Gold’s Historic Rise as the S&P Teeters Toward Mean-Reverting Pain

In this engaging, 30-minute conversation, VON GREYERZ partner, Matthew Piepenburg, sits down with Liberty Finance’s Elijah Johnson to discuss Gold’s recent surpassing of the 2100 (USD) marker in the backdrop of an S&P totally disconnected from global and national economic warning signs. For Piepenburg, such price action in gold is no surprise, and in fact, is only just beginning as global and US debt levels tip toward the absurd while credit markets, currency markets and central bank policies near their cracking points. In addition to these much-discussed trends, Piepenburg also addresses the historical changes in the London and New York gold and silver exchanges, each of which are seeing massive (and one-way) deliveries OUT of their exchanges and into the waiting arms of central and commercial banks losing faith in the USD/UST. Instead, the bigger names are gathering a far safer Tier-1 asset (gold) in anticipation of seismic shifts in the global economy and financial markets. The implications of these deliveries out of the OTC exchanges are immense, as they strongly curtail the ability of the bullion banks to manipulate honest pricing in precious metals.

Piepenburg turns an equally concerned (yet characteristically blunt) eye toward an S&P breaking all-time highs on the backs of only five, highly over-valued names. For Piepenburg, this so-called “bullish” move in equities could not be further from the truth, as once this bubble “pops,” as all bubbles do (and Piepenburg explains HOW), there is literally no good “narrative” left for the US to cling to in its desperate attempts to confuse a bloated stock market with a “resilient” economy. For Piepenburg, such warnings are not just felt and shared by “gold bulls,” but equally so by a long list of esteemed portfolio managers, from Jeremy Grantham to Paul Singer. In short, the evidence of a dangerously topping and soon-to-be mean-reverting S&P are now undeniable.

The outlook for gold is ultimately so convincing and so strong because the outlook for cornered Fed officials and an openly trapped and bankrupt US economy is so week. As always, Piepenburg addresses these sober realities with facts rather than hyperbole. He closes the conversation reminding viewers that understanding WHY investors need gold is now fairly obvious, but further reminds that it is equally important to understand HOW to own/hold gold outside of the banking system, which of course, includes ETF or “paper” gold.

Gold’s Historic Rise as the S&P Teeters Toward Mean-Reverting Pain

All Empires die without fail, so do all Fiat currencies. But gold has been shining for 5000 years and as I explain in this article, Gold is likely to outshine virtually all assets in the next 5-10 years.

In early 2002 we made major investments in physical gold for our investors and ourselves. At the time gold was around $300. Our primary objective was wealth preservation. The Nasdaq had already crashed 67% but before the bottom was reached, it lost another 50%. The total loss was 80% with many companies going bankrupt.

In 2006, just over 4 years later, the Great Financial Crisis started. In 2008, the financial system was minutes from imploding. Banks like JP Morgan, Morgan Stanley and many others were bankrupt – BANCA ROTTA – (see my article First Gradually then Suddenly, The Everything Collapse)

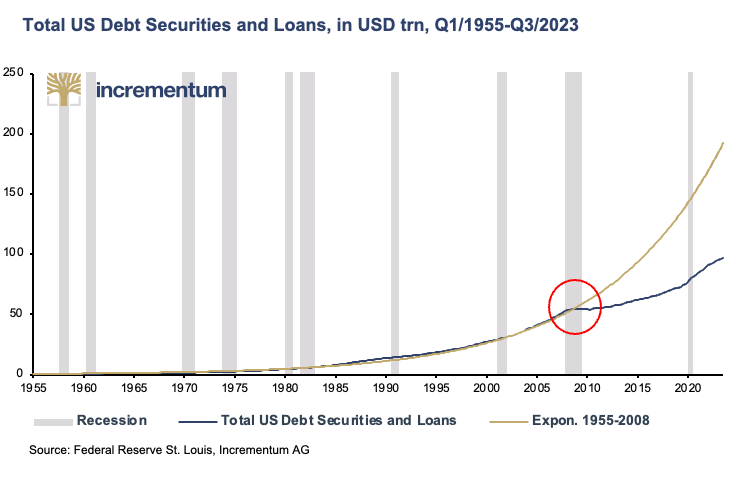

Virtually unlimited money printing postponed the collapse and since 2008 US total debt has almost doubled to $100 trillion.

Gold backing of a currency doesn’t always solve a debt problem but it certainly makes it more difficult for the government to cook the books which they do without fail.

BONFIRE OF THE US BUDGET BOOKS

So tricky Dick (Nixon) couldn’t make ends meet in the late 1960s – early 70s partly due to the Vietnam war.

Thus in 1971 Nixon, by closing the Gold window, started the most spectacular bonfire of the US government budget books. How wonderful, no more accountability, no more shackles and no more gold deliveries to de Gaulle in France who was clever to ask for gold instead of dollars in debt settlement from the US.

So from August 1971, the US embarked on a money printing and credit expansion bonanza never seen before in history.

Total US debt went from $2 trillion in 1971 to $200 trillion today – up 100X!

Since most major currencies were linked to the dollar under the Bretton Woods system, the closing of the gold window started a global free for all with the printing press (including bank credit) replacing REAL MONEY i.e. GOLD.

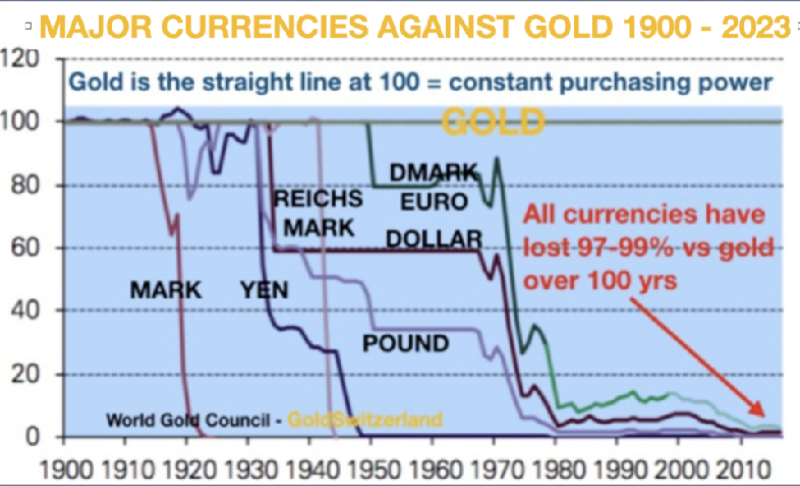

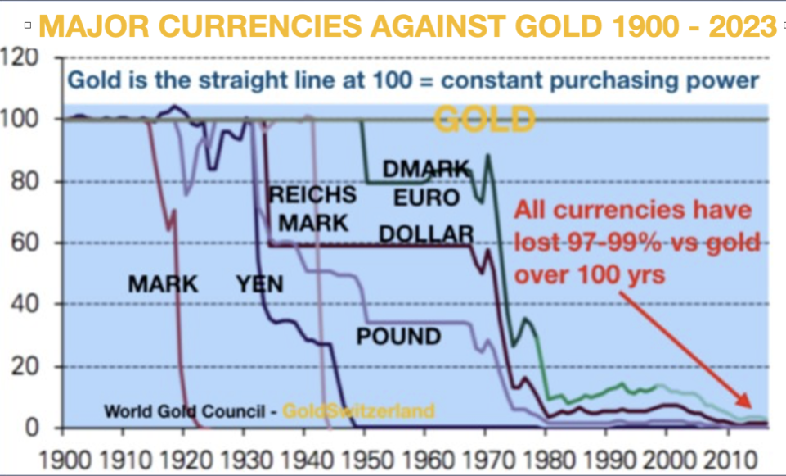

The consequences of this “temporary” move by Nixon is that all Fiat or paper money has declined by 97-99% since 1971.

The price of assets have obviously inflated correspondingly. In 1971 total US financial assets were $2 trillion. Today they are $130 trillion, up 65X.

And if we include off balance sheet assets including the shadow banking system and derivatives, we are looking at assets (which will become liabilities) in excess of $2 quadrillion.

I forecast the derivative bubble and demise of Credit Suisse in this article (Archegos & Credit Suisse – Tip of the Iceberg) and also in this one (The $2.3 Quadrillion Global Debt Time Bomb).

HEADS, GOLD WINS – TAILS, GOLD WINS

Luke Gromen in his Tree Rings report puts forward two options for the world economy which can be summarised as follows:

1. Dedollarisation continues, the Petrodollar dies and gold gradually replaces the dollar as a global commodity trading currency especially in the commodity rich BRICS countries. This would allow commodity prices to stay low as gold rises and drives a virtuous circle of global trade.

If the above option sounds too good to be true especially bearing in mind the bankrupt status of the global financial system, Luke puts forward a much less pleasant outcome.

And in my view, Luke’s alternative outcome is sadly more likely, namely:

2. “China, the US Treasury market, and the global economy implode spectacularly, sending the world into a new Great Depression, political instability, and possibly WW3…in which case, gold probably rises spectacularly all the same, as bonds and then equities scramble for one of the only assets with no counterparty risk – gold. (BTC is another.)”

Yes, Bitcoin could go to $1 million as I have often said but it could also go to Zero if it is banned. Too binary for me and not a good wealth preservation risk in any case.

As Gromen says, there is a virtuous case and there is a vicious case for the world economy.

But above both cases shines GOLD!

So why hold the worthless paper money or bubble assets when you can protect yourself with Gold!

FOR THE CBO BAD TIMES DON’T EXIST

The US Central Budget Office – CBO – has recently made a 10 year forecast.

Obviously, the CBO assumes no depression or even a little recession in the next 10 years!

Isn’t it wonderful to be a government employee and have a mandate to only forecast GOOD NEWS!

And although the CBO forecasts a debt increase of $21 trillion by 2034 to a total of $55 trillion, they expect inflation to stay around 2%!

