THE EVIL CYCLES OF WAR AND ECONOMIC DESTRUCTION

As we approach what usually should be a blissful holiday period, the treacherous path the world is now on does not bode well for 2025 and beyond.

Two global crises will dominate the world for at least several years and possibly decades.

FINANCIAL CRISIS

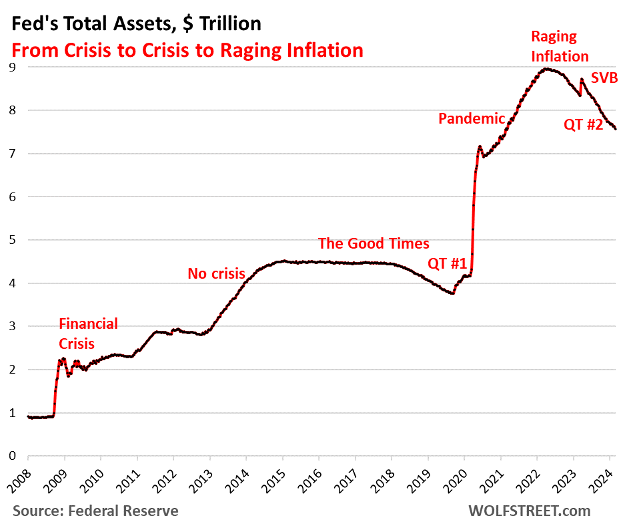

The crisis I have been discussing and writing about for many years is the end of the current monetary era, especially in the West. The exponential growth of debt, which we have experienced since 1971 when Nixon closed the gold window, is reaching an uber-exponential phase in the current century with runaway deficits and debt.

The likely course of events is unlimited money printing to counter an uncontrollable debt crisis. This leads to monetary debasement, high inflation or hyperinflation, which eventually turns into a deflationary collapse of the financial system and depression.

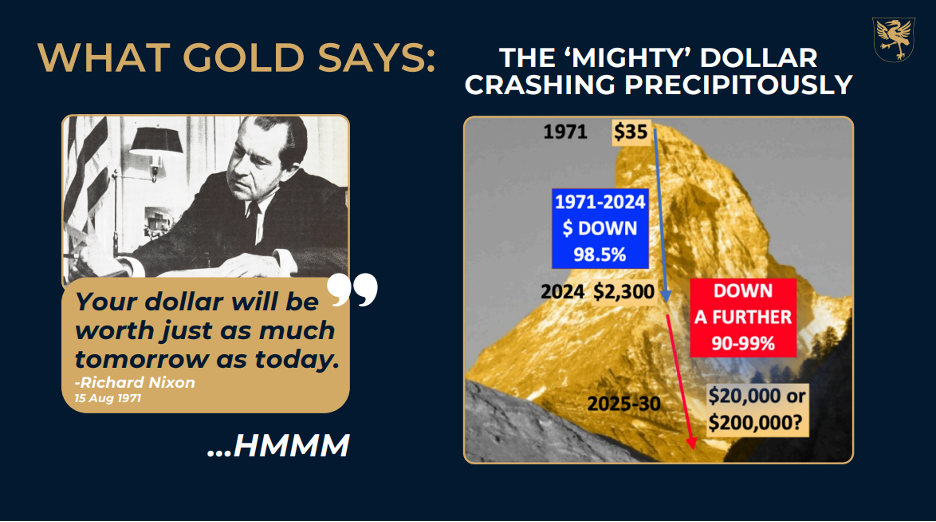

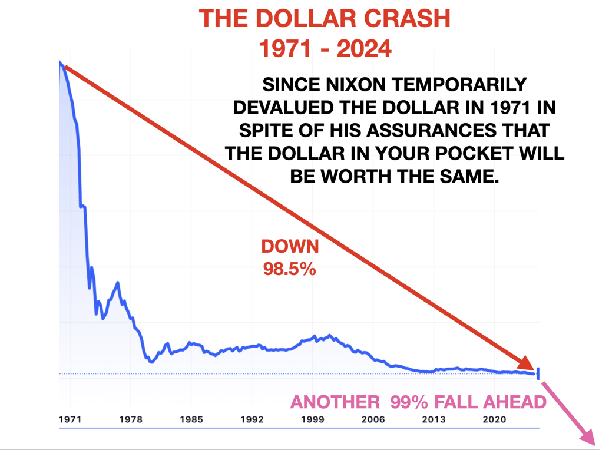

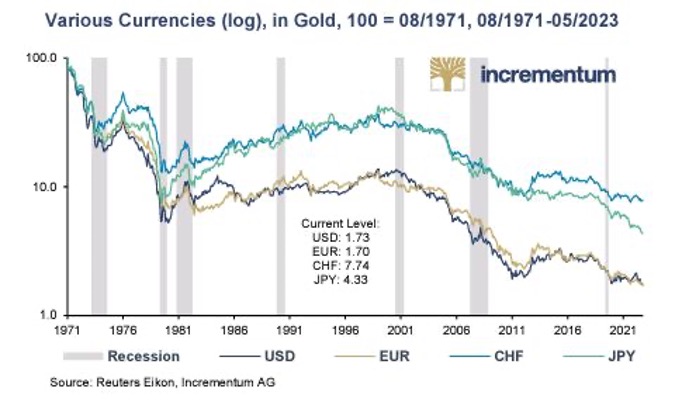

THERE CAN BE NO CLEARER SIGN OF THE END OF AN ECONOMIC ERA THAN WHEN THE RESERVE CURRENCY DECLINES BY 99%.

A possible alternative would be that the financial system implodes before the money printing has taken effect, with a subsequent deflationary implosion. This would mean a period without functioning banks and money.

As this is the way every monetary system has ended in history, without fail, anyone questioning this inevitable outcome will be entirely wrong. It is only a question of when, not if.

As the Austrian economist von Mises said:

As always in history, an economic crisis always goes hand in hand with political or geopolitical turmoil.

When a country spends money it doesn’t have, starting a war is the most convenient way of creating new paper money, which, of course, has ZERO intrinsic value.

Expanding credit or printing money does not create economic value, but buys time.

Money printing also buys votes. Reelection is the primary objective of any government in a democratic system.

Consecutive US governments have increased US Federal debt almost every year since the early 1930s.

The current deficit is over $2 trillion, and tax revenue is only $5 trillion. With over $7 trillion in federal spending, the US government needs to borrow another 40% on top ($2T) to make ends meet.

I created the graph below in November 2016, when Trump was elected the 45th President of the United States. I forecast that 8 years later (whoever was president), the debt that Trump inherited ($20 trillion) would be $40 trillion in early 2025. I based the forecast on a simple extrapolation. Since 1981, US debt has, on average, doubled every 8 years. Well, the debt will probably not reach $40T by 20 January 2025, but still, it went up by $16T rather than the $20T that I forecast.

More importantly, as the graph below shows, debt has increased 44X since 1981, but tax revenue has only increased 6X to $4.9T.

Can anyone explain how this debt will be repaid? The standard reply is that governments don’t need to repay their debt.

Well, let me again cite history, which is such a useful empirical tool.

Throughout history, a country which has not repaid its debts has, without fail, always defaulted, and the currency has gone to ZERO.

No one must believe that it will be different this time!

A monetary crisis at the end of a major cycle leads to economic collapse, poverty and misery.

However, this current financial cycle is already developing in parallel with a geopolitical crisis of a magnitude and scale that could be greater than those of WWI and WWII.

GEOPOLITICAL CRISIS

The financial and geopolitical conflicts are clearly linked. As in many armed conflicts, the US has been involved since WWII, although the country is not directly threatened.

This has been the case in Vietnam, Afghanistan, Iraq, Libya, Syria and Ukraine.

Most of these wars are about fear of losing the US hegemony. The US government subscribes to the 1904 Mackinder theory that whoever controls the Heartland controls the world. The Heartland is the area of Eastern Europe stretching to the Yangtze River in the east and the Himalayas in the south. This area has massive natural resources.

Syria probably just fell to opposition groups backed by Turkey in an attack supported by the US military. Interestingly, the latest conflict started the same day as the ceasefire between Israel and Lebanon. Clearly, it’s not a coincidence.

So Turkey, which for a while has ridden two horses, a Russian and an American, has now taken the US side.

