Balancing Wealth Preservation and Growth: The Role of Physical Gold

Gold, a significant part of human history for thousands of years, is revered for its beauty, rarity, and enduring value. For modern investors, physical gold is a unique asset – unlike stocks or bonds, it doesn’t generate income, yet its appeal lies in something equally valuable: wealth preservation. This duality often raises the question, ‘Is storing physical gold better suited for preserving family wealth or generating growth?’

The answer lies in understanding gold’s role within the financial ecosystem and how it can support your broader economic goals.

A Timeless Strategy of Preserving Wealth With Gold

Historically, gold has been prized for preserving wealth over time. In the face of inflation, currency devaluation, or geopolitical crises, physical gold has consistently maintained its purchasing power. Here’s why:

1. Gold as an Antidote to Inflation

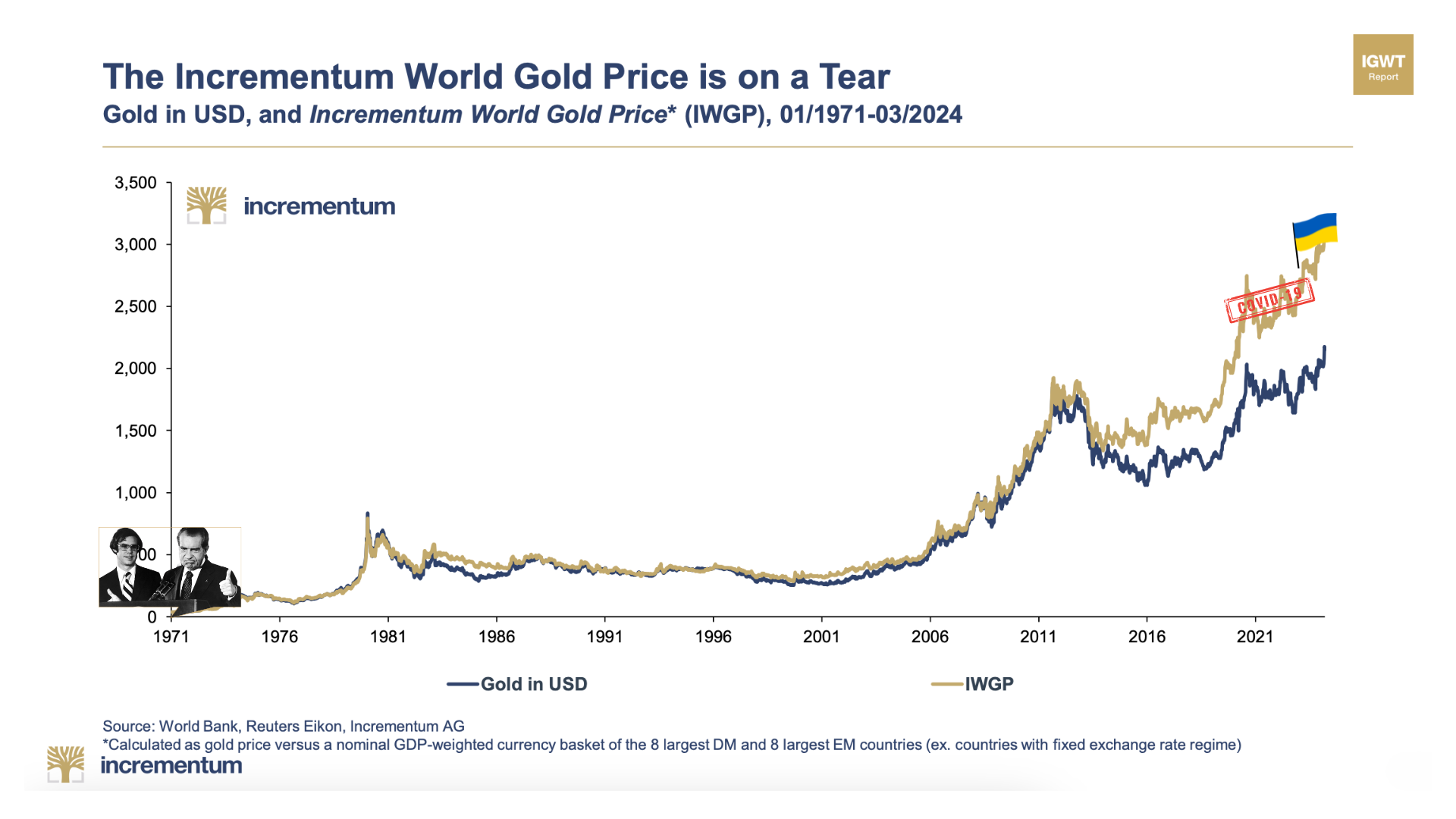

Gold is often referred to as a hedge against inflation because its value tends to rise when the purchasing power of paper currencies declines. For example, during high inflation in the 1970s and early 1980s, gold prices surged as investors sought refuge from the eroding value of fiat currencies.

2. Gold’s Stability in Uncertain Times

Gold’s resilience during economic downturns makes it a safe-haven asset. During the global financial crisis of 2008, physical gold prices rose significantly as investors sought stability amidst the chaos. Similarly, during the COVID-19 pandemic, gold prices spiked as uncertainty gripped markets.

3. Strategic Wealth Preservation Against Weakened Currencies

3. Strategic Wealth Preservation Against Weakened Currencies

Gold operates independently of any single country’s monetary policies. When currencies weaken, particularly in emerging markets, physical gold often rises in value, safeguarding investors exposed to currency volatility.

4. Diversification

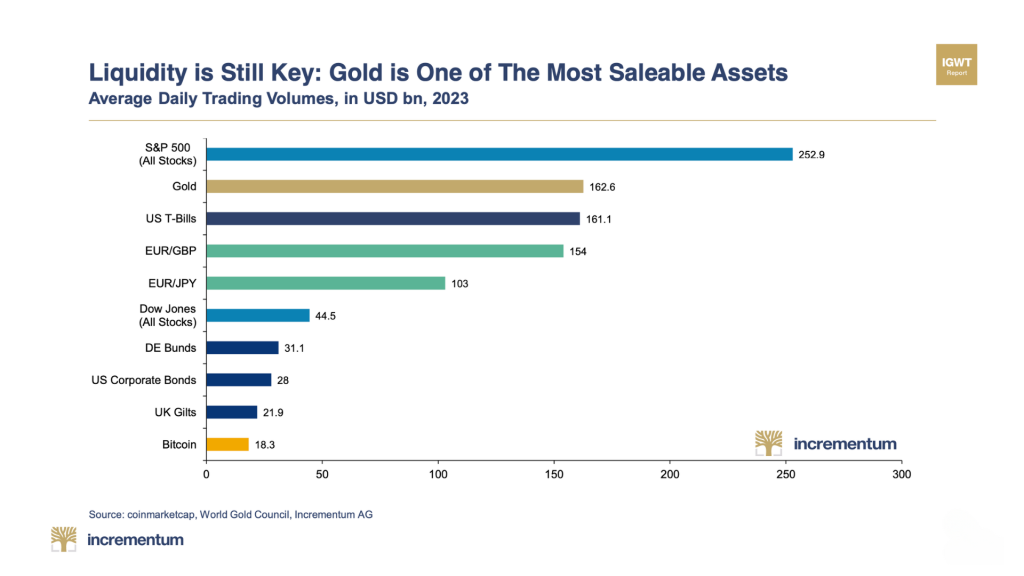

Gold has a low correlation with traditional asset classes like equities and bonds. This characteristic makes it an excellent diversification tool, reducing overall portfolio risk and preserving capital during market corrections.

In essence, gold doesn’t promise dramatic, immediate returns, but it does offer a hedge against financial and geopolitical turmoil, ensuring your wealth is protected when other assets falter.

Gold as a Vehicle for Strategic Wealth Preservation

While physical gold is primarily seen as a wealth-preservation tool, it can also contribute to wealth growth under certain circumstances. Over the long term, gold’s value has steadily increased, outpacing inflation and delivering returns that rival or even surpass some asset classes, including the S&P, since 2000. This growth potential can be a source of optimism for investors.

- Price AppreciationGold prices have risen from under $300 per ounce in the early 2000s to highs exceeding $2,700 in 2024. This growth underscores its potential to generate returns over time, especially during periods of economic uncertainty or declining interest rates, which increase the opportunity cost of holding non-yielding assets like gold.

- Cyclical Bull MarketsGold’s performance often aligns with specific market cycles. Gold outperforms during declining real interest rates, weakening currencies, or geopolitical instability. Investors who own gold for the long term can realise significant gains.

- Demand-Driven GrowthFactors like central bank purchases, increasing use of gold in technology, and rising demand from emerging markets contribute to price appreciation. For example, central banks have been net buyers of gold for over a decade, adding to upward price momentum.

- Speculative Opportunities Short-term investors can also benefit from gold’s price volatility. While not its primary function, physical gold’s ability to swing with market sentiment creates opportunities for profit in active trading environments.

Wealth Preservation vs. Growth: Finding the Balance

So, which is it – preservation or growth? The answer depends on your financial objectives and how gold fits into your investment strategy.

- Best Way to Preserve WealthIf your primary goal is to protect your family’s wealth from inflation, currency devaluation, or financial crises, storing physical gold is an excellent strategy. Its inherent stability and historical resilience make it ideal for long-term security.

- For Growth

Gold can still play a role if you’re seeking growth, particularly during market instability or when other asset classes underperform. However, its growth potential is generally lower than equities, high-yield investments or tech speculation stocks masquerading as “digital gold.”

A balanced approach often works best. Allocating 5-10% of your portfolio to physical gold ensures a mix of wealth preservation and financial growth. This balance provides a hedge against uncertainty while allowing for some upside potential, which can reassure investors.

Why Physical Gold?

Investors often choose physical gold – bars and coins – over paper gold or gold-backed ETFs because it eliminates counterparty risk. You retain full ownership and control when you store physical gold in a secure, private vault like those VON GREYERZ offers. This ensures your wealth is preserved and safeguarded against potential financial system failures or government intervention.

Physical gold also offers privacy and portability, which are especially valuable in times of crisis. While paper gold can be liquid, it’s tied to the broader financial system and may not provide the same level of security or independence.

Storing physical gold isn’t just about choosing between preserving your family’s wealth and growth – it’s about creating financial resilience. Gold is an anchor, preserving strategic wealth during turbulent times while offering modest growth opportunities when conditions align.

Whether safeguarding generational wealth or seeking a reliable hedge against inflation, gold provides a unique combination of stability and value appreciation. With VON GREYERZ’s secure storage solutions, you can ensure your investment is protected, empowering you to navigate the complexities of today’s financial landscape confidently.