Debt’s Toxic Ripple Effects: Gold Flowing Toward Historical Repricing

In Part I of this two-part conversation with Michelle Makori of Kitco News, Matterhorn Asset Management Partner, Matthew Piepenburg, looks at the key financial themes of 2023 and the critical trends to impact the year ahead.

With markets rising on Powell’s projection of 2024 rate cuts, Piepenburg unpacks the Pavlovian nature of artificial (Fed-driven) rather than natural (balance-sheet-driven) markets and recognizes the near-term bull-case for risk assets in such a dovish backdrop. Piepenburg reminds, however, that there is a massive difference between artificial market moves and Main Street realities. Toward this end, he provides an evidence-based/indicator-heavy case for a current recession and even harder landing to come.

Key to his outlook on risk assets, bond markets, recession projections, currency direction, precious metal pricing, crypto moves and even geopolitical direction is the open and obvious elephant in the room, namely: Absurd debt levels. Piepenburg explains how the ripple effects of mis-managed fiscal and monetary policies have made the debt trap easy to see, and from this debt trap, the consequences are equally easy to track.

The rapidly changing role of a weaponized USD in the wake of the Putin sanctions have had undeniable impacts on the world reserve currency, as commodity markets de-dollarize and the trade in oil and gold, in particular, moves slowly but openly away from the Dollar. Piepenburg carefully unpacks the arbitrage playing out today as money and gold moves East. He sees big shifts ahead in gold pricing as the Shanghai Gold Exchange gains greater momentum and as Saudi Arabia edges ever closer to its BRICS+ direction (and hence more oil moving away from the Greenback). Although impossible to time with precision, these geopolitical ripple effects are equally impossible to ignore as gold enters the opening chapters of an historical re-pricing.

Ultimately, Powell is losing control of his own narrative as debt pressures send rates and the USD lower and risk assets dangerously higher. In the end, of course, Uncle Sam’s debt is just too high to pay without more mouse-clicked (and hence debased) Dollars, which will serve as a further tailwind for gold.

Debt’s Toxic Ripple Effects: Gold Flowing Toward Historical Repricing

Matterhorn Asset Management founder, Egon von Greyerz, sits down with Darryl and Brian Panes from as Good as Gold Australia to discuss the major economic and precious metal themes, including the slow and now more imminent demise of the global financial system in the wake of irrational and destructive credit expansion.

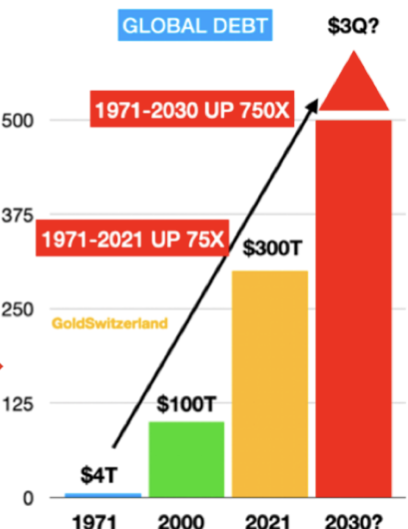

With necessary humor and humility, Egon discusses how this otherwise serious and destructive debt and currency cycle, warned decades ago, is reaching its objective (and exponential) culmination following the American closing of the gold window in 1971.

Toward this end, von Greyerz tracks how US debt/GDP in particular and the global debt/GDP in general foreshadows inevitable and greater money creation. This leads to an equally inevitable (and accelerating) currency destruction for which current global leadership is either too ignorant or arrogant to openly comprehend (or at least honestly confess).

As von Greyerz reminds, not only does basic math confirms such trends, but history even more so. Unfortunately, leaders and citizens are often blind to (and hence ripe to repeat) these historical lessons/examples, from Ancient Rome to today.

As debt levels grow so high that only debased currencies can sustain them, credit systems suffer, inflation becomes the end game, one that is marked by attendant and rising social and geopolitical conflicts, answered by increasingly centralized governmental policies.

In this backdrop, including the rise of the BRICS and the slow trend away from the USD due to myopic (stupid) Western sanctions against Russia, the discussion turns to preparing for, rather than arguing over, the inevitable, regardless of how impossible such massive shifts are to time with precision. Despite the USD’s relative strength, its inherent purchasing power, like that of all fiat currencies, will sink to the bottom, and there is “no first prize for falling to the bottom first.”

The conversation naturally turns toward gold as an obvious asset to protect against these open currency and hence wealth risks.

Debt’s Toxic Ripple Effects: Gold Flowing Toward Historical Repricing

As my last report for 2023, I wanted to hit the big issues blunt in the face—from debt and sovereign bond markets to themes on the USD, inflation, risk markets and physical gold.

This will not be short, but hopefully simple.

No one likes hard macro facts, especially at holiday parties, so I’ll sip my champagne in silence and share my views here instead.

Powell: From Hawk to Dove to Jive Turkey in 30 Days

So, hawkish Powell is now talking about dovish rate cuts in 2024.

Powell, however, is neither a hawk nor dove but more of a jive turkey or, in the spirit of Christmas, a cooked goose.

The sad but simple fact of the matter is that our Fed Chairman, like so many of the so-called “experts,” has a genuine problem with admitting failure or speaking honestly—which is why I recommended long ago to bet against the experts…

Looming Rate Cuts? No Surprise at All

For any who have been following my blunt views on US debt markets, bond volatility, interest rate gyrations and Fed-speak vs. Fed-honesty (our first oxymoron), this pivot toward rate cuts should come as zero surprise.

ZERO.

As indicated many times, rising rates break things, and so many things have broken (banks, Gilts, USTs, the middle class…) that even Powell can’t deny this anymore.

Powell, as I wrote earlier this year, has only been raising rates so that when the denied recession that we are already in becomes an official 2024 recession according to the always too-late NBER, at least the Fed will have something to cut.

Powell, of course, is a politician, and like all politicians, has learned the art of bending truth to straighten his career and legacy.

It’s The Recession, Stupid

But even Powell, despite all his rhetoric on (mis) hitting target inflation via his pseudo-Volcker-esque profile of “higher-for-longer,” always knew (and still knows) that America is already in a hard-landing recession thirsty for cheaper rates and even more debt…

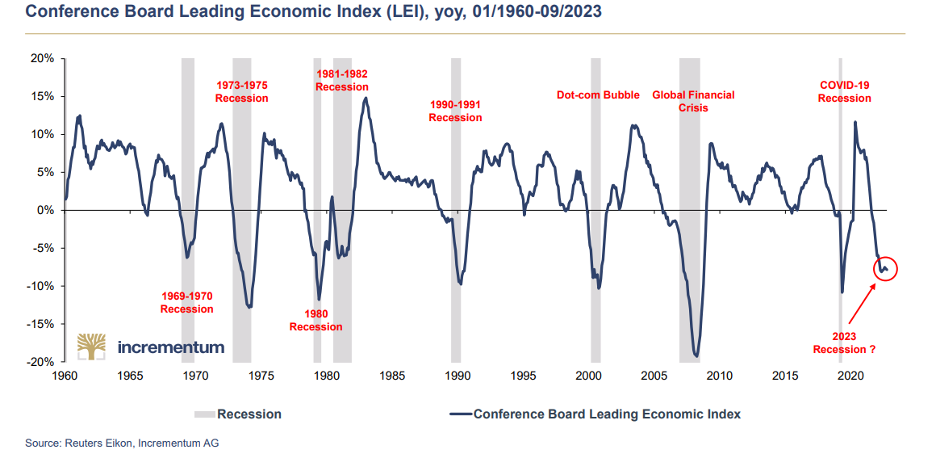

The evidence of this recession, as I’ve said, is literally everywhere—from classic economic indicators like the yield curve (inverted), the Conference Board of Leading Indicators (dipped below 4% threshold last December) and a dramatic 4% decrease in the M2 money supply (inherently deflationary), to basic Main Street indicators like record-breaking bankruptcy filings, ongoing lay-offs, equally record-breaking car and credit card delinquencies—all encapsulated by the Oliver Anthony Indicator.

Debt-Rollovers Needed Lower Rates

But there are more reasons these rate cuts are of no surprise…

Never forget this: The Fed serves Wall Street (and capital gain taxes), not Main Street. And Wall Street is screaming for help.

The over-valued and cheap-credit-addicted S&P 500 (led by 7 names only) is riddled with countless zombie enterprises staring down the barrel of $740B in debt rollovers in 2024, and another $1.2T in 2025—all at currently Powell-higher rates.

That is a problem.

And Uncle Sam is looking at 30% of his $34T in IOUs (about $17T worth) re-pricing over the next 36 months at equally higher, Powell-driven rates.

That too is a problem.

And as I warned: Rates would have to be cut to avoid a market bloodbath and sovereign bond debt trap.

Et voila—here comes Powell announcing rate cuts. Real shocker…

A Mug’s Game

Does such foresight make me/us psychic? Blessed with mystical powers?

Hardly.

Predicting any near-term move in the markets or even in the minds of a Fed official (which are essentially now the same thing), is indeed a mug’s game.

No one can pick the day, hour or even month of a watershed move.

But for those who follow deficits, debt markets and hence bond dysfunction, the signals (i.e., basic math) can offer pretty sound ideas of what’s coming.

Such instincts are nothing radical or genius, but boil down to common sense, something most of us own. You know, like how most of us reach for an umbrella on a cloudy day—because, well: Clouds warn of rain ahead.

What the Storm Clouds (and Debt Bubbles) Portend

The clouds we’ve been tracking in the bond markets were easy to see for everyone willing to open their eyes–except perhaps for politicians, who prefer to keep their well-made heads buried in the sand.

For months and months, we’ve been pounding our patient little fists that debt actually matters, and hence by extension, bond markets actually matter.

With this simple, (i.e., common sense) premise in mind, we thus had very little long-term faith in the short-term words or policies of our fork-tonged and financially-trapped central bankers about “higher for longer.”

Like Luke Gromen, and frankly even Charles Calomiris of the St. Louis Fed, we saw (and warned over and over and over) that the cost of Uncle Sam’s own IOUs under Powell’s “higher-for-longer” meme-war against inflation would fail.

Why?

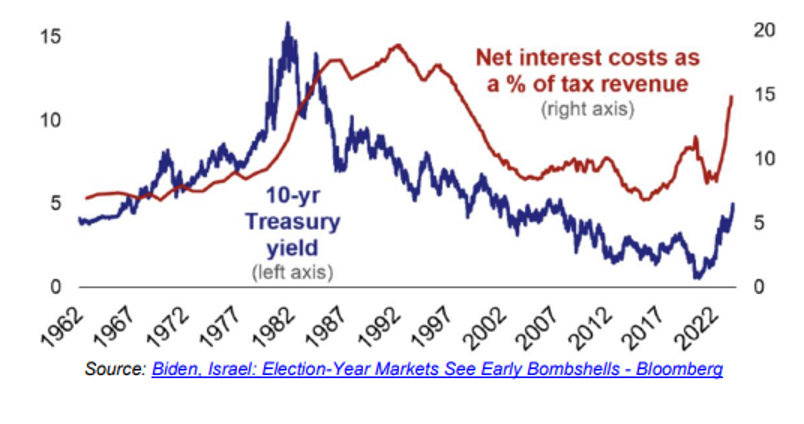

For the simple reason that rising debt costs would force the Fed to reduce rates and eventually print more money just to pay for Uncle Sam’s True Interest Expense.

That’s called “Fiscal Dominance.”

In short, and despite all of Powell’s rate-hiking and chest-puffing, we saw a rate pause, as well as rate cuts, as effectively inevitable.

As warned, Powell then paused the rate hikes. And now, as 2023 winds toward a disastrous end, he is talking of rate cuts for 2024.

Again: Hardly a shocker. And here’s why.