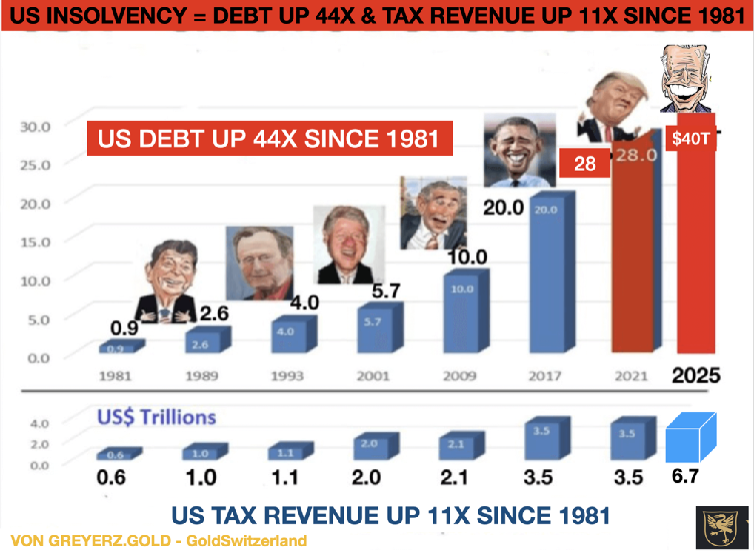

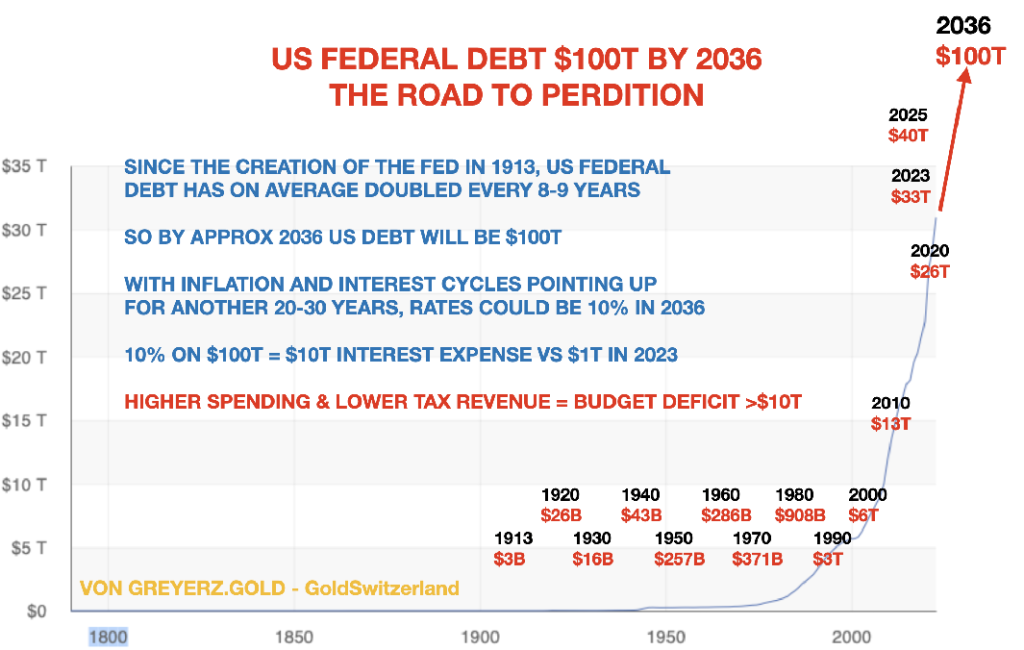

As I have stated in many articles, the US Federal debt has doubled every 8 years on average since Reagan became President in 1981!

I see no reason to deviate from that long term trend although there can be short term deviations. So based on that simple but historically accurate extrapolation, I could forecast the increase from $10 trillion to $20 trillion debt in 2009 when Obama took over from Bush Jr.

Extrapolating this trend, the US Federal Debt will reach $100 trillion in 2036.

With debts and deficits increasing exponentially, it is not unlikely that as inflation catches fire again, $100 trillion Federal Debt will be reached earlier than 2036.

Just think about a big number of bank failures, which is guaranteed, plus major defaults in the $2+ quadrillion derivative market. Against such dire background, it would be surprising if US debt doesn’t go far beyond $100 trillion by the mid 2030s!

STOCK MARKET BUBBLE & LEADERSHIP SWAPS

Investors and many analysts are still bullish about the stock market. As we know, markets will move higher until all investors, especially retail, are sucked in and until most of the shorts have liquidated their positions.

It has been a remarkable bull market based on unlimited debt creation. Nobody worries about the fact that 7 stocks are creating this mania. These stocks are well known to most investors: Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, Nvidia and Tesla.

These Magnificent 7 have a total market cap of $13 trillion. That is the same as the combined GDP of Germany, Japan, India and the UK! Only the US and China are bigger.

When 7 companies are greater than 4 of the biggest industrial economies in the world, it is time to fire the management of these countries and maybe do a swap.

GATES, COOK, MUSK TAKING OVER GERMANY, UK & FRANCE

What about Germany’s Chancellor Scholz running Amazon. Or Rishi Sunak in the UK being in charge of Microsoft? How long would it take them to destroy these companies? Not many years in my view. They would quickly double the benefits for workers and increase debts to unsustainable levels.

But Germany and the UK would most certainly benefit from Bill Gates of Microsoft taking on Germany and Tim Cook of Apple running the UK. They would of course need dictatorial powers in order to take the draconian measures required. Only then could they slash inefficiencies, halve benefits and reduce taxes by at least 50%.

If the entrepreneurs just got a very small percentage of the improvement in the countries’ finances as remuneration, they would make much more money than they are currently.

Even more fascinating would be to see Elon Musk as French President. He would fire at least 80% of state employees and by doing that he might even get the militant French unions on his side and get the country back on its feet.

An interesting thought experiment that of course will never happen.

WHY IS EVERYONE WAITING FOR NEW GOLD HIGHS IN ORDER TO BUY???

For almost 25 years I have been standing on a soapbox to inform investors of the importance of wealth preservation.

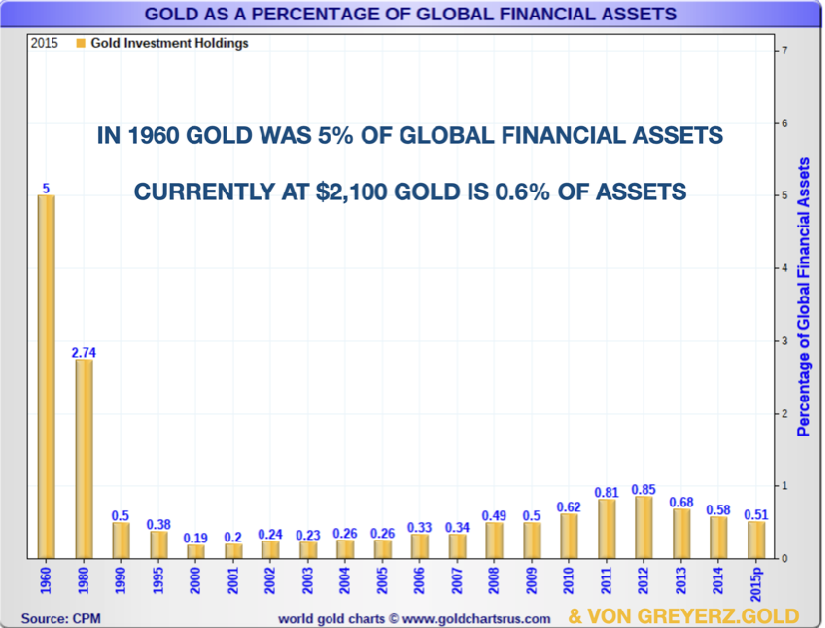

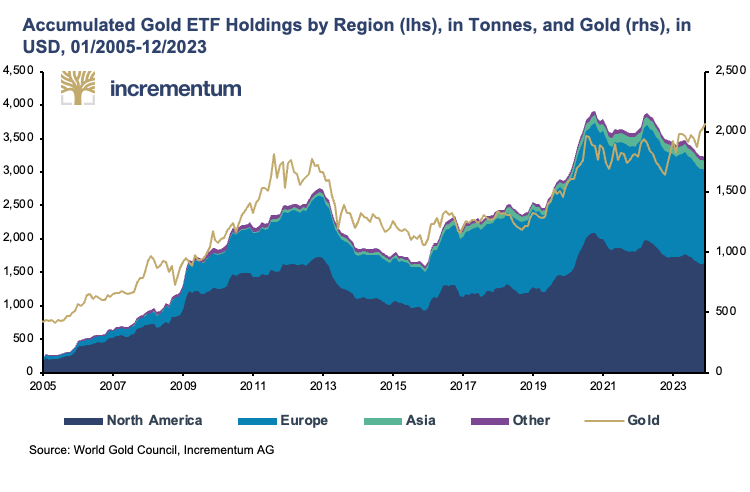

Still only just over 0.5% of global financial assets have been invested in gold. In 1960 it was 5% in gold and in 1980 when gold peaked at $850, it was 2.7%.

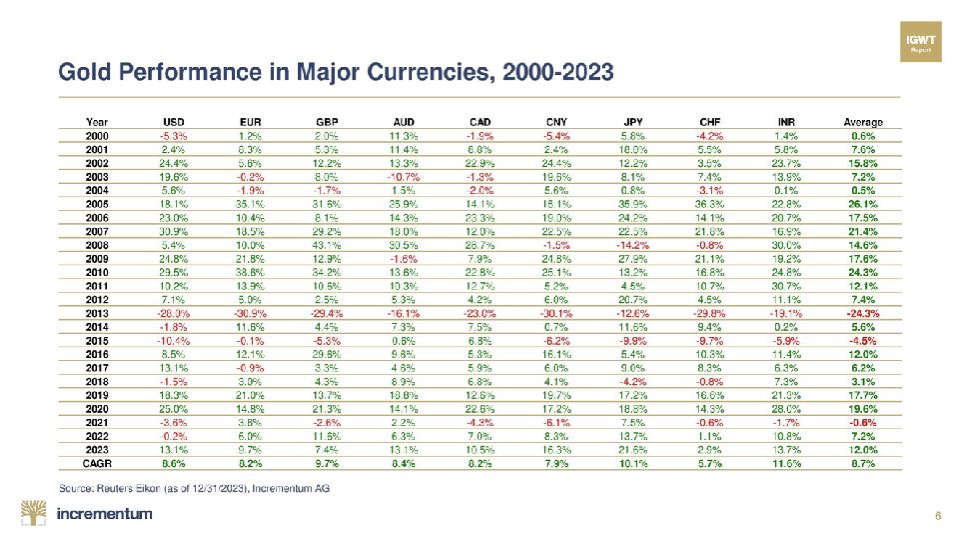

For a quarter of a century, gold has gone up 7- 8X in most Western currencies and exponentially more in weak currencies like the Argentine Pesos or Venezuelan Bolivar.

In spite of gold outperforming most asset classes in this century, it remains at less than 1% of Global Financial Assets – GFA. Currently at $2,100 gold is at 0.6% of GFA.

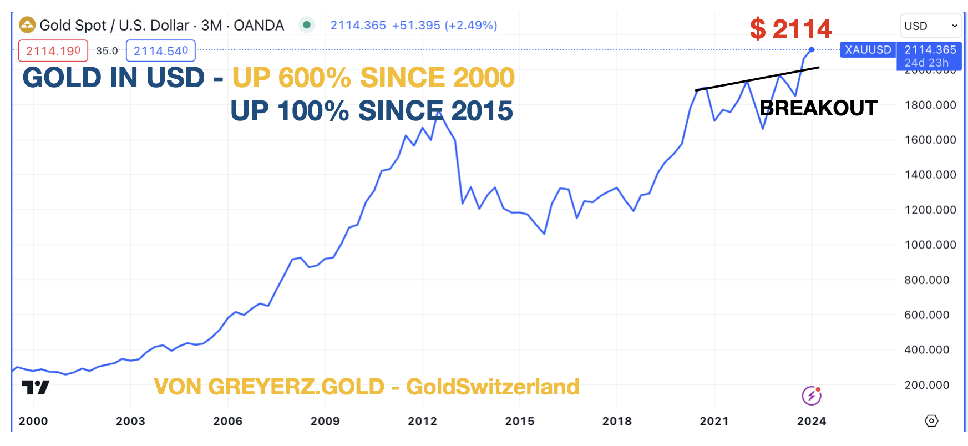

WE HAVE LIFTOFF!

So gold has now broken out and very few investors are participating.

