawn from the reverse repo markets, the Treasury General Account (TGA), the Bank Term Funding Program (BTFP) are just QE by another pathway.

In addition to these tricks, tack on Yellen’s desperate attempt to issue trillions from the short end of the yield curve to take supply (and price) pressure off the sacred U.S. 10-Year, we can trace more examples of open desperation and backdoor liquidity by another name.

But at some point, all these liquidity tricks (as well as liquidity) run dry.

And when this “grease” runs out, that is when the bond engine stalls and the global financial system, led by a broke(n) U.S.A, starts its slow stall to the side of the proverbial road as the engine hisses, coughs and then dies.

Stated otherwise, the kids in DC are running out of cookies and jars (i.e., liquidity), and their lies and excuses are getting harder to hide.

Don’t believe it? Just look at the unloved US bond market.

A Very Telling & Embarrassing Treasury Auction

Having issued too many IOU’s (T-Bills) from the short end of the yield curve, Yellen’s Treasury Dept recently tried to auction off some IOUs from the longer end, namely the US 20Y UST.

Folks: It was embarrassing.

Foreign bidders for Uncle Sam’s 20-Year bond dropped to under 60% (they were 74% of the bidders in November).

This means that primary dealers (i.e., big banks) were forced to fill the gap by purchasing almost 22% of Uncle Sam’s increasingly unloved bar-tab of 20Y IOUs…

In simple speak, this is an open sign that the bond market is cracking. In fact, however, it has been cracking for a while…

Memories are short, as many have already forgotten the extreme dysfunction on the short end of the curve in Q1 of 2023 (not to mention the bank failures that followed, and with more to come, as warned…).

A similar disfunction is now openly obvious on the long-end of the bond curve, at least for those paying attention.

When bonds are unloved, their prices begin to fall, and their yields, which move inversely to price, start to rise, which means their interest rates rise too—adding more pressure (and cost) on Uncle Sam’s ability to repay the same.

Fiscal Dominance—More Than Just a Term of Art

This moment of interest expense “uh-oh” for DC is what the St. Louis Fed described in June of last year as “Fiscal Dominance,” namely that point where rising rates (and debt costs) get so high (i.e., dysfunctional), that the only option (and source) for more “greasy liquidity” (i.e., USDs) to support those ugly bonds is with money “clicked” out of thin air.

In short: More QE to the moon is inevitable, not debatable.

This QE inevitability is inherently inflationary, and this by the way, is the end-game for the Dis-United States, even if we experience a dis-inflationary recession somewhere in the middle of this tragic playing field.

Dollar Debasement—Right Before Our Eyes

Needless to say, such fake liquidity in the from an increasingly weaponized (and hence unloved) USD, places even more negative pressure on a DXY, which at the time of the aforementioned (and embarrassing) auction, was at 104, down from its 110+ levels of Q3 2022…

In the last four years of increasing bond dysfunction in the wake of drying liquidity, DC has shown five times in a row that it will come quickly and aggressively to the rescue to provide more fake grease (again, from the TGA, the BTFP, the repo markets etc.) to “save” the bond market at the expense of the currency.

Soon, we’ll just see plain ol’ QE, which will debase the USD even more, regardless of its “relative strength” to other equally, if not more, debased global currencies.

Such currency debasement, again, fits the pattern of all nations slowly dying from their own debt sins.

For now, of course, the markets are expecting Powell’s promised rate cuts to become actual rate cuts.

As a result, these markets are just giddy in anticipation and have recently hit all-time-highs on Powell words rather than Fed actions.

These already dangerously bloated markets will rise even further whenever the Fed has no choice but to hit the QE red button at the Eccles Building.

Tread Carefully You Top-Chasers

For those few, very few, who know how to trade nose-bleed tops without getting burned when net-incomes/margins trend south, the speculation and momentum trade juices are flowing.

But as I recently warned with evidence rather than hyperbole, today’s S&P, which is little more than a glorified tech ETF lead by 5 names, is the most dangerous bubble I’ve ever seen, traded or studied.

That Clever Pet Rock

Gold, meanwhile, will clearly get, and is already getting, the last laugh as stock bubbles inflate and bond markets scream for more debased USD grease.

The recent 20Y bond auction, above, with its foretelling of rising yields, should have been a massive headwind for that “yield-less pet rock.”

But as I argued from Vancouver in January, gold is breaking away from the standard correlations to rate, currency and inflation/deflation indicators.

Why?

For the simple reason that the overall system is now so openly broken, cracked, and dis-trusted that gold’s historically trusted (as well as speculator-ignored) role as a provider of real value (and 52-week highs) in world of diluted yet inflated currencies and bubble assets is becoming more obvious.

Again, this easily explains why central banks are stacking (and TRUSTING) this pet rock and dumping Uncle Sam’s IOUs at record levels.

That is, the world’s central banks (and leaders) see a US Humpty Dumpty about to fall off a wall, and when it does, gold will do far more to protect investors and sovereigns than bad IOUs and bubble assets measured in paper “money.”

