The Fatal Effects of Debt: Rising Gold & Silver

VON GREYERZ partner, Matthew Piepenburg, joins Nomi Prins with Ted Butler of VRIC Media to separate facts from fiction as to the key themes facing the global financial system, namely: US recession indicators, Fed policy in the face of ongoing inflationary forces, the longer-term direction of the USD, the implications of a Chinese slowdown, US equity market direction and the financial consequences of escalating war drums.

Each of these key theme are the ripple effects of unsustainable national and global debt levels, all of which point toward increasing currency debasement to inflate away sovereign debt with diluted fiat money.

Prins and Piepenburg close the discussion with a look at the gold market as well as the forces impacting supply and demand mismatches in the silver market.

The Fatal Effects of Debt: Rising Gold & Silver

In an insightful interview, Jonny Haycock, Partner at VON GREYERZ, explores critical topics shaping the global financial landscape and the signals family offices must not ignore.

Jonny explores the power shift from West to East, underscored by the systematic gold buying by BRICS countries, increasing geopolitical risk, unsustainable levels of debt, de-dollarisation, extreme levels of gold under-ownership and the constant debasement of paper money.

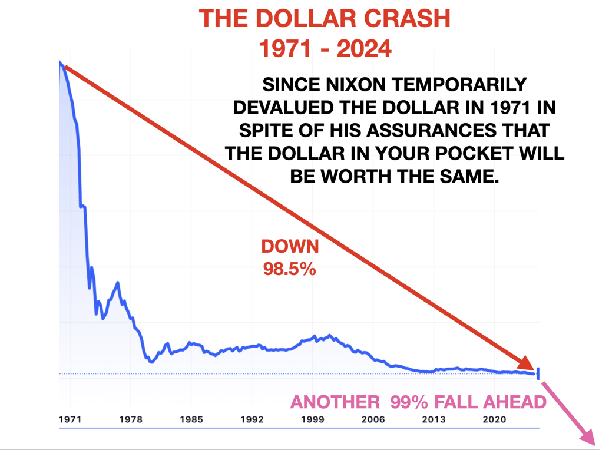

In a historical context, Jonny highlights the pivotal moment when Nixon abandoned the gold standard in 1971, an event that set the stage for today’s economic imbalances. By comparing gold’s value against debased currencies – citing the UK and US as prime examples – he shows how gold has maintained its purchasing power against all paper currencies.

The conversation also delves into gold’s exceptional performance during stagflationary periods and how central banks have manipulated markets to control perceptions. With the BRICS nations potentially backing their currencies with commodities, Jonny outlines the inflation risks and far-reaching implications for global investors, particularly family offices seeking to protect part of their wealth against looming financial uncertainties.

Watch now to learn more about how family offices can prepare for the power shift from West to East.

The Fatal Effects of Debt: Rising Gold & Silver

It was always inevitable that the GOLD price would reach $ 1 million!

So, now we are there.

The price for a 400-ounce gold bar has now reached $ 1 million.

It reached $ 1 million on August 16, 2024 – 53 years and 1 day after the US (Nixon) permanently said farewell to the dollar as a store of value by closing the Gold Window.

Let’s just recap what has happened to the cost of a 400 oz gold bar since 1971:

So, has the value of gold gone up 71x since 1971? (71x$14,000=$1M)

No, of course not. The dollar has collapsed by 98.5%.

Or, if we look at it differently:

That is a loss of purchasing power of 98.5% over the 53 years between 1971 and 2024.

Just think about it: If you put $14,000 in the bank in 1971 and earned, say 4% on average, that would be $116,000 today. A far cry from the $ 1 million that the same amount invested in gold – REAL MONEY – would be worth.

So, what does closing the gold window actually mean?

It simply means that after August 15, 1971, the dollar could no longer be converted to gold by any investor, private or sovereign.

FOLLY OF THE WEST

Before we look at the fatal consequences, let’s just look at the Folly of the West.

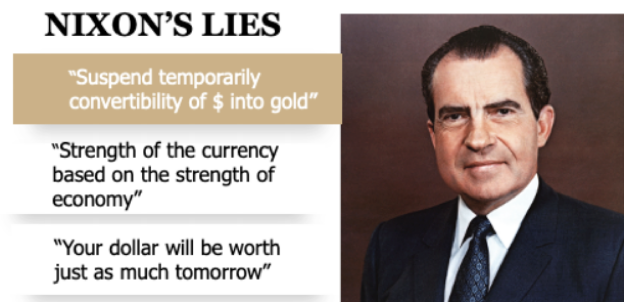

First, we see the West’s prediction of the consequences as interpreted by Nixon on 15 August 1971:

WISDOM OF THE EAST

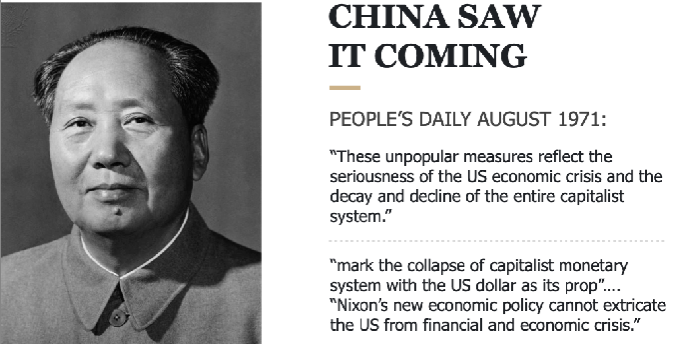

And below follows the Wisdom of the East (Mao) as written by the official Government body, the People’s Daily:

So the US (Nixon) said, “Your dollar will be worth as much tomorrow”.

And China said, “These measures mark the collapse of the capitalist monetary system with the US dollar as its prop”.

So the West is only interested in instant gratification, issuing debt and thus buying short-term prosperity and votes, leading to “decay and decline”.

DECAY AND DECLINE OF THE WEST

So, let’s look at the “decay and decline” of the US and the West reflected perfectly in the fall of the US dollar.

Here is the performance of the dollar since August 1971:

Nixon said in 1971 that the “strength of the currency is based on the strength of the economy”.

Hmmm…

A 98.5% fall in the value of the dollar (in real terms, against gold) since 1971 can hardly be called “worth the same”.

Measuring the dollar against gold is the only correct method to determine the real purchasing power of the dollar. To measure currencies against each other serves no purpose. All that tells us is which currency will win the race to the bottom.

What will destroy the dollar and all Western currencies, will be the exponential growth of debt led by the US.

US ROAD TO PERDITION

The table below shows the inevitable road to perdition that the US dollar’s is now on:

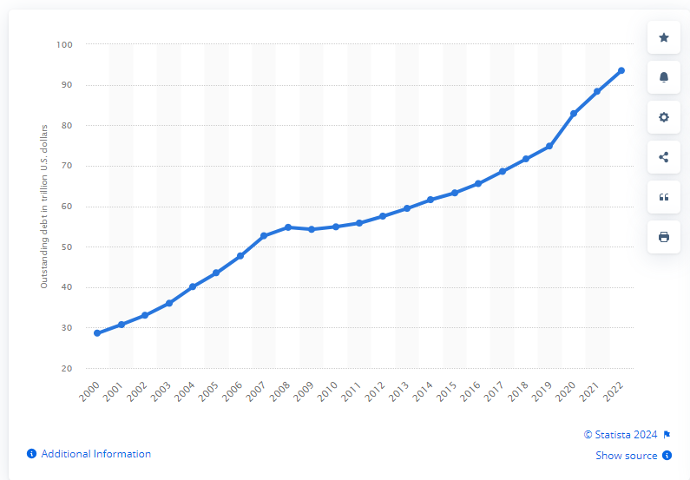

With debt up 82x since Nixon closed the gold window in 1971 and GDP only up 26x, it is not difficult to see that the US engine is running on empty.

Just look at the super-exponential phase of debt since 2009, the year that the Great Financial Crisis was supposed to have ended. Since 2009, US debt has trebled, while GDP has only doubled.

But it has, of course, not ended at all.

More and more debt is required to create growth. Consequently, since 1971, US debt to GDP has gone from 39% to 122%.