This stealth move that gold has made has left virtually every investor behind as this table shows:

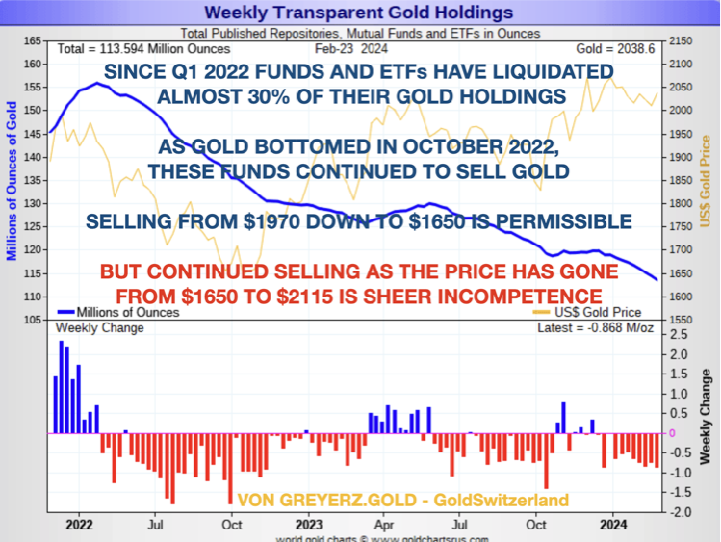

The clever buyers are of course the BRICS central banks. Almost all of their purchases are off market so in the short term it has only a marginal effect on the gold price.

But now the squeeze has started as my good friend Alasdair Macleod explains so well on King World News. The Comex was never meant for physical deliveries but only for cash settlements. But now buyers are standing for physical delivery. We have also seen last month major exports of gold from the US to Switzerland. These are either Comex 400 ounce bars or US government bars sold/leased and sent to the Swiss refiners and broken down to 1 kg bars for onwards export to the BRICS. These bars will never return again even if they are only leased and not sold.

The above process will one day bring panic to the gold market as there will be nowhere near enough physical gold for all the paper claims.

So for any gold investors who don’t hold physical gold in a safe jurisdiction (NOT USA), I suggest that they quickly move their gold to a private vault where they have personal access, preferably in Switzerland or Singapore.

So NO FRACTIONAL GOLD OWNERSHIP, NO GOLD ETFs or FUNDS and NO GOLD IN BANKS!

At least not if you want to be sure to get hold of your gold as the gold squeeze starts.

GOLD IS ON THE CUSP OF A MAJOR MOVE

Having just broken out, gold is now on its way to much, much higher levels.

As I keep on saying, forecasting the gold price is a mug’s game.

What is the purpose of predicting a price level when the unit you measure gold in (USD, EUR, GBP etc) is continually debasing and worth less every month.

All investors need to know is that every single currency in history has without fail gone to ZERO as Voltaire said already in 1727.

Since the early 1700s, over 500 currencies have become extinct, most of them due to hyperinflation.

Only since 1971 all major currencies have lost 97-99% of their purchasing power measured in gold. In the next 5-10 years they will lose the remaining 1-3% which of course is 100% from here.

But gold will not only continue to maintain purchasing power, it will do substantially better. This is due to the coming collapse of all bubble assets – Stocks, Bonds, Property etc. The world will not be able to avoid the Everything Collapse or First Gradually then Suddenly – The Everything Collapse as I wrote about in two articles in 2023.

YES, GOLD IS ON THE CUSP OF A MAJOR MOVE AS:

- Wars continue to ravage the world.

- Inflation rises strongly due to ever increasing debts and deficits.

- Currency continues their journey to ZERO.

- The world flees from stocks, bonds, and the US dollar.

- The BRICS countries continue to buy ever bigger amounts of gold.

- Central Banks buy major amounts of gold as currency reserves instead of US dollars.

- Investors rush into gold at any price to preserve their wealth.

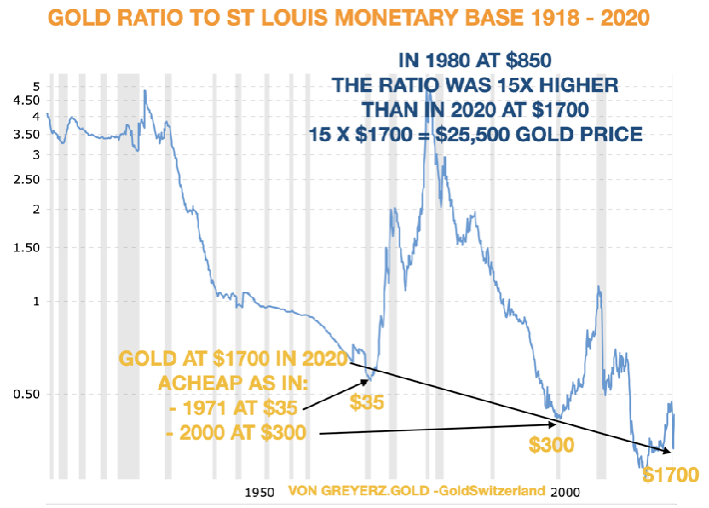

GOLD AS CHEAP AS IN 1971 OR 2000

The chart below indicates that gold in early 2020 at $1700 was as cheap as in 1971 at $35 and in 2000 at $300 in relation to money supply.

At this point we do not have an updated chart but it is our estimate that the monetary base has probably kept pace with the gold price meaning that the level in 2024 is similar to 2020.

So let me repeat my mantra:

Please jump on the Gold Wagon while there is still time to preserve your wealth.

The coming surge in gold demand cannot be met by more gold because more than the current 3000 tonnes of gold per annum cannot be mined.

THUS THE ONLY MEANS TO SATISFY THE COMING GOLD MANIA IS THROUGH MUCH HIGHER PRICES.

Gold’s Historic Rise as the S&P Teeters Toward Mean-Reverting Pain

In this brief yet refreshingly blunt discussion, VON GREYERZ partner, Matthew Piepenburg joins David Lin at the Vancouver Resource Investment Conference. From Canada, Piepenburg fleshes out the longer-term facts vs. the short-term inflation “debate” and the now mathematical inevitability of further USD debasement to “save” an objectively broken financial system.

The conversation opens with the media-ignored (and almost comical) denial of an economic hard-landing despite current market highs driven by forward-guided rate hikes. Piepenburg reduced the stock market to a Pavlovian dog which simply turns up or down on dovish or hawkish Fed policies. Free market capitalism is now entirely perverted.

Powell’s projected rate cuts, necessary to bail out private and sovereign bonds repricing in 2024, is a tailwind for over-valued stocks but is not a sign of economic strength. Instead, we are seeing centralized markets, Fed desperation and a further postponed debt reckoning. The end-game will be “mouse-clicked” trillions to monetize unwanted USTs, the net result of which, is naturally inflationary.

Piepenburg reminds that such an inflationary end-game is part of undeniable and historical debt patterns which are always blamed on “external” forces which then justify increased policy dishonesty, as well as political control and centralization. This sickening pattern, he says, is historically true “without exception” as policy makers “prostitute sound debt policies at the expense of the many for the benefit of the few.”

Of course, sacrificing the currency to extend and pretend otherwise broken risk asset markets and purchase votes in the near-term ruins Main Street purchasing power while creating social unrest–the political, social, cultural and financial evidence of which is literally everywhere we look.

Gold, by itself, can’t save the financial system from these abuses and mis-uses of power and political opportunists. Leaders and central bankers will continue to maintain power while perverting currencies and pointing the blame outside their bathroom mirrors. This, however, does not prevent sophisticated investors from protecting their own wealth against currency destruction by owning their own physical gold outside of a failed financial order and Fed-protected banking system.

Gold’s Historic Rise as the S&P Teeters Toward Mean-Reverting Pain

In this brief yet substantive conversation with Charlotte McLeod of Investing News Network, VON GREYERZ partner, Matthew Piepenburg, bluntly answers the financial questions and concerns which political figures and central bankers have a vested interest in mis-representing.

Toward that end, he highlights the recessionary facts which are currently being ignored by an S&P rising on rate cut projections from the US Federal Reserve. As for pending rate cuts, Piepenburg argues that Powell will indeed cut rates in 2024 for the simple reason that Uncle Sam (and risk asset markets) can’t afford “Higher for Longer” much longer…

Of course, rate cuts make Piepenburg temporarily bullish on equities, as lower rates are an obvious tailwind for risk assets which go up or down depending on whether central banks are dovish or hawkish.

As for gold, this asset wins regardless of which direction—hawkish or dovish—the Fed takes. Should Powell cut rates (dovish), the USD declines and gold outperforms. However, should Powell be bluffing and stick to higher rates (hawkish), then risk asset markets tank and gold ultimately rises above that chaos. Again, gold will rise in either scenario.

Most importantly, Piepenburg sees an ultimate and inflationary end-game when the Fed is eventually required to resort to extreme QE (mouse-click money) to monetize the trillions in deficit spending projected out of the US Congressional Budget Office. Stated simply, Uncle Sam is drowning debt, and the only buyer of his IOUs will be a Fed money printer, which is inherently inflationary. As such, gold will rise because the USD will be debased to pay Uncle Sam’s debt.

As Piepenburg concludes, this pattern of debasing sovereign currencies to save otherwise rotten debt systems is nothing new. In fact, and without exception, this is what all broke(n) regimes have done throughout history. The US, and USD, will be no exception, which means gold will be exceptional.

Gold’s Historic Rise as the S&P Teeters Toward Mean-Reverting Pain

VON GREYERZ founder and chairman, Egon von Greyerz, sits down with Investor Talk’s Jan Kneist to discuss his outlook for 2024, which includes clear signs that now, more than ever, investors need to be prepared for an historic wealth transfer.

Egon opens with a brief explanation of the naturally evolved name change from Matterhorn Asset Management AG to VON GREYERZ AG. He places specific emphasis on the values and principles behind the family name–the very same values which will mark his enterprise for generations to come.

As to looking forward, Egon’s core views of current and future financial conditions are driven by a consistent understanding of past lessons and patterns. Market patterns today, for example, are reminiscent of the boom and bust cycles of yesterday; he addresses the massive (and dangerous) over-valuation in current markets with greater detail.

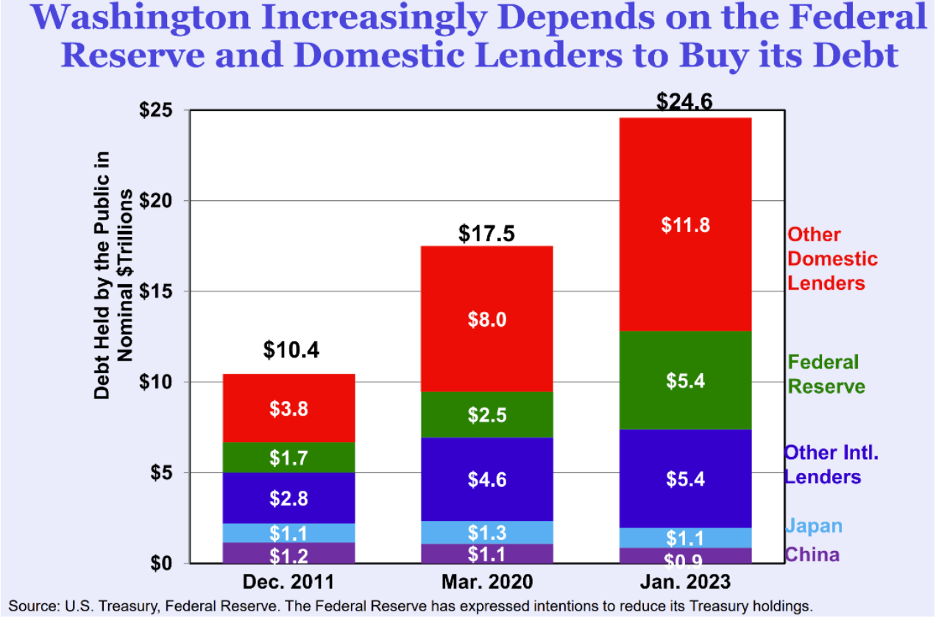

As to inflation concerns, Egon’s conviction for a much higher inflationary end-game remains the same. Current Fed balance sheet tightening (QT) is also discussed. Given massive deficit levels in the US, the shift toward synthetic liquidity to monetize US debts will make future QE inevitable. As Egon reminds, demand for USTs is weakening not strengthening, a fact made even more obvious by the West’s absurd decision to freeze the FX reserves of a major economy like Russia.

In short, trust in the American IOU has now irrevocably fallen, all of which places more pressure on the Fed as the buyer of last resort for its own national debt—all classic characteristics of a banana republic.

Turning to gold, its superior performance over the last two decades remains ignored and misunderstood by the vast majority of pundits and investors. Of course, once this misunderstanding (and BIS-led great deception) becomes clear to more investors, the subsequent demand for this relatively fixed-supply asset will send gold’s price much higher in the years ahead. The DOW-Gold ratio, Egon argues, will reach 1:1, which means risk assets will see pain and physical gold will surge in price as global debt levels send markets and economies toward historical turning points, from the US to China.

This, of course, requires sophisticated investors to think more about preparation and wealth preservation over delusion and speculation. Gold, and VON GREYERZ, serve to provide such preservation.

Gold’s Historic Rise as the S&P Teeters Toward Mean-Reverting Pain

In late December, I published a final report on the themes of 2023 while looking ahead at their implications for the year to come.

I repeated my claim that debt markets and debt levels made the future of Fed policies, currency moves, rate markets and gold’s endgame fairly clear to see.

Of course, as facts change, opinions change as well.

But the facts are only worsening, which means my opinions in late 2023 are only growing stronger as we conclude the first month of 2024.

Then as now, the debt-soaked US is tilting ever more toward policies which will weaken its currency, wound its middleclass and reward its false idols (and false markets) with even greater desperation.

In particular, some recent facts below are emerging which further support my otherwise sad conviction that the American economy (not to be confused with its Fed-supported stock exchanges) is literally living on borrowed time.

The Latest Bits of Crazy from the CBO

Almost a year ago to date, I was shaking my head and rubbing my eyes as the Congressional Budget Office (CBO) announced a staggering $422B Federal budget deficit for Q1 2023.

Now that’s a lot of borrowing in a short amount of time…

For some strange reason, this bothered me in early 2023, as I was still under this odd impression that debt, and hence deficits, actually mattered.

Fast forward to January 2024, and that same CBO has just announced a $509B Federal budget deficit for Q1 2024.

Folks, that adds up to annual deficit run rate of $2.2T.

Please: Re-read that last line again.

Do the Math: DC is Getting Even Dumber

In this 12-month interim, fiscal revenues did increase by about 8%, but outlays (i.e., expenses) for that same period rose by 12%, which is just a mathematical way of saying that either: 1) Uncle Sam is out of his mind in debt; or 2) that I am out of my mind in common sense.

But it seems I’m not the alone in saying out loud what no one DC can say to themselves, namely: The US is now in an open and obvious debt spiral.

Uncle Sam’s embarrassing bar tab of debt is now racing at a rate that far exceeds his GDP, pushing the deficit to GDP ratio toward 8% and higher–ratios we’ve never seen except during the GFC of 2008 and the “COVID” (i.e., hidden bond) crisis of 2020.

From Debt Spiral to Super QE

If recent memory serves me correctly, in both of those embarrassing years (and ratios), what followed was QE to the moon and the ongoing fantasy that every debt problem can be solved with trillions of fiat dollars mouse-clicked out of thin air.

And this time around will likely be no different, as I and others like Luke Gromen have been warning week after week, and month after month.

Such warnings, which NO ONE can time, are not merely bearish “opinions” and don’t require a crystal ball or sensational guessing.

They just require a calculator and a basic understanding of history.

Simple Math

As to basic math, one can have their own opinions but not their own facts, and the facts (i.e., math) tell us that the current cost of servicing the aforementioned debt is 16% of Federal tax receipts.

Again: Please re-read that last line. It matters, because, well…debt destroys nations.

Nor am I alone in this sober understanding.

As the former head of European block trading at Goldman Sachs, Alex Harfouche, just warned, these sickening debt ratios mean the US economy’s ability to shoulder such debt is both “horrible” and “crippling.”

Which means we all know (or should know) what’s coming next.

The Patterns of the Foolish

As in 2008 and 2020, we can now see a pattern playing out in 2024, namely an inevitable shift from rate hikes and pauses toward rate cuts and the inevitable shift from QT to QE.

Why inevitable?

Because stupidity combined with a Will to Power that would make Nietzsche blush are the profile traits of nearly all math-ignorant but ego-savvy policy makers seeking re-election or a Nobel Prize in Economics (fiction?).

That is, and especially in an election year, policy makers will not cut spending but increase it in a desperate bid to bribe the gullible masses into a Pavlovian voting pattern based on generations of political over-promising and grotesque under-delivering.

This political inability to cut entitlement spending makes a US debt spiral (and hence QE to the moon) as foreseeable as the NY Yankees beating my high-school baseball team.

DC Cutting Rates Rather than Spending

Furthermore, since the DC children running our country into the ground won’t cut spending, the only thing they can (and will) cut is interest rates.

Why?

Because cutting rates not only takes pressure off Uncle Sam’s IOUs (USTs), but also eases the pain of those complicit S&P zombies staring down the barrel of over $740B in debt rollovers in 2024.

Main Street Screwed Again

Remember: The Fed serves TBTF banks and exchanges, not citizens and their realities.

Interest rate cuts + QE = a further debased USD and rising inflation (with a deflationary recession in the middle).

And this means the voters on Main Street are about to feel the darker side of DC’s real mandate: Covering their own A$$’es while keeping Wall Street on a respirator.

Meanwhile, the masses feel pain, but can’t quite see from where it’s coming, as the media, MMT hucksters and political Ken and Barbies keep telling them that deficits don’t matter.

Deficits Don’t Matter?

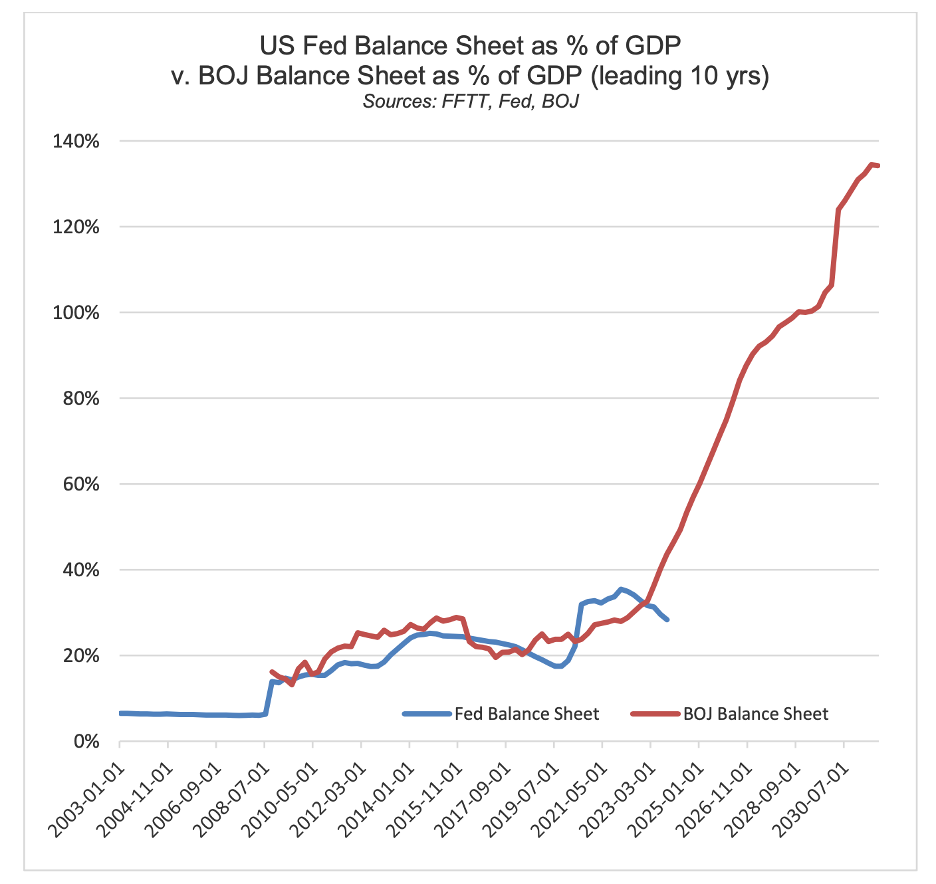

Even worse, there are those sitting in private wealth management suites smugly reminding their clients that Japan is in much worse debt (see below) than Uncle Sam, and if Japan can muddle through, certainly the US has nothing to fear.

But as I recently reminded the attendees at the Vancouver Resource Investment Conference, Japan does not have twin deficits, a negative 65% Net International Investment Position nor an externally financed bond market.

In short: Japan aint America. But even if it were, it’s nothing of which to boast…

Whistling Past the Debt Graveyard with More Spending

Like Luke Gromen, I am of the sober and math-based view that unless the US cuts entitlement and defense spending by 40% (unthinkable in an election year and a world of beating [US?] war drums almost everywhere), such austerity is about as likely as an honest man in Congress…

Failing such needed cuts and sound budget honesty, policy makers will merely whistle past another year of multi-trillion deficit levels and pass the bill on to current and future generations while inflating their way out of debt with more of the debased money in your pockets.

As I’ve written before, this is no surprise. In fact, it was the plan all along, despite Powell’s efforts to pretend otherwise.

Keep It Simple: Powell Will Pivot

Debtors, including Uncle Sam, need inflation and need a debased currency.

They need negative real rates whereby inflation outpaces the yield on 10Y bonds.

Powell, of course, tried pushing real rates to a positive 2% to allegedly “fight inflation,” but, and as in 2018-19, the net result was that he simply broke nearly everything but the USD in the process.

In fact, Powell was merely raising rates and thinning the Fed balance sheet so that he’d have something (anything) to cut (rates) and fatten (balance sheet) when the recession that his higher-for-longer policies ushered in (and then denied) became too impossible to ignore.

Or stated more bluntly: His recent QT was a planned precursor to more QE, and his recent rate hikes were a planned precursor to more rate cuts.

Keep It Simple: A Future of Debased Currency

Thus, and long before hitting “target 2%,” Powell will once again throw in the towel in 2024 on rate hikes for the simple reason that Uncle Sam can’t afford them.

Or stated (and repeated) more simply, his “war on inflation,” waged in the last 2 years, will ultimately (and ironically) end in even greater inflation.

Ahhh the ironies. Or better yet: “The horror, the horror…”

History confirms this pattern in one debt-failed nation after the next.

In fact, and without exception, currencies are always sacrificed to save a broken regime. And folks, our regime is objectively broke(n).

Thus, for those who know the math (above), and the history of yesterday, preparing for tomorrow is simple.

