Jim Rogers & Egon von Greyerz: Navigating Economic Uncertainty

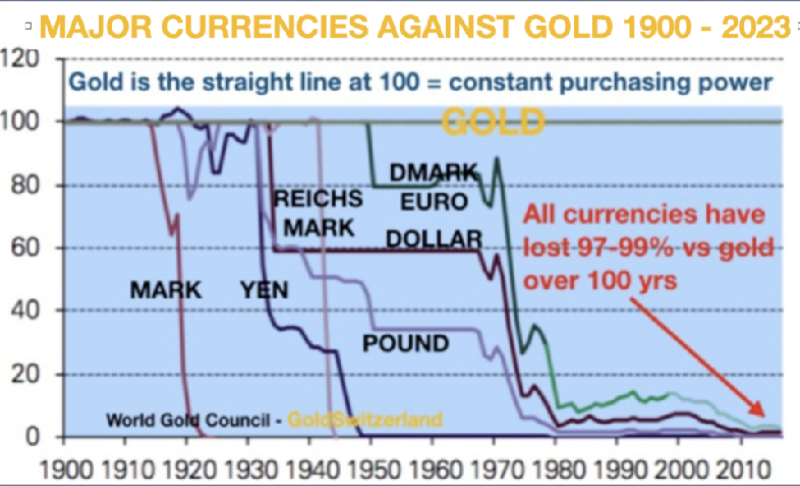

In this profound discussion held in Singapore, financial experts Egon von Greyerz and Jim Rogers explore the complexities of global economics, investment strategies, and the future of currencies. During the interview, Rogers shares his adventurous past and cautious optimism about the future, emphasising the unpredictability of political and economic landscapes. Both express concerns over the mismanagement of economies and the inherent risks in the current global financial system, especially the decline in the value of major currencies against gold.

Both Greyerz and Rogers discuss their personal investment approaches, favouring tangible assets like gold and silver over volatile currencies and highlighting the protective role these commodities can play in times of economic instability. Rogers and Greyerz also touched on the geopolitical tensions and the historical repetitiveness of nations’ failures to maintain robust economic structures. The dialogue concludes on a personal note, reflecting on the importance of family, stability, and the simple pleasures of life against the backdrop of global economic uncertainty.

- [0:00-1:03] Introduction: Jim Rogers’ reflects on his adventurous past, discussing his motivations for exploring the world despite inherent dangers.

- [1:03-2:08] Discussion on personal safety and the measures taken during travels to ensure vehicle and personal security, highlighting ongoing concerns about potential dangers.

- [2:08-3:12] Rogers talks about the challenges facing younger Americans, including national debt, contrasting with his experiences and choices.

- [3:12-4:19] Egon von Greyerz shares concerns about the global direction, particularly the economic, political, and moral decline observed in Western countries due to poor immigration and crime management.

- [4:19-7:04] The conversation shifts to the stability and safety of living in Singapore, with Rogers expressing a high sense of security compared to Europe. They discuss the economic stability of countries like Switzerland and the changes over time.

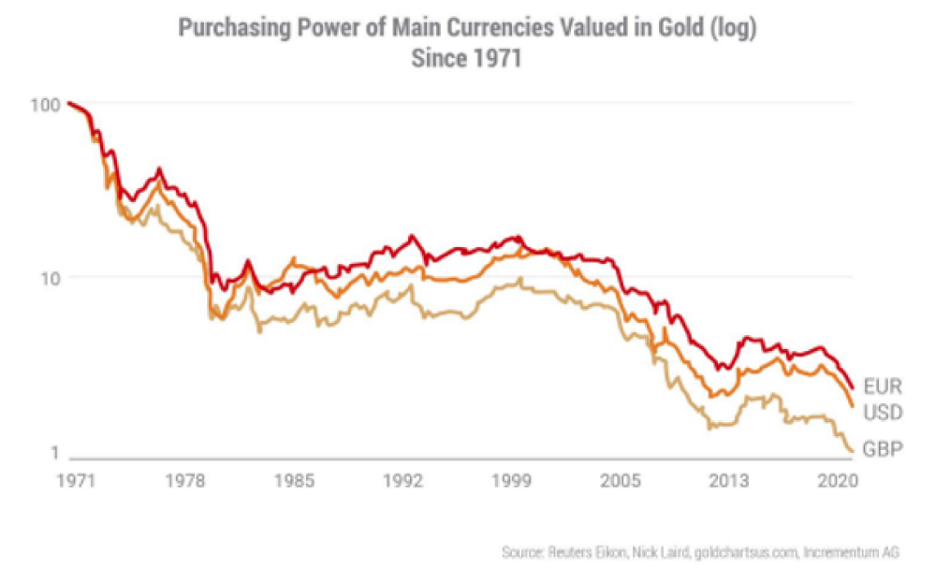

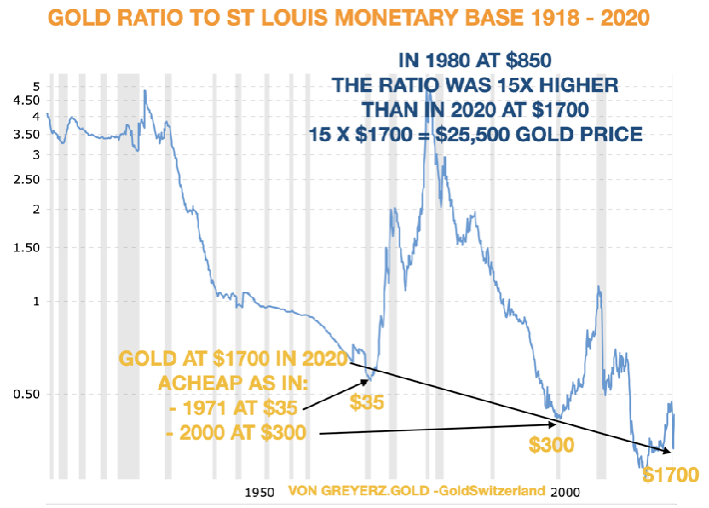

- [7:04-10:09] A deep dive into currency depreciation over the decades, with a focus on the Swiss Franc and the US dollar. They discuss central banks’ roles and the shift in reserves from gold to equities.

- [10:09-16:02] Discussion on commodities, particularly gold and silver, and their historical performance against currencies. They emphasize the strategic importance of holding precious metals as a hedge against currency devaluation.

- [16:02-22:48] The dialogue covers investment strategies, the importance of agricultural commodities, and Rogers’ approach to trading and long-term investment.

- [22:48-39:18] They delve into geopolitical risks, the potential for global conflict, and the importance of strategic relocation in extreme scenarios. The discussion also revisits the importance of precious metals in securing financial stability.

- [39:18-41:02] Closing remarks on life philosophies, the importance of family, and maintaining optimism amidst global challenges, along with a reflection on their personal experiences and future outlook.

This conversation offers deep insights into the economic philosophies and personal reflections of two prominent financial thinkers, set against the backdrop of a rapidly changing global environment.

Jim Rogers & Egon von Greyerz: Navigating Economic Uncertainty

Below, we soberly assess the lessons of history and math against the current realities of a debt-defined America to ask and answer a painful yet critical question: Is America losing?

The End of History and the Last Man

In 1992, while I was still an undergrad with a seemingly endless optimism in life in general and the American Dream in particular, the American political scientist, Francis Fukuyama, published a much-discussed book entitled, The End of History and the Last Man.

Released in the wake of the wall coming down in Berlin and a backdrop of continually low rates and rising US markets, this best-selling and optimistic work captured the Western mindset with obvious pride.

With its central theme (supported by an overt Hegelian and dialectal framework) of capitalism and liberal democracy’s penultimate and victorious evolution (Aufhebung moment) beyond the Soviet dark ages of a debt-soaked and centralization/autocratic communism, the famous book made headline sense in this Zeitgeist of American exceptionalism.

But even then, amidst all the evidence of Soviet failures (from extended wars, currency destruction, unpayable debts and a clearly dishonest media and police-state leadership), my already history-conscious (and fancy-school) mind could not help but wonder out loud if this book’s optimistic conclusion of the West’s ideological and evolutional end-game was not otherwise a bit, well: naïve.

Had the West truly reached a victorious “end of history” moment?

Pride & An Insult to History?

In fact, and as anyone who truly understands history should know then as now, history is replete with rhyming turning points, but never a victorious and eternal “end-game.”

Stated more simply, the famous book, which made so much sense at that particular moment in time, seemed to me even in 1992 as a classic example of “hubris comes before the fall.”

In other words, it may have been a bit too soon to declare victory for liberal democracy and capitalism, as these fine systems require fine leadership and even finer principles to survive history’s forward flow.

Today’s History…

Fast-forward many decades (grey hairs, advanced degrees and sore muscles) later, and it would seem that my young skepticism (and historical respect) was well-placed.

The evidence around us now suggests that the “victorious” capitalism Fukuyama boasted of in 1992 died long ago, replaced in the interim years by obvious and mathematically-corroborated examples of unprecedented wealth inequality and modern feudalism.

Furthermore, if one were to contrast the principles of America’s founding fathers as evidenced by their first 10 Amendments to the US Constitution (remember our Bill of Rights?) to the current and obvious destruction of the same in what is now a far more centralized, post-9-11 “Patriot Act” USA, the evidence of democracy’s crumbling façade is literally all around us.

In other words, perhaps Fukuyama got a little too ahead of himself.

Or more to the point, perhaps he was dead wrong about the final “victory” of genuine US capitalism and an actual, living/breathing liberal democracy?

Is the USA the Old USSR?

In fact, and with a humble nod to modesty, blunt-speak, current events, simple math and almost tragic irony, the actual evidence of history since 1992 suggests that today’s Divided States of America (DSA) (and Pravda-like media) appears to look far more like the defeated USSR than the victor presented by Mr. Fukuyama…

Such dramatic statements, of course, mean nothing without facts, and we all deserve a careful use of the same if we seek to replace emotion with data and hence see, argue and prepare ourselves politically and financially with more clarity.

Facts Are Stubborn Things

Toward this end, I am once again grateful for the facts and figures which Luke Gromen provides in supporting the otherwise “sensational” conclusion that America may have won the “cold battle” with the USSR, but it is now losing a “cold war” with the Russians and Chinese.

Really?

C’mon.

Really?

Again, let’s look at the facts. Let’s look at the numbers. Let’s look at current events, and let’s look at history, which is anything but at an “end.”

For those whose respect for history goes beyond a twitter-level attention span or the assistance of mainstream media Ken and Barbies (from CNN to The View), none of whom understand anything of history, you will recall that Regan’s successful war against the USSR was won by bankrupting the Soviets.

But as Gromen so eloquently reminds us, “nobody seems to notice that is EXACTLY what the Russians and Chinese are doing to us now.”

This is not fable but fact, and I warned of this in How the West was Lost the moment the US weaponized the USD in 2022. This desperately myopic (i.e., stupid) policy gave a very patient and history-savvy Russia and China just the opportunity they have been waiting for to turn the tables on the DSA.

History’s Fatal Debt Trap Lesson

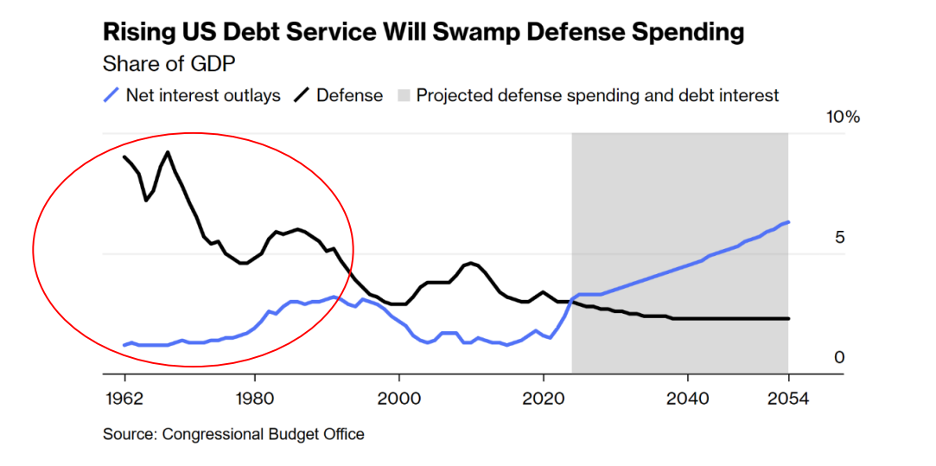

As I also recently wrote, with the insights of both Niel Ferguson and Luke Gromen, you know (and history confirms) a nation (or empire) is ALWAYS doomed the moment its debt expenses (in interest terms alone) exceed its defense spending.

