Gold Revaluation: Trump’s Red Button Option?

Could a gold revaluation be on Trump’s mind? Below, we consider the options facing a debt-sick America.

A Bug Racing for a Windshield

As we’ve been warning for years, the US and USD are a bug rapidly seeking a debt-hard windshield.

The trend and speed of this collision (and debt trap) are becoming increasingly more obvious with each passing day and headline.

In simplest terms, as US debt levels soar moon-bound, trust and interest in its IOUs (and the currency/dollar backing those IOUs) are sinking toward the ocean floor.

The evidence of such otherwise “dramatic” statements is literally everywhere.

Hard Questions

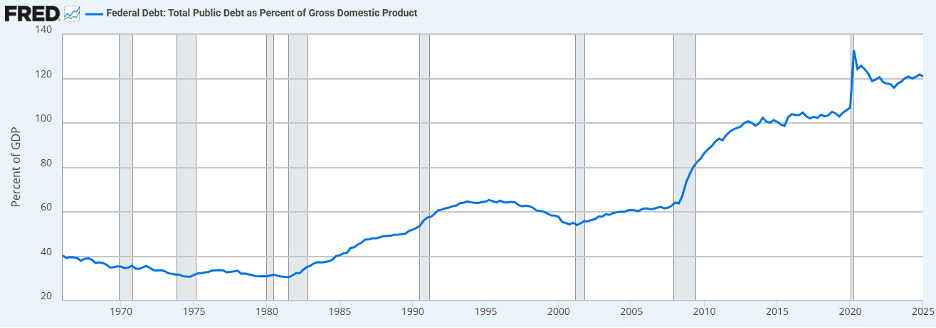

For example, although not at war, the US is running World War 2 debt-to-GDP ratios at the 120% level.

How did this happen? What’s the “emergency” behind this grotesque ratio?

And more importantly, how can Uncle Sam save himself?

Simple Answer

Answering the first question is fairly simple.

We arrived at this appalling turning point because the US has been getting debt drunk for decades.

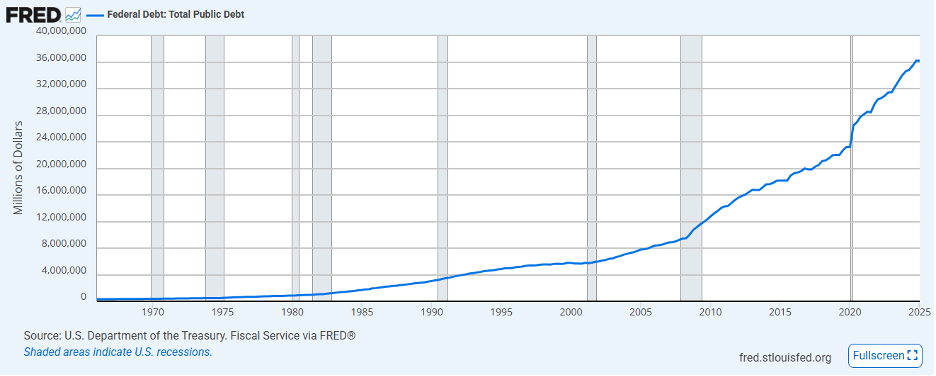

Ever since Nixon took away the gold chaperone from the USD, politicians have been buying temporary prosperity, debt-based “growth” and duped voters by taking US public debt levels from $248B in 1971 to $37T (and counting) today.

This number alone is staggering.

Trillions Matter

The difference between “billions” and “trillions” is not merely alphabetical, it’s brutal.

1 BILLION seconds ago, for example, places us in 1997. Bit 1 TRILLION seconds ago places us at 30,000 BC.

Let that sink in for a moment.

If this shocks or bothers you, well… you’re not alone.

