Why Wealth Managers Recommend Gold Allocation for Family Offices

Wealth management is more than just growing assets for family offices – it’s about long-term preservation, risk management, and intergenerational stability. In an era of economic uncertainty, inflationary pressures, and geopolitical turbulence, wealth managers increasingly advocate for gold allocation as a core component of a well-balanced portfolio.

Physical gold has historically served as a store of value, a hedge against systemic risk, and an asset that thrives in economic downturns. Unlike stocks, bonds, or real estate, it is free from counterparty risk and has stood the test of time as a reliable safe haven.

Gold is the ultimate wealth preservation tool

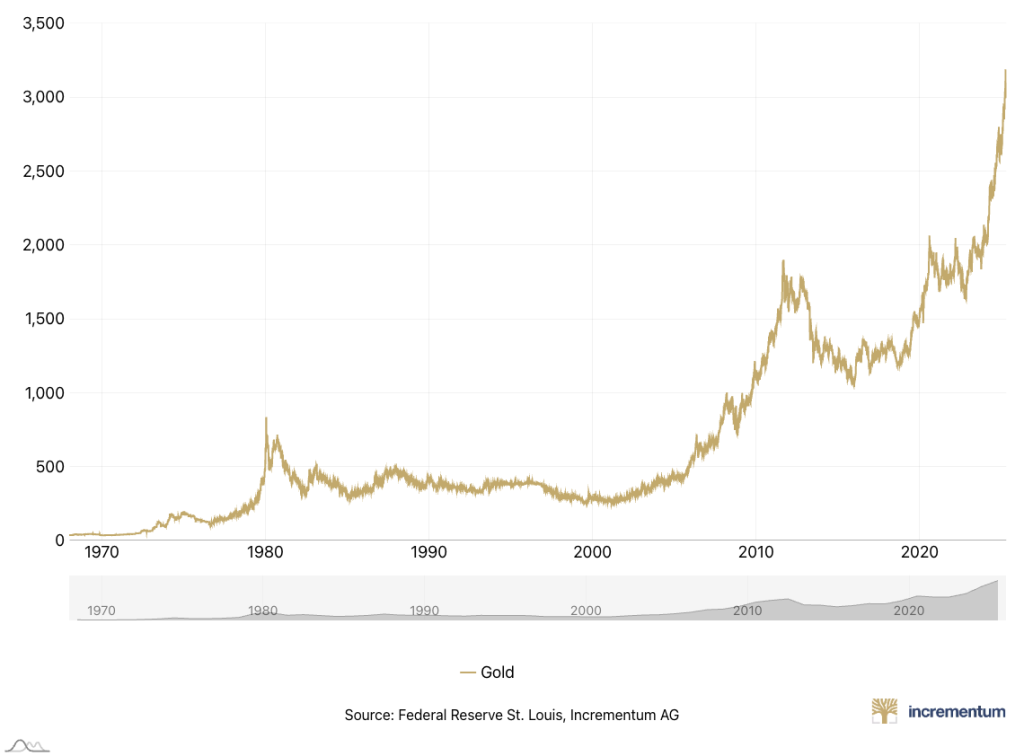

One of the biggest concerns for family offices is wealth erosion over generations. Traditional investment vehicles like equities and bonds are vulnerable to market cycles, central bank policies, and inflation. Gold, however, has maintained its value across centuries, making it a fundamental asset for multi-generational wealth protection.

Hedging against inflation & currency depreciation

Inflation erodes the purchasing power of cash and fixed-income investments, reducing actual returns. Over the last century, fiat currencies – including the US dollar, euro, and British pound – have depreciated significantly due to inflationary policies.

Gold, however, is a natural hedge against inflation because it maintains its intrinsic value. Historical data consistently shows that as inflation rises, so does gold’s price. Family offices with significant cash holdings or fixed-income assets can mitigate inflationary risk by allocating a percentage of their portfolio to physical gold stored safely outside the commercial banking system.

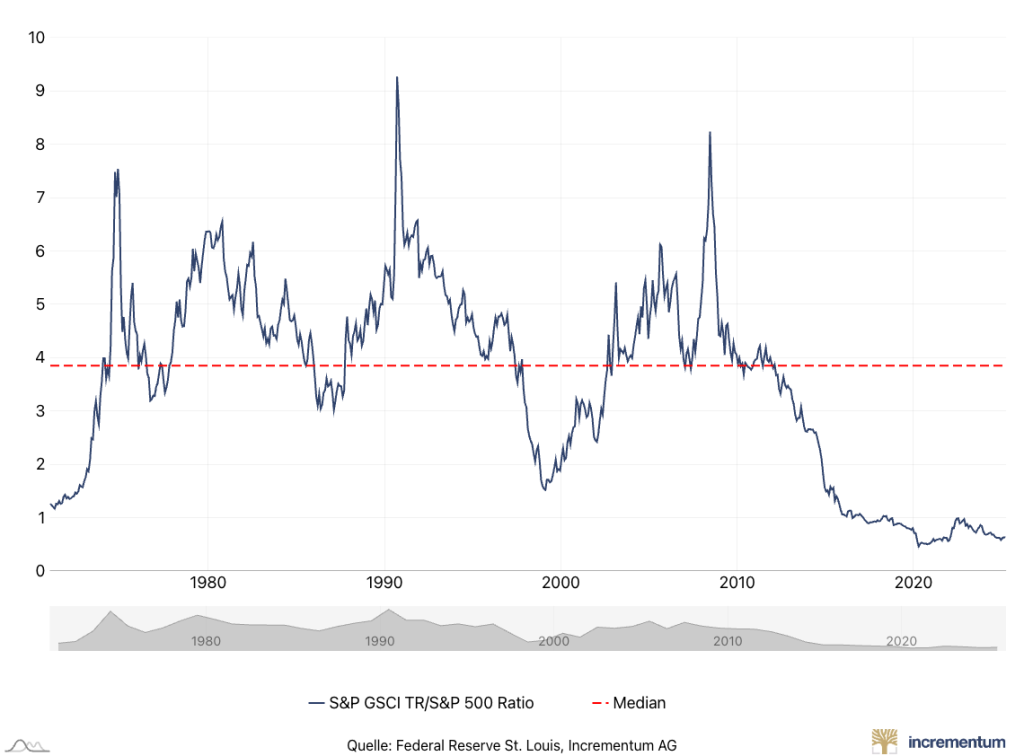

Reducing Portfolio Volatility and Systemic Risk

A well-diversified portfolio is crucial for long-term wealth management, and gold uniquely reduces overall risk. Unlike equities or bonds, gold has a low correlation to traditional asset classes, meaning it performs well during market downturns, i.e.:

- During the 2008 financial crisis, the S&P 500 lost over 50% of its value, while gold surged.

- In the COVID-19 market crash of 2020, global markets collapsed, but gold reached new all-time highs.

Protecting Against Geopolitical and Economic Uncertainty

Geopolitical instability is one of the greatest threats to wealth security. Wars, economic sanctions, trade conflicts, and political turmoil can severely impact global markets and currency values.

- Gold remains a neutral and universally recognised asset that is not tied to any single government or economy. During extreme instability, investors flock to gold as a safe haven, increasing its value.

- Gold offers protection that no other asset can provide for family offices managing wealth across multiple jurisdictions. It ensures that a portion of their wealth remains independent of political and economic risks.

Gold’s Liquidity and Global Acceptance

Gold is highly liquid, unlike real estate, private equity, or collectables, which can be challenging to sell in times of crisis. It is recognised and valued worldwide, making it an asset that can be converted into cash or traded anytime.

Gold is accepted in every financial market worldwide, while central banks, institutional investors, and governments hold gold as a strategic reserve. This precious metal also retains its value regardless of location or jurisdiction, giving family offices flexibility and financial security, with instant liquidity without being tied to volatile financial systems.

The Case for Direct Gold Ownership

While some investors turn to gold ETFs or mining stocks, wealth managers recommend physical gold to preserve wealth for generations.

Gold ETFs are paper-based and carry counterparty risks, making them vulnerable to financial crises; mining stocks are also tied to corporate performance and broader market fluctuations. On the other hand, physical gold ensures full ownership, free from third-party control.

Family offices often choose secure, insured, and audited vault storage solutions in jurisdictions like Switzerland and Singapore, ensuring that their gold is protected and accessible at all times.

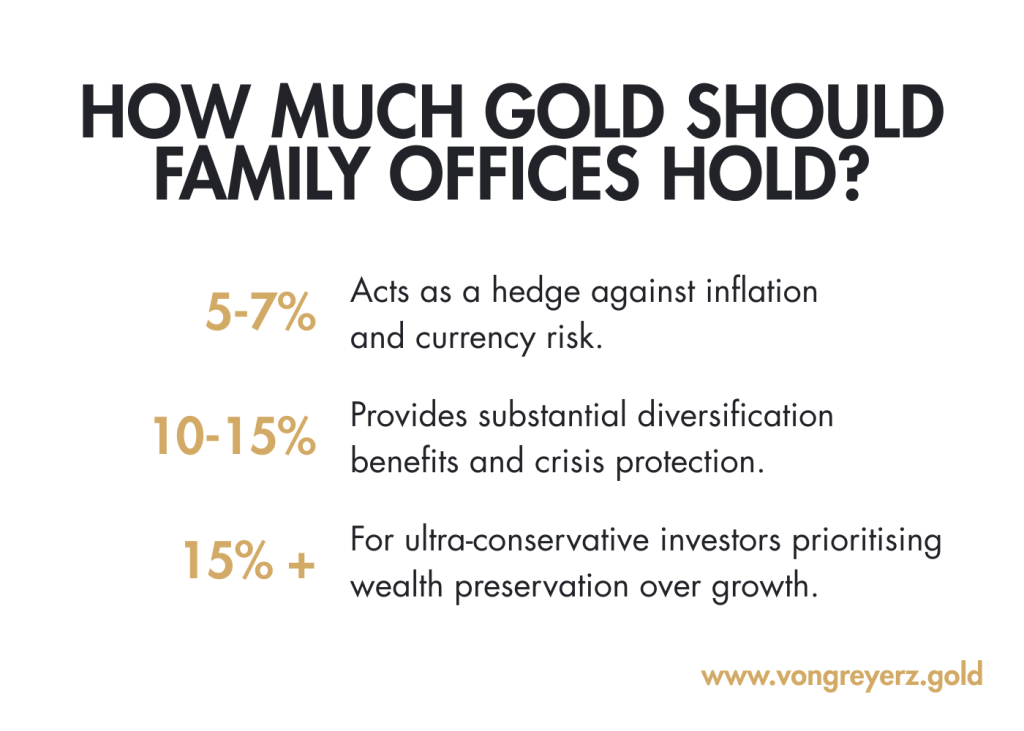

How Much Gold Should Family Offices Hold?

The optimal allocation of gold within a portfolio depends on risk tolerance, investment goals, and global market conditions. However, leading wealth managers typically recommend allocating between 5% and 15% of a portfolio to gold. This measured allocation ensures family offices benefit from gold’s stability while maintaining exposure to other high-growth assets.

For family offices managing significant wealth across generations, gold’s strategic allocation is not an optional investment – preserving your family’s wealth is necessary.

For family offices managing significant wealth across generations, gold’s strategic allocation is not an optional investment – preserving your family’s wealth is necessary.