AS DOMINOES FALL, GOLD WILL STAND STRONGER THAN EVER

At the end of a monetary era a number of dominoes will keep falling, initially gradually and then suddenly as Hemingway explained when asked how you go bankrupt.

Some of the important dominoes the world will see falling are: Political, Geopolitical, Currency, Debt and Investment Assets.

The consequences will be unthinkable – Social Unrest, War, Hyperinflation, Deflationary Implosion of Assets, Debt Defaults and much more.

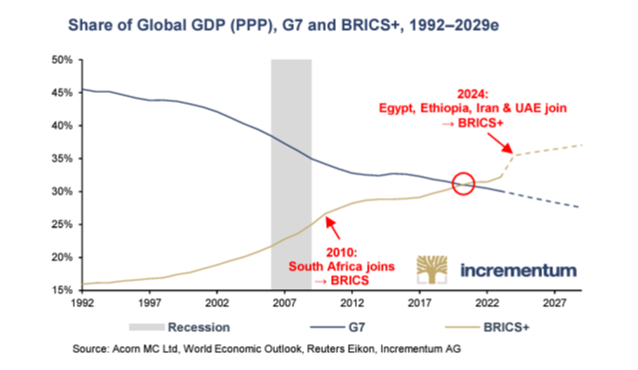

But when things settle down, there will also be offsetting forces such as the emergence of powerful BRICS nations often backed by commodities.

Gold will play a major role during this process. Both central banks, sovereign wealth funds and investors will turn to gold as the most stable part of a crumbling system. This will lead to a fundamental revaluation of gold. As more gold cannot be produced, increased demand can only be satisfied by higher prices.

The likely result will be a revaluation of gold by multiples.

FALL OF THE LEADERSHIP DOMINO

Inept leaders and lack of statesmen are the typical prerequisites for these periods and thus one of the falling dominoes.

I have always argued that a country gets the leaders it deserves.

As we get to the end of one of the worst periods in history, both financially and morally, weak leadership exists in most major Western economies.

So, let’s look at the motley crew of world leaders and their unpopularity.

Political leaders will not only be thrown out at elections but also before their period is finished.

The recent European election is a typical example of a failed system. Most ruling parties are being rejected and in many cases parties on the right gain popularity.

Just look at the picture above from the recent G7 meeting in Italy. With the exception of Italy’s Meloni, the remaining G7 leaders have disapproval ratings of 57% to 72%.

With elections in the UK & France this year, the ruling parties are guaranteed to lose. The French Presidential election is not until 2027 so Macron could be a lame duck for 3 more years. The French people are unlikely to accept that and might force him out before then.

Whoever is elected in France, the powerful trade unions are likely to bring the country to a halt.

UK’s Sunak is one of Britain’s most ineffective leaders in history. But the new Labour Prime Minister, Kier Starmer was not even seen to stand a chance 2-3 years ago. He will not be voted in, but Sunak will be voted out by the people. Next will be a very dark period in UK history with high taxes, high debt, poor leadership and political instability and hard times.

The US situation today is even worse, with a president who seems incapable of taking any decisions. Instead, the US is led by an unelected and unaccountable group of neocons who tell the president what to say and what to do. But even that is difficult for Biden to execute. Just his recent appearance in Italy at the G7 meeting confirms that.

He can obviously not be blamed for being senile. But he should no longer have the ultimate power.

The US election is likely to be a disaster. Looking at the poor health of Biden, it is unlikely that he will stand for re-election in November. Kamala Harris will clearly not stand for election. It would not be surprising to see Hillary Clinton ushered in as the Democratic candidate. Although Trump is loved by around half of the people, he is hated by the other half and thus a very divisive choice. And a rerun of the Clinton – Trump election could easily lead to trouble or insurgence in the US whoever wins.

Germany’s Scholz’ coalition might not make it to the 2025 election due to its unpopularity and the decline of the German economy.

In summary, the political stage will be a total mess in coming years and lack of strong leadership will not only bring political unrest but also social unrest.

FALL OF THE CURRENCY & DEBT DOMINOES

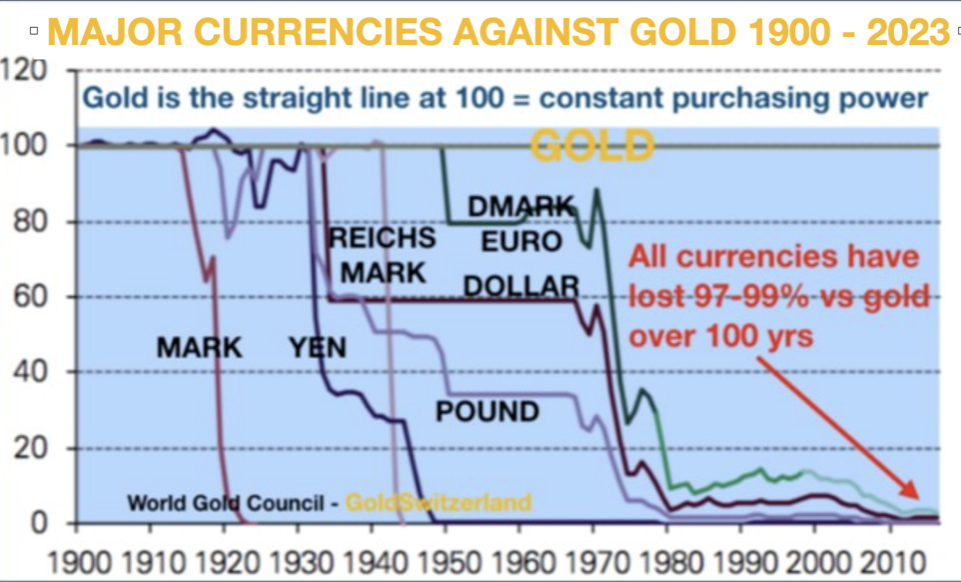

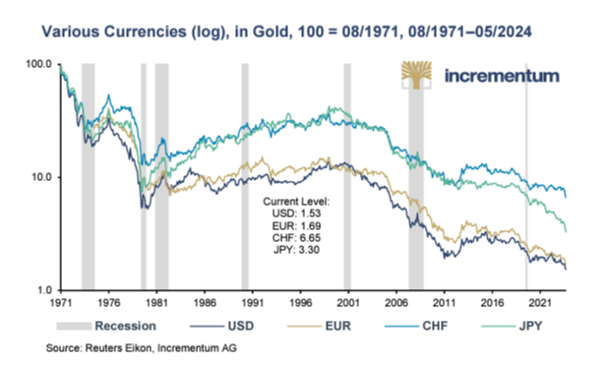

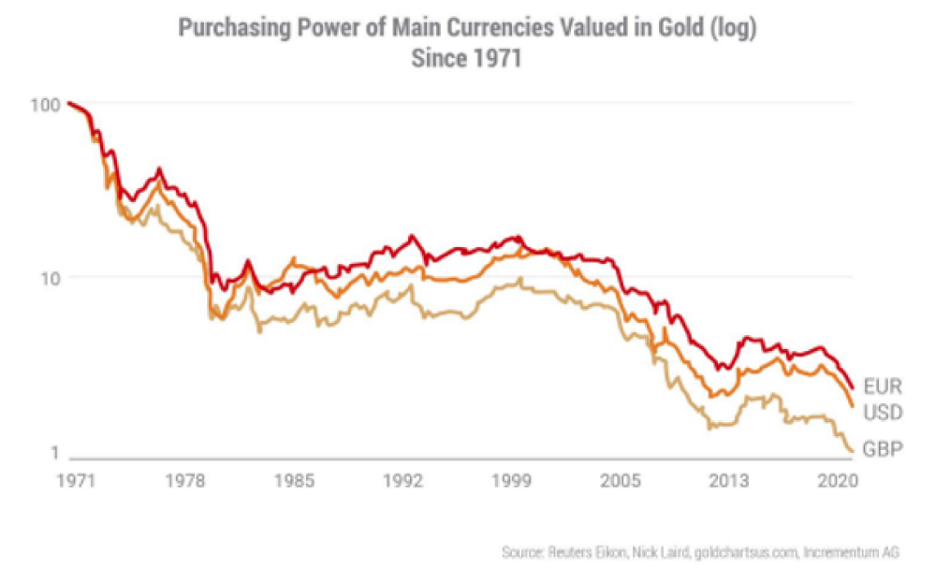

The currency domino has been falling ever since Nixon closed the gold window in 1971.

With high spending and deficits on top of Debt to GDP above 100% in many nations, the West in particular is facing a very dark period with galloping debt growth and collapsing currencies.

This will lead to debt defaults, bank defaults, more printing, higher interest rates and still higher deficits.

All currencies will accelerate their debasement process.

In such a scenario, there will be no winner. It is possible that the dollar due to demand will be slightly stronger than other Western currencies at least for a period.

But a temporary relative strength of the dollar should be totally ignored. There is no prize for coming 2nd or 3rd to the bottom. All currencies will lose dramatically in real terms which means against gold.

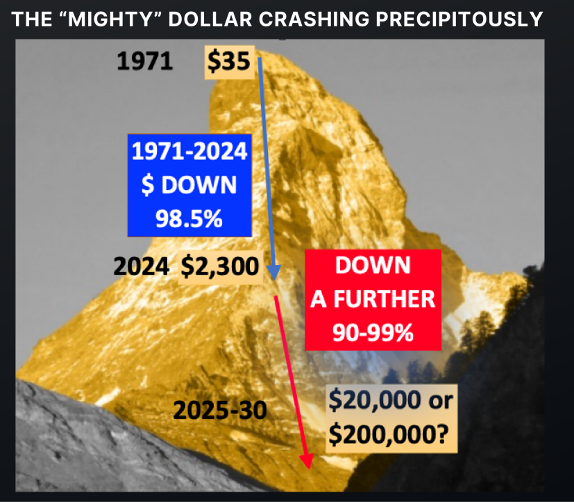

We must remember that we are now in the final collapse of the current monetary system. Since 1971 all currencies have lost 97-99% in real terms which means GOLD!

The final 1-3% fall (100% from now) will take place in the next 3-8 years. So, yet another currency system will be laid to rest.

This one lasted since 1913 so a bit over a century. Its demise was predestined the day it was born. It was only a matter of time. As always in history, the consequences will be much more far reaching than just the death of Money.

Debt and currency collapses happen hand in hand. They are partners in crime and are the inevitable consequence of sustained government deficit spending.

After a period of unlimited currency printing, the financial system will fail partly or totally.

Political and social unrest also follows, possibly civil war.

Governments under economic pressure normally start a war or escalate an existing one to divert the attention from domestic problems. A war is also a good excuse for printing more money.

FALL OF THE ASSET DOMINO

Initially there will be high inflation, possibly hyperinflation and high interest rates. Thereafter as the system implodes, inflated asset prices in stocks, bonds, property etc will crash by 50-100% in real terms.

Most sovereign bonds (if they are printed) will serve best as wallpaper.

I rate the chances of this chain of events taking place as very high, especially in the West.

Financial, economic, political and social collapses of this kind are nothing new as they have happened throughout history, albeit not on a scale of this magnitude.

FALL OF THE NUCLEAR WAR DOMINO

Will we have a nuclear war?

We obviously don’t need to worry about this option since if we have a global nuclear war, there will be very few, if any, people left on earth.

As the world potentially moves as close to a nuclear war as it can without starting one, we must ask ourselves, WHO IS RUNNING THE WORLD?