And as of this writing, the DSA’s gross interest is 40% higher than its military spending.

Nor are we, the Russians, the Chinese or even a select minority of informed Americans alone in this knowledge of the DSA’s fatal debt trap.

No Hiding the Obvious

The current turning point in American debt is now increasingly and more globally understood in what Ben Hunt calls “the Common Knowledge Game.”

Stated more simply, and as evidenced by the now undeniable move away from the US IOU and USD by an ever-increasing (and ever de-Dollarizing) BRICS+ membership roster, the world is catching on to the blunt fact that the American empire (of citizen lions led by political donkeys) is spending fatally more than it earns.

What is far more sickening, however, is that Uncle Sam is then paying its IOUs with debased Dollars literally mouse-clicked into existence at the not-so “federal” and not-so “reserved” Federal Reserve.

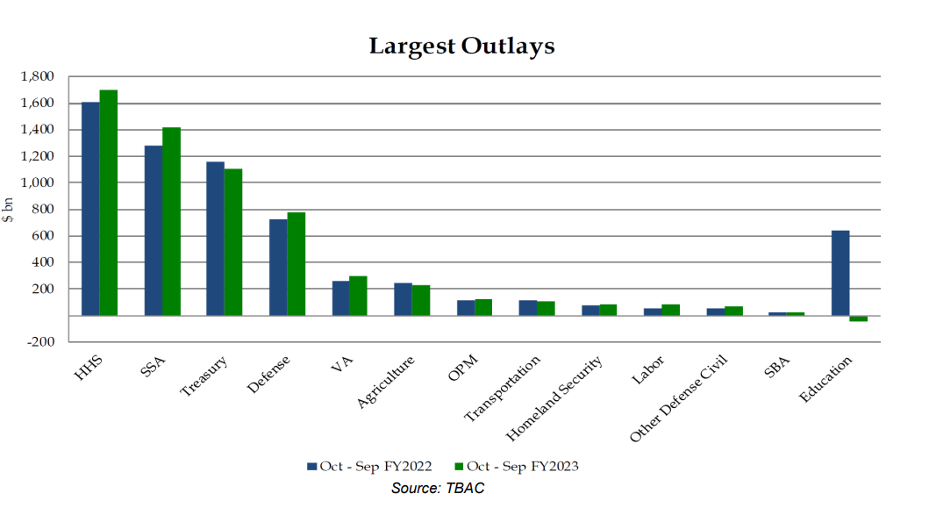

This desperate reality, and completely fantasy-based monetary “solution,” has resulted in an empirically bankrupt nation who quantifiably spends more on entitlements (cashed out by 2030), sovereign IOUs and warfare than it does on transportation, agriculture, veteran benefits and citizen education (our apologies to Thomas Jefferson).

See for yourself:

Returning from simple math to otherwise forgotten (or now increasingly “cancelled) history, it becomes harder to deny Gromen’s observation “that the US appears to be reprising the role of the USSR this time, with a heavy debt load, uncompetitive and hollowed-out industrial base, reliant on a Cold War adversary for imported manufactured goods, and needing ever-higher oil prices in order to keep its oil production from falling.”

Democracy’s Suicide?

In other words, and in the many years since Fukuyama declared victory in 1992, the interim sins/errors of increasingly suicidal (or grotesquely negligent/stupid) US military, financial and foreign policies have irrevocably placed the DSA into a defeated decline rather than victorious “End of History.”

This reality, of course, gives me no pleasure to share, as I was, am and will always remain a patriotic American—or at least patriotic to the ideals for which America originally stood.

But as I’ve said many times, today’s DSA is almost unrecognizable to the American I was when Fukuyama’s book of hubris was released over three decades ago.

As our second US President, John Adams, warned his wife Abigail: “Remember, democracy never lasts long. It soon wastes, exhausts, and murders itself. There never was a democracy yet that did not commit suicide.”

Again, this is history, and it appears to be a history that Fukuyama misunderstood in 1992, when he apparently thought it had reached its happy “end.”

The Past Informs the Future

Looking forward, I/we must be equally capable of looking backward.

History has far more to teach us than the stump-speeches (or pathetic cue cards) of current political opportunists (puppets?) who, with very few exceptions, care far more about preserving their power (via coalitions, the legalized bribery of K-Street lobbyists, the promulgation of mis-information and the deliberate omission of mal-information) than serving their public.

The Sad History of Currency Debasement

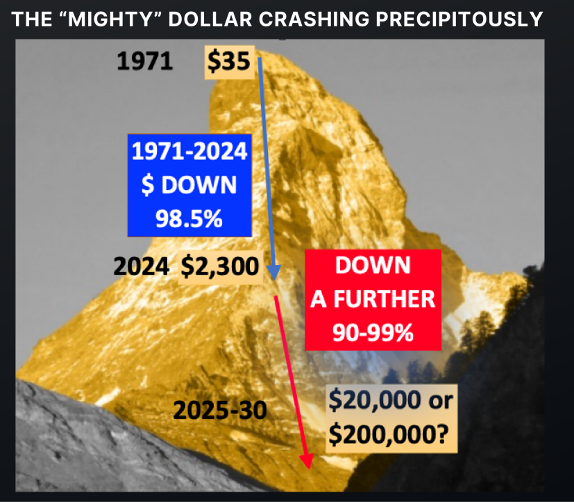

History also warns/teaches that the leadership of all debt-soaked and failing regimes will buy time saving their “systems” (and covering their @$$’s) by debasing their currencies to monetize their debts.

Folks, this is true throughout history, and WITHOUT EXCEPTION.

Sadly, the DSA and its hitherto “exceptionalism” is no exception to this otherwise ignored historical lesson.

Toward this end, and as Egon and I have argued for years, the DSA will thus pretend to “fight inflation” while simultaneously seeking inflation, as all debt-strapped (and hence failed) regimes need inflation rates to exceed interest rates (as measured by the yield on the US10Y UST) in what the fancy lads call “negative real rates.”

The Sad History of Dishonesty

Inflation, however, is not only politically embarrassing, but stone-cold proof of failed monetary and fiscal leadership.

To get around this embarrassment, politicos from the Fed and the White House to the so-called House of Representatives (and the Don-Lemonish/Chris Cuomo/ 1st Amendment-insulting/hit-driven legacy media which supports them) will do what most children do when faced with making an error, that is: Lie.

And in this case: Lie about inflation data.

Of course, a nation that lies to its people is not best suited for leading its people.

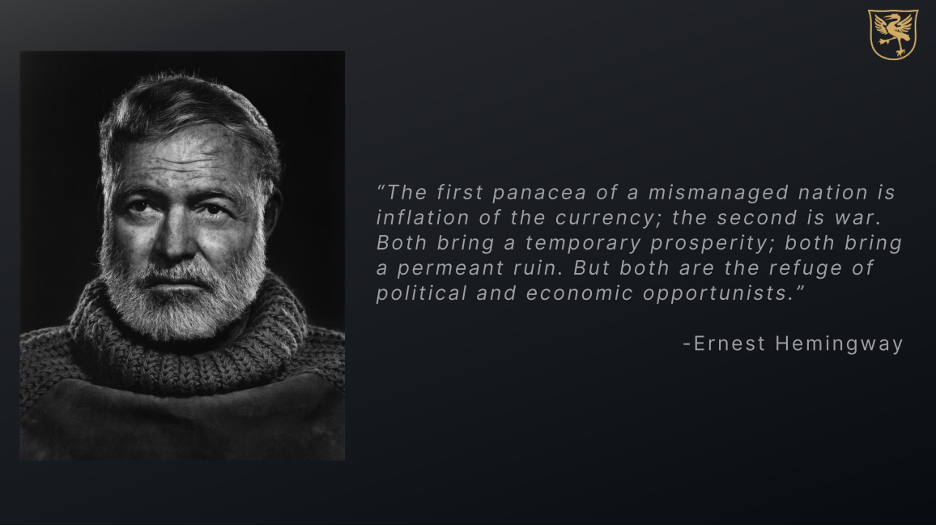

As Hemingway warned, and as I often repeat, those at fault will point the fingers of blame to others (from Eastern bad guys, and man-made viruses to political fear campaigns on everything from global warming, white nationalism or green men from Mars); or worse, leaders will distract their constituents in perpetual wars.

Sound familiar?

In the interim, those “people” will continually and increasingly suffer from the sins of their childish leadership under the crippling yet invisible tax of the debased purchasing power of their so-called “money.”

This too, is nothing new to those who track history…

Golden Solutions?

Gold, of course, cannot and will not solve all of the myriad and “human, all too human” failures of national leadership and the monetary, social and centralized disfunctions which ALWAYS follow in the wake of too much debt.

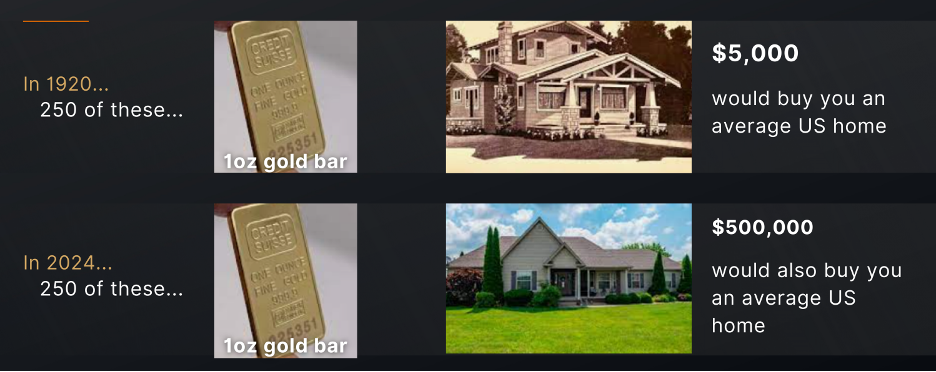

But as history also confirms (and equally without exception), each of us can at least protect the purchasing power of our wealth by measuring that wealth in ounces and grams rather than openly dying paper/fiat money.

This is not a biased argument. This is not a “gold bug” argument.

It is far more simply a historical argument, which further explains why governments don’t want you to understand the history of money nor the history of gold.

In fact, even Fukuyama’s now embarrassing book ignores this simple lesson of gold lasting and paper money dying, which only adds to my opening observation that history never “ends” it simply teaches and protects the informed.

The same is true of physical gold.

Jim Rogers & Egon von Greyerz: Navigating Economic Uncertainty

In this detailed interview with Silver Bullion Television, Matthew Piepenburg, partner at Von Greyerz, joins host Patrick Vierra in Singapore to discuss the pressing issues facing the global economy. Matthew offers his expert analysis on the dynamics of gold prices, the weakening US dollar, and the historical context of currency debasement. He also addresses the implications of central bank policies, including Quantitative Easing and its effects on both the economy and individual financial stability. Dive into this conversation to understand why and how nations resort to debasing their currencies and the strategic importance of investing in gold for preserving wealth. Don’t miss Matthew’s insights on the current economic trends and the future of financial markets.

The discussion revolves around critical economic themes such as the influence of central banks, the enduring value of gold, and the ramifications of currency debasement. This conversation sheds light on the current economic landscape and strategies for safeguarding wealth.

Summary with Key Takeaways:

- Central Bank Influence: The substantial power that central banks, especially the Federal Reserve, wield over the economy is emphasized. Their control over interest rates and monetary policy has significant global and domestic impacts.

- Currency Debasement: The historical tendency of governments to print money to cover debts leads to weaker currencies. The rise in gold prices is highlighted as a reaction to currency depreciation, particularly of the US dollar.

- Role of Gold: Gold is portrayed as a crucial asset for wealth preservation against currency debasement. It remains stable in value over time, unlike fiat currencies which have experienced significant purchasing power erosion.

- Economic Debt and Inflation: The unsustainable debt levels in the U.S. and other countries are discussed, which may lead to fiscal crises and influence central bank policies, potentially resulting in economic downturns.

- Global Shifts in Currency Use: The interview touches on the trend of de-dollarization, with more countries reducing their reliance on the US dollar, which could weaken its status as the global reserve currency.

- Socio-Economic Impacts: Financial policies often lead to wealth inequality and social divisions, which can cause broader social unrest.

- Gold as a Strategic Investment: Gold is recommended as a strategic investment, not for speculation but as a means to secure financial stability amidst economic uncertainties caused by weakening currencies and inflation.

This conversation provides a compelling overview of the economic challenges and strategies for navigating them, emphasizing the importance of understanding central banking practices, currency valuation, and investment in stable assets like gold. Matthew’s insights offer valuable guidance for those looking to secure their wealth in turbulent economic times.