Hitting a Wall of Fiscal Dominance

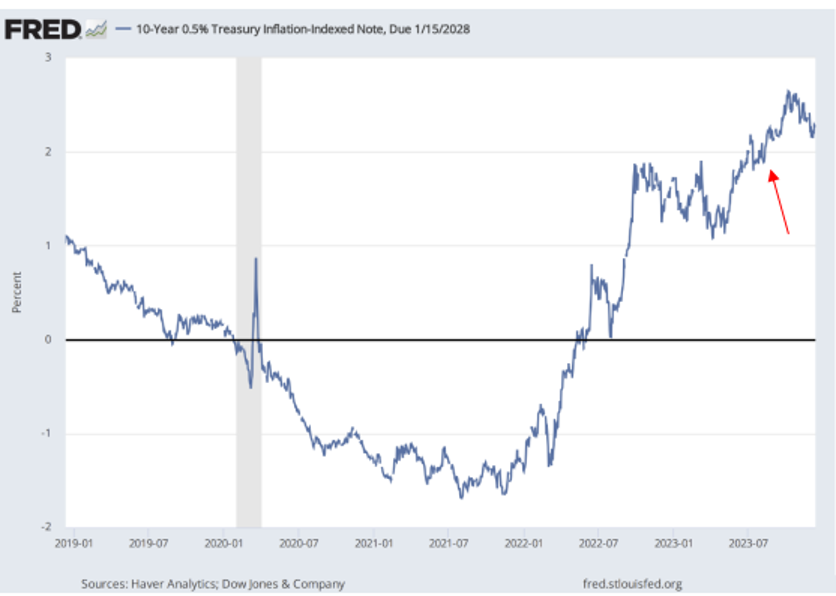

When official (as opposed to honest) CPI inflation falls while interest rates (as best measured by the yield on the unloved 10Y UST) rise, then “real” (i.e. inflation-adjusted) rates go positive and north.

And when real rates approach 2%, this means debt becomes really painful for companies, individuals, and, of course, broke governments like the U.S.

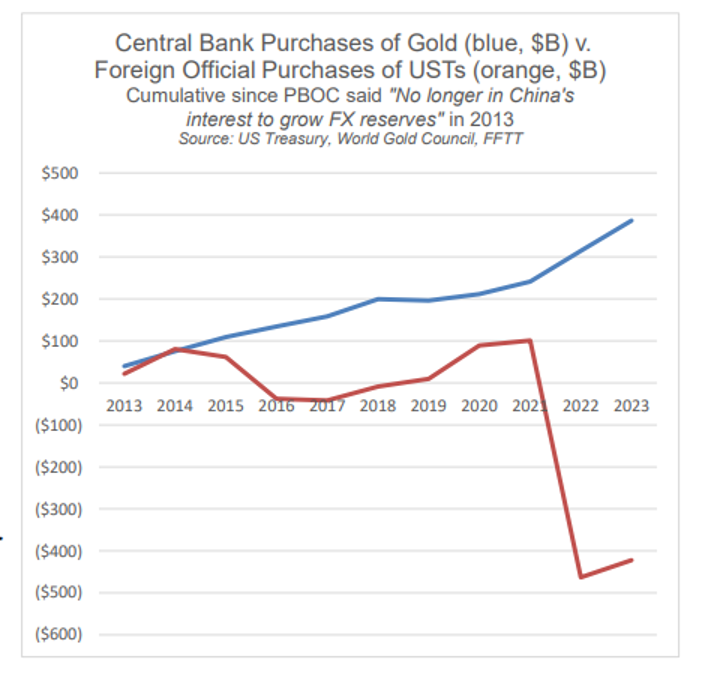

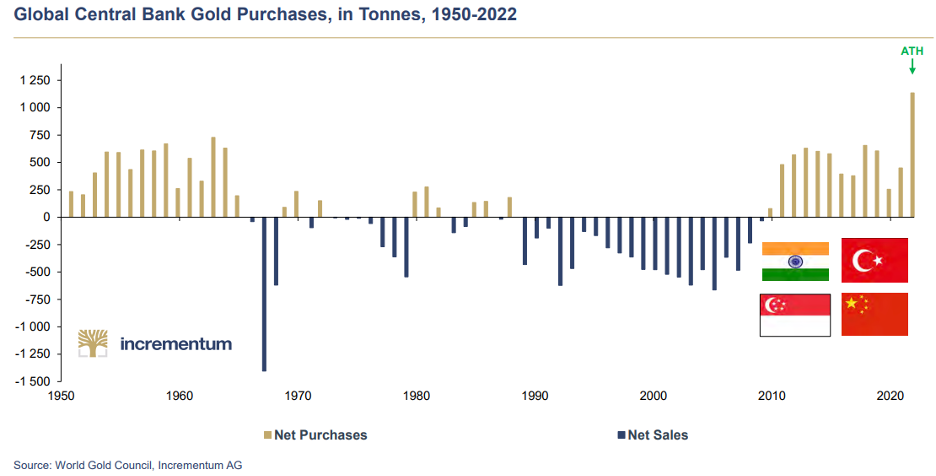

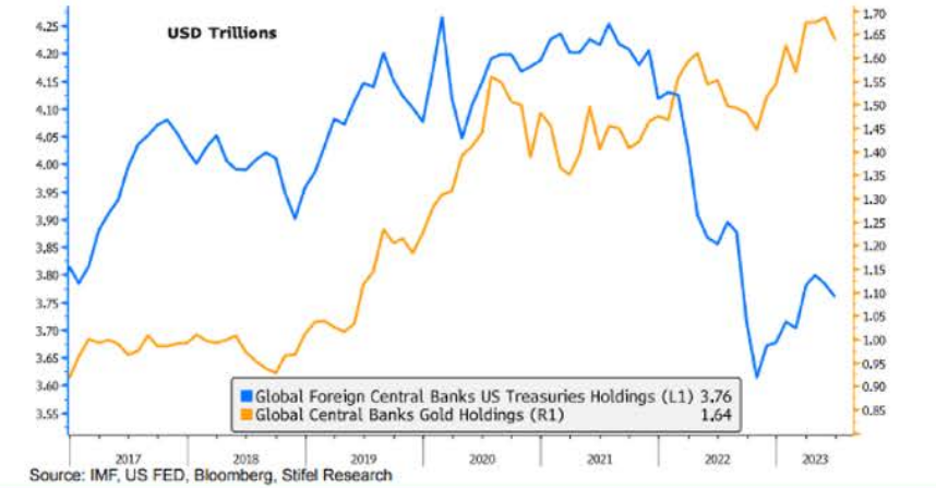

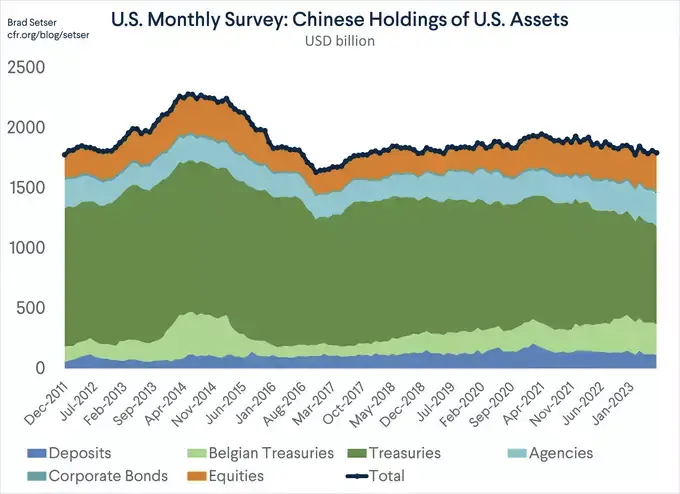

The rest of the world knows this too, which is why central banks have been dumping Uncle Sam’s unloved USTs (red line) and stacking gold (blue line), as they’d rather own real money than a declining asset from a bad credit.

This global dumping of USTs pushed bond prices down and hence yields and rates up, which meant Uncle Sam’s interest payments only got worse—i.e. $1T a year.

That stings.

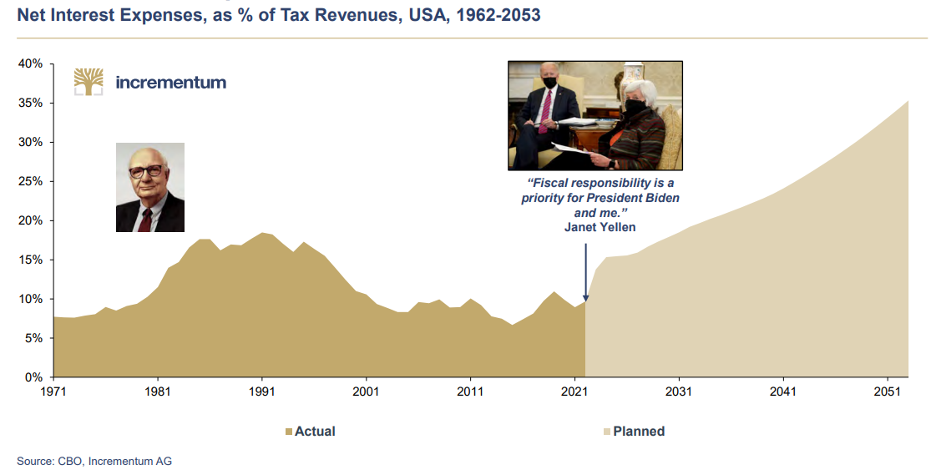

And even poor old Janet Yellen, having slithered from a position as Fed Chair to Treasury Secretary (how’s that for insider power?) realized there was a real problem with Powell’s rate hikes.

As she confessed just last week: “Rising real rates may impact Fed decision on rate path.”

Well, as we seasoned bond experts say on Wall Street: “Duh.”

Meanwhile, the Financial Media Gets It All Wrong: The Truth About US Bonds

But despite this moment of “duh,” the main stream financial media, which like all media, has simply devolved into a propaganda arm of a centralized government with a weaponized Dollar and a “puppet-ized” president, tried to tell the world that November was a banner month for Uncle Sam’s bonds, which saw its best month in 40 years.

This, they boasted, was proof that America’s IOUs were loved IOUs.

As usual, however, just about everything the mainstream media says is approximately 180 degrees from the facts and hence truth…

November’s historical yield compression and bond price rise, for example, was not the result of resurging natural demand, but rather a spike in un-natural DC intervention at its best and most desperate.

For the fifth time in four years, and reminiscent of the already forgotten Treasury General Account tricks of last October, the Fed and US Treasury Department were hard at work at trickery hiding in plain sight.

That is, panicking central planners saw a need for liquidity that wasn’t coming from the rest of the world.

They thus saved the 10Y UST from an over-supply sky-fall by simply over-issuing more bonds from the short end of the yield curve to buy time.

And at the same time DC was shuffling risk from the 10Y to the 2Y UST, they got even more clever by sucking liquidity out of the Treasury General Account to the monthly tune of $150B to keep bond yields from spiking out of the Fed’s increasingly weakening control.

And that, folks, is what made November an historical month: Not a natural rebirth of global demand for Uncle Sam’s IOUs, but a series of loosening tricks wherein DC drinks its own expensive Kool aide and calls it a national victory.

But if, according to consensus, November was such a Fed and bond victory, why is the December version of a once-hawkish Powell now talking dovishly about more rate cuts in 2024?

From Fake Victory to Open Decline: No Good Options Left at the Fed

The simple answer is because America is not in a period of victory, but one of open and obvious decline clear to everyone but the word-heavy yet math-challenged media, the deficit-popular-politicos and the cornered central-bankers.

And boy do I mean cornered.

Why?

Because as warned month after month, debt destroys nations and hence corners central planners, who have nothing but bad options to address very bad math.

That is, if they don’t cut rates and print more fake money, risk assets tank and the economy falls with it into a hard recession.

But if central bankers loosen policy to save the system, they kill the currency’s inherent purchasing power, which is precisely what Powell will do next—as all broke nations sacrifice their money to cover their butts…

Very Scary Math

To keep this sensational but all too sad point real, just consider the facts rather than the drama of a nation whose debt profile makes growth impossible.