Well, no one individual of course. But the US leadership is probably the main contender when it comes to dictating, at their whim, to any country in the world.

This can be starting wars in a country which is no threat to the US. It can be controlling the global financial system through the dollar or regulating the banking system via edicts like FATCA requiring the world to report any dollar transaction to the US authorities. It can also involve coups in countries which the US leadership finds unacceptable or even eliminating enemies.

It can be sanctions or freezing of assets against countries whose actions the US leadership disapprove. The list is endless.

What is interesting is that the US people never has a say in any of these decisions. All the actions above and many more are taken by the US president and his advisors with zero accountability to the people.

None of that would be possible in for example Switzerland where people power rules through direct democracy.

What the world should ask itself is: How does it solve the extremely serious situation the world is in?

I am not talking about the Ukrainian war which, as Trump has indicated, could be stopped within a few days if the US stopped sending weapons and money to Ukraine.

Putin recently made it clear that what Russia wants is to keep the Russian speaking areas of Eastern Ukraine and no NATO membership for Ukraine. But no one is interested in exploring this.

Instead, there has just been a peace conference in Switzerland where neither Russia nor China was present. Such a conference is a total waste of time and money.

Without two of the mightiest military and economic powers on earth, one of which (Russia) is directly involved in the war, this conference will achieve absolutely nothing.

This is just posing for the cameras with a bland meaningless statement at the end.

So instead of these useless conferences, the leaders of China, Russia and the USA should get together to end the Ukraine war and then tackle the real problems facing the world like poverty, famine, crime, drugs, debt etc, etc.

Imagine what the combined brain power and resources of these countries could achieve assisted by many more nations.

But sadly, that is a dream that is unlikely to be realised.

Much easier to print money and start a war rather than to find REAL and sustainable solutions to the major global problems that the world is facing.

So, world leaders have a choice – pick up the phone and talk to your fellow leaders or start a war.

What sane leader would choose nuclear war before a small loss of ego and peace?

WEALTH PRESERVATION FOR FINANCIAL SURVIVAL

So, what can investors do to protect themselves?

Some DONT’S are obvious, like:

Don’t keep most of your wealth in a fragile banking system whether in cash or in securities –

With many banks likely to default, it might take too long before your assets are released, if ever!

Bail ins or forced investments are likely in government securities at low interest rates and for extended periods like 10 years or more.

Don’t hold sovereign bonds –

Many governments will default.

Don’t bet on inflation reducing your debt –

High interest rates or indexation of loans might make it impossible to repay borrowings.

Don’t forget that stocks have been inflated by massive credit expansion which will end.

The list of don’ts in the biggest global debt and asset bubble in history and is of course endless.

So, some DOs could be more useful –

Do hold a lot of physical gold and some physical silver in safe jurisdictions like Switzerland and possibly Singapore outside the banking systems –

Precious metals must be held in very safe non-bank vaults, in your name with direct access to the metals.

To minimise confiscation or freezing of your metals, best to keep them outside your country of residence.

Hold a meaningful amount of physical gold and silver –

Most of our clients who are HNW wealth preservation investors have more than 20% of their investment assets in gold and with a smaller percentage in silver due to its volatility.

Gold is up 9-10x in this century in most currencies, still.

THE REAL MOVE IN GOLD AND SILVER HASN’T STARTED YET

The move away from the dollar as the global trading currency is likely to accelerate over the next few years.

BRICS countries are whenever possible settling bilateral trading in their local currencies with gold as the ultimate settlement money. This will be a gradual move away from the dollar. At some point the move will accelerate as the need for trading via another nation’s currency will be seem superfluous, especially since final settlement can be in gold.

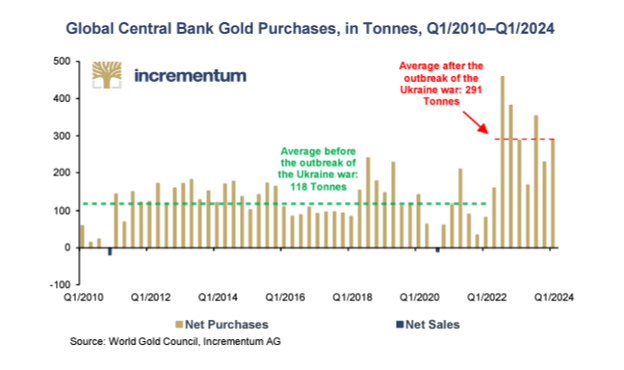

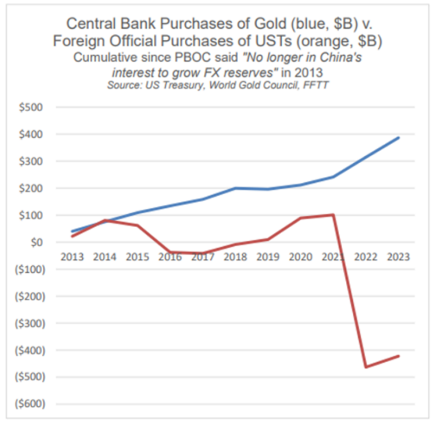

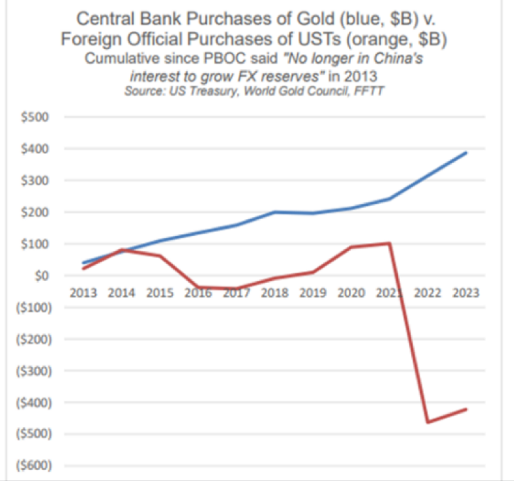

As I have made clear many times, the US confiscation of Russian assets will lead to central banks no longer holding dollar reserves but instead gold will be the only acceptable reserve asset.

The move by Central Banks to gold as a reserve asset will lead to a fundamental revaluation of gold over the next few years to a price which will be multiples of the current price.

The major increase in demand can only be satisfied by higher prices and not by more gold since the world cannot produce more than the current 3,000 tonnes p.a.

In my 55-year working life I have experienced 2 major bull markets in Gold.

The first one was from 1971 to 1980 with gold up 25X from $35 to $850.

The second one started in 2001 at $250 and has only started a move which will reach multiples of the current price.

But my 55 years of gold history is just over 1% of the long-term bull market in gold.

Since the emergence of the fiat money system, the gold bull market is sadly more a reflection of governments’ mismanagement of the economy leading to ever growing deficits and debts. In such a system, the price of gold mainly reflects the chronic debasement of paper money.

Governments and central banks are gold’s best friend.

They have without fail always destroyed the value of fiat money, by debasing the currency through deficit spending and debt creation.

For example, in the Roman Empire around 180 to 280 AD the Denarius Silver coin went from almost 100% silver content to 0%, replacing the silver with cheaper metals.

This obviously leads to the question, why should anyone hold fiat or paper money?

Well, in a sound economy with no deficits, virtually no inflation and a balanced government budget, holding cash that yields an interest return is absolutely fine.

But the world has not experienced such Shangri-La times since 1971 when Nixon closed the gold window.

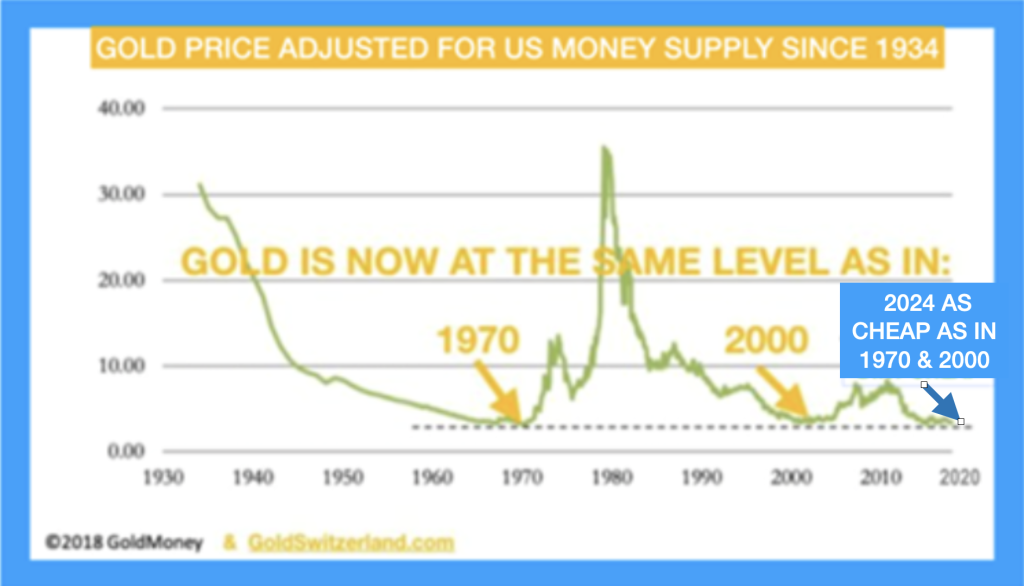

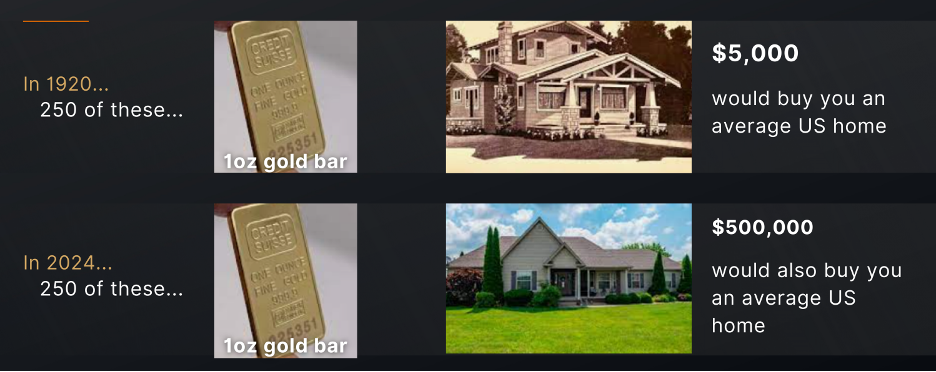

Still, even at $2,320 today, gold in relation to money supply is as cheap as in 1970 when it was $35 or in 2000 when the gold price was $300.

WEALTH PRESERVATION AND LIFE’S PRIORITIES

With the falling of the dominoes outlined above, most people in the world will experience a lot more hardship than currently.

For anyone with savings, whether it is $100 or $100 million, wealth preservation should be a top priority. Gold and some silver in physical form safely stored outside the banking system should be an absolute priority.

As we encounter difficult times, helping family and friends is more important than anything else. This will be extremely important in order to deal with the trials which we will all encounter.

And please don’t forget that in addition to family and friends, some of the best things in life are free such as nature, books, music and hobbies.

AS DOMINOES FALL, GOLD WILL STAND STRONGER THAN EVER

VON GREYERZ partner, Matthew Piepenburg, joins Dunagun Kaiser of Liberty & Finance to discuss the clear and present dangers facing the US and global economy despite rising equity markets.