Jim Rogers & Egon von Greyerz: Navigating Economic Uncertainty

Poor America. Poor Jerome Powell…

A Real Cliff, Fake Smile

It is no fun to be openly trapped, and even less fun to be in open decline while meekly declaring all is fine.

I have the image of Uncle Sam (or Aunt Yellen) hanging off a cliff with a forced (i.e., political) smile.

Above the cliff is a grizzly bear; below the cliff is a pool of sharks.

In short: Whichever direction one picks, the end result is messy.

And yet the markets still wait for Powell to make the right choice.

What right choice?

Rate Cut Salvation?

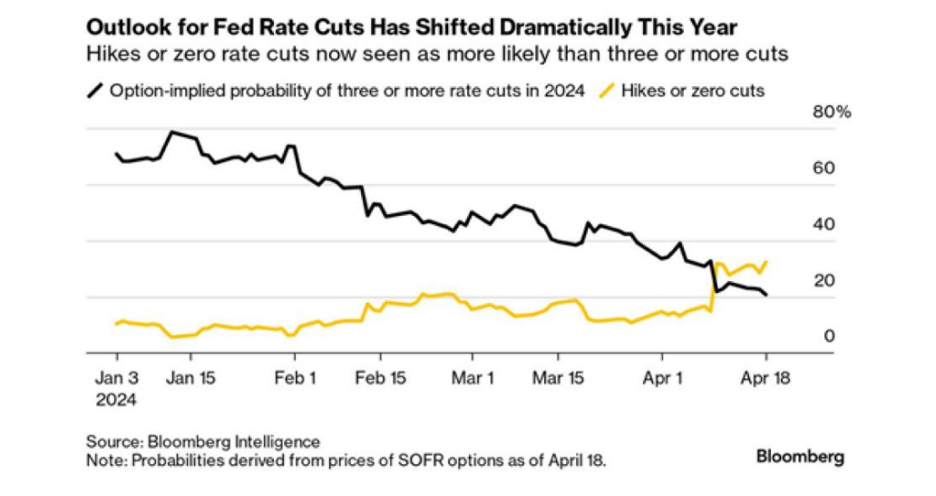

As of today, the markets, pundits and FOMC circus followers are all wondering when Powell’s promised rate cuts will come to save the Divided States of America and its Dollar-thirsty, debt-dependent “growth narrative.”

In January, Powell was “forward guiding” rate cuts and thus, right on cue, the Pavlovian markets, which react to Fed liquidity in the same way Popeye reacts to spinach, ripped north on words alone.

YTD, the S&P, SPX and NASDAQ are rising on rising rates hoping to morph lower.

Even gold and BTC are rising on rising rates—all of which makes no traditional sense—unless, of course, markets are just waiting for the inevitable rate cuts, right?

And who could blame them? After all, Powell promised the same, and Powell, the voice of “transitory inflation,” never mis-speaks, right?

But now the May markets, and even the Bloomberg Intelligence Reports, are worrying out loud about no rate cuts at all for 2024?

So, what will it be? Higher for longer? No more cuts? Three cuts in 2024?

What to do? How to know?

Break out the tarot cards? Read Powell’s palm? Beg?

Here’s My Take: Stop Caring, Because Either Way, We’re Screwed…

As for rate cuts, the case for them is fairly obvious, as I’ve opined elsewhere.

With trillions in USTs repricing in 2024, and over $700B in zombie bonds from S&P issuers doing the same, if Powell doesn’t cut rates, then sovereign and corporate bond markets are staring down a loaded barrel.

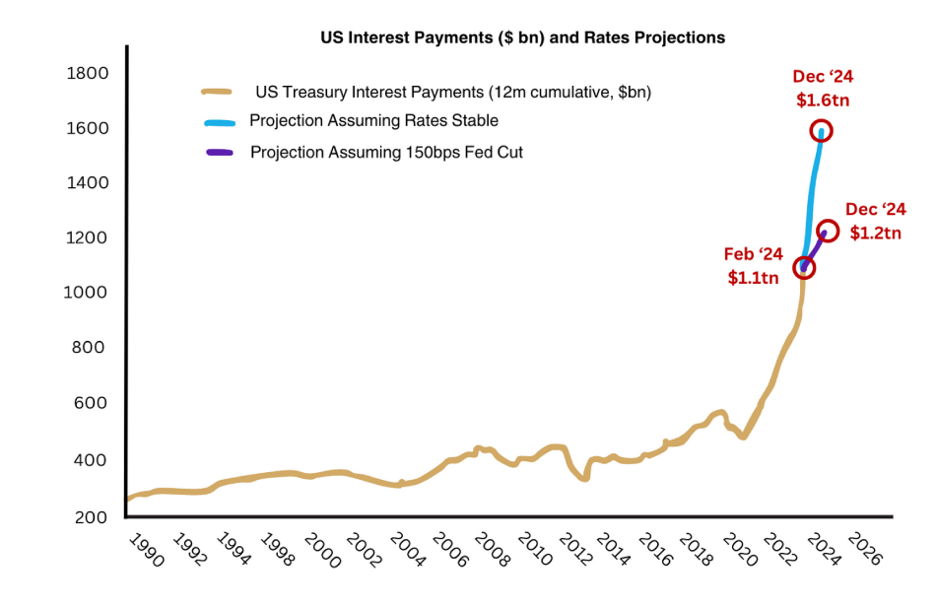

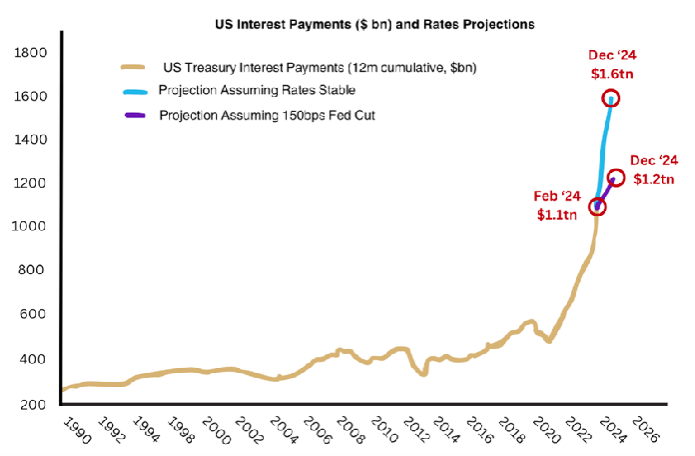

This is real. BofA’s own data confirms that Uncle Sam is looking at $1.6T in interest expense payments by year end if Powell doesn’t cut rates soon.

It’s also an election year, and a nice rate cut would be a tailwind for an incumbent (somnolent) White House that needs every possible tail wind it can get.

So, Why Wouldn’t Powell Cut?

The official answer, which, by the way, is never the honest answer, is that Powell and his “data dependent” Fed is still worried about inflation, which has failed to reach its “target 2%” level, whatever that is.

If one believes this narrative, then higher rates are still needed to “win the war on inflation.”

The great irony, and comedy, however, is that actual inflation, as even Larry Summers (or John Williams at Shadow Stats) would remind, is deeply in the double digits, and hence the Fed’s “data dependence” is nothing but a comical lie of “data manipulation.”

Another case for no rate cuts is Powell’s fear of making the “Volcker mistake” of 1980, when the then-Fed Chairman, believing inflation was tamed, cut rates too soon, and what followed was a dramatic spike in well: Even more inflation.

Perhaps Powell has a similar fear of cutting too soon and getting more inflationary egg on his politically two-faced brow?

Furthermore, if Powell cuts rates, demand for USTs, already a global joke since 2014, could worsen, and the US survives off others purchasing its increasingly unloved IOUs.

A rate cut, or series of rate cuts, would only add to this embarrassing demand lag, and hence put even greater pressure on finding new sources of fake money to pay America’s increasingly pathetic bar tab.

In short, cases can be made for looming rate cuts, and cases can be made for no rate cuts, but regardless of what happens, the case for a palpably tanking America stays the same.

Here’s why.

The No-Cut Scenario

If Powell stays higher-for-longer just about everything (from stocks and bonds to mortgages and economies) will break but the USD—at least as measured by the DXY’s relative strength.

In this regard, America can brag about being one of the best horses in the global currency glue factory.

But soon thereafter, the rising cost of Uncle Sam’s interest expense on ever-increasing UST issuance will become so high that the only way to pay for those higher-for-longer rates will be via fake money, which I remind Mr. Powell, is, well: Inflationary.

This is the classic, but undeniably real matter of “Fiscal Dominance,” which simply means that Powell’s war on inflation via rising rates ends ironically in an inflationary end-game of mouse-clicked liquidity.

We saw this same pattern (rising rates and QT) in 2018, which lead to falling rates and unlimited QE by 2020.

But then again, it seems for most investors, that kind of history (and hence lesson) is just too far away to recall…

Of course, the Fed, and BLS, will then… mis-report actual inflation.

The Three or More Cut Scenario

Alternatively, Powell could cut rates in 2024, weaken the USD, save the debt (and hence rate) sensitive stock markets and let inflation creep further north as whoever is running the Biden White House seeks to bribe the electorate.

Of course, the Fed, and BLS, will then… mis-report actual inflation.

In short, and in either scenario, the end-game is inflationary, and however misreported the CPI scale will be to hide this embarrassment, the inherent purchasing power of the USD (a melting ice cube) by which many measure their wealth, will get weaker and weaker, as the rich get a little less rich and the poor American serfs just get knee-capped.

But this is the lesson and warning of a nation and economy at the full mercy of a central bank rather than natural and free price discovery.

A Not-So-Free-Market Reality

The sad fact is capitalism died long ago.

Instead, we are all slowly frog-boiling within a centralized economy whose central planners/bankers, in cahoots with a failed, pathologically power-hungry and vote-purchasing DC “leadership,” who circa 1913 sold the nation down the river of a fatal debt quagmire paid for by fake liquidity and the open fantasy-made-mainstream-policy that one can save a debt-strapped nation with more, well…debt.

Or stated more simply, the US will desperately seek to inflate away its self-inflicted debt disaster (and increase its wealth inequality index) on the backs of ordinary, inflation-soaked citizens.

But as John Cougar Mellencamp once noted, “Awe, but aint that America…”

In all fairness to America, however, such historical slides into open mediocrity and a currency-debased debt quagmire are nothing new.

[Ignored] History Lessons

All failing nations ultimately resort to killing their currencies in order to buy time and “save” a system that is mathematically beyond the ability to be saved.

As Niel Ferguson recently reminded, “any great power that spends more on debt service than on defense will not stay great for very long. True of Hapsburg Spain, ancient regime France, the British Empire…”

It frankly staggers us that so few “sophisticated” market participants understand the simple (though increasingly “cancelled”) lessons and patterns of yesterday.

History, far more than an MBA or the promises of your Private Wealth Managers at banks X, Y or Z, can teach far-sighted investors how and where to position themselves.

Rising Gold Patiently Getting the Final Say

This slow but then sudden death of fiat money, seen countless times in our collective past yet ignored by our collective policy makers and day traders, makes history-confirmed anti-fiat solutions like gold all too obvious to ignore.

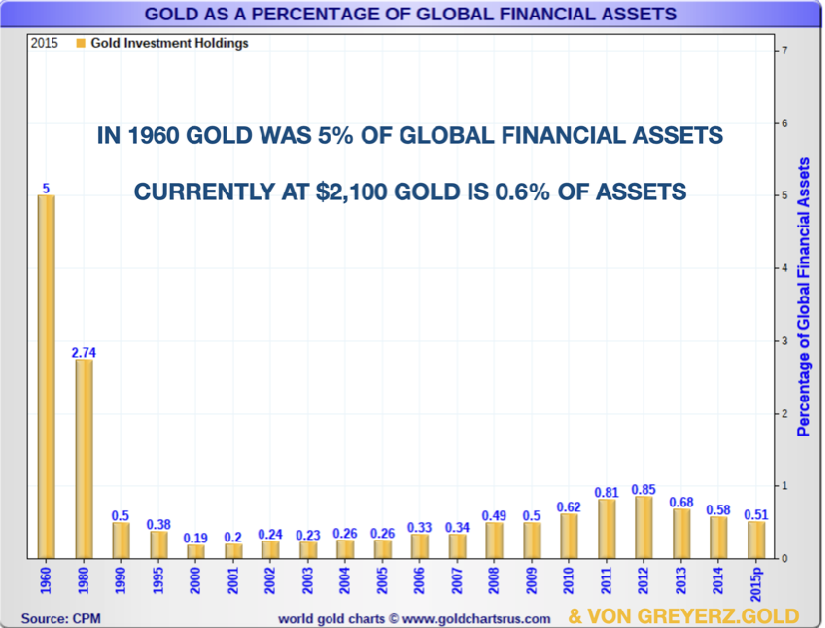

And yet, as my colleague Egon Greyerz recently observed, only about 0.5% of global financial asset allocations are made to gold.