Not surprisingly, the 0.5% of global financial assets allocated to gold are and will be rewarded not because they are just “contrarian for contrarian’s sake,” but because this remarkably small/informed minority are wise enough to think ahead rather just follow the sell-side sirens (and the crowd).

Which Needle Will Pop the Red Debt Ballon?

For now, and in the surreal backdrop of spiking markets and a Main Street on its knees and waiting for the “wealth effect” of a feudalistic rather that capitalistic financial system, all we can do is stare at the greatest debt bubble in history and guestimate which needle will “pop” it…

Will it be spiking rates colliding with the white swan of unprecedented global debt? A derivative market implosion? A geopolitical black swan? Another war? A collapsing Japan? China? America? A fractured/fragile EU? An immigration-lead fracturing of social order?

Who knows.

With so many needles pointed at a now historically unfathomable (and mathematically unpayable) red debt balloon, the actual needle that pricks us is rarely the one we see coming…

A Bank Needle?

As in 2008, the next crisis may come from where most crises are born, namely behind the glass doors of our stupid (and system-protected) banks…

The commercial real estate (CRE) crisis, of which I warned as far back as 2020, is anything but a minor matter.

The CRE losses on non-performing loans (NPLs) now exceeds the loss reserves at many of the largest US banks (Citi, Goldman, Wells, Morgan Stanley, JP Morgan etc.)

The Fed’s Real Mandate

Ironically, however, I don’t worry about these silly banks, because their Rich Uncle Fed’s real mandate is not inflation and employment, but making sure the foregoing banks, from which the Fed was un-naturally spawned, do not fail.

Bank regulators, who are just former bank executives, will meet FOMC and Treasury “experts” in DC and paste-together more back-room extend and pretend programs (which is how all failed banks deal with their failing loans and leadership) to provide the bigger boys with needed “grease” (i.e., liquidity) to stay alive (via forced yet subsidized UST, MBS and syndicated CRE/ABS purchases) as the Fed, once again, decides between saving the banking system or the currency.

Needless to stay, the suspense is hardly killing any of us who know how DC and Wall Street work.

In other words, expect more mouse-clicked trillions to save Uncle Fed’s spoiled banking nephews in a NYC which has slowly become not only a den of thieves, but a half-way house for millions of illegals which we like to call “asylum seekers” …

Ah, the American Dream, ah, the city that never sleeps…and the nightmare that never ends for every inflation-braced Main Street from Sea to Shining Sea.

Big Trouble in Little China

Of course, the US is not alone with yet another real estate cancer. China’s CRE crisis is arguably and mathematically worse.

But is that any real consolation to those facing an increasingly debased Greenback and unloved UST?

Are we supposed to be happy that our currency and bonds, though awful, are still better (for now, at least) than China’s?

Well, if our Dollar and IOU are so relatively special, why are the yields on our 10Y UST spiking 200 basis points above the CGB (Chinese Government Bond) yields?

Well, unlike the US, China is not pretending to be above total control over its markets and people, a trend which will come to the West once its childish leaders are forced into a debt corner.

History’s Sad Pattern

As I’ve warned for years, the syllogism from debt-crisis to market-crisis to currency and inflation crisis, followed by social unrest and then increased centralization from the extreme left or right is a pattern as old as history itself.

China has no shame about overt capital controls or state-owned banking.

But are our Fed-supported TBTF banks any less “centralized” just because their CEO’s get paid like capitalists despite being bailed out like state-sponsored entities?

We have had Wall Street socialism for years, but have put a nice “free market” lipstick on what is in essence just an “insider” pig.

Based on the trends above, and the pattern just described, the slow-drip toward more currency debasement, inflation and centralized (and capital) controls (think CBDC) in the wake of social unrest (from truckers and tractors fighting their “lords” from NYC to Berlin) is not only here and now, but the tragic road ahead.

This pattern of centralization, sadly, is just history and math. The cycles will play out. And gold, though no cure-all for all the overt and covert sins of our failed leadership, will at least be a cure for our failed currency.

The Facts and Math Are Clear: Gold’s Rise is Only Beginning

In this critically important Gold Matters discussion, VON GREYERZ principals, Egon von Greyerz and Matthew Piepenburg, place the enormous risks of the current U.S. equity bubble within the much-needed context of unprecedented global economic factors.

Egon opens the discussion with a brief review of the unprecedented string-cite of global geopolitical, social, economic and debt risks. From a preventable and escalating land war in the Ukraine to conflicts in Gaza and the broader Arab world to nose-bleed global debt levels in the backdrop of now undeniable social tensions and de-dollarization, the need to be realistic rather than just “negative” is of common-sense importance. As we head into a year already marked by such massive fissures, any attempt to gloss over these facts with an S&P making record highs would be missing the forest for the trees. In fact, the current U.S. bubble is far more of a dangerous rather than safe indicator when placed into needed context.

Toward this end, Matt speaks to something all-too familiar, having managed a hedge fund as well as a family office during prior asset bubbles. Matt gives particular attention to the overt risk indicators of the current S&P bubble, which teeters on the twin edge of unprecedented concentration and over-valuation metrics.

Matt’s perspective is not theoretical, but hands-on, as he explains how the current asset bubble, like the dot.com bubble of 2000, is in fact driven by the same fundamentals. He compares the Magnificent 7 to equally profitable and “good” names like the Microsoft, Cisco and Qualcomm of 1999-2000, noting that such otherwise profitable companies rising on margin growth eventually experience inevitable contraction in net income once price, volume and cost advantages trend negatively. No one, of course, can time such shifts, but “this time is NOT different,” as all such bubbles end the same: They pop.

What makes the current bubble (AI mania) so much more dangerous, however, is that it is led by 5-7 names, and when they mean-revert, as all over-valued companies do, there’s nothing left to prop the S&P. In short, when these names fall, everything falls with it, and this time around, the entire global economy is already on its knees. This is bad.

Egon closes the conversation with his own, and equally hands-on, perspective of investing through asset cycles and bubbles, offering needed insights on the risks, as well as lessons, of prior manias. Naturally, the conversation turns to real money and real assets, namely the far less “maniacal” gold. As the foregoing risks continue their exponential growth, gold rewards the far-sighted investor in obvious ways not otherwise understood by speculators. Matt, though not averse to the speculative mind-set, warns of the seductive appeal of chasing (and buying tops) and makes an equally straightforward case for gold in a world losing perspective.

The Facts and Math Are Clear: Gold’s Rise is Only Beginning

All the fundamentals are now in place for the above equation to be true:

- Wars will sadly not go away but instead escalate since there is ZERO desire for peace from the US neocons or the weak Europeans.

- Inflation and interest rates will increase rapidly, driven by deficits and exponential growth of debt.

- Wars and inflation will lead to a major shift into GOLD by Central Banks, the BRICS as well as for wealth preservation purposes.

“Poverty is the parent of revolution, crime and war” is what Aristotle stated 2,300 years ago. I added “war” since this is often the consequence of poverty and bankruptcy for a nation in a desperate attempt to borrow more money and blame the war for the economic woes.

As the US is now totally losing its hegemony, we can on a daily basis follow the desperate actions that a failing super power takes.

As every empire and nation that fails, the US has followed the same pattern whether we talk about the Roman, Mongol, Ottoman, Qing or British Empires.

Initial economic success as well as military might lead to illusions of grandeur and infallibility.

Riches, often stolen from other nations, turn to deficits and debts, collapsing currencies and decadence. That leads to money printing followed by the collapse of the currency. At that stage wars are often started which generally have disastrous consequences.

The RISK OF A COLLAPSE OF THE global geopolitical and economic SYSTEM is crystal clear BUT the outcome is extremely murky.

So let us look at what is clear on the geopolitical side:

- The US is not led by a visible leader but by an invisible and unaccountable group of neocons who only want war. And in Europe there is not a statesman to be found. Instead, weak European leaders follow the headless US.

- The US Neocons want to crush Russia by any means, even if it leads to nuclear war. Thus the US has implemented sanctions against Russia and forced Europe to take their full part by also sending weapons, money and military expertise to Ukraine. The cost of these measures is destroying the European economy and making the US even more bankrupt than it is, by running a deficit approaching $2 trillion with total US debt at soon $100 trillion. Remember it was $1.7 trillion in 1971 when Nixon closed the gold window. See graph further down.

- If the US war against Russia (carried out in Ukraine) escalates, Russia will have many friends on their side like China, North Korea and Iran. The US and NATO do not have the capacity to win a war on the ground so any war involving the West will be in the Air and very likely nuclear.

- The US also wants to crush the Muslim/Arab world. Iran is currently the principal enemy. But the US is also supporting Israel against Hamas and the Houthis in Yemen. The Muslim world has no capacity for a major war against the West but they have a much more effective method of paralysing the West which is terrorism on a major scale. Most Western countries have well armed Muslim cells, most probably also with dirty nuclear weapons. So surprise attacks on strategic buildings or major shopping centres in the US, UK and rest of Europe are probable. That would totally paralyse the countries involved.

- A cyber war is also very likely. Whether Russian and Chinese missiles can take out major communication satellite systems, as recently published, remains, to be seen. But they have well developed skills for cyber attacks anywhere.

- The US has no desire for peace. They and other NATO countries are not sending a single peacemaker to Russia but only weapons and money.

- The majority reaction to the recent Tucker Carlson 2 hour interview is typical for the propaganda led hatred for Putin. Most people in the West have been told by MSM to hate Putin and blame him for all evil acts and thus not listen to the interview. I am by no means saying that Putin is an angel because he definitely isn’t. But nor is any other leader of course. Nevertheless Sun Tzu, the Chinese General, strategist and philosopher told us 2,500 years ago: KNOW YOUR ENEMY.

- So how can anyone in the West understand Russia or Putin when they are not prepared to listen to him calmly presenting the Russian side for 120 minutes?

- Tucker Carlson – Biden interview. Some US politicians wanted to ban Tucker Carlson from coming back to the US after the interview. Instead I would suggest that Tucker would be given a 2 hour interview with Biden. Just like with Putin, there should be no advisors present, no crib sheets and no teleprompters.

- Let the world thereafter compare the quality of the argument of the two leaders, their clarity and if they are both Compos Mentis. After all, these are the minimum requirements for a leader of a major power and someone who personally can press the nuclear button.

I have above covered the global geopolitical situation which is “crystal clear” from a risk point of view.

I have since the Ukraine war started been very clear that Ukraine can never beat Russia. After a lot of initial enthusiasm for the underdog and a lot of fake news that Ukraine was winning, the world now realises that this war is a human catastrophe with both sides reporting big losses for the enemy and minimal for themselves. Total deaths are probably well above 500,000 but we will never know.

The tragedy is of course that the leaders sit in their safe offices and send 100s of thousands of men to their slaughter with no resolution in sight.

How this war will play out in detail, we will of course only know afterwards. But in the end it will be seen as another futile war with no winners and one or several million losers, just like most wars that megalomanic leaders start.

THE RISK OF A COLLAPSE OF THE WESTERN ECONOMY IS CRYSTAL CLEAR

So let us now look at the global economic picture.

The risk of your wealth declining by 70-90% in the next 5-7 years is today probably greater than any time in history.

The US market is driven by a handful of tech stocks which are massively overvalued.

On any measure, US stocks are greatly overvalued and as the US debt disaster starts to dominate the discussion, markets will quickly realise that the US is bankrupt.

TOTAL US DEBT IS NOW GROWING EXPONENTIALLY

US debt has almost quadrupled this century.

As I have set out in several articles, the interest cycle bottomed in 2020 and we will now see a long term trend up for 20-30 years.

US Federal debt has doubled every 8 years on average since 1980. With the state of the US finances, the debt is likely to now grow super exponentially. Thus it is likely that $100 trillion Federal debt will be reached before 2036 as a mere doubling every 8 years would result in.

So with $100 trillion or more of Federal debt within the next 10-12 years, the US economy will default, especially if interest rates reach 10% or more. Remember they were around 20% in the late 1970s and early 80s.

Obviously, at that point, or more likely well before it, the US dollar will have collapsed and gold will be the only real money that central banks and ordinary investors will be willing to hold.

Yes, there will probably be a few rounds of other forms of fake money in between like CBDC’s issued by central banks, in the next few years. But they will fail as CBDC’s will just be another Fiat currency backed by debt and no assets.

So there we have it. Aristotle’s prediction is coming to pass. The US debt and deficit is the Poverty for the country as a whole and will rapidly spread to the people as the financial system implodes. Revolution or internal conflicts will follow both in the US and Europe. The truckers’ action in the US and in many European countries is the start of a form of Revolution. But it will get much worse. There will be conflict between various political fractions whether it is Trump supporters against the system or neo-Nazis against immigrants or just ordinary people against the wealthy. Extreme income and wealth inequalities, like we are currently seeing in the West, normally lead to conflicts or revolutions.

And anyone living in the WEST knows that Crime (as Aristotle said) is rampant and the prisons in most countries are full.

Anyone who doesn’t see that we are at the end of a major era, with massive calamities next, will soon have a rude awakening.

So overvalued stock markets will crash as will bond markets with interest rates surging.

SO WHAT ABOUT CASH IN A BANK– will that save investors?

Your cash in a bank belongs to the bank: And that is where most people keep their cash.

What people don’t realise is that your cash in the bank isn’t your money.

No, all you have is a claim on the bank as an unsecured creditor.

And as soon as the bank receives your electronic money, it lends it out up to 10X!

The consequence of that is if one borrower out of the ten can’t repay his loan, you have lost all your money.

This process is now happening slowly but just as debt is accelerating exponentially, so will defaults. I explain the process in this article.

First Gradually and then Suddenly – The Everything Collapse

Banca Rotta or Bankrupt: This expression comes from the Italian financial system in Florence in the 1600s when banking was conducted on a bench or desk. If the banker couldn’t honour his obligations, his bench was broken. And that is where the word Bankrupt (Banca Rotta in Italian) derives from.

So there we have it, a broken or rotten banking system is what the world is looking at now.

We had the first signs just under one year ago when four US banks had to be saved, starting with Silicon Valley Bank. Shortly thereafter Credit Suisse, Switzerland’s second largest bank, had to be saved by the Swiss National Bank and government and then UBS were made an offer by the Swiss government that they weren’t allowed to refuse and bought Credit Suisse.

What we saw during the Ides of March last year (March 15 when Caesar was murdered), was the first warning signal for the world that the banking system is broken.