The conversation opens with the “embarrassing ice cube” of paper money losing purchasing power in the face of growing debt levels. Despite these objective realities, the majority still measure their wealth in a factually declining paper “asset/currency” in a dangerous group-think which ignores history (and a fiat crisis) occurring in real time. Piepenburg walks through the “backdoor” liquidity measures which artificially sustain markets near-term at the long-term expense of the currency whose inflationary realities are openly but legally misrepresented.

Inflation, in fact, is just theft by another name. Piepenburg unpacks this otherwise dramatic observation with sobering math and reveals the desperate tricks used by DC to mask this desperate practice of inflating away government debt via currency debasement on the backs of the citizens.

Debt and inflation are two obvious signals of currency debasement; of equal and rising importance is the equally ignored (or misunderstood) reality of de-dollarization as the BRICS+ nations continue their slow and steady policies to trade outside the USD. This has immediate and future implications on USD demand and hence USD strength. Piepenburg discusses the failed politics and failed messaging behind these otherwise open and obvious changes/trends, all of which point with common sense to the rise of real assets in general and precious metals in particular.

The conversation moves from the obvious importance of gold ownership as an antidote to the foregoing trends toward the more amorphous but undeniable important conversation of politics in general and the timeless importance of freedom in particular. Gold, privately owned/held, is one pathway to ensuring private freedoms despite the increasing declines of such freedoms, from lockdown memories to the future CBDC risks and current failures in the mainstream public and financial media.

AS DOMINOES FALL, GOLD WILL STAND STRONGER THAN EVER

There is much legitimate (as well as dramatic) talk about the failing US, its debased currency and its identity-fractured, inflation-taxed middle class, which has been increasingly described more aptly as the working poor.

The End, or Just Change?

But is America coming to an end? Will the USD lose its world reserve currency status? Will the greenback disappear? Will gold or BTC save us from all that is breaking before our media-clouded eyes and increasingly centralized state?

Nope.

America is slipping, but not ending.

The USD is being repriced not replaced.

The greenback is still a key spending, liquidity and FX currency. But it’s no longer the premier savings asset or store of value.

Gold (now a Tier-1 asset btw…) will continue to store value (i.e., preserve wealth) better than any fiat money; and BTC will certainly make convexity headlines in the future.

And yes, we all know the Fourth Estate died long before Don Lemon or Chris Cuomo stained our screens or insulted our collective IQ.

And as for centralization, it’s not coming, but already here.

Be Prepared Rather than Emotional

So, yes there is tremendous reason for informed and genuine concern, but rather than wait for the end of the world, it would be far more effective to logically prepare for a changing world.

Rather than debate left or right, black or white, straight or trans, safe or effective, smart (Barrington Resolution) or stupid (Fauci), we’d likely serve our individual and collective minds far better by embracing the logical and tabling the emotional.

Toward that end, we’d be equally better off relying on our own judgement rather than that of the children making domestic, monetary or foreign policy decisions from DC to Belgium…

Logically speaking, the USD (and US of A) is changing.

Like its recent swath of weak leadership, the greenback and US IOU are quantifiably less loved, less trusted, less inherently strong and well…far less than they were at Bretton Woods circa 1944.

Change Is Obvious

Since our greatest generation stormed the beaches of Normandy in June of 44, we’ve gone from being the world’s leading creditor and manufacturer to the world’s greatest debtor and labor-off-shorer by June of 2024.

This is not fable but fact. A recent Normandy veteran admitted that he no longer recognizes the country he fought for—and that’s worth a pause rather than “patriotic” critique.

When the post-2001-WTO-daft policy makers weaponized what should have been a neutral world reserve currency in 2022 against a major nuclear power (i.e. stole $400B worth of Russian assets) already in economic bed with a China-driven and now growing BRICS coalition, the “payback” writing was on the wall for the greenback—as many of us understood from day-1 of the Putin of sanctions.

De-Dollarization Is a Reality, not a Headline

In short, many nations of the world, including the oil nations, quickly understood that the world wants a reserve asset that can’t be frozen/stolen at will and that simultaneously retains (rather than loses) its value.

But rather than end the USD as the world reserve currency, most of that world is simply going around (or outside of) it…

Or even more bluntly, the prior hegemony of the UST, and by extension, the USD, irrevocably changed in 2022.

Thank You Ronni & Luke

Thanks to data-focused and credit/currency-savvy thinkers like Ronnie Stoeferle and Luke Gromen, we can plainly see the facts rather than drama of these trends.

The actions rather than mere words of the BRICS+ nations and global central banks, who prefer to save in physical gold rather than US IOUs, speak loudly for themselves, which Stoeferle’s objective charts remind.

That is, since the US weaponized its Dollar, there has been an undeniable move away from the greenback and its UST in favor of gold as a reserve asset:

The COMEX et al…

The hard facts are in, and dozens of BRICS+ countries are trading outside the USD, purchasing in local currencies for local goods, and then net settling the surpluses in physical gold, which is far better/fairer priced in Shanghai than in London or New York, two critical exchanges that are seeing more physical deliveries out of their exchanges than in.

Immodestly, we saw this coming years ahead of the White House…

This means decades of artificially rigging precious metal pricing on legalized fraud platform like the COMEX are coming to a post-Basel III and post-sanction slow end.

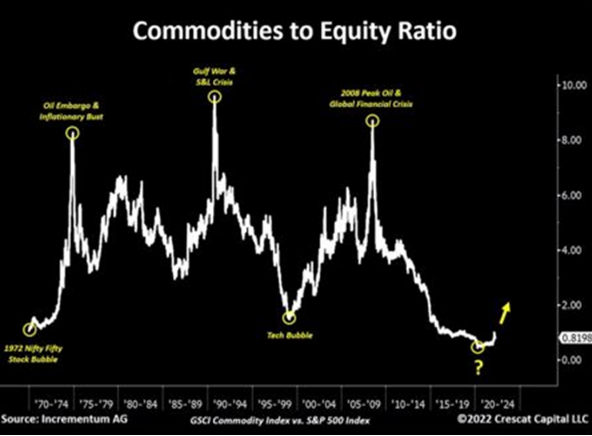

This matters, because like it or not, the rising power of the BRICS+ nations, generationally tired of being the dog wagged by the USD’s inflation-exporting tail, are growing in economic power away from a debt-driven West, which again, the facts (global share of GDP) make clear rather than sensational.

The Chart of the Decade?

Ronni posted a similarly critical chart over a year ago, asking, somewhat rhetorically, if it was not the chart of the decade?

That is, he asked if the world is moving toward a commodity super-cycle wherein real assets begin their slow rise against falling (yet currently inflated) equity markets and a falling (yet increasingly debased) USD.

As Grant Williams, would say, this should make far-sighted investors all go hmmm.

Commodity Markets: Change is Gonna Come to the Petrodollar

And as for commodities, currencies and hence gold, the changes are all around us, at least for those with eyes to see and ears to hear.

Toward this end, we can’t ignore what has been happening in the global energy markets, topics which I’ve previously (and so-far, correctly) addressed here and here.

But when it comes to understanding oil, the USD and gold, Luke Gromen leads the way in clear thinking and has informed us as well as anyone.

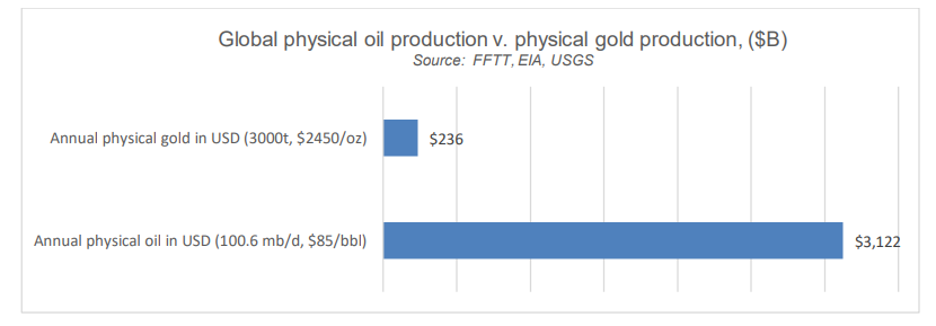

He reminds, for example, that oil, like any other object of international supply and demand (i.e., trade), can be equally net-settled in gold rather than UST-linked petrodollars.

(In 2023, by the way, 20% of global oil sales were outside of the USD, a fact otherwise unthinkable until the Biden White House sanctioned Russia.)

The implications of this simple observation of (as well as its impact on) the USD, commodity pricing and gold are extraordinary.

Oil: The Recent Past, Prior to Sanctions…

Before the US weaponized its USD against Russia (and publicly insulted its key oil partner, Saudi Arabia), the world towed the line of both the UST and the USD-denominated oil trade, which was very, very, very convenient for Uncle Sam and his Modis Operandi of exporting US inflation to everyone else.

For example, in the past, when commodity prices got too high, nations like Saudi Arabia would absorb USTs and effectively go long the USD, which the US pumps out faster than the Saudis do oil…

This, of course, was good for stabilizing and absorbing an otherwise over-produced and debasement-vulnerable USD while simultaneously helping US government bonds stay loved and hence yields compressed/controlled.

In a way, this was even good for global growth, as it kept the USD stable and low enough for nations like China and other EM countries to grow.

These other nations, in turn, would keep buying the “risk-free-returning” UST’s and thus help refund (“reflate”) the US’s own debt-based “growth narrative.”

After all, if every one else is buying his IOUs, Uncle Sam can forever go deeper and deeper into debt-financing the American Dream, right?

Oil: Present Facts, Post the Sanctions…

Well, that is true only if you assume the world never changes, and that reported—i.e. utterly dishonest inflation makes our USTs truly “risk-free” rather than just returning negative real yields.

Fortunately (or unfortunately), the rest of the world is seeing the changes which DC pretends to hide.

Specifically, and as of November of last year, the Saudi’s met with a bunch of BRICS+ nations looking for ways around the USD and UST when it comes to trading among themselves—and this includes the oil trade.

Think about that for a second.

This means that what has been working in favor of the USD and sovereign bond market since the early 70’s (i.e., global demand for the USD via oil) is slowly (but surely) unwinding right before Biden’s barely open eyes…

All those decades of prior support/demand for USDs and USTs is going down not up, which means unloved UST’s will have to be supported by fake (i.e., inflationary) at-home liquidity rather than immortal foreign demand.

This, by the way, leads to currency debasement—the endgame of all debt-soaked nations.

Oil: The Changing Future, Post Sanctions…

It also means that commodities, from copper to yes, even oil, can and will continue to be purchased outside the Dollar and net settled in gold, which likely explains why central banks have been net stacking gold (top line) and net-dumping USTs (bottom line) since 2014…

Again, watch what the world is actually doing rather than what your politicos (or even bank wealth advisors) are telling you.

Gold & Oil: Impossible to Ignore?

As for gold and oil in the foregoing backdrop of a changing rather than static world, any sane investor has to give serious consideration to the changing petrodollar dynamics which Luke Gromen has been tracking with sober farsightedness.

The compressed but inevitably rising super cycle (Stoeferle chart above) in commodities this time around will differ markedly from past rallies.

As oil, for example, goes up (for any number of reasons), the old system that once recycled those costs in UST purchases can (and has) pivoted/changed to another asset.

You guessed it: GOLD.

