Insights

Egon von Greyerz has built a global reputation as one of the leading voices of precious metal ownership as a critical wealth preservation asset. For decades, he has written and presented internationally on gold topics and themes.

Partner, Matthew Piepenburg, compliments this legacy via an extensive background in risk asset markets - the fractures, risks and signals of which greatly inform his own and shared conviction for precious metal ownership. Together, von Greyerz and Piepenburg are the co-authors of Gold Matters, Real Solutions to Surreal Risks.

UN MARCHÉ DE L’OR ÉPIQUE SUCCÉDERA À UNE BULLE BOURSIÈRE ÉPIQUE

La plupart des investisseurs sont davantage intéressés par la possibilité de s’enrichir que par la préservation de leur patrimoine. C’est pourquoi ils continuent d’investir dans le m...

Egon von Greyerz / February 10, 2021

Read More

THE BIG THEMES IN PRECIOUS METALS, THE BEST THINGS IN LIFE

Speaking recently with Palisades Gold Radio, Matterhorn Asset Management founder, Egon von Greyerz, addresses an array of pertinent questions concerning the gold & silver markets in these extraord...

Egon von Greyerz / February 9, 2021

Read More

ENDING TOXIC RELATIONSHIPS, RETURNING TO GOLD

Breaking Up is Hard to Do - In markets, as in love, it’s obviously hard to let go of something familiar yet clearly not working; but as all sober romantics eventually discover: Toxic relationsh...

Matthew Piepenburg / February 8, 2021

Read More

THE GREAT INFLATION DEBATE & PRECIOUS METAL PRICE DISTORTION

In this 17-minute MAMChat, Matterhorn principals Egon von Greyerz and Matthew Piepenburg discuss the “great inflation debate” and the ongoing as well as open secret of price manipulation in the paper...

Egon von Greyerz / February 5, 2021

Read More

MONUMENTALER AKTIENBLASE FOLGT MONUMENTALER GOLDMARKT

Die meisten Investoren sind eher am Reichwerden interessiert als am Vermögensschutz. Deswegen werden sie auch nie aus dem Aktienmarkt aussteigen. Da der Dow in den letzten 50 Jahren um das 30-fache ge...

Egon von Greyerz / February 5, 2021

Read More

MAX KEISER & EGON VON GREYERZ DISCUSS DISHONEST MARKETS

Matterhorn Asset Management founder, Egon von Greyerz, discusses the impossibility of fair pricing in a distorted precious metals market with Max Keiser, of the Keiser Report.

Egon von Greyerz / February 4, 2021

Read More

Gold: Anklage und Verteidigung & Bitcoin

Die meisten Juristen eint die Fähigkeit, zwei Seiten eines Falls in Betracht zu ziehen, ungeachtet der ersten persönlichen Einschätzung.

Matthew Piepenburg / February 3, 2021

Read More

PAPER SILVER IS TOXIC & PHYSICAL SILVER THE INVESTMENT OF THE DECADE

“All things are poison and nothing is without poison; only the dose makes a thing not poison”. These words were expressed by the famous Swiss physician and scientist Paracelsus in the 16th century.

Egon von Greyerz / February 2, 2021

Read More

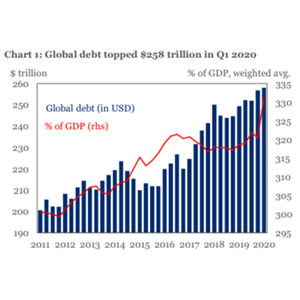

THE PHILOSOPHY OF DEBT, THE MATH OF PRECIOUS METALS

Market insights often come from unexpected sources. One of Harvard’s most beloved and popular professors, for example, was not an economist, but the brilliant (and thus controversial) campus philosoph...

Matthew Piepenburg / January 29, