Shielding Wealth Against Geopolitical Risks & Fiat Currency with Physical Gold

For many hard-working individuals, wealth is not just about accumulation – it’s about protection, stability, and resilience in an unpredictable world. As global markets become increasingly volatile and governments resort to aggressive monetary policies, one asset stands out as the ultimate shield against geopolitical risks and fiat currency depreciation: physical gold.

While stocks, bonds, and even real estate are vulnerable to external economic shocks, gold remains an independent store of value that has safeguarded wealth for centuries. In times of crisis, it serves as an insurance policy, protecting purchasing power and ensuring financial sovereignty.

What are the upcoming dangers of geopolitical instability and the erosion of fiat money?

Storing gold as protection against geopolitical risks

We live in a time of increasing geopolitical tension. Conflicts, sanctions, trade wars, and political instability have become everyday disruptors to financial markets. These events can send stock markets into freefall, devalue national currencies, and even lead to capital controls restricting investor freedom.

Unlike paper assets dependent on government policies and corporate performance, gold is a tangible, borderless asset that holds value regardless of political turmoil.

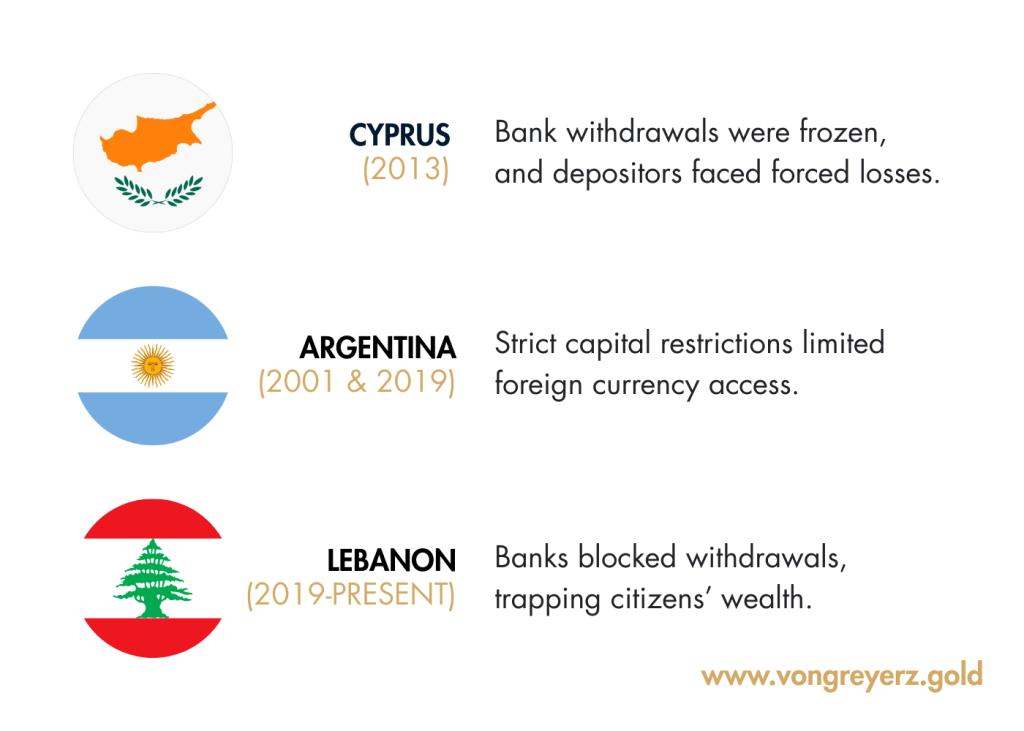

When governments face financial crises, they often impose capital controls to prevent money from leaving the country. This has happened in places like:

By storing physical gold in secure offshore jurisdictions, HNWIs can bypass capital controls, ensuring access to their wealth even in times of crisis.

Protecting wealth from monetary erosion & inflation

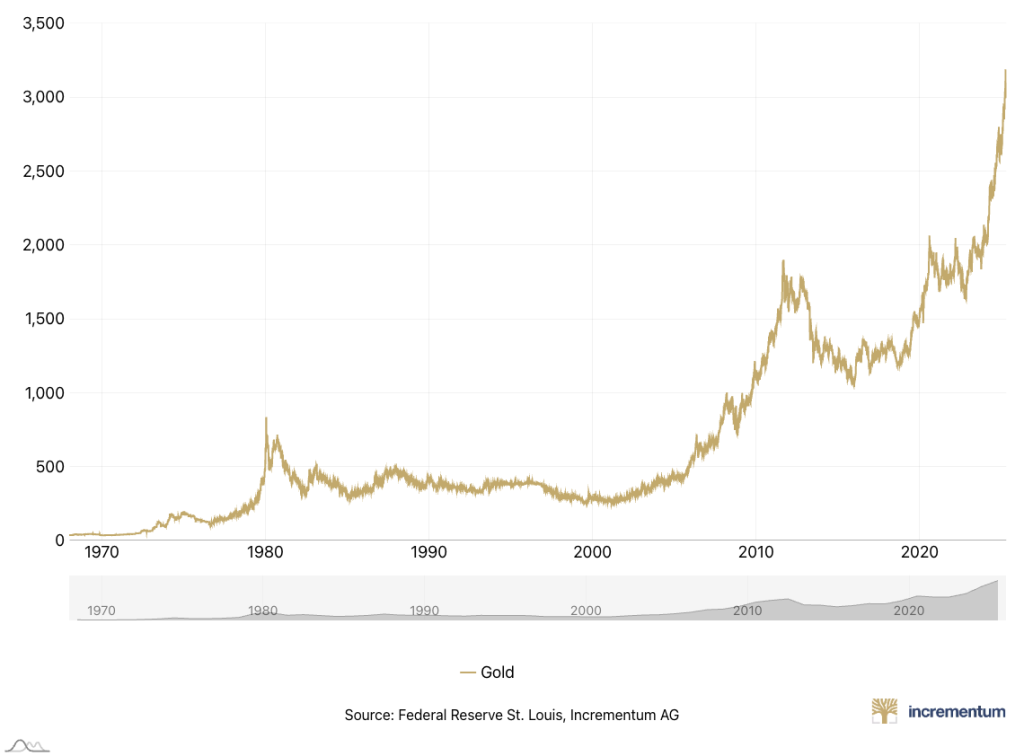

The second biggest risk to wealth preservation is the ongoing debasement of fiat currencies. Since the abandonment of the gold standard in 1971, global currencies have lost significant purchasing power due to excessive money printing and inflationary policies.

- The US dollar has lost over 98% of its value since 1913.

- The euro has seen significant devaluation since its introduction in 1999.

- Currencies in countries like Turkey, Argentina, and Venezuela have collapsed due to hyperinflation.

When governments print trillions in new money (as seen in the 2008 crisis, COVID-19 stimulus, and recent global bailouts), they dilute the value of existing money. This means cash savings, bonds, and even fixed-income investments gradually lose purchasing power. Central banks cannot print, manipulate, or devalue physical gold unlike paper currency. This makes it the ultimate protection against monetary debasement.

By holding a portion of wealth in physical gold, all wealthy individuals can ensure that their purchasing power remains intact, regardless of inflationary cycles.

Outside of banking system that failed

The modern financial system is built on debt, leverage, and institutional fragility. Bank collapses, stock market crashes, and economic crises are becoming more frequent, threatening investor wealth.

Because this precious metal operates outside the traditional banking system, it is:

- Not subject to bank failures or financial institution insolvencies;

- Not dependent on interest rates, stock market performance, or corporate health;

- A fully sovereign asset, free from counterparty risks.

Wealth sovereignty for wealthy individuals

For HNWIs, financial freedom is paramount. When governments push for increased financial surveillance, central bank digital currencies (CBDCs), or restrictions on cash usage, the ability to hold private, tangible wealth becomes ever more valuable.

Physical gold remains one of the few assets that offers complete financial independence. Unlike digital assets or paper investments, it is:

- Non-traceable by financial institutions;

- Unaffected by cybersecurity threats or digital hacking;

- Recognised globally as a valuable and easy-to-liquidate asset.

Using gold as a diversifier provides a discreet, portable, and secure store of value for investors seeking effective wealth preservation — away from increasing state control.

For high-net-worth investors, protecting wealth from geopolitical risks and fiat currency devaluation is not just a strategy today but a necessity. As global uncertainty rises, those who fail to hedge against these risks will find their wealth eroded, restricted, or lost. Savvy investors, however, understand that storing physical gold is not just an investment but an ultimate shield for wealth preservation and financial freedom for years to come.