Think it through: Russia can sell oil to China, Saudi Arabia can sell oil to China. But now in Yuan not USDs. These trading partners can then take their Yuan payments to buy Chinese “stuff” (once made in America…) and finally net settle any surpluses in gold rather than USTs.

That gold can then be converted into any EM/BRICS+ local currency (from rupees to reals) rather than Dollars to trade among themselves for other raw commodities, of which many BRICS+ nations are resource rich.

This, by the way, is not some distant possibility, but a current and ongoing reality. It can be devastating to USD demand and hence strength.

When copper and other commodities, including, oil starts repricing (and stockpiling) outside the USD with increasing frequency, the Dollar’s so-called “hegemony” becomes increasingly hard to believe, telegraph or sustain.

The Ignored Gold/Oil Ratio

As Luke Gromen observes, but few wish to see…if/when gold becomes the “de facto release valve for non-USD commodity pricing and net settlement,” the impact this will have on the long-term gold price is simply a matter of math rather than debate.

He repeatedly reminds that the global oil market is 12-15x the size of the global gold markets in physical production terms:

We thus can surmise that gold can and will be pushed higher by oil in particular and other commodities in general, a reality already in play as measured by the global gold/oil ratio, which has risen (not so coincidentally) by 4x since Moscow began stacking gold in 2008 while the Fed was preparing to mouse-click trillions of fake Dollars in DC…

The Most (Deliberately) Misunderstood Asset…

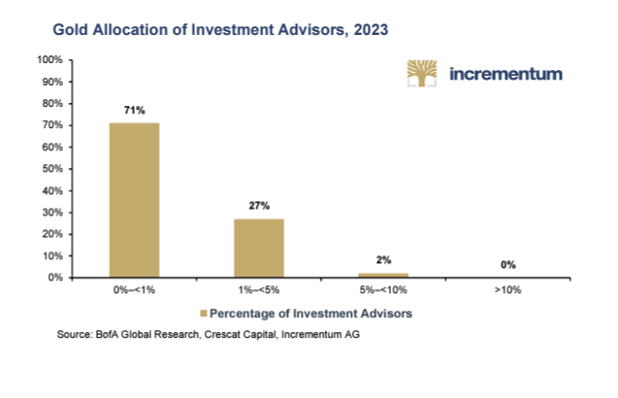

Meanwhile, as we stare in awe at the consensus-think which still places gold at only 0.5% of global asset allocations (the 40Y mean is 2%) and just barely over 1% of all family office allocations (still crawling further and further on the risk branch for yield), we have to wonder if it is human nature (or just political and monetary self-interest) to fear change, even when the evidence of it is all around us.

Yet few see gold’s real role…

For gold investors (rather than speculators) who think generations ahead rather than news cycles per day, and who understand that preserving wealth is the secret to having wealth, this asset (and change) is not feared.

It is understood.

And that is how we understand gold. It preserves wealth while paper currencies destroy it.

That is why despite positive real yields, a relatively strong USD and so-called contained inflation, gold is breaking away from these correlations and making all-time-highs despite their profiles as traditional gold “headwinds.”

It’s so simple.

Gold is trusted far more than broken currencies from broke countries, including the once revered USA in particular and the West and East in general:

As Ronni correctly says: “In gold we trust.”

Makes a lot of (common/historical) sense. Just do the math and read some history…

AS DOMINOES FALL, GOLD WILL STAND STRONGER THAN EVER

In this critically important conversation, VON GREYERZ principals, Egon von Greyerz and Matthew Piepenburg, join VRIC Media’s Jesse Day in an important and timely examination of gold’s role within an increasingly precarious global backdrop.

The conversation opens with a frank discussion about the slow demise of the USD in actual purchasing power rather than relative strength yardsticks. Von Greyerz reminds that all fiat monetary systems ultimately self-destruct, and the USD will be no exception as it suffers its final days of so-called “hegemony.” Timing such an end-game is far less important than ignoring (and preparing for) the obvious symptoms of the process unfolding in real time. For Piepenburg, the evidence of the USD’s endgame (net UST selling vs. net central bank gold buying) is literally all around us as the sins of mismanaged Western monetary and debt policies become harder and harder to ignore.

The fall of fiat money in general and the USD in particular is, of course, deeply tied to rising global debt levels, which are lead by the home of the world reserve currency and its embarrassing balance sheet. Von Greyerz warns of debt levels now reaching the exponential phase. Like Piepenburg, he argues that such debt levels (including derivative market distortions) can’t be monetised without further currency debasement and rising inflationary forces.

Unsustainable debt has an equally tight correlation to failing political systems. Von Greyerz and Piepenburg agree that politicians are instruments of their time, and that the current era is one characterised by weak statesmen more interested in retaining power than serving public interest with open accountability and transparency for their actions. The implications of mismanaged (and frankly immoral) leadership today will continue to take many centralising forms including what Piepenburg discusses as the sad inevitability CBDC.

The conversation on currencies, debt and increasingly failing and hence centralising political systems is nothing new, but rather a cyclical aspect of basic history, which Piepenburg and von Greyerz discuss with blunt clarity. The almost comical economic ignorance which characterises the vast majority of global leaders is discussed in objective detail.

Each of the foregoing threads point directly to the undeniably rising importance of physical gold and silver. Toward this end, Egon von Greyerz and Matthew Piepenburg employ simple math and clear historical lessons to conclude their consistent warning that measuring and preserving one’s wealth in paper currencies rather than grams or tonnes defies common sense and undeniable historical patterns.

AS DOMINOES FALL, GOLD WILL STAND STRONGER THAN EVER

In this profound discussion held in Singapore, financial experts Egon von Greyerz and Jim Rogers explore the complexities of global economics, investment strategies, and the future of currencies. During the interview, Rogers shares his adventurous past and cautious optimism about the future, emphasising the unpredictability of political and economic landscapes. Both express concerns over the mismanagement of economies and the inherent risks in the current global financial system, especially the decline in the value of major currencies against gold.

Both Greyerz and Rogers discuss their personal investment approaches, favouring tangible assets like gold and silver over volatile currencies and highlighting the protective role these commodities can play in times of economic instability. Rogers and Greyerz also touched on the geopolitical tensions and the historical repetitiveness of nations’ failures to maintain robust economic structures. The dialogue concludes on a personal note, reflecting on the importance of family, stability, and the simple pleasures of life against the backdrop of global economic uncertainty.

- [0:00-1:03] Introduction: Jim Rogers’ reflects on his adventurous past, discussing his motivations for exploring the world despite inherent dangers.

- [1:03-2:08] Discussion on personal safety and the measures taken during travels to ensure vehicle and personal security, highlighting ongoing concerns about potential dangers.

- [2:08-3:12] Rogers talks about the challenges facing younger Americans, including national debt, contrasting with his experiences and choices.

- [3:12-4:19] Egon von Greyerz shares concerns about the global direction, particularly the economic, political, and moral decline observed in Western countries due to poor immigration and crime management.

- [4:19-7:04] The conversation shifts to the stability and safety of living in Singapore, with Rogers expressing a high sense of security compared to Europe. They discuss the economic stability of countries like Switzerland and the changes over time.

- [7:04-10:09] A deep dive into currency depreciation over the decades, with a focus on the Swiss Franc and the US dollar. They discuss central banks’ roles and the shift in reserves from gold to equities.

- [10:09-16:02] Discussion on commodities, particularly gold and silver, and their historical performance against currencies. They emphasize the strategic importance of holding precious metals as a hedge against currency devaluation.

- [16:02-22:48] The dialogue covers investment strategies, the importance of agricultural commodities, and Rogers’ approach to trading and long-term investment.

- [22:48-39:18] They delve into geopolitical risks, the potential for global conflict, and the importance of strategic relocation in extreme scenarios. The discussion also revisits the importance of precious metals in securing financial stability.

- [39:18-41:02] Closing remarks on life philosophies, the importance of family, and maintaining optimism amidst global challenges, along with a reflection on their personal experiences and future outlook.

This conversation offers deep insights into the economic philosophies and personal reflections of two prominent financial thinkers, set against the backdrop of a rapidly changing global environment.

AS DOMINOES FALL, GOLD WILL STAND STRONGER THAN EVER

Below, we soberly assess the lessons of history and math against the current realities of a debt-defined America to ask and answer a painful yet critical question: Is America losing?

The End of History and the Last Man

In 1992, while I was still an undergrad with a seemingly endless optimism in life in general and the American Dream in particular, the American political scientist, Francis Fukuyama, published a much-discussed book entitled, The End of History and the Last Man.

Released in the wake of the wall coming down in Berlin and a backdrop of continually low rates and rising US markets, this best-selling and optimistic work captured the Western mindset with obvious pride.

With its central theme (supported by an overt Hegelian and dialectal framework) of capitalism and liberal democracy’s penultimate and victorious evolution (Aufhebung moment) beyond the Soviet dark ages of a debt-soaked and centralization/autocratic communism, the famous book made headline sense in this Zeitgeist of American exceptionalism.

But even then, amidst all the evidence of Soviet failures (from extended wars, currency destruction, unpayable debts and a clearly dishonest media and police-state leadership), my already history-conscious (and fancy-school) mind could not help but wonder out loud if this book’s optimistic conclusion of the West’s ideological and evolutional end-game was not otherwise a bit, well: naïve.

Had the West truly reached a victorious “end of history” moment?

Pride & An Insult to History?

In fact, and as anyone who truly understands history should know then as now, history is replete with rhyming turning points, but never a victorious and eternal “end-game.”

Stated more simply, the famous book, which made so much sense at that particular moment in time, seemed to me even in 1992 as a classic example of “hubris comes before the fall.”

In other words, it may have been a bit too soon to declare victory for liberal democracy and capitalism, as these fine systems require fine leadership and even finer principles to survive history’s forward flow.

Today’s History…

Fast-forward many decades (grey hairs, advanced degrees and sore muscles) later, and it would seem that my young skepticism (and historical respect) was well-placed.

The evidence around us now suggests that the “victorious” capitalism Fukuyama boasted of in 1992 died long ago, replaced in the interim years by obvious and mathematically-corroborated examples of unprecedented wealth inequality and modern feudalism.

Furthermore, if one were to contrast the principles of America’s founding fathers as evidenced by their first 10 Amendments to the US Constitution (remember our Bill of Rights?) to the current and obvious destruction of the same in what is now a far more centralized, post-9-11 “Patriot Act” USA, the evidence of democracy’s crumbling façade is literally all around us.

In other words, perhaps Fukuyama got a little too ahead of himself.

Or more to the point, perhaps he was dead wrong about the final “victory” of genuine US capitalism and an actual, living/breathing liberal democracy?

Is the USA the Old USSR?

In fact, and with a humble nod to modesty, blunt-speak, current events, simple math and almost tragic irony, the actual evidence of history since 1992 suggests that today’s Divided States of America (DSA) (and Pravda-like media) appears to look far more like the defeated USSR than the victor presented by Mr. Fukuyama…

Such dramatic statements, of course, mean nothing without facts, and we all deserve a careful use of the same if we seek to replace emotion with data and hence see, argue and prepare ourselves politically and financially with more clarity.

Facts Are Stubborn Things

Toward this end, I am once again grateful for the facts and figures which Luke Gromen provides in supporting the otherwise “sensational” conclusion that America may have won the “cold battle” with the USSR, but it is now losing a “cold war” with the Russians and Chinese.

Really?