Turkey is a NATO member and also a prospective BRICS member, among others, Russia, China, Iran and India.

With Turkey now on the US side and against Russia, we see the first military conflict between the West and BRICS.

Nobody knows if Syria will regroup again with Assad in Moscow and the soldiers deserting the army. For the Russia – Iran axis, Syria is strategically critical. But Russia cannot win that war with just air power and most probably does not want to divert resources from Ukraine.

Thus, we now have yet another crisis in the Middle East, a situation with dire consequences for the area and the world.

So we are likely to see continued war in Syria, with anarchy and the rise of more jihadist groups.

As Thanassis Cambanis, a senior fellow at the Century Foundation, said: “In the best case scenario, Syria’s factions will struggle for primacy through contained local battles. At the other extreme, the collapse will spur a renewed period of total warfare in which factions target civilians.”

So, it is likely that more Syrian people will be homeless and migrate to Europe and the US. As we know, no Western country has the capacity to take care of these people, so again, another humanitarian catastrophe has hit the world.

Losing access to Syria and the Mediterranean has weakened Iran, which will look for other options. The danger has always been that Iran blocks the Strait of Hormuz, which would lock in 24% of global oil. The US could not stop this. It would lead to oil prices at least doubling or more and a major global depression.

The UAE (United Arab Emirates), which includes Dubai, is right by the Strait of Hormuz.

Personally, I have always been surprised that so many people move to and invest in Dubai, given the major geopolitical risk that this area carries.

The world is in a severe war cycle, which, at best, will include insoluble and intractable wars in the Middle East and Eastern Europe with both the US and Russia involved. And at worst, a nuclear war.

I was always of the opinion that the Ukrainian conflict is a war Russia is very unlikely to lose. And neither the US nor European NATO troops have sufficient resources to win a war with boots on the ground.

Russian missiles are currently superior, but anything can happen in a nuclear conflict.

In a nuclear war, there is no winner, and that could be the end of the world, so it is not worth speculating about the outcome of such a war.

THE TRIUMPH OF DEATH

Peter Bruegel painted the “Triumph of Death” in 1562.

Currently, the world, and especially the West, is on a path to geopolitical and economic destruction.

No one knows how this will end. Even if it takes years, the world is unlikely to be the same once these two cycles have run their course.

I have already stated that the end of the current economic cycle will be devastating for the world but bearable relative to the worst outcome of the war cycle.

I had a hope that Trump would settle the Ukrainian situation if the US Neocons didn’t manage to escalate it severely before January 20.

However, the Middle East conflict, with Iran involved, makes the situation much more complex, even with Trump’s best intentions.

I always believe in finding solutions, but it is hard to be optimistic when the two Cycles of Evil prevail so strongly.

At least anyone who has savings should take action to protect these against the coming implosion of financial assets.

MARKETS

Stocks in the US are massively overvalued.

The Buffett Indicator, US Stocks to GDP, is at 208%, an all-time high.

Just a normal correction would be a 50% to 75% fall.

The Price Earnings Ratio of Nasdaq stocks is 49X.

A decline of at least 80%, like in the early 2000s, is likely.

Obviously, bubbles can always grow bigger before they implode.

However, the risk of a market collapse sometime in the next few months is extremely high.

Inflation will rise rapidly, as will interest rates, driven by money printing.

The US 10-year treasury will greatly exceed 10%, as in the 1970s.

WEALTH PRESERVATION

Finally, gold will continue to reflect the destruction of the dollar and most currencies.

Gold in US dollars is up 10X in this century. It is likely to rise by multiples from here as money dies. I explain why in this article: THE CASE FOR GOLD IS INCONTROVERTIBLE.

Gold must be held in physical form and outside the financial system with direct access to your gold. And preferably in a safe jurisdiction outside your country of residence.

Finally, especially in periods of crisis, helping others and having a close circle of family and friends is more important than all the gold in the world.

THE EVIL CYCLES OF WAR AND ECONOMIC DESTRUCTION

VON GREYERZ partner, Matthew Piepenburg, joins Nomi Prins with Ted Butler of VRIC Media to separate facts from fiction as to the key themes facing the global financial system, namely: US recession indicators, Fed policy in the face of ongoing inflationary forces, the longer-term direction of the USD, the implications of a Chinese slowdown, US equity market direction and the financial consequences of escalating war drums.

Each of these key theme are the ripple effects of unsustainable national and global debt levels, all of which point toward increasing currency debasement to inflate away sovereign debt with diluted fiat money.

Prins and Piepenburg close the discussion with a look at the gold market as well as the forces impacting supply and demand mismatches in the silver market.

THE EVIL CYCLES OF WAR AND ECONOMIC DESTRUCTION

In an insightful interview, Jonny Haycock, Partner at VON GREYERZ, explores critical topics shaping the global financial landscape and the signals family offices must not ignore.

Jonny explores the power shift from West to East, underscored by the systematic gold buying by BRICS countries, increasing geopolitical risk, unsustainable levels of debt, de-dollarisation, extreme levels of gold under-ownership and the constant debasement of paper money.

In a historical context, Jonny highlights the pivotal moment when Nixon abandoned the gold standard in 1971, an event that set the stage for today’s economic imbalances. By comparing gold’s value against debased currencies – citing the UK and US as prime examples – he shows how gold has maintained its purchasing power against all paper currencies.

The conversation also delves into gold’s exceptional performance during stagflationary periods and how central banks have manipulated markets to control perceptions. With the BRICS nations potentially backing their currencies with commodities, Jonny outlines the inflation risks and far-reaching implications for global investors, particularly family offices seeking to protect part of their wealth against looming financial uncertainties.

Watch now to learn more about how family offices can prepare for the power shift from West to East.

THE EVIL CYCLES OF WAR AND ECONOMIC DESTRUCTION

How does one hedge against open stupidity?

Left, right or center, our policy makers – from parliaments and executive branches to central banks and think tanks – have taken the world closer to war, immigration disasters, infrastructure failures, credit traps, wealth inequality, social unrest and currency destruction than any other time in recent memory.

Like myself, many are asking, privately or publicly: How did we get to this historical economic, social and political inflection point?

Perhaps the answer lies, at least in part, from trusting false idols, false slogans and even false notions of success.

The Philosophy of Success

Aristotle included aspects of the heroic in his definition of Success; one was “successful” who made it a priority to serve something larger than one’s self.

But between Paris, Virginia and Paris, France, I’ve often discovered that many who make political power or dollars an end in itself have missed the bullseye of thinking beyond their own interests…

My grandfather was a pilot in the Second World War. Never, not even once, did he speak of aerial combat or brag of a kill.

By the end of the Battle of Britain, hundreds of RAF pilots had perished, but England remained free. As Winston Churchill famously remarked when referring to these pilots:

“Never in the field of human conflict was so much owed by so many to so few.”

But when I consider the embarrassing, DC/Wall Street history of self-interest at the expense of public interest, many of our modern “success stories” boil down to this:

“Never in the field of human vanity was so little owed by so few, to so many.”

Today’s Mis-Understanding of “Success”

As recent whiz-kids from Mark Zuckerberg and Adam Neuman to Sam Bankman Fried, or ARC to Theranos remind, so many of our former “heroes” are anything but heroic.

Like Wall Street, DC has even less heroes to admire. The historical evidence of this is worth a brief reminder.

Wilson

Unlike Thomas Jefferson, who would have fought to the death to prevent a private central bank from taking over our economy and “coin,” Woodrow Wilson let a private bank raid our nation’s economic destiny in exchange for his own political self-interest when signing the Fed into law in 1913.

Andrew Jackson previously described the very notion of such a private central bank as the “prostitution of our government for the advancement of the few at the expense of the many.”