In short, the ignoring (or ignorance) plunges forward…

But when this relatively finite assetof infinite duration reaches and surpasses its 40-year mean allocation of just 2%, the 4X increase in gold demand, and hence price, will be just the beginning of gold’s final response to unsound money.

Meanwhile, The Circus Continues

For now, clever traders and speculators can, will and should keep their eyes on a DXY (and Dollar) which, like the markets, can and will gyrate on the wings of a vast range of current and pending liquidity (backdoor QE) tricks, from the Treasury General Account, the repo markets and Supplementary Leverage Ratios to the Treasury’s Quarterly Refunding Announcements.

These same tricks (artificial liquidity-deck-chair shuffling on the Titanic) can have short-term implications on moving equities as well, perhaps buying more time for an otherwise narrow and entirely Fed-supported basket case S&P et al.

But what these same liquidity tricks are hiding in plain site is that America’s fiscal problems have gone from embarrassing to the iceberg-level desperate, and investors are measuring their “liquidity-supported” returns with an openly diluted Dollar.

As F. Gump would say, “stupid is as stupid does.”

From Frog Boil to Fully Cooked

Tax receipts and debt-driven GDP forecasts will never, not ever, be sufficient to plug the hole in the bow of the sinking US debt ship.

Despite whatever the trapped Powell or forked-tongued DC says, the only option forward is inflationary, (with a little bit of war to keep us distracted).

In fact, since Nixon decoupled from gold in 1971, that frog boil toward an ever-debased USD has been in full swing, losing purchasing power against physical gold at levels now too obvious to be ignored:

Apologists, however, will rightfully argue that compared to other currencies, including the poor Japanese Yen, which is experiencing multi-decade lows against the Greenback, that the USD is one’s best “relative choice.”

But why compare one fiat currency against another, when gold outperforms them all?

Just a thought, no?

Jim Rogers & Egon von Greyerz: Navigating Economic Uncertainty

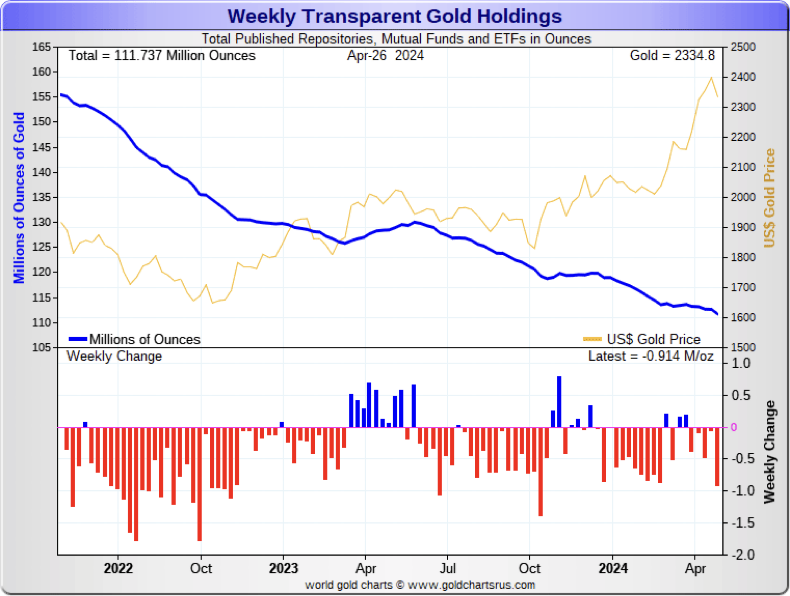

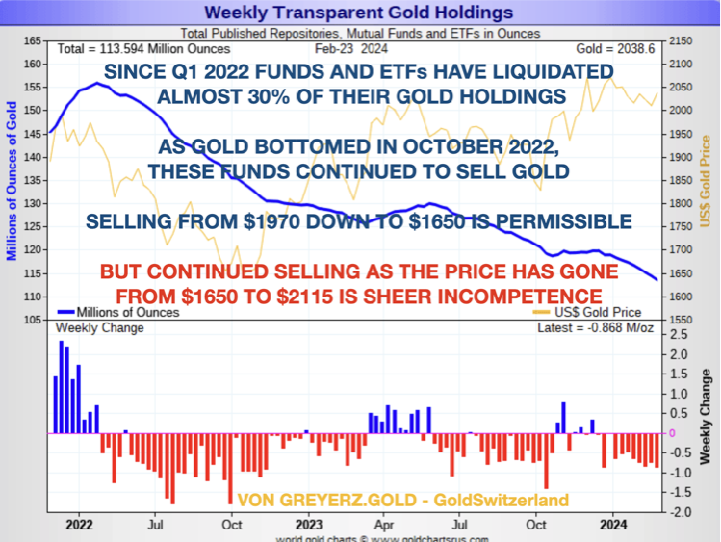

Since the October 2023 gold low of just over $1,600 gold is up but is anyone buying?

Well no, certainly none of the normal players.

Gold Depositories, Gold Funds and Gold ETFs have lost just under 1,400 tonnes of their gold holdings in the last 2 years since May 2022.

But not only gold funds are seeing weak buying but also mints such as the Perth Mint and the US Mint with its coin sales down 96% year on year.

Clearly gold knows something that the market hasn’t discovered yet.

RATES MUCH HIGHER

For the last few years I have been clear that there will be no lasting interest rate cuts.

As the chart shows below, the 40 year down trend in US rates bottomed in 2020 and since then rates are in a secular uptrend.

I have discussed this in many articles as well as in for example this interview from 2022 when I stated that rates will exceed 10% and potentially much higher in the coming inflationary environment, fuelled by escalating deficits and debt explosion.

“But the Fed will keep rates down” I hear all the experts call out!

Finally the “experts” are changing their mind and believe that cuts will no longer happen.

No central bank can control interest rates when its government recklessly issues unlimited debt and the only buyer is the central bank itself.

PONZI SCHEME WORTHY OF A BANANA REPUBLIC

This is a Ponzi scheme only worthy of a Banana Republic. And this is where the US is heading.

So strongly rising long rates will pull short rates up.

And that’s when the fun panic starts.

As Niall Ferguson stated in a recent article:

“Any great power that spends more on debt service (interest payments on the national debt) than on defence will not stay great for very long. True of Habsburg Spain, true of ancien régime France, true of the Ottoman Empire, true of the British Empire”.

So based on the CBO (Congressional Budget Office), the US will spend more on interest than defence already at the end of 2024 as this chart shows:

But as often is the case, the CBO prefers not to tell uncomfortable truths.

The CBO forecasts interest costs to reach $1.6 trillion by 2034. But if we extrapolate the trends of the deficit and apply current interest rate, the annualised interest cost will reach $1.6 trillion at the end of 2024 rather than in 2034.

Just look at the steepness of the interest cost curve above. It is clearly EXPONENTIAL.

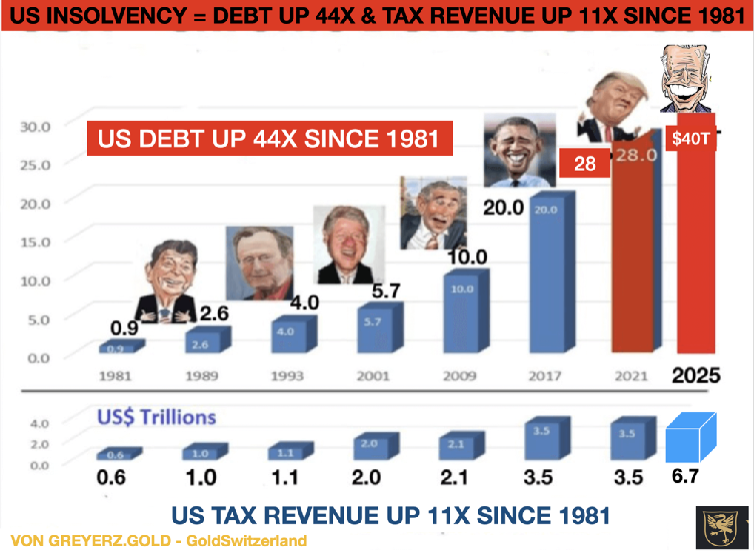

Total Federal debt was below $1 trillion in 1980. Now, interest on the debt is $1.6 trillion.

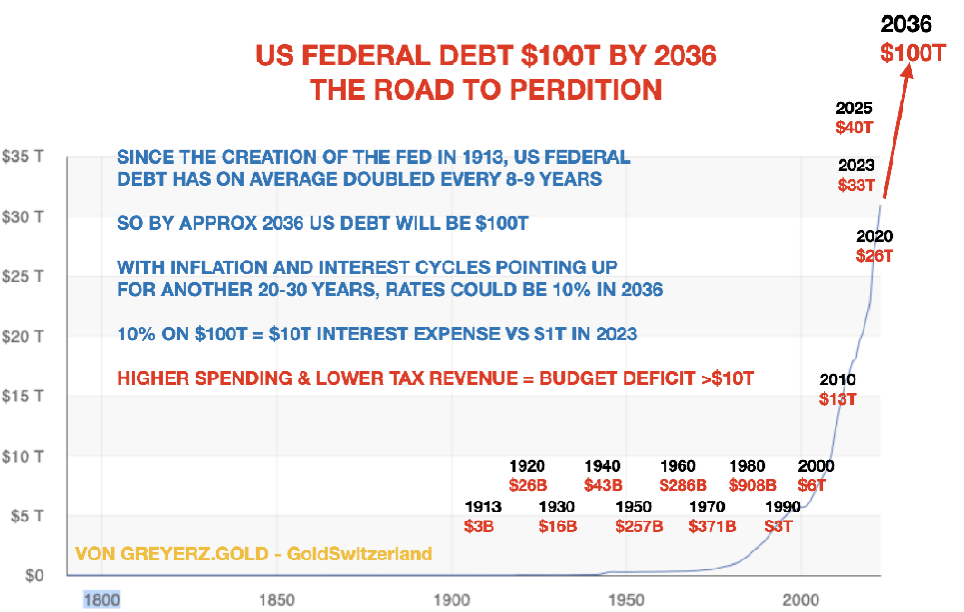

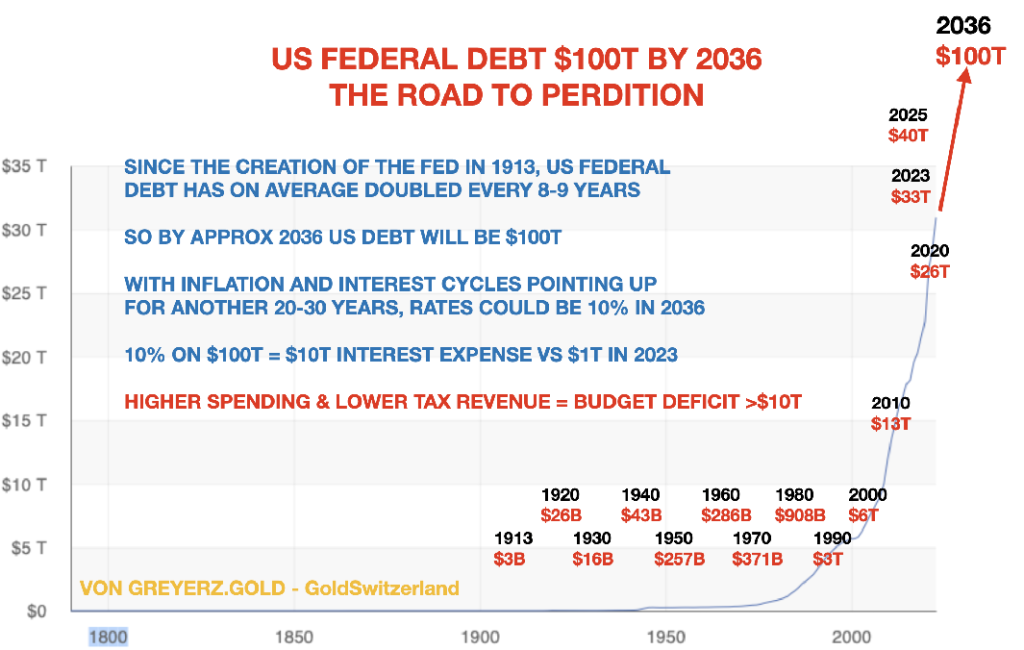

Debt today $35 trillion rising to $100 trillion by 2034.