Over 90% of Debt to GDP is considered junk, and 122% is Banana Republic territory.

But it won’t stop there.

A pure statistical extrapolation of the debt trend tells us that by 2036, the debt will be $100 trillion.

I have explained many times how fast the exponents’ phase of a dot crisis and currency collapse develops: “THE REAL MOVE IN GOLD & SILVER IS YET TO START”

The conclusion is simple.

The US government, together with all Western governments, are destroying the fabric of society by constantly spending more than they earn. Even the word “earn” is deceitful.

Governments don’t earn anything. They will just wilfully levy taxes and other charges against the people without their consent. After decades of suffering from high taxes, people are entirely “socialised” and expect the government to pay for everything.

Do the people of the US and Europe want to send $100s of billions to Ukraine? Do they want to pay similar amounts for the immigrants, many of whom get preferential treatment when it comes to housing, social security, hospital treatments, etc?

Well, nobody knows what the people want since they are never asked. But I doubt they would approve this spending if they had a say.

WHERE IS THE MONEY COMING FROM?

Nor does anyone ask where all this money is coming from. It definitely hasn’t been earned by the government.

The government doesn’t even have the money it is paying out. It just creates money out of thin air and creates ever-increasing deficits that lead to exponentially growing debts.

The people are pacified since they believe that the government is paying. Nobody understands that all this debt is owed by the people.

CONSEQUENCES

But they can, of course, never afford to repay it in taxes and other levies. Nobody understands that the consequences will be the value of money dropping catastrophically, poverty, famine, shortages of many items, homelessness, social unrest and probably war.

And once a country reaches that stage, the government is powerless. They are bankrupt and have no funds to assist anyone. The risk of anarchy is high since the government will have few tools to maintain law and order.

So, how can we predict such a dark period? It requires no predictive powers but just a study of history. Please read “THE DARK YEARS ARE HERE II”, a 2018 update of my 2009 article. It was even more important today than it was in 2018.

Just take the US government’s mismanagement of the country’s finances as the inevitable journey to serfdom. With a handful of exceptional years, the US has increased the Federal debt since the early 1930s. Even during the so-called “Clinton surplus years”, the debt went up. So, the surpluses were fake.

AN ILLUSORY FANTASY GAME

As current growth is derived from creating debt with ZERO intrinsic value, the growth is only illusory.

The world will soon understand that it is all a fantasy game, with trillions of unreal assets created by even more trillions and quadrillions of debt (including derivatives) made out of thin air.

In the next few years, the world will realise that debt has zero value since neither sovereigns, corporations, or individuals can repay their debt or even afford the interest.

Remember that the official global debt is around $350 trillion plus a big part of the derivative time bomb which could be into the quadrillions. Much of that will transition to debt.

As the debt implodes, so will all the bubble asset values.

The billionaires will lose all or most of their zeros (of their wealth), and so will the trillion-dollar companies.

The wealth transfer will be shocking. The wealthy have the most to lose. Some have been clever and are debt-free. But most are leveraged and will lose everything.

Everyone will suffer, rich or poor. However, the poor and ordinary people have the most to lose with no reserves, no safety net, and a bankrupt government that can’t help them.

The few who have understood that future prosperity comes from natural resources will obviously be in a better position. Technology will also be a growth area, but it is currently overvalued, as it was in the 1990s.

The asset-rich BRICS countries will be major beneficiaries, whilst the debt-infested West will experience the end of a major era. These are all major shifts that will evolve over decades and even centuries.

But the beginning could be very rapid and most probably violent for the whole world, West and East…

So many factors come into play.

Economic decline, financial collapse, wars, political and social unrest, poverty, food shortages, as well as mass migration led to major cultural shifts.

So how can we be so confident that all this will take place?

Well, that is what history tells us with great certainty. History never lies, and it never fails us as lying politicians do, without exception, for their political survival.

But history doesn’t tell us when, of course. So, the exact timing is always unknown.

We also know that the world has never experienced a global debt bubble of such magnitude.

So, the timing is almost irrelevant.

It’s important to understand that the risk is now higher globally than at any point in history.

DOLLAR, GOLD AND EXCHANGE CONTROLS

As I have outlined in this article, a continued and steep dollar decline in the coming years is a virtual certainty.

As there has been no gold window to close since 1971, the US government is almost certain to implement foreign exchange controls as the dollar falls. I wouldn’t be surprised if it comes relatively soon, but the timing is irrelevant. The risk is here today and now is the time to prepare for it.

Thus, for Americans, it would be an advantage to have funds or assets outside of the US as soon as possible. Physical gold and silver are clearly the best assets to hold as they also protect against the dollar debasement.

Switzerland and Singapore are obvious places to hold gold. Switzerland has a strong currency and a very sound economy. Exchange controls would be unlikely here.

What is extremely important is not to hold your precious metals through a US company or other entity, which the US government can order to return the gold or silver from a foreign vault to the US.

Instead, hold your metals through a Swiss or Singaporean company that has no US links.

MOST PEOPLE CAN AFFORD SOME GOLD OR SILVER

For anyone who has savings, big or small, putting them into physical precious metals can make the difference between survival and misery.

Most people can afford to buy a few silver coins every month, and many can afford one or more small gold bars or coins.

With the acceleration of the dollar’s (and other currencies) debasement and shift in Central Bank reserves out of dollars into gold, the revaluation of gold in coming years will be by multiples. As I keep on saying, the real move in the gold and silver hasn’t started yet.

But above all, a harmonious and close circle of family members and friends is crucial to survive the difficult times ahead.

The Fatal Effects of Debt: Rising Gold & Silver

VON GREYERZ Founder, Egon von Greyerz, joins CapitalCosm to discuss current financial risks and the critical differences between short-term investing and long-term wealth preservation.

The interview addresses the following core themes:

– The multi-decade consequences of ending the US gold standard under Nixon in 1971

– The greater importance of preparing for, rather than timing, the inevitable end of the next financial bubble

– The implications behind record-level physical gold stacking by global (mostly eastern) central banks

– Gold’s short and longer-term reactions to political and market dislocations

– The inevitable and historically-confirmed destruction of paper money by debt-broken sovereigns

– Cautious yet positive insights on the silver price going forward

– Egon’s own experience with preserving wealth outside of a fractured banking system

Such insights provide a pathway to understanding today’s risks to better preserve wealth in a dangerously unfolding tomorrow.

The Fatal Effects of Debt: Rising Gold & Silver

In this latest Gold Matters discussion, VON GREYERZ principals Egon von Greyerz and Matthew Piepenburg squarely address the rising symptoms of a financially and politically unstable financial system reaching the end of an openly embarrassing cycle reminiscent of prior cycles, from Ancient Rome to today.

Piepenburg gives an American perspective on the dispositive evidence of an American crisis, citing the toxic levels of both governmental and consumer debt data. In addition, signals of a looming banking crisis (underwater UST collateral combined with massive credit risks and non-performing loans) and dangerously narrow equity markets suggest far more pain than pleasure ahead for families, citizens and investors.

As von Greyerz reminds, however, the stressors and failures facing the US extend well beyond its borders into Europe and beyond. The EU merely (and wrongly) follows US policies to their own detriment, whether in terms of monetary reactions to Fed policies or foreign policy fiascos, including the backfiring sanctions against Russia. Meanwhile, signs of open political fractures in the UK, France, Germany etc. increasingly suggest that majority rule (i.e. democracy) in Europe has been eclipsed by a patchwork of coalition governments (from London to Paris) which make less and less sense. Instead, this open and sustained level of political mediocrity (from DC to Brussels) is just more evidence of a political and financial system in open decline and at the end of a cycle.

Piepenburg shares similar concerns, and underscores the fact that financial and political disaster is not a looming or pending event, but one taking place in real time—i.e.: Right now. It is often hard, he says, to see history playing out when one is right in the middle of it, but the changes we are seeing in markets, banking, inflation and, of course, currencies are “frog boiling” us toward clear financial decline.

This currency “frog boil”, of course, has massive implications (from both math and history) for owning physical gold outside a precarious banking system and held privately in one’s own name. Given that gold is not only real money, but “nature’s money,” the case for something natural rather than man-made makes historical and common sense, as it is the one asset that man can not create (or distort) at will.