Current US debt to GDP has crossed the Rubicon of 100% well into the 120% range; our deficit to GDP is at 8% and rising; our Net International Investment Position (i.e., piggy bank of foreign assets) is at negative 65%; our public debt is at 34 TRILLION and counting, and according the Congressional Budget Office, Uncle Sam is about to spit out at least another $20T in US IOUs over the next 10 years, and this modest number (?) is assuming no intervening recession…

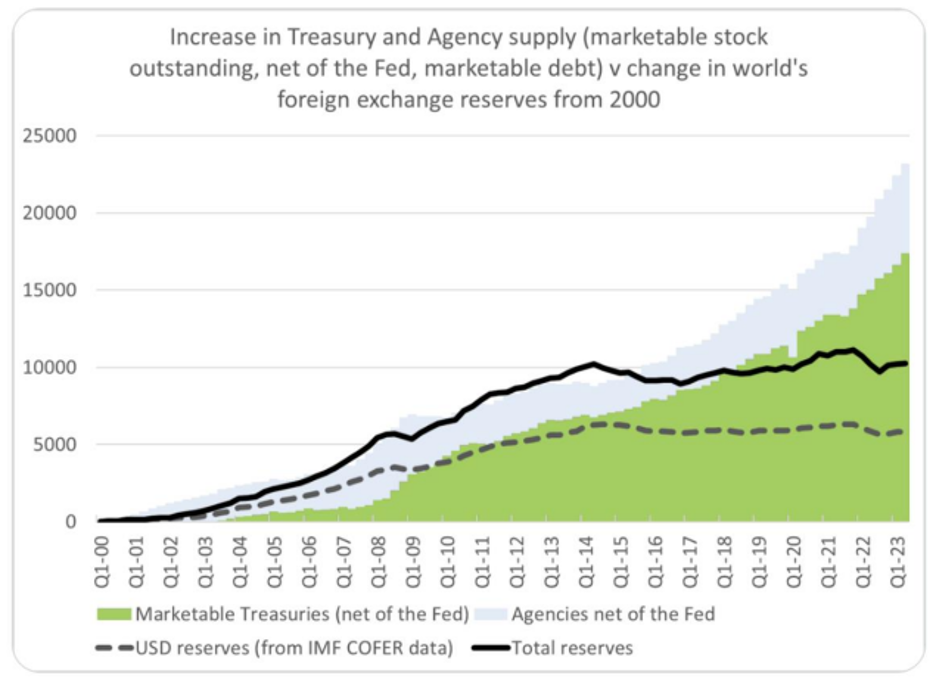

But who will buy Uncle Sam’s IOUs to cover his skyrocketing deficits?

According to simple math and hard facts, the answer since 2014 is basically no one but the Fed…

Such facts have the global chief economist at Citi Group worried and wondering, and it’s never a good thing when even the beneficiaries of a Fed-driven debt bubble are worried about the size of that bubble…

Meanwhile, combined public, corporate and household debt in the debt-imprisoned land of the free is around $100T.

I don’t even know how to write this number out, but I can assure you that no one in DC knows how to pay it either.

This, of course, is a problem…

Collateral Debt Damage—The Dollar, Inflation, Markets Etc.

All of this debt, alas, brings us to the corollary topics of inflation and the next chapters of the USD, because debt and currencies, like just about everything else, including risk assets, are all connected and inter-twined.

That is, if one understands debt, one can see the patterns of broader markets—past, present and future.

The USD: Relative Strength Aint Enough

When it comes to the USD, let’s not kid ourselves: The world still needs it. 70% of global GDP is measured in USDs and 80% of global trade is settled in Dollars.

And as Brent Johnson’s milkshake theory reminds, there is a great big straw (“sucking sound”?) of global demand for USDs coming from Euro Dollar markets, derivative markets and oil markets.

I agree that this super straw (or better yet, global “sponge”) is enormously powerful, and hence the need for Dollar liquidity is a massive tailwind for the USD.

But… this massive tailwind is not an immortal tailwind.

De-Dollarization: More Than Many Think

Evidence of increasing de-dollarization post-US-Russia sanctioning (and Dollar-weaponization) is not merely a bearish meme but an open and undeniable reality.

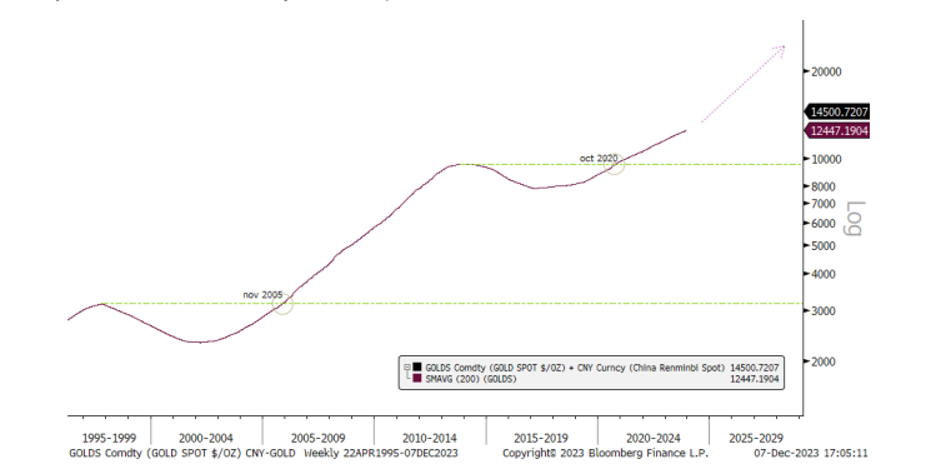

China and Russia are moving ever more toward oil purchases in CNY (which Russia then converts into gold on the Shanghai Gold Exchange/SGE) while an exponentially increasing number of bilateral trade agreements among the BRICS+ nations are now happening OUTSIDE of the USD.

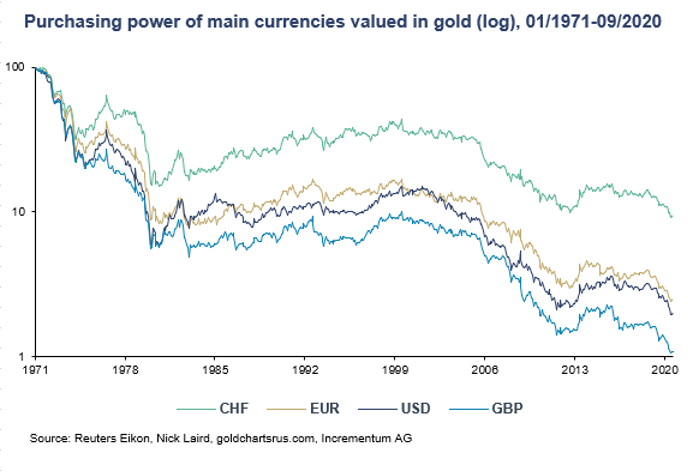

Just as Nixon’s de-coupling of the gold-standard in 1971 lead to a slow death by a thousand cuts of the USD’s inherent purchasing power (a 98% loss when measured against gold), the weaponization of the USD will lead to a similar (but slow) death by a thousand cuts of the USD’s global hegemony (when measured against a world turning away from the debt-backed rather than gold-backed USD).

We warned of this from day 1 of the sanctions against Russia.

A Supreme Dollar Losing Respect

For now, however, the USD is still supreme, but unlike Brent Johnson, I don’t see even its relative strength pushing the DXY to 150.

This is for the simple reason that even Uncle Sam knows that the rest of his global friends and enemies can’t afford to pay-back $14T in Dollar-denominated debt at such a level without having to dump more of their foreign held USTs (about $7.6T worth), which would crush UST pricing and lead to skyrocketing (and unsustainable) UST yields and rates for Uncle Sam himself.

In short: Even Uncle Sam fears rising rates and a too-strong USD.

Such a fear of rising rates along with the reality of growing US deficits (and hence a growing need for more US IOUs) will soon lead to an over-supply/issuance of USTs down the road.

And the only buyers of those USTs to control yields/rates will be the Fed, not the rest of the world (See graph above…).

That kind of bond buying with money created out of thin air kills a currency.

No Milkshake Straw for USTs = Mega Money Printing Ahead

Thus, while the milkshake theory correctly sees immortal global demand for USDs, there is no similar straw (or demand) for USTs.

This means the Fed will have to print trillions of more Dollars to buy its own sovereign bonds, an inherently inflationary policy which weakens rather than strengthens the Dollar longer term.

This is why Powell’s “pause,” and now “cutting” in 2024 will eventually be followed, in my opinion, by “mega printing.”

After all, “pause, cut and print” is the pattern of debt- cornered central bankers, and eventually (despite TGA and short-duration bond tricks) Powell will need massive amounts of mouse-click money to monetize Uncle Sam’s sickening (and growing) deficits.

We saw this exact pattern between 2018 (QT) and 2020 (unlimited QE).

The end-game is thus more money creation, more money debasement and hence more inflation.

But First the Deflation

But before then, we are marching into an “official” recession in 2024, and recessions are inherently dis-inflationary if not outright deflationary.

Again, the inflation-deflation debate is not a debate but a cycle.

Historically, moreover, the dramatic declines in M2 ALWAYS result in deflation. Always.

And More Risk Asset Bubbles?

As for our stock and bond bubbles, they certainly like cheaper debt (i.e., lower rates) and mouse-clicked trillions (i.e., QE).

For now, markets are expecting (pricing in) the former and waiting for the latter, which can and will make them giddy.

With about 25% of US GDP sitting in cash equivalents, Powell’s 2024 projected rate cuts will send a lot of that money into the market bubbles, sending asset inflation even higher, which means more needed tax revenues for Uncle Sam.

If the DXY stays low, markets will rise. And if the Fed is accommodative, markets will rise. This includes BTC.

It’s just that simple: Tight policies are a market headwind, loose policies are a market tailwind.

This is because capitalism died long ago and the Fed is essentially the de facto market-maker for the S&P, Dow & NASDAQ.

But trying to determine, or time, how long this charade of Fed-driven asset bubbles can avoid a sickening moment of mean-reversion is the topic of another article.

Gold: The Brightest Star on the Tree

Gold, of course, merely sits back and patiently watches all these debt forces—and hence inflationary and currency debates/reactions–with a calm smile.

Why?

Well, gold loves chaos, and thanks to decades and decades of policy makers who believed they could solve one debt crisis after the next (think Paul Krugman) with more debt, the financial/recessionary chaos (as per above) is literally everywhere.

Thus, even when rates are officially positive, gold reached record highs, despite my own argument that gold loves negative real rates.

And even with a relatively strong USD and DXY, gold has reached record highs, despite the standard view that gold favors a weak USD.

And even with yields spiking, gold has reached record highs, despite another common misconception that investors prefer higher-yielding bonds over zero-yielding “pet rocks.”

Gold, in other words, follows more than just conventional indicators. It has a profile, life and history of its own, one which few investors understand unless their aim is solvency and wealth preservation.

In fact, the easiest way to understand gold is that it’s more loyal than paper money.

Despite all the endless debating, and all the spot-price manipulationsin the OTC markets and all the crypto comparisons and fiat-money apologists, the fact is that informed investors, like a growing list of informed countries, just don’t trust the US, its bonds or its fiat-Dollar like they used do.

They’d rather have gold:

And in the years ahead, they’ll get a fairer gold price on the SGE than in London or New York, which means the West will soon have to behave on actual supply and demand principles rather LBMA bank price manipulations…

Iconic America has devolved from a gold-backed currency and the world’s leading creditor, manufacturer and trade partner to a debt-soaked America with a gold-welched-dollar and is now the world’s biggest debtor, weakest manufacturer and open loser to a trade war with China.

This is hardly a proud evolution from its Greatest Generation…

In short, the iconic America is no more, and there’s a far better Sharpe Ratio in gold than there is in topping risk portfolios…

Like it or not, believe it or not: Gold is rising because the home of the world reserve currency with its shining façade of free market price discovery has lost its way, replacing capitalism with feudalism and altruistic leadership with egotistic opportunism.

If WE know this. So too does gold.

Debt’s Toxic Ripple Effects: Gold Flowing Toward Historical Repricing

The primary stages of grief include: Denial, anger, bargaining, depression and finally, acceptance.

When it comes to grieving over the slow demise of the American economy, sovereign IOU/USD and the absolute failure of our “re-election-only-focused” policy makers, these stages of grief are easy to see yet easier to ignore.

But false hope won’t help us.

Denying a Recession

With the vast majority of sectors that make up the U.S. economy evidencing three months of negative GDP growth while a laundry list of leading homebuilder indicators (housing starts and prospective buyers) drops into recessionary red, I keep wondering when the recession debate will finally end.

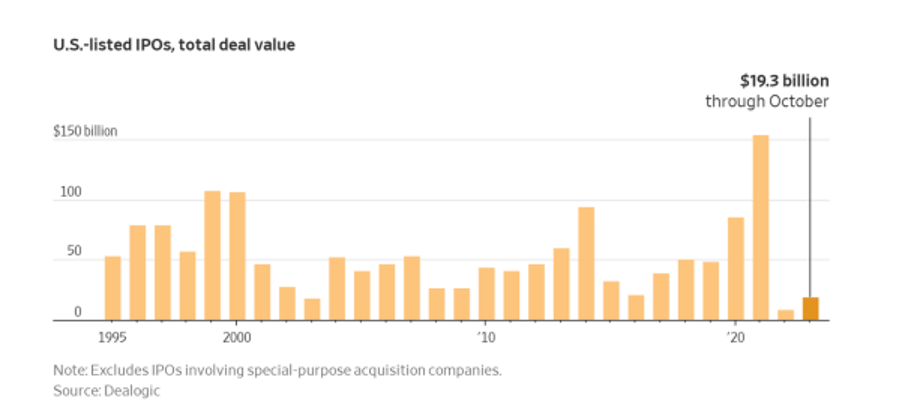

Walmart is worrying, Jamie Dimon is worrying, commercial real estate delinquencies are rising and IPO markets are all but dead on arrival.