The same with the US Federal Debt. Extrapolating the trend since 1980, the debt will be $100 trillion by 2036 and that is probably conservative.

With the interest trend up as explained above, a 10% rate in 2036 or before is not unrealistic. Remember rates back in the 1970s and early 1980s were well above 10% with a much lower debt and deficit.

US BONDS – BUY THEM AT YOUR PERIL

Let us analyse the current and future of a US treasury debt (and most sovereign debt):

- Issuance will accelerate exponentially

- It will never be repaid. At best only deferred or more probably defaulted on

- The value of the currency will fall precipitously

HYPERINFLATION COMING

So where are we heading?

Most probably we are facing an inflationary period leading to probable hyperinflation

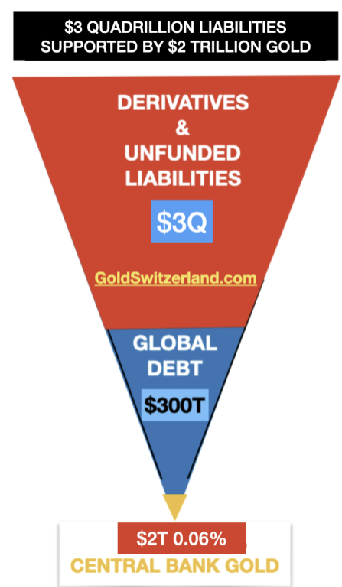

With global debt already up over 4x this century from $80 trillion to $350 trillion. Add to that a Derivative mountain of over $2 quadrillion plus unfunded liabilities and the total will exceed $3 quadrillion.

As central banks frenetically try to save the financial system, most of the 3 quadrillion will become debt as counterparties fail and banks will need to be saved with unlimited money printing.

BANCA ROTTA – BANKRUPT FINANCIAL SYSTEM

But a rotten system can never be saved. And this is where the expression Banca Rotta derives from – broken bench or broken bank as my article from April 2023 explained.

But neither a bank nor a sovereign state can be saved by issuing worthless pieces of paper or digital money.

In March 2023, four US banks collapsed within a matter of days. And soon thereafter Credit Suisse was in trouble and had to be rescued.

The problems in the banking system have just started. Falling bond prices and collapsing values of property loans are just the beginning.

This week Republic First Bancorp had to be saved.

Just look at US banks’ unrealised losses on their bond portfolios in the graph below.

Unrealised losses on bonds held to maturity are $400 billion.

And losses on bonds available for sale are $250 billion. So the US banking system is sitting on identified losses of $650 billion just on their bond portfolios. As interest rates go up, these losses will increase.

Add to that, losses on loans against collapsing commercial property values and much more.

EXPONENTIAL MOVES

So we will see debt grow exponentially as it has already started to do. Exponential moves start gradually and then suddenly whether we talk about debt, inflation or population growth.

The stadium analogy below shows how it all develops:

It takes 50 minutes to fill a stadium with water, starting with one drop and doubling every minute – 1, 2, 4, 8 drops etc. After 45 minutes the stadium is only 7% full and the last 5 minutes it goes form 7% to 100%.

THE LAST 5 MINUTES OF THE FINANCIAL SYSTEM

So the world is most probably now in the last 5 minutes of our current financial system.

The coming final phase is likely to go very fast as all exponential moves do, just like in the Weimar Republic in 1923. In January 1923 one ounce of gold cost 372,000 marks and at the end of November in 1923 the price was 87 trillion marks!

The consequences of a collapse of the financial system and the global economy, especially in the West can take many decades to recover from. It will involve a debt and asset implosion plus a massive contraction of the economy and trade.

The East and South and especially the countries with major commodity reserves will recover much faster. Russia for example has $85 trillion in commodity reserves, the biggest in the world.

As US issuance of treasuries accelerate, the potential buyers will decline until there is only one bidder which is the Fed.

Even today no sane sovereign state would buy US treasuries. Actually no sane investor would buy US treasuries.

Here we have an already insolvent debtor that has no means of repaying his debt except for issuing more of the same rubbish which in future would only be good for toilet paper. But electronic paper is not even good for that.

This is a sign in a Zimbabwe toilet:

Let us analyse the current and future of a US treasury debt (and most sovereign debt):

- Issuance will accelerate exponentially

- It will never be repaid. At best only deferred or more probably defaulted on

- The value of the currency will fall precipitously

That’s all there is to it. Thus anyone who buys US treasuries or other sovereign bonds has a 99.9% guarantee of not getting his money back.

So Bonds are no longer an asset of value but just a liability for the borrower that will or can not be repaid.

What about stocks or corporate bonds. Many companies won’t survive or experience a major decline in the stock price together with major cash flow pressures.

As I have discussed in many articles, we are entering the era of commodities and especially precious metals.

The coming era is not for speculation but for trying to keep as much of what you have as possible. For the investor who doesn’t protect himself, there will be a wealth destruction of an unprecedented magnitude.

There will no longer be a question what return you can get on your investment.

Instead it is a matter of losing as little as possible.

Holding stocks, bonds or property – all the bubble assets – are likely to lead to massive wealth erosion as we go into the “Everything Collapse”.

THE NEW ERA OF GOLD AND SILVER

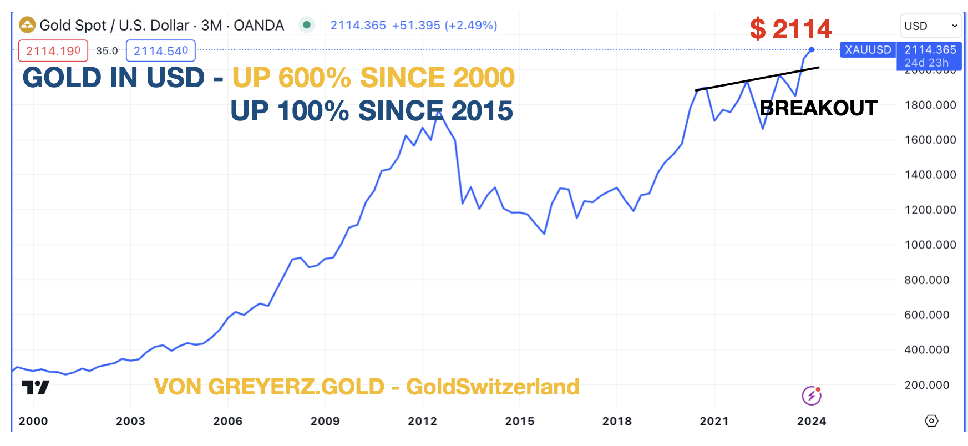

For soon 25 years I have been urging investors to hold gold to preserve their wealth. Since the beginning of this century gold has outperformed most asset classes.

Between 2000 and today, the S&P, including reinvested dividends, has returned 7.7% per annum whilst gold has returned 9.2% per year or 8X.

In the next few years, all the factors discussed in this article will lead to major gains in the precious metals and falls in most conventional assets.

There are many other positive factors for gold.

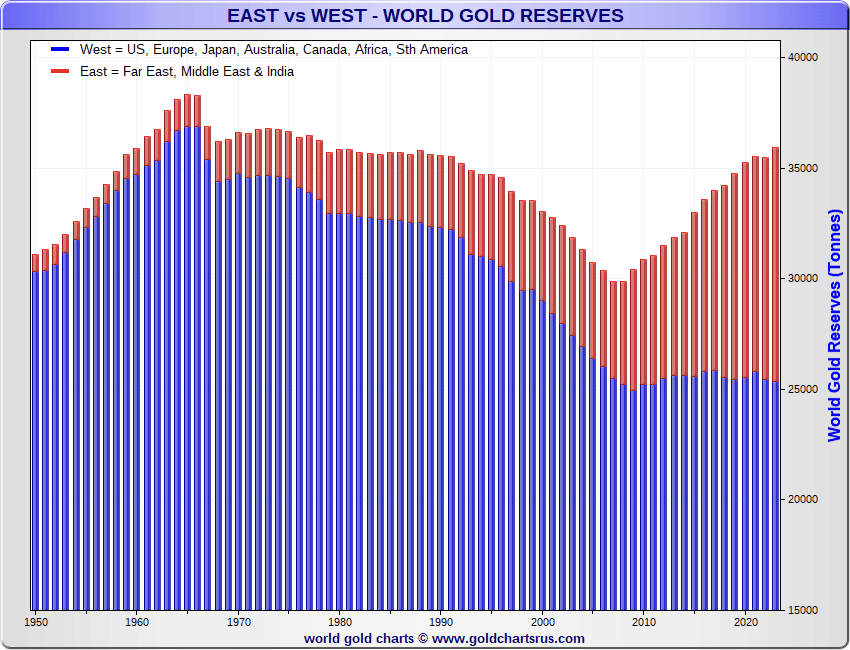

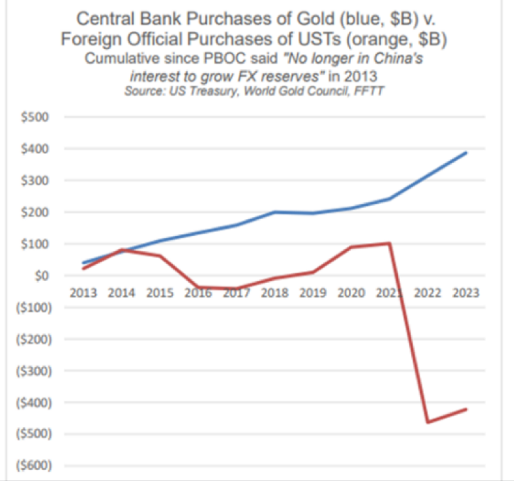

As the chart below shows, the West has reduced its gold reserves since the late 1960s, whilst the East is growing its gold reserves strongly. And we have just seen the beginning of this trend.

The US and EU sanctioning of Russia and the freezing/confiscation of the Russian assets in foreign banks are very beneficial for gold.

No sovereign states will hold their reserves in US dollars any more. Instead we will see central bank reserves move to gold. That shift has already started and is one of the reasons for gold’s rise.

In addition, gradually the BRICS countries are moving away from the dollar to trading in their local currencies. For commodity rich countries, gold will be an important part of their trading.

Thus there are major forces behind the gold move which has just started and will reach further both in price and time than anyone can imagine.

HOW TO OWN GOLD

But remember for investors, holding gold is for financial survival and protection of assets.

Therefore gold must be held in physical form outside the banking system with direct access for the investor.

Also gold must be held in safe jurisdictions with a long history of rule of law and stable government.

The cost of storing gold should not be the primary consideration for choosing a custodian. When you buy life insurance you mustn’t buy the cheapest but the best.

First consideration must be the owners and management. What is their reputation, background and previous history.

Thereafter secure servers, security, liquidity, location and insurance are very important.

Also, high level of personal service is paramount. Many vaults fail in this area.

Preferably gold should not be held in the country where you are resident, especially not in the US with its fragile financial system.

Neither gold nor silver has started the real move yet. Any major correction is likely to come from much higher levels.

Gold and silver are in a hurry so it is not too late to jump on the gold wagon.

Jim Rogers & Egon von Greyerz: Navigating Economic Uncertainty

VON GREYERZ partner, Matthew Piepenburg, joins John Buttler (Southbank Research) and David Lin in a spirited discussion on the omni-present yet undeniably important theme of the USD and its historical implications for rising gold.

Understanding gold tailwinds requires an understanding of debt forces and their impact on fiat currencies in general and the USD in particular. Toward that end, Piepenburg opens with a high-level (yet fact-focused) assessment on the current and unprecedented debt crisis in the land of the world reserve currency. Piepenburg unpacks how such debt crises impact a broad range of market themes—from risk assets, rate policies, recessionary forces, inflation cycles and precious metals.

When asked about the time horizon for such events to unfold, Piepenburg argues that the process has already begun. He gives example after example of real-time signals of a USD in open distrust and hence open decline. David asks if and how sovereign deficits impact stock markets. Piepenburg and Buttler address this question in divergent ways, but both agree that even a Fed-supported market rising in a background of cancerous debt levels can only be “maintained” at the expense of a debased and terminally ill (Fed-printed) currency. Piepenburg and Buttler then address the causes, risks and opportunities in a rising equity market bubble.

David asks why the USA has yet to experience hyperinflation, to which Piepenburg and Buttler share their opinions. For Piepenburg, the inflationary end-game is a matter of cycling through dis-inflationary interest rate and recessionary cycles, which will be followed by highly inflationary direct and indirect QE policies out of DC. In this light, the conversation turns to current and projected Fed policies, record UST issuance, long-term interest rate direction and the hard math behind real rather than reported inflation.