The Fatal Effects of Debt: Rising Gold & Silver

In his latest conversation with the David Lin, VON GREYERZ partner, Matthew Piepenburg, addresses US political volatility (post-assassination attempt, pre-Biden drop out) and social unrest, with special attention on their near and longer-term implications for US and global markets.

Turning to US political headlines, Piepenburg addresses the history of markets under Democratic and Republican administrations in general before specifically addressing expected forms of market support (from regulatory, M&A, taxation, tech, trade and rate signals) under a potential Trump White House. Although prior evidence and even projected risk-on expectations are near-term possibilities under a Trump administration, Piepenburg warns that longer-term signals (narrow, over-valued equities and unsustainable debt and rate markets) portend far greater mean-reversion risk than reward heading into election season in late 2024 and the year to follow.

Although recorded prior to Biden dropping out of the next election, Piepenburg realistically confessed that “Trump is looking pretty hard to beat.” As far as Biden goes, this issue is now settled.

That said, Piepenburg bluntly reminds that regardless of who wins in 2024, no one—from “Papa Smurf to Albert Einstein”- can solve or prevent the debt-driven iceberg already scraping the bow of the US markets and economy. Lin asked of the increasing risk of “civil war” in the already divided-states. According to Piepenburg, the divisions are (and have been) openly apparent; there are no easy answers. We can, however, foresee that increasing centralization is the more real and present danger as inflationary realities undermine the political, social and financial stability of a nation in open decline.

Beneath these inflationary (and hence currency-destroying) currents lies the undeniable debt crisis facing the US in particular and the world in general. The additional de-dollarization forces add further pressures against the USD (and fiat money in general) and point directly to the undeniable case for (and role of) physical gold as an essential allocation.

The Fatal Effects of Debt: Rising Gold & Silver

The failure of Western financial structures, including the currency system, is in its final stages.

Sadly, no one takes any notice – YET!

Global debt has already tripled this century, with the dollar and most currencies having lost 98.5% of their purchasing power since 1971.

Experts say the US can never default as they have a printing press. Whatever lies the US and European governments come up with, a 98.5% fall in the value of a nation’s currency is an absolute default. All other explanations are just noise.

With global debt at around $350 trillion and global GDP $100 trillion, the Global Debt to GDP is 350%.

Over 100% Debt to GDP is unsustainable and cannot be financed over the longer term.

And 350% Debt to GDP is bankruptcy – Banca Rotta.

With financial markets distorted and leveraged to the hilt, global risk today is greater than ever.

There is an obvious path that small and big investors can take to minimise this risk.

The best solution is to create your own Gold Bank that will almost entirely eliminate financial risk and provide instant liquidity. In addition, compared to virtually all other asset classes, it will enhance your wealth substantially in the coming years.

US & EUROPE – TERMINAL ILLNESS

We are not just talking about terminal illness for the US, European and probably Japanese, which are all fatally wounded by debt, deficits and decadence with no chance of recovering in the next few hundred years.

We are also talking about China and many emerging markets with debts, as well as demographic and structural problems, which, even though not incurable, will slow down their economies for many years. And yet, not to the same extent as in the West.

So, are the US and Europe now Banana Republics?

Banana Republic can be described as:

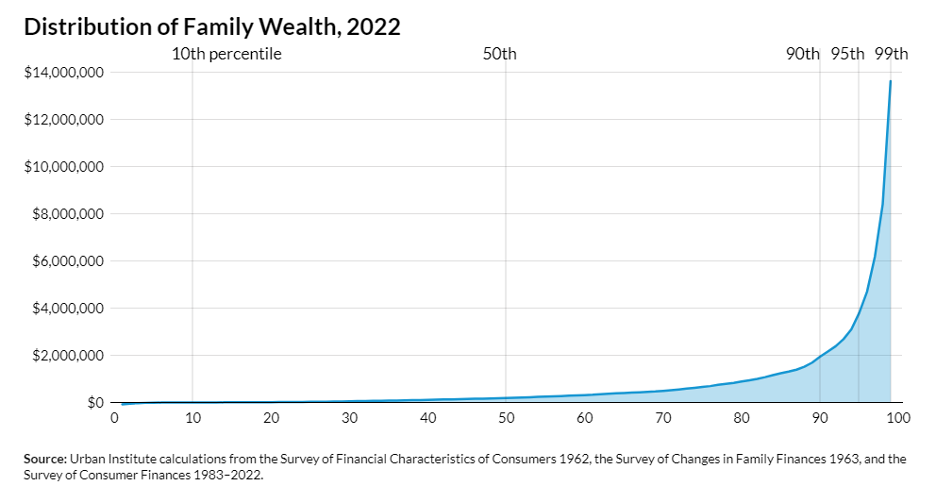

A highly stratified, politically unstable socioeconomic structure, with a small ruling class that controls access to wealth and resources.

That definition certainly fits the US and Europe, with a small elite of 1% owning 1/3 of the total wealth in the US.

Global financial assets are $600 trillion (incl. PNFC – Private Non-Financial Corporations) plus potentially $2+ quadrillion of derivatives, much of which will become debt when counterparties fail.

How can we expect a global value of the output of goods and services (GDP) totalling $100 trillion to support debt of $350 trillion-plus the high risk of derivatives of $2 quadrillion exploding or rather imploding one day?

This is a daisy chain and Ponzi scheme scam all in one.

Print money to inflate markets and then print some more to keep it all going. As history tells us, this can only end in one way.

As Joe Biden finally decided not to stand for re-election, this will have little bearing on America’s insoluble financial problems.

The upcoming US election will not change this risk. Donald Trump, Kamala Harris or someone else cannot stop the avalanche of debt triggered back in 1971 with the closing of the Gold Window. It will reach its maximum force in the next 3-7 years. It could be earlier, but it could take longer. Most of the signs we see tell us that it will be sooner. But as I often say, forecasting is a mug’s game. So, let’s focus on imminent risk rather than if it happens tomorrow or the day after.

NO EMPIRE AND NO CURRENCY SYSTEM HAS SURVIVED

History tells us that no empire has ever survived, nor has any currency system.

So anyone who believes that “it is different this time because …” ignores thousands of years of history.

This is not meant to be sensational – it is based on history, which tells us that, without exception, a debt crisis leads to a currency crisis with inflation, asset and debt implosion, political and geopolitical instability, including social unrest and wars.

Let’s look at the collapse of the Roman Empire, which underwent the same decline as we see today. It doesn’t matter which empire we pick since they all end the same way.

The current US empire with its European “colonies” is more of a financial than a geographical empire. I call Europe “colonies” (tongue in cheek) because whatever the US decides (e.g., attacking Iraq or Libya, FATCA (control of global banks), sanctions or freezing Russian assets, etc.), Europe conforms without any resistance.

The peak of the Roman Empire was around the birth of Jesus. The decline started gradually, and by the time of Marcus Aurelius (161 AD), the Denarius, the Roman silver coin, was already down 25%.

The build-up of debt and the debasement of the currency created the Crisis of the 3rd Century (235- 283 AD). During that period, there were more than 50 emperors, most of them assassinated and some killed in battle. During that period there were also barbarian invasions and migration into the Roman territory. Multiple civil wars and peasant rebellions also occurred, enabling many to grab power illegally or by force.

The financial and economic decline of the empire continued unabated, with more debts and deficits. By the time of Gallienus (260 AD), the Denarius had lost 99.5% of its silver content. At the end of the Crisis of the 3rd Century, the Empire split into three political entities.

ROME’S DECLINE

This gradual decline led to the weakening of central political control, power struggles, budget deficits, increasing debts, corruption, a weakening currency, hyperinflation, higher taxes, plague, as well as a decreasing army not paid enough to deal with great numbers of invading barbarians.

Finally, in 476AD, the Goths (Germanic people), led by Odoacer, captured Rome and deposed Romulus Augustulus. Odoacer became the new ruler.

So, 476AD became the official end of the Roman Empire, although parts of the Eastern Empire still survived.

Looking at the bolded paragraph above, there is virtually no difference between the fall of the Roman Empire and the fall of the US-Western Empire today.

La plus ça change, la plus c’est la même chose. (translation: The more it changes, the more it stays the same)

There is actually not one single word or description that differs. The Plague, for example, is today’s COVID-19, while the Barbarians in ancient times were people who did not belong to one of the great civilisations (Greek, Roman, Christian).

In the same way today, the migrants are coming in great numbers from other non-Western cultures. And since there is no political will to stop the migration, the numbers are more likely to increase than decline. Thus, it’s obvious, the US and Europe will look very different in 50-100 years.

So, it is similar today, and all major Empires end in the same fashion. How the US-Western Empire will end is already described in old history books. But sadly, no politician ever studies history, which, if they did, they would see the description of their own destiny.

COMING DESTRUCTION OF INVESTORS’ ASSETS

There are several major risks in the next few years that can destroy investors’ assets, for example:

- Systemic failure of the financial system

- Bank collapses

- Custodian failure

- Derivatives failure

- Currency debasement

- Political/Social risk – civil unrest

- Geopolitical risk – war

It is no surprise that the final stages of empires, such as the Han, Roman, Mongol, Ottoman, Spanish and British, always included all the above ingredients.

Let us start with currency debasement.

Most people don’t understand what fiat (paper) money stands for.

It is not your money that always has a guaranteed value. History has clearly proven that no fiat money has ever survived – WITHOUT FAIL!

All currencies have gone to ZERO through the irresponsible and incompetent management of the economy.

Voltaire said it already in 1729:

Paper money eventually returns to its intrinsic value – ZERO.

Or as JP Morgan testified before Congress in 1912:

Gold is money – Everything else is credit.

A bank credit balance in your bank account is just a promise by the bank to pay.

The money you deposited in the bank is not your money.

The only right you have is a claim on the bank. You are just a general creditor of the bank.

However, the bank has leveraged your deposit 10x or more. So, for your deposit to be repaid, all debtors of that bank (clients who have borrowed money) must repay their loans.

The banking system is like a Ponzi scheme. It depends on a never-ending stream of new deposits or printed money.

With derivatives and other synthetic instruments, the real leverage of some banks can be 30x or more.

Yes, the government can save the depositors of a few small banks, but there after only massive money printing can save them, leading to a total debasement of the currency once again.

You take insurance for the potential of your house burning down.

When you insure your house, you don’t expect it to burn down, but if it does, fire insurance becomes critical.

The same goes for your money. You don’t expect the financial system to collapse, but if it does, you will lose all your money, whether it is deposits or securities that are held in custody in the system.

Yes, securities held in custody by a financial institution should, in theory, be yours. However, as we saw in 2008, banks used customer assets as security for their trading positions.

The other danger with securities is that a big percentage is actually not in financial assets such as stocks or bonds, but instead in synthetic securities or derivatives with no underlying real investment.

GOLD BANK

Back in 2002, I created my own gold bank. That was the same year that in my father of the bride speech, I told all of the guests to buy physical gold. Gold was then only $300.

As global debt has grown more than 3x since 2002 to $350 trillion, risk has grown exponentially, including the explosion in derivatives.

The best way to protect your financial assets is to create your own gold bank.

It is incredibly simple.

You acquire gold for the percentage of your financial assets that you find appropriate.

Our clients hold up to 25% of their financial assets in physical gold and silver. Many of us have a much higher percentage.

The metals should be stored in a professionally managed ultra-secure vault in a safe jurisdiction. Preferably outside your country of residence, enabling you to “flee” to your gold in an emergency. Personally, I prefer Switzerland and Singapore.

This also makes it more difficult for your government to seize your gold like the US did in 1933.

Then, whenever you need liquidity, the vaulting company (like VON GREYERZ) that organises the storage for you will also provide liquidity. We also ship clients’ gold from anywhere in the world to our vaults in Switzerland or Singapore.

Remember that gold is instantly liquid, so you can have the funds transferred to your bank account within a few days.

It is advisable to keep at least three months’ spending in your bank account plus a small reserve. If you have no other income, you can sell sufficient gold every three months.

Gold and silver then become your reserve asset.

More importantly, gold is no one else’s liability.

Just to remind investors that since the year 2000, gold is up 8x or 700%.

More importantly, gold has outperformed all major asset classes in this century.

The compound annual return for gold since 2000 is 9.6%, and for the S&P with dividends reinvested, it is 7.5%.

With the bubble in stocks bound to burst at some point, whether it is soon or in the next few years, I wouldn’t be surprised to see the Dow vs Gold ratio decline by 75-95%.

Stocks can never be a reserve asset or insurance for preserving wealth.

Only physical gold fulfils that role.

Gold is nature’s money

Gold is real wealth

Gold is wealth preservation

The Fatal Effects of Debt: Rising Gold & Silver

The rise in the gold price this spring was undoubtedly spectacular. In just a few weeks, the gold price rose by almost 20% in USD terms, with a gain of 21.7% for the first half of the year alone. In EUR terms, gold increased 16.4% in the year’s first six months.

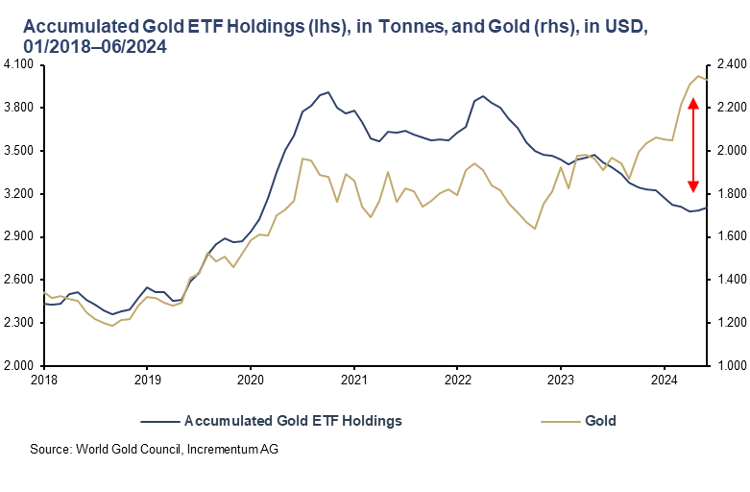

The showdown in the gold price we predicted in the In Gold We Trust Report 2023 has passed. What is remarkable is that all of this is happening in an environment where, according to the previous playbook, the gold price should have fallen. The collapse of the correlation between the gold price and actual interest rates raises many questions. In the old paradigm, it was unthinkable that the gold price would trend firmer during sharply rising real interest rates. Gold and gold investors are now entering terra incognita.

Traditional correlations are breaking down

In addition to the high negative correlation between the gold price and US actual interest rates, the once strong link between investor demand from the West and the gold price has dissolved in recent quarters. Given gold’s record run, one would have expected ETFs to register record inflows. First, things turn out differently, and second, they unfold contrary to expectations: from April 2022 to June 2024, there was a net outflow of almost 780 tons or 20% from gold ETFs. The old gold playbook shows gold should be around USD 1,700, given the fall in ETF holdings.

Consequently, a vital element of the new gold playbook is that the Western financial investor is no longer the marginal buyer or seller of gold. The significant demand from central banks and private Asian investors is the main reason why the price of gold has thrived even in an environment of rising real interest rates.

A reduction in gold ETF holdings when actual interest rates rise is undoubtedly a rational decision from the point of view of the players in the West, provided they assume that:

- They are not exposed to increased counterparty risks and, therefore, do not need a default-proof asset;

- Actual interest rates will remain positive in the future, and a second wave of inflation will not occur;

- They suffer opportunity costs if they underweight traditional asset classes such as equities and bonds or even “concrete gold” (=real estate) at the expense of gold.

In our opinion, all three assumptions should be questioned – and that sooner rather than later.

The marginal actor in the gold market moves from West to East

The global East, on the other hand, is becoming increasingly important. This is hardly surprising given that the West’s share of global GDP continues to decline due to weakening growth and an ageing population.

In addition, many Asian countries have a historical affinity for gold (India and the Gulf States, mainly, are worth mentioning). Still, China is increasingly discovering its preference for gold.

In 2023, demand for gold jewellery totalled 2,092 tonnes. China accounted for 630 tonnes, India for 562 tonnes, and the Middle East for 171 tonnes. Together, these amounts to almost two-thirds of the total demand. Of the nearly 1,200 tonnes of gold bars and coins that were in demand in 2023, almost half went to China (279 tonnes), India (185 tonnes), and the Middle East (114 tonnes).

Gold is also benefiting from other developments. China is discovering gold as an alternative retirement provision precisely because of the structural problems in the real estate market. Gold in beans is currently trendy, especially among China’s youth. The strong demand for gold from Asian central banks is another pillar of this epochal change. These changes are also why certainties, such as the close correlation between the gold price and actual US interest rates, are disintegrating.

Central banks are becoming increasingly crucial for gold demand

Central bank demand accelerated significantly in the wake of the freezing of Russian currency reserves immediately after the Ukraine war outbreak. As a result, central bank demand for gold reached a new record high of over 1,000 tons in 2022, which was only narrowly missed in 2023. Q1/2024 was then the strongest first quarter since records began. It is, therefore, hardly surprising that the share of central bank demand in total gold demand has increased significantly: from 2011 to 2021, the share of central banks fluctuated around the 10% mark, whereas in 2022 and 2023, the share amounted to almost 25%.

The profound distortions triggered by the sanctioning of Russian currency reserves will keep central bank demand for gold high for some time. This is also shown by the recently published World Gold Survey 2024 by the World Gold Council (WGC). According to the survey, 70 central banks assume that central bank gold reserves will continue to grow. Geopolitical instability is the third most crucial reason for central banks’ investment decisions. And geopolitical instability will undoubtedly be with us for some time to come.

The debt bomb is ticking – also increasingly in the West

We are entering a new era, particularly evident from developments in the countries with the highest total debt (government, non-financial corporations & households).

Japan occupies the inglorious top spot with just over 400%. The dramatic fall in the value of the Japanese yen -12.3% in the first half of 2024, -32.6% in the past five years and even around 50% compared to the almost all-time high in 2012 – is a symptom of Japan’s increasing imbalance. Accordingly, the economic thermometer in the form of gold prices in the Japanese yen is beating intensely. At the end of June, the gold price had risen by 28.7% since the beginning of the year. Since 2023, it has increased by just over 50% and around 165% since 2019.

France is in second place worldwide and first place in Europe with 330%, making it a much bigger problem child than Italy, which is much maligned in the media. Italy’s total debt is around 80 percentage points lower. The unclear political situation following the surprising election victory of the far-left New Popular Front in the new elections to the National Assembly unexpectedly called by the French President will further exacerbate France’s debt situation.

In addition to the continued, highly loose fiscal policy, the US is in an increasingly tricky domestic political situation just four months before the presidential elections, following the disastrous performance of US President Joe Biden in his first TV debate with his predecessor and challenger – Donald Trump. This will also make solving the US debt problem more difficult, especially as Donald Trump, who is leading in the polls, described himself as the “king of debt” a few years ago. An easing of the situation is, therefore, not to be expected. On the contrary, the next major debt crisis could affect some leading industrialized nations.

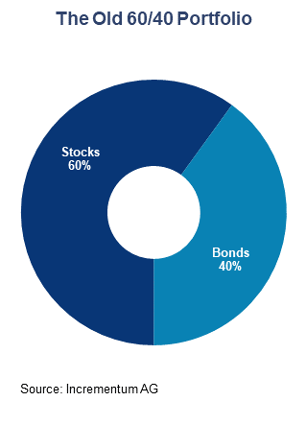

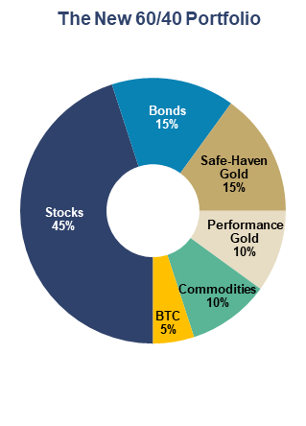

The new 60/40 portfolio

The investment environment for gold investors has fundamentally changed. The reorganization of the global economic and political order, the dominant influence of emerging markets on the gold market, the reaching of the limits of debt sustainability, and possibly multiple waves of inflation are causing gold to appreciate. It is, therefore, also time to adapt the traditional 60/40 portfolio to these new realities.

Aside from gold, we also see other alternative asset classes, such as commodities and Bitcoin, as beneficiaries of the new gold playbook. Therefore, we are convinced these two asset classes are indispensable in preparing a portfolio for the new playbook. A suitable portfolio comprises 60% equities and bonds + 40% alternative asset classes.

Our interpretation of the new 60/40 portfolio for long-term investors provides for the following allocation:

| Stocks | 45% |

| Bonds | 15% |

| Stocks + Bonds | 60% |

| Safe-haven gold | 15% |

| Performance gold | 10% |

| Commodities | 10% |

| Bitcoin | 5% |

| Alternative Assets | 40% |

Source: Incrementum AG

This marks a clear departure from traditional 60/40 portfolios. Of course, this positioning is not a rule set in stone but rather a guideline based on current market conditions and will evolve with time and changes in the currency environment. The new playbook applies as long as we are in a period of currency instability characterized by vast debt burdens and above-average inflation volatility. In other words, a higher proportion of hard currencies seems necessary until we return to an environment with a stable hard currency – be it a sovereign hard currency or a gold/Bitcoin standard.

Conclusion

We are currently witnessing a fundamental transformation. Old certainties are fading; established strategies are failing. The willingness to question established patterns of thought and break new ground often requires courage, but for those who recognize the signs of the times and dare to change, implementing the new gold playbook opens the door to growth and stability.

In principle, the new gold playbook suggests that the portfolio’s allocation to alternative asset classes should be higher to align appropriately with changes in the investment environment.

The Fatal Effects of Debt: Rising Gold & Silver

In this compelling conversation with Tom Bodrovics of Palisades Gold, VON GREYERZ partner, Matthew Piepenburg, bluntly dissects the empirical realities from the main stream fantasies regarding the risk-asset and economic narratives making the current headlines. He touches upon risk asset facts, the deep implications of debt-to-GDP levels globally, the real rather than sensational consequences of ongoing de-dollarization and the now undeniable fact that gold is replacing the UST as a global reserve asset.

The conversation opens with a candid assessment of the common denominator (and common sense) reality of unsustainable debt and its now obvious ripple effects on all the current narratives and debates regarding stocks, bonds, currencies, deflation/inflation and sound vs. fiat money, all of which culminate in a realistic and sober discussion of gold.

As Piepenburg reminds, the outsized risks in credit and equity markets (from scary “private credit pools” and “low-yield” junk bonds to dangerously narrow/tech-meme-driven stock indexes) can no longer be relegated to the cynicism of “gold bug” thinking, as even the finest minds in the stock and bond markets are drawing the same clear conclusions.

Piepenburg makes an equally blunt case for the risks facing paper money in a global backdrop of open currency debasement. He shares his views on how even the “smartest money” in the room continues to deny or avoid these realities by measuring their wealth in currencies (melting like ice cubes) and chasing yield in increasingly more dangerous corners of the credit and equity markets.

Toward this end, Piepenburg gives his views on family office dynamics and allocations derived from direct managerial experience and a host of recent conversations around the world with many principals in this space. Their relatively low allocations to physical gold in a world otherwise replete with debt, risk-asset and currency risk is fascinating yet otherwise understandable given how fundamentally misunderstood gold remains as an asset class.

Piepenburg holds nothing back in explaining just how and why gold is in fact intentionally misunderstood by many of the most sophisticated investors.

The Fatal Effects of Debt: Rising Gold & Silver

With the collapse of the Western financial and political systems now happening before our eyes, wealth preservation takes on a totally different meaning.

As political parties, currencies, stocks, bonds and other bubble assets fall, the indisputable winners will be gold and silver.

The world and in particular the West is now entering a period of political and social unrest that signifies the end of a major era.