The World Has Called the USA’s Bluff

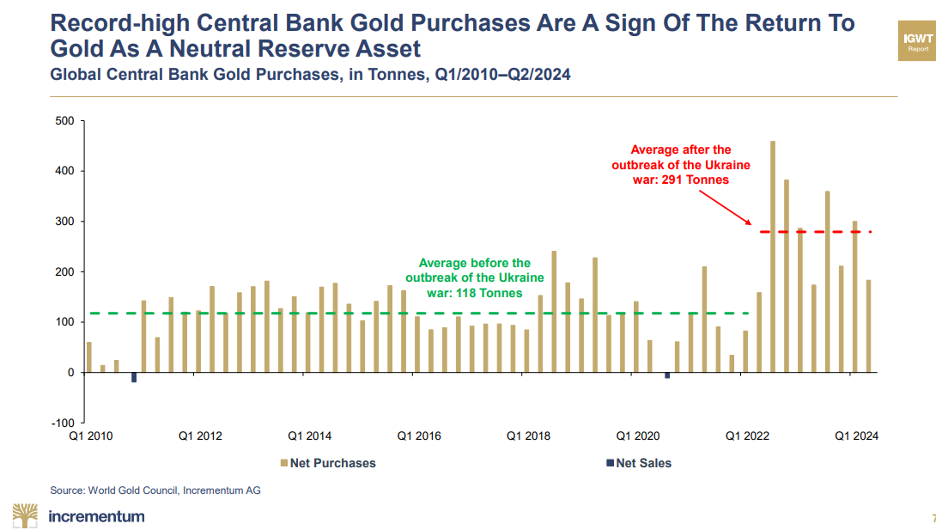

The rest of the world is shocked too, which explains why its central banks have been quietly net-dumping USTs and net-stacking physical gold since 2014.

This further explains why freezing the FX reserves of Russia in 2022 only accelerated the distrust of a now weaponized (and once neutral) world reserve currency.

De-Dollarization…

What followed was a well-telegraphed and carefully forewarned trend of de-dollarization from the BRICS+ coalition.

Tier-1 Status…

This trend took off around the very same time that the BIS, the mother of all central banks, officially classified gold as a Tier-1 reserve asset, making an open mockery of its “sister Tier-1 asset,” the UST.

Central Bank Gold Stacking…

Gold stacking by central banks, of course, continued to skyrocket at the same time:

COMEX Panic…

If such signs of US dollar and debt woes/distrust were not obvious enough, the COMEX and LBMA exchanges out of New York and London then began scurrying like headless chickens.

Why?

Because they were trying to find enough physical gold to meet delivery demands to get the gold off of these exchanges, which, since 1974, were once just derivative schemes used to manipulate rather than deliver gold.

But the hidden facts (and implications) were far simpler. Counterparties to this legalized price-fixing scam now wanted their actual gold more than their paper contracts.

Why?

Because they saw physical gold’s growing, inevitable and superior role in a future monetary system moving away from the debt-discredited USD and UST.

Petrodollar Signposts…

To add insult to the USD’s injury, a growing and simultaneous trend away from the petrodollar during the same period was as obvious as it was media-ignored.

But the message was clear: Faith in a USD-driven future was openly in decline.

The Denial Stage?

Defenders of the USD, of course, were quick and right to remind the world that no other nation or currency could beat or replace the mighty Dollar.

After all, it is the world’s reserve currency.

It still holds the majority position in global FX reserves and, let’s be honest, neither China, Russia, nor any other nation has the reputation or bond market to replace the dollar, right?

Right.

Reality Check: Gold’s Future in a Fiat Swamp

But, here’s the kicker.

Nations like China or Russia aren’t trying to replace the USD with their Ruble or Yuan.

They, like the rest of the world, are slowly going to replace the USD with gold.

This doesn’t mean a gold-backed world reserve currency, just a gold-based world settlement system.