All themes, of course, lead to gold and the conversation ends with a review of all the forces–from the oil markets, de-dollarization trends among the BRICS+ nations to COMEX changes and a debt-trapped/cornered US Fed–which point toward an inherently weaker USD. This all explains the current gold rise and a much greater to rise to come.

Jim Rogers & Egon von Greyerz: Navigating Economic Uncertainty

Needless to say, we at VON GREYERZ spend a good deal of time thinking about, well… gold.

The Complex, the Simple, the Math and the History

Year after year, and week after week, there is always a new way to examine gold price moves and decipher the obvious and not-so obvious forces which flow behind, ahead, above and below its monetary and, yes, metallic, move through time.

Today, deep into the early decades of the 21st century, and well over 100 years since the not-so immaculate conception of the Fed in the early 20th century, we could (and have) spent pages and paragraphs on key turning points in the rigged to fail history of paper vs. metallic money.

At times, this effort can and has seemed intense and even complex, with all kinds of historical facts, mathematical comparisons and “big events.”

The turning points of gold’s relationship with fiat currencies, and its role in preserving wealth, for example, are known to an admitted minority—as only about 0.5% of global financial allocations include physical gold.

Gold’s Language

Yet the need, role and direction of gold is fairly blunt, at least for those with eyes to see and ears to hear.

History, for example, has some clear things to say about paper money.

And so does gold.

From the Bretton Woods promises of 1944 and Nixon’s open and subsequent welch on the same in 1971 to the 2001 outsourcing of the American dream to China under Clinton (and the WTO) or the recent weaponization of USD in Q1 of 2022, gold has been watching, acting and speaking to those who understand her language.

The Big Question: Why Is Gold Rising Now?

And this year, with gold reaching all-time-highs, piercing resistance lines and racing toward what the Wall Street fancy lads call “price discovery,” we are understandably getting a lot of interview requests, phone calls and even emails from friends otherwise silent for years and now suddenly asking the same thing:

“Why is gold rising now?”

The Wall Street side of my odd brain, like it or not, gets all excited by such questions.

Never at a loss for words, my pen and mouth rapidly seek to wax poetic on the many answers to why gold matters forever in general, and why it is rising in particular now.

Toward that end, the list of the fancy and not-so-fancy answers to this question in recent years, articles and interviews could look as simple (or as complex) as the following list of 7 key factors:

The Malignant Seven

- Every debt crisis leads to a currency crisis—hence: Good for gold.

- All paper currencies, as Voltaire quipped, eventually revert to their paper value of zero, and all debt-soaked nations, as von Mises, David Hume and even Ernest Hemingway warned, debase their currencies to retain power—hence: Good for gold.

- Rising rates (and fiscal dominance) used to “fight inflation” are too expensive for even Uncle Sam’s wallet, thus he, like all debt-soaked nations, will debase his currency to pay his own IOUs—hence: Good for gold.

- Global central banks are dumping unloved and untrusted USTs and stacking gold at undeniably important levels—hence: Good for gold.

- After generations of importing US inflation and being the dog wagged by the tail of the USD, the BRICS+ nations, prompted by a weaponized Greenback, are now turning their tails slowly but surely away from the USD dog—hence: Good for gold.

- The Gulf Cooperation Council oil powers, once seduced (circa 1973) into a Petrodollar arrangement by a high-yielding UST and globally revered USD, are now openly selling oil outside of the 2024 version of that far less-yielding UST and far less-trusted USD—hence: Good for gold.

- That legalized price-fixing sham otherwise known as the COMEX employed in 1974 to keep a permanent boot to the neck of the gold price, is running out of the physical gold needed to, well…price fix gold—hence: Good for gold.

In short, each of these themes–from sovereign (and unprecedented) debt levels, historical debt lessons, the secrets of the rate markets, global central banks dumping USTs or the implications of changing oil markets to the OTC derivatives scam masquerading as capitalism–all DO explain why gold is rising now.

This list, of course, may be simple, but the forces, indicators, lingo, math and trends within each theme can be admittedly complex, as each theme is in fact worthy of its own text book rather than bullet point.

Indeed, currencies, markets, history, bonds, geopolitics, energy moves and derivative desks are complicated little creatures.

But despite all this complexity, study and deliberation, if you really want to address the question of “why is gold rising now?”—the answer is almost too simple for those of us who wish to appear, well… “complex.”

The Too-Simple Answer to the Big Question

In other words, the simple answer—the answer that cuts through all the fog, lingo and math of “sophisticated” financial markets–boils down to this:

GOLD IS NOT RISING AT ALL. THE USD IS JUST GETTING WEAKER AND WEAKER.

At VON GREYERZ, we never measure gold’s value in dollars, yen, euros or any other fiat currency. We measure gold in ounces and grams.

Why?

Because history and math (as well as all the current and insane financial, geopolitical, and social events staring us straight in the eyes today) teach us not to trust a currency backed by man (or the “full faith in trust” of the UST or a Fed’s mouse-clicked currency), but instead to seek value in monetary metals created by nature.

Fake Money & Empty Promises

Once a currency loses a gold backing (nod to Nixon), it is nothing more than the empty promise of a government now free to print and spend without a chaperone to buy votes, market bubbles and even a Nobel Prize (i.e., what Hemingway called “temporary prosperity”) but then hand the bill and inflation to future generations (what Hemingway then called “permanent ruin”).

Gold Does Nothing

So yes, gold, as Buffet and others have quipped, “does nothing.” It just sits there and stares at you.

But while this yield-less pet rock sits there “doing nothing,” the currency by which you measure your wealth is in fact quite busy melting like an ice cube–one day, month and year at a time.

Here’s to Doing Nothing: Price vs. Value

Sometimes a picture can say a thousand words and make the most complex economic topics or themes, like “price vs. value” or “store of value,” make immediate sense.

Think, for example, about a 1-ounce bar of gold just doing nothing in say… 1920.

Well, if you had 250 of those do-nothing ounces in a shoe box in 1920, which was “priced” then at around $20 USD per ounce, you could afford the average US home, then priced at $5000.

Today, however, the average price of a US home is $500,000.

So, if your grandfather left you a shoebox with 5000 crumpled Dollars inside, it would not even pay for the landscaping needed for that same house today.

But if your grandfather had instead handed you a shoebox with those same 250 singe-ounce bars of gold (today “priced” at 2300/ounce), you could buy the same average home and the landscaper too—with a nice tip for the latter.

So, do you still think those little gold bars just stared back at you, doing nothing?

After all, the shoe box with the 5000 USDs inside was very busy doing one thing very well, namely: Losing its value like snow melting off a spring mountainside…

So, which shoebox would you want to measure your wealth?

The one measured in fiat dollars actively losing value? Or the one measured in gold ounces “doing nothing” but retaining its value?

Sometimes the complex really is that simple.

The Next Big Question: Where’s Gold Headed Tomorrow?

The pathway to answering such a question is just as clear as the one we just traveled.

The aforementioned “Malignant Seven” are each factors which we believe will continue to push the USD down and hence gold higher, because, and to repeat: It’s not that gold will get stronger, it’s just that all fiat currencies in general, and the weaponized, distrusted and over-indebted USD in particular, get weaker.

But for those still understandably and realistically convinced that despite its myriad and almost endless flaws, the US (and its Dollar) is still, for now at least, the best horse in the glue factory, a case can be made that measured relative to other currencies (i.e., the DXY), that the USD is supreme, and that when and as financial markets weaken, investors will flock to it like a lifeboat in a tempest.

Milkshake Theory?

Such a credible view is held by very smart folks like Brent Johnson, with whom I have discussed the USD at length.

Brent’s “milkshake theory” intelligently argues that powerful demand forces from the euro dollar, SWIFT and derivative markets, for example, create a massive, “straw-like” sucking sound for the “milky” USD, which demand will keep it strong, and send it stronger, in the seasons ahead.

He may in fact be right.

But I think differently.

Why?

Two primary reasons stick out.

No “Straw” for the UST

First, despite the undeniably powerful demand forces at play for the USD, demand for USTs is, and has been, tanking around the world since 2014. That is, foreigners don’t trust the US IOUs as much as they did before America became a debt trap.

Ever since foreign (central bank) interest in USTs began net-selling in 2014, and gold interest began net-buying in 2010, the only buyer of last resort for US public debt has been the US Fed, and the only tool the US Fed has to purchase that debt is a mouse-clicker (“money printer”) at the Eccles Building.

Unfortunately, creating money out of thin air is not a sustainable policy but a near-term fantasy. More importantly, such a policy is inherently, and by definition: Inflationary.

My US Realpolitik Theory…

The second, and perhaps more important reason the USD’s declining future is fairly easy to see (or argue), is this:

EVEN UNCLE SAM WANTS AND NEEDS A WEAKER DOLLAR.

Why?

Because the only way out of the biggest debt hole the US has ever seen is to inflate its way out of it by debasing the currency to “save” an otherwise rotten system.

We’ve argued this for years, and the facts supporting this historically-repeated pattern (and view) haven’t changed; they’ve just grown worse.

That is why it was easy to foresee that inflation would not be “transitory” despite all the useless commentary (and Fed-speak) arguing to the contrary.

That is also why it was easy to see that Powell’s “war on inflation” was a political ruse—an optics play.

Powell’s real aim was (and remains) inflationary via negative real rates (i.e., inflation higher than 10Y bond yields).

Thus, even while pursuing his “higher-for-longer” and anti-inflationary rate hikes, actual inflation, which Powell needed, was still ripping.

But he (and the BLS) was able get around this embarrassing CPI reality by simply lying about the actual inflation…

In other words: Classic DC fork-tonguing…

China is Not Turning Japanese

But in case you still need further proof that the US wants and needs a weaker USD to fake its way out of their self-created debt disaster via an increasingly diluted USD at YOUR expense, just consider what’s happening with China.

Unbeknownst to many, Yellen has been scurrying off to Asia to convince, cajole or even threaten China into accepting a weaker USD vs the CNY.

Why?

Because the prior, “stronger” 40-year version of the Dollar has rendered expensive US exports (and trade deficits) unable to compete with cheaper Chinese goods.

This floating currency game was a trick the US played on Japan when I was a kid—i.e., weaken the USD to fight the then-rising Sun of Japan’s then rising power.

But China ain’t Japan. It won’t float its currency in dollar terms.

So, what then can the US do to weaken the USD without upsetting China?

Does DC Finally Want Higher Gold Prices?

Well, as Luke Gromen once again makes beautifully clear, the easiest path forward for all parties concerned is to simply (and finally) let gold go much, much higher.

The surest and steadiest path to a weaker USD is higher gold.

Yellen’s Treasury Department could use its Exchange Stabilization Fund to buy/sell gold and other financial securities to control the USD without having to rely so much on the Fed’s now embarrassing money printer.

Gold is now a critical pivot point and tool for the US. If gold went, for example, to $4000 while CNY gold sits at 16,000, China’s central bank would have to re-rate higher in Dollar terms, pushing the CNY higher.

But such an arrangement won’t upset China, as it holds a lot more gold than the World Gold Council reports.

Rather than float the CNY in Dollar terms, China could instead float its CNY in GOLD terms.

In short: A veritable win-win for the China and the US, with gold now leading the way.

Or stated otherwise, you know it’s gonna be a gold tailwind, when both China and DC are seeking higher gold.

Based on the foregoing, do you still think gold does nothing?

Think harder.

Jim Rogers & Egon von Greyerz: Navigating Economic Uncertainty

In this full-ranging discussion with Anthony Fatseas of WT Finance, VON GREYERZ partner, Matthew Piepenburg, squarely addresses the financial, market, currency and central bank forces which evidence an embarrassing disconnect between markets at blow-off tops and a Main Street economy openly blowing away…In this backdrop, the direction and role of gold is now undeniably significant.

Piepenburg opens by distinguishing a rising market from a so-called “resilient” economy by citing recessionary facts and math against the so-called “full employment” and “robust GDP” public narrative. Piepenburg sees a dangerously narrow S&P “ripping” in a Pavlovian response to promises of 2024 rate cuts and what he describes as “backdoor QE” trending toward direct QE to “save” broke(n) credit markets at the expense of the USD. These facts explain gold’s secular move north. As for markets, once net-income margins in the S&P 5 transition from expansion to contraction, stocks will fall in the backdrop of a global rather than regional recession, which makes the current bubble far more dangerous than prior market reversals/mean-reversions in 2000 or 2008.