It is the consequence of deficit spending, major debt expansion, currency debasement, inflation leading to political and economic turmoil and misery.

Politics in the West are already a total mess. Whatever party gets into power, the deficit spending will accelerate, probably exponentially. That is certain in the UK with the new Labour led government, in France with a motley coalition government and in the US where one candidate might end up in jail (or become president) and the other one is too senile to stand for election. In either case, the US will have an insoluble debt crisis.

What a mess!

Financial markets will, in coming months and years, reflect this mess.

Geopolitical risk is of course also significant. A major war is a big risk, even nuclear war. But leaders of China, Russia and the US are of course aware of the finality of nuclear war and only an “accident” is likely to start one. But there are so many new ways of modern warfare as drones become so much more sophisticated.

Even more effective are Cyberwars. China, Russia and the US all have the ability to immobilise computer, electronic and electrical systems to the extent that major parts of countries and even the world would be totally paralysed. In today’s sophisticated world, virtually nothing would function without computer systems – financial markets including banks, travel by any means, shipping, supply of goods including food, telecommunications, internet etc, etc.

It is quite frightening how in the last 50-60 years the world has become totally dependent on electrical and electronic systems without which we could quickly go back to the Stone Age.

WARS WITH STICKS AND STONES

As Einstein said:

Sadly, certain humans in power have an innate instinct to self-destruct so Einstein’s prediction is not so unrealistic.

Also, the world is now for the first time in history in possession of weapons such as cyber, drones and nuclear that can all virtually end life on earth.

POLITICAL TURMOIL

Anyone elected to President, Prime Minister or Chancellor in the West in the next few years is likely to at best stay in the position for a full term but more likely to be thrown out before that.

For example, the newly elected UK Prime Minister Keir Starmer won an overwhelming majority in parliament with only 33% of the vote. Even more remarkable is that 80% of all people eligible to vote did not support him.

Well, a day is a very long time in politics. Five years ago, Labour lost so big to the conservatives that no one thought that Labour would come back in the next decade or two.

The US will have a similar problem after the November election. As it looks now Trump will win although a lot can happen before then. But even if Trump wins, he will probably have a thin majority. So around half of the people will be against him. And if a Democrat would win (definitely Biden will not stand) the Trump supporters would never accept the result.

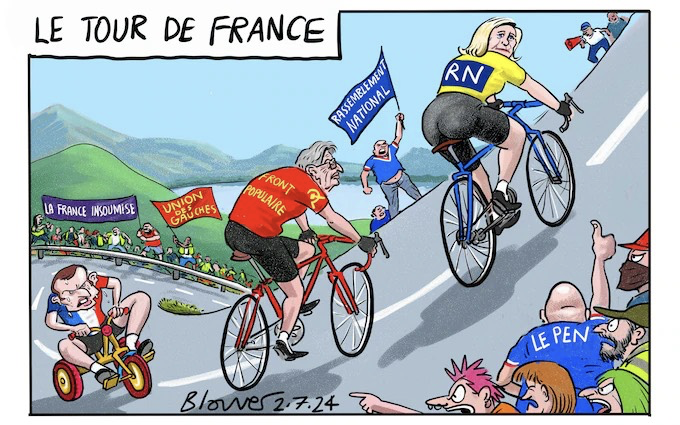

And in France Macron suffered a devastating defeat in the first round. Macron (on the tricycle below) is now a lame duck president. But he is still arrogantly behaving like the French Marshall Foch in the Battle of the Marne in WW I who famously said: “My centre is giving way, my right is retreating; situation excellent, I am attacking!” But Macron is certainly no Marshall Foch.

Still through skilful political manoeuvring, Macron might succeed in being part of a new coalition government with feeble support both from the right and the left.

So, the order in the caricature below from the first week has now reversed although Le Pen’s National Rally is the biggest party.

A WEEK IS A LONG TIME IN POLITICS

Yes, a week is a long time in politics as desperate leaders cling on to power. By the time France holds the presidential election, Le Pen now has a bigger chance of winning. But it is not unlikely that the coalition collapses long before then.

What is important to understand is that new governments are seldom voted in. Instead, it is the sitting government which is voted out. The Brits had had enough of the Conservatives, the French hate Macron, the Germans don’t respect Scholz and the US people are in the unenviable position to choose between two octogenarians (or a new democratic candidate), neither of which is respected by the rest of the world.

Historically these political upheavals always happen at the end of an era whether it was Rome, France, Ottoman or the British to mention a few.

Currently we are seeing the fall of the US empire which is financial rather than territorial. Most European governments are slaves or more appropriately lapdogs under the US might and follow virtually all US dictates whether they are financial like FATCA (Foreign Account Tax Compliance Act) or political like freezing and confiscating Russian assets.

But as the US lead debt bubble bursts, their financial and military superiority will rapidly evaporate.

WITHOUT WEALTH PRESERVATION THERE WILL BE WEALTH DESTRUCTION

For 25 years I have stood on a soap box, advising investors about the importance of wealth preservation in the form of physical gold. During that time, gold as a share of world financial assets has stayed at 0.5% in spite of the fact that gold has outperformed most asset classes including the S&P 500 with dividends reinvested.

Between 2000 and today, the S&P, including reinvested dividends, has returned 7.7% per annum whilst gold has returned 9.2% per year or 8X.

As the world approaches the end of an era, it is fascinating to watch the (un-)awareness among fellow investors.

Having recently spent a couple of days at a family office conference and given a speech on wealth preservation and gold, it is discouraging to observe the total lack of fear and or awareness of risk.

More wealth has been accumulated by the average investor than ever in history. Most investors believe that they are masters of the universe and that their investment trees grow to heaven.

For these investors wealth preservation means spreading risk between a number of investment classes such as stocks, bonds, private equity, property etc.

A typical spread for a Family office is: Stocks 32%, bonds 18%, private equity 18%, property 10%, cash 10%, hedge funds 6% plus a total of 3% in gold, precious metals, art, commodities and antiques.

It could be argued that up to 80% of the above asset classes are correlated since they are affected by credit expansion or money printing. Cash is also correlated as it declines in real terms (measured in gold), the more money supply expands.

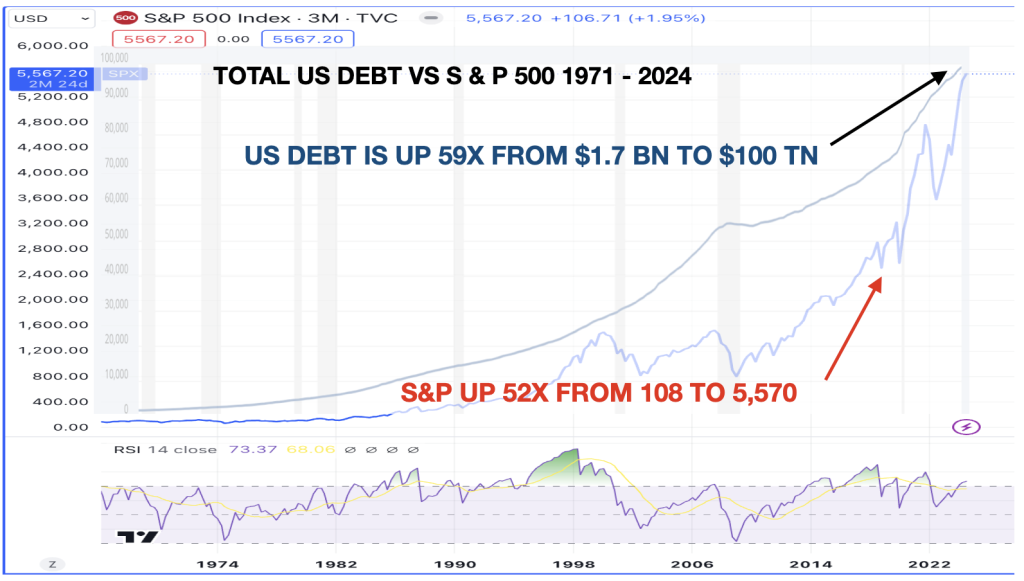

US DEBT UP 59X SINCE THE GOLD WINDOW WAS CLOSED

The graph below shows US total debt going from $1.7 billion in 1971 to $100 trillion today.

As the graph shows, the stock market needs a continuous injection of the debt drug to function and grow.

This is how US successive governments buy votes. Just expand credit to artificially inflate stocks. It is amazing how far you can get in a successful Ponzi scheme before investors discover that the whole market rests on quicksand. But it won’t be long now.

GOLD’S INEVITABLE RISE

A simple method for measuring the massive wealth destruction and transformation that especially the West will experience in coming years is the DOW – GOLD ratio.

Back in early 1980 this ratio reached 1 for 1. Thus, Gold was $850 and the Dow index 850. The long term trend line now targets a ratio of 0.5 for 1.

As the graph shows, that could be gold $10,000 Dow 5,000 or it could be gold $ 20,000 and Dow 10,000.

As we enter the golden era with BRICS countries increasing their purchases continuously and central banks selling US treasuries to buy gold.

No country and no central bank will in future hold dollars as a reserve asset.

Physical gold is the only proper reserve asset, just as it has been throughout history.

Also, the total of US held gold has on average been 40% of US treasuries outstanding.

Today it is only 7%.

If gold were to reach the average level it needs to be revalued 6x at least – a gold price of $16,000

And if gold were to reach the 1979 – 80 level of 140% gold need to be revalued 19x to over $40,000.

Silver could move twice as fast.

These are obviously not forecasts but the consequence of gold returning as a reserve asset and also to historical norms.

But investors should not focus on potential targets for gold or silver.

Instead, just think of gold as financial life insurance which just as throughout history will at least preserve investors’ assets but most probably also enhance them.

The only question is what percentage of financial assets to hold in gold.

In my view 20% is a minimum but bearing in mind the magnitude of the coming crisis, 50% or more might be the cheapest insurance that investors can buy.

Remember to only hold physical gold and silver stored in the most secure vaults and the safest jurisdictions.

The Fatal Effects of Debt: Rising Gold & Silver

In this extensive interview with Adam Taggart of Thoughtful Money, VON GREYERZ partner, Matthew Piepenburg, addresses a wide range of market forces impacting investors in an almost surreal 2024 of rate tensions, credit vulnerabilities, currency (USD) shifts and geopolitical unknowns. The interview includes a “post-script” analysis of Piepenburg’s observations by two independent portfolio managers worthy of careful attention.

Piepenburg is concerned by an almost “over-confidence” in gold, which the cynical see as “gold-bug book-talking” rather than common sense conviction. That is, every vertical–from credit, equity, recession, inflation and historical indicators–all objectively and plainly point toward precious metals entering the early chapters of an historical reckoning and bull market. This is largely due to unprecedented debt levels which will require increasing currency debasement to monetize the same. In short, and for nations like the US (and its dollar): It’s inflate or die.

As for equity markets, Piepenburg is concerned by their narrow leadership and an S&P whose charts look dangerously familiar to prior bubble/burst cycles like the NASDAQ of 2000. Although he recognizes and addresses the case for further, blow-off, highs, he feels far more concern for mean-reversion risks which outweigh the potential rewards of near-term gains, all of which, if achieved, would only occur at the expense of the dollar’s inherent purchasing power.

Piepenburg is equally, if not more concerned, with the “blood sport” of the US bond market, from corporate to sovereign credits, none of which’s yields are beating actual rather than deliberately mis-reported inflation. The risks in private credit pools and private equity “valuations” are especially alarming yet dangerously overlooked by the majority of yield-desperate yet risk-blind investors. This is followed by a blunt discussion on inflation and recession realities which Main Street feels far more honestly than Wall Street “reports.”

Of course, the key risk is currency debasement, the evidence of which is everywhere but deliberately ignored by the consensus-think banking and portfolio advisory circles. Piepenburg and Taggart discuss the West’s denial of these open risks in contrast to the views Piepenburg has observed among Eastern investors. He sees de-dollarization not as a BRICS “Plan B” but a patiently practiced “Plan A” to slowly but steadily trade outside the USD and net-settle in gold. This is not fable but ignored fact, as clearly evidenced by Eastern central banks stacking physical gold and dumping USTs.

Piepenburg’s observations are subsequently (and independently) reviewed by the portfolio managers at New Harbor Financial for further perspective.

The Fatal Effects of Debt: Rising Gold & Silver

I spend a lot of time tracking the ripple effects of embarrassing and unsustainable debt levels on our credit markets, rate markets, equity bubbles, inflation metrics and, of course, the daily-debasement of our currency’s inherent purchasing power.

Inevitably, I round that all up with the role precious metals play in insuring against the same.

But there’s more to debt than gold and other financial conversations.

We All Cherish Our Children’s Future

Global and national debt forces have a ripple effect on far more than portfolio returns; they affect our kids.

For anyone blessed to parent a child, there is no greater love, no greater joy nor any greater vulnerability and source for endless concern.

This is intuitive, axiomatic and universal. As John Kennedy said (hauntingly) just weeks before his own death in 1963:

“For, in the final analysis, our most basic link is that we all inhabit this small planet. We all breathe the same air. We all cherish our children’s future. And we are all mortal.”

But what does cherishing our children’s future have to do with the current state of the global and financial markets?

Invisible and Visible Forces

Love for family, friends and partners of all stripes (despite its painful lessons, mistakes and contradictions) is the most important yet invisible wealth. As Saint-Exupery’s Little Prince reminds, “the essential is invisible.”

But there are other invisible forces, from politics to inflation, which have a direct bearing on our collective well-being from one generation to the next.

And if we were to pause to reflect on the hard math of unprecedented debt, openly (criminally?) failed monetary policies and a US-lead global economy falling to its knees in deficits and the concomitant currency destruction which always follows, it would seem, at least at an “economic” level, that we and our leadership do not hold a very high regard for, well—our children…

Below, we soberly consider the evidence that the prior generations (including my own) seem to be collectively thinking more of themselves and less of the next generation.

Really?

Passing the Buck and the Bill

When a once-great nation like the U.S. reaches a debt-to-GDP ratio of 120%+, when its national balance sheet has trillions more in unfunded liabilities (210T) than it does assets, and when its own Congressional Budget Office confesses that its social security and Medicare budget will be tapped out by 2030 unless we print more money, we should be concerned about the reckoning—i.e., the bills to pay.

And when the holder of the world reserve currency runs an annual twin (budget and trade) deficit of $3T and counting, or mis-reports actual inflation to achieve a carefully hidden negative real return on its IOUs to inflate its way out of debt on the backs of the working poor, we should not only be concerned about the bills to pay (and who pays them), but also consider the neutered profile of the “bucks” used to pay them.

But perhaps such concerns feel less immediate to the Baby Boomer et al generation who, knowingly or unknowingly, can (via the help of an increasingly geriatric leadership) simply pass this embarrassing tab on to the next generation?

The Club Baller…

If I, for example, wanted to flaunt my status at the nearest “Popinjay Club” by arriving in the latest fashions and fastest car while indulging in the most elaborate and consistent dinner tabs, polo fees and trendiest wine selections, I suppose I’d have the right to spend as I please and flaunt my “success.”

After all, I am a capitalist, and like all capitalists, who doesn’t prefer first-class over economy seats?

But what if I lived this life for years, smiling through every chucker, wine bottle and sports car only to leave this world in my sleep at ripe ol’ age while leaving the entire invoice to my kids?

That is, what if I enjoyed it all, but then made them pay for it? What if I thrived so that they could suffer?

Seems insane, no? Diabolical? Selfish beyond belief? Absolutely grotesque at the micro level.

But here’s the rub: At the macro level, that is precisely what the older generation of American financial “leadership” is now doing to the younger generation.

The Past Thrives, The Future Suffers

As a nation, my generation has thrived–mostly on debt, extend-and-pretend monetary policies, grotesquely (debt-driven) inflated market bubbles, feudalistic rather than capitalistic wealth transfers, and entirely myopic politicos—so that our collective children will be stuck with the bill.

This is not fable but fact, this is not sensational, it’s merely historical.