But that’s just the latest hard data.

One can cite everything from the Conference Board of Leading Indicators, negative M2 growth, yield curve movements and a drying repo market to make it empirically clear that the US is not heading for recession but has already been in one for nearly a year.

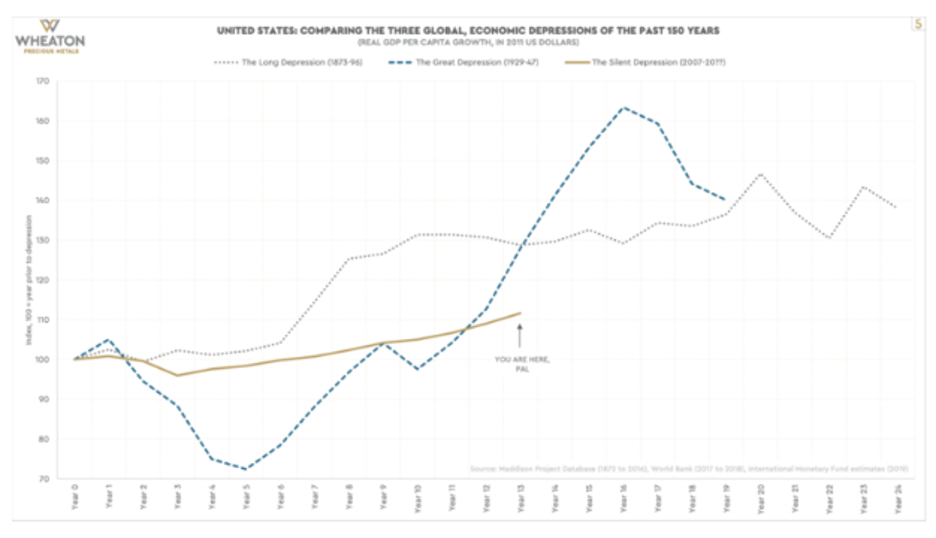

In fact, if we were to define a Depression by growth rates of inflation-adjusted GDP per capita, then factually speaking, we have also been in a quantifiable depression for the last 16 years.

Such data, of course, is depressing, but are we all still hoping for kinder facts or a political and monetary Santa Claus to cure our denial?

I for one favor preparation over denial.

Then Comes the Anger

Citizens storming the Capital, or grabbing guitars and singing “I’m taxed to no end and my dollar aint $#!T” are just the first signs of the anger stage.

Even if the average (and indeed heroic) member of a grotesquely ravaged middle class can’t fully articulate every nasty detail of Wall Street lingo behind a Rigged to Fail market economy, they are catching on to a system which has turned capitalism into feudalism–making them veritable serfs while C-Suite hucksters, from Sam Bankman Fried to Adam Neumann fashion themselves as lords of the manor.

(Now Barron Larry Summers has joined the Marquis de Sam Altman at OpenAI, the perfect combo of perfect [insider] little devils.)

The backbone of America may not fully know the statistics which confirm that 90% of the wealth created by a Fed-driven market bubble circa 2009 was enjoyed by only the top 10%, but they certainly can “feel” it.

Meanwhile, the politicos and central bankers will keep inventing platitudes to mask honest math as market pundits debate soft and hard landings while US voters prepare for an election between a dark-state sleep-walker and an arrested-state swamp-cleaner as soldiers and money are ear-marked toward no-win wars.

Next, the Bargaining and the Depression

Despite obvious evidence of an angry, post-lockdown/mandate society and economy in open decline, some folks still want to believe (bargain) in the iconic America and intuitively turn toward the public “experts” for a miracle solution.

But as I’ve warned with facts rather than invective: Please don’t trust the experts.

The squawking and headlines from our mental midgets in DC are clever diversions from current truths, but as my colleague, Egon von Greyerz, recently made factually clear, truth is as fatal to policy makers as garlic is to vampires.

This, again, IS depressing. And according to the current Zeitgeist (and clinical depression/anxiety data from big pharma), depressed is exactly where America sits today.

Finally: Stone Cold Acceptance

Now that we pass from denial, anger, bargaining and depression, it’s time to accept the recession which our leaders refuse to acknowledge.

Acceptance, at the very least, allows us to think and then act even in the worst of settings.

So then: What can we ACCEPT, EXPECT, and hence DO while our policy makers fight for votes like donkeys scurrying for hay?

Deflation, Inflation and a Neutered Dollar Ahead

The short answer is this: Brace yourselves for a deflation to inflation roller coaster followed by bond volatility and a currency-killing wave of fake money.

Why?

Because math and history still matter.

Whether admitted or hidden, recessions tend to clip the wings of tax receipts. But what does that have to do with markets, currencies and, well… each of us?

In fact, a heck of a lot.

Falling Tax Receipts + Rising Deficits = “Super QE”

In a recession, we can reasonably assume a potential tax receipt decline of 10% in 2024. This will come at the same time that Entitlement spending is rising by 10%.

That’s a double-whammy.

And if one were to then include (as Luke Gromen has done) an average 4% interest rate for 2024, then all of these recessionary percentage numbers add up to a stark piece of easy math but hard days ahead.

That is, we are looking down the barrel of a probable (rather than sensational) True Interest Expense on Uncle Sam’s public debt equal to 120% of US tax receipts.

Think about that.

This percentage is higher than what we saw during the COVID crash of 2020, which was followed by unthinkable trillions of fake money from our equally fake, but all too human, Federal Reserve.

Having thus done the math, Gromen foresees “Super QE” ahead, and I agree.

Relative Strength Is Still No Strength: Brace for Inflationary End-Game

For me at least, this means all the debating about the USD’s relative strength, is still missing the point of its ever-debasing (and hence declining) inherent strength in the face of an impending deluge of “easy money” to keep Uncle Sam on his clay feet.

In other words, get ready for lots and lots of inflationary and currency-debasing fake money in the months ahead once a deflationary recession and potential market massacre are followed by an inflationary fire hose of “accommodative” liquidity (and rate cuts).

No Good Options Left

If not, Uncle Sam’s only other option is to remain higher-for longer, whereby the USD spikes on the tailwind of higher rates as the rest of the world, beaten down by an expensive USD, falls flat on its face ala Japan.

But even in such a scenario, the end-game, which has been true for every debt-cornered nation, empire, kingdom or democracy in history (from ancient Rome to today) will be the same: Save a broken system by killing its currency.

This recession-based prognosis on the longer-term direction of the Fed, rates and the USD is no surprise to the bond jocks either.

Accepting Bond Market Reality

Having argued that history and math matter, let me repeat that bonds matter even more.

What are they telling us?

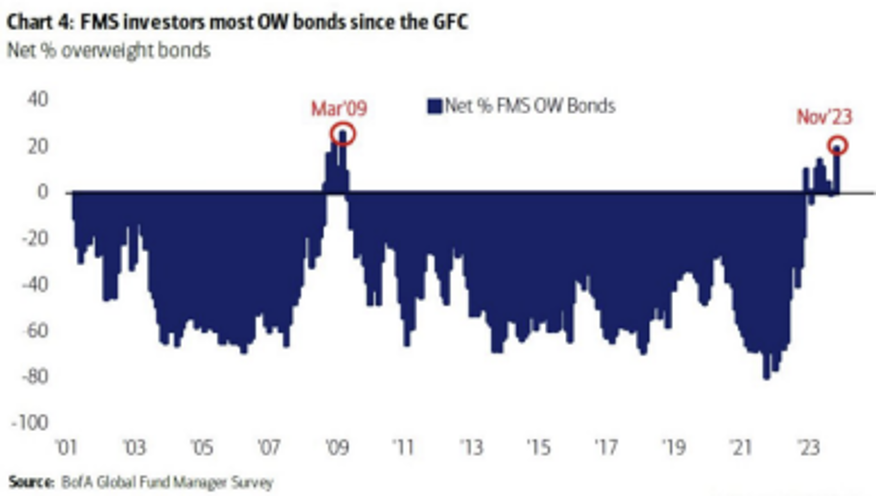

In recent weeks, investors have been dumping dollars and leaping into longer-duration bonds in anticipation of a recessionary “safe-haven.” This explains recent falls in UST yields.

In fact, investors are overweight bonds at levels not seen since 2009.

For retail investors, this flow toward bonds is based on the belief that inflation and yields will drop in 2024 thanks to Powell’s brilliant war on inflation having been won.

Eh-Hmmm.

But portfolio managers are jumping into bonds because they see a recession ahead and are positioning themselves to be early buyers of a rising (i.e., Fed-rescued) bond price.

Smart Money & Dumb Money: Both Wrong

What’s ironic, however, is that both the so-called “smart” and the “dumb” money may be wrong for totally different reasons, as they are each missing the longer-term forces at play—namely an over-supply flood of more USTs ahead.

This means falling bonds and rising yields—longer term.

Why do I take this view? Well, because recessions are not only easy to see, but easy to pattern.

Missing the Importance of UST Over-Supply

Recessions, for example, typically mean growing deficits, and growing deficits mean more USTs spitting out of Uncle Sam’s IOU box.

This looming rise in UST supply eventually means more downward rather than upward pressure on UST pricing longer term.

Thus, even if the USD spikes near term into 2024, foreigners pegged to that expensive Dollar will dump even more of their $7.6T worth of USTs to “milk-shake-suck” more needed USDs, adding even further downward pressure on UST pricing.

By natural math, and simple history, this decline in UST pricing due to massive UST over-supply will spur even higher yields, which in turn means higher rates, which in turn means Uncle Sam won’t be able to afford/pay his higher-rate IOUs without a lot of help from the inflationary money printers at the Eccles Building.

Short of a default or Bretton Woods 2.0, such mouse-clicked money is all Uncle Sam will have left to pay for his own and ever-increasing debt.

This is How Currencies Die

Again, this end-game is nothing new. In fact, it’s always the same choice: Save the bonds or kill the currency.

And you know where my bet (and history’s lesson) lies.

In the interim, be ready for a bumpy ride and more debating pundits splitting hairs on the Dollar, the UST, interest rates, M2 data, CPI correlations and FOMC tea leaves.

Toward this end, yes, the USD can rise, as can UST demand and price. And yes, deflation can, and will come as well—prior to much higher inflation.

This is because the longer play is as easy to see as the destiny of any debt-soaked nation: More and more IOUs paid for with a weaker and weaker currency.

Or stated more contemporaneously, get ready for rising and then falling USTs and falling and then rising yields “saved” by more fake Dollars to “accommodate” an already and inevitably over-supplied UST from an objectively broke America.

Milk-Shake Straws & Sponges Won’t Save the Dollar

To those who follow the milk-shake theory, there is the defensible view that enough national and global demand for USDs will act as a powerful sponge to soak up all the printed Dollars to come, keeping the DXY value of the USD forever (and relatively) safe, strong and victorious.

Hmmm…

But I lean on the view that even a super sponge (or global “straw”) of such magnitude will be unable to absorb the fire hose of milk-shake liquidity about to come pouring through it in the years ahead to “keep America on a respirator again.”

More importantly, and as alluded above, even if the USD’s relative strength survives on the power of that magical sponge (or straw) of eternal Dollar demand, when measured in real terms—i.e., in terms of constant purchasing power –that Dollar’s inherent purchasing power will get weaker and weaker as inevitable synthetic/fake liquidity rises higher and higher.

And this is why anyone who measures their wealth in this paper currency is …well: Screwed.

Your Dollar simply buys less and less, and though it may be relatively stronger than other fiat currencies, is it really any consolation to be betting on the best patient in the ICU, when all the patients are in fact fatally ill?

What very few pundits and even fewer investors wish to fully accept is that once debt levels for a nation go from absurd to flat-out inconceivable (i.e., a debt/GDP ratio of 120%+), the only real option ahead is to inflate away that debt with debased money.