Piepenburg cites the lessons of math (trillions in debt-based “growth”) and history (from 18th century France to today) to plainly reveal what Hemingway described as the sad transition from “temporary prosperity to permanent ruin” via an historically repeated template of debasing the currency (inflation) and going to war (proxy or direct) to distract a centralized public from the debt failures of their weak leaders. Toward this end, Piepenburg addresses all the forces destroying the USD (debt, de-dollarization, petrodollar shifts, example after example of hidden, “backdoor” QE, record-high T-Bill issuance and unlimited yet hidden leverage permission by the big banks to buy unloved government debt off the Fed’s balance sheet).

Piepenburg makes an open joke of “reported inflation” and gets to the honest data to explain why the US needs a weaker USD. Gold, of course, is rising, and will continue to rise, simply because the USD is now, and will continue to be, inherently weaker, regardless of its relative strength. Again: “It’s common sense” colliding with the lessons of basic math & history.

The discussion closes with the unspoken danger (and current reality) of increased centralization, grotesque wealth inequality and less freedoms, the evidence of which is sadly everywhere. Is there a “way out” of currency debasement, economic risk and continued social unrest? Piepenburg is not so hopeful, as leadership today, across the world, is largely devoid of basic honesty, economic savvy or a respect for history.

Preparation is up to each of us, not our leaders.

Jim Rogers & Egon von Greyerz: Navigating Economic Uncertainty

In recent weeks, gold has reached new all-time highs in many currencies, including the US dollar, the euro and the Swiss franc. We want to take the euphoric mood among gold investors as an opportunity to focus on a fundamental topic. From our point of view, the gold sector is riddled with an elementary misunderstanding. Many gold investors and analysts operate on an erroneous assumption: they attach too much importance to annual production and annual demand. We often read that the gold price cannot drop below production costs. We would like to discuss this misconception in the following.

Every gramme of gold that is held for a variety of reasons is for sale at a certain price. Many owners would sell at a price slightly above spot, others would only sell at a substantially higher price. If, due to favorable prices, a private individual wants to sell his gold holdings that he acquired decades ago, it will not reduce the overall supply of gold. All that happens is the transfer from one private portfolio to another private portfolio. To the buyer, it makes no difference whether the gold was produced three weeks or three millennia ago.

This means the annual gold production of currently more than 3,600 tons is of relatively little significance to the pricing process. Rather, the supply side consists of all the gold that has ever been produced. The recycling of existing gold accounts for a much larger share of supply than is the case for other commodities. Paradoxically, gold is not in short supply– the opposite is the case: it is one of the most widely dispersed goods in the world. Given that its industrial use is limited, the majority of all gold ever produced is still available.

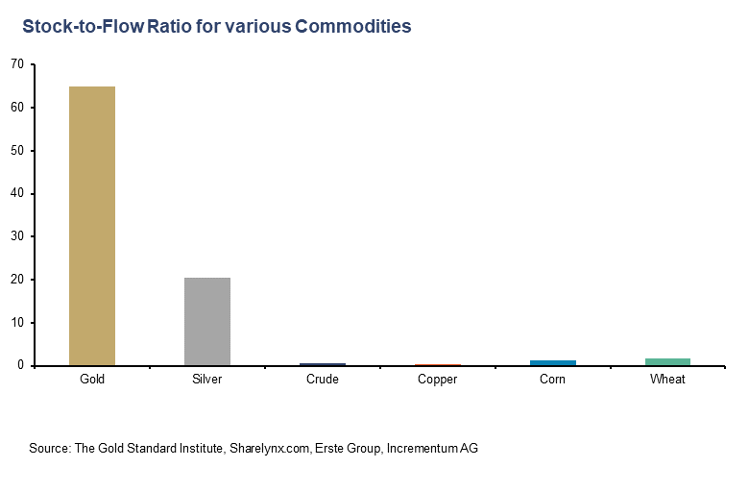

In contrast to other commodities such as oil, copper or agricultural products, there is an enormous discrepancy between annual production (= flow) and the total available stock of gold. In other words, gold has a high stock-to-flow ratio (SFR). The high stock-to-flow ratio is the most important characteristic of gold (and silver). The total gold ever mined amounts to almost 213,000 tons. Annual production in 2023 was just over 3,650 tons. Dividing the two amounts gives a stock-to-flow ratio of 58.4, which means that the current annual production must be maintained for more than 58 years to double the current gold stock.

| Total reserves in tons (stock) | % share of total reserves (stock) | |

| Jewelry | 96,500 | 45% |

| Private holdings (bars, coins, ETF) | 47,500 | 22% |

| Central bank holdings | 36,.700 | 17% |

| Others | 32,000 | 15% |

| Total | 212,600 | 100% |

| Estimated mining production (flow) | 3,600 | 1.7% of total stock |

Gold holdings are currently growing by around 1.7% a year, which is much slower than all monetary aggregates around the world. This growth is roughly in line with population growth. Confidence in the current and future purchasing power of money depends largely on how much money is currently available and how the quantity will change in the future.

Gold Stock (Above Ground Gold), in Tonnes, Money Supply (US M2), in USD bn, 1910-2023

| Year | Gold Stock | yoy | Money Supply | yoy | Year | Gold Stock | yoy | Money Supply | yoy |

| 1910 | 35,626 | 2.0% | 1970 | 90,695 | 1.7% | 626.5 | 6.6% | ||

| 1911 | 36,325 | 2.0% | 1971 | 92,145 | 1.6% | 710.3 | 13.4% | ||

| 1912 | 37,030 | 1.9% | 1972 | 93,535 | 1.5% | 802.3 | 13.0% | ||

| 1913 | 37,724 | 1.9% | 1973 | 94,885 | 1.4% | 855.5 | 6.6% | ||

| 1914 | 38,387 | 1.8% | 26.0 | 1974 | 96,135 | 1.3% | 902.1 | 5.4% | |

| 1915 | 39,091 | 1.8% | 30.0 | 15.4% | 1975 | 97,335 | 1.2% | 1,016.2 | 12.6% |

| 1916 | 39,776 | 1.8% | 34.9 | 16.3% | 1976 | 98,545 | 1.2% | 1,152.0 | 13.4% |

| 1917 | 40,407 | 1.6% | 40.9 | 17.1% | 1977 | 99,755 | 1.2% | 1,270.3 | 10.3% |

| 1918 | 40,985 | 1.4% | 46.2 | 12.9% | 1978 | 100,965 | 1.2% | 1,366.0 | 7.5% |

| 1919 | 41,535 | 1.3% | 52.0 | 12.7% | 1979 | 102,175 | 1.2% | 1,473.7 | 7.9% |

| 1920 | 42,042 | 1.2% | 51.3 | -1.4% | 1980 | 103,395 | 1.2% | 1,599.8 | 8.6% |

| 1921 | 42,540 | 1.2% | 45.7 | -10.9% | 1981 | 104,675 | 1.2% | 1,755.5 | 9.7% |

| 1922 | 43,021 | 1.1% | 50.5 | 10.5% | 1982 | 106,015 | 1.3% | 1,905.9 | 8.6% |

| 1923 | 43,575 | 1.3% | 50.7 | 0.4% | 1983 | 107,415 | 1.3% | 2,123.5 | 11.4% |

| 1924 | 44,167 | 1.4% | 53.9 | 6.3% | 1984 | 108,875 | 1.4% | 2,306.4 | 8.6% |

| 1925 | 44,758 | 1.3% | 57.6 | 6.9% | 1985 | 110,405 | 1.4% | 2,492.1 | 8.1% |

| 1926 | 45,360 | 1.3% | 56.1 | -2.5% | 1986 | 112,015 | 1.5% | 2,728.0 | 9.5% |

| 1927 | 45,957 | 1.3% | 56.7 | 1.1% | 1987 | 113,675 | 1.5% | 2,826.4 | 3.6% |

| 1928 | 46,560 | 1.3% | 58.2 | 2.6% | 1988 | 115,545 | 1.6% | 2,988.2 | 5.7% |

| 1929 | 47,169 | 1.3% | 57.7 | -0.9% | 1989 | 117,555 | 1.7% | 3,152.5 | 5.5% |

| 1930 | 47,817 | 1.4% | 54.3 | -5.8% | 1990 | 119,735 | 1.9% | 3,271.8 | 3.8% |

| 1931 | 48,512 | 1.5% | 47.7 | -12.3% | 1991 | 121,895 | 1.8% | 3,372.2 | 3.1% |

| 1932 | 49,266 | 1.6% | 44.3 | -7.1% | 1992 | 124,155 | 1.9% | 3,424.7 | 1.6% |

| 1933 | 50,059 | 1.6% | 42.9 | -3.1% | 1993 | 126,435 | 1.8% | 3,474.5 | 1.5% |

| 1934 | 50,900 | 1.7% | 49.4 | 15.0% | 1994 | 128,695 | 1.8% | 3,486.4 | 0.3% |

| 1935 | 51,824 | 1.8% | 58.4 | 18.3% | 1995 | 130,925 | 1.7% | 3,629.5 | 4.1% |

| 1936 | 52,854 | 2.0% | 66.6 | 14.0% | 1996 | 133,215 | 1.7% | 3,818.6 | 5.2% |

| 1937 | 53,954 | 2.1% | 62.7 | -5.8% | 1997 | 135,665 | 1.8% | 4,032.9 | 5.6% |

| 1938 | 55,124 | 2.2% | 68.4 | 9.0% | 1998 | 138,165 | 1.8% | 4,375.2 | 8.5% |

| 1939 | 56,354 | 2.2% | 77.5 | 13.3% | 1999 | 140,735 | 1.9% | 4,638.0 | 6.0% |

| 1940 | 57,664 | 2.3% | 90.1 | 16.3% | 2000 | 143,325 | 1.8% | 4,925.0 | 6.2% |

| 1941 | 58,744 | 1.9% | 103.4 | 14.7% | 2001 | 145,925 | 1.8% | 5,433.8 | 10.3% |

| 1942 | 59,864 | 1.9% | 133.9 | 29.6% | 2002 | 148,475 | 1.7% | 5,772.0 | 6.2% |

| 1943 | 60,760 | 1.5% | 168.8 | 26.0% | 2003 | 151,015 | 1.7% | 6,067.3 | 5.1% |

| 1944 | 61,573 | 1.3% | 191.3 | 13.3% | 2004 | 153,435 | 1.6% | 6,418.3 | 5.8% |

| 1945 | 62,335 | 1.2% | 215.6 | 12.7% | 2005 | 155,905 | 1.6% | 6,681.9 | 4.1% |

| 1946 | 63,195 | 1.4% | 226.4 | 5.0% | 2006 | 158,275 | 1.5% | 7,071.6 | 5.8% |

| 1947 | 64,095 | 1.4% | 238.0 | 5.1% | 2007 | 160,625 | 1.5% | 7,471.6 | 5.7% |

| 1948 | 65,027 | 1.5% | 234.6 | -1.4% | 2008 | 162,925 | 1.4% | 8,192.1 | 9.6% |

| 1949 | 65,991 | 1.5% | 234.0 | -0.3% | 2009 | 165,415 | 1.5% | 8,496.0 | 3.7% |

| 1950 | 66,870 | 1.3% | 244.5 | 4.5% | 2010 | 168,246 | 1.7% | 8,801.8 | 3.6% |

| 1951 | 67,753 | 1.3% | 258.1 | 5.6% | 2011 | 171,145 | 1.7% | 9,660.1 | 9.8% |

| 1952 | 68,621 | 1.3% | 268.1 | 3.8% | 2012 | 174,057 | 1.7% | 10,459.7 | 8.3% |

| 1953 | 69,485 | 1.3% | 271.0 | 1.1% | 2013 | 177,196 | 1.8% | 11,035.0 | 5.5% |

| 1954 | 70,450 | 1.4% | 278.4 | 2.7% | 2014 | 180,571 | 1.9% | 11,684.9 | 5.9% |

| 1955 | 71,397 | 1.3% | 284.6 | 2.2% | 2015 | 183,945 | 1.9% | 12,346.8 | 5.7% |

| 1956 | 72,375 | 1.4% | 288.1 | 1.3% | 2016 | 187,498 | 1.9% | 13,213.4 | 7.0% |

| 1957 | 73,395 | 1.4% | 286.0 | -0.7% | 2017 | 191,048 | 1.9% | 13,857.9 | 4.9% |

| 1958 | 74,445 | 1.4% | 297.0 | 3.8% | 2018 | 194,693 | 1.9% | 14,362.7 | 3.6% |

| 1959 | 75,575 | 1.5% | 298.6 | 0.6% | 2019 | 198,295 | 1.9% | 15,320.7 | 6.7% |

| 1960 | 76,765 | 1.6% | 312.4 | 4.6% | 2020 | 201,738 | 1.7% | 19,114.6 | 24.8% |

| 1961 | 77,995 | 1.6% | 335.5 | 7.4% | 2021 | 205,309 | 1.8% | 21,546.6 | 12.7% |

| 1962 | 79,285 | 1.7% | 362.7 | 8.1% | 2022 | 208,921 | 1.8% | 21,346.3 | -0.9% |

| 1963 | 80,625 | 1.7% | 393.2 | 8.4% | 2023 | 212,582 | 1.8% | 20,827.2 | -2.4% |

| 1964 | 82,015 | 1.7% | 424.7 | 8.0% | |||||

| 1965 | 83,455 | 1.8% | 459.2 | 8.1% | |||||

| 1966 | 84,905 | 1.7% | 480.2 | 4.6% | |||||

| 1967 | 86,325 | 1.7% | 524.8 | 9.3% | |||||

| 1968 | 87,765 | 1.7% | 566.8 | 8.0% | |||||

| 1969 | 89,215 | 1.7% | 587.9 | 3.7% |

Annual gold production is relatively small

What does this mean in concrete terms? If mine production were to double – which is extremely unlikely – this would only mean an increase of 3.4% for the total stock of gold. This would still be a relatively insignificant inflation of the gold stock, especially compared to the current central bank inflation. If, on the other hand, production were to cease for a year, this would also have little impact on the total stock and pricing. If, on the other hand, a significant proportion of oil production were to be lost for a longer period of time, stocks would be depleted after a few weeks. Strong increases or decreases in production can therefore be absorbed much more easily.