The pressure on the banking system continues. The number of companies that failed to meet required repayments increased by 83% in 2023.

US corporate debt has increased by 18% since 2000 and is now at $13.7 trillion.

Further deterioration is expected for 2024 due to higher rates. 40% of debt Rated B- or below is risking to be downgraded in 2024.

The market is hoping for lower rates in 2024 but as I have stated many times, inflation and continued deficits will put pressure on the debt markets.

Commercial property is a real timebomb with vacancy rates approaching 15% and rents under pressure. Office sales prices are also falling rapidly by between 20% and 66% (in San Francisco).

The commercial property market is likely to lead to major write-offs for the banks and eventually either rescue actions (=money printing) or defaults – Banca Rotta!

But let’s face it, the exponential growth of total US debt is unsustainable.

Please read my article on how exponential moves explode towards the end. So whether US debt goes to $200 trillion, $500t or quadrillions will be determined in particular by the collapse of the derivative market.

I have in many articles explained that the outstanding derivatives are likely to be a lot higher than the BIS figure of just under $700 trillion like in this article: $2 quadrillion debt precariously resting on $2 trillion gold.

There are sources quoting up to $7 quadrillion derivatives but since I cannot prove it, I cannot make that claim myself. But since there are so many “bets” outside the banking sector and in the shadow banking sector, most of them uncollateralised, we will never know the true size until the system implodes. But whatever the sum is “only” $700 trillion or as much as $7 quadrillion, it is at least 8X global GDP which is enough to break the world financial system and collapse the world economy.

This is not a fantasy. It is a nightmare. Because when counterparties fail the gross outstanding derivates cannot be netted and the gross amount outstanding is due.

Initially governments will assist banks in turning the derivatives into on balance sheet debt but as the sheer weight of the debt becomes unmanageable and hyperinflation ravages, that’s when the system will fail.

Yes, central banks will issue CBDS (Central Bank Digital Currencies) and try to hide the debt but CBDS is just another form of fake money and will suffer the same fate as paper money.

Besides the risk of the financial system, governments and central banks around the world, have throughout history destroyed our money without fail.

Only since the early 1700s over 500 currencies worldwide have become extinct, the majority through hyperinflation.

Just take the dollar which has lost 98% of its purchasing power since 1971 and 86% since 2000.

GOLD

As I declared in a recent article – Catch the Goldwagon or lose your Fortune.

If stocks crash there might be some short-lived gold sales but

GOLD IS ON THE CUSP OF A MAJOR MOVE AS:

- Wars will continue to ravage the world.

- Inflation will rise strongly due to ever increasing debts and deficits.

- The world flees from stocks, bonds, and the US dollar.

- The BRICS countries continue to buy ever bigger amounts of gold.

- Central Banks buy major amounts of gold as currency reserves instead of US dollars.

- Investors rush into gold at any price to preserve their wealth.

SO PLEASE DO NOT MISS THE GOLD WAGON BECAUSE IT WILL BE YOUR LAST CHANCE TO PRESERVE YOUR WEALTH

The Facts and Math Are Clear: Gold’s Rise is Only Beginning

VON GREYERZ partner, Matthew Piepenburg, joins VON GREYERZ advisor, Grant Williams along with Andy Schectman and Jay Martin in the opening presentation at the recent Vancouver Resource Investment Conference to discuss the truly “tectonic shifts” in the global political and financial playing field.

The panel gives specific attention to the now undeniable and growing trend toward de-dollarization and the rise of the BRICS+ trading alliances outside of the USD. The evidence of the shift away from the USD and UST in the wake of the 2022 Putin sanctions is literally everywhere, from Main Street and the bond market to global currency, energy and gold markets.

For longer-term investors seeking to prepare for these changes, this special panel makes it clear that change is not just coming, it is already here. Knowing where currency and bond markets are moving, as well as global trade, the extent and implications of these changes won’t be scary but opportunistic. Of course, gold will play a central role in the new world unfolding before our very eyes.

The Facts and Math Are Clear: Gold’s Rise is Only Beginning

The French poet, Arthur Rimbaud famously wrote that “Nothing is true.”

Hmmm.

Fairly sensational, no?

Deciphering the nuance behind such poetic phrases is almost as difficult as deciphering the meaning behind so many political (and hence central banking) phrases.

Reality Amidst Fantasy: Putin Speaks

Of course, not everything is a lie—but in the backdrop of a now openly discredited legacy media and the growing swells of mis-information, dis-information and mal-information, one has to be selective in sifting through pounds of fantasy for an ounce reality.

Recent headlines regarding the Carlson/Putin interview, for example, will draw passionate reaction, commentary and bias depending largely upon whether or not one views Putin as Hitler 2.0 or a Realpolitik pragmatist, Zelenskyy as George Washington reborn or a puppet thespian, or Tucker Carlson as a media lightweight or awe-shucks truth seeker.

