Is the USD Really Too Big to Fail?

Between politics (driven by self rather than public servants), markets (driven by debt rather than profits) and currencies (diluted by over-creation rather than chaperoned by a real asset), it is fair to say we live in not interesting but surreal times.

But amidst the surreal, the dollar, as many believe, is our rock, our immortal albeit often unloved constant.

The USD: Too Big to Fail?

Whatever one thinks of the dollar, we can’t deny its centrifugal force, exorbitant privilege and entirely unequaled market power (from the current SWIFT and Eurodollar systems to the derivative and petrodollar markets).

And even as broken, debased, inflated (and inflation-exporting) as the USD is, its place as a world reserve currency (with 80%+ of global FX transactions) is firm.

More importantly, the USD is a currency (base money) that only the Fed can print into existence and which the rest of the dollar-thirsty and dollar-indebted world (i.e. Eurodollar markets) can only lend into existence (like a second derivative credit currency) in a perpetual dollar-roulette of “debt and print” or “debt and lend.”

This effectively makes the USD the world’s base money (and denomination) for the vast majority of derivative global debt instruments, which means everything else (including Eurodollar lending) is essentially just credit-related.

And because credit makes the $330T debt-world spin, the USD, by extension, makes the world spin.

In short, one might argue the USD is too big to fail, right?

The Immortal Greenback?

Given the baked-in global demand and credit role for this otherwise diluted super-dollar, the national and global system which it has ruled since 1944 will thus likely and only end (save for a miraculously peaceful Plaza Accord 2.0) in some form of what Brent Johnson rightfully described as “profound violence—economic and/or military.”

But according to the dollar bulls, even a collapsing system and, hence, tanking US bond market, would send UST yields to the moon and, hence, the USD (ironically) even higher.

In short, no matter how some spin it—the dollar is king, and every central banker in DC knows this, right?

After all, such dollar realists have discovered the hard truth through the lens of realpolitik global finance: The dollar, love or hate it, is the base money of the global financial system and, as such, will be “the last to fall.”

Gold Backing?

As for any return to a gold-backed dollar, those same realists would remind us of the infamous 1896 “Cross of Gold” case laid out by William Jennings Bryan, who warned that with a dollar tied to gold, credit would eventually tighten to such levels that the average citizen and small business would be left bleeding credit-dry in the streets.

Furthermore, there’s the equally realistic stance that no country would want to be tied to a gold chaperone (or “standard”) for long, as this would only impede their sovereign ability to mouse-click their own currencies into existence when needed (i.e., whenever backed into a self-created debt wall).

Money, and hence the USD, they ruefully conclude, will therefore be whatever the strongest country (bully) on the block says it is, and like it or not, the US and USD are still flexing the strongest biceps in the global neighborhood, right?

Assuming Nothing (or History) Ever Changes

But each of the foregoing (and reasonable) conclusions only hold true if one assumes that the US is and remains the strongest bully (and money) on the block.

The evidence of history, however, which is dynamic rather than static, may suggest otherwise.

For now, however, the dollar matters most to many.

China, Russia, or India, for example, may be important, but few of us can or would predict that the yuan, ruble, or rupee will replace the greenback.

I certainly don’t.

So again, the USD will remain the king of liquidity.

And even for those who take de-dollarization seriously, will the BRICS+ nations really be able to agree to a gold-backed BRICS+ currency redeemable in, say, Moscow or Shanghai?

I have my doubts—for the simple reason that as much as the BRICS+ nations collectively distrust the now weaponized USD, they don’t trust each other enough to relinquish their option to print their own currencies at will.

But that doesn’t end the discussion on gold’s new and rising role in a changing dollar/world.

Going Around Rather than Replacing the Dollar

For me, debating a gold-backed new currency or “end of the dollar” drama thesis is missing the bullseye.

The facts and evolving history of today and tomorrow suggest that the real story is not about replacing the dollar, but simply going around it in a new price direction paved in both black and real gold.

Toward that end, look at what the rest of the world and its central banks are doing, not what they (or our financial leadership) are saying:

- Since 2008’s GFC, Putin has been hoarding gold;

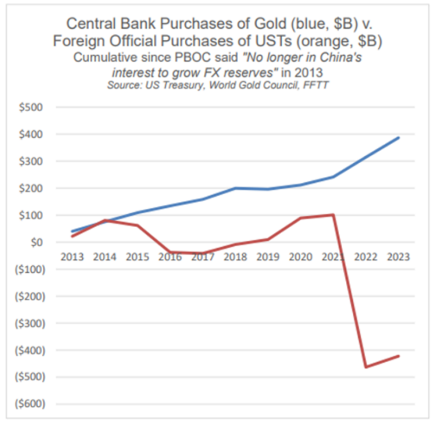

- Since 2014, global central banks have been net-sellers of USTs and net buyers of physical gold;

- In 2023, 20% of global oil sales were outside of the USD;

- Despite being pegged to the USD, Saudi Arabia, the UAE, and other GCC nations’ favorite import out of Switzerland this year is physical gold;

- More than 44 nations are currently executing trade settlements outside of the USD;

- Both Japan and China, historically the most reliable buyers of Uncle Sam’s IOUs, are now dumping billions and billions worth of them;

- Russia is the world’s greatest commodity exporter, and China is the world’s greatest commodity importer—and they like each other far more than they do Biden or the next White House resident; more importantly, it is a matter of national survival for China to buy oil outside the USD;

- Russia is now selling oil to China in yuan, which the Russians then use to buy Chinese goods (once made in America); thereafter, any delta in the trade is net settled in gold (not dollars) on the Shanghai Exchange. This, folks, is BRICS scalable (think India…);

- Between swap lines, the CIPS alternative to the SWIFT system and rising negotiations between Gulf oil nations and other BRICS+ big-whigs, the current move away from dollar-denominated oil trades is real rather than imaginary;

- Given the growing decline of physical gold and silver levels in the New York and London exchanges, they can no longer price fix gold as in the days of yore, nor can they justify a different 200 moving day gold price than one more fairly priced in China’s exchange;

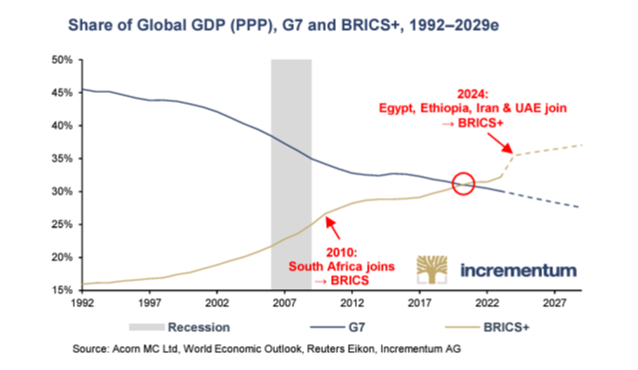

- The BRICS+ nations are no longer USD pawns but rising rooks. Their share of global GDP is surpassing that of the G-7;

- In 2023, the Bank of International Settlements declared physical gold a tier-one asset alongside the 10Y UST;

- Nations are openly (and naturally) preferring gold as a reserve asset over the other “tier-one” option–a dollar-based IOU of “risk-free-return,” which by any honest (current and future) measure of inflation offers a negative real yield, in other words: “return-free-risk;”

- No matter how enamored the green crowd is of ESG, we are decades and decades (as well as trillions and trillions) away from carbon-neutral, and like it or not, energy matters and fossil fuels literally fuel the world;

- China and India each have populations of over 1.4B. If oil demand increases even slightly in either of these BRICS countries, oil prices in rupees and yuan (and every other fiat currency) will explode—and two of the biggest players in the oil space don’t want to use dollars to pay for it. Instead, they’d prefer to net settle their oil and gas in gold, which buys more energy than dollars can;

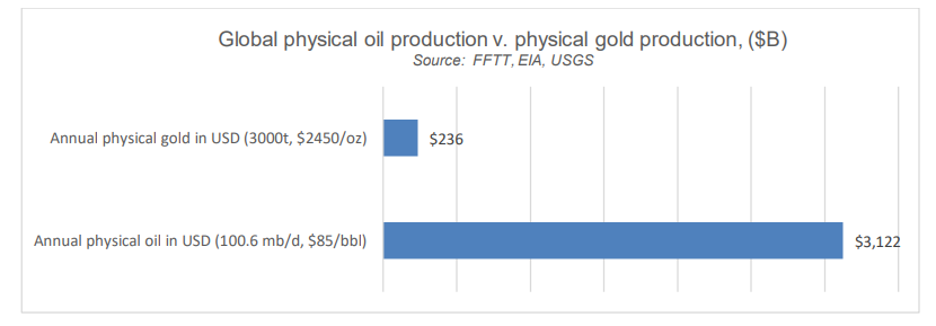

- Given that the annual production capacity for oil is 12-15X that of global gold, and with gold increasingly becoming the favored oil payment, gold’s price relative to oil can only go up;

- This explains why gold is openly (not theoretically) becoming a more trusted reserve asset than the UST:

In short, Energy matters, and rather than the USD being the base layer of money (see above), energy very well could be.

And THAT, folks, is how a system changes “violently and or militarily,” as most US direct and proxy wars have something to do with…oil.

And that oil, by the way, is increasingly being net-settled in gold—day by day, and minute by minute, for the simple reason that history is like a hockey puck: You play where it is headed (gold), not where it sits (the USD).

The Other Bullies Are Coming Together

Returning to the prior assumptions of the Immortal Dollar thesis above, if money is whatever the strongest bully/power says it is, what happens to the previous notion of “money” when a collection of rising and resource-rich bullies/powers (BRICS+) is growing stronger, and their preferred focus is oil and not the dollar?

What happens after a neutral reserve asset is weaponized against a major nuclear power and energy exporter (Russia) already in financial bed with the world’s largest energy importer (China)?

The answer is simple: That once “immortal” reserve currency is less trusted and hence less in demand.

Is it any coincidence, for example, that after DC weaponized the USD, the BRICS+ roster of nations increased to include the major oil exporters?

Is it a coincidence that Saudi Arabia’s crown prince, whatever you think of him, gave Biden a fist-pump and Xi a warm handshake?

And let’s be blunt: Does anyone truly believe oil is irrelevant? That American wars (direct or indirect) with Iraq, Libya and Syria were about protecting freedom and democracy?

Or might these conflicts have had something a bit more to do with energy in general and oil in particular?

What the US elite doesn’t want you to know is that oil matters more than dollars, and that more countries today would rather pay for that oil in gold.

And do we think the Saudis haven’t noticed that gold-backed oil sales are significantly and historically more stable than dollar-backed oil?