This means Powell’s “war on inflation” is a public ruse.

As I’ve argued, he NEEDS inflation, but has the added luxury of being able to openly lie about the current CPI scale, which grossly under-reports actual inflation.

Too Late for Austerity

As for the more sober approach of simply confessing to America’s debt nightmare and accepting the need for austerity, the FED, which was created by (and lives only for) Wall Street, knows that any such attempt at austerity sends the sovereign bond market into a liquidity crisis.

In the second quarter of 2022 and the 3rd quarter of 2023, brief attempts at governmental “austerity” resulted in immediate dysfunction in the UST market.

In short, it’s too late for austerity. Sovereign bonds can’t stomache the volatility which follows and which we are now seeing in real time.

America’s current debt/GDP ratio is too high for an austerity option as it would cripple credit markets, drive down GDP, further weaken tax receipts and hence make Uncle Sam’s IOUs even harder to pay.

Again, few investors wish to fully accept that America has “no way out.” The nation is too far in debt to “GDP its way” forward, which means it’s left with “inflating/printing its way backward.”

Gold Investors See What Few Are Willing to Accept

Or stated more simply: Your currency is about to lose even more of its already diluted purchasing power.

Gold investors, whether on Main Street, Wall Street or among a BRICS+ nations, of course, are not afraid to see (and ACCEPT) this.

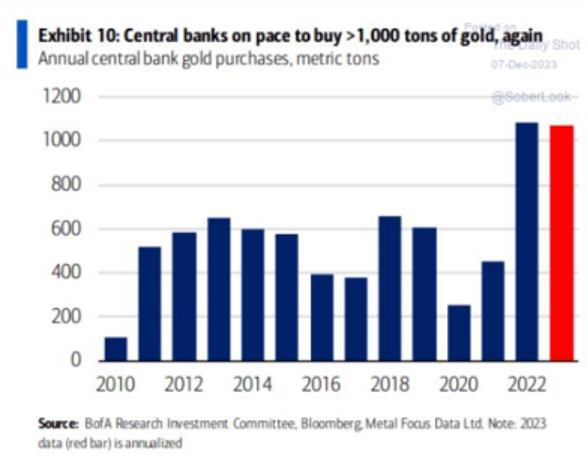

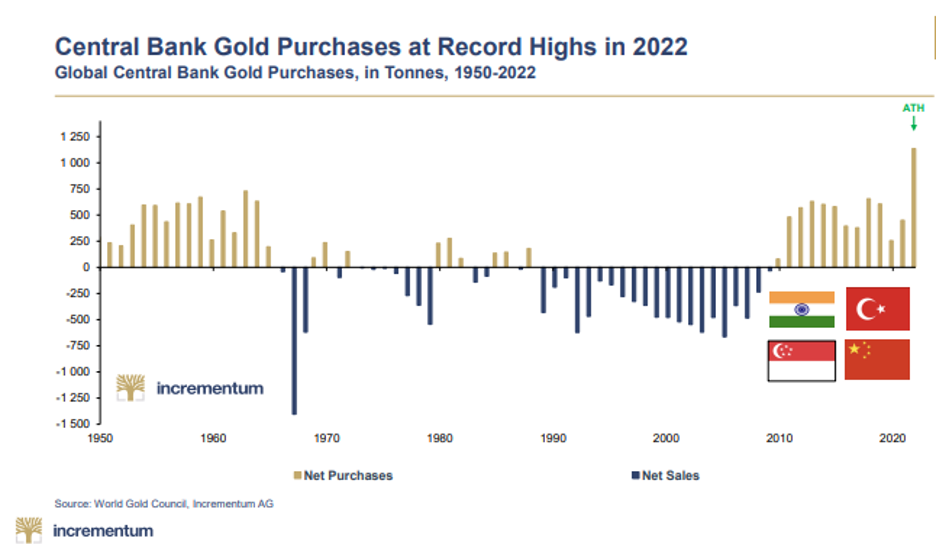

Even Central Banks see this: They are net seller’s of USTs and buying physical gold at record levels.

In short, many have already replaced false hope and paper money with cold facts and real money to preserve their wealth.

What about you?

Debt’s Toxic Ripple Effects: Gold Flowing Toward Historical Repricing

Matterhorn Asset Management, AG partner, Matthew Piepenburg joins Kai Hoffmann, CEO of Soar Financially, to follow-up on core themes discussed earlier in the year. Sadly, the trends previously addressed in May (sovereign debt spiral, Main Street pain, recessionary “debates,” open currency risk, inflation forces and a cornered Fed) are empirically worsening. In short: An admittedly dark yet fact-based prognosis for the US and global economy.

Piepenburg discusses in detail why Powell’s attempt to “buffer” against a “soft landing” is an objective failure. Ironically, Powell’s policies suggest he is not avoiding a recession but openly preparing for one.

Piepenburg then addresses fatal bond signals and their implications on future markets and economies. Given the extraordinary “punch bowl” of fake liquidity to stimulate debt-based “growth” and an historically unprecedented debt crisis (9% deficit to GDP), it’s easy to blame this distortion on central bankers, but as Hoffmann and Piepenburg discuss, fingers can also be pointed at production-exporting CEO’s and a retail investor class addicted to years of cheap money. Now, however, the end-game of monetizing debt, markets and political careers is already in motion, and this is not, nor will be, pretty.

Piepenburg is asked how this end-game plays out in greater detail, and offers blunt perspectives which leads toward increased centralization from the very policy-makers who placed the global economy in the distorted corner it now finds itself.

Debt’s Toxic Ripple Effects: Gold Flowing Toward Historical Repricing

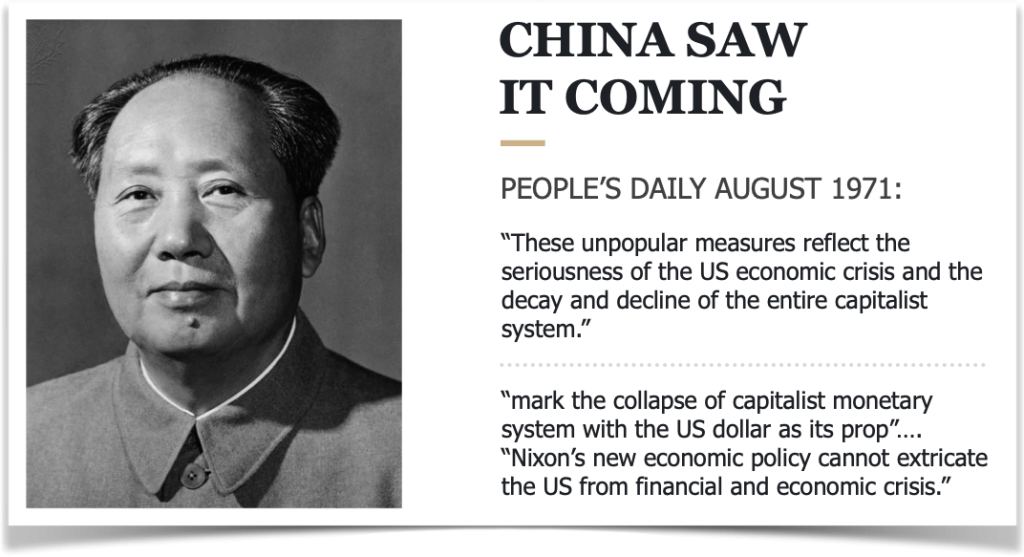

The world is now witnessing the end of a currency and financial system which the Chinese already forecast in 1971 after Nixon closed the gold window.

Again, remember von Mises words: “There is no means of avoiding the final collapse of a boom brought about by credit expansion.”

History tells us that we have now reached the point of no return.

So denying history at this point will not just be very costly but will lead to a total destruction of investors’ wealth.

POLITICIANS LIE WITHOUT FAIL

History never lies but politicians do without fail. In a fake system based on false values, lying is considered to be an essential part of political survival.

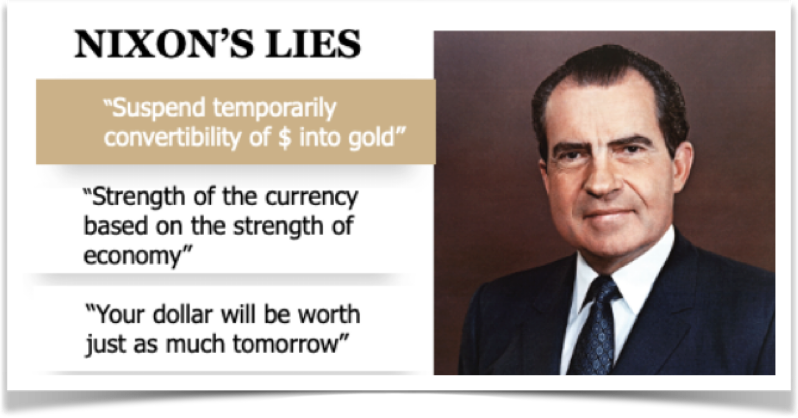

Let’s just look at Nixons ignorant and irresponsible statements of August 15, 1971 when he took away the gold backing of the dollar and thus all currencies.

Later on we will show how clearsighted the Chinese leaders were about the destiny of the US and its economy.

So there we have tricky Dick’s lies.

- The suspension of the convertibility of the dollar in 1971 is still in effect 52 years later.

- As the dollar has declined by almost 99% since 1971, the “strength of the economy” is also declining fast although using fiat money as the measure hides the truth.

- And now to the last lie: “Your dollar will be worth as much tomorrow”. Yes, you are almost right Dick! It is still worth today a whole 1% of the value when you closed the gold window.

The political system is clearly a farce. You have to lie to be elected and you have to lie to stay in power. That is what the gullible voters expect. The sad result is that they will always be cheated.

CHINA FORECAST THE CONSEQUENCES ALREADY IN 1971

So in 1971 after Nixon closed the gold window, China in its official news media the People’s Daily made the statements below:

Clearly the Chinese understood the consequences of the disastrous US decision which would destroy the Western currency system as they said:

- Seriousness of the US economic crisis and decay and decline of the capitalist system

- Mark the collapse of the monetary system with the US dollar as its prop

- Nixon’s policy cannot extricate the US from financial and economic crisis

I am quite certain that the US administration at the time ridiculed China’s official statement. As most Western governments, they showed their arrogance and complete ignorance of history.

How right the Chinese were.

But the road to perdition is not immediate and we have seen over 50 years the clear “decline of the capitalist system”. The end of the current system is unlikely to be far away.

Interestingly it seems that a Communist non-democratic system is much more clairvoyant than a so called Western democracy. There is clearly an advantage not always having to buy votes.

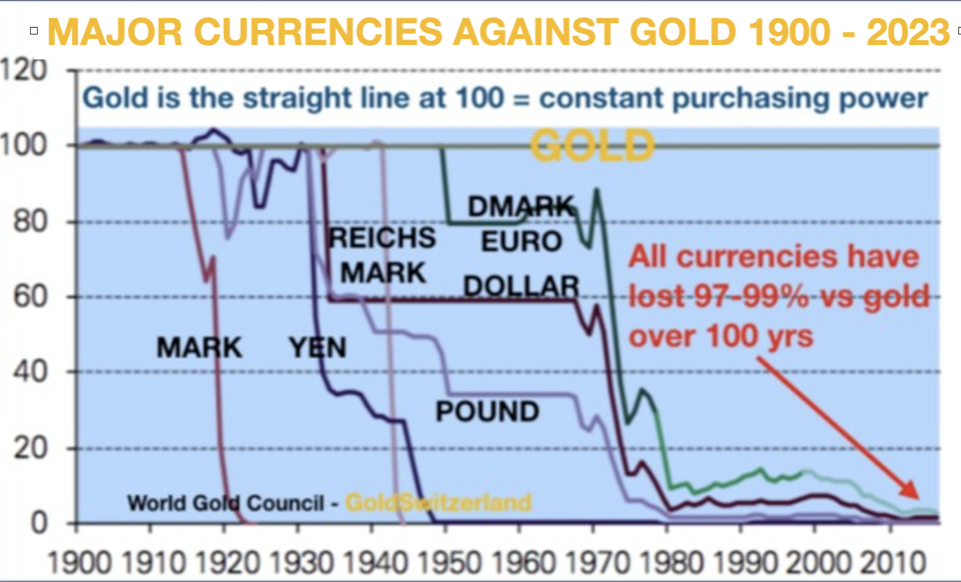

IRRELEVANT WHICH CURRENCY WINS THE RACE TO THE BOTTOM

As the whole currency system is about to implode, it is in my view totally irrelevant where the US dollar is heading short term measured against other fiat currencies.