Nothing we say here will change such personal biases floating above a cesspool of politicized and weaponized tricks and messages, from the DOJ to the WSJ, or the FOMC to NYT.

Stick to the Math

That is why math and factual data, far more than prompt-readers, sell-side bankers and power-prioritized politicos offer the safest lighthouse in the current financial and geopolitical fog.

So, let’s stick to math and facts and let us/you be our/your own judges.

Putin Getting Cheeky?

Putin, for example, wondered out loud why the US is spending billions in an avoidable war protecting its Ukrainian satellite nation despite its own country drowning in over 33 (in fact 34) trillion in public debt, a clear immigration disaster on its southern border and undeniable signs of de-dollarization as China and Russia, along with a whole lot of BRICS+ nations, move gradually away from the Greenback.

He also made a few sly, and potentially prophetic observations about the slow demise of the petrodollar, a theme we’ve addressed many times.

Was this just dis-information? Pro-Russian propaganda and hence more biased lies?

You can decide for yourselves.

Putin is no angel, after all, but that doesn’t mean he’s stupid, and when it comes to certain mathematical facts, he does have a few points worth considering…

Debt Matters

When it comes to US national debt (now over 120% of its GDP), we and many others, have been openly warning for years that it’s not only a national embarrassment (and managerial sin), but that such abstract trillions of debt are also mathematical deterrents to genuine (rather than debt-based) “growth.”

After all, debt-based “growth” is not actual growth, it’s just more debt—akin to giving teenage frat boys a credit card to party every semester while ignoring the subsequent invoice until graduation…

We’ve also reminded that the war on inflation, which Powell famously described as “transitory,” is not only far from over, but that its worst battle wounds (i.e., inflation pains) are yet to come.

In plain speak, Powell needs inflation and a debased dollar (via inevitable rate cuts and more mouse-clicked trillions, i.e., QE to the moon) to pay for (and inflate away) not only Uncle Sam’s rising, and embarrassing public debt, but the trillions more in unfunded liabilities off the public balance sheet.

Caught in this fatal undertow of debt, the Fed, and hence the US economy and dollar, is now openly trapped, and whatever one thinks of Putin, he knows this to be true.

Powell’s “higher-for-longer” rate hikes since 2022 were indeed dis-inflationary, but they also strengthened the USD, crushed bond prices and sent bond yields too high (and too costly) for foreigners holding over $13T in debt obligations pegged to those rising yields.

This forced foreigners to sell large chunks of their $7.6T in USTs to come up with the cash (i.e., USDs) to pay their dollar-denominated debts.

The net result was an increasingly disorderly bond market as the USD and yields rose while bond prices tanked, which only added more depth to US deficits (fiscal dominance), more pain to small businesses, more interest expense for Uncle Sam, tighter lending at the banks and increasing IOU issuance (i.e., more debt) from the US of A.

The Big Rub

But here’s the rub—and it’s a BIG RUB: No one wants those IOU’s. (They prefer gold.)

Trust in American debt just aint what it used to be, and faith in that weaponized USD (as we warned since 2022) is fading—slowly, yes, but surely.

Recently, Jay Martin, Andy Schechtman, Grant Willaims and myself knew this; central banks know this, and not surprisingly, even that clever and hated/loved Mr. Putin knows this…

Thus, unless Uncle Sam wants to default on its debt (aint gonna happen) or allow a UST auction to fail (aint gonna happen), the only realistic option for more needed dollar liquidity (short of a Bretton Woods 2.0) is going to boil down to more synthetic liquidity, first from the repo markets and Treasury General Account (as seen in Sept of 2019 and 2022, and in March and October of 2023) and finally, from QE to the moon (as seen in March of 2020).

As for when the bow breaks and “Super QE” kicks in (and the USD falls and inflation once again rips), don’t ask me for a date, as NO ONE knows—but it’s coming, and at a faster pace than even Putin thinks…

Where the Rubber Meets the Road for Investors

So, what does all this debt, bond, currency and Fed disfunction mean for YOU, the markets and your fiat money?

Well, a helluva lot.

As for Main Street, the suffering, as I’ve shown and argued many times, is as loud and clear as Oliver Anthony’s guitar.

Stated simply—the middle class is already screwed.

Stocks, Gold, BTC and Bonds

Job cuts are objectively trending up, which ironically boosts earnings for companies with less over-head due to, well less employees…

Full-time employment has tanked by 1.4 million Americans in the past 3 months at a pace rarely seen in US history while politicians are bragging about GDP growth.

But, and to repeat, that GDP “growth” is coming from deficit spending (deficit to GDP at 8%), not a robust Main Street.

Think about that a second.

In the near-term, these disfunctions, lay-offs, lower-rate projections by the Fed and embarrassing debt levels are actually bullish for equities, a point which seemed to shock one of my recent interviewers.

Be Careful You Near-Term Dragon Slayers

But tread carefully in this so-called “bull market” of new stock highs, as there’s a great deal of comical rot beneath its rising wings.