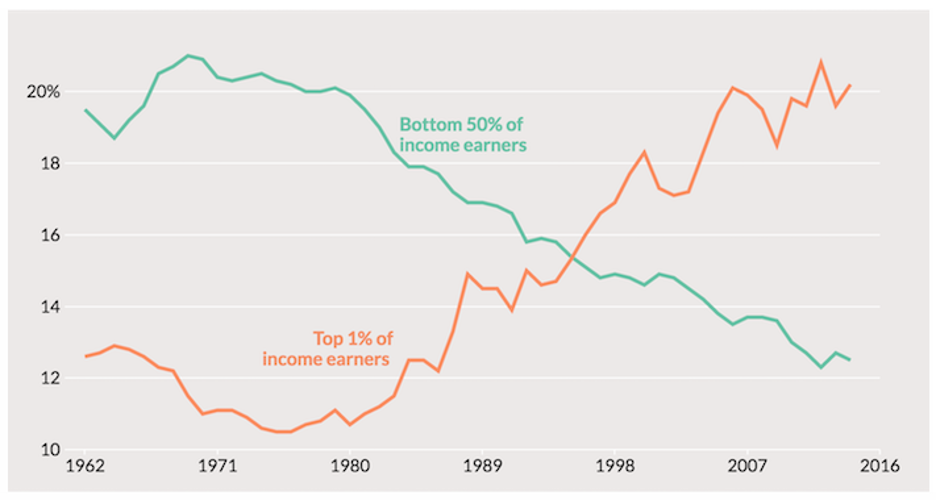

The unprecedented wealth inequality that exists today in America is proof that Jackson was right.

FDR

It was not a local bank run that caused the markets to tank in 1929; rather it was the now all-too-familiar low-interest rate policy/pattern and debt orgy of the prior and roaring 20’s that caused markets to grow too hot – a theme repeated to this day in market bust, after market bust–from 1929 to 1987, 2000 to 2008 or 2020 to the next disaster looming off our bow.

FDR helped create a subsequent template whereby America solves old debt problems, by well…taking on more debt paid for with debased money.

By removing the dollar from the gold exchange, FDR, like other anti-heroic actors to come, focused on manipulating the US currency rather than addressing US productivity—the veritable “P” in GDP.

FDR’s macro policies interfered with the hard but informative lesson of free markets, namely: Deep recession always follows deep debt. There’s just no such thing as a free ride…

Policy makers, however, like to sell free-rides to get or stay elected.

As I recently argued with math rather than emotion, the net result has been the death of democracy, which has piggy-backed off an equally empirical death of capitalism.

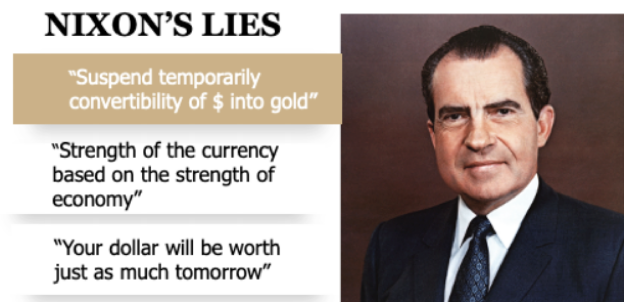

Nixon

In 1971, Nixon was staring down the barrel of an economy on the brink of bad news.

The gold standard, revived by the Post World War II Bretton Woods Accord (and the heroic fiscal restraints of Eisenhower and Martin) meant the dollar was once again tied to a restraining asset upon which global markets and trade partners relied.

But in a move similar to FDR in the 30’s, Nixon jettisoned the gold standard and once again welched on US dollar holders and currency-honest trade partners overseas in order to retain power for himself via unlimited dollar liquidity.

He promised the USD would remain as strong as ever. He lied. It has lost 98% of its purchasing power vs. gold since 1971.

Gold, however, is far more honest in its actions than politicians are with words:

In short, and as always, the currency was sacrificed to “save” a broke system and buy political time.

He won by a landslide.

Nixon’s policies strengthened the template for a now trend-setting perversion of free market price discovery via a familiar pattern of:

1) removing the dollar from a gold standard,

2) lowering rates to encourage short-term speculation which

3) ends in unnaturally large market bubbles and corrections.

Look familiar?

The Greenspan Monster

The spark which set off the crash of 87′ was the ironic fear/rumor that the new Fed Sheriff in town (Alan Greenspan) might put an end to the Wall Street binge party by raising rates in a “Volcker-like” scenario.

And so, in a single day, the stock index suddenly dropped 23% – double the 13% declines on the worst day of the 29 Crash.

But even more astounding than this Black Monday was the Lazarus-like resurrection of the market recovery on the White Tuesday to follow. By 12:30 PM the next day, the market saw massive buy orders which, in a miraculous swoop, stopped the panic.

The Greenspan Fed was clearly no “Volcker 2.0” (or Bill Martin either), but instead, this patient-zero of the current bubble cycle came to the rescue of wayward markets and an over-valued Wall Street.

That is, rather than allow painful corrections (i.e. natural market hangovers or what the Austrians call “constructive destruction”) to teach investors a lesson about derivatives, leverage and other land mines dotting the S&P futures pits (which dropped by 29% in a single day), the Fed came in with buckets of cheap money and thus destroyed any chance for the cleansing, tough-love of naturally correcting markets.

Modern Wall Street – Almost Nothing but Anti-Heroes

Self-seeking, career-preserving policy makers who create environments where the dollar is unrestrained, credit is cheap and regulation is lax (or favors “creativity”) stay popular, get rich and keep their jobs.

The mantra everyone knows in Wall Street is simple: “Bears get fired and bulls get hired,”

Such thinking has set a stage where clever market players are free to scheme their ways into ever-increasing bubbles which enrich insider whales and crush the middle-class/retail plankton.

The Exchange Pits and the Modern Derivatives Cancer

Irrational credit expansion creates a cancer to form in every asset class, including within the once humble mercantile exchange.

It was in this former cob-web-modest Chicago-based exchange where another anti-hero, Leo Melamed, applied the notion of using futures contracts (originally and modestly created to help humble farmers and suppliers adjust for price volatility) to global currencies.

Shortly thereafter, Melamed, having conferred with well-paid “advisors” like Greenspan and other easy-money, self-interested minds (including Milton Friedman), got the green light to open currencies to an entirely new level of speculative alchemy via addictive leverage.

Four decades later, the volume of currency (and risk) traded in 1 hour on the bankers-only commodities exchange exceeded the annual volume of funds traded on the original, farmers-only MERC.

Now, like all post-71 markets, the exchange pits have morphed into a casino with an astonishing 50,000X growth based on derivative time bombs that set up 100:1 ratios of hedging volume to the underlying activity rate.

These “modern derivative pits” (now surpassing the quadrillion levels in notional risk) are nothing more than levered and cancerous hot potatoes whose degree of risk and intentional confusion will be a party to the next liquidity crisis.

In short, this is not our grandfather’s MERC…

Long-Term Capital Management

In yet another example of the non-heroic, we saw the 1998 collapse of LTCM—aka, Long Term Capital Management —a hedge fund leveraging over $125B at the height of its drunken splendor.

This Greenwich, CT-based creation of the not-so-heroic John Meriwether, with a staff of the best and brightest Wall Street algorithm writers and Nobel Laureate advisors, stands out as a telling reminder of three repeated observations regarding Wall Street:

1) The smart guys really aren’t that smart,

2) wherever there is exaggerated leverage, a day of reckoning awaits, and

3) the Fed will once again come to the aid of Wall Street (its real shadow mandate) whenever its misbehaving “elites” get caught in yet another market DUI—that is trading under the influence of easy credit and hence easy leverage.

Of course, the pattern (and lesson) after LTCM was not headed, it simply continued…

The Dot.Com Anti-Heroes…

Just as the smoke was rising from the Connecticut rubble of LTCM, another classic asset bubble misconstrued as free-market prosperity was playing itself out in the form of a dot.com tech hysteria.

In retrospect, the dot.com implosion seems obvious. But even at the time it was happening, that market (precisely like today’s) felt, well: Immortal, meme-driven and surreal.

Consider Dell Inc. It started at $0.05 per share and grew to $54.00/share (a 1,100X multiple), only to slide back to 10.00/share.

Today, similar unicorns abound and the magnificent 7, which comprise 30% of the S&P’s market cap (while violating every principal of the anti-trust laws I studied in law school) continue to act as sirens seducing FOMO sailors to the fatal rocks.

The dot.com champagne party of the 1990’s, like its predecessor in the dapper 1920’s, ended in ruins, with the S&P down 45% and the wild-child NASDAQ off its prior highs by 80% in 2003.

Today’s tech, real estate and bond bubbles, by the way, will be no different in their eventual fall from grace…

Playing with Rates Rather than Reality

In the rubble of the dot.com bubble, the market-enamored policy makers at the Fed began the greatest rate reduction yet seen, resulting in a wide-open spigot for more easy credit, leverage and hence debt-induced market deformations.

That is, they solved one tech bubble crisis by creating a new real estate bubble.

A wide and embarrassing swath of wasteful M&A, stock-by-backs and LBO deals also took place.

Highlights of this low point in “American deal making” include GE’s dive from $50 to $10 share prices. Net result? Did GE’s Mr. Jeffrey Immelt take his lumps heroically? Did the company learn the necessary lessons of reckless speculation in the fall from its 40X valuation peaks?

No. Instead, GE’s CEO took a bailout…

Larry Summers

And then there’s the endless Larry Summers, the veritable patient-zero of the derivatives cancer…

Larry Summers was the president of Harvard. He worked for Clinton; served as a Treasury Secretary. He made lots of opinionated (and well paid) speaking appearances. Even Ray Dalio hangs with him.

But let’s not let credentials get in the way of facts. As La Rouchefoucauld noted centuries ago, the highest offices are not always – or even often – held by the highest minds.

Opinions, of course, differ, but it’s hard not to list Larry Summers among the key architects behind the 2008 financial debacle “Where Larry Summers Went Wrong.“

Most veterans of recent market cycles pre and post 08, concede that OTC derivatives were the heart of the 2008 darkness.

Bullied Hero

During this period, Brooksley Born, then head of the CFTC (Commodity Futures Trading Commission)- openly warned of the derivative dangers of, well…derivatives.

But in 1998, then Deputy Treasury Secretary Larry Summers telephoned her desk and openly bullied her: “I have 13 bankers in my office,” he shouted, “who tell me you’re going to cause the worst financial crisis since World War II” if she continued moving forward in bringing much needed transparency and reporting requirements to the OTC market.

Larry then went on to attack Born publicly, condescendingly assuring Congress that her concerns about the potential unwieldiness of these instruments were exaggerated. As he promised:

“The parties to these kind of contracts are largely sophisticated financial institutions that would appear to be eminently capable of protecting themselves from fraud and counter-party insolvencies.”

But fast-forward less than a decade later (and an OTC derivatives market which Summers helped take from $95 Trillion to $670 Trillion), and we all learned how those “eminently capable” and “largely sophisticated financial institutions” (Bear, Lehman, Goldman, AIG et al…) created the worst financial crisis (and bailout) since World War II.

More Bad Ideas, More Anti-Heroes

It’s worth remembering that neither Greenspan in 01 nor Bernanke in 08 ever saw these market crashes coming. Of course, neither did any of the “heroes” running the private banks or the US Treasury.

Powell will be no different. The Fed’s record for calling a recession or market implosion in 0 in 10.

Revisiting “Success”

A man, Walt Whitman reminds, is many things. Most would agree that we are philosophically, economically, morally and historically designed to screw up – over and over again.

What is less forgivable is not a lack of perfection, but rather a lack of accountability, even humility.

We can’t all be brave RAF pilots.

But sometimes, just being honest is heroic enough.

Unfortunately, the anti-heroes touched upon above, and the countless other Wall Street “supermen” (whose executive to worker salary ratios are at 333:1) do not represent anything close to serving a cause greater than one’s own income or position.

Anti-heroes like those above help explain the graph below and the new Feudalism that has replaced American capitalism:

More Candor—Less Anti-Heroes

We stand today at the edge of a market, social and political cliff built upon unprecedented levels of post-08 debt and money supply expansion.

The current public debt of $35T and a government debt-to-GDP ratio of 125-30% is mathematically unsustainable and makes real (rather than debt-driven) growth objectively impossible.

Today, we and our children’s generation are the inheritors of the sins of such anti-heroes.

If easy money leads to market bubbles, drunk investing and sobering crashes, then we can all see what’s coming as Powell inches predictably from rate hikes, to a rate pause to rate cuts.

Next, will come a deflationary recession and/or market correction followed by Super QE to absorb Uncle Sam’s unwanted IOUs, $20 trillion of which are projected in the next 10 years by our Congressional Budget Office.

The anti-heroes, of course, won’t say this, and they certainly won’t take accountability.

Instead, they will lie – blaming the troubles now and to come on Putin, COVID, global warming and their opposing party.

Gold, however, will be more honest. Gold is not a debate against paper or crypto money, but a voice of yesterday, today and tomorrow.

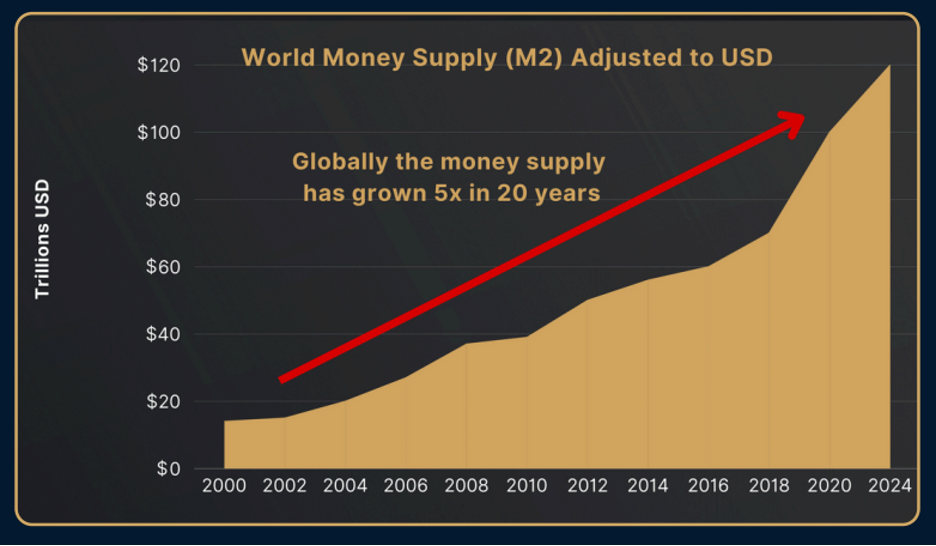

When money is expanded by 5X in just 20 years, it dilutes its value…

…which explains why gold, even at all-time-highs, is still under-valued when measured against the broad money supply:

As in every liquidity, market and political crisis throughout history, gold will store value far better than any debased currency engineered to inflate away national debt disasters with debased money.

This explains gold’s deliberately ignored tier-one asset status, its greater favor (and performance) over USTs and USDs and its historically-confirmed answer to every currency crisis since time was recorded.

It also explains why none of our Anti-heroes – from DC to Brussels – will talk about gold out loud. They are literally allergic to blunt truth, historical lessons or simple math.

For an informed minority, however, sophisticated investors will forever hedge against the golden tongues of anti-heroes with the golden bars of time and nature.

THE EVIL CYCLES OF WAR AND ECONOMIC DESTRUCTION

It was always inevitable that the GOLD price would reach $ 1 million!

So, now we are there.

The price for a 400-ounce gold bar has now reached $ 1 million.

It reached $ 1 million on August 16, 2024 – 53 years and 1 day after the US (Nixon) permanently said farewell to the dollar as a store of value by closing the Gold Window.

Let’s just recap what has happened to the cost of a 400 oz gold bar since 1971:

So, has the value of gold gone up 71x since 1971? (71x$14,000=$1M)

No, of course not. The dollar has collapsed by 98.5%.

Or, if we look at it differently:

That is a loss of purchasing power of 98.5% over the 53 years between 1971 and 2024.

Just think about it: If you put $14,000 in the bank in 1971 and earned, say 4% on average, that would be $116,000 today. A far cry from the $ 1 million that the same amount invested in gold – REAL MONEY – would be worth.

So, what does closing the gold window actually mean?

It simply means that after August 15, 1971, the dollar could no longer be converted to gold by any investor, private or sovereign.

FOLLY OF THE WEST

Before we look at the fatal consequences, let’s just look at the Folly of the West.

First, we see the West’s prediction of the consequences as interpreted by Nixon on 15 August 1971:

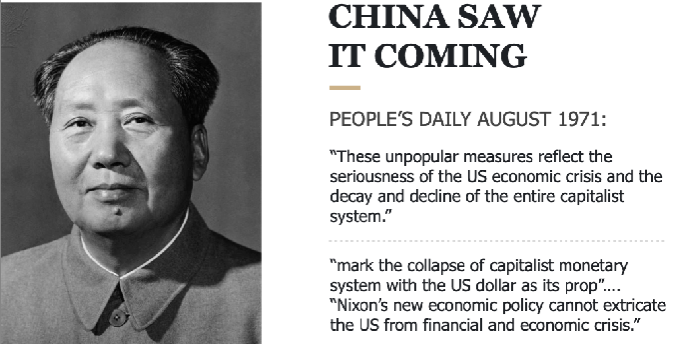

WISDOM OF THE EAST

And below follows the Wisdom of the East (Mao) as written by the official Government body, the People’s Daily:

So the US (Nixon) said, “Your dollar will be worth as much tomorrow”.

And China said, “These measures mark the collapse of the capitalist monetary system with the US dollar as its prop”.

So the West is only interested in instant gratification, issuing debt and thus buying short-term prosperity and votes, leading to “decay and decline”.

DECAY AND DECLINE OF THE WEST

So, let’s look at the “decay and decline” of the US and the West reflected perfectly in the fall of the US dollar.

Here is the performance of the dollar since August 1971:

Nixon said in 1971 that the “strength of the currency is based on the strength of the economy”.

Hmmm…

A 98.5% fall in the value of the dollar (in real terms, against gold) since 1971 can hardly be called “worth the same”.

Measuring the dollar against gold is the only correct method to determine the real purchasing power of the dollar. To measure currencies against each other serves no purpose. All that tells us is which currency will win the race to the bottom.

What will destroy the dollar and all Western currencies, will be the exponential growth of debt led by the US.

US ROAD TO PERDITION

The table below shows the inevitable road to perdition that the US dollar’s is now on:

With debt up 82x since Nixon closed the gold window in 1971 and GDP only up 26x, it is not difficult to see that the US engine is running on empty.

Just look at the super-exponential phase of debt since 2009, the year that the Great Financial Crisis was supposed to have ended. Since 2009, US debt has trebled, while GDP has only doubled.

But it has, of course, not ended at all.

More and more debt is required to create growth. Consequently, since 1971, US debt to GDP has gone from 39% to 122%.

Over 90% of Debt to GDP is considered junk, and 122% is Banana Republic territory.

But it won’t stop there.

A pure statistical extrapolation of the debt trend tells us that by 2036, the debt will be $100 trillion.

I have explained many times how fast the exponents’ phase of a dot crisis and currency collapse develops: “THE REAL MOVE IN GOLD & SILVER IS YET TO START”

The conclusion is simple.

The US government, together with all Western governments, are destroying the fabric of society by constantly spending more than they earn. Even the word “earn” is deceitful.

Governments don’t earn anything. They will just wilfully levy taxes and other charges against the people without their consent. After decades of suffering from high taxes, people are entirely “socialised” and expect the government to pay for everything.

Do the people of the US and Europe want to send $100s of billions to Ukraine? Do they want to pay similar amounts for the immigrants, many of whom get preferential treatment when it comes to housing, social security, hospital treatments, etc?

Well, nobody knows what the people want since they are never asked. But I doubt they would approve this spending if they had a say.

WHERE IS THE MONEY COMING FROM?

Nor does anyone ask where all this money is coming from. It definitely hasn’t been earned by the government.

The government doesn’t even have the money it is paying out. It just creates money out of thin air and creates ever-increasing deficits that lead to exponentially growing debts.

The people are pacified since they believe that the government is paying. Nobody understands that all this debt is owed by the people.

CONSEQUENCES

But they can, of course, never afford to repay it in taxes and other levies. Nobody understands that the consequences will be the value of money dropping catastrophically, poverty, famine, shortages of many items, homelessness, social unrest and probably war.

And once a country reaches that stage, the government is powerless. They are bankrupt and have no funds to assist anyone. The risk of anarchy is high since the government will have few tools to maintain law and order.

So, how can we predict such a dark period? It requires no predictive powers but just a study of history. Please read “THE DARK YEARS ARE HERE II”, a 2018 update of my 2009 article. It was even more important today than it was in 2018.

Just take the US government’s mismanagement of the country’s finances as the inevitable journey to serfdom. With a handful of exceptional years, the US has increased the Federal debt since the early 1930s. Even during the so-called “Clinton surplus years”, the debt went up. So, the surpluses were fake.

AN ILLUSORY FANTASY GAME

As current growth is derived from creating debt with ZERO intrinsic value, the growth is only illusory.

The world will soon understand that it is all a fantasy game, with trillions of unreal assets created by even more trillions and quadrillions of debt (including derivatives) made out of thin air.

In the next few years, the world will realise that debt has zero value since neither sovereigns, corporations, or individuals can repay their debt or even afford the interest.

Remember that the official global debt is around $350 trillion plus a big part of the derivative time bomb which could be into the quadrillions. Much of that will transition to debt.

As the debt implodes, so will all the bubble asset values.

The billionaires will lose all or most of their zeros (of their wealth), and so will the trillion-dollar companies.

The wealth transfer will be shocking. The wealthy have the most to lose. Some have been clever and are debt-free. But most are leveraged and will lose everything.

Everyone will suffer, rich or poor. However, the poor and ordinary people have the most to lose with no reserves, no safety net, and a bankrupt government that can’t help them.

The few who have understood that future prosperity comes from natural resources will obviously be in a better position. Technology will also be a growth area, but it is currently overvalued, as it was in the 1990s.

The asset-rich BRICS countries will be major beneficiaries, whilst the debt-infested West will experience the end of a major era. These are all major shifts that will evolve over decades and even centuries.

But the beginning could be very rapid and most probably violent for the whole world, West and East…

So many factors come into play.

Economic decline, financial collapse, wars, political and social unrest, poverty, food shortages, as well as mass migration led to major cultural shifts.

So how can we be so confident that all this will take place?

Well, that is what history tells us with great certainty. History never lies, and it never fails us as lying politicians do, without exception, for their political survival.

But history doesn’t tell us when, of course. So, the exact timing is always unknown.

We also know that the world has never experienced a global debt bubble of such magnitude.

So, the timing is almost irrelevant.

It’s important to understand that the risk is now higher globally than at any point in history.

DOLLAR, GOLD AND EXCHANGE CONTROLS

As I have outlined in this article, a continued and steep dollar decline in the coming years is a virtual certainty.

As there has been no gold window to close since 1971, the US government is almost certain to implement foreign exchange controls as the dollar falls. I wouldn’t be surprised if it comes relatively soon, but the timing is irrelevant. The risk is here today and now is the time to prepare for it.

Thus, for Americans, it would be an advantage to have funds or assets outside of the US as soon as possible. Physical gold and silver are clearly the best assets to hold as they also protect against the dollar debasement.

Switzerland and Singapore are obvious places to hold gold. Switzerland has a strong currency and a very sound economy. Exchange controls would be unlikely here.

What is extremely important is not to hold your precious metals through a US company or other entity, which the US government can order to return the gold or silver from a foreign vault to the US.

Instead, hold your metals through a Swiss or Singaporean company that has no US links.

MOST PEOPLE CAN AFFORD SOME GOLD OR SILVER

For anyone who has savings, big or small, putting them into physical precious metals can make the difference between survival and misery.

Most people can afford to buy a few silver coins every month, and many can afford one or more small gold bars or coins.

With the acceleration of the dollar’s (and other currencies) debasement and shift in Central Bank reserves out of dollars into gold, the revaluation of gold in coming years will be by multiples. As I keep on saying, the real move in the gold and silver hasn’t started yet.

But above all, a harmonious and close circle of family members and friends is crucial to survive the difficult times ahead.

THE EVIL CYCLES OF WAR AND ECONOMIC DESTRUCTION

VON GREYERZ Founder, Egon von Greyerz, joins CapitalCosm to discuss current financial risks and the critical differences between short-term investing and long-term wealth preservation.

The interview addresses the following core themes:

– The multi-decade consequences of ending the US gold standard under Nixon in 1971

– The greater importance of preparing for, rather than timing, the inevitable end of the next financial bubble

– The implications behind record-level physical gold stacking by global (mostly eastern) central banks

– Gold’s short and longer-term reactions to political and market dislocations

– The inevitable and historically-confirmed destruction of paper money by debt-broken sovereigns

– Cautious yet positive insights on the silver price going forward

– Egon’s own experience with preserving wealth outside of a fractured banking system

Such insights provide a pathway to understanding today’s risks to better preserve wealth in a dangerously unfolding tomorrow.

THE EVIL CYCLES OF WAR AND ECONOMIC DESTRUCTION

Political opinions are almost as vast as financial opinions—from bull to bear, or left to right.

But there are differences, no?

Political opinions, unlike market evaluations, for example, more often lean on emotion, media/partisan influence or even Californian hair styles rather than simple math.

But in the spectrum of negative to euphoric market pundits, even math can be ignored to confirm biases, euphoria and group-think.

Ideally, of course, we’d like our politics, like our investing, to be equally rational; but as history and philosophy confirm, man is not very, well: Rational…

When one supplements human irrationality with open dishonesty and misinformation (think Main Stream/Legacy Media and self-serving rather than pubic-serving “leadership”), an otherwise clear path to rational deliberation can become all the more clouded.

Take Joe Biden…

From literally day-1 of his administration, it was fairly clear to anyone (left or right) that his mental fitness was undeniably declining.

The physical and verbal examples of Biden’s “resting 25th Amendment face” and condition are and were endless.

Equally endless were the efforts of his “concealers in chief” (from his vice president, press secretaries, cabinet and point-of-view “journalists”) to hide, deny or contradict this open fact for years—repeating the lie of Biden’s robust mind long enough to convince the masses of the political equivalence to the sky is green and the grass is blue.

But then came a moment of truth: A single presidential debate in which Biden was all alone without prompts, ear phones, note cards or his wife’s elbow.

Not surprisingly, he imploded for all the world to see.

Not even mental giants like actor George Clooney or “journalist” (actress?) Rachel Maddow could save him from our own two eyes and ears.

Soon thereafter, Biden dropped out of the race.

Shocker?

In short, and with the entire world watching, a lie that was otherwise obvious (and deliberately ignored) for years, was suddenly exposed: The emperor had no clothes (or the President had no clue).

This sad fact should not have been partisan, but moral.

But what does this have to do with markets, portfolios and your currency?

Well, the answer is: Everything.

A Pattern of Lies, Denial and Public Gaslighting

The Biden example, or denial-template above, is literally identical to a similar template of economic lies, denial and public gaslighting as acted out by our central bankers, debt-addicted (economically juvenile) politicians and utterly clueless financial media for years.

The Bankers…

Anyone, and I mean anyone, who hails from Wall Street’s big banks, for example, knows that bears are fired and bulls are promoted.

Why?

Because banks are in the business of levering depositor money for year-end bonuses and an endless stream of risky (rather than fiduciary) “products” that have nothing to do with long-term value but everything to do with short-term fee collecting.

Any honest banker who questions the financial weapons of mass destruction developed in those banks (from MBS derivative schemes to current “private credit pools” and non-performing CRE loans) is shown the door.

The Fed…

Such financial vanity is equally true of our central bankers.

Near-term power at the expense of longer-term prosperity is the name of their distorted game and the surest path to a Nobel Prize in economics (Bernanke) or a prestigious post at the US Treasury Department (Yellen)…

But as Thomas Hoenig, one of the very few FOMC players (and Kansas City Fed Presidents) with actual integrity, reminds: The Fed, if run properly, “should make policy for the long-term and let the near-term work itself out.”

But the Fed’s actual practice, as Hoenig himself confesses, has been the precise (and sickening) opposite.

As Hoenig (and the few of us who speak what we think rather than what are told) have been warning for years, the Fed (from Greenspan to Powell) is more worried about bailing out the next bank or bond crisis than preventing the next generationfrom suffering permanent inflation/currency ruin in the endless wake of their repulsive “spend and print” policies.

The Politico’s…

Needless to say, this same pattern of near-termism and me-first-ism (nation-be-damned) is most glaringly apparent in the halls of political decision-making.

Congress is where heavily-lobbied and embarrassingly math-challenged Ken, Barbies and stumbling octogenarians deficit spend like crack addicts for near-term re-election while leaving the bill (and twin deficits) to our kids…

In short, even when openly in decline, they cling to power.

This explains why an entire party could stand behind an otherwise zombie-fied Biden for years: So long as their machine (and happy-idiot) was in power, they could scramble for personal promotion, power and wealth at department or agency X, Y or Z.

For this class of politico’s (both red and blue), the cry is not “ask what you can do for your country,” but simply, “what can DC do for me and my CV?” as the U.S. just witnessed the highest level of corporate bankruptcies since early 2020…

Such open selfishness, arrogance and deliberate economic/debt ignorance is a symptom of decadence and decline which precedes the inevitable fall of all once-great nations.

The Great American Debt Lie

Like Biden’s mental health, America’s hidden financial health has been a perfect homage to the smoke and mirrors denial of what were otherwise obvious shark fins circling our economic prosperity for years.

And yet for years, we and others have been warning of these open and irrevocable risks with candor, while Wall Street and anonymous YouTube comment-cowards gaslight us as “gloom and doomers.”

The ironies just abound…

Candor Matters

For over four years, by way of example only, we have been shouting from the electronic rooftops that western sovereign debt in general, and USTs in particular, are racing toward a moment of implosion that can’t be blamed on COVID, global warming, Putin or even little green men from Mars.

For even more years, we have been warning that nations cannot spend or borrow 3-4X more than they earn by monetizing the delta with liquidity literally created out of thin air without eventually destroying their currency and stoking an inflationary fire, which the Fed got 100% wrong.

And by the way, this fire always leads to social unrest and distractive wars followed by democracy-insulting centralization from the extreme political left or right.

Meanwhile, those very forces of currency debasement, inflation, war and social unrest are ALREADY and LITERALLY occurring all around us, to the bemused dismay and denial of our so-called “elites.”

Yet like Biden’s yes-sayers, crony-capitalists, position-grabbing lackies and complicit media mouthpieces, our current financial and political elites are still making a daily effort to ignore the obvious and force-feed us their well-telegraphed counter-narrative of deficits without tears.

Fortunately, and like the Biden template above, at some point even the cleverest lies can no longer hide the most basic math and history of nations free-falling from a debt-cliff of their own design.

Signs of a Broken Narrative

Recently, for example, the mother of all central banks, the Bank of International Settlements (BIS), published its annual report, which the media, DC and Wall Street largely ignored.

Specifically, the BIS finally, in 2024, said out loud what we have been saying for years: When economic growth slows to a level outpaced by debt growth, sovereign IOUs get weaker not stronger.

And when sovereign bonds get weaker (i.e., sell off), their prices fall and hence their yields rise.

And when yields rise (mathematically), so too do interest rates.

BUT herein lies the rub:

Rising rates + historically unprecedented global debt levels = $#!T hitting the fan.

The Bond Market’s “Biden Moment”

This, then, is a kind of “Biden moment” for the $130T global credit market.

Even the BIS is confessing that the bond market, like America’s current emperor, may have no clothes.

And yet the majority still want to believe a fantasy narrative that all is (and will be) fine, recession and inflation facts notwithstanding…

That is, the vast majority of investors and bank salesmen are still trying to convince themselves and the world that a growth slowdown—or even a recession—will lead to a goldilocks scenario of increased buying (rather than selling) of government “safe-haven” bonds, which, in their collective fantasy, means higher bond prices ahead and hence lower bond yields and interest rates ahead.

This, folks, is the economic equivalent of believing Joe Biden will be the next Jeopardy Champion or Olympic Marathon gold medalist…

Natural vs. Un-Natural Forces

In the end, and despite the 800+ PhD’s at the Fed (who completely got inflation wrong) and all the happy idiots in both red and blue in the US House, natural forces (i.e., supply and demand) ultimately humble human forces (i.e., stupidity and vanity).

That is, not even the Fed or other central banks can control rates; instead, the natural forces of the bond markets get the final say.

As demand for over-indebted and unloved sovereign IOUs falls, yields and rates will rise to levels no nation can afford to pay.

This reality (aka moment of fiscal dominance) can only be monetized/paid with fake money, which is by definition inflationary.

Like Biden’s mental decline—it’s just that obvious. It’s also math.

Inflation is killing the purchasing power of the “wealth” by which you measure your savings account, paycheck, portfolio and legacy.

Think about that with eyes that see and ears that hear.

Speaking of Nature…

Nature, unlike most bankers, politicians and artificial market bubbles, has an embedded honesty which, cruel or kind, has a way of self-correcting the un-natural interference of man-made designs.

There’s no hubris or vindictive spite, for example, in an iceberg that challenges a poorly steered and otherwise “unsinkable” Titanic.

Nor is there anything personal when a flood washes away a mansion poorly built on the river’s edge.

And any yachtsman who thinks he or she can tame a hurricane, quickly learns a lesson in humility.

The same, of course, is true of paper or digital money. Man can make, and hence debase, as much of it as he wishes.

But nature’s money, gold, is far less arrogant and far more honest.

In addition, nature’s money is far more patient.

Gold’s detractors, of course, will say that it merely sits there doing nothing.

But while dollars, yen, pounds, pesos and euros are all very busy swapping, trading, collateralizing and debasing, gold calmly does one thing very well: Retain its value.

The World is Catching On

Your private wealth advisors, political representatives or family office CEOs (typically just former bankers) may not wish to see such natural honesty among the teargas of financial group-think and complex market lingo, but many nations and their central banks are catching on.

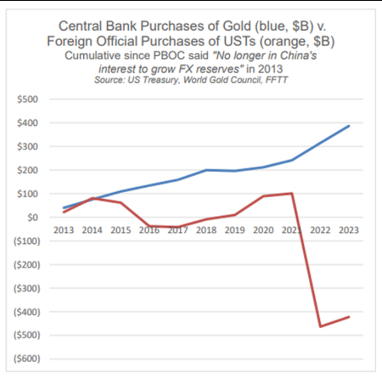

As outlined in detail many times, these players (i.e., the BRICS+ et al) are, and have been for years, quietly and now openly stacking nature’s money at historical levels while dumping USTs.

Why?

Because after years of enduring a debt-debased world reserve currency and its “return-free-risk” IOUs, the world wants: 1) a neutral Tier-1 asset that can’t be frozen at DC’s will, and 2) which actually retains rather than loses its value.

Imagine that? The world actually prefers natural gold over a man-made sovereign IOU as a reserve asset?

Rather than replace the USD and other fiat currencies (which are critical spending tools), more and more nations are simply going to reprice currencies like the USD while storing their reserves in real money (gold).

This trend is now obvious, from India, China and Russia to Nigeria, Thailand or Saudi Arabia: Gold, a yield-less asset, which is outperforming a dollar bull market and so-called “yielding” 10Y UST, is clearly emerging as the premier inflation-fighting, savings and net trade settlement asset.

Yet despite this otherwise obvious shift, akin to Biden’s obvious mental decline, many would intentionally have you ignore what your eyes see and your ears hear.

“The dollar,” they cry, “is king!”

But as Biden’s fall poetically reminds, a king with no clothes, is a crown (and money) with no value.

As asked elsewhere: Which will you prefer? A crown of paper or a crown of gold?

THE EVIL CYCLES OF WAR AND ECONOMIC DESTRUCTION

In this latest Gold Matters discussion, VON GREYERZ principals Egon von Greyerz and Matthew Piepenburg squarely address the rising symptoms of a financially and politically unstable financial system reaching the end of an openly embarrassing cycle reminiscent of prior cycles, from Ancient Rome to today.

Piepenburg gives an American perspective on the dispositive evidence of an American crisis, citing the toxic levels of both governmental and consumer debt data. In addition, signals of a looming banking crisis (underwater UST collateral combined with massive credit risks and non-performing loans) and dangerously narrow equity markets suggest far more pain than pleasure ahead for families, citizens and investors.

As von Greyerz reminds, however, the stressors and failures facing the US extend well beyond its borders into Europe and beyond. The EU merely (and wrongly) follows US policies to their own detriment, whether in terms of monetary reactions to Fed policies or foreign policy fiascos, including the backfiring sanctions against Russia. Meanwhile, signs of open political fractures in the UK, France, Germany etc. increasingly suggest that majority rule (i.e. democracy) in Europe has been eclipsed by a patchwork of coalition governments (from London to Paris) which make less and less sense. Instead, this open and sustained level of political mediocrity (from DC to Brussels) is just more evidence of a political and financial system in open decline and at the end of a cycle.

Piepenburg shares similar concerns, and underscores the fact that financial and political disaster is not a looming or pending event, but one taking place in real time—i.e.: Right now. It is often hard, he says, to see history playing out when one is right in the middle of it, but the changes we are seeing in markets, banking, inflation and, of course, currencies are “frog boiling” us toward clear financial decline.

This currency “frog boil”, of course, has massive implications (from both math and history) for owning physical gold outside a precarious banking system and held privately in one’s own name. Given that gold is not only real money, but “nature’s money,” the case for something natural rather than man-made makes historical and common sense, as it is the one asset that man can not create (or distort) at will.

THE EVIL CYCLES OF WAR AND ECONOMIC DESTRUCTION

In his latest conversation with the David Lin, VON GREYERZ partner, Matthew Piepenburg, addresses US political volatility (post-assassination attempt, pre-Biden drop out) and social unrest, with special attention on their near and longer-term implications for US and global markets.

Turning to US political headlines, Piepenburg addresses the history of markets under Democratic and Republican administrations in general before specifically addressing expected forms of market support (from regulatory, M&A, taxation, tech, trade and rate signals) under a potential Trump White House. Although prior evidence and even projected risk-on expectations are near-term possibilities under a Trump administration, Piepenburg warns that longer-term signals (narrow, over-valued equities and unsustainable debt and rate markets) portend far greater mean-reversion risk than reward heading into election season in late 2024 and the year to follow.

Although recorded prior to Biden dropping out of the next election, Piepenburg realistically confessed that “Trump is looking pretty hard to beat.” As far as Biden goes, this issue is now settled.

That said, Piepenburg bluntly reminds that regardless of who wins in 2024, no one—from “Papa Smurf to Albert Einstein”- can solve or prevent the debt-driven iceberg already scraping the bow of the US markets and economy. Lin asked of the increasing risk of “civil war” in the already divided-states. According to Piepenburg, the divisions are (and have been) openly apparent; there are no easy answers. We can, however, foresee that increasing centralization is the more real and present danger as inflationary realities undermine the political, social and financial stability of a nation in open decline.

Beneath these inflationary (and hence currency-destroying) currents lies the undeniable debt crisis facing the US in particular and the world in general. The additional de-dollarization forces add further pressures against the USD (and fiat money in general) and point directly to the undeniable case for (and role of) physical gold as an essential allocation.

THE EVIL CYCLES OF WAR AND ECONOMIC DESTRUCTION

The failure of Western financial structures, including the currency system, is in its final stages.

Sadly, no one takes any notice – YET!

Global debt has already tripled this century, with the dollar and most currencies having lost 98.5% of their purchasing power since 1971.

Experts say the US can never default as they have a printing press. Whatever lies the US and European governments come up with, a 98.5% fall in the value of a nation’s currency is an absolute default. All other explanations are just noise.

With global debt at around $350 trillion and global GDP $100 trillion, the Global Debt to GDP is 350%.

Over 100% Debt to GDP is unsustainable and cannot be financed over the longer term.

And 350% Debt to GDP is bankruptcy – Banca Rotta.

With financial markets distorted and leveraged to the hilt, global risk today is greater than ever.

There is an obvious path that small and big investors can take to minimise this risk.

The best solution is to create your own Gold Bank that will almost entirely eliminate financial risk and provide instant liquidity. In addition, compared to virtually all other asset classes, it will enhance your wealth substantially in the coming years.

US & EUROPE – TERMINAL ILLNESS

We are not just talking about terminal illness for the US, European and probably Japanese, which are all fatally wounded by debt, deficits and decadence with no chance of recovering in the next few hundred years.