The dilemma is that most “experts” use the Dollar Index (DXY) as the measure of the dollar’s strength or weakness. This is like climbing the ladder of success only to find out that the ladder is leaning against the wrong building.

To measure the dollar against its partners in crime (the other fiat currencies) misses the point as they are all on the way to perdition.

So the dollar index measures the dollar against six fiat currencies: Euro, Pound, Yen, Canadian Dollar, Swedish Kroner and Swiss Franc. The Chinese Yuan shines in its absence even though China is the second biggest economy in the world.

But here is the crux. The dollar is in a race to the bottom with 6 other currencies.

Since Nixon closed the gold window in 1971 all 7 currencies, including the US dollar, have declined 97-99% in real terms.

Real terms means constant purchasing power.

And the only money which has maintained constant purchasing power for over 5,000 years is of course gold.

So let’s make it clear – the only money which has survived in history is GOLD!

All other currencies have without fail gone to ZERO and that without exception.

Voltaire said it already in 1729:

PAPER MONEY EVENTUALLY RETURNS TO ITS INTRINSIC VALUE – ZERO

And that has been the destiny of every currency throughout history.

Every single currency has without fail gone to ZERO. And this is where the dollar and its lackeys are heading.

To debate if a currency, which has fallen 98.2% in the last 52 years, is going to strengthen or weaken in the next year or two is really missing the point.

It is virtually 100% certain that the dollar and all fiat money will complete the cycle (which started in 1913 with the creation of the Fed) and fall the remaining 1-3% to ZERO.

But we must remember that the final fall involves a 100% loss of value from today.

BRENT JOHNSON & MATT PIEPENBURG DEBATE THE DOLLAR

So to debate whether the dollar index which today is 103, will reach 150 first as my good friend Brent Johnson argues in his Dollar Milk Shake Theory or that it will fall from here as my colleague Matt Piepenburg contends, really misses the point.

There is no prize for coming first to the bottom. The dollar is down almost 99% in real terms since 1971. So it has a bit over 1% to fall to reach ZERO.

And history tells us that the final fall is INEVITABLE.

So why worry if the Dollar or the Euro becomes worthless first? It really is a moot point.

Brent Johnson and Matt Piepenburg recently had a debate on Adam Taggart’s new platform “Thoughtful Money”. Adam is an outstanding host with great speakers and both Brent and Matt were superb in their presentation of the arguments for or against the dollar. But even though they both like and understand gold, they got a bit too caught up in the dollar up or down debate rather than focusing on the only money which has survived in history. Still, I know that they both appreciate that gold is the ultimate money.

NOT ALL CURRENCIES ARE BAD

The world’s reserve currency has had a sad performance based on lies, poor real growth, all due to a mismanaged economy based on debt and printed money.

So although most currencies have lost 97-99% in real terms since 1971 there are shining exceptions.

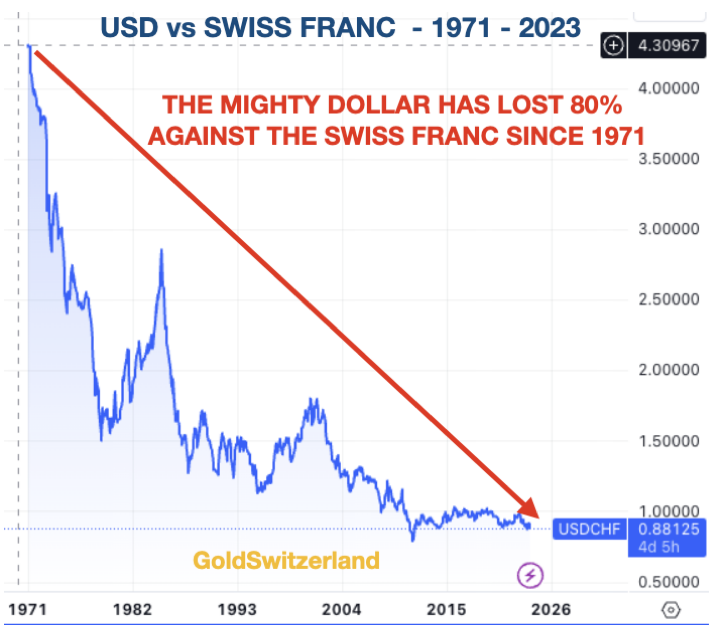

When the gold window was closed in 1971 I was working in a Swiss bank in Geneva. At the time, one dollar cost Swiss Franc 4.30. Today, 52 years later, one dollar costs Swiss Franc 0.88!

This means that the dollar has declined 80% against the Swiss Franc since 1971.

So a country like Switzerland with virtually no deficits and a very low debt to GDP proves that a well managed economy with very low inflation doesn’t destroy its currency like most irresponsible governments.

The Swiss system of direct democracy and people power is totally unique and gives the people the right to have a referendum on almost any issue they choose.

This makes the people much more responsible in their choices as a winning vote on any issue becomes part of the constitution and cannot be changed by government or parliament. Only a new referendum can change such a decision.

THE US BANANA REPUBLIC

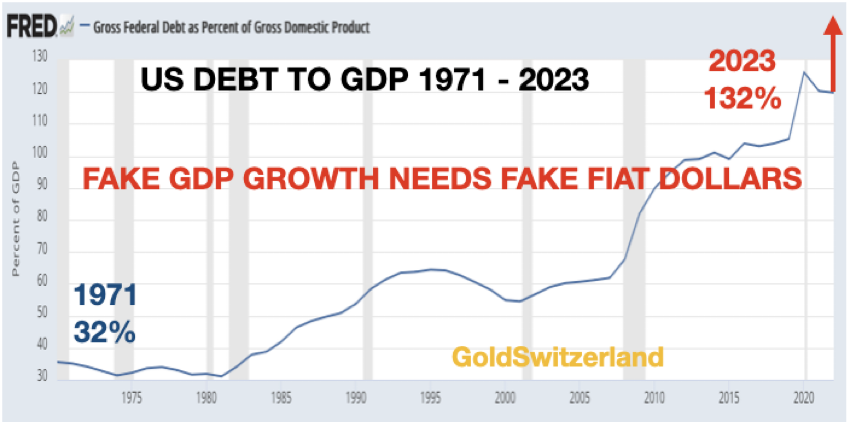

Swiss Debt to GDP is around 40%. This was the level of US debt back in 1971 before the gold window was closed.

As the graph below shows, US debt to GDP is now 132%. In 2000 it was 55%.

132% debt to GDP is the level of a Banana Republic which is frantically trying to survive by printing and borrowing ever increasing amounts of worthless fiat money.

So debt to GDP is now reaching the exponential phase. I have explained the final phases of exponential moves in many articles like here.

Since there is no intent or possibility to reduce the US deficit, the likely deficit for next fiscal year is most probably in excess of $2 trillion and that is before any bad news like higher inflation, higher interest rates, bank failures, more war, more QE etc.

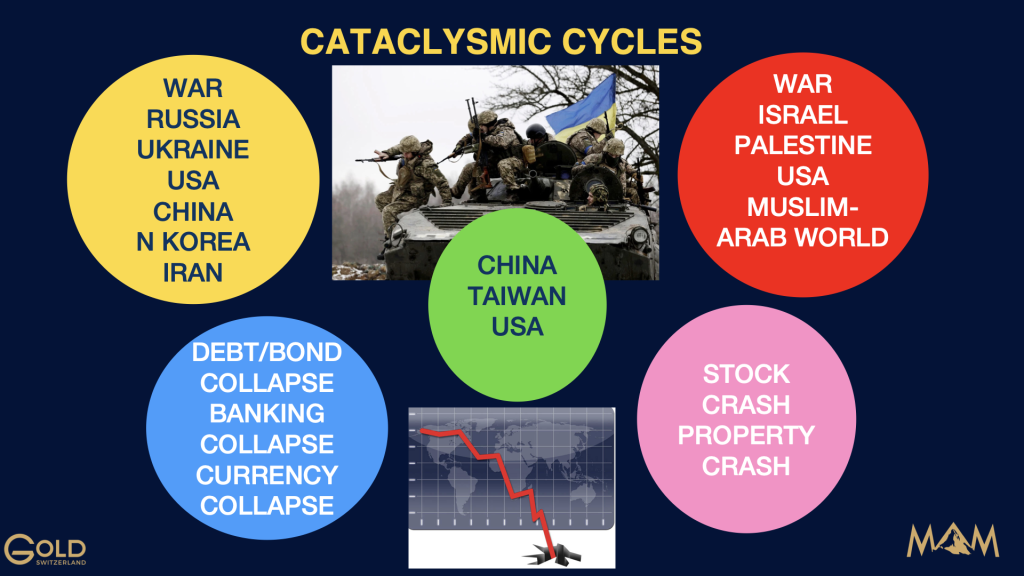

As I discussed in a recent article,“THE CYCLE OF EVIL”, the world is today facing unprecedented risks of a magnitude never before seen in history.

THE TIME TO PRESERVE WEALTH IS NOW

The combination of geopolitical and financial risk makes wealth preservation an absolute necessity.

Most asset markets look extremely vulnerable be it stocks bond or property. Few investors understand that current asset prices are in cloud cuckoo land as a result of an unprecedented credit expansion.

Personally I think we are now at a point when asset markets could tank.

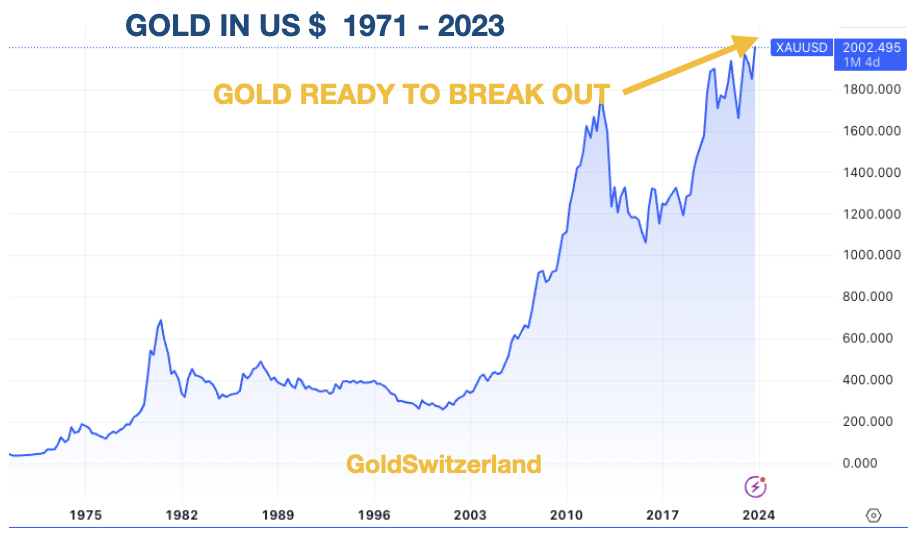

At the same time gold looks ready to soon break out of its consolidation since 2020.

Once gold leaves the $2,000 level behind, the move is likely to be fast.

Silver will most probably move twice as fast as gold.

But this is not a question of price and speculation. No, it is all about risk and wealth preservation.

So short term timing is irrelevant. The next few years will be about financial survival.

Sadly most investors will buy the dips in conventional asset markets like stocks and lose most of their gains in the last few decades.

As gold is insurance against a rotten financial system it must be acquired and owned outside a fragile banking system which is unlikely to survive in its present form.

Here are a few of the SINE QUA NON (indispensable conditions) for gold ownership:

- Gold must be held in physical form. No funds, ETFs or bank held gold.

- The investor must have direct access to his own gold bars/coins.

- Any counterparty must be eliminated whenever possible.

- Gold must be stored in ultra safe vaults outside the banking system.

- Gold should not be stored in a major city.

- Gold must be insured.

- Only gold that you are prepared to lose should be stored at home.

- Gold should be stored outside your country of residence and in a gold friendly jurisdiction.

- The country where the gold is stored must have a long history of democracy, political stability and peace.

As we are approaching one of the most precarious times in history both financially, socially, politically and geopolitically, Wealth Preservation in the form of gold and some silver will make the difference between financial survival or ruin.

As always, most important in life is looking after family and helping friends.

And remember that in the difficult times ahead there are many wonderful things that are free like nature, books, music, sports etc.

Debt’s Toxic Ripple Effects: Gold Flowing Toward Historical Repricing

Matterhorn Asset Management partner, Matthew Piepenburg discusses the future of the USD with Brent Johnson of Santiago Capital in this thoughtful “debate” hosted by Adam Taggart of Thoughtful Money.

As the author of the compelling “Milkshake Theory,” Brent Johnson is known for his logical argument that despite all of the USD’s extraordinary flaws, over-creation, and inflation-exporting “bully power,” its relative strength today and tomorrow is undeniable, and that a case for a stronger USD (DXY at 150?) is the most likely path forward.

Piepenburg and Johnson in fact agree on many of the primary forces (Euro Dollar demand, derivative market demand, SWIFT dominance etc.) in play which create a profound demand “tailwind” for the USD, and hence all but assure its relative strength over other fiat currencies. They further agree that gold will rise significantly in the coming years.

Where they disagree is the end-game for this world reserve super currency, which Piepenburg argues, will eventually grow too strong for even US policy makers, whose constant and increasingly addictive need to create more liquidity to monetize record-breaking debt levels, combat recession and improve its trade imbalance will necessitate a weaker USD in the end.

Johnson argues that if so much fake liquidity, which has already reached unprecedented levels, will eventually weaken the USD, then how can one explain the Dollar’s 25% rise from the days before QE even began some 15 years ago? Meanwhile Piepenburg asks where would interest rates be with a DXY at 140. Unfortunately, time prevented a full discussion of either question.

Piepenburg sees extreme and extraordinary QE (or YCC, more Swap lines, TGA “emptying”) and other synthetic “backdoor” liquidity measures (weakening the USD) as inevitable, short of a second Plaza Accord or an already IMF-telegraphed Bretton Woods 2.0 to further prevent a soaring USD.

Ultimately, Piepenburg argues that all debt-soaked regimes, without exception, debase their currency to save their “system,” while Johnson argues that the USD, with its unique world reserve currency status and extreme sources of external demand, will avoid a dramatic fall. In the end, however, both agree strongly that gold will be a key asset regardless of who wins the “DXY” debate.

Of course, 60+ minutes is never enough time to fully address all the salient questions and concerns raised here. For example, even if the USD (or DXY) were to spike to record new highs (Johnson), this ignores the far more salient issue of the Dollar’s inherent purchasing power, which has lost greater than 98% against gold since 1971.

In short, percentages, theories and data matter, but regardless of where the USD goes relative to other broken fiat currencies, its inherent purchasing power has been falling faster than its relative strength.

Perhaps in the next conversation, this key point can be more directly addressed. Meanwhile, as the debates continue, so too does the rise in gold.

Debt’s Toxic Ripple Effects: Gold Flowing Toward Historical Repricing

Matterhorn Asset Management, AG partner, Matthew Piepenburg, sits down with David Lin of the David Lin Report to help end a number of false debates and narratives currently making the headlines.

Piepenburg begins by squarely addressing the so-called GDP “surge” in the U.S. as little more than a deficit-spending contradiction, as more debt-based “growth” is not genuine growth, but, well…just more debt. Piepenburg describes the trio of rising yields, rising GDP and rising deficits in the US as little more than the profile of an EM nation rather than a leading developed economy. He further explains how rising yields/rates just add more pressure to an already over-burdened consumer’s debt costs as the invisible tax of grossly under-reported inflation pours salt on the wound.

Turning to bonds, Piepenburg warns against the so-called lure of bond “value” and rising yields. He argues that stress in the bond market is far from over. The only way to support/lift sovereign bond prices and hence compress yields would and will require more magical Fed money, which means even a “saved” or rising bond market will be superficial, as such gains will be eaten away by debased money and rising inflation and negative real rates. In short: No easy way out of the Fed’s debt spiral. It’s either save the bonds or kill the currency, and the direction ahead, he argues, is historically clear.

With the Fed (Powell) supporting higher rates while the Treasury Dept (Yellen) grossly expands public debt, the net and comical result is more debt at higher cost/rates, all of which will require more inflationary liquidity to pay. Alas: Powell’s war/policy against inflation will end in more inflation.

Piepenburg also addresses what he describes as the false debate over hard vs. soft landings when the evidence of a hard landing is literally and abundantly right before our eyes. The conversation then turns to the reality rather than hype of de-dollarization, the questioned performance of gold vs. equities or other assets in an inflationary setting and the ultimate role of precious metals in far-sighted portfolios.

Debt’s Toxic Ripple Effects: Gold Flowing Toward Historical Repricing

It doesn’t require decades of financial expertise to balk at the notion of selling retail air conditioning units in Siberia or lemonade stands in the heart of the Arctic.

That is, even a high-school freshman would foresee the likely mis-match in supply and demand. After all, unwanted assets, including USTs, can often have more supply than demand.

In other words: Common sense matters.

But in the land of twin deficits, pathologically dishonest/lobbied politicians, negative net international investment positions, chronically obese Fed balance sheets, the Paul Krugman-like blue pill of solving every debt problem with more debt and a Noble prize granted to a central banker who pays that debt with money created out of thin air, common sense appears to be the latest concept to be cancelled in DC.

In fact, if DC’s open incompetence (or blatant corruption) wasn’t otherwise so tragic, it could almost make anyone burdened with self-awareness laugh out loud.

Almost.

The Not-So Funny Facts

But there’s nothing funny about a nation living at historical levels above its means and drowning in an openly ignored 120% debt/GDP debt spiral.

Meanwhile, emotional-heavyweights (yet evidence-free-lightweights) openly signal their virtue – pandering to safe consensus (and voters) about everything from trans-gender bathrooms and the original sin of white privilege to an increasingly vocal chorus bent on slowly eradicating each of our ten Bill of Rights, from free-speech to due process.

In other words, the divided are squawking as Rome burns…

Nor is there anything funny about debating “hard vs. soft landings”with a middle-class suffering record-high credit card debt at 20% interest rates while repo men collect delinquent autos at a pace higher than the Great Financial Crisis of 2008.

And let us not forget, of course, pundits debating about a recession or “looming” recession when the inverted yield curve, YoY M2 declines, the Conference Board of Leading Indicators and ignored illiquidity in the repo markets make it factually clear that America is already in a recession.

At the same time, the U.S. is approaching year-end with over 400 bankruptcies and rising lay-offs as its debt-driven S&P 7 pretends “resilience” while ignoring the over $750B in corporate bonds beneath those stocks about to roll-over at higher (Powell-made) debt costs in 2024, and another $1.2T more roll-overs coming in 2025.

Given that the now distorted American Dream lives off debt, when the cost of that debt rises, the “dream,” as well market, dies.

Dying Beyond Our Means

This hidden skunk in the debt roll-over woodpile of a nation in slow decline (as all debt-soaked nations do) is only made worse when we realize that the pattern of marching toward a rate-hike cliff is even worse for US government debt (racing toward $34T and counting).

Folks, unless the Fed pivots toward QE, rate cuts, and likely YCC, 30% of that already unpayable public debt is about to be re-priced at higher (Fed-made) rates in the next 36 months.

This means that more than 40% of US tax receipts (which will be even less if markets tank) will be allocated to just paying down the interest expense on Uncle Sam’s openly grotesque bar-tab.

Such debt, interest rate and credit market realities prove that America is not living beyond its means, but actually (as an impoverished Oscar Wilde moaned from his death bed in a Parisian hotel) “dying beyond its means.”

This slow death, of course, may sound sensational, but facts (and basic math) are stubborn things, no?

Our Own Opinions, Not Our Own Facts

Although we are all entitled to our own opinions, we are not entitled to our own facts, despite our “data dependent” Federal Reserve forever seeking to re-engineer the “data” of our so-called CPI/inflation scale, recession metrics and unemployment rates.

The ironies just abound as each of us struggle to thread the needle of information vs. misinformation on everything from vaccine efficiency to George Santos’ college volleyball stats… (assuming he went to college?)

In sum, it’s getting increasingly hard to perceive the lighthouse of truth or the little voices of our own common sense among an ever-thickening fog of top-down distortion and bottom-up resignation.

Which brings me back to my opening thoughts of lemonade stands in the Arctic and the need for resurrecting our common sense.

A Foreseeably Bad Treasury Auction

Toward this end, let’s consider the otherwise “boring” but oh-so seminal importance of the sovereign bond markets in general and the UST market in particular, for as I’ll say nearly every chance I get: The bond market is everything.

It’s very likely, given the Sturm und Drang of current headlines, that some of you may have missed Uncle Sam’s recent attempt to sell 30-Year Treasuries at auction in November.

Like that lemonade stand in the Arctic, there were very few buyers at Uncle Sam’s garage sale…

This, of course, is no shocker to those (both within and outside America’s borders) who already know that Uncle Sam is little more than a bad credit issuing a declining and increasingly unloved asset (UST).

The evidence of this tanking demand is most evident among global central banks, who ever since 2014, have been net sellers of USTs, and in recent years, record-breaking buyers of physical gold.

Of course, as demand for Uncle Sam’s IOUs falls, so too does their pricing, which explains why their yields (which move inversely to price) have been rising like nasty little shark fins among a credit sea of frothy chum.

Earlier this month, yields on the 30Y UST climbed from 4.65% to 4.8% after $24B in US bonds saw less love/demand from investors than Uncle Sam had otherwise hoped.

(Apparently, the policy makers in DC were still hoping that lemonade in the Arctic was a great deal…)

Who Wants a Declining Asset from a Bad Credit?

But when fewer and fewer buyers show up at those Treasury auctions, the primary dealers (i.e., big banks) are forced to finance the leftovers (i.e., fill in the demand gap).

In fact, these “branch office banks of the Fed” had to buy nearly 25% of those unloved bonds themselves.

This level of “gap purchasing” by the primary dealers is now more than double the average rate, which means interest in Uncle Sam’s 30Y UST is openly tanking at a similar rate.

When Billions Are No Longer Enough

What is far scarier, however, is the fact that the US Treasury Department’s recent sale of $24B in bonds bought Uncle Sam only 5 days (as opposed to months) of liquidity and US deficit “coverage” otherwise essential to keep the government on its respirator of seemingly endless deficit spending.

By the way, once DC finally confesses the US is officially in a recession (always months after the fact), such US deficit spending, already beyond the pale of common sense, will only increase, which will mathematically push the US fiscal deficit (now at 8% of GDP) to well over 10-15% of GDP.

Such simple math places unbearable pressure on the traditional/forced buyers (suckers?) of Uncle Sam’s debt (banks, pension funds, and foreigners), who will become increasingly thirsty for USD liquidity (nod to Brent Johnson) and hence be forced to sell more of those very same USTs to obtain that “sucking straw” of Dollar liquidity.

Of course, more UST selling only puts more downward pressure on UST pricing, and hence more upward pressure on UST yields and interest rates.

And that, dear readers, is how a debt spiral looks, functions and corrupts economies. As yields rise, more and more of US tax revenues will be wasted on just paying interest expenses on DC’s IOUs…

That is, the more the US goes into debt, the more it costs and the more it breaks things, from banks and middle-class car owners to an ever-dwindling small business sector and a rightfully angry guitar player in Farmville, Va.

The Open Need for More Inflationary Liquidity

As importantly, given the now empirical fact that billions of IOUs per auction only buys Uncle Sam days rather than months of deficit coverage, it seems fairly clear to me, at least, that Uncle Sam is going to need more than just primary dealers to keep his bond market alive (and debt-based “growth” model in motion).

As I’ve consistently argued, the only place/buyer where Uncle Sam can eventually turn to support his unloved bond markets is a money printer (digital currency mouse-clicker) at the Fed.

This means at some point, the only option left (short of a Plaza Accord/Bretton Woods 2.0) for America is QE to the moon, which will send the USD’s purchasing power to the ocean’s floor.

In the interim, as Powell’s higher-for-longer (or even “pause”-for-longer) policies collide with rising deficits and declining UST demand, the only charts about to go up in the near-term are yields, the USD, gold and BTC, each of which has been doing precisely that.

Gold & the USD

Many will say, of course, that gold does best only when the USD is weak and rates and yields are low.

Yet gold is nearing record USD-priced highs despite rising rates and hence a rising USD.

Why?

It’s simple: Faith in a broke(n) USA is falling.