Notwithstanding a 2024 market opening of all-time highs marked by extreme volatility, short-earnings momentum and AI mis-pricings reminiscent of the dot.com mania, the market is dangerously narrow—lead by Amazon, Microsoft, Nvidia and META.

The fact that Microsoft is bigger than the French GDP has me wondering about my anti-trust books in law school as well the definition of corporatism in the annals of fascism… As warned elsewhere, what I see is more akin to feudalism not free-market capitalism.

Meanwhile, in the span of 30 days, Nvidia has become another Tesla in terms of market cap, with mind-numbing factor pair moves (i.e., price to value mismatches). The signals we are seeing look almost identical to 1998-2000, 2006-08 and 1970-73, circumstances which ended “with blood in the streets.”

Just saying…

Longer Term Wisdom

Longer-term investors tend to be more prudent than short-term speculators. They see the broader debt (and death) spiral of the US currency and IOU (measured by the US sovereign bond index, or TLT).

The growing performance of the GLD/TLT, BTC/GLD and SPX/TLT ratios (i.e., gold, Bitcoin and S&P outperforming the US10Y bond), for example, is fairly clear evidence that the markets are seeing what we have been warning, namely: Cash and bonds are no longer a “safe haven” in a nation on its knees in debt and a debased dollar.

Gold Matters

Of course, our bias, and more importantly, our conviction in a world wherein currency debasement is effectively inevitable and already in play regardless of relative strength comedies, is to protect your wealth in the best currency debasement asset history has ever known: Gold.

As for gold, I recently reminded that among the many foreseeable consequences of the stupid idea of weaponizing the USD to “hurt” Putin was the slow but equally inevitable move from Western to Eastern gold repricing, which is just another way of saying “fairer repricing.”

In short, fundamentals are slowly returning to a once completely price-fixed NY and London based gold market.

The SGE Matters

That is, as more nations are moving away from the weaponized USD and net-settling their trade deltas in gold rather than greenbacks (a fact which Putin, love him or hate, coyly reminded Tucker Carlson), the Shanghai Gold Exchange (SGE) is getting busier by the day converting Rubbles, CNY and other currencies into gold to settle trade imbalances outside USD circles.

Premiums on the SGE, as well as pricing of the metal, are moving from West to East.

At some point, the 200-day moving averages in the gold price set on exchanges in London and New York will have to mirror rather than ignore what’s happening in the increasingly more popular Chinese exchange.

And speaking of the SGE, big things are happening right before our eyes.

Gold Withdrawals—Scary or Bullish?

Specifically, the SGE just saw 271 tons of gold withdrawals in a single month, the largest amount seen in 10 years.

Is that not bad for gold? Is it not akin to a “run on the [gold] bank”?

Actually, it’s the very opposite.

First, this move openly signals that Chinese investors trust gold more than their stock and real estate portfolios, something American investors have been slower to realize—often until it’s too late.

But in the US, gold held in ETF’s (which is not a smart place to “own” gold…) is also seeing big withdrawals at the same time the Spot price has been surging rather than falling.

Such Western gold ETF sell-offs occurred before in 2015 and 2013, and it drove the gold price down—not because investors hated it, but because the LBMA banks in London needed more of it.

This time, however, as ETF withdrawals increase, the gold price is going up.

Hmmm.

Why the new direction?

How the West Mistakenly Created a New Gold/Oil Order

Well, it has a lot to do with what we’ve been saying about the SGE.

Unlike 2013, the world now has an increasingly powerful Yuan-driven gold exchange as well as a Yuan-driven oil contract (with, among others, Russia…).

This creates a Yuan-based gold/oil ratio, as we predicted from Day 1 of the back-firing Putin sanctions, and this ratio is competing with the USD-based gold/oil ratio.

Again, and we can’t repeat this enough: Weaponizing the USD against Putin in Q1 of 2022 was a watershed momentin global currency (and hence oil, gold and other commodity markets).

Why?

Because it brought two major powers (Russia & China) closer in geopolitical and financial alignment, along with a growing list of eager BRICS+ nations now making bi-lateral trade deals outside the USD.

Don’t believe us or our warnings two years back? Well: See for yourself, here.

We also said this process would be slow, rather than overnight, but even we are amazed by the speed and scope of these market changes.

Given that global markets will not tolerate two-prices and two-markets for gold and oil, it is our contention (as well as Luke Gromen’s) that “the USD gold/oil ratio must remain the same as the CNY gold/oil ratio.”

The West Forced to Acknowledge Gold’s Monetary Role

As Gromen further argues, and I agree, this means that if the USD price of gold were to crash, then USD oil prices would have to crash along side the gold price, which would “crush” US shale production and “effectively cede the global oil market to Russia and Saudi.”

This makes the US nervous. More importantly, it will force some changes…

Stated more simply (and ironically), thanks to the knee-jerk Western sanctions against Putin, the West now and unwittingly has a vested interest in keeping gold more fairly priced as a primary net reserve asset for commodity and energy trade deltas/imbalances.