C’mon.

Really?

Again, let’s look at the facts. Let’s look at the numbers. Let’s look at current events, and let’s look at history, which is anything but at an “end.”

For those whose respect for history goes beyond a twitter-level attention span or the assistance of mainstream media Ken and Barbies (from CNN to The View), none of whom understand anything of history, you will recall that Regan’s successful war against the USSR was won by bankrupting the Soviets.

But as Gromen so eloquently reminds us, “nobody seems to notice that is EXACTLY what the Russians and Chinese are doing to us now.”

This is not fable but fact, and I warned of this in How the West was Lost the moment the US weaponized the USD in 2022. This desperately myopic (i.e., stupid) policy gave a very patient and history-savvy Russia and China just the opportunity they have been waiting for to turn the tables on the DSA.

History’s Fatal Debt Trap Lesson

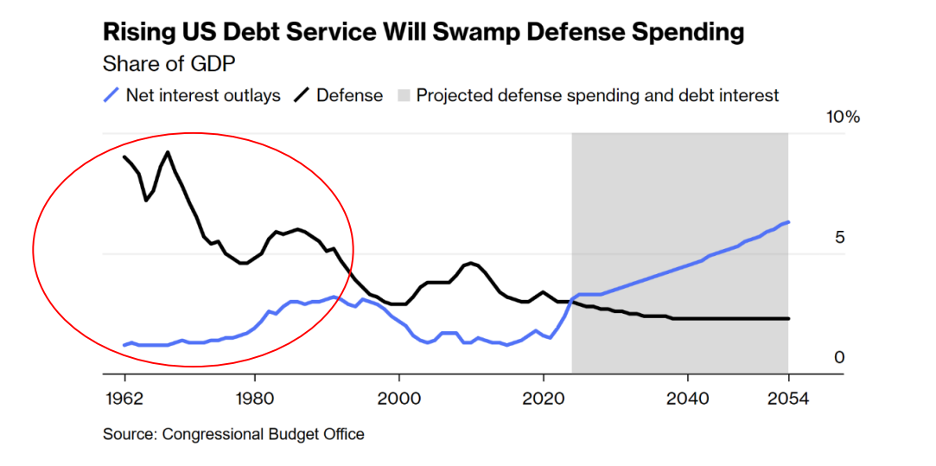

As I also recently wrote, with the insights of both Niel Ferguson and Luke Gromen, you know (and history confirms) a nation (or empire) is ALWAYS doomed the moment its debt expenses (in interest terms alone) exceed its defense spending.

And as of this writing, the DSA’s gross interest is 40% higher than its military spending.

Nor are we, the Russians, the Chinese or even a select minority of informed Americans alone in this knowledge of the DSA’s fatal debt trap.

No Hiding the Obvious

The current turning point in American debt is now increasingly and more globally understood in what Ben Hunt calls “the Common Knowledge Game.”

Stated more simply, and as evidenced by the now undeniable move away from the US IOU and USD by an ever-increasing (and ever de-Dollarizing) BRICS+ membership roster, the world is catching on to the blunt fact that the American empire (of citizen lions led by political donkeys) is spending fatally more than it earns.

What is far more sickening, however, is that Uncle Sam is then paying its IOUs with debased Dollars literally mouse-clicked into existence at the not-so “federal” and not-so “reserved” Federal Reserve.

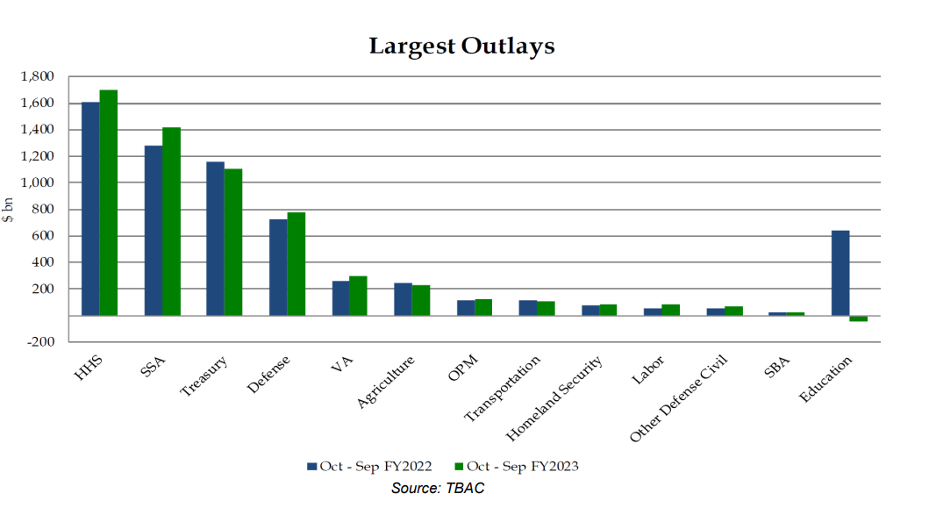

This desperate reality, and completely fantasy-based monetary “solution,” has resulted in an empirically bankrupt nation who quantifiably spends more on entitlements (cashed out by 2030), sovereign IOUs and warfare than it does on transportation, agriculture, veteran benefits and citizen education (our apologies to Thomas Jefferson).

See for yourself:

Returning from simple math to otherwise forgotten (or now increasingly “cancelled) history, it becomes harder to deny Gromen’s observation “that the US appears to be reprising the role of the USSR this time, with a heavy debt load, uncompetitive and hollowed-out industrial base, reliant on a Cold War adversary for imported manufactured goods, and needing ever-higher oil prices in order to keep its oil production from falling.”

Democracy’s Suicide?

In other words, and in the many years since Fukuyama declared victory in 1992, the interim sins/errors of increasingly suicidal (or grotesquely negligent/stupid) US military, financial and foreign policies have irrevocably placed the DSA into a defeated decline rather than victorious “End of History.”

This reality, of course, gives me no pleasure to share, as I was, am and will always remain a patriotic American—or at least patriotic to the ideals for which America originally stood.

But as I’ve said many times, today’s DSA is almost unrecognizable to the American I was when Fukuyama’s book of hubris was released over three decades ago.

As our second US President, John Adams, warned his wife Abigail: “Remember, democracy never lasts long. It soon wastes, exhausts, and murders itself. There never was a democracy yet that did not commit suicide.”

Again, this is history, and it appears to be a history that Fukuyama misunderstood in 1992, when he apparently thought it had reached its happy “end.”

The Past Informs the Future

Looking forward, I/we must be equally capable of looking backward.

History has far more to teach us than the stump-speeches (or pathetic cue cards) of current political opportunists (puppets?) who, with very few exceptions, care far more about preserving their power (via coalitions, the legalized bribery of K-Street lobbyists, the promulgation of mis-information and the deliberate omission of mal-information) than serving their public.

The Sad History of Currency Debasement

History also warns/teaches that the leadership of all debt-soaked and failing regimes will buy time saving their “systems” (and covering their @$$’s) by debasing their currencies to monetize their debts.

Folks, this is true throughout history, and WITHOUT EXCEPTION.

Sadly, the DSA and its hitherto “exceptionalism” is no exception to this otherwise ignored historical lesson.

Toward this end, and as Egon and I have argued for years, the DSA will thus pretend to “fight inflation” while simultaneously seeking inflation, as all debt-strapped (and hence failed) regimes need inflation rates to exceed interest rates (as measured by the yield on the US10Y UST) in what the fancy lads call “negative real rates.”

The Sad History of Dishonesty

Inflation, however, is not only politically embarrassing, but stone-cold proof of failed monetary and fiscal leadership.

To get around this embarrassment, politicos from the Fed and the White House to the so-called House of Representatives (and the Don-Lemonish/Chris Cuomo/ 1st Amendment-insulting/hit-driven legacy media which supports them) will do what most children do when faced with making an error, that is: Lie.

And in this case: Lie about inflation data.

Of course, a nation that lies to its people is not best suited for leading its people.

As Hemingway warned, and as I often repeat, those at fault will point the fingers of blame to others (from Eastern bad guys, and man-made viruses to political fear campaigns on everything from global warming, white nationalism or green men from Mars); or worse, leaders will distract their constituents in perpetual wars.

Sound familiar?

In the interim, those “people” will continually and increasingly suffer from the sins of their childish leadership under the crippling yet invisible tax of the debased purchasing power of their so-called “money.”

This too, is nothing new to those who track history…

Golden Solutions?

Gold, of course, cannot and will not solve all of the myriad and “human, all too human” failures of national leadership and the monetary, social and centralized disfunctions which ALWAYS follow in the wake of too much debt.

But as history also confirms (and equally without exception), each of us can at least protect the purchasing power of our wealth by measuring that wealth in ounces and grams rather than openly dying paper/fiat money.

This is not a biased argument. This is not a “gold bug” argument.

It is far more simply a historical argument, which further explains why governments don’t want you to understand the history of money nor the history of gold.

In fact, even Fukuyama’s now embarrassing book ignores this simple lesson of gold lasting and paper money dying, which only adds to my opening observation that history never “ends” it simply teaches and protects the informed.

The same is true of physical gold.

AS DOMINOES FALL, GOLD WILL STAND STRONGER THAN EVER

In this detailed interview with Silver Bullion Television, Matthew Piepenburg, partner at Von Greyerz, joins host Patrick Vierra in Singapore to discuss the pressing issues facing the global economy. Matthew offers his expert analysis on the dynamics of gold prices, the weakening US dollar, and the historical context of currency debasement. He also addresses the implications of central bank policies, including Quantitative Easing and its effects on both the economy and individual financial stability. Dive into this conversation to understand why and how nations resort to debasing their currencies and the strategic importance of investing in gold for preserving wealth. Don’t miss Matthew’s insights on the current economic trends and the future of financial markets.

The discussion revolves around critical economic themes such as the influence of central banks, the enduring value of gold, and the ramifications of currency debasement. This conversation sheds light on the current economic landscape and strategies for safeguarding wealth.

Summary with Key Takeaways:

- Central Bank Influence: The substantial power that central banks, especially the Federal Reserve, wield over the economy is emphasized. Their control over interest rates and monetary policy has significant global and domestic impacts.

- Currency Debasement: The historical tendency of governments to print money to cover debts leads to weaker currencies. The rise in gold prices is highlighted as a reaction to currency depreciation, particularly of the US dollar.

- Role of Gold: Gold is portrayed as a crucial asset for wealth preservation against currency debasement. It remains stable in value over time, unlike fiat currencies which have experienced significant purchasing power erosion.

- Economic Debt and Inflation: The unsustainable debt levels in the U.S. and other countries are discussed, which may lead to fiscal crises and influence central bank policies, potentially resulting in economic downturns.

- Global Shifts in Currency Use: The interview touches on the trend of de-dollarization, with more countries reducing their reliance on the US dollar, which could weaken its status as the global reserve currency.

- Socio-Economic Impacts: Financial policies often lead to wealth inequality and social divisions, which can cause broader social unrest.

- Gold as a Strategic Investment: Gold is recommended as a strategic investment, not for speculation but as a means to secure financial stability amidst economic uncertainties caused by weakening currencies and inflation.

This conversation provides a compelling overview of the economic challenges and strategies for navigating them, emphasizing the importance of understanding central banking practices, currency valuation, and investment in stable assets like gold. Matthew’s insights offer valuable guidance for those looking to secure their wealth in turbulent economic times.