China Playing Chess

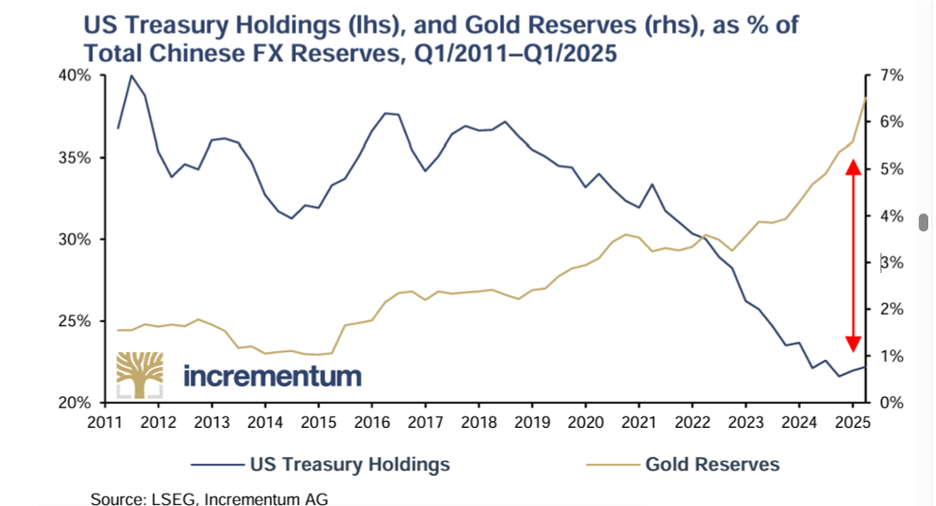

Take China as an obvious example.

They have no problem de-valuing their fiat currency when measured against gold, an asset they’ve been quietly stacking and misreporting for decades in a chess game of common sense as the USA plays checkers with QE.

Nor does China have much love for USTs…

As I type this, China continues to pair gold to the oil it imports from Russia and Iran (conveniently dubbed “evil” by the weaponized US media).

In just over a decade, China’s gold-to-oil ratio was 8 barrels of oil to one ounce of gold. Today, that same ounce of gold buys China 50 barrels of oil.

Meanwhile, China has no problem seeing its Yuan price of gold rise from 7000/ounce in 2014 to 24,000/ounce today.

In short, the Yuan has collapsed against gold but not against the USD.

But China can live with this for the simple reason that it sees a gold-based new world order, and it has been stacking that gold for years.

Why?

Because the BIS, the IMF, and, of course, the BRICS+ nations see a world in which gold is superior to the debt-discredited USD as a strategic reserve asset.

Gold: Far More than an “Allocation”

Gold is no longer an allocation, hedge or subject of debate—it is the future of global trade and currency settlements. Period.

My colleague, Egon von Greyerz, saw this decades ago.

Of even date, for example, gold is now 20 % of global FX reserves. The USD percentage is falling dramatically to a 46% position, and the Euro holds a 16% slot.

But if central backs and BRICS+ nations continue to stack gold at current levels, gold may not be an official “world reserve currency” in substance or title, but it will be the new leading FX reserve asset in both title and power.

In sum, each of the foregoing themes, of which we have detailed and warned in numerous prior articles, explains the debt “emergency” facing the USD.

The Real Question: What Can the USA Do Now?

But what about the corollary question? That is: What options do the US have left to solve its debt (and hence currency) crisis?

This, too, has been on our minds for years.

More Fantasy Money?

Ultimately, there are no easy solutions or good scenarios left.

The MMT fantasy, for example, of solving a debt crisis with more debt that is paid for with mouse-clicked money has been tried in earnest since the QE guns took the Fed from a pre-08 balance sheet of $800B to a 2022 high of nearly $9 9T.

As reminded above, that difference between a Billion and Trillion is just plain madness.

The US, faced with solving its debt crisis (and bond market) at the expense of its paper dollar, is running out of time, options and global patience.

So, again—what can the US do today?

More War?