And as every sober economist or thinker from David Hume, von Mises or even Reinhart and Rogoff to Mark Twain or Ernest Hemingway already knew: A nation which lives on debt for decades of joy leaves the next generation with decades of pain–all in the form of unsustainable expenses paid for with debased paper money.

Any who understand the fantasy of MMT, the open crimes of the US Fed and its various (direct and indirect) forms of “liquidity” (from QE and Operation Twist to the Reverse Repo Markets, Supplementary Leverage Ratios and the Treasury General Account) already knows: We are expanding our debt while weakening our dollar.

And that, folks, is a double whammy for our children and grandchildren.

Enjoying the Punch Bowl, Transferring the Hangover

How we got here is simple.

For generations, we as a nation have been getting drunk (and re-elected) on debt at levels far beyond our national income (as measured by tax receipts or GDP).

In short, prior generations enjoyed the Fed martinis (and even a Bernanke Noble Prize) while the next are left with the hangover and the tab.

And what does this “drunk phase” look like?

Well, drunk is fun, and it makes a nation appear all warm and happy and seemingly care-free. It also makes us a bit greedy, as we keep putting the drinks (fake liquidity) on a credit card whose pains and costs are less noticed so long as the punch bowl is constantly re-filled and the bill ignored.

To help this sink in, let’s add some data to the drama.

Data Point 1: Greed

As for greed, America in particular has had it in spades.

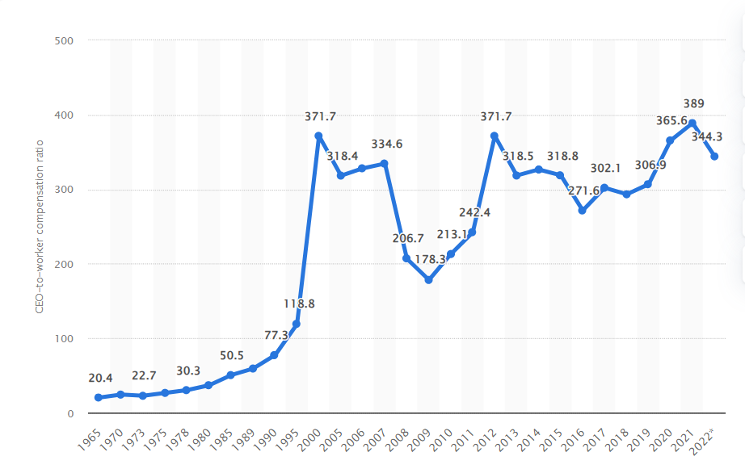

When my grandfather was an executive at Ford long before my birth, the aggregated CEO-to-worker compensation ratio for the largest publicly traded companies was 20-to-1.

Today (Statistica data below) that ratio has leapt to 340-to-1.

And in the case of those oh-so essential (Main-Street-destroying/Sherman and Clayton Act violating) executives at Amazon, the ratio is a staggering 6,474-to-1.

Again, I’m a capitalist, but such wealth inequality and c-suite greed are not the products of a fair playing field and an equal access to credit or genuine, capitalistic competition.

Instead, it’s an open symptom not only of individual psychopathy but of insider advantages based on credit and legal mechanizations that far more resembles a case of modern feudalism than traditional capitalism.

Scott Galloway described it as a generation focused on “increasing compensation while reducing accountability,” as the $34M annual salary of BOEING’s CEO, for example, makes comically apparent.

Data Point 2: Stock Markets

But let’s not forget the oh-so rigged playing field of the US stock market, of which 90% of its actual wealth belongs to the top 10% of the population, most of whom came of age in the aforementioned “greed” generation.

This wealth effect is largely due to a generation of Fed chairs who never let a market dip suffer too long before reflating the same with money literally created out of thin air.

I came of age when Greenspan sold his PhD to the highest bidders on Wall Street, sending rates to the floor and building a credit-driven tech bubble 1.0 which allowed my generation of young dragon-slayers the chance to buy Amazon, Apple and Netflix at single digit share prices.

By contrast, today’s market-tracking youth (the very few who can even afford to speculate after tech sirens) are chasing blow-off tops in a meme-familiar NVIDIA comedy.

Yesterday’s policies, from bank bailouts (Wall Street socialism) to the current (oxymoronic) narrative of “debt-based growth” ($35T and ticking), have led to the greatest wealth inequality and poorest “next gen” population in US history, yet Powell openly denies that the Fed has anything to with this.

Hmmm.

Data Point 3: The Cost of the American Dream

Unfortunately, our kids already feel what Powell’s demographic often ignores.

The last two U.S. generations, for example, are making less money on an inflation adjusted basis, while their cost of living, on everything from unaffordable housing to grotesquely rigged (debt enslaved) tuition goes higher.

My generation saw public university as an option, with an average admission rate of 27% and student debt at 31% of first-year incomes.

Today, however, those public education admission rates have sunk to 6% yet the debt percentage of first-year salaries has skyrocketed to 53%.

This objectively means that less and less young people can access and afford a real education, which Thomas Jefferson understood as the foundation to our nation’s future.

Sadly, most current 20-somethings can’t afford that future and have lost both hope and faith.

In my day, the average house price to first-year income was 4.4x, today it’s 8.5x.

For the first time in American history, 30-year-olds are not doing as well as their parents were at 30, which suggests that the social contract from one generation to the next is now officially broken.

But as Galloway also observes, the results of this broken contract are far more than economic.

He argues that the inequities (or national bar tab) passed to this generation are “incendiary,” creating a collective sense of undeserved “rage and shame” that finds its current, splintered and identity-obsessed expression in everything from MeToo, BLM and LBGTQ to the highest self-harm (especially among women), overdose, teen depression, gun death and suicide rates in our history.

The young are even having statistically more problems finding someone to sleep with, which stems more from depression, tech-induced isolationism and growing tribalism (self-censorship) than from natural biology…

In short, economics do impact society, and when those economics are characterized by the highest debt levels ever recorded in history, the consequences are not theoretical but appallingly real.

Data Point 4: Political Zombies

As for politics, it should be obvious that our so-called leadership is hardly representative of the coming generation, but an openly embarrassing (and power-holding) representation of their own generation (interests).

Galloway, who observed that “DC has become a crossroads between the land of the dead and the golden girls,” calls our top leadership options the “walking (or in Biden’s case, stumbling) dead,” as the following images remind (average age: 80.5)

This is not “agism” but power-ism, and though it is nice to see that senior poverty is down from 17% in the 70’s to less than 8% today, the fact that child poverty has risen to 19% in the same era should make even my generation pause.

But let’s not blame everything on the old faces…

The New “Success” Icons?

The few new faces of the latest generation to make “success headlines” and motivate today’s youth have more than just a little bit of a problem with being financial or social role models…

The damage that “success stories” like Adam Neuman or a socially-troubled Mark Zuckerberg have done to the coming generation are not to be missed.

That censoring and profoundly toxic “compare me” site otherwise known as Facebook, for example is, in my opinion, one of the worst things to infect our country since the 1916 Influenza.

The Wealth Transfer is a Debt Transfer

The foregoing and highly complex financial, political, social and generational concerns all stem from something as otherwise “academic” and straightforward as debt.

Prior generations have been gorging on it, and coming generations will be paying for it—not just in absolute or nominal terms, but far more invisibly yet insidiously in real, inflation-adjusted returns.

This is because central bankers will continue to steadily devalue the inherent purchasing power of their national currency with inevitably rising levels of mouse-clicked, fiat “money,” the ultimate (but largely invisible) insult to our children’s and grandchildren’s generation.

Since 1989, the 70+ group has expanded its share of national Household wealth by 58%, whereas the share of wealth held by those under 40 has fallen by 42% in the same period.

This is not by accident, but policy design. And it’s not because Americans don’t love their children, but because those making financial policy decisions just love themselves even more.

My kids often tell me they aren’t keeping up with dad when I was their age.

But unlike their dad, their generation was born with a politically-culpable debt canon ball chained to their ankles which was unlike anything my generation knew in our 20’s or 30’s.

Most of my children’s generation are working harder for less, and yet they somehow think it’s their fault.

It’s not.

The new generation inherited a $93T (public, household & corporate) debt nightmare and we gave it to them.