AS DOMINOES FALL, GOLD WILL STAND STRONGER THAN EVER

Poor America. Poor Jerome Powell…

A Real Cliff, Fake Smile

It is no fun to be openly trapped, and even less fun to be in open decline while meekly declaring all is fine.

I have the image of Uncle Sam (or Aunt Yellen) hanging off a cliff with a forced (i.e., political) smile.

Above the cliff is a grizzly bear; below the cliff is a pool of sharks.

In short: Whichever direction one picks, the end result is messy.

And yet the markets still wait for Powell to make the right choice.

What right choice?

Rate Cut Salvation?

As of today, the markets, pundits and FOMC circus followers are all wondering when Powell’s promised rate cuts will come to save the Divided States of America and its Dollar-thirsty, debt-dependent “growth narrative.”

In January, Powell was “forward guiding” rate cuts and thus, right on cue, the Pavlovian markets, which react to Fed liquidity in the same way Popeye reacts to spinach, ripped north on words alone.

YTD, the S&P, SPX and NASDAQ are rising on rising rates hoping to morph lower.

Even gold and BTC are rising on rising rates—all of which makes no traditional sense—unless, of course, markets are just waiting for the inevitable rate cuts, right?

And who could blame them? After all, Powell promised the same, and Powell, the voice of “transitory inflation,” never mis-speaks, right?

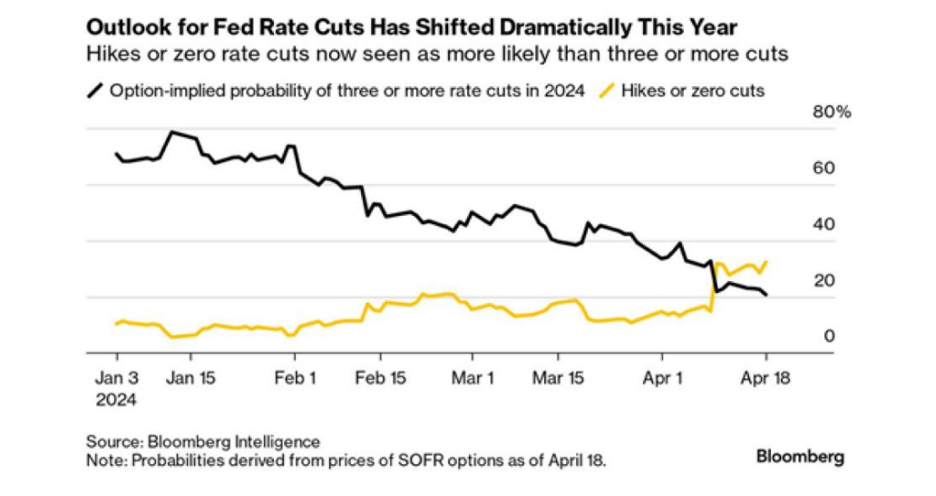

But now the May markets, and even the Bloomberg Intelligence Reports, are worrying out loud about no rate cuts at all for 2024?

So, what will it be? Higher for longer? No more cuts? Three cuts in 2024?

What to do? How to know?

Break out the tarot cards? Read Powell’s palm? Beg?

Here’s My Take: Stop Caring, Because Either Way, We’re Screwed…

As for rate cuts, the case for them is fairly obvious, as I’ve opined elsewhere.

With trillions in USTs repricing in 2024, and over $700B in zombie bonds from S&P issuers doing the same, if Powell doesn’t cut rates, then sovereign and corporate bond markets are staring down a loaded barrel.

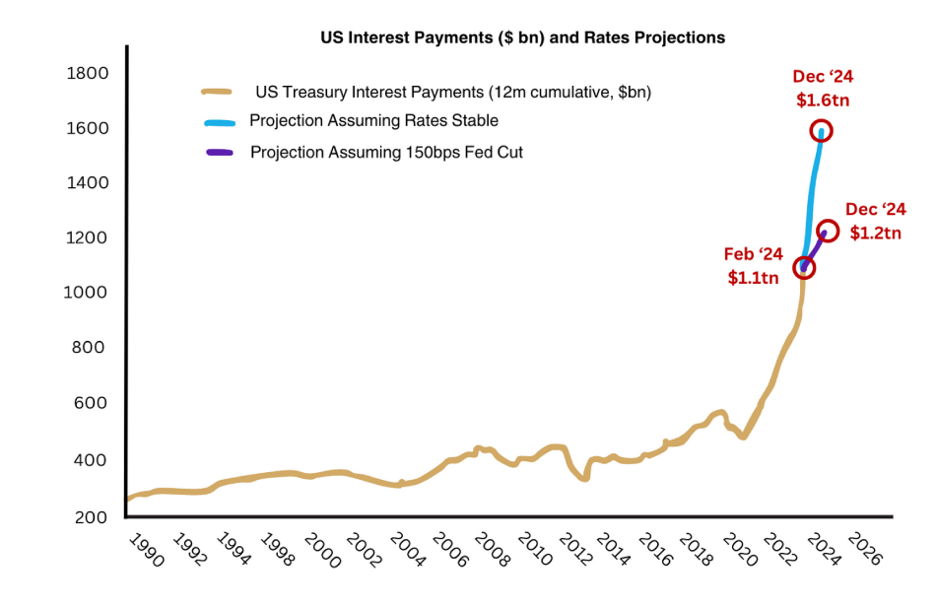

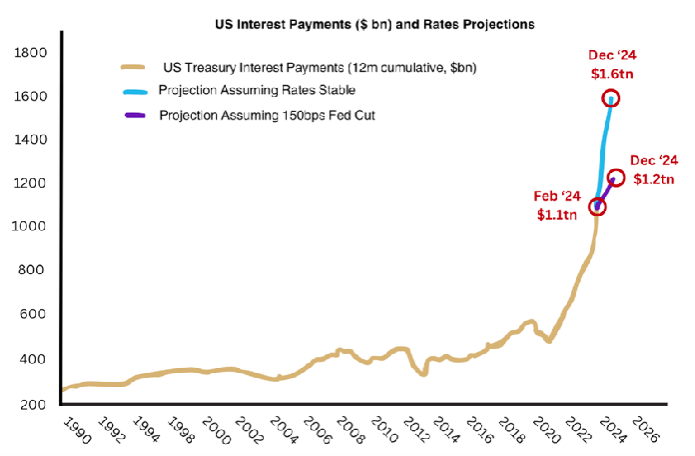

This is real. BofA’s own data confirms that Uncle Sam is looking at $1.6T in interest expense payments by year end if Powell doesn’t cut rates soon.

It’s also an election year, and a nice rate cut would be a tailwind for an incumbent (somnolent) White House that needs every possible tail wind it can get.

So, Why Wouldn’t Powell Cut?

The official answer, which, by the way, is never the honest answer, is that Powell and his “data dependent” Fed is still worried about inflation, which has failed to reach its “target 2%” level, whatever that is.

If one believes this narrative, then higher rates are still needed to “win the war on inflation.”

The great irony, and comedy, however, is that actual inflation, as even Larry Summers (or John Williams at Shadow Stats) would remind, is deeply in the double digits, and hence the Fed’s “data dependence” is nothing but a comical lie of “data manipulation.”

Another case for no rate cuts is Powell’s fear of making the “Volcker mistake” of 1980, when the then-Fed Chairman, believing inflation was tamed, cut rates too soon, and what followed was a dramatic spike in well: Even more inflation.

Perhaps Powell has a similar fear of cutting too soon and getting more inflationary egg on his politically two-faced brow?

Furthermore, if Powell cuts rates, demand for USTs, already a global joke since 2014, could worsen, and the US survives off others purchasing its increasingly unloved IOUs.

A rate cut, or series of rate cuts, would only add to this embarrassing demand lag, and hence put even greater pressure on finding new sources of fake money to pay America’s increasingly pathetic bar tab.

In short, cases can be made for looming rate cuts, and cases can be made for no rate cuts, but regardless of what happens, the case for a palpably tanking America stays the same.

Here’s why.

The No-Cut Scenario

If Powell stays higher-for-longer just about everything (from stocks and bonds to mortgages and economies) will break but the USD—at least as measured by the DXY’s relative strength.

In this regard, America can brag about being one of the best horses in the global currency glue factory.

But soon thereafter, the rising cost of Uncle Sam’s interest expense on ever-increasing UST issuance will become so high that the only way to pay for those higher-for-longer rates will be via fake money, which I remind Mr. Powell, is, well: Inflationary.

This is the classic, but undeniably real matter of “Fiscal Dominance,” which simply means that Powell’s war on inflation via rising rates ends ironically in an inflationary end-game of mouse-clicked liquidity.

We saw this same pattern (rising rates and QT) in 2018, which lead to falling rates and unlimited QE by 2020.

But then again, it seems for most investors, that kind of history (and hence lesson) is just too far away to recall…

Of course, the Fed, and BLS, will then… mis-report actual inflation.

The Three or More Cut Scenario

Alternatively, Powell could cut rates in 2024, weaken the USD, save the debt (and hence rate) sensitive stock markets and let inflation creep further north as whoever is running the Biden White House seeks to bribe the electorate.

Of course, the Fed, and BLS, will then… mis-report actual inflation.

In short, and in either scenario, the end-game is inflationary, and however misreported the CPI scale will be to hide this embarrassment, the inherent purchasing power of the USD (a melting ice cube) by which many measure their wealth, will get weaker and weaker, as the rich get a little less rich and the poor American serfs just get knee-capped.

But this is the lesson and warning of a nation and economy at the full mercy of a central bank rather than natural and free price discovery.

A Not-So-Free-Market Reality

The sad fact is capitalism died long ago.

Instead, we are all slowly frog-boiling within a centralized economy whose central planners/bankers, in cahoots with a failed, pathologically power-hungry and vote-purchasing DC “leadership,” who circa 1913 sold the nation down the river of a fatal debt quagmire paid for by fake liquidity and the open fantasy-made-mainstream-policy that one can save a debt-strapped nation with more, well…debt.

Or stated more simply, the US will desperately seek to inflate away its self-inflicted debt disaster (and increase its wealth inequality index) on the backs of ordinary, inflation-soaked citizens.

But as John Cougar Mellencamp once noted, “Awe, but aint that America…”

In all fairness to America, however, such historical slides into open mediocrity and a currency-debased debt quagmire are nothing new.

[Ignored] History Lessons

All failing nations ultimately resort to killing their currencies in order to buy time and “save” a system that is mathematically beyond the ability to be saved.

As Niel Ferguson recently reminded, “any great power that spends more on debt service than on defense will not stay great for very long. True of Hapsburg Spain, ancient regime France, the British Empire…”

It frankly staggers us that so few “sophisticated” market participants understand the simple (though increasingly “cancelled”) lessons and patterns of yesterday.

History, far more than an MBA or the promises of your Private Wealth Managers at banks X, Y or Z, can teach far-sighted investors how and where to position themselves.

Rising Gold Patiently Getting the Final Say

This slow but then sudden death of fiat money, seen countless times in our collective past yet ignored by our collective policy makers and day traders, makes history-confirmed anti-fiat solutions like gold all too obvious to ignore.

And yet, as my colleague Egon Greyerz recently observed, only about 0.5% of global financial asset allocations are made to gold.

In short, the ignoring (or ignorance) plunges forward…

But when this relatively finite assetof infinite duration reaches and surpasses its 40-year mean allocation of just 2%, the 4X increase in gold demand, and hence price, will be just the beginning of gold’s final response to unsound money.