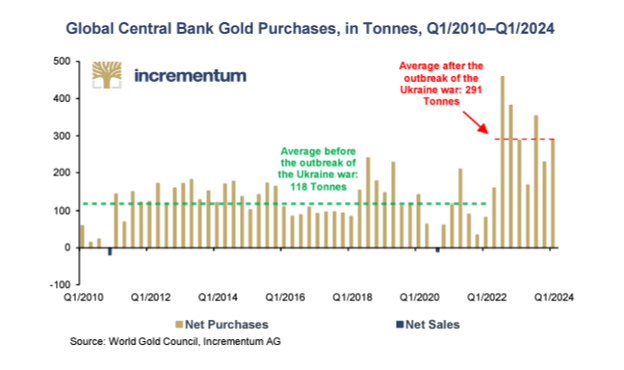

Is it, therefore, a coincidence that since DC weaponized the USD, global central banks have been stacking gold at historical levels?

Is it a coincidence that more and more nations are net settling commodities and other trade deals in gold rather than dollars?

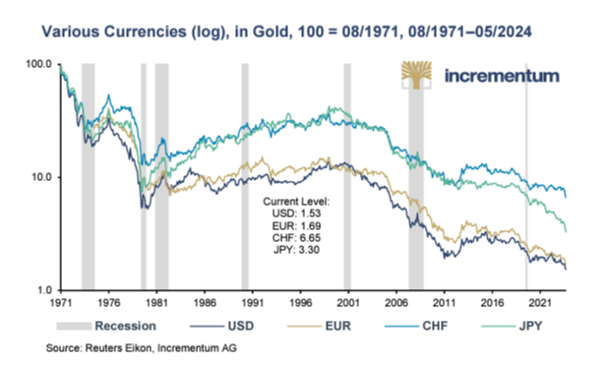

Is it a coincidence that nations and their central banks would rather save in gold (a finite asset of infinite duration) rather than US IOU’s (an infinite asset of finite duration), whose returns can’t beat inflation and whose purchasing power, even in dollar terms, has fallen greater than 98% when measured against a milligram of gold since 1971?

Is it a coincidence that within 2 years of de-coupling the USD from gold in 1971, DC desperately raised its interest rates and strengthened its dollar so that Saudi Arabia et al. would agree to force the world to buy oil in strong dollars, thereby creating forced demand for an otherwise over-supplied/printed USD?

But is it also just a coincidence that 50+ years (and a 98% weaker dollar later), Gulf nations like Saudi Arabia are now slowly turning away from that petrodollar after a generation of seeing it debased by over $100T in US public, private, and household debt—all of which has made an increasingly unloved UST increasingly unable to withstand further rate hikes and hence dollar-strength?

It’s Good to Be the King

But as per above, the smart bankers at the Fed and big banks still want us to believe the dollar is king, and that despite all its flaws, the great straw-sucking demand from a dollar-centric world is precisely what makes the greenback too big to fail.

But what if the world is energy rather than dollar-centric? And what if the BRICS rise is more than a chimera but a new puck direction?

Think about that. No one in DC or Wall Street wants you to.

Pride Comes Before the Fall

The certainty that tomorrow’s dollar will remain yesterday’s dollar is, in fact, a dangerous sign of hubris (and historical ignorance) before the fall.

After all, if we can see the decline of the USD’s purchasing power since 1971, can’t others?

And if we can see that UST returns are losing (technically defaulting) to current and future inflation, can’t others?

And if we can see that the fake liquidity (QE or other) required to pay Uncle Sam’s rising bar tab will continue to be highly inflationary (and dollar-debasing), is it not reasonable to assume that the rest of the world can see this too?

Going Around Rather than Against

In fact, and based on what is being done rather than said, the rest of the world appears to see precisely what we are seeing.

The BRICS nations are not seeking to destroy or replace the dollar. Instead, and like the Germans facing the Maginot line, they are already and openly going around it.

How?

By using local currencies for local goods which are then net settled in a timeless asset: Gold.

And if we can see that holders of gold can purchase significantly more energy (i.e., oil or gas) with gold ounces and kilos than they can with American dollars and USTs, is not at least reasonable to assume that gold’s role as a trade settlement asset will have higher demand as the USD suffers declining demand?

And if demand for the USD as a net trade settlement asset continues to fall rather than rise, is it not equally plausible (if supply and demand forces still apply) to suggest that tomorrow’s dollar may be weaker rather than stronger?

Two Crowns: The Timeless vs. The Temporary

And even if we were to concede the milk-shake theory’s reasonable postulate that despite all its blemishes, the dollar will be “the last to fall,” the simple fact remains that regardless of whether it falls or fails “last,” it is already being repriced, even if it may never be fully replaced?

Finally, and perhaps most importantly (and obviously), even if the USD remains “king” relative to all other fiat currencies (and this matters if you live in countries—like Turkey or Argentina-where your currency is far weaker), we can still objectively see, again, that gold holds its value even better than that USD “king.”

In short, there’s a far better “king” than the USD—it was always there.

The central bankers just don’t want you to see it.

And this precious king has a crown of gold rather than paper.

Which king will you choose?

Is the USD Really Too Big to Fail?

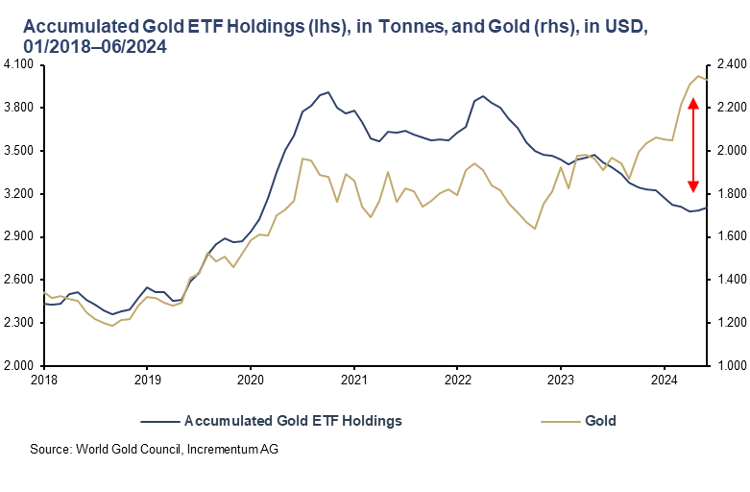

The rise in the gold price this spring was undoubtedly spectacular. In just a few weeks, the gold price rose by almost 20% in USD terms, with a gain of 21.7% for the first half of the year alone. In EUR terms, gold increased 16.4% in the year’s first six months.

The showdown in the gold price we predicted in the In Gold We Trust Report 2023 has passed. What is remarkable is that all of this is happening in an environment where, according to the previous playbook, the gold price should have fallen. The collapse of the correlation between the gold price and actual interest rates raises many questions. In the old paradigm, it was unthinkable that the gold price would trend firmer during sharply rising real interest rates. Gold and gold investors are now entering terra incognita.

Traditional correlations are breaking down

In addition to the high negative correlation between the gold price and US actual interest rates, the once strong link between investor demand from the West and the gold price has dissolved in recent quarters. Given gold’s record run, one would have expected ETFs to register record inflows. First, things turn out differently, and second, they unfold contrary to expectations: from April 2022 to June 2024, there was a net outflow of almost 780 tons or 20% from gold ETFs. The old gold playbook shows gold should be around USD 1,700, given the fall in ETF holdings.

Consequently, a vital element of the new gold playbook is that the Western financial investor is no longer the marginal buyer or seller of gold. The significant demand from central banks and private Asian investors is the main reason why the price of gold has thrived even in an environment of rising real interest rates.

A reduction in gold ETF holdings when actual interest rates rise is undoubtedly a rational decision from the point of view of the players in the West, provided they assume that:

- They are not exposed to increased counterparty risks and, therefore, do not need a default-proof asset;

- Actual interest rates will remain positive in the future, and a second wave of inflation will not occur;

- They suffer opportunity costs if they underweight traditional asset classes such as equities and bonds or even “concrete gold” (=real estate) at the expense of gold.

In our opinion, all three assumptions should be questioned – and that sooner rather than later.

The marginal actor in the gold market moves from West to East

The global East, on the other hand, is becoming increasingly important. This is hardly surprising given that the West’s share of global GDP continues to decline due to weakening growth and an ageing population.

In addition, many Asian countries have a historical affinity for gold (India and the Gulf States, mainly, are worth mentioning). Still, China is increasingly discovering its preference for gold.

In 2023, demand for gold jewellery totalled 2,092 tonnes. China accounted for 630 tonnes, India for 562 tonnes, and the Middle East for 171 tonnes. Together, these amounts to almost two-thirds of the total demand. Of the nearly 1,200 tonnes of gold bars and coins that were in demand in 2023, almost half went to China (279 tonnes), India (185 tonnes), and the Middle East (114 tonnes).

Gold is also benefiting from other developments. China is discovering gold as an alternative retirement provision precisely because of the structural problems in the real estate market. Gold in beans is currently trendy, especially among China’s youth. The strong demand for gold from Asian central banks is another pillar of this epochal change. These changes are also why certainties, such as the close correlation between the gold price and actual US interest rates, are disintegrating.

Central banks are becoming increasingly crucial for gold demand

Central bank demand accelerated significantly in the wake of the freezing of Russian currency reserves immediately after the Ukraine war outbreak. As a result, central bank demand for gold reached a new record high of over 1,000 tons in 2022, which was only narrowly missed in 2023. Q1/2024 was then the strongest first quarter since records began. It is, therefore, hardly surprising that the share of central bank demand in total gold demand has increased significantly: from 2011 to 2021, the share of central banks fluctuated around the 10% mark, whereas in 2022 and 2023, the share amounted to almost 25%.

The profound distortions triggered by the sanctioning of Russian currency reserves will keep central bank demand for gold high for some time. This is also shown by the recently published World Gold Survey 2024 by the World Gold Council (WGC). According to the survey, 70 central banks assume that central bank gold reserves will continue to grow. Geopolitical instability is the third most crucial reason for central banks’ investment decisions. And geopolitical instability will undoubtedly be with us for some time to come.

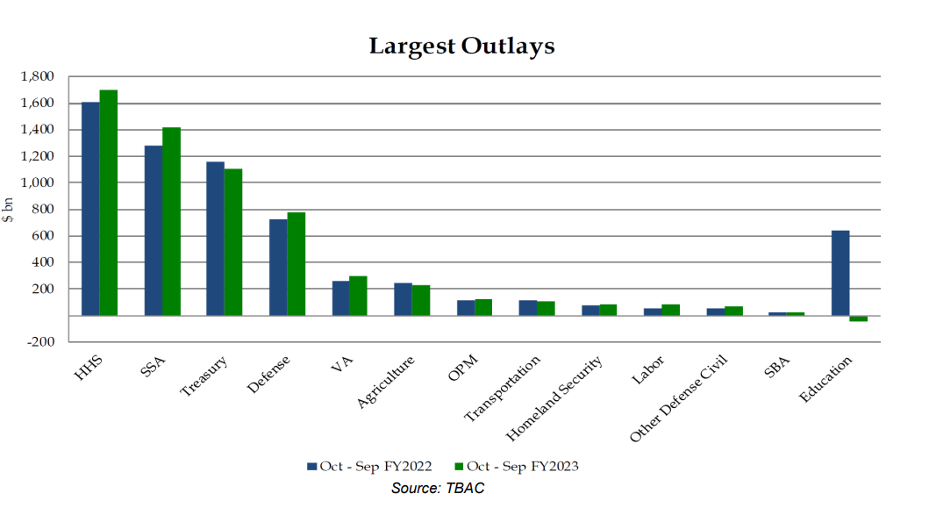

The debt bomb is ticking – also increasingly in the West

We are entering a new era, particularly evident from developments in the countries with the highest total debt (government, non-financial corporations & households).

Japan occupies the inglorious top spot with just over 400%. The dramatic fall in the value of the Japanese yen -12.3% in the first half of 2024, -32.6% in the past five years and even around 50% compared to the almost all-time high in 2012 – is a symptom of Japan’s increasing imbalance. Accordingly, the economic thermometer in the form of gold prices in the Japanese yen is beating intensely. At the end of June, the gold price had risen by 28.7% since the beginning of the year. Since 2023, it has increased by just over 50% and around 165% since 2019.

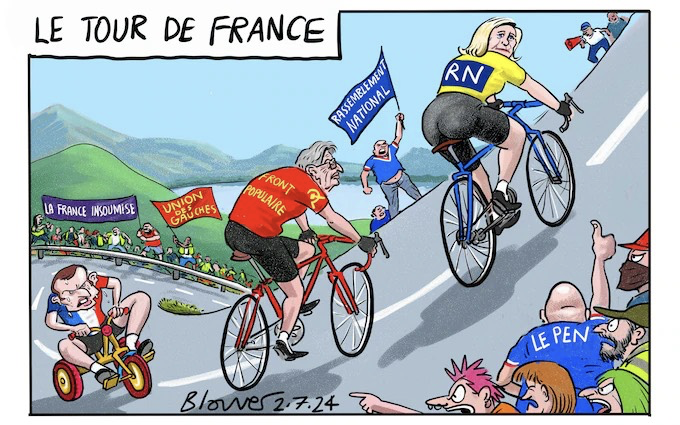

France is in second place worldwide and first place in Europe with 330%, making it a much bigger problem child than Italy, which is much maligned in the media. Italy’s total debt is around 80 percentage points lower. The unclear political situation following the surprising election victory of the far-left New Popular Front in the new elections to the National Assembly unexpectedly called by the French President will further exacerbate France’s debt situation.

In addition to the continued, highly loose fiscal policy, the US is in an increasingly tricky domestic political situation just four months before the presidential elections, following the disastrous performance of US President Joe Biden in his first TV debate with his predecessor and challenger – Donald Trump. This will also make solving the US debt problem more difficult, especially as Donald Trump, who is leading in the polls, described himself as the “king of debt” a few years ago. An easing of the situation is, therefore, not to be expected. On the contrary, the next major debt crisis could affect some leading industrialized nations.

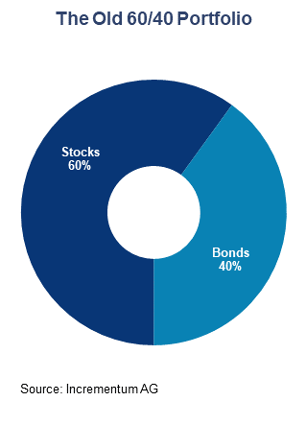

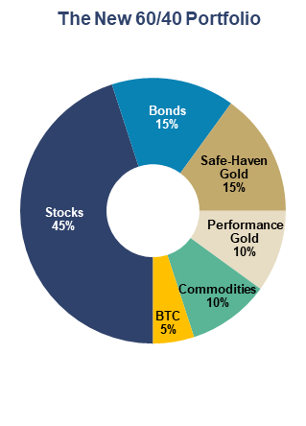

The new 60/40 portfolio

The investment environment for gold investors has fundamentally changed. The reorganization of the global economic and political order, the dominant influence of emerging markets on the gold market, the reaching of the limits of debt sustainability, and possibly multiple waves of inflation are causing gold to appreciate. It is, therefore, also time to adapt the traditional 60/40 portfolio to these new realities.

Aside from gold, we also see other alternative asset classes, such as commodities and Bitcoin, as beneficiaries of the new gold playbook. Therefore, we are convinced these two asset classes are indispensable in preparing a portfolio for the new playbook. A suitable portfolio comprises 60% equities and bonds + 40% alternative asset classes.

Our interpretation of the new 60/40 portfolio for long-term investors provides for the following allocation:

| Stocks | 45% |

| Bonds | 15% |

| Stocks + Bonds | 60% |

| Safe-haven gold | 15% |

| Performance gold | 10% |

| Commodities | 10% |

| Bitcoin | 5% |

| Alternative Assets | 40% |

Source: Incrementum AG

This marks a clear departure from traditional 60/40 portfolios. Of course, this positioning is not a rule set in stone but rather a guideline based on current market conditions and will evolve with time and changes in the currency environment. The new playbook applies as long as we are in a period of currency instability characterized by vast debt burdens and above-average inflation volatility. In other words, a higher proportion of hard currencies seems necessary until we return to an environment with a stable hard currency – be it a sovereign hard currency or a gold/Bitcoin standard.

Conclusion

We are currently witnessing a fundamental transformation. Old certainties are fading; established strategies are failing. The willingness to question established patterns of thought and break new ground often requires courage, but for those who recognize the signs of the times and dare to change, implementing the new gold playbook opens the door to growth and stability.

In principle, the new gold playbook suggests that the portfolio’s allocation to alternative asset classes should be higher to align appropriately with changes in the investment environment.

Is the USD Really Too Big to Fail?

In this compelling conversation with Tom Bodrovics of Palisades Gold, VON GREYERZ partner, Matthew Piepenburg, bluntly dissects the empirical realities from the main stream fantasies regarding the risk-asset and economic narratives making the current headlines. He touches upon risk asset facts, the deep implications of debt-to-GDP levels globally, the real rather than sensational consequences of ongoing de-dollarization and the now undeniable fact that gold is replacing the UST as a global reserve asset.

The conversation opens with a candid assessment of the common denominator (and common sense) reality of unsustainable debt and its now obvious ripple effects on all the current narratives and debates regarding stocks, bonds, currencies, deflation/inflation and sound vs. fiat money, all of which culminate in a realistic and sober discussion of gold.

As Piepenburg reminds, the outsized risks in credit and equity markets (from scary “private credit pools” and “low-yield” junk bonds to dangerously narrow/tech-meme-driven stock indexes) can no longer be relegated to the cynicism of “gold bug” thinking, as even the finest minds in the stock and bond markets are drawing the same clear conclusions.

Piepenburg makes an equally blunt case for the risks facing paper money in a global backdrop of open currency debasement. He shares his views on how even the “smartest money” in the room continues to deny or avoid these realities by measuring their wealth in currencies (melting like ice cubes) and chasing yield in increasingly more dangerous corners of the credit and equity markets.

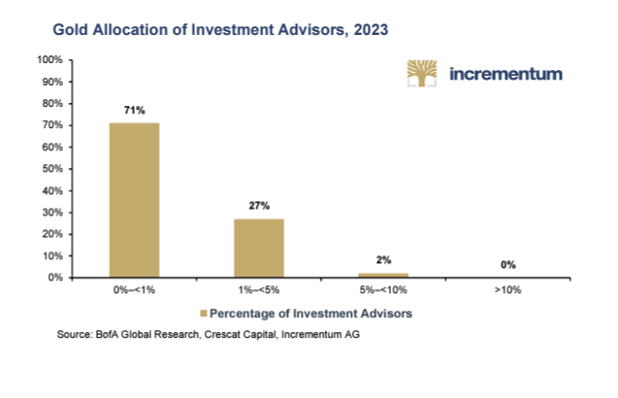

Toward this end, Piepenburg gives his views on family office dynamics and allocations derived from direct managerial experience and a host of recent conversations around the world with many principals in this space. Their relatively low allocations to physical gold in a world otherwise replete with debt, risk-asset and currency risk is fascinating yet otherwise understandable given how fundamentally misunderstood gold remains as an asset class.

Piepenburg holds nothing back in explaining just how and why gold is in fact intentionally misunderstood by many of the most sophisticated investors.

Is the USD Really Too Big to Fail?

With the collapse of the Western financial and political systems now happening before our eyes, wealth preservation takes on a totally different meaning.

As political parties, currencies, stocks, bonds and other bubble assets fall, the indisputable winners will be gold and silver.

The world and in particular the West is now entering a period of political and social unrest that signifies the end of a major era.

It is the consequence of deficit spending, major debt expansion, currency debasement, inflation leading to political and economic turmoil and misery.

Politics in the West are already a total mess. Whatever party gets into power, the deficit spending will accelerate, probably exponentially. That is certain in the UK with the new Labour led government, in France with a motley coalition government and in the US where one candidate might end up in jail (or become president) and the other one is too senile to stand for election. In either case, the US will have an insoluble debt crisis.

What a mess!

Financial markets will, in coming months and years, reflect this mess.

Geopolitical risk is of course also significant. A major war is a big risk, even nuclear war. But leaders of China, Russia and the US are of course aware of the finality of nuclear war and only an “accident” is likely to start one. But there are so many new ways of modern warfare as drones become so much more sophisticated.

Even more effective are Cyberwars. China, Russia and the US all have the ability to immobilise computer, electronic and electrical systems to the extent that major parts of countries and even the world would be totally paralysed. In today’s sophisticated world, virtually nothing would function without computer systems – financial markets including banks, travel by any means, shipping, supply of goods including food, telecommunications, internet etc, etc.

It is quite frightening how in the last 50-60 years the world has become totally dependent on electrical and electronic systems without which we could quickly go back to the Stone Age.

WARS WITH STICKS AND STONES

As Einstein said:

Sadly, certain humans in power have an innate instinct to self-destruct so Einstein’s prediction is not so unrealistic.

Also, the world is now for the first time in history in possession of weapons such as cyber, drones and nuclear that can all virtually end life on earth.

POLITICAL TURMOIL

Anyone elected to President, Prime Minister or Chancellor in the West in the next few years is likely to at best stay in the position for a full term but more likely to be thrown out before that.

For example, the newly elected UK Prime Minister Keir Starmer won an overwhelming majority in parliament with only 33% of the vote. Even more remarkable is that 80% of all people eligible to vote did not support him.

Well, a day is a very long time in politics. Five years ago, Labour lost so big to the conservatives that no one thought that Labour would come back in the next decade or two.

The US will have a similar problem after the November election. As it looks now Trump will win although a lot can happen before then. But even if Trump wins, he will probably have a thin majority. So around half of the people will be against him. And if a Democrat would win (definitely Biden will not stand) the Trump supporters would never accept the result.

And in France Macron suffered a devastating defeat in the first round. Macron (on the tricycle below) is now a lame duck president. But he is still arrogantly behaving like the French Marshall Foch in the Battle of the Marne in WW I who famously said: “My centre is giving way, my right is retreating; situation excellent, I am attacking!” But Macron is certainly no Marshall Foch.

Still through skilful political manoeuvring, Macron might succeed in being part of a new coalition government with feeble support both from the right and the left.

So, the order in the caricature below from the first week has now reversed although Le Pen’s National Rally is the biggest party.

A WEEK IS A LONG TIME IN POLITICS

Yes, a week is a long time in politics as desperate leaders cling on to power. By the time France holds the presidential election, Le Pen now has a bigger chance of winning. But it is not unlikely that the coalition collapses long before then.

What is important to understand is that new governments are seldom voted in. Instead, it is the sitting government which is voted out. The Brits had had enough of the Conservatives, the French hate Macron, the Germans don’t respect Scholz and the US people are in the unenviable position to choose between two octogenarians (or a new democratic candidate), neither of which is respected by the rest of the world.

Historically these political upheavals always happen at the end of an era whether it was Rome, France, Ottoman or the British to mention a few.

Currently we are seeing the fall of the US empire which is financial rather than territorial. Most European governments are slaves or more appropriately lapdogs under the US might and follow virtually all US dictates whether they are financial like FATCA (Foreign Account Tax Compliance Act) or political like freezing and confiscating Russian assets.

But as the US lead debt bubble bursts, their financial and military superiority will rapidly evaporate.

WITHOUT WEALTH PRESERVATION THERE WILL BE WEALTH DESTRUCTION

For 25 years I have stood on a soap box, advising investors about the importance of wealth preservation in the form of physical gold. During that time, gold as a share of world financial assets has stayed at 0.5% in spite of the fact that gold has outperformed most asset classes including the S&P 500 with dividends reinvested.

Between 2000 and today, the S&P, including reinvested dividends, has returned 7.7% per annum whilst gold has returned 9.2% per year or 8X.

As the world approaches the end of an era, it is fascinating to watch the (un-)awareness among fellow investors.

Having recently spent a couple of days at a family office conference and given a speech on wealth preservation and gold, it is discouraging to observe the total lack of fear and or awareness of risk.

More wealth has been accumulated by the average investor than ever in history. Most investors believe that they are masters of the universe and that their investment trees grow to heaven.

For these investors wealth preservation means spreading risk between a number of investment classes such as stocks, bonds, private equity, property etc.

A typical spread for a Family office is: Stocks 32%, bonds 18%, private equity 18%, property 10%, cash 10%, hedge funds 6% plus a total of 3% in gold, precious metals, art, commodities and antiques.

It could be argued that up to 80% of the above asset classes are correlated since they are affected by credit expansion or money printing. Cash is also correlated as it declines in real terms (measured in gold), the more money supply expands.

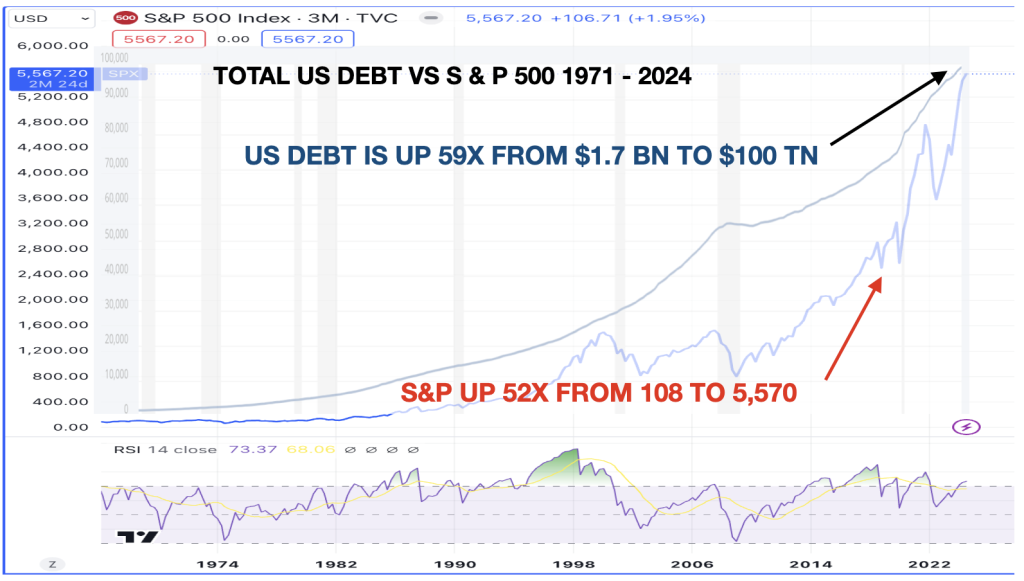

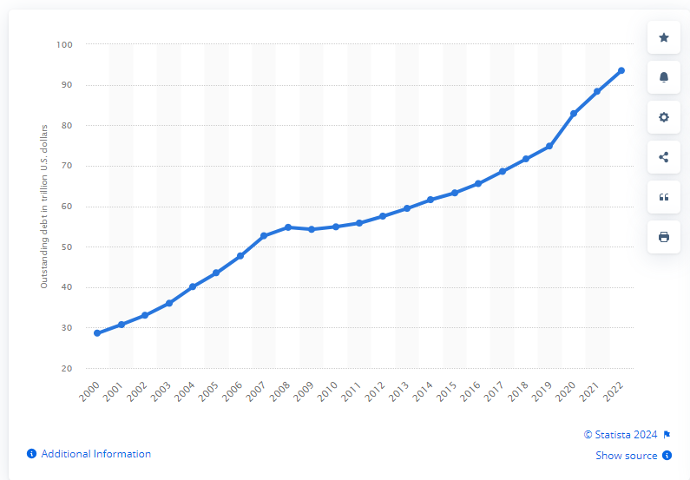

US DEBT UP 59X SINCE THE GOLD WINDOW WAS CLOSED

The graph below shows US total debt going from $1.7 billion in 1971 to $100 trillion today.

As the graph shows, the stock market needs a continuous injection of the debt drug to function and grow.

This is how US successive governments buy votes. Just expand credit to artificially inflate stocks. It is amazing how far you can get in a successful Ponzi scheme before investors discover that the whole market rests on quicksand. But it won’t be long now.

GOLD’S INEVITABLE RISE

A simple method for measuring the massive wealth destruction and transformation that especially the West will experience in coming years is the DOW – GOLD ratio.

Back in early 1980 this ratio reached 1 for 1. Thus, Gold was $850 and the Dow index 850. The long term trend line now targets a ratio of 0.5 for 1.

As the graph shows, that could be gold $10,000 Dow 5,000 or it could be gold $ 20,000 and Dow 10,000.

As we enter the golden era with BRICS countries increasing their purchases continuously and central banks selling US treasuries to buy gold.

No country and no central bank will in future hold dollars as a reserve asset.

Physical gold is the only proper reserve asset, just as it has been throughout history.

Also, the total of US held gold has on average been 40% of US treasuries outstanding.

Today it is only 7%.

If gold were to reach the average level it needs to be revalued 6x at least – a gold price of $16,000

And if gold were to reach the 1979 – 80 level of 140% gold need to be revalued 19x to over $40,000.

Silver could move twice as fast.

These are obviously not forecasts but the consequence of gold returning as a reserve asset and also to historical norms.

But investors should not focus on potential targets for gold or silver.

Instead, just think of gold as financial life insurance which just as throughout history will at least preserve investors’ assets but most probably also enhance them.

The only question is what percentage of financial assets to hold in gold.

In my view 20% is a minimum but bearing in mind the magnitude of the coming crisis, 50% or more might be the cheapest insurance that investors can buy.

Remember to only hold physical gold and silver stored in the most secure vaults and the safest jurisdictions.

Is the USD Really Too Big to Fail?

In this extensive interview with Adam Taggart of Thoughtful Money, VON GREYERZ partner, Matthew Piepenburg, addresses a wide range of market forces impacting investors in an almost surreal 2024 of rate tensions, credit vulnerabilities, currency (USD) shifts and geopolitical unknowns. The interview includes a “post-script” analysis of Piepenburg’s observations by two independent portfolio managers worthy of careful attention.

Piepenburg is concerned by an almost “over-confidence” in gold, which the cynical see as “gold-bug book-talking” rather than common sense conviction. That is, every vertical–from credit, equity, recession, inflation and historical indicators–all objectively and plainly point toward precious metals entering the early chapters of an historical reckoning and bull market. This is largely due to unprecedented debt levels which will require increasing currency debasement to monetize the same. In short, and for nations like the US (and its dollar): It’s inflate or die.

As for equity markets, Piepenburg is concerned by their narrow leadership and an S&P whose charts look dangerously familiar to prior bubble/burst cycles like the NASDAQ of 2000. Although he recognizes and addresses the case for further, blow-off, highs, he feels far more concern for mean-reversion risks which outweigh the potential rewards of near-term gains, all of which, if achieved, would only occur at the expense of the dollar’s inherent purchasing power.

Piepenburg is equally, if not more concerned, with the “blood sport” of the US bond market, from corporate to sovereign credits, none of which’s yields are beating actual rather than deliberately mis-reported inflation. The risks in private credit pools and private equity “valuations” are especially alarming yet dangerously overlooked by the majority of yield-desperate yet risk-blind investors. This is followed by a blunt discussion on inflation and recession realities which Main Street feels far more honestly than Wall Street “reports.”

Of course, the key risk is currency debasement, the evidence of which is everywhere but deliberately ignored by the consensus-think banking and portfolio advisory circles. Piepenburg and Taggart discuss the West’s denial of these open risks in contrast to the views Piepenburg has observed among Eastern investors. He sees de-dollarization not as a BRICS “Plan B” but a patiently practiced “Plan A” to slowly but steadily trade outside the USD and net-settle in gold. This is not fable but ignored fact, as clearly evidenced by Eastern central banks stacking physical gold and dumping USTs.

Piepenburg’s observations are subsequently (and independently) reviewed by the portfolio managers at New Harbor Financial for further perspective.

Is the USD Really Too Big to Fail?

I spend a lot of time tracking the ripple effects of embarrassing and unsustainable debt levels on our credit markets, rate markets, equity bubbles, inflation metrics and, of course, the daily-debasement of our currency’s inherent purchasing power.

Inevitably, I round that all up with the role precious metals play in insuring against the same.

But there’s more to debt than gold and other financial conversations.

We All Cherish Our Children’s Future

Global and national debt forces have a ripple effect on far more than portfolio returns; they affect our kids.

For anyone blessed to parent a child, there is no greater love, no greater joy nor any greater vulnerability and source for endless concern.

This is intuitive, axiomatic and universal. As John Kennedy said (hauntingly) just weeks before his own death in 1963:

“For, in the final analysis, our most basic link is that we all inhabit this small planet. We all breathe the same air. We all cherish our children’s future. And we are all mortal.”

But what does cherishing our children’s future have to do with the current state of the global and financial markets?

Invisible and Visible Forces

Love for family, friends and partners of all stripes (despite its painful lessons, mistakes and contradictions) is the most important yet invisible wealth. As Saint-Exupery’s Little Prince reminds, “the essential is invisible.”

But there are other invisible forces, from politics to inflation, which have a direct bearing on our collective well-being from one generation to the next.

And if we were to pause to reflect on the hard math of unprecedented debt, openly (criminally?) failed monetary policies and a US-lead global economy falling to its knees in deficits and the concomitant currency destruction which always follows, it would seem, at least at an “economic” level, that we and our leadership do not hold a very high regard for, well—our children…

Below, we soberly consider the evidence that the prior generations (including my own) seem to be collectively thinking more of themselves and less of the next generation.

Really?

Passing the Buck and the Bill

When a once-great nation like the U.S. reaches a debt-to-GDP ratio of 120%+, when its national balance sheet has trillions more in unfunded liabilities (210T) than it does assets, and when its own Congressional Budget Office confesses that its social security and Medicare budget will be tapped out by 2030 unless we print more money, we should be concerned about the reckoning—i.e., the bills to pay.

And when the holder of the world reserve currency runs an annual twin (budget and trade) deficit of $3T and counting, or mis-reports actual inflation to achieve a carefully hidden negative real return on its IOUs to inflate its way out of debt on the backs of the working poor, we should not only be concerned about the bills to pay (and who pays them), but also consider the neutered profile of the “bucks” used to pay them.

But perhaps such concerns feel less immediate to the Baby Boomer et al generation who, knowingly or unknowingly, can (via the help of an increasingly geriatric leadership) simply pass this embarrassing tab on to the next generation?

The Club Baller…

If I, for example, wanted to flaunt my status at the nearest “Popinjay Club” by arriving in the latest fashions and fastest car while indulging in the most elaborate and consistent dinner tabs, polo fees and trendiest wine selections, I suppose I’d have the right to spend as I please and flaunt my “success.”

After all, I am a capitalist, and like all capitalists, who doesn’t prefer first-class over economy seats?

But what if I lived this life for years, smiling through every chucker, wine bottle and sports car only to leave this world in my sleep at ripe ol’ age while leaving the entire invoice to my kids?

That is, what if I enjoyed it all, but then made them pay for it? What if I thrived so that they could suffer?

Seems insane, no? Diabolical? Selfish beyond belief? Absolutely grotesque at the micro level.

But here’s the rub: At the macro level, that is precisely what the older generation of American financial “leadership” is now doing to the younger generation.

The Past Thrives, The Future Suffers

As a nation, my generation has thrived–mostly on debt, extend-and-pretend monetary policies, grotesquely (debt-driven) inflated market bubbles, feudalistic rather than capitalistic wealth transfers, and entirely myopic politicos—so that our collective children will be stuck with the bill.

This is not fable but fact, this is not sensational, it’s merely historical.

And as every sober economist or thinker from David Hume, von Mises or even Reinhart and Rogoff to Mark Twain or Ernest Hemingway already knew: A nation which lives on debt for decades of joy leaves the next generation with decades of pain–all in the form of unsustainable expenses paid for with debased paper money.

Any who understand the fantasy of MMT, the open crimes of the US Fed and its various (direct and indirect) forms of “liquidity” (from QE and Operation Twist to the Reverse Repo Markets, Supplementary Leverage Ratios and the Treasury General Account) already knows: We are expanding our debt while weakening our dollar.

And that, folks, is a double whammy for our children and grandchildren.

Enjoying the Punch Bowl, Transferring the Hangover

How we got here is simple.

For generations, we as a nation have been getting drunk (and re-elected) on debt at levels far beyond our national income (as measured by tax receipts or GDP).

In short, prior generations enjoyed the Fed martinis (and even a Bernanke Noble Prize) while the next are left with the hangover and the tab.

And what does this “drunk phase” look like?

Well, drunk is fun, and it makes a nation appear all warm and happy and seemingly care-free. It also makes us a bit greedy, as we keep putting the drinks (fake liquidity) on a credit card whose pains and costs are less noticed so long as the punch bowl is constantly re-filled and the bill ignored.

To help this sink in, let’s add some data to the drama.

Data Point 1: Greed

As for greed, America in particular has had it in spades.

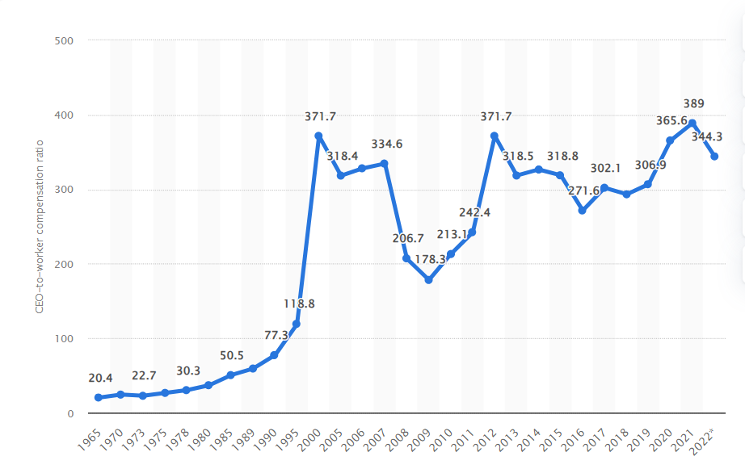

When my grandfather was an executive at Ford long before my birth, the aggregated CEO-to-worker compensation ratio for the largest publicly traded companies was 20-to-1.

Today (Statistica data below) that ratio has leapt to 340-to-1.

And in the case of those oh-so essential (Main-Street-destroying/Sherman and Clayton Act violating) executives at Amazon, the ratio is a staggering 6,474-to-1.

Again, I’m a capitalist, but such wealth inequality and c-suite greed are not the products of a fair playing field and an equal access to credit or genuine, capitalistic competition.

Instead, it’s an open symptom not only of individual psychopathy but of insider advantages based on credit and legal mechanizations that far more resembles a case of modern feudalism than traditional capitalism.

Scott Galloway described it as a generation focused on “increasing compensation while reducing accountability,” as the $34M annual salary of BOEING’s CEO, for example, makes comically apparent.

Data Point 2: Stock Markets

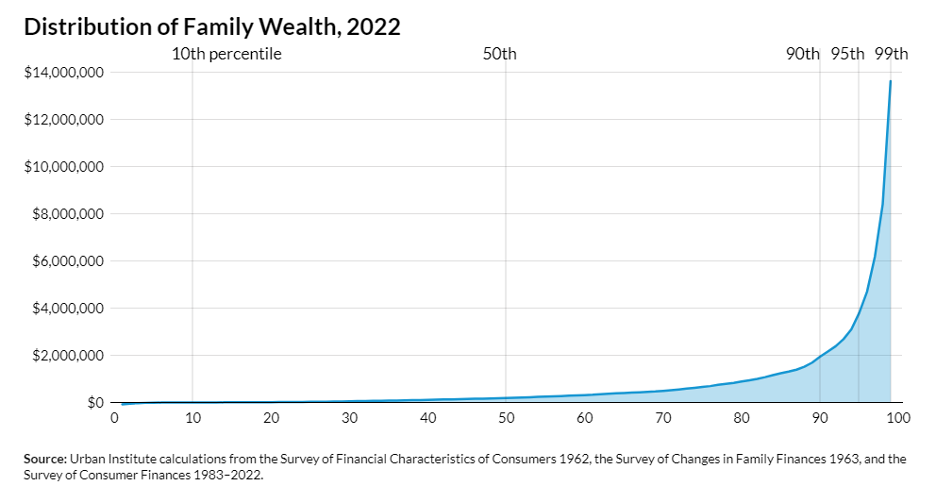

But let’s not forget the oh-so rigged playing field of the US stock market, of which 90% of its actual wealth belongs to the top 10% of the population, most of whom came of age in the aforementioned “greed” generation.

This wealth effect is largely due to a generation of Fed chairs who never let a market dip suffer too long before reflating the same with money literally created out of thin air.

I came of age when Greenspan sold his PhD to the highest bidders on Wall Street, sending rates to the floor and building a credit-driven tech bubble 1.0 which allowed my generation of young dragon-slayers the chance to buy Amazon, Apple and Netflix at single digit share prices.

By contrast, today’s market-tracking youth (the very few who can even afford to speculate after tech sirens) are chasing blow-off tops in a meme-familiar NVIDIA comedy.

Yesterday’s policies, from bank bailouts (Wall Street socialism) to the current (oxymoronic) narrative of “debt-based growth” ($35T and ticking), have led to the greatest wealth inequality and poorest “next gen” population in US history, yet Powell openly denies that the Fed has anything to with this.

Hmmm.

Data Point 3: The Cost of the American Dream

Unfortunately, our kids already feel what Powell’s demographic often ignores.

The last two U.S. generations, for example, are making less money on an inflation adjusted basis, while their cost of living, on everything from unaffordable housing to grotesquely rigged (debt enslaved) tuition goes higher.

My generation saw public university as an option, with an average admission rate of 27% and student debt at 31% of first-year incomes.

Today, however, those public education admission rates have sunk to 6% yet the debt percentage of first-year salaries has skyrocketed to 53%.

This objectively means that less and less young people can access and afford a real education, which Thomas Jefferson understood as the foundation to our nation’s future.

Sadly, most current 20-somethings can’t afford that future and have lost both hope and faith.

In my day, the average house price to first-year income was 4.4x, today it’s 8.5x.

For the first time in American history, 30-year-olds are not doing as well as their parents were at 30, which suggests that the social contract from one generation to the next is now officially broken.

But as Galloway also observes, the results of this broken contract are far more than economic.

He argues that the inequities (or national bar tab) passed to this generation are “incendiary,” creating a collective sense of undeserved “rage and shame” that finds its current, splintered and identity-obsessed expression in everything from MeToo, BLM and LBGTQ to the highest self-harm (especially among women), overdose, teen depression, gun death and suicide rates in our history.

The young are even having statistically more problems finding someone to sleep with, which stems more from depression, tech-induced isolationism and growing tribalism (self-censorship) than from natural biology…

In short, economics do impact society, and when those economics are characterized by the highest debt levels ever recorded in history, the consequences are not theoretical but appallingly real.

Data Point 4: Political Zombies

As for politics, it should be obvious that our so-called leadership is hardly representative of the coming generation, but an openly embarrassing (and power-holding) representation of their own generation (interests).

Galloway, who observed that “DC has become a crossroads between the land of the dead and the golden girls,” calls our top leadership options the “walking (or in Biden’s case, stumbling) dead,” as the following images remind (average age: 80.5)

This is not “agism” but power-ism, and though it is nice to see that senior poverty is down from 17% in the 70’s to less than 8% today, the fact that child poverty has risen to 19% in the same era should make even my generation pause.

But let’s not blame everything on the old faces…

The New “Success” Icons?

The few new faces of the latest generation to make “success headlines” and motivate today’s youth have more than just a little bit of a problem with being financial or social role models…

The damage that “success stories” like Adam Neuman or a socially-troubled Mark Zuckerberg have done to the coming generation are not to be missed.

That censoring and profoundly toxic “compare me” site otherwise known as Facebook, for example is, in my opinion, one of the worst things to infect our country since the 1916 Influenza.

The Wealth Transfer is a Debt Transfer

The foregoing and highly complex financial, political, social and generational concerns all stem from something as otherwise “academic” and straightforward as debt.

Prior generations have been gorging on it, and coming generations will be paying for it—not just in absolute or nominal terms, but far more invisibly yet insidiously in real, inflation-adjusted returns.

This is because central bankers will continue to steadily devalue the inherent purchasing power of their national currency with inevitably rising levels of mouse-clicked, fiat “money,” the ultimate (but largely invisible) insult to our children’s and grandchildren’s generation.

Since 1989, the 70+ group has expanded its share of national Household wealth by 58%, whereas the share of wealth held by those under 40 has fallen by 42% in the same period.

This is not by accident, but policy design. And it’s not because Americans don’t love their children, but because those making financial policy decisions just love themselves even more.

My kids often tell me they aren’t keeping up with dad when I was their age.

But unlike their dad, their generation was born with a politically-culpable debt canon ball chained to their ankles which was unlike anything my generation knew in our 20’s or 30’s.

Most of my children’s generation are working harder for less, and yet they somehow think it’s their fault.

It’s not.

The new generation inherited a $93T (public, household & corporate) debt nightmare and we gave it to them.

Is the USD Really Too Big to Fail?

At the end of a monetary era a number of dominoes will keep falling, initially gradually and then suddenly as Hemingway explained when asked how you go bankrupt.

Some of the important dominoes the world will see falling are: Political, Geopolitical, Currency, Debt and Investment Assets.

The consequences will be unthinkable – Social Unrest, War, Hyperinflation, Deflationary Implosion of Assets, Debt Defaults and much more.

But when things settle down, there will also be offsetting forces such as the emergence of powerful BRICS nations often backed by commodities.

Gold will play a major role during this process. Both central banks, sovereign wealth funds and investors will turn to gold as the most stable part of a crumbling system. This will lead to a fundamental revaluation of gold. As more gold cannot be produced, increased demand can only be satisfied by higher prices.

The likely result will be a revaluation of gold by multiples.

FALL OF THE LEADERSHIP DOMINO

Inept leaders and lack of statesmen are the typical prerequisites for these periods and thus one of the falling dominoes.

I have always argued that a country gets the leaders it deserves.

As we get to the end of one of the worst periods in history, both financially and morally, weak leadership exists in most major Western economies.

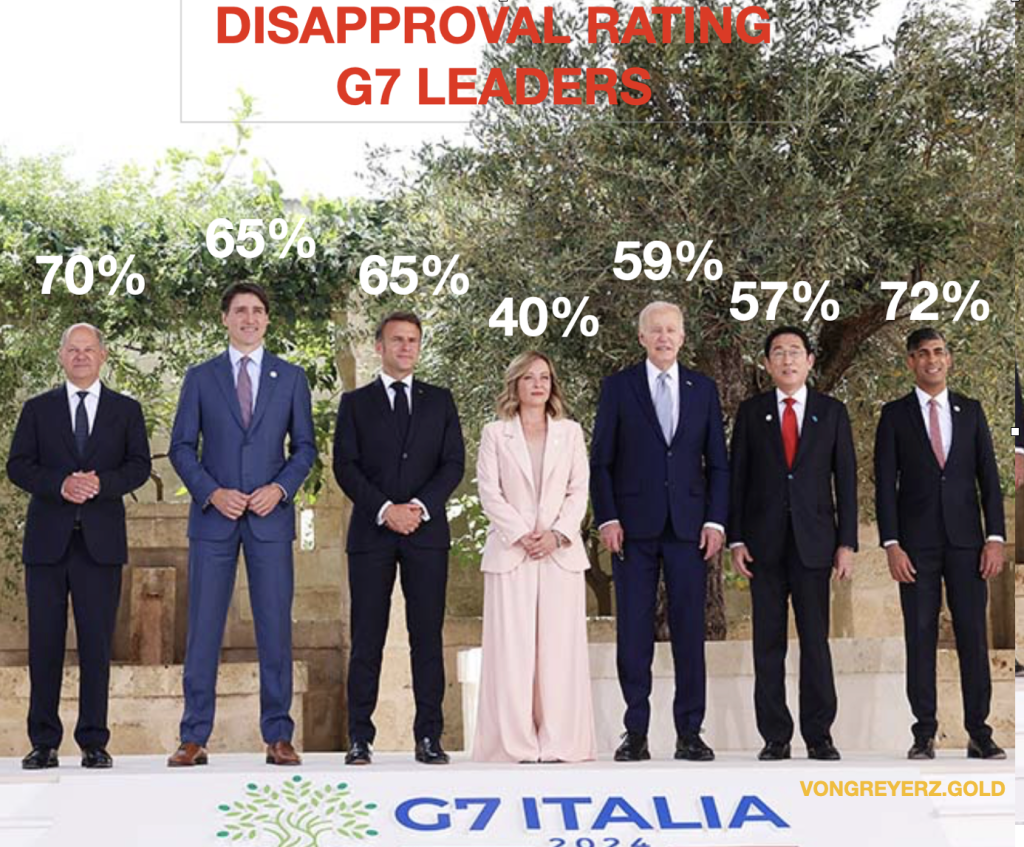

So, let’s look at the motley crew of world leaders and their unpopularity.

Political leaders will not only be thrown out at elections but also before their period is finished.

The recent European election is a typical example of a failed system. Most ruling parties are being rejected and in many cases parties on the right gain popularity.

Just look at the picture above from the recent G7 meeting in Italy. With the exception of Italy’s Meloni, the remaining G7 leaders have disapproval ratings of 57% to 72%.

With elections in the UK & France this year, the ruling parties are guaranteed to lose. The French Presidential election is not until 2027 so Macron could be a lame duck for 3 more years. The French people are unlikely to accept that and might force him out before then.

Whoever is elected in France, the powerful trade unions are likely to bring the country to a halt.

UK’s Sunak is one of Britain’s most ineffective leaders in history. But the new Labour Prime Minister, Kier Starmer was not even seen to stand a chance 2-3 years ago. He will not be voted in, but Sunak will be voted out by the people. Next will be a very dark period in UK history with high taxes, high debt, poor leadership and political instability and hard times.

The US situation today is even worse, with a president who seems incapable of taking any decisions. Instead, the US is led by an unelected and unaccountable group of neocons who tell the president what to say and what to do. But even that is difficult for Biden to execute. Just his recent appearance in Italy at the G7 meeting confirms that.

He can obviously not be blamed for being senile. But he should no longer have the ultimate power.

The US election is likely to be a disaster. Looking at the poor health of Biden, it is unlikely that he will stand for re-election in November. Kamala Harris will clearly not stand for election. It would not be surprising to see Hillary Clinton ushered in as the Democratic candidate. Although Trump is loved by around half of the people, he is hated by the other half and thus a very divisive choice. And a rerun of the Clinton – Trump election could easily lead to trouble or insurgence in the US whoever wins.

Germany’s Scholz’ coalition might not make it to the 2025 election due to its unpopularity and the decline of the German economy.

In summary, the political stage will be a total mess in coming years and lack of strong leadership will not only bring political unrest but also social unrest.

FALL OF THE CURRENCY & DEBT DOMINOES

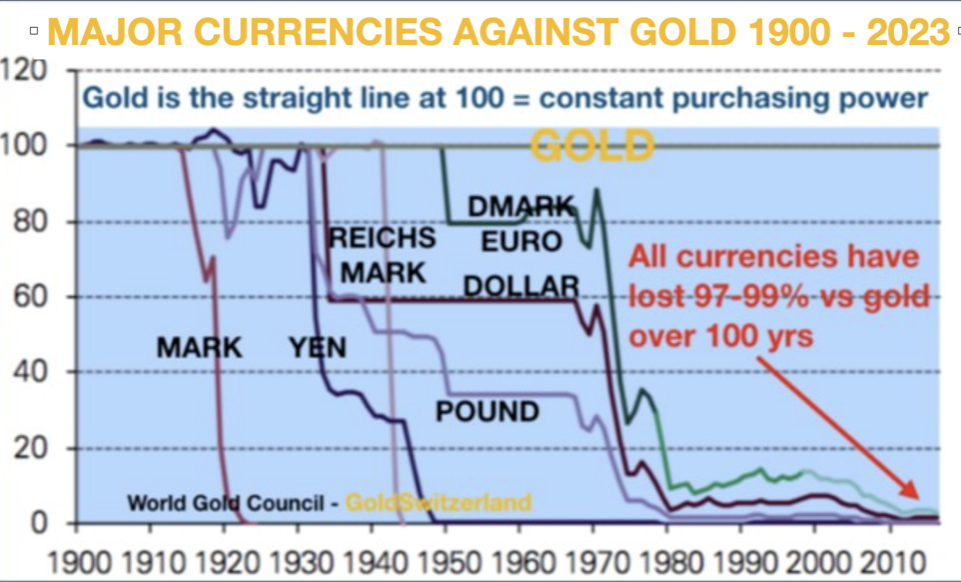

The currency domino has been falling ever since Nixon closed the gold window in 1971.

With high spending and deficits on top of Debt to GDP above 100% in many nations, the West in particular is facing a very dark period with galloping debt growth and collapsing currencies.

This will lead to debt defaults, bank defaults, more printing, higher interest rates and still higher deficits.

All currencies will accelerate their debasement process.

In such a scenario, there will be no winner. It is possible that the dollar due to demand will be slightly stronger than other Western currencies at least for a period.

But a temporary relative strength of the dollar should be totally ignored. There is no prize for coming 2nd or 3rd to the bottom. All currencies will lose dramatically in real terms which means against gold.

We must remember that we are now in the final collapse of the current monetary system. Since 1971 all currencies have lost 97-99% in real terms which means GOLD!

The final 1-3% fall (100% from now) will take place in the next 3-8 years. So, yet another currency system will be laid to rest.

This one lasted since 1913 so a bit over a century. Its demise was predestined the day it was born. It was only a matter of time. As always in history, the consequences will be much more far reaching than just the death of Money.

Debt and currency collapses happen hand in hand. They are partners in crime and are the inevitable consequence of sustained government deficit spending.

After a period of unlimited currency printing, the financial system will fail partly or totally.

Political and social unrest also follows, possibly civil war.

Governments under economic pressure normally start a war or escalate an existing one to divert the attention from domestic problems. A war is also a good excuse for printing more money.

FALL OF THE ASSET DOMINO

Initially there will be high inflation, possibly hyperinflation and high interest rates. Thereafter as the system implodes, inflated asset prices in stocks, bonds, property etc will crash by 50-100% in real terms.

Most sovereign bonds (if they are printed) will serve best as wallpaper.

I rate the chances of this chain of events taking place as very high, especially in the West.

Financial, economic, political and social collapses of this kind are nothing new as they have happened throughout history, albeit not on a scale of this magnitude.

FALL OF THE NUCLEAR WAR DOMINO

Will we have a nuclear war?

We obviously don’t need to worry about this option since if we have a global nuclear war, there will be very few, if any, people left on earth.

As the world potentially moves as close to a nuclear war as it can without starting one, we must ask ourselves, WHO IS RUNNING THE WORLD?

Well, no one individual of course. But the US leadership is probably the main contender when it comes to dictating, at their whim, to any country in the world.

This can be starting wars in a country which is no threat to the US. It can be controlling the global financial system through the dollar or regulating the banking system via edicts like FATCA requiring the world to report any dollar transaction to the US authorities. It can also involve coups in countries which the US leadership finds unacceptable or even eliminating enemies.

It can be sanctions or freezing of assets against countries whose actions the US leadership disapprove. The list is endless.

What is interesting is that the US people never has a say in any of these decisions. All the actions above and many more are taken by the US president and his advisors with zero accountability to the people.

None of that would be possible in for example Switzerland where people power rules through direct democracy.

What the world should ask itself is: How does it solve the extremely serious situation the world is in?

I am not talking about the Ukrainian war which, as Trump has indicated, could be stopped within a few days if the US stopped sending weapons and money to Ukraine.

Putin recently made it clear that what Russia wants is to keep the Russian speaking areas of Eastern Ukraine and no NATO membership for Ukraine. But no one is interested in exploring this.

Instead, there has just been a peace conference in Switzerland where neither Russia nor China was present. Such a conference is a total waste of time and money.

Without two of the mightiest military and economic powers on earth, one of which (Russia) is directly involved in the war, this conference will achieve absolutely nothing.

This is just posing for the cameras with a bland meaningless statement at the end.

So instead of these useless conferences, the leaders of China, Russia and the USA should get together to end the Ukraine war and then tackle the real problems facing the world like poverty, famine, crime, drugs, debt etc, etc.

Imagine what the combined brain power and resources of these countries could achieve assisted by many more nations.

But sadly, that is a dream that is unlikely to be realised.

Much easier to print money and start a war rather than to find REAL and sustainable solutions to the major global problems that the world is facing.

So, world leaders have a choice – pick up the phone and talk to your fellow leaders or start a war.

What sane leader would choose nuclear war before a small loss of ego and peace?

WEALTH PRESERVATION FOR FINANCIAL SURVIVAL

So, what can investors do to protect themselves?

Some DONT’S are obvious, like:

Don’t keep most of your wealth in a fragile banking system whether in cash or in securities –

With many banks likely to default, it might take too long before your assets are released, if ever!

Bail ins or forced investments are likely in government securities at low interest rates and for extended periods like 10 years or more.

Don’t hold sovereign bonds –

Many governments will default.

Don’t bet on inflation reducing your debt –

High interest rates or indexation of loans might make it impossible to repay borrowings.

Don’t forget that stocks have been inflated by massive credit expansion which will end.

The list of don’ts in the biggest global debt and asset bubble in history and is of course endless.

So, some DOs could be more useful –

Do hold a lot of physical gold and some physical silver in safe jurisdictions like Switzerland and possibly Singapore outside the banking systems –

Precious metals must be held in very safe non-bank vaults, in your name with direct access to the metals.

To minimise confiscation or freezing of your metals, best to keep them outside your country of residence.

Hold a meaningful amount of physical gold and silver –

Most of our clients who are HNW wealth preservation investors have more than 20% of their investment assets in gold and with a smaller percentage in silver due to its volatility.

Gold is up 9-10x in this century in most currencies, still.

THE REAL MOVE IN GOLD AND SILVER HASN’T STARTED YET

The move away from the dollar as the global trading currency is likely to accelerate over the next few years.

BRICS countries are whenever possible settling bilateral trading in their local currencies with gold as the ultimate settlement money. This will be a gradual move away from the dollar. At some point the move will accelerate as the need for trading via another nation’s currency will be seem superfluous, especially since final settlement can be in gold.

As I have made clear many times, the US confiscation of Russian assets will lead to central banks no longer holding dollar reserves but instead gold will be the only acceptable reserve asset.

The move by Central Banks to gold as a reserve asset will lead to a fundamental revaluation of gold over the next few years to a price which will be multiples of the current price.

The major increase in demand can only be satisfied by higher prices and not by more gold since the world cannot produce more than the current 3,000 tonnes p.a.

In my 55-year working life I have experienced 2 major bull markets in Gold.

The first one was from 1971 to 1980 with gold up 25X from $35 to $850.

The second one started in 2001 at $250 and has only started a move which will reach multiples of the current price.

But my 55 years of gold history is just over 1% of the long-term bull market in gold.

Since the emergence of the fiat money system, the gold bull market is sadly more a reflection of governments’ mismanagement of the economy leading to ever growing deficits and debts. In such a system, the price of gold mainly reflects the chronic debasement of paper money.

Governments and central banks are gold’s best friend.

They have without fail always destroyed the value of fiat money, by debasing the currency through deficit spending and debt creation.

For example, in the Roman Empire around 180 to 280 AD the Denarius Silver coin went from almost 100% silver content to 0%, replacing the silver with cheaper metals.

This obviously leads to the question, why should anyone hold fiat or paper money?

Well, in a sound economy with no deficits, virtually no inflation and a balanced government budget, holding cash that yields an interest return is absolutely fine.

But the world has not experienced such Shangri-La times since 1971 when Nixon closed the gold window.

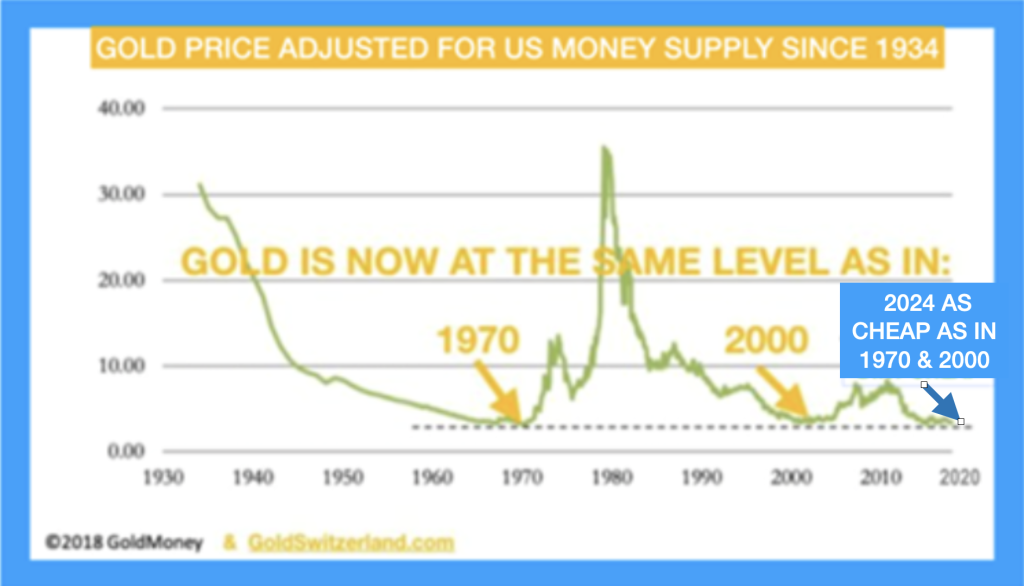

Still, even at $2,320 today, gold in relation to money supply is as cheap as in 1970 when it was $35 or in 2000 when the gold price was $300.

WEALTH PRESERVATION AND LIFE’S PRIORITIES

With the falling of the dominoes outlined above, most people in the world will experience a lot more hardship than currently.

For anyone with savings, whether it is $100 or $100 million, wealth preservation should be a top priority. Gold and some silver in physical form safely stored outside the banking system should be an absolute priority.

As we encounter difficult times, helping family and friends is more important than anything else. This will be extremely important in order to deal with the trials which we will all encounter.

And please don’t forget that in addition to family and friends, some of the best things in life are free such as nature, books, music and hobbies.

Is the USD Really Too Big to Fail?

VON GREYERZ partner, Matthew Piepenburg, joins Dunagun Kaiser of Liberty & Finance to discuss the clear and present dangers facing the US and global economy despite rising equity markets.

The conversation opens with the “embarrassing ice cube” of paper money losing purchasing power in the face of growing debt levels. Despite these objective realities, the majority still measure their wealth in a factually declining paper “asset/currency” in a dangerous group-think which ignores history (and a fiat crisis) occurring in real time. Piepenburg walks through the “backdoor” liquidity measures which artificially sustain markets near-term at the long-term expense of the currency whose inflationary realities are openly but legally misrepresented.

Inflation, in fact, is just theft by another name. Piepenburg unpacks this otherwise dramatic observation with sobering math and reveals the desperate tricks used by DC to mask this desperate practice of inflating away government debt via currency debasement on the backs of the citizens.

Debt and inflation are two obvious signals of currency debasement; of equal and rising importance is the equally ignored (or misunderstood) reality of de-dollarization as the BRICS+ nations continue their slow and steady policies to trade outside the USD. This has immediate and future implications on USD demand and hence USD strength. Piepenburg discusses the failed politics and failed messaging behind these otherwise open and obvious changes/trends, all of which point with common sense to the rise of real assets in general and precious metals in particular.

The conversation moves from the obvious importance of gold ownership as an antidote to the foregoing trends toward the more amorphous but undeniable important conversation of politics in general and the timeless importance of freedom in particular. Gold, privately owned/held, is one pathway to ensuring private freedoms despite the increasing declines of such freedoms, from lockdown memories to the future CBDC risks and current failures in the mainstream public and financial media.

Is the USD Really Too Big to Fail?

There is much legitimate (as well as dramatic) talk about the failing US, its debased currency and its identity-fractured, inflation-taxed middle class, which has been increasingly described more aptly as the working poor.

The End, or Just Change?

But is America coming to an end? Will the USD lose its world reserve currency status? Will the greenback disappear? Will gold or BTC save us from all that is breaking before our media-clouded eyes and increasingly centralized state?

Nope.

America is slipping, but not ending.

The USD is being repriced not replaced.

The greenback is still a key spending, liquidity and FX currency. But it’s no longer the premier savings asset or store of value.

Gold (now a Tier-1 asset btw…) will continue to store value (i.e., preserve wealth) better than any fiat money; and BTC will certainly make convexity headlines in the future.

And yes, we all know the Fourth Estate died long before Don Lemon or Chris Cuomo stained our screens or insulted our collective IQ.

And as for centralization, it’s not coming, but already here.

Be Prepared Rather than Emotional

So, yes there is tremendous reason for informed and genuine concern, but rather than wait for the end of the world, it would be far more effective to logically prepare for a changing world.

Rather than debate left or right, black or white, straight or trans, safe or effective, smart (Barrington Resolution) or stupid (Fauci), we’d likely serve our individual and collective minds far better by embracing the logical and tabling the emotional.

Toward that end, we’d be equally better off relying on our own judgement rather than that of the children making domestic, monetary or foreign policy decisions from DC to Belgium…

Logically speaking, the USD (and US of A) is changing.

Like its recent swath of weak leadership, the greenback and US IOU are quantifiably less loved, less trusted, less inherently strong and well…far less than they were at Bretton Woods circa 1944.

Change Is Obvious

Since our greatest generation stormed the beaches of Normandy in June of 44, we’ve gone from being the world’s leading creditor and manufacturer to the world’s greatest debtor and labor-off-shorer by June of 2024.

This is not fable but fact. A recent Normandy veteran admitted that he no longer recognizes the country he fought for—and that’s worth a pause rather than “patriotic” critique.

When the post-2001-WTO-daft policy makers weaponized what should have been a neutral world reserve currency in 2022 against a major nuclear power (i.e. stole $400B worth of Russian assets) already in economic bed with a China-driven and now growing BRICS coalition, the “payback” writing was on the wall for the greenback—as many of us understood from day-1 of the Putin of sanctions.

De-Dollarization Is a Reality, not a Headline

In short, many nations of the world, including the oil nations, quickly understood that the world wants a reserve asset that can’t be frozen/stolen at will and that simultaneously retains (rather than loses) its value.

But rather than end the USD as the world reserve currency, most of that world is simply going around (or outside of) it…

Or even more bluntly, the prior hegemony of the UST, and by extension, the USD, irrevocably changed in 2022.

Thank You Ronni & Luke

Thanks to data-focused and credit/currency-savvy thinkers like Ronnie Stoeferle and Luke Gromen, we can plainly see the facts rather than drama of these trends.

The actions rather than mere words of the BRICS+ nations and global central banks, who prefer to save in physical gold rather than US IOUs, speak loudly for themselves, which Stoeferle’s objective charts remind.

That is, since the US weaponized its Dollar, there has been an undeniable move away from the greenback and its UST in favor of gold as a reserve asset:

The COMEX et al…

The hard facts are in, and dozens of BRICS+ countries are trading outside the USD, purchasing in local currencies for local goods, and then net settling the surpluses in physical gold, which is far better/fairer priced in Shanghai than in London or New York, two critical exchanges that are seeing more physical deliveries out of their exchanges than in.

Immodestly, we saw this coming years ahead of the White House…

This means decades of artificially rigging precious metal pricing on legalized fraud platform like the COMEX are coming to a post-Basel III and post-sanction slow end.

This matters, because like it or not, the rising power of the BRICS+ nations, generationally tired of being the dog wagged by the USD’s inflation-exporting tail, are growing in economic power away from a debt-driven West, which again, the facts (global share of GDP) make clear rather than sensational.

The Chart of the Decade?

Ronni posted a similarly critical chart over a year ago, asking, somewhat rhetorically, if it was not the chart of the decade?

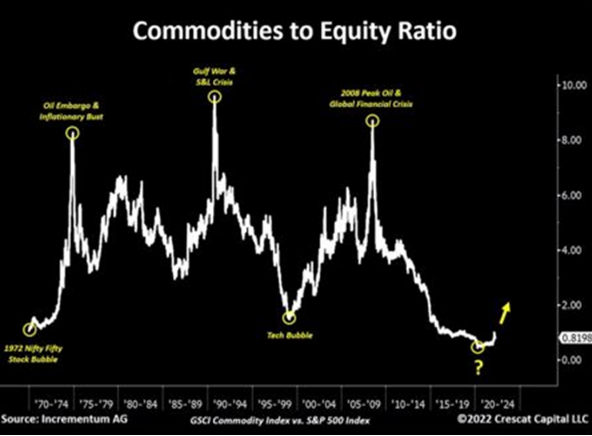

That is, he asked if the world is moving toward a commodity super-cycle wherein real assets begin their slow rise against falling (yet currently inflated) equity markets and a falling (yet increasingly debased) USD.

As Grant Williams, would say, this should make far-sighted investors all go hmmm.

Commodity Markets: Change is Gonna Come to the Petrodollar

And as for commodities, currencies and hence gold, the changes are all around us, at least for those with eyes to see and ears to hear.

Toward this end, we can’t ignore what has been happening in the global energy markets, topics which I’ve previously (and so-far, correctly) addressed here and here.

But when it comes to understanding oil, the USD and gold, Luke Gromen leads the way in clear thinking and has informed us as well as anyone.

He reminds, for example, that oil, like any other object of international supply and demand (i.e., trade), can be equally net-settled in gold rather than UST-linked petrodollars.

(In 2023, by the way, 20% of global oil sales were outside of the USD, a fact otherwise unthinkable until the Biden White House sanctioned Russia.)

The implications of this simple observation of (as well as its impact on) the USD, commodity pricing and gold are extraordinary.

Oil: The Recent Past, Prior to Sanctions…

Before the US weaponized its USD against Russia (and publicly insulted its key oil partner, Saudi Arabia), the world towed the line of both the UST and the USD-denominated oil trade, which was very, very, very convenient for Uncle Sam and his Modis Operandi of exporting US inflation to everyone else.

For example, in the past, when commodity prices got too high, nations like Saudi Arabia would absorb USTs and effectively go long the USD, which the US pumps out faster than the Saudis do oil…

This, of course, was good for stabilizing and absorbing an otherwise over-produced and debasement-vulnerable USD while simultaneously helping US government bonds stay loved and hence yields compressed/controlled.

In a way, this was even good for global growth, as it kept the USD stable and low enough for nations like China and other EM countries to grow.

These other nations, in turn, would keep buying the “risk-free-returning” UST’s and thus help refund (“reflate”) the US’s own debt-based “growth narrative.”

After all, if every one else is buying his IOUs, Uncle Sam can forever go deeper and deeper into debt-financing the American Dream, right?

Oil: Present Facts, Post the Sanctions…

Well, that is true only if you assume the world never changes, and that reported—i.e. utterly dishonest inflation makes our USTs truly “risk-free” rather than just returning negative real yields.

Fortunately (or unfortunately), the rest of the world is seeing the changes which DC pretends to hide.

Specifically, and as of November of last year, the Saudi’s met with a bunch of BRICS+ nations looking for ways around the USD and UST when it comes to trading among themselves—and this includes the oil trade.

Think about that for a second.

This means that what has been working in favor of the USD and sovereign bond market since the early 70’s (i.e., global demand for the USD via oil) is slowly (but surely) unwinding right before Biden’s barely open eyes…

All those decades of prior support/demand for USDs and USTs is going down not up, which means unloved UST’s will have to be supported by fake (i.e., inflationary) at-home liquidity rather than immortal foreign demand.

This, by the way, leads to currency debasement—the endgame of all debt-soaked nations.

Oil: The Changing Future, Post Sanctions…

It also means that commodities, from copper to yes, even oil, can and will continue to be purchased outside the Dollar and net settled in gold, which likely explains why central banks have been net stacking gold (top line) and net-dumping USTs (bottom line) since 2014…

Again, watch what the world is actually doing rather than what your politicos (or even bank wealth advisors) are telling you.

Gold & Oil: Impossible to Ignore?

As for gold and oil in the foregoing backdrop of a changing rather than static world, any sane investor has to give serious consideration to the changing petrodollar dynamics which Luke Gromen has been tracking with sober farsightedness.

The compressed but inevitably rising super cycle (Stoeferle chart above) in commodities this time around will differ markedly from past rallies.

As oil, for example, goes up (for any number of reasons), the old system that once recycled those costs in UST purchases can (and has) pivoted/changed to another asset.

You guessed it: GOLD.

Think it through: Russia can sell oil to China, Saudi Arabia can sell oil to China. But now in Yuan not USDs. These trading partners can then take their Yuan payments to buy Chinese “stuff” (once made in America…) and finally net settle any surpluses in gold rather than USTs.

That gold can then be converted into any EM/BRICS+ local currency (from rupees to reals) rather than Dollars to trade among themselves for other raw commodities, of which many BRICS+ nations are resource rich.

This, by the way, is not some distant possibility, but a current and ongoing reality. It can be devastating to USD demand and hence strength.

When copper and other commodities, including, oil starts repricing (and stockpiling) outside the USD with increasing frequency, the Dollar’s so-called “hegemony” becomes increasingly hard to believe, telegraph or sustain.