Trapped within a debt bubble, currency crisis and global policy corner as thoroughly distorted and beyond the pale of natural supply and demand as the current DC now finds itself, the world’s central banks are positioning themselves for an eventual and inevitable pivot toward trillions in more fake liquidity from an equally discredited Fed.

This means the USD’s relative strength and days of current (yet artificial) glory are indeed numbered.

This positioning is easy to see.

Just as armies preparing for an invasion bring their horses, troops, canons and men nearer to their borders for protection, central banks and BRICS+ nations are stacking physical gold day by day, month by month and year by year in anticipation for the kind of emergency (and bogus) liquidity that drowns all fiat currencies—including a world reserve currency.

Differing Opinions, Shared Facts

This liquidity end-game, which involves an inevitable debasement of the USD, is, in MY opinion, how the foregoing debt facts play out.

That is, the USD will be sacrificed to save the UST—and all that flows therefrom, i.e., equity markets, pension funds, tax receipts etc. In short: The “system” can only be “saved” by trillions of fake, new Dollars.

This is nothing new.

Throughout history, and without exception, all debt-soaked nations sacrifice their currencies to temporarily save their broken “systems.”

As mentioned above, we are all entitled to our own opinions, just not our own facts.

Toward this end, it is equally important to consider contrary opinions on the same facts, and I have enjoyed, as well as respected, other informed opinions on these same facts, including my recent discussions/debates with Brent Johnson.

Like myself, Brent Johnson is a powerful supporter of physical gold as a patient yet ultimate victor (and asset) as the foregoing debt endgame approaches its final hour.

But we don’t agree on everything.

He argues that entrenched global demand for the USD (via trade agreements, Euro Dollar and derivative markets, global USD-denominated debt contracts etc.) will continue to offer tailwind support to America’s otherwise distorted currency (DXY at 140+?) as per the admirable logic of his famous “milkshake theory,” which is not only rich with data, but common sense as well.

The Same Common Sense

But whether my opinion or Brent Johnson’s opinion as to the near-term direction of the USD prevails (I don’t see a 140 DXY), the stubborn reality of a paper and now weaponized currency losing its trust, respect and legs longer-term is as easy to see as the growing shine (and open demand) of physical gold as a far superior preserver of generational wealth than a corrupted Greenback.

For both Brent Johnson and myself, this end-game is not just evidence-backed, but simple common sense—a quality DC may have cancelled but which most of us still proudly possess.

Regardless then, of the USD’s relative strength (or weakness) in the months ahead, its inherent purchasing power is dying by the day.

Gold is one historically-confirmed way of addressing this reality with common sense.

Debt’s Toxic Ripple Effects: Gold Flowing Toward Historical Repricing

Below, we consider just how far America has fallen from its founding vision (and something we can do about it).

Union Matters—Poor Ol’ Jefferson

When sitting down to “channel the people’s will” through his own pen, the author of the American Declaration of Independence, Virginian Thomas Jefferson, had one key principle and theme in mind, namely: Union.

According to University of Virginia scholars, Garry Gallagher and John Nau, this concept of Union was premised upon the ideals (and “experiment”) of: 1) equality (despite, of course, can-kicking the slavery issue…); 2) compromise and 3) a fundamental disdain for any form of coercion (or “capture”) by a centralized body (or bodies) within an otherwise fragile republic based upon a federalist structure.

Here, of course, is not the place to unpack or debate the myriad concepts of a republic, federalism, or even constitutional democracy.

However, one issue of economic relevance worth raising today is the core and defining fear shared by America’s founding fathers, namely the fear that critical notions of equality and our three branches of government could one day be captured/coerced by bad actors and hence destroy the experiment of striving/evolving toward equality and union, however imperfect its growing pains.

Captured by a Private Bank

Which brings us to our central bank, whose power over the price (interest rate controls) and supply (balance sheet size) of the world reserve currency, has effectively and constructively become a fourth branch of government.

This centralizing central bank has not only been the direct and empirical cause of historical wealth inequality in America, but has now fully “captured” (i.e., taken centralized control of) the American economy in general and the price control of global bond and currency markets in particular.

The entire world, most of which is directly or indirectly pegged to the price and supply of the USD, literally sits on the edge of its seat to see what the FOMC will (or will not do) with the price and supply of a now weaponized and entirely “captured” USD.

In other words, Jefferson, whose admirable memorial stands just a few blocks from the Treasury Department and an easy walk from the impressive Eccles Building, would be shaking his head in despair if he were alive today.

Or stated more simply, America has sunken, irrevocably it seems, from its original and enlightened ideals of equality.

After all, when a post-08 central bank creates a zero-rate-driven and QE 1-4+ equity bubble, 90% of whose riches were enjoyed by only the top 10% of its population, we see just how “unequal” such coercive institutions can be…

Needless to say, no one in DC, and certainly not Powell, will confess that such centralization of power (and “free” markets) by unelected private bankers is a mark of feudalism rather than capitalism, and a carefully veiled symbol of authoritarianism hiding in “Federal” clothing.

[The Federal Reserve, I’ll remind again, is neither federal nor a reserve, nor even constitutional, despite its address on Constitution Ave…]

No Profiles in Courage

Nor are our lobbied politicians, who collectively know less about history, economics or basic math than just about any college freshman, asking themselves “what they can do for their country” …

Instead, they have been doing a heck of a lot of thinking about how to brand themselves for re-election and maintaining their power.

Toward this end, these “profiles in zero courage” (although Santos will likely claim he also has a PhD in applied math from MIT) have been making promises their budgets can’t pay for.

Thereafter, they blindly fill this deficit “gap” with trillions of annual IOUs (i.e., USTs) per year which are then paid for with inflationary money clicked out of thin air by the IT wizards at the Fed.

Farce After Farce After Farce

Of course, it is such magical money, and not COVID, Putin, global warming or little green men from Mars, which explains our farcically under-reported (i.e., openly dishonest) inflation rate, which if measured by the same CPI scale Volcker used, would place US inflation at well above 11% today, and not the open lie of headline 3.7%.

Such actual rather than “official” inflation means that every single IOU issued by Uncle Sam is a negative-yielding bond, and hence by definition, puts them technically and already in default.

Others Are Catching On

The rest of the world, including the growing BRICS+ nations, knows this, which explains why central banks have been net-sellers of USTs since 2014 and why de-dollarization is not just a concept but a steady reality today.

In short, demand for, as well as trust in, the great “risk free return” of the most important sovereign bond in the world (which is now mathematically “return free risk”) has been tanking while central bank gold-purchasing has been breaking records.

But as the graph immediately below confirms, this lack of love for US Treasuries has not stopped Uncle Sam from issuing trillions and trillions worth of more such IOUs, creating a perfect disaster (i.e., mismatch) of over-supply and under-demand.

This mismatch, as even a high-school econ student knows (but our politicians do not), creates massive downward pressure on the price of those bonds.

And given the fact that bond prices move inversely to bond yields, those yields are now screaming north, which means interest rates, and the cost of debt (for individuals, corporations and even Uncle Sam), are now at record-breaking, bank-breaking and economy-breaking levels.

Meanwhile, the pundits and politico’s will still have you/us debating about hard-landings or soft-landings, despite the open evidence that our economic plane has already crashed…

Just Follow the Debt

Thus, and with simple candor, it’s high time we stop arguing over desert choices on the Titanic’s A-lounge menu and start considering the implications of the debt iceberg off our bow.

Our mental midgets in DC, for example, have placed American public debt at a 120% ratio to its GDP, which mathematically makes growth impossible rather debatable, as such debt ratios are the equivalent of swimming with a cannon ball chained to each foot.

Ultimately, however, the bond market in the USA, which is the key to our nationalized equity markets (which live or die based on bond yields and debt pricing) need to be understood plain and simply.

And I just can’t say this enough: Everything hinges on bonds in general and yields in particular.

When rates/yields are low, things work; when they are high, things break.

This is because cheap debt has been the core of America’s debt-based “growth” model for years, and this alone explains the survival of our respirator-economy and its otherwise bankrupt pension system.

When Too Big to Fail = A Desperate Rescue

Given this plain fact, the US sovereign bond market is indeed, and literally, “too big to fail.”

But given that tax receipts, GDP and foreign interest in Uncle Sam’s IOUs are not nearly enough to “accommodate” this sovereign debt market/bubble, the money needed to “save” it will have to come from somewhere.

And that “somewhere,” in my view, is going to be a money printer, which in turn means an eventual expansion of the money supply and thus an eventual end-game of currency destruction.

Such currency destruction means greater rather than less inflation ahead, with a likely dis-inflationary market crash in the interim.

Again, the rest of the world knows this, which explains why central banks are dumping USTs and stacking physical gold at record levels.

Alternative Views?

The milk-shake theory, however, makes credible counter-arguments to my current view of the US bond and currency forces.

It holds that when and as the world sinks deeper into recession, even that wart-covered USD and unloved UST will become the ironic and superior safe-havens of last resort.

After all, the USD is not about to be replaced by the Rubel, CNY, peso, yen, franc or euro any time soon, or frankly, perhaps any time ever…

I actually agree.

Furthermore, given that “great straw sucking sound” from global derivative and euro-dollar markets which survive off collateralized USTs, the embedded and systemic demand for the USD may very well maintain its relative supremacy for a long while, right?

Nor should we forget the embedded demand for the USD in the form of that oh-so important petro-dollar, which Kissinger made his swan song in the 1970’s.

In sum, there are many sound reasons why one could argue that the USD, in cohorts with the UST, is, and always will be, the best horse in the global glue factory.

But What About History, Math & Tomorrow?

But… and as I’ve argued and written elsewhere, such hubris and faith in the relative superiority of the USD assumes that history doesn’t matter, that math is optional and that tomorrow always looks like yesterday.

The petro-dollar, for example, is no longer a sure thing, as I and others have argued at length elsewhere.

And the belief that the world will just “flow” into USTs when the next storm hits is a belief which ignores the dumping rather than buying of USTs in the most recent market disaster of 2020.

In short, maybe that “flow” has already come and gone?

Other Bad Scenarios

Equally worth considering, of course, is the possibility that DC can save its bond market by just cutting entitlement and military spending by say, 70%, but I wouldn’t hold my breath for that…

Or perhaps America can just look forward to a massive crash in the stock market on the tailwind of rising rates to “scare” bloodied investors back into the UST market and thereby “save” Uncle Sam’s IOUs by killing its stock market (as well as capital gain tax income?).

Hmmm.

Or Just Kill the Currency

More likely, and more politically expedient yet more disastrous to the people, will be the destruction of the currency to save the credit markets, a monetary cancer which now defines our debt-soaked “democracy.”

I’ll say this again and again and again: History confirms that every debt-soaked nation kills its currency to save its @$$ by inflating away their debt with debased money.

Thereafter, those same “wizards” then resort to controlling their inflation-exhausted (i.e., angry) citizenry with more centralized controls.

Jefferson & Gold?

In short, and returning to our sad, old friend Jefferson, America is already “captured” by a financial system and an unelected fourth branch of government which has coerced its nation into a corner with no exit.

At least no exit other than a currency trap whose Dollar’s inherent purchasing power, when measured against that barbarous relic, gold, has lost greater than 95% of its relative strength since Nixon welched on America’s golden chaperone back in 71.

Gold, of course, can not prevent the usurpation (i.e., nefarious “capture”) of power which Jefferson so feared would one day destroy the American “union.”

Sadly, and as wise individuals have known and warned for centuries, debt destroys nations. Not just sometimes, but every time.

Nor can gold act as a Talisman against branded rather than visionary politicos, left or right, American or global, from the dark shadows of Davos to the open comedy of DC.

This is why history-wise, math-competent and financially informed investors, burdened by critical-thinking rather than the partisan or “koo-koo,” have always (and will always) protect their own sanity, their own wealth and even their own private “union” of family (which Jefferson defined as the foundation of freedom) with a healthy allocation of that barbarous relic, that so-called “pet rock.”

In other words, just because political opportunists may have taken away the gold standard to buy votes while slowly destroying nations (and national unity) in all too familiar patterns of debt and centralization, this does not prevent us gold “stackers” from being far smarter than our so-called “leaders.”

It’s time, in sum, that we back our own currencies with gold rather than wait for others to do it for us.

Debt’s Toxic Ripple Effects: Gold Flowing Toward Historical Repricing

We are on the inevitable road to perdition for the world economy & financial system, ending in a potential global conflict of uncontrollable proportions.

Evil begets evil as The Cycle of Evil hits countries at the end of an uncontrollable debt expansion.