We are also talking about China and many emerging markets with debts, as well as demographic and structural problems, which, even though not incurable, will slow down their economies for many years. And yet, not to the same extent as in the West.

So, are the US and Europe now Banana Republics?

Banana Republic can be described as:

A highly stratified, politically unstable socioeconomic structure, with a small ruling class that controls access to wealth and resources.

That definition certainly fits the US and Europe, with a small elite of 1% owning 1/3 of the total wealth in the US.

Global financial assets are $600 trillion (incl. PNFC – Private Non-Financial Corporations) plus potentially $2+ quadrillion of derivatives, much of which will become debt when counterparties fail.

How can we expect a global value of the output of goods and services (GDP) totalling $100 trillion to support debt of $350 trillion-plus the high risk of derivatives of $2 quadrillion exploding or rather imploding one day?

This is a daisy chain and Ponzi scheme scam all in one.

Print money to inflate markets and then print some more to keep it all going. As history tells us, this can only end in one way.

As Joe Biden finally decided not to stand for re-election, this will have little bearing on America’s insoluble financial problems.

The upcoming US election will not change this risk. Donald Trump, Kamala Harris or someone else cannot stop the avalanche of debt triggered back in 1971 with the closing of the Gold Window. It will reach its maximum force in the next 3-7 years. It could be earlier, but it could take longer. Most of the signs we see tell us that it will be sooner. But as I often say, forecasting is a mug’s game. So, let’s focus on imminent risk rather than if it happens tomorrow or the day after.

NO EMPIRE AND NO CURRENCY SYSTEM HAS SURVIVED

History tells us that no empire has ever survived, nor has any currency system.

So anyone who believes that “it is different this time because …” ignores thousands of years of history.

This is not meant to be sensational – it is based on history, which tells us that, without exception, a debt crisis leads to a currency crisis with inflation, asset and debt implosion, political and geopolitical instability, including social unrest and wars.

Let’s look at the collapse of the Roman Empire, which underwent the same decline as we see today. It doesn’t matter which empire we pick since they all end the same way.

The current US empire with its European “colonies” is more of a financial than a geographical empire. I call Europe “colonies” (tongue in cheek) because whatever the US decides (e.g., attacking Iraq or Libya, FATCA (control of global banks), sanctions or freezing Russian assets, etc.), Europe conforms without any resistance.

The peak of the Roman Empire was around the birth of Jesus. The decline started gradually, and by the time of Marcus Aurelius (161 AD), the Denarius, the Roman silver coin, was already down 25%.

The build-up of debt and the debasement of the currency created the Crisis of the 3rd Century (235- 283 AD). During that period, there were more than 50 emperors, most of them assassinated and some killed in battle. During that period there were also barbarian invasions and migration into the Roman territory. Multiple civil wars and peasant rebellions also occurred, enabling many to grab power illegally or by force.

The financial and economic decline of the empire continued unabated, with more debts and deficits. By the time of Gallienus (260 AD), the Denarius had lost 99.5% of its silver content. At the end of the Crisis of the 3rd Century, the Empire split into three political entities.

ROME’S DECLINE

This gradual decline led to the weakening of central political control, power struggles, budget deficits, increasing debts, corruption, a weakening currency, hyperinflation, higher taxes, plague, as well as a decreasing army not paid enough to deal with great numbers of invading barbarians.

Finally, in 476AD, the Goths (Germanic people), led by Odoacer, captured Rome and deposed Romulus Augustulus. Odoacer became the new ruler.

So, 476AD became the official end of the Roman Empire, although parts of the Eastern Empire still survived.

Looking at the bolded paragraph above, there is virtually no difference between the fall of the Roman Empire and the fall of the US-Western Empire today.

La plus ça change, la plus c’est la même chose. (translation: The more it changes, the more it stays the same)

There is actually not one single word or description that differs. The Plague, for example, is today’s COVID-19, while the Barbarians in ancient times were people who did not belong to one of the great civilisations (Greek, Roman, Christian).

In the same way today, the migrants are coming in great numbers from other non-Western cultures. And since there is no political will to stop the migration, the numbers are more likely to increase than decline. Thus, it’s obvious, the US and Europe will look very different in 50-100 years.

So, it is similar today, and all major Empires end in the same fashion. How the US-Western Empire will end is already described in old history books. But sadly, no politician ever studies history, which, if they did, they would see the description of their own destiny.

COMING DESTRUCTION OF INVESTORS’ ASSETS

There are several major risks in the next few years that can destroy investors’ assets, for example:

- Systemic failure of the financial system

- Bank collapses

- Custodian failure

- Derivatives failure

- Currency debasement

- Political/Social risk – civil unrest

- Geopolitical risk – war

It is no surprise that the final stages of empires, such as the Han, Roman, Mongol, Ottoman, Spanish and British, always included all the above ingredients.

Let us start with currency debasement.

Most people don’t understand what fiat (paper) money stands for.

It is not your money that always has a guaranteed value. History has clearly proven that no fiat money has ever survived – WITHOUT FAIL!

All currencies have gone to ZERO through the irresponsible and incompetent management of the economy.

Voltaire said it already in 1729:

Paper money eventually returns to its intrinsic value – ZERO.

Or as JP Morgan testified before Congress in 1912:

Gold is money – Everything else is credit.

A bank credit balance in your bank account is just a promise by the bank to pay.

The money you deposited in the bank is not your money.

The only right you have is a claim on the bank. You are just a general creditor of the bank.

However, the bank has leveraged your deposit 10x or more. So, for your deposit to be repaid, all debtors of that bank (clients who have borrowed money) must repay their loans.

The banking system is like a Ponzi scheme. It depends on a never-ending stream of new deposits or printed money.

With derivatives and other synthetic instruments, the real leverage of some banks can be 30x or more.

Yes, the government can save the depositors of a few small banks, but there after only massive money printing can save them, leading to a total debasement of the currency once again.

You take insurance for the potential of your house burning down.

When you insure your house, you don’t expect it to burn down, but if it does, fire insurance becomes critical.

The same goes for your money. You don’t expect the financial system to collapse, but if it does, you will lose all your money, whether it is deposits or securities that are held in custody in the system.

Yes, securities held in custody by a financial institution should, in theory, be yours. However, as we saw in 2008, banks used customer assets as security for their trading positions.

The other danger with securities is that a big percentage is actually not in financial assets such as stocks or bonds, but instead in synthetic securities or derivatives with no underlying real investment.

GOLD BANK

Back in 2002, I created my own gold bank. That was the same year that in my father of the bride speech, I told all of the guests to buy physical gold. Gold was then only $300.

As global debt has grown more than 3x since 2002 to $350 trillion, risk has grown exponentially, including the explosion in derivatives.

The best way to protect your financial assets is to create your own gold bank.

It is incredibly simple.

You acquire gold for the percentage of your financial assets that you find appropriate.

Our clients hold up to 25% of their financial assets in physical gold and silver. Many of us have a much higher percentage.

The metals should be stored in a professionally managed ultra-secure vault in a safe jurisdiction. Preferably outside your country of residence, enabling you to “flee” to your gold in an emergency. Personally, I prefer Switzerland and Singapore.

This also makes it more difficult for your government to seize your gold like the US did in 1933.

Then, whenever you need liquidity, the vaulting company (like VON GREYERZ) that organises the storage for you will also provide liquidity. We also ship clients’ gold from anywhere in the world to our vaults in Switzerland or Singapore.

Remember that gold is instantly liquid, so you can have the funds transferred to your bank account within a few days.

It is advisable to keep at least three months’ spending in your bank account plus a small reserve. If you have no other income, you can sell sufficient gold every three months.

Gold and silver then become your reserve asset.

More importantly, gold is no one else’s liability.

Just to remind investors that since the year 2000, gold is up 8x or 700%.

More importantly, gold has outperformed all major asset classes in this century.

The compound annual return for gold since 2000 is 9.6%, and for the S&P with dividends reinvested, it is 7.5%.

With the bubble in stocks bound to burst at some point, whether it is soon or in the next few years, I wouldn’t be surprised to see the Dow vs Gold ratio decline by 75-95%.

Stocks can never be a reserve asset or insurance for preserving wealth.

Only physical gold fulfils that role.

Gold is nature’s money

Gold is real wealth

Gold is wealth preservation