Projected rate cuts (and the scent of more synthetic liquidity) can and (already have) sent inflated risk assets higher as the inherent purchasing power of the currency gets weaker.

Keep It Simple: Natural Gold vs. An Un-Natural Dollar

This simply means gold, though never marching in a straight line, will reach higher highs and lower lows for no other reason than paper currencies like the USD will get more debased.

And this is all because the issuance of unloved sovereign USTs will become greater and greater, as the opening data from the CBO in Q1 now makes factually clear.

Soon the Fed will run out of tricks within Treasury General Account (Yellen’s game) and the Reverse Repo Markets to generate fake liquidity for those over-supplied and under-demanded USTs.

And this means Powell will once again crank out the money printers at the Eccles Building to “buy” those IOUs.

Fortunately, Powell has no machine in DC to produce physical gold, which means this natural precious metal of unlimited duration yet finite supply will rise, while USTs, an unnatural asset of finite duration yet infinite supply, will continue to sink.

It’s just that simple.

Gold’s Historic Rise as the S&P Teeters Toward Mean-Reverting Pain

In this first discussion of a longer series focusing on key risk themes nearing a 2024 breaking point, Matterhorn Asset Management principals, Egon von Greyerz and Matthew Piepenburg, open with a blunt discussion on the critical (as well as controversial) topics of geopolitics, escalating war signals and the key differences between gold and BTC in a global setting of open currency destruction.

Beginning with the topic of war, Egon and Matthew discuss a daisy chain of expensive and ultimately unsuccessful wars with DC origins but global ramifications. Of course, the rising tensions within the middle east form a part of this narrative, one which includes an ongoing (and still unresolved) war in the Ukraine and now headlines of further NATO expansion into Sweden and Finland.

Neither Egon nor Matthew offers easy solutions or predictions for such volatile issues. However, what can be easily foreseen is the simple and historically-confirmed relationship between escalating wars and hence escalating costs, debt levels and hence currency debasement to monetize the same. This relationship between war, inflation, and currency destruction, which even Hemingway foresaw, is anything but fictional and points yet again to the absolute necessity of protecting against such currency risk with real money, namely: Physical gold.

Of course, many crypto investors see BTC as an equally convincing form of “digital gold” to one day emerge as a viable store of value to protect against similar risks. Neither Egon nor Matthew ridicule crypto as an asset nor the investors who trade them. One can be a tenacious proponent of physical gold without having to cast dispersions at BTC, which has been a superlative speculation trade (and risk) for countless investors.

That, however, is precisely how both Egon and Matthew distinguish gold from BTC: With Gold being an undeniably (and historically-confirmed) store of value and hence wealth preservation asset; and BTC being an equally undeniable speculation asset. Egon and Matt track the price moves, for example, in BTC and compare its volatility to gold to make this conclusion objective rather than sensational. Matt, moreover, defends BTC against recent headlines, like SBF’s corruption or Binance’s multi-billion-dollar legal judgements, which are not blockchain failures but human failures. Toward that end, Matt addresses the equally “human” risks which Larry Fink’s Blackrock poses to the BTC narrative.

Although cryptos like BTC have adopted the same narrative as gold to highlight the themes of being an alternative currency outside of an openly failing global banking and fiat monetary system, the more popular (and frankly, actual) use/role of BTC has been as an astonishing speculation asset. The fact, moreover, that numerous crypto millionaires have approached Matterhorn to convert their speculative BTC into wealth-preserving gold adds anecdotal evidence to this conviction. The additional fact that central banks are stacking gold rather than BTC at historical levels suggests that when serious concerns over currency stability are the key drivers, gold is the obvious choice.

Of course, speculation and preservation are each important aspects of wealth, but Egon and Matt remind that gold preserves generational wealth with far greater effect and far less risk.

In the coming weeks, Egon and Matt will address other key risk themes (oil, currencies, BRICs etc.) as we enter a very important 2024.

Gold’s Historic Rise as the S&P Teeters Toward Mean-Reverting Pain

With the US shooting itself in the foot again, we are now certain that this is the final farewell to the bankrupt dollar based monetary system.

More about this follows but, in the meantime, an extremely important warning:

If you have never been a goldbug, this is the time to become one.

I decided 25 years ago that the destiny of the world economy and the financial system necessitated the best form of wealth preservation that money could buy.

And physical gold performs that role beautifully just as it has done for several thousands of years as every currency or fiat monetary system has collapsed without fail throughout history.

Thus, at the beginning of this century we told our investor friends and ourselves to buy gold for up to 50% of investable liquid asset.

So at $300 we acquired important amounts of gold and have never looked back. We have of course never sold any gold but only added since.

I have never called myself a goldbug, just someone who wanted to protect assets against the risk of the destruction of the financial system including all currencies. But now is really the time to become a real gold bug.

So, today just over 20 years later, gold is up 7 – 8X in most Western currencies and multiples of that in weaker economies like Argentina, Venezuela, Turkey etc.

The total mismanagement of the US financial system has led to the dollar losing 98% of it’s value since Nixon closed the gold window in 1971. Most other currencies have followed the dollar down at varying speeds.

But now comes the really exciting phase of this race to the bottom.

We have only 2% left for the dollar based currency system goes to ZERO.

As Voltaire said in 1728, “Paper money always returns to its intrinsic value – ZERO.”

What we must remember is that the dollar doesn’t just have a further 2% to fall to reach zero. Because to reach zero, it will next fall 100% from where it is today.

I know the sceptics will say that this is not possible. But these sceptics don’t know their history. Since fiat currencies’ record is perfect, no one must believe that because we live today, it is different to a 5,000 year faultless record of success, or shall we call it failure, of currencies always reaching zero.

THE US CONTINUES TO SHOOT ITSELF IN THE FOOT

How many times can you shoot yourself in the foot and still walk upright with pride?

Well, the US government certainly has wounded itself mortally with both feet being so full of holes that there is hardly any space left for another hole.

So, the latest hole in the US dollar foot is a proposal to steal $300 billion of Russian reserves and use the funds for the reconstruction of Ukraine.

A deadline has been set for the G7 nations to come up with the detailed proposal by 24 February.

The proposal has obviously come from the US backed by its faithful lapdog the UK.

Now don’t get me wrong, I really like the US and also the UK and their people but that doesn’t mean that I concur with the idiotic decisions taken by their governments without the consent of their people.

So will 2024 be the year which, when all the evils which the West has created, erupt in the most violent chain of events political, civil wars, geopolitical, more war, terrorism, economic collapse including the fall of the monetary system.

Well the ingredients are certainly present to create a picture similar to The Triumph of Death painting by Bruegel.

We obviously hope that this is not where the world is heading but all the ingredients are sadly in place for the start of a series of events which will be both unpredictable and uncontrollable. “The Financial System has reached the End”

MOST MAJOR WARS SINCE WWII HAVE BEEN INSTIGATED BY THE US

As Merkel admitted, since the Minsk agreement in 2014, it was always the intention of the US to push Ukraine into a conflict with Russia.

This war is still going on with more than 500,000 having been killed. (Since propaganda from both sides is a major part of a war, we will never know the correct figure.)

It will obviously be very tempting for the G7 to use the $ 300 billion funds stolen, for the war since many countries’ parliaments are becoming reluctant to fund this war.

So is the US and its allies going to set a precedent that should also apply for other wars?

Since the US initiated the attacks on Vietnam, Iraq, Libya, Syria and many other countries, should not the US foreign reserves be applied for the reconstruction of all these nations?

But as always, it is one rule for the mighty US and another rule for its enemies.

As Bush Jr said, “Either you are with us or you are with the terrorists.”

THE LAST PHASE OF THE DOLLAR DEBASEMENT NEXT

This very final phase of the dollar debasement to zero really started on June 29, 2022 when the US decided to seize all Russian financial assets.

That action was the nail in the coffin (as well as the shot in the foot) of the Petrodollar system. This has been in place since 1973 to support the dollar with a payment system for black gold since yellow gold was no longer supporting the dollar.

To seize a major sovereign state’s (Russia’s) assets can never end well. And then to give those assets to an enemy of that state (Ukraine) is guaranteed to seal the fate of the dollar dominant currency system and its backers.

An economically weak EU gave its support with the Brexit UK always obeying its US masters.

A historical post mortem of this total submission to the command of the US will clearly conclude that it was totally disastrous for the German economy as well as the rest of Europe. But sadly weak leaders always make disastrous decisions.

And as the West has a massive surplus of weak leaders, it is running from one crisis to the next.

Is Treasury Secretary Yellen blind to what is happening to her economy or is she just giving the world the propaganda lies that all politicians must do to buy votes?

This is what Yellen said to the House Financial Services Committee in August 2023:

“The dollar plays the role it does in the world financial system for very good reasons that no other country is able to replicate, including China. We have deep liquid open financial markets, strong rule of law and an absence of capital controls that no country is able to replicate….. But the dollar is far and away the dominant reserve asset.” –

“Deep liquid financial markets” means “we” have until now been able to create unlimited amounts of worthless fiat money. “Strong rule of law” means that whoever totally obeys the US increasingly totalitarian system, like for example the Patriot Act, is protected by the law. And as regards capital controls, FATCA (Foreign Account Tax Compliance Act) that the US forced upon the world’s finical system in 2014 has led to a total US control of the global financial system.

And as regards “the dollar is far and away the dominant reserve asset”, not for long Mrs Yellen.

Has Janet heard of de-dollarisation, has she heard of the BRICS and has she understood that the runaway debts and deficits are destroying the fabric of the US economy and financial system?

Yes of course she knows all of this and she also knows that she can’t do anything about it except to print more money. So her principal role is to keep the pretences up and hope that the system will not collapse on her watch. And then hopefully she can pass the baton to the next treasury secretary unscathed, so that he/she can get the blame.

BRICS

The BRICS already has 10 members, India, China, Brazil, Russia, South Africa, Saudi Arabia, UAE, Iran, Egypt and Ethiopia.

In addition, another 30 countries want to join including for example Venezuela.

The BRICS produce just under 50% of global oil.

But if we look at oil reserves, the existing BRICS plus aspiring members like Venezuela, have over 20X the oil reserves of the US.

PEAK ENERGY

Another major economic crisis for the world is the contracting energy system.

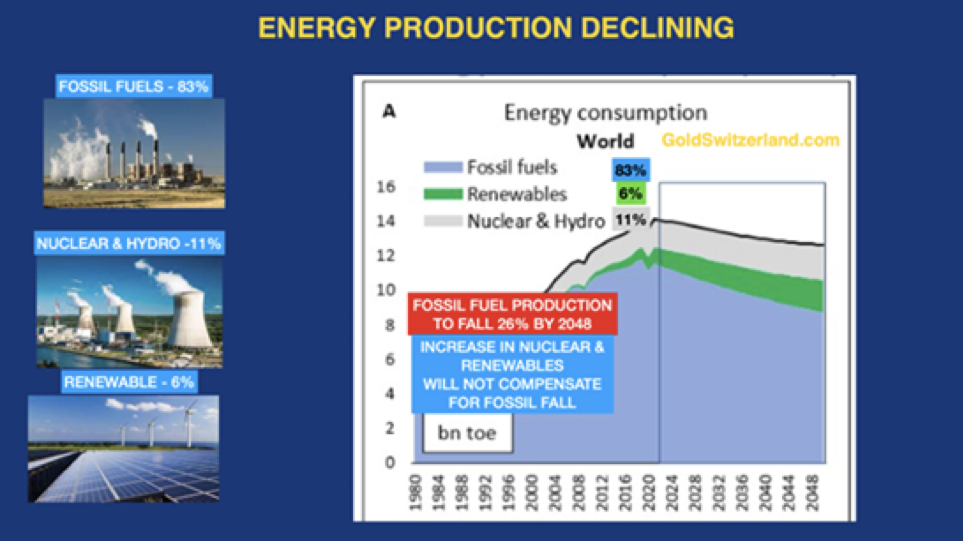

The world economy is driven by energy which means fossil fuels. Without sufficient energy the living standards would decline fatally. Currently fossil fuels account for 83% of the world’s energy. The heavy dependence on fossil fuels is unlikely to change in the next few decades.

And as I have always believed, even electric vehicles are no longer the holy grail that world governments are trying to push onto consumers. There are just too many problems such as cost of buying and cost of repairs, range and questionable CO2 benefits. Also environmentally EVs are a disaster since batteries have a short life and cannot be recycled.

But that’s not the only problem. For the first 60-70,000 miles an EV produces more CO2 than an ordinary vehicle.

Stocks are building up of unsold EVs, exacerbated by companies like Hertz selling off 20,000 vehicles.

Also, to produce ONE battery takes 250 tons of rock and minerals. The effect is 10-20 tons of CO2 from mining and manufacturing even before the vehicle has been driven 1 metre.

In addition, car batteries cannot be recycled but go to landfill which has major environmental implications.

And as concerns renewable energy, it is unlikely to replace fossil fuels for a very, very long time even if this is a politically uncomfortable view for the climate control activists. What very few realise is that most renewable energy sources are very costly and also all dependent on fossil fuels whether it is electric cars, wind turbines or solar panels.

As the graph shows, the energy derived from fossil fuels has declined for the last few years. This trend will accelerate over the next 20+ years as the availability of fossil fuels decline and the cost increases. The economic cost of producing energy has gone up 5X since 1980.

What very few people realise is that the world’s prosperity does not improve with more debt but with more and cheaper energy.

But sadly, as the graph above shows, energy production is going to decline for at least 20 years.

Less energy means lower prosperity for the world. And remember that this is in addition to a major decline in prosperity due to the implosion of the financial system and asset values.

The graph above shows that energy from fossil fuels will decline by 18% between 2021 and 2040. But although Wind & Solar will proportionally increase, it will in no way compensate for the fall in fossil fuels. For renewable energy to make up the difference, it would need to increase by 900% with an investment exceeding $100 trillion. This is highly unlikely since the production of Wind & Solar are heavily dependent on fossil fuels.

Another major problem is that there is no efficient method for storing Renewable energy.

Let’s just take the example of getting enough energy from batteries. The world’s largest battery factory is the Tesla Giga factory. The annual total output from this factory would produce 3 minutes of the annual US electricity demand. Even with 1,000 years of battery production, the batteries from this factory would produce only 2 days of US electricity demand.

So batteries will most probably not be a viable source of energy for decades especially since they need fossil fuels to be produced and charged.

Nuclear energy is the best available option today. But the time and cost of producing nuclear means that it will not be a viable alternative for decades. Also, many countries have stopped nuclear energy for political reasons. The graph above shows that nuclear and hydro will only increase very marginally in the next 20 years.

Of course the world wants to achieve cleaner and more efficient energy. But today we don’t have the means to produce this energy in quantity from anything but fossil fuels.

So stopping or reducing the production of fossil fuels, which is the desire of many politicians and climate activists, is guaranteed to substantially exacerbate the decline of the world economy.

We might get cleaner air but many would have to enjoy it in caves with little food or other necessities and conveniences that we have today.

So what is clear is that the world is not prepared for even the best scenario energy case which entails a major decline in the standard of living in the next 20-30 years at least.

IMMINENT DECLINE OF THE WORLD ECONOMY

The above explanation, of the world economy as an energy driven system, is important to grasp in order to understand the effect of the declining energy production. This decline together with the increased energy cost of producing energy will exacerbate the decline of the world economy.

To add to this longer term energy crisis which very few people discuss or fathom, the world is facing the end of the current monetary system.

Yes, the BRICS countries will over time assume the mantle of the waning Western empire.

But it won’t happen overnight, especially since the world’s second biggest economy, China, also has a debt problem almost as big as the US one.

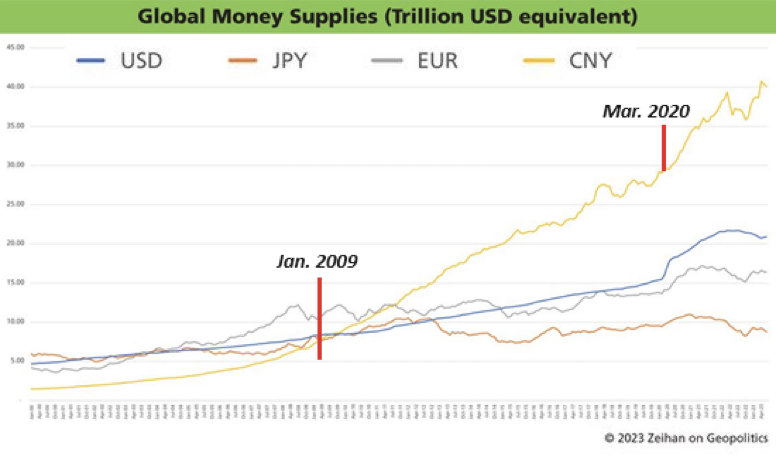

Just look at the growth of China’s money supply in this century. No country has survived such an explosion of money supply without serious consequences.

The advantage that China has is that their financial and currency system is principally domestic and can therefore be resolved “in-house”.

JUMP ON THE GOLD WAGON

No one can forecast with certainty when an event will take place.

But what we can determine with great certainty is that the risk is imminent for the world economy and the Western monetary system to go through an uncontrollable reset of proportions never seen before in history.

What we also feel certain about is that the gold price very soon will reflect the major problems that the world economy is facing.

In this century, gold has performed very strongly against all currencies as the table below shows.

All major central banks will do all they can to support the gold price.

The BRICS and other Eastern countries will accelerate their already substantial purchases of gold. And the West, led by the US will accelerate the debt creation and spend unfathomable amounts in futile attempts to save their collapsing economies.

In June 2016 I advised investors to jump on the Goldwagon when gold was $1,300. https://vongreyerz.gold/get-on-the-goldwagon-to-10000/

Today with gold at $2,050 gold is still very cheap and anyone with some savings, small to very big, must now jump on the goldwagon and buy as much physical gold (and a bit of silver) as you can afford and then some more.

Owning gold will not solve all our problems, but it will at least give us a very important nest egg and protection against the coming financial debacle that will hit the world.

Gold’s Historic Rise as the S&P Teeters Toward Mean-Reverting Pain

In Europe, many countries have been seething since 2015, when the first major wave of refugees reached Germany and Austria in particular. In the US, it was the election of Donald Trump as President in November 2016 that brought the deep divide between Republicans and Democrats to everyone’s attention. A few months earlier, to the surprise of many, the UK had opted for Brexit, an exit from the EU. Only a few years have passed since then, but the density of crises has increased rather than decreased: Covid-19, the climate crisis, inflation, the war in Ukraine, the energy crisis, and finally Hamas’ terrorist attack on Israel and its response.

2024 will see a number of important elections in these times of multiple crises: presidential elections in the USA, elections to the European Parliament, and three state elections in eastern federal states in Germany(in each of which the AfD is leading in the polls by more than 30%). 2024 could be the year of major social and political upheavals.

Because business and investment always take place in a specific political and social environment, in this article we want to look at investment as a topic in a broader sense. Over the course of dozens of events and hundreds of client visits, we exchanged views with professional market participants such as asset managers, fund managers and private investors, as well as with private clients and representatives from a wide range of media. In the course of many discussions, we have been able to diagnose, roughly speaking, three different world views with regard to the assessment of the overall economic situation. We want to outline these below and, based on this, the respective affinity for a gold investment:

- “Believers in the system”

Among these are, for example, financial analysts and market commentators who believe that the interventionist Keynesian economic policy, which has been implemented in the wake of the global financial crisis, is in principle correct and necessary. According to their view, the economy is in a recovery process which, due to unforeseeable regional economic difficulties, such as the euro area debt crisis, slowing growth in China, the aftermath of the Covid-19 crisis, interest rate shock etc. has been developing at a slower pace than expected. All in all, the “patient” that is our global economy, is however on the way to regaining his health, and the financial markets are in the process of gradually sounding the “all clear”. The supervisory authorities have moreover learned much-needed lessons from the crisis and have lowered systemic risk by implementing better regulations.

Representatives of this camp are increasingly critical of the fact that expansive monetary policy has lately been “the only game in town”. According to believers in the system “secular stagnation” or the “new normal” are the paradigms which best describe the current phase of weak growth. This state of affairs is supposed to be countered by more stimulus, such as fiscal stimulus measures, and/or “helicopter money”. They also consider a rapid and radical energy transition to be indispensable, whatever it takes. Gold allocation in the portfolios of this group has been extremely low, effectively zero over the past decade. It could even happen that gold could get a public reputation problem from this group, who are very influential in state and public institutions, as gold could increasingly be branded as the asset of potentates and conspiracy theorists.

- “The Sceptics”

This camp comprises people who harbor doubts about the sustainability of the extreme economic policy measures that have been taken and deemed necessary to overcome the global financial crisis, the sovereign debt crisis in the eurozone and the coronavirus pandemic. After these crises, many of them instinctively came to the conclusion that fighting a debt crisis with even more debt, and extravagant monetary policy measures, is probably not an appropriate therapy. This group includes, inter alia, hedge fund managers and traditional asset managers who are often unable or unwilling to communicate their critical assessments, especially publicly. Sometimes a schizophrenic situation arises in which fund managers position their private portfolios in a much more crisis-proof way, with a higher allocation to gold.

With respect to gold allocations within the portfolios managed by this group, many have acted in a pragmatic manner: In the years after the global financial crisis, they accumulated a lot of gold. But from 2013 onwards, these positions were reduced, and in some cases even sold in their entirety, often on account of performance pressures. From 2016 onwards, ETF inflows were on the rise again. This significant increase in ETF inflows indicate that, inter alia, these skeptical investors have partially returned to the market. ETF holdings more than doubled by October 2020. Since then, interest in Europe and the US has been on the decline, while demand from Asia has increased slightly.

In recent years, due to the current “investment emergency” and the pressures exerted by reporting structures and benchmarks, many sceptics have joined the bandwagon in traditional “risk-on” asset classes like (technology) stocks, private equity, real estate, high yield bonds etc. However, in many cases this was done half-heartedly, in order to “ride the wave”.

It is remarkable how many market participants are questioning the sustainability of current economic and monetary policy measures behind closed doors. It is also worth noting that the group of sceptics has, in our assessment, gradually grown in recent years and has likely become the largest group.

We believe the sceptics could play a particularly important role as marginal buyers in driving the future gold price trend: Many of them have not yet invested in gold, but are keeping an eye on it from the side-lines. As soon as the “slow recovery of the economy” narrative no longer holds up, they will be among the first to shift portfolio allocations in favor of gold.

- “Critics of the System”

Members of this group are convinced that the monetary architecture is systematically flawed. Criticism of the system can be formulated on the basis of several schools of thought, or at times even based on common sense. In our opinion, the most consistent critical assessment of the status quo can be performed by employing the analytical methods of the Austrian School of Economics. Austrian theory systematically explains why the forecasted economic mini-recovery is neither sustainable nor self-supporting.

People who have come to adopt this critical stance have one thing in common: It is almost impossible for them to regain faith in the system. Thus, there is a one-way street into this camp, and the growth of this group is almost inevitable.

We are making no secret of the fact that we belong to the third group. We only regard criticism of the system as serious if it results from investigations free of value judgements. Our findings are based on the methodological framework of the Austrian School. We want to emphasize that we are opposed to system rejection, for mere ideological reasons. Simply being against the system is a childish attitude of defiance that will not improve anything.

The instability of credit expansion induced growth, which we routinely criticize, is impressively illustrated by the following chart. Since 1959, “total credit market debt” – the broadest debt aggregate in the US – has increased by 12,800%, bringing the annualized growth rate to 7.4%. In every decade, outstanding debt has – at least – doubled. In order to trigger credit-induced GDP growth again – after the volume of total outstanding debt dipped slightly for the first time in 2009 – the Fed implemented a series of never-before-seen monetary policy measures.

Currently, the US federal government, in particular, is piling up the debt burden through persistently high budget deficits. In the fiscal year 2023, which concluded in September 2023, the deficit reached 6.3%, compared to 5.4% in the fiscal year 2022. In the two pandemic years 2020 and 2021, the deficit even reached the double-digit percentage range, at 15.0% and 12.4% respectively. In the first quarter of the current fiscal year, there is no sign of a reduction in the spending orgy.

This inevitably leads to a rapid increase in US debt. This debt is now over USD 34 trillion and the latest trillion was added in only 14 weeks. As around a third of US debt has to be refinanced within a year, interest payments will continue to rise. More than a third of federal taxes already have to be spent on servicing interest alone.

There is no reverse gear that can be engaged in today’s monetary system – the money supply has to be increased incessantly – which in turn means that the amount of credit in the system continually rises as well.

Critics of the system know: The fact that the steady expansion in the volume of outstanding debt has run into snags in recent years, characterizes the current (critical) phase in the monetary system’s evolution. Over the medium-term, these record levels of debt will either be dealt with by defaults, financial repression, or a forceful reflation, possibly in the form of “helicopter money”.

Conclusion

In light of this critical assessment, we advocate more strongly than ever for a strategic allocation to physical gold in long-term investment portfolios. This is because one of the most important portfolio characteristics of gold is and remains that it has no counterparty risk.

Precisely because gold is such an important part of the financial safety net against severe systemic crises, any efforts by governments, authorities or interest groups to demonize gold as an asset of extremist groups or rogue states, and therefore to regulate it more strictly, should be resolutely opposed. The current monetary system is not facing a crisis because citizens could switch to gold, but rather because citizens are increasingly switching to gold, precisely because the current monetary system is bound to face a crisis sooner or later. Bad-mouthing gold does not prevent a crisis, it exacerbates it, because it deprives the population of the golden safety net. Without a safety net, people are known to fall deeper and harder.

Gold’s Historic Rise as the S&P Teeters Toward Mean-Reverting Pain

Ever since day-one of the predictably disastrous and politically myopic insanity of weaponizing the world reserve currency against a major power like Russia, we warned that the USD had reached an historical turning point of slow demise and increasing de-dollarization.

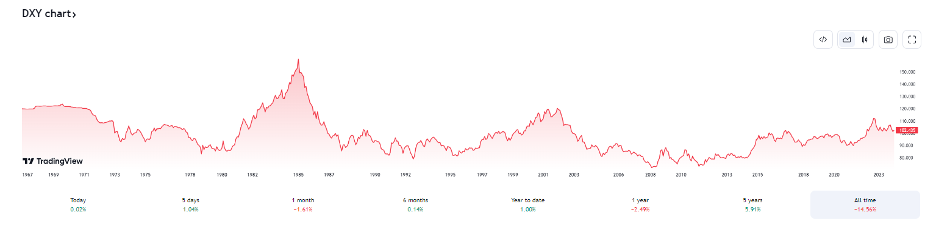

We also warned that this would be a gradual process rather than over-night headline, much like the slow but steady death of the USD’s purchasing power since Nixon left the gold standard in 1971:

But as we’ll discover below, this gyrating process is happening even faster than we could have imagined, and all of this bodes profoundly well for physical gold, yet not so well for the USD.

Bad Actors, Bad Policies & Predictable Patterns

Regardless of what the media-mislead world thinks of Putin, weaponizing the USD was a foreseeable disaster which, naturally, none of DC’s worst-and-dimmest, could fully grasp.

This is because chest-puffing but math-illiterate neocons pushing policy from the Pentagon were pulling the increasingly visible strings of a Biden puppet at the White House.

In short, the dark state of which Mike Lofgren warned is not only dark, but dangerously dumb.

These political opportunists have forgotten that military power is not as wise as financial strength, which is why broke (and increasingly centralized nations) inevitably lead their country toward a state of permanent ruin preceded by cycles of war and currency-destroying inflation.

Sound familiar?

Despite no training in economics, Ernest Hemingway, who witnessed two world wars, saw this pattern clearly:

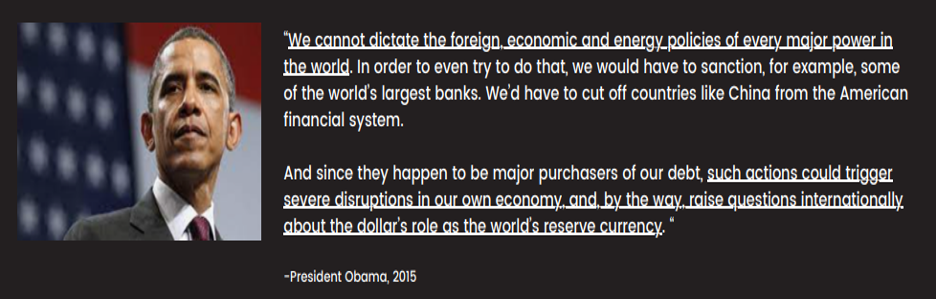

We also found “Biden’s” sanctions particularly comical, given that his former boss clearly understood the dangers of such a policy for the USD as far back as 2015:

The myopic (i.e., patently stupid) sanctions against Putin simply (and predicably) pushed Russia and China closer together while the BRICS+ nations increasingly began arbitraging gold for oil.

Or stated more bluntly, DC’s plan to weaken the Rubble has only served to put the USD at historical risk.

Does the Petrodollar Suck?

Throughout2022 and 2023, we warned of the weakening respect Saudi Arabia has for the allegedly Biden-“lead” US in general and its increasingly unloved UST and weaponized USD in particular.

Of course, we were specifically warning of the slow, gradual and yet again—inevitable—demise of the oh-so important Petrodollar which has been a critical “straw” of the milkshake theory’s faith in global demand for the USD.

But as the facts are now making increasingly clear, that “straw” is no longer sucking on a USD which much of the world now considers, well, a Dollar that sucks…

Three days after Christmas, the Wall Street Journal confessed what JP Morgan’s head of global commodities strategy had been tracking since 2015, namely that approximately 20% of the global oil bought and sold in 2023 was in currencies other than the USD.

Ouch.

That Dollar-straw appears to be losing its sucking-power, no?

Currently, this is because two nations all too familiar with American sanctions—i.e., Iran and Russia—just happen to have a lot of oil and have cranked up their oil selling in alternative currencies among willing buyers like China and India.

By the Way: This is All VERY Good for Gold

One, for example, can sell oil in London for gold, then transfer that gold to a Yuan trade hub where the gold is converted to CNY, and then use that CNY to buy oil outside of the USD.

Or stated more simply, gold will slowly be filling the delta in a BRICS+ oil trade once ruled by the USD, which mean’s gold’s price, hitherto controlled by NY and London, is about to return to actual fundamentals rather than OTC price fixing.

As gold traded on the Shanghai Exchange gathers greater and greater momentum (and premiums), the 200-day moving average of gold priced in USD will have to keep pace for the 200-day moving average in CNY…

Again, all of this was foreseeable but only now is the math finally making the headlines.

How Much Worse Can It Get for the USD?

Given the rapid pace and percentages of oil trading outside of the USD, the obvious next question is how much worse can it get?

The short answer: A lot worse.

Iran and Russia, for example, are playing hard-ball, but what happens if Saudi Arabia, which is now an official BRICS member (and more prone to fist-pumping Biden while shaking hands with Xi) decides to look more East than West in the coming years?

Saudi Arabia’s increasingly open relations with the Shanghai Cooperation Organization and BRICS New Development Bank suggest that unlike former nations who tried to sell oil outside of the USD (think Iraq and Libya), the Saudi Crown Prince appears far less afraid of meeting the same coincidental fate of say, Saddam Hussein or Muamar Gaddafi…

As we’ve warned numerous times, once the US weaponized the USD, there was no turning back, as nations both friendly or not-so-friendly to the US would never trust a non-neutral reserve currency in the same way they had in prior times.

Thanks to folks like Nixon and now Biden, we are a looonnnggg way from the Bretton Woods USD…

Stated simply, broken trust has made the once tolerated USD less tolerable, and like a genie that can never be put back in the bottle again, the USD will never be fully trusted again, which means demand for that Dollar will never be the same again.

But What About the UAE and Saudi Dollar Peg?

Defenders of the Petrodollar (and hence milkshake theory) will rightfully point out that both the Saudi riyal and UAE dirham are pegged to the USD, which might suggest that both of these mega oil powers have a vested interest in seeing a stronger rather than weaker role of the USD in their critical oil markets.

It’s also worth admitting that Russian oil enterprises are slamming into liquidity issues with Indian rupees and Chinese yuan, which are not nearly as liquid as the USD, which despite its weak legs and twisted back, is still the best horse in the global currency glue factory.

These are fair, very fair points.

This is why we still maintain our belief that the USD’s supremacy, just like it’s post-1971 purchasing power, will die slowly by a thousand cuts rather than an overnight headline.

So yes, the riyal and dirham are both pegged to the USD, but as Luke Gromen recently observed, that’s only true “…for now.”

Gromen makes a compelling case that most investors are underestimating the ability by which both the UAE and Saudis have to de-peg their currencies from a weakening USD and re-peg “their energy to gold… while having their currencies APPRECIATE against the USD.”

Brent Johnson, who argues for a stronger USD, would counter such an argument by reminding us that OPEC considered cutting its link with the USD in 1975, and it never happened.

But like Gromen, I’d argue that we are not in 1975 (or Kansas) anymore.

Much has changed—including the distrust of that post-sanction USD, the subsequent rise of the BRICS+ nations, the aforementioned percentage of oil volumes trading outside the USD and the open decline of US monetary and foreign policy in recent years and headlines.

And like Gromen, I’d remind readers that even the hint of an OPEC link-cut in 1975 with the USD sent the gold price up by 5X in a period of less than five years.

This explains why the Fed of that same period hiked rates from 5.25% to over 18% to make the USD more attractive to OPEC.

BLACK Gold Colliding with Real Gold = A GREENback in the RED

But folks, with public US debt now racing past $34T, the current Fed has no ability to put such rate-hike lipstick on a high-debt pig of the current magnitude, which means Powell, unlike Volcker, simply can’t make the USD attractive to OPEC in 2024 like it could in the late 1970’s.

Or stated more simply, the USD, like the cornered US Fed, is running out of both credibility and options.

And This Again, Is Good for Gold

The implications and ripple effects of a now weaponized Greenback are nothing short of extraordinary as gold slowly rises to the status of an oil currency for the first time since Nixon welched on the gold standard in 1971.

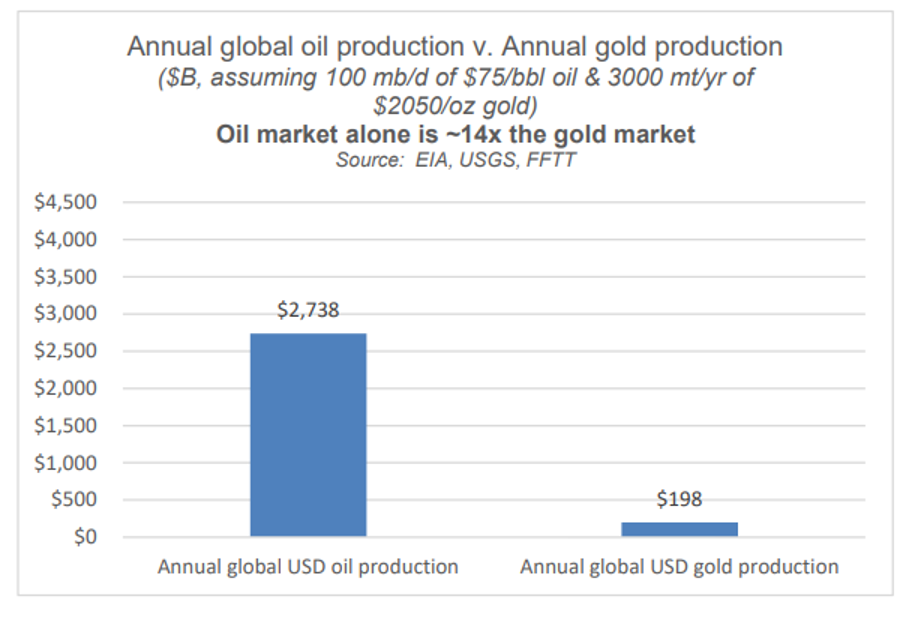

And given the disconnect between current USD oil production (massive) and USD gold production (tiny), the potential for an historically significant repricing of gold is as powerful (and predictable) as good ol’ fashioned supply and demand.

After all, when a golden asset of infinite duration yet finite supply collides with spiking demand, the price of that asset skyrockets.

By contrast, when an unloved asset of finite duration yet infinite supply—like a UST—collides with tanking demand, the price of that asset sinks to the ocean floor…

Don’t Get Too Comfortable with Lower Rates and Defeated Inflation…

Thus, despite recent and openly desperate attempts by the FOMC to project reduced rates while declaring victory over inflation (after having engineered a deflationary, yet unreported and rate-hike-driven recession), we foresee a longer-term scenario of tanking USTs and hence rising yields, which means rising interest rates.

Such bond-market-determined (rather than Fed-set) rate hikes will also be colliding with a US Congressional Budget Office forecasting another $20T of UST issuance in the next 10 years.

This will be a perfect storm of more IOU issuance colliding with even higher rates and hence higher costs, which will in turn only be payable if the Fed prints even more trillions of USDs out of thin air to pay Uncle Sam’s bar tab.

Needless to say, such inevitable synthetic liquidity (i.e., QE to the moon) will lead to further rather than less debasement of an already debased USD (very good for gold…), proving that Hemingway’s predictions above make him a far more deserving recipient of the Nobel Prize in Economics than Bernanke.

Ah, the ironies, they do abound…

Bernanke’s thesis of solving a debt crisis with more debt is far more deserving of a prize in fiction than math, but as per above, it was Papa Hemingway, the novelist, who understood history and math far better than this falsely idolized central banker…

All Signs Point to Gold

In 2023, we saw gold reaching record highs in all currencies including the USD despite a year marked by a relatively strong USD, positive real rates and spiking yields—all traditional headwinds for USD-priced gold.

This disconnect from traditional metrics is based upon the USA’s disconnect from sound monetary and foreign policies, all of which have left the USD, UST and US Government looking more like the island of misfit toys rather than a trusted land of the reserve currency.

Gold will continue to diverge from traditional metrics as its role as a net trade settlement among the growing BRICS+ nations makes the issue of positive or negative US real rates less relevant in a world turning away from, well…the US and its broken/dis-trusted currency.

These hard facts, combined with the inevitable return to mega QE to monetize massive and projected UST issuance (and hence debt) in the coming years, will further debase the USD to support the UST market.

Ludwig von Mises, Ernest Hemingway, and David Hume understood the philosophy of debt long before the first central banker was spawned. They warned that all debt-soaked and failing nations have and will sacrifice their currency to save their rotten “system.”

They were and are correct.

In blunt yet historically and math-confirmed terms, gold, priced in USDs, will continue to rise much higher for the simple reason that the USD, despite its powerful reserve status, will continue to debase itself in real terms.

Gold’s Historic Rise as the S&P Teeters Toward Mean-Reverting Pain

In this opening MAMChat for 2024, Matterhorn Asset Management principles, Egon von Greyerz and Matthew Piepenburg, take a sober look ahead at a macro environment riddled with undeniable event-risk—from geopolitics and asset bubbles to debased currencies and distrusted global leadership. None of these facts are pretty, yet they point the way to protective thinking as well as open appreciation in precious metal markets for the coming year.

Egon opens with a sober analysis of geopolitical risks emanating from the Ukraine and Middle East to inflamed election cycles in socially fractured nations like the UK and U.S. An obvious pell-mell of both predictable and unpredictable events in any of these areas can and will have headline-making impact on our personal and financial security. In addition to such geopolitical vulnerabilities, investors are crawling toward open market, currency and rate market risks. As Egon reminds, the temporary and rate-cut-driven euphoria in bloated stock markets can easily and will inevitably lead to disaster in a setting of undeniable risk asset bubbles and increasingly distrusted sovereign bonds like the UST.

Matthew sees similar ripple effects in global markets, all of which emanate from absurd debt levels across the globe in general and from within the US in particular. The increasingly obvious gap between fantasy (“resilient markets” or “transitory/defeated inflation”) and cold reality is getting harder to ignore or politically white-wash. Gold, despite the traditional headwinds of positive real rates, rising yields or a relatively strong USD, has been making record highs because the world is openly distrustful of US Dollars, IOUs and failed foreign policy.

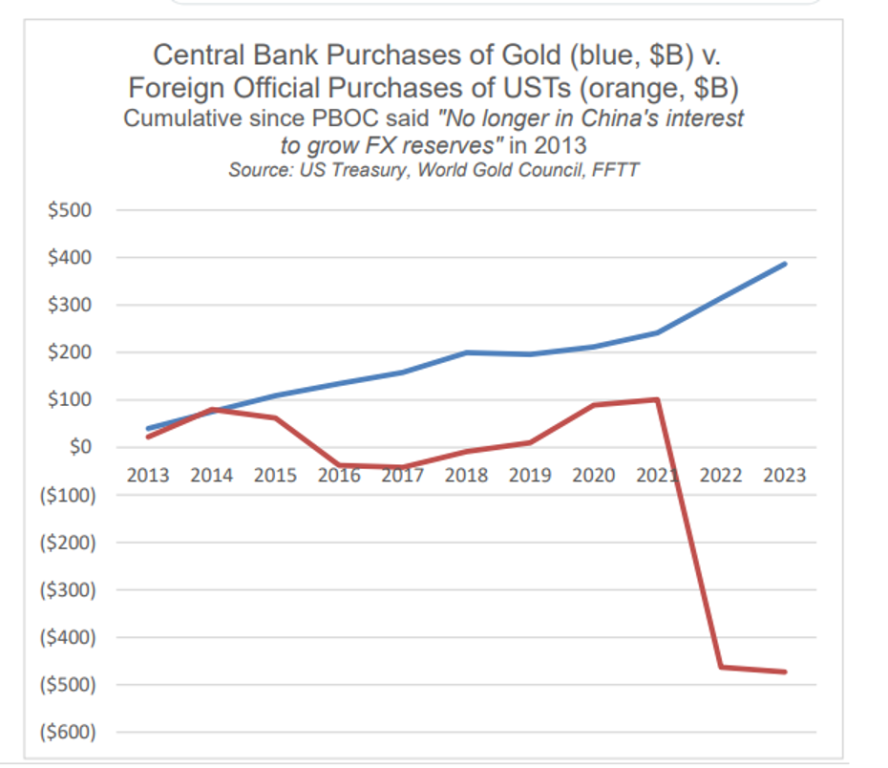

Matthew highlights the record-breaking levels of central bank gold purchasing and UST dumping as clear signals of this distrust. In addition, the obvious weaponization of the mainstream media to hide open lies from within the CDC, the DOJ and other US agencies have truncated American credibility. Even recent attempts to weaponize the 14th Amendment to manipulate the democratic process (however messy) have tarnished US credibility in the wake of disastrous foreign policy failures from Afghanistan to Kiev, and all in the backdrop of an historically embarrassing leadership vacuum at the White House.

Turning specifically to the subject of physical gold, Egon and Matthew trace gold’s cyclical price moves and place the same into the current context of the foregoing (and enhanced) event risks. Despite rising by 8X against the major currencies since Matterhorn was founded, gold, as well as its use and power in a backdrop of monetary policy failures, remains misunderstood by the majority of investors.

As the same central banks which destroyed fiat money are now stacking physical gold, precious metals are currently and uniquely poised for significant moves north to not only serve as wealth preservation assets, but also as wealth enhancement assets. In this backdrop, Egon and Matthew further remind that despite the critical importance of understanding WHY investors should own gold, it is equally important to understand WHERE and HOW gold should be held (and not held) in a setting of objective banking, currency, market and political risk.

Gold’s Historic Rise as the S&P Teeters Toward Mean-Reverting Pain

In Part II of this two-part conversation with Michelle Makori of Kitco News, Matterhorn Asset Management Partner, Matthew Piepenburg, answers questions about crypto currencies, gold’s critical wealth preservation profile, the rising list of geopolitical failures/risks and the very future of Western Democracy as debt-trapped nations drift openly toward greater centralization.

Piepenburg addresses the latest headlines in the BTC markets, from the SBF/FTX debacle to the recent penalties imposed on Binance. These failures are human failures rather than BTC failures, and Piepenburg acknowledges the rising role of BTC in the minds of many speculators. He raises questions about the radical pivot at Blackrock from its openly anti-BTC stance to now pushing for a BTC spot ETF, which risks centralizing the de-centralized profile of BTC.

As for geopolitics, Piepenburg holds little back in his open critique of undeniably failed policies from Afghanistan to the Ukraine, and now equally worrisome challenges coming out of the Middle East. The risk of escalation from Israel to Iran is objectively discussed, as is the cost of U.S. support for more off-shore conflicts, all of which add increased pressure on an already over-supplied UST market and hence increasingly diluted world reserve currency.

The conversation turns to recent moves within the US by states like Colorado to impact the 2024 election. Toward this end, Piepenburg warns that such mis-use (abuse) of a politicized judicial system is extremely concerning, regardless of whether one’s politics are left or right, blue or red. As warned in countless interviews and articles in recent months, Piepenburg uses both historical and economic indicators which underscore his concern that as nations fall deeper into debt, they rise higher into centralization, of which these recent judicial tricks are just the latest symptoms.