We therefore assume that gold is not so valuable because it is so rare, but quite the opposite: gold is valued so highly because the annual production is so low in relation to the stock. This characteristic has been acquired over the centuries and can no longer change. This stability and security is a key prerequisite for creating trust. This clearly distinguishes gold as a monetary metal from other commodities and precious metals. Commodities are consumed, while gold is hoarded. This also explains why conventional supply/demand models can only be used to a limited extent on the gold market. Or as Robert Blumen once put it: “Contrary to the consumption model, the price of gold does clear the supply of recently mined gold against coin buyers; it clears all buyers against all sellers and holders. The amount of gold available at any price depends largely on the preferences of existing gold owners, because they own most of the gold.”[1]

For a commodity that is consumed, a rising deficit would clearly trigger higher prices until equilibrium is restored. Not so with a good that is hoarded. A simple consumption model therefore only works for goods that are consumed and whose annual production is high in relation to the stock (= low stock-to-flow ratio).

Current mining costs are insignificant for the gold price

This is why the production costs of gold play a subordinate role in pricing. They are primarily relevant for the performance of gold stocks. In our opinion, analyses that state that the gold price cannot fall below production costs are based on a fundamental fallacy. Although mining would be uneconomical for the majority of mine operators above a certain price, trading in gold that has already been mined would not come to a standstill. While mining therefore has little influence on the gold price, the reverse is not true. The gold price naturally has a considerable influence on mining and its profitability.[2]

There is no generally equal production cost rate for all mines – the costs depend on the characteristics of the mine and the reserves. Even the cost of producing individual ounces from the same mine can vary. The gold price in relation to labor costs and the cost price of capital goods determines whether a mine is profitable or not, and what gold can be profitably extracted from a mine. As the price of gold rises in relation to production costs, previously unprofitable reserves can become profitable to mine.

The demand side consists of investors, the jewelry industry, central banks and industry. However, this is actually only a fraction of the total demand. The majority of demand is so-called reservation demand. This term describes gold owners who do not want to sell gold at the current level. By not selling at the current price level, they are responsible for ensuring that the price remains at the same level.[3]

The decision not to sell gold at the current price level is therefore just as important as the decision to buy gold. The net effect on price discovery is the same. The supply of gold is therefore always high. At a price of USD 5,000, the supply of old gold would amount to a multiple of annual production. This also explains why the much-cited “gold deficit” is a myth and why there can be no shortage. Robert Blumen once formulated this aspect as follows: “Gold is an asset. Supply and demand should be understood in the same way that we understand the shares of a company. Every time shares change hands, the shares are demanded by a buyer and supplied by a seller. For each and every transaction, supply equals demand. Adding up all of the transactions that occur on a particular exchange, over the course of a month or a year, tells you absolutely nothing…If you said that buyers in China had bought 100 million shares of Microsoft but ‘no supplier could supply that many shares,’ nor was the company issuing enough new shares to meet the demand, you would readily see the error in that statement… Everyone understands that new shares only dilute the value of the existing shareholders, that it is not required for a company to issue new shares for the price to go up or down and that most trading of shares consists of existing shareholders selling to people who have dollars.”[4]

Just as increasing the money supply dilutes the purchasing power of the money in circulation and issuing new shares leads to a dilution of the old ones, an increase in the supply of gold should be seen as a dilution of the existing supply. An increase of 1% is absorbed by the market by the price falling by 1%, while the nominal supply remains the same.

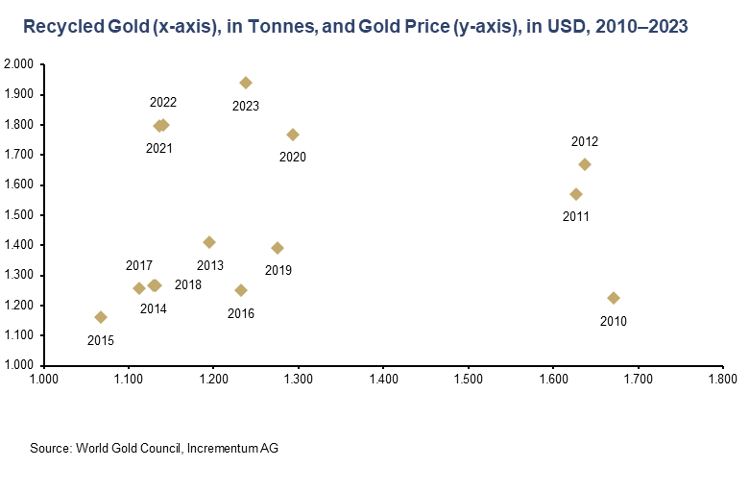

With the exception of the past four years, there is a clear positive correlation between the gold price in US dollars and the expanding supply of recycled gold. The low volume of recycled gold in relation to the gold price over the past four years could indicate that market participants are becoming accustomed to the higher price level and will only sell at significantly higher price levels. It also appears that gold is gradually moving from shaky to firm hands.

Whenever someone sells, it means that the gold price has reached its reserve price. Thus, someone is selling to someone with an implicitly higher reservation price – which results from the fact that they are willing to buy at that price. This means that larger sales (for example by central banks) contribute to an improvement in the market structure.

Conclusion

The gold market should be seen as a holistic market. In our opinion, the distinction between annual new supply and total supply is incorrect and leads to false conclusions. All sources of supply are of equal value, as every ounce of gold available for sale is in competition with other ounces. It does not matter whether the gold was mined 3,000 years ago or 3 months ago or consists of recycled dental gold, for example. The current annual gold production of more than 3,600 tons is therefore relatively insignificant for pricing.

Annual gold production is also only subject to very minor fluctuations, in contrast to fiat money, whose annual rate of change fluctuates strongly. Over the past quarter of a century, M1 for the euro has fluctuated on a quarterly basis between just under -10% in Q3/2023 and +17% in Q4/2005, while M2 for the US dollar has gone from -4.1% in Q2/2023 to more than +25% in Q1/2021. Ludwig von Mises summarized these theoretical findings perfectly: “If a thing has to be used as a medium of exchange, public opinion must not believe that the quantity of this thing will increase beyond all bounds.”

[1] Blumen, Robert: “Does Gold Mining Matter?”, Mises Institute, August 14, 2009

[2] See Blumen, Robert: “Does Gold Mining Matter?”, Mises Institute, August 14, 2009

[3] See Blumen, Robert: „WSJ does not understand how the gold price is formed“, May 30, 2010

[4] Blumen, Robert: “Does Gold Mining Matter?”, Mises Institute, August 14, 2009

Jim Rogers & Egon von Greyerz: Navigating Economic Uncertainty

In this brief, 13-minute compilation of insights from 2023, VON GREYERZ, AG partner, Matthew Piepenburg, reminds us of prior warnings which are truer than ever (and playing out) today as the stock market totally divorces itself from the real (and recessionary) economy. There’s a reason gold is spiking, for despite a Fed-driven and hence entirely “Pavlovian” S&P, recessionary forces will force further currency debasement to monetize unsustainable debt levels. Looking purely at the recessionary forces of 2023, which Piepenburg bluntly unpacks with data rather than drama, the current disconnect between rising markets and a bleeding economy into 2024 should have all investors thinking carefully about what lies ahead, including an inflationary endgame which Piepenburg will unpack in subsequent video compilations.

For now, keep the economic facts discussed here clear in mind when positioning and protecting your wealth, and hence gold, in the currents to come.

Jim Rogers & Egon von Greyerz: Navigating Economic Uncertainty

The world’s best kept investment secret is GOLD.

- Gold has gone up 7.5X this century

- Gold Compound annual return since 2000 is 9.2%

- Dow Jones Compound annual return since 2000 is 7.7% incl. reinvested dividends

So why are only 0.6% of global financial assets in gold?

The simple answer is that most investors don’t understand gold because governments suppress the virtues of gold.

GOVERNMENTS WILL ALWAYS LIE TO THEIR PEOPLE

Has anyone ever heard a Western government tell their people that gold is the best protection against their government’s total mismanagement of the economy and their currency?

Has any government ever told their people that throughout history all governments, without fail, have destroyed the total value of the people’s money?

That includes every single currency in history since no currency has ever survived.

And have current governments told their people that since 1971, their currencies have declined by 97% to 99%?

So why don’t governments tell their people that in the next 50-100 years their currency will lose another 97-100%?

Obviously, no government would ever be elected if they told their people the truth that the economy and their money will continue to be mismanaged and destroyed like it has throughout history.

And why don’t governments study history where they could learn from their predecessors mistakes?

And why don’t journalists study the history of money and educate the people?

The answer is obvious, journalism is just government propaganda and there is not a serious investigative journalist around today.

INVESTMENT MANAGEMENT INDUSTRY IN DENIAL.

In addition, the whole investment management industry neither understands nor likes gold.

Studying and understanding money doesn’t serve their purpose. Better to create a mystique around a mediocre industry that on average underperforms the market.

A greedy and self-serving investment management industry is not interested in gold. Gold doesn’t allow them to churn commission which is important for their survival.

This whole industry could be abolished with most investments being held in index funds and physical gold. The net performance would most probably be superior to a very and inefficient industry.

DRIVERS FOR GOLD

In the 12 minute video extract from a Palisade Radio interview below, I discuss the drivers for gold.

In summary the important drivers discussed which will soon propel gold to much higher levels are:

- Global deficits & debts – US, Europe, China, Japan, Emerging markets

- War

- Social unrest

- Gold buying by BRICS countries

- Central bank gold purchases of gold due to move from Dollar reserve assets to Gold

GOLD IS THE BEST WEALTH PRESERVATION ASSET THROUGHOUT HISTORY

- Gold is not an investment. It is nature’s money and thus the only money which has survived in history.

- Governments and Central Banks are Gold’s best friend. Throughout history they have without fail destroyed the value of Fiat money whilst Gold has for thousands of years maintained its purchasing power.

- As I discuss in the interview, risk is today greater globally than any time in history.

- Physical Gold is the ultimate protection against such risk.

- Gold for WEALTH PRESERVATION purposes must be held in physical form with direct access by the investor.

- Gold must obviously be held outside a fractured financial system. No use holding your gold in the system that you are protecting against.

- NEVER, EVER hold gold in paper form or ETFs.

- Gold must be held in a safe jurisdiction outside your country of residence and especially outside the US, Canada and the EU.

- Gold and Silver are not just for the wealthy. You can buy 1 gram for $70 or one ounce of silver for $25.

- With major bubbles in virtually all asset classes including stocks, bonds and property, the allocation to physical gold and some silver should be at least 25% of your financial assets and potentially much more.

NEVER worry about the gold price. Governments will continue to devalue your fiat money and thus revalue gold as they have throughout history.

Jim Rogers & Egon von Greyerz: Navigating Economic Uncertainty

All Empires die without fail, so do all Fiat currencies. But gold has been shining for 5000 years and as I explain in this article, Gold is likely to outshine virtually all assets in the next 5-10 years.