After all, the USA can’t simply ignore what the rest of the world is doing with gold and oil.

This, of course, creates even more ironies and more challenges for the openly cornered US.

For example, everyone in DC and Wall Street knows the open secret that a rising gold price, as well as a rising gold role in international trade, is an open insult and embarrassment to an increasingly unloved, debased and mouse-clicked fiat USD.

It’s also an open embarrassment to years of central bank mismanagement of the USD.

But now the West in general, and the US in particular, can no longer ignore the golden elephant in the room nor openly ignore (and quietly manipulate) the gold price.

The East, in short, is now reminding the world, and the West, that in a world of increasingly crappy paper dollars, money-printing and debt gone wild: Gold matters.

It really matters.

Fork in the Road

This means the US-led west will have to face realities about its currency and debt markets, as well as its society and Main Street.

Putin, whether trusted or untrusted, has suggested peace and more cooperation.

Does our power-thirsty and Pentagon-led DC, so openly disconnected from its citizens and once credible State Department, seek the same?

Or will DC simply do what Hemingway warned, and drag us further into wars and a debased Dollar in your wallet?

We shall see…

The Facts and Math Are Clear: Gold’s Rise is Only Beginning

In this brief yet refreshingly blunt discussion, VON GREYERZ partner, Matthew Piepenburg joins David Lin at the Vancouver Resource Investment Conference. From Canada, Piepenburg fleshes out the longer-term facts vs. the short-term inflation “debate” and the now mathematical inevitability of further USD debasement to “save” an objectively broken financial system.

The conversation opens with the media-ignored (and almost comical) denial of an economic hard-landing despite current market highs driven by forward-guided rate hikes. Piepenburg reduced the stock market to a Pavlovian dog which simply turns up or down on dovish or hawkish Fed policies. Free market capitalism is now entirely perverted.

Powell’s projected rate cuts, necessary to bail out private and sovereign bonds repricing in 2024, is a tailwind for over-valued stocks but is not a sign of economic strength. Instead, we are seeing centralized markets, Fed desperation and a further postponed debt reckoning. The end-game will be “mouse-clicked” trillions to monetize unwanted USTs, the net result of which, is naturally inflationary.

Piepenburg reminds that such an inflationary end-game is part of undeniable and historical debt patterns which are always blamed on “external” forces which then justify increased policy dishonesty, as well as political control and centralization. This sickening pattern, he says, is historically true “without exception” as policy makers “prostitute sound debt policies at the expense of the many for the benefit of the few.”

Of course, sacrificing the currency to extend and pretend otherwise broken risk asset markets and purchase votes in the near-term ruins Main Street purchasing power while creating social unrest–the political, social, cultural and financial evidence of which is literally everywhere we look.

Gold, by itself, can’t save the financial system from these abuses and mis-uses of power and political opportunists. Leaders and central bankers will continue to maintain power while perverting currencies and pointing the blame outside their bathroom mirrors. This, however, does not prevent sophisticated investors from protecting their own wealth against currency destruction by owning their own physical gold outside of a failed financial order and Fed-protected banking system.

The Facts and Math Are Clear: Gold’s Rise is Only Beginning

In this brief yet substantive conversation with Charlotte McLeod of Investing News Network, VON GREYERZ partner, Matthew Piepenburg, bluntly answers the financial questions and concerns which political figures and central bankers have a vested interest in mis-representing.

Toward that end, he highlights the recessionary facts which are currently being ignored by an S&P rising on rate cut projections from the US Federal Reserve. As for pending rate cuts, Piepenburg argues that Powell will indeed cut rates in 2024 for the simple reason that Uncle Sam (and risk asset markets) can’t afford “Higher for Longer” much longer…

Of course, rate cuts make Piepenburg temporarily bullish on equities, as lower rates are an obvious tailwind for risk assets which go up or down depending on whether central banks are dovish or hawkish.

As for gold, this asset wins regardless of which direction—hawkish or dovish—the Fed takes. Should Powell cut rates (dovish), the USD declines and gold outperforms. However, should Powell be bluffing and stick to higher rates (hawkish), then risk asset markets tank and gold ultimately rises above that chaos. Again, gold will rise in either scenario.

Most importantly, Piepenburg sees an ultimate and inflationary end-game when the Fed is eventually required to resort to extreme QE (mouse-click money) to monetize the trillions in deficit spending projected out of the US Congressional Budget Office. Stated simply, Uncle Sam is drowning debt, and the only buyer of his IOUs will be a Fed money printer, which is inherently inflationary. As such, gold will rise because the USD will be debased to pay Uncle Sam’s debt.

As Piepenburg concludes, this pattern of debasing sovereign currencies to save otherwise rotten debt systems is nothing new. In fact, and without exception, this is what all broke(n) regimes have done throughout history. The US, and USD, will be no exception, which means gold will be exceptional.

The Facts and Math Are Clear: Gold’s Rise is Only Beginning