Bitcoin vs. Physical Gold: Which Holds More Value?

As global economic uncertainty and inflation concerns dominate financial headlines, investors are increasingly drawn to assets considered “safe havens.” Gold, the timeless standard of wealth preservation, and Bitcoin, the emerging digital disruptor, are often compared for their potential as stores of value. While both assets offer unique advantages, their differences in history, utility, and risk profile highlight the challenges of choosing between them.

What Does It Mean to Be a Store of Value?

A store of value is any asset that maintains its purchasing power over time. To fulfil this role, the asset should resist depreciation, be easily tradable, and have widespread recognition. Gold has served this function for millennia, while Bitcoin, introduced in 2009, is a newcomer vying for the same status. To assess which is better, let’s explore their defining characteristics.

The Case for Gold: A Proven History

For over 5,000 years, gold has served as money, a reserve asset, and a store of value. Its durability, scarcity, and universal appeal have made it a cornerstone of wealth preservation. Governments, central banks, and individuals across the globe continue to rely on gold during times of crisis.

- Intrinsic Value and Tangibility

Unlike Bitcoin, physical gold is a tangible asset. Its physical presence makes it inherently valuable, independent of technological systems or third-party verification. In economic collapse or geopolitical turmoil, gold’s intrinsic worth provides a reliable hedge against fiat currency devaluation.

- Stability Over Volatility

Gold’s price fluctuates far less than Bitcoin’s, making it a more stable store of value. While Bitcoin can see 10% or more price swings in a single day, gold’s movements are usually far more measured, reinforcing its reputation as a “safe haven.”

- Universal Recognition

Gold’s value is universally recognised and easily liquidated in almost every country. This global acceptance makes it an ideal choice for investors seeking stability and reliability.

The Case for Bitcoin: Digital Innovation

Bitcoin, often called “digital gold,” presents a compelling alternative. Its supposedly decentralised nature and innovative blockchain technology have captured the imagination of a new generation of investors.

- Scarcity and Supply Control

Like gold, Bitcoin is finite – its supply is capped at 21 million coins. This scarcity underpins its value and protects it from the inflationary pressures of fiat currencies. Additionally, its issuance is algorithmically controlled, ensuring a predictable and transparent supply.

- Portability and Accessibility

Bitcoin’s digital nature makes it incredibly portable and easy to store. With the right technology, investors can carry millions of pounds worth of Bitcoin in a small hardware wallet or access it from anywhere with an internet connection.

- High Growth Potential

As a relatively new asset class, Bitcoin offers significant upside potential compared to gold. Its adoption by institutional investors, integration into payment systems, and potential as a hedge against fiat currency instability have fuelled dramatic price appreciation over the past decade.

- Decentralised and Censorship-Resistant

Bitcoin operates on a decentralised blockchain, free from government control or interference. This makes it particularly appealing in regions with unstable political or financial systems.

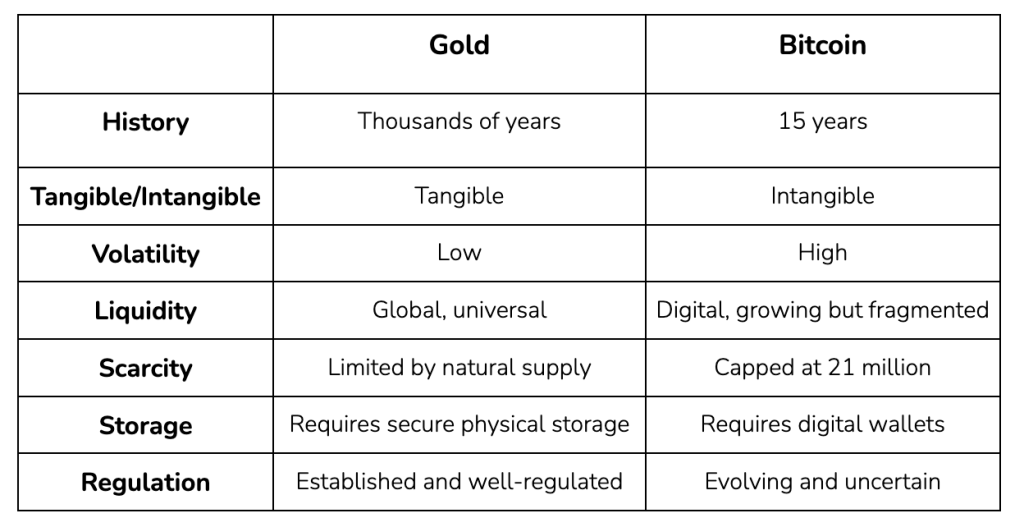

Key Differences Between Gold and Bitcoin

Challenges of Each Asset

While gold’s stability is unmatched, it does have drawbacks. Physical gold requires secure storage and insurance; transporting it across borders can be cumbersome.

In contrast, Bitcoin’s volatility and regulatory uncertainty make it a high-risk option for investors seeking predictability. Moreover, its reliance on technology exposes it to potential cybersecurity threats.

Which Is the Better Store of Value?

The answer depends on the investor’s goals, risk tolerance, and time horizon.

- Gold remains the go-to asset for wealth preservation, particularly for those seeking stability and protection against economic downturns. Its proven track record and universal acceptance make it a cornerstone of any long-term portfolio.

- Bitcoin, however, may appeal to those with a higher risk tolerance and an interest in technological innovation. Its potential for outsized returns and digital accessibility position it as a dynamic complement to traditional assets like gold.

The Balanced Approach

Rather than choosing one over the other, a diversified strategy may be the most prudent path.

- Gold acts as a stable anchor in a portfolio.

- Bitcoin provides exposure to a rapidly growing digital asset class.

This balanced approach allows investors to leverage the strengths of both assets while mitigating their weaknesses.

Final Thoughts

Both gold and Bitcoin have merit, but they serve different purposes and appeal to distinct types of investors.

- Gold’s enduring stability makes it indispensable for wealth preservation, especially during economic turbulence.

- Bitcoin offers a glimpse into the future of money and technology, presenting opportunities and risks.

Holding a combination of gold and Bitcoin may be the smartest strategy for those seeking to preserve and grow their wealth in today’s uncertain environment.

- BTC can “go to the moon” or crash to zero – no one really knows. Its standard deviation (over 160%) and history of 80% drawdowns make it challenging to defend as a store of value.

- In reality, Bitcoin behaves more like a highly leveraged tech index than a stable medium of exchange, account unit, or value store. At its core, it is an exciting speculative asset masquerading as a digital currency.