Why Physical Gold Thrives During Market Volatility

In times of economic uncertainty, when markets falter and currencies fluctuate, physical gold is a beacon of stability and security. Unlike paper assets prone to volatility, gold boasts a centuries-long history of safeguarding wealth. Here are a few reasons why physical gold thrives during economic turmoil and remains a cornerstone of financial resilience.

1. A Proven Safe Haven

Gold’s reputation as a haven asset is well-deserved. During financial crises, geopolitical unrest, or periods of high inflation, investors flock to gold as a store of value. Its intrinsic worth, independence from government policies, and scarcity make it a reliable option when traditional investments falter.

For instance, during the 2008 financial crisis, the value of gold surged by over 25% as stock markets plummeted. Similarly, in 2020, amidst the global uncertainty triggered by the COVID-19 pandemic, gold prices hit record highs, exceeding $2,000 per ounce. As sovereign debt levels exploded in the backdrop of a weaponised USD, gold surpassed 2700 in 2024 and is poised to climb far higher in the long term. These trends underscore gold’s role as a hedge against systemic risks.

2. Protection Against Inflation

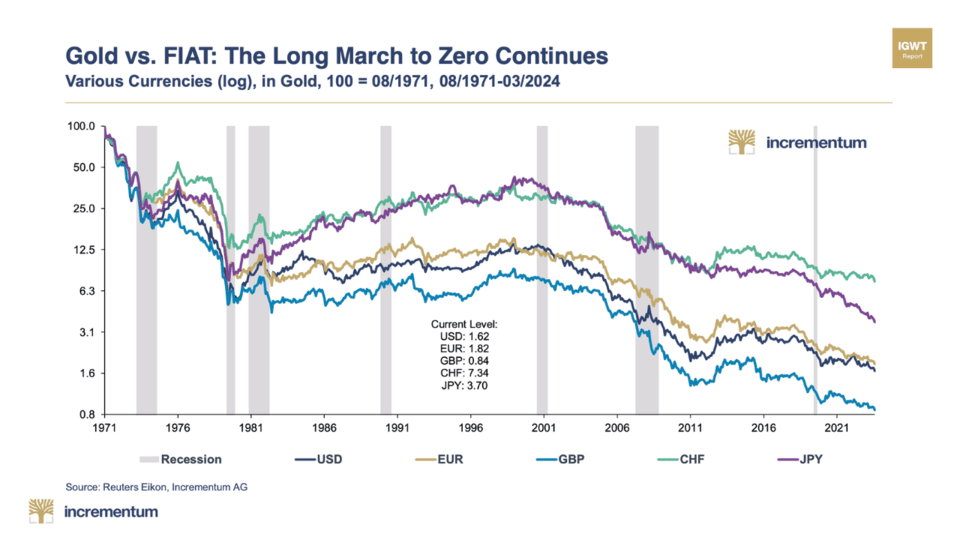

Inflation erodes the purchasing power of fiat currencies, but gold has historically acted as a shield against this loss. Unlike paper money, which can be printed in unlimited quantities, gold’s supply remains finite, and this scarcity underpins its value.

When inflation rises, central banks often implement policies like quantitative easing, which further devalues currencies. In such scenarios, physical gold typically appreciates as investors seek to preserve their wealth. For example, during the 1970s, marked by high inflation and economic stagnation, gold prices soared by more than 500%!

3. Currency Hedge in Times of Crisis

Gold also serves as a hedge against currency devaluation. When a nation’s currency weakens due to economic mismanagement, geopolitical conflict, or trade deficits, gold’s value often increases in that currency. For investors, owning physical gold can help offset losses caused by declining exchange rates.

4. Gold As a Diversifier & Portfolio Stabiliser

Economic uncertainty often results in market volatility, with sharp declines in equities and other risk-on assets. Gold, however, has a low or even negative correlation with these assets, making it an excellent diversification tool.

A well-balanced portfolio that includes physical gold is less susceptible to the fluctuations of traditional markets. While stocks and bonds might underperform during a recession, gold tends to hold its value or even appreciate. This balance can mitigate losses and provide stability.

5. Physical Gold vs. Paper Assets

While some investors turn to gold exchange-traded funds (ETFs) or other paper gold products during economic uncertainty, physical gold offers distinct advantages. ETFs depend on the solvency of financial institutions and can be subject to redemption restrictions in crises. On the other hand, physical gold is a tangible asset you fully control, free from counterparty risk.

Moreover, physical gold stored in secure, private vaults, such as those offered by VON GREYERZ, provides unparalleled peace of mind. It is protected from potential bank failures, government intervention, or withdrawal restrictions, which can occur during economic turmoil.

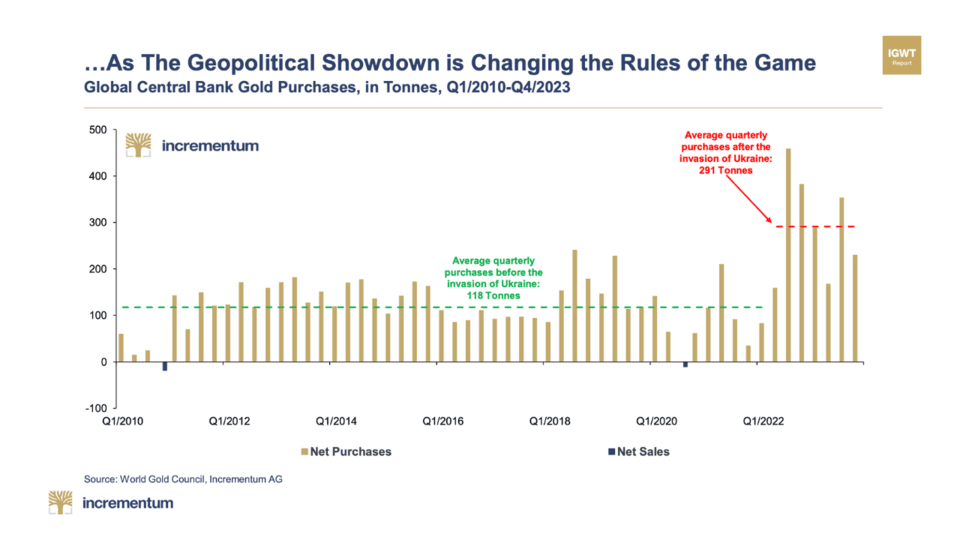

6. Gold’s Geopolitical Appeal

Geopolitical tensions, such as wars, trade disputes, or sanctions, often compound economic uncertainty. In such times, gold is a universal asset with global acceptance. Unlike other investments tied to specific economies or currencies, gold transcends borders, retaining its value regardless of location.

7. The Psychological Factor

Gold’s performance during economic uncertainty concerns financial fundamentals and investor psychology. In times of crisis, fear drives people to seek tangible assets they can trust. With its timeless allure and intrinsic value, physical gold provides a sense of security that few other investments can match.

Conclusion:

Economic uncertainty is inevitable in financial cycles, but gold remains a timeless solution for navigating turbulent times. Its ability to hedge against inflation, protect against currency devaluation, and provide diversification makes it a cornerstone of any prudent investment strategy.