Meanwhile, The Circus Continues

For now, clever traders and speculators can, will and should keep their eyes on a DXY (and Dollar) which, like the markets, can and will gyrate on the wings of a vast range of current and pending liquidity (backdoor QE) tricks, from the Treasury General Account, the repo markets and Supplementary Leverage Ratios to the Treasury’s Quarterly Refunding Announcements.

These same tricks (artificial liquidity-deck-chair shuffling on the Titanic) can have short-term implications on moving equities as well, perhaps buying more time for an otherwise narrow and entirely Fed-supported basket case S&P et al.

But what these same liquidity tricks are hiding in plain site is that America’s fiscal problems have gone from embarrassing to the iceberg-level desperate, and investors are measuring their “liquidity-supported” returns with an openly diluted Dollar.

As F. Gump would say, “stupid is as stupid does.”

From Frog Boil to Fully Cooked

Tax receipts and debt-driven GDP forecasts will never, not ever, be sufficient to plug the hole in the bow of the sinking US debt ship.

Despite whatever the trapped Powell or forked-tongued DC says, the only option forward is inflationary, (with a little bit of war to keep us distracted).

In fact, since Nixon decoupled from gold in 1971, that frog boil toward an ever-debased USD has been in full swing, losing purchasing power against physical gold at levels now too obvious to be ignored:

Apologists, however, will rightfully argue that compared to other currencies, including the poor Japanese Yen, which is experiencing multi-decade lows against the Greenback, that the USD is one’s best “relative choice.”

But why compare one fiat currency against another, when gold outperforms them all?

Just a thought, no?

AS DOMINOES FALL, GOLD WILL STAND STRONGER THAN EVER

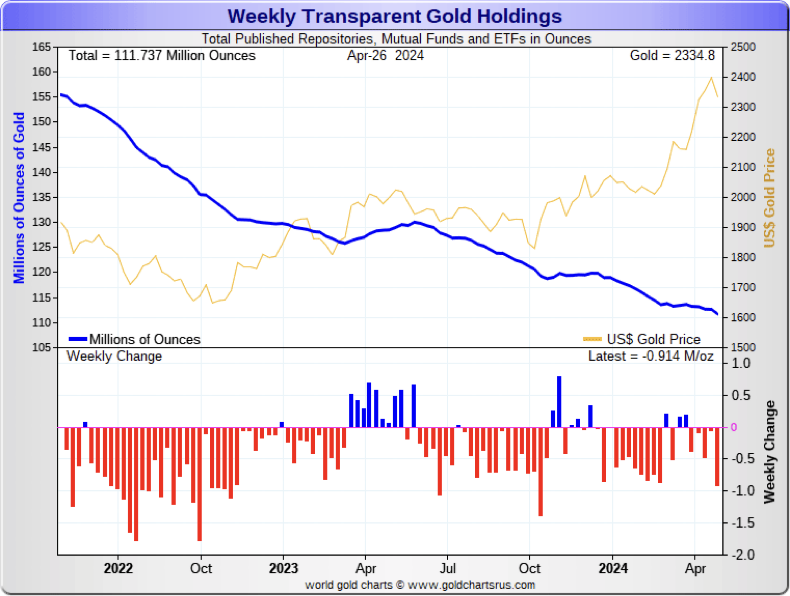

Since the October 2023 gold low of just over $1,600 gold is up but is anyone buying?

Well no, certainly none of the normal players.

Gold Depositories, Gold Funds and Gold ETFs have lost just under 1,400 tonnes of their gold holdings in the last 2 years since May 2022.

But not only gold funds are seeing weak buying but also mints such as the Perth Mint and the US Mint with its coin sales down 96% year on year.

Clearly gold knows something that the market hasn’t discovered yet.

RATES MUCH HIGHER

For the last few years I have been clear that there will be no lasting interest rate cuts.

As the chart shows below, the 40 year down trend in US rates bottomed in 2020 and since then rates are in a secular uptrend.

I have discussed this in many articles as well as in for example this interview from 2022 when I stated that rates will exceed 10% and potentially much higher in the coming inflationary environment, fuelled by escalating deficits and debt explosion.

“But the Fed will keep rates down” I hear all the experts call out!

Finally the “experts” are changing their mind and believe that cuts will no longer happen.

No central bank can control interest rates when its government recklessly issues unlimited debt and the only buyer is the central bank itself.

PONZI SCHEME WORTHY OF A BANANA REPUBLIC

This is a Ponzi scheme only worthy of a Banana Republic. And this is where the US is heading.

So strongly rising long rates will pull short rates up.

And that’s when the fun panic starts.

As Niall Ferguson stated in a recent article:

“Any great power that spends more on debt service (interest payments on the national debt) than on defence will not stay great for very long. True of Habsburg Spain, true of ancien régime France, true of the Ottoman Empire, true of the British Empire”.

So based on the CBO (Congressional Budget Office), the US will spend more on interest than defence already at the end of 2024 as this chart shows:

But as often is the case, the CBO prefers not to tell uncomfortable truths.

The CBO forecasts interest costs to reach $1.6 trillion by 2034. But if we extrapolate the trends of the deficit and apply current interest rate, the annualised interest cost will reach $1.6 trillion at the end of 2024 rather than in 2034.

Just look at the steepness of the interest cost curve above. It is clearly EXPONENTIAL.

Total Federal debt was below $1 trillion in 1980. Now, interest on the debt is $1.6 trillion.

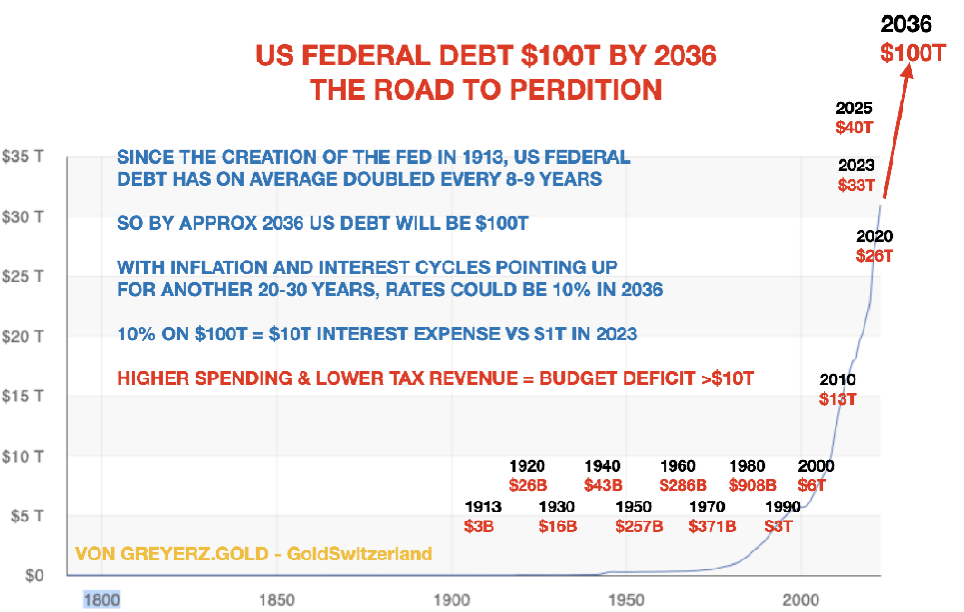

Debt today $35 trillion rising to $100 trillion by 2034.

The same with the US Federal Debt. Extrapolating the trend since 1980, the debt will be $100 trillion by 2036 and that is probably conservative.

With the interest trend up as explained above, a 10% rate in 2036 or before is not unrealistic. Remember rates back in the 1970s and early 1980s were well above 10% with a much lower debt and deficit.

US BONDS – BUY THEM AT YOUR PERIL

Let us analyse the current and future of a US treasury debt (and most sovereign debt):

- Issuance will accelerate exponentially

- It will never be repaid. At best only deferred or more probably defaulted on

- The value of the currency will fall precipitously

HYPERINFLATION COMING

So where are we heading?

Most probably we are facing an inflationary period leading to probable hyperinflation

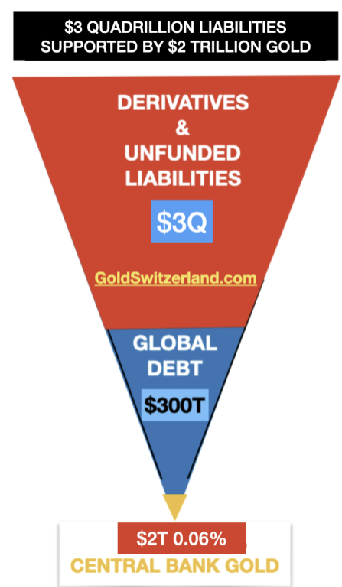

With global debt already up over 4x this century from $80 trillion to $350 trillion. Add to that a Derivative mountain of over $2 quadrillion plus unfunded liabilities and the total will exceed $3 quadrillion.

As central banks frenetically try to save the financial system, most of the 3 quadrillion will become debt as counterparties fail and banks will need to be saved with unlimited money printing.

BANCA ROTTA – BANKRUPT FINANCIAL SYSTEM

But a rotten system can never be saved. And this is where the expression Banca Rotta derives from – broken bench or broken bank as my article from April 2023 explained.

But neither a bank nor a sovereign state can be saved by issuing worthless pieces of paper or digital money.

In March 2023, four US banks collapsed within a matter of days. And soon thereafter Credit Suisse was in trouble and had to be rescued.

The problems in the banking system have just started. Falling bond prices and collapsing values of property loans are just the beginning.

This week Republic First Bancorp had to be saved.

Just look at US banks’ unrealised losses on their bond portfolios in the graph below.

Unrealised losses on bonds held to maturity are $400 billion.

And losses on bonds available for sale are $250 billion. So the US banking system is sitting on identified losses of $650 billion just on their bond portfolios. As interest rates go up, these losses will increase.

Add to that, losses on loans against collapsing commercial property values and much more.

EXPONENTIAL MOVES

So we will see debt grow exponentially as it has already started to do. Exponential moves start gradually and then suddenly whether we talk about debt, inflation or population growth.

The stadium analogy below shows how it all develops:

It takes 50 minutes to fill a stadium with water, starting with one drop and doubling every minute – 1, 2, 4, 8 drops etc. After 45 minutes the stadium is only 7% full and the last 5 minutes it goes form 7% to 100%.

THE LAST 5 MINUTES OF THE FINANCIAL SYSTEM

So the world is most probably now in the last 5 minutes of our current financial system.

The coming final phase is likely to go very fast as all exponential moves do, just like in the Weimar Republic in 1923. In January 1923 one ounce of gold cost 372,000 marks and at the end of November in 1923 the price was 87 trillion marks!

The consequences of a collapse of the financial system and the global economy, especially in the West can take many decades to recover from. It will involve a debt and asset implosion plus a massive contraction of the economy and trade.

The East and South and especially the countries with major commodity reserves will recover much faster. Russia for example has $85 trillion in commodity reserves, the biggest in the world.

As US issuance of treasuries accelerate, the potential buyers will decline until there is only one bidder which is the Fed.

Even today no sane sovereign state would buy US treasuries. Actually no sane investor would buy US treasuries.

Here we have an already insolvent debtor that has no means of repaying his debt except for issuing more of the same rubbish which in future would only be good for toilet paper. But electronic paper is not even good for that.