For Hemingway, at least, the most obvious next step is further currency debasement and war, which the past, current and even future headlines seem to confirm, from the Middle East to Eastern Europe:

But with distrust in US politics and foreign policies rising in alternative media platforms highlighting left and right scandals on everything from Russia-Gate laptops to Epstein cover-ups and AIPAC-guided uh-ohs, trust in the left and right stirrups of the DC saddle is tanking at a rapid rate.

Re-sets, DOGE Cuts & Tariff Walls?

Meanwhile, the IMF has been telegraphing a great reset since COVID, and the current Trump administration has been trying to use DOGE cuts and tariff wars to bring debt and spending levels down.

But regardless of one’s political bias, let’s be mathematical: None of these policies is enough, and none of them, as of today, are even working – as the Elon/Trump social media war intensifies in a backdrop of rising rather than falling deficit levels.

More Financial Repression?

I also expect, and have warned of, more financial repression and capital controls around the corner.

But again, not much of a solution given current and future debt levels, debased dollars (worst DXY Q3 in 40 years) and a middle class already on its knees.

The Red Button Option: Gold Revaluation?

But DC has another option, which even the Fed’s recent May 2025 Manual openly hints toward.

I call it the “red-button option” of a radical gold revaluation to effectively use a precious metal (rather than a Fed mouse-click) to achieve QE-like monetization without having to issue more unloved USTs.

One can read the Fed’s lengthy May report on their own, but the Fed-speak boils down to this:

The Fed can add gold certificates to its balance sheet, which can then become assets of the Treasury Department’s TGA account to pay down a sliver of its $37 37-TRILLION-dollar public debt.

But the trillion-dollar question remains: How will these $42.00 gold certificates be re-valued?

Doing the Math

In a February Forbes article, for example, there was talk of marking these certificates to market.

If that were the case, the 8131 tons of US gold (roughly 260 million ounces) at the current spot price would give Uncle Sam about $850B in instant new money to pay off some debts.

This is nice, but hardly a solution to getting the aforementioned 120% debt-to-GDP figure down to pre-08 levels at a ratio compelling enough to restore trust in—and demand for—Uncle Sam’s unwanted IOUs.

But what if the US government put in a bid for $20,000 gold?

This would create a new price floor for the precious metal while simultaneously placing newly revalued gold certificates ahead of UST’s and mortgage-backed-securities on the Fed’s balance sheet?

Sound crazy?

If you read the May Fed Report, they hint at such a balance sheet “example” but shy away from naming a new price valuation on the gold certificates.

This means we can only guess at what comes next.

Desperate Times, Desperate Measures?

But desperate times require desperate measures, and there is nothing more desperate than the USA (and balance sheet) in its current form.

An emergency gold re-valuation of $20,000, by way of just one example (perhaps lower, perhaps higher?), would create instant trillions in liquidity to address Uncle Sam’s otherwise mathematically unsustainable bar tab.

Such a measure would buy time for US IOUs and votes for a beleaguered White House.

Such considerations, once thought extreme, must now be considered with desperate seriousness in a backdrop of only desperate options.

Nixon made a radical change in 1971. Can a red-button gold revaluation in 2025 or 2026 be equally ignored?

Let’s wait and see.

Be Careful of What You Wish For

And regardless of whether the inflationary red button is pushed or not, gold wins either way, as the dollar’s purchasing power in such a debt landscape has no absolute direction left to it other than downward.

Gold, as the ultimate, most stable, stacked and historically most trusted anti-fiat asset, has no direction left than upward.

Let’s also not forget that if gold is so re-valued, then the nation with the most gold will have the most leverage in this new system.

But as I’ve suggested elsewhere, that nation is more likely to be China than the USA. It has a lot more gold than the World Gold Council reports…

If so, like all empires whose average hegemonic age hovers around 250 years, the era of the American empire is coming to an obvious turning point, no matter how you stack it.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD