Search results

How Major World Events Drive Up the Gold Price

Gold has long been recognised as a “safe haven” asset, offering stability and security in times of uncertainty. Whether geopolitical tensions, economic crises, or natural disasters, gold p...

Eliza Bonecka / February 3, 2025

Read More

Why Gold Remains the World’s Most Trusted Asset

Gold has long captivated civilisations’ imaginations, symbolising wealth, power, and security. Over the centuries, it has proven to be much more than a precious metal; it is an enduring store of...

Eliza Bonecka / February 3, 2025

Read More

How Market Instability Boosts Demand for Physical Gold

Gold has been synonymous with wealth, security, and stability throughout history. When financial markets falter, currencies fluctuate, and geopolitical tensions rise, investors often turn to physical...

Eliza Bonecka / February 3, 2025

Read More

Gold: Solid Solution for Desperate Times

VON GREYERZ partner, Matthew Piepenburg, sits down with the TDLR’s David Lin at the recent VRIC event in Vancouver, Canada to make sense of the financial and geopolitical year ahead. Piepenburg explai...

Matthew Piepenburg / February 3, 2025

Watch Now

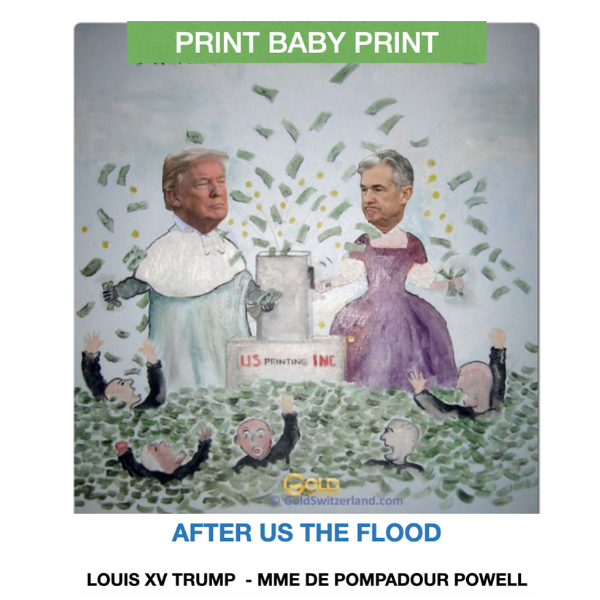

PRINT BABY PRINT (AFTER US THE FLOOD)

When all the euphoria about the election and the Executive Orders is gone, the annoying small problem of the $36 trillion US debt remains – a debt growing exponentially. And also a debt that Tru...

Egon von Greyerz / January 29, 2025

Read More

The New Wave of Investors Turning to Physical Gold

In a world dominated by digital assets, high-growth stocks, and innovative tech investments, gold might seem like an outdated choice. However, as millennials face increasing economic uncertainties, ri...

Eliza Bonecka / January 28, 2025

Read More

Why Physical Gold Thrives During Market Volatility

In times of economic uncertainty, when markets falter and currencies fluctuate, physical gold is a beacon of stability and security. Unlike paper assets prone to volatility, gold boasts a centuries-lo...

Eliza Bonecka / January 20, 2025

Read More

Gold In 2025: After The Rally Is Before The Rally

2024 was an eventful year in politics. Around half of the world’s population was called to the polls for presidential or parliamentary elections. For the first time in the history of Western democraci...

Ronnie Stoeferle / January 19, 2025

Read More

5 Key Benefits of Physical Gold vs. ETFs

When considering preserving your wealth in gold, you must first decide whether to opt for physical gold or Gold Exchange-Traded Funds (ETFs). While ETFs offer understandable convenience and accessibi...

Eliza Bonecka / January 17, 2025

Read More

Balancing Wealth Preservation and Growth: The Role of Physical Gold

Gold, a significant part of human history for thousands of years, is revered for its beauty, rarity, and enduring value. For modern investors, physical gold is a unique asset – unlike stocks or...

Eliza Bonecka / January 15, 2025

Read More

8 Reasons to Invest in Physical Gold in 2025

As we navigate an era of economic uncertainty and evolving financial systems, physical gold remains one of the most reliable and prudent investment choices. While other assets face fluctuating risks b...

Eliza Bonecka / January 14, 2025

Read More

Von Greyerz & Piepenburg: 2025 Looks Mighty Risky

In this opening Gold Matters discussion for 2025, VON GREYERZ principals, Egon von Greyerz and Matthew Piepenburg, address their major risk concerns for the year ahead, namely: market risk, political...

Egon von Greyerz / January 9, 2025

Watch Now