This is a sign in a Zimbabwe toilet:

Let us analyse the current and future of a US treasury debt (and most sovereign debt):

- Issuance will accelerate exponentially

- It will never be repaid. At best only deferred or more probably defaulted on

- The value of the currency will fall precipitously

That’s all there is to it. Thus anyone who buys US treasuries or other sovereign bonds has a 99.9% guarantee of not getting his money back.

So Bonds are no longer an asset of value but just a liability for the borrower that will or can not be repaid.

What about stocks or corporate bonds. Many companies won’t survive or experience a major decline in the stock price together with major cash flow pressures.

As I have discussed in many articles, we are entering the era of commodities and especially precious metals.

The coming era is not for speculation but for trying to keep as much of what you have as possible. For the investor who doesn’t protect himself, there will be a wealth destruction of an unprecedented magnitude.

There will no longer be a question what return you can get on your investment.

Instead it is a matter of losing as little as possible.

Holding stocks, bonds or property – all the bubble assets – are likely to lead to massive wealth erosion as we go into the “Everything Collapse”.

THE NEW ERA OF GOLD AND SILVER

For soon 25 years I have been urging investors to hold gold to preserve their wealth. Since the beginning of this century gold has outperformed most asset classes.

Between 2000 and today, the S&P, including reinvested dividends, has returned 7.7% per annum whilst gold has returned 9.2% per year or 8X.

In the next few years, all the factors discussed in this article will lead to major gains in the precious metals and falls in most conventional assets.

There are many other positive factors for gold.

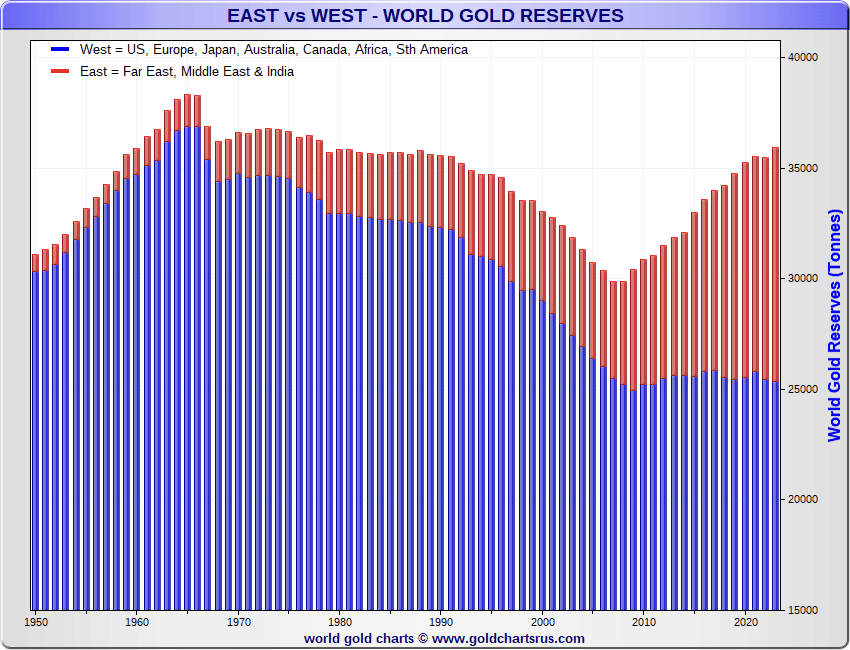

As the chart below shows, the West has reduced its gold reserves since the late 1960s, whilst the East is growing its gold reserves strongly. And we have just seen the beginning of this trend.

The US and EU sanctioning of Russia and the freezing/confiscation of the Russian assets in foreign banks are very beneficial for gold.

No sovereign states will hold their reserves in US dollars any more. Instead we will see central bank reserves move to gold. That shift has already started and is one of the reasons for gold’s rise.

In addition, gradually the BRICS countries are moving away from the dollar to trading in their local currencies. For commodity rich countries, gold will be an important part of their trading.

Thus there are major forces behind the gold move which has just started and will reach further both in price and time than anyone can imagine.

HOW TO OWN GOLD

But remember for investors, holding gold is for financial survival and protection of assets.

Therefore gold must be held in physical form outside the banking system with direct access for the investor.

Also gold must be held in safe jurisdictions with a long history of rule of law and stable government.

The cost of storing gold should not be the primary consideration for choosing a custodian. When you buy life insurance you mustn’t buy the cheapest but the best.

First consideration must be the owners and management. What is their reputation, background and previous history.

Thereafter secure servers, security, liquidity, location and insurance are very important.

Also, high level of personal service is paramount. Many vaults fail in this area.

Preferably gold should not be held in the country where you are resident, especially not in the US with its fragile financial system.

Neither gold nor silver has started the real move yet. Any major correction is likely to come from much higher levels.

Gold and silver are in a hurry so it is not too late to jump on the gold wagon.

AS DOMINOES FALL, GOLD WILL STAND STRONGER THAN EVER

VON GREYERZ partner, Matthew Piepenburg, joins John Buttler (Southbank Research) and David Lin in a spirited discussion on the omni-present yet undeniably important theme of the USD and its historical implications for rising gold.

Understanding gold tailwinds requires an understanding of debt forces and their impact on fiat currencies in general and the USD in particular. Toward that end, Piepenburg opens with a high-level (yet fact-focused) assessment on the current and unprecedented debt crisis in the land of the world reserve currency. Piepenburg unpacks how such debt crises impact a broad range of market themes—from risk assets, rate policies, recessionary forces, inflation cycles and precious metals.

When asked about the time horizon for such events to unfold, Piepenburg argues that the process has already begun. He gives example after example of real-time signals of a USD in open distrust and hence open decline. David asks if and how sovereign deficits impact stock markets. Piepenburg and Buttler address this question in divergent ways, but both agree that even a Fed-supported market rising in a background of cancerous debt levels can only be “maintained” at the expense of a debased and terminally ill (Fed-printed) currency. Piepenburg and Buttler then address the causes, risks and opportunities in a rising equity market bubble.

David asks why the USA has yet to experience hyperinflation, to which Piepenburg and Buttler share their opinions. For Piepenburg, the inflationary end-game is a matter of cycling through dis-inflationary interest rate and recessionary cycles, which will be followed by highly inflationary direct and indirect QE policies out of DC. In this light, the conversation turns to current and projected Fed policies, record UST issuance, long-term interest rate direction and the hard math behind real rather than reported inflation.

All themes, of course, lead to gold and the conversation ends with a review of all the forces–from the oil markets, de-dollarization trends among the BRICS+ nations to COMEX changes and a debt-trapped/cornered US Fed–which point toward an inherently weaker USD. This all explains the current gold rise and a much greater to rise to come.

AS DOMINOES FALL, GOLD WILL STAND STRONGER THAN EVER

Needless to say, we at VON GREYERZ spend a good deal of time thinking about, well… gold.

The Complex, the Simple, the Math and the History

Year after year, and week after week, there is always a new way to examine gold price moves and decipher the obvious and not-so obvious forces which flow behind, ahead, above and below its monetary and, yes, metallic, move through time.

Today, deep into the early decades of the 21st century, and well over 100 years since the not-so immaculate conception of the Fed in the early 20th century, we could (and have) spent pages and paragraphs on key turning points in the rigged to fail history of paper vs. metallic money.

At times, this effort can and has seemed intense and even complex, with all kinds of historical facts, mathematical comparisons and “big events.”

The turning points of gold’s relationship with fiat currencies, and its role in preserving wealth, for example, are known to an admitted minority—as only about 0.5% of global financial allocations include physical gold.

Gold’s Language

Yet the need, role and direction of gold is fairly blunt, at least for those with eyes to see and ears to hear.

History, for example, has some clear things to say about paper money.

And so does gold.

From the Bretton Woods promises of 1944 and Nixon’s open and subsequent welch on the same in 1971 to the 2001 outsourcing of the American dream to China under Clinton (and the WTO) or the recent weaponization of USD in Q1 of 2022, gold has been watching, acting and speaking to those who understand her language.

The Big Question: Why Is Gold Rising Now?

And this year, with gold reaching all-time-highs, piercing resistance lines and racing toward what the Wall Street fancy lads call “price discovery,” we are understandably getting a lot of interview requests, phone calls and even emails from friends otherwise silent for years and now suddenly asking the same thing:

“Why is gold rising now?”

The Wall Street side of my odd brain, like it or not, gets all excited by such questions.

Never at a loss for words, my pen and mouth rapidly seek to wax poetic on the many answers to why gold matters forever in general, and why it is rising in particular now.

Toward that end, the list of the fancy and not-so-fancy answers to this question in recent years, articles and interviews could look as simple (or as complex) as the following list of 7 key factors:

The Malignant Seven

- Every debt crisis leads to a currency crisis—hence: Good for gold.

- All paper currencies, as Voltaire quipped, eventually revert to their paper value of zero, and all debt-soaked nations, as von Mises, David Hume and even Ernest Hemingway warned, debase their currencies to retain power—hence: Good for gold.

- Rising rates (and fiscal dominance) used to “fight inflation” are too expensive for even Uncle Sam’s wallet, thus he, like all debt-soaked nations, will debase his currency to pay his own IOUs—hence: Good for gold.

- Global central banks are dumping unloved and untrusted USTs and stacking gold at undeniably important levels—hence: Good for gold.

- After generations of importing US inflation and being the dog wagged by the tail of the USD, the BRICS+ nations, prompted by a weaponized Greenback, are now turning their tails slowly but surely away from the USD dog—hence: Good for gold.

- The Gulf Cooperation Council oil powers, once seduced (circa 1973) into a Petrodollar arrangement by a high-yielding UST and globally revered USD, are now openly selling oil outside of the 2024 version of that far less-yielding UST and far less-trusted USD—hence: Good for gold.

- That legalized price-fixing sham otherwise known as the COMEX employed in 1974 to keep a permanent boot to the neck of the gold price, is running out of the physical gold needed to, well…price fix gold—hence: Good for gold.

In short, each of these themes–from sovereign (and unprecedented) debt levels, historical debt lessons, the secrets of the rate markets, global central banks dumping USTs or the implications of changing oil markets to the OTC derivatives scam masquerading as capitalism–all DO explain why gold is rising now.

This list, of course, may be simple, but the forces, indicators, lingo, math and trends within each theme can be admittedly complex, as each theme is in fact worthy of its own text book rather than bullet point.

Indeed, currencies, markets, history, bonds, geopolitics, energy moves and derivative desks are complicated little creatures.

But despite all this complexity, study and deliberation, if you really want to address the question of “why is gold rising now?”—the answer is almost too simple for those of us who wish to appear, well… “complex.”

The Too-Simple Answer to the Big Question

In other words, the simple answer—the answer that cuts through all the fog, lingo and math of “sophisticated” financial markets–boils down to this:

GOLD IS NOT RISING AT ALL. THE USD IS JUST GETTING WEAKER AND WEAKER.

At VON GREYERZ, we never measure gold’s value in dollars, yen, euros or any other fiat currency. We measure gold in ounces and grams.

Why?

Because history and math (as well as all the current and insane financial, geopolitical, and social events staring us straight in the eyes today) teach us not to trust a currency backed by man (or the “full faith in trust” of the UST or a Fed’s mouse-clicked currency), but instead to seek value in monetary metals created by nature.

Fake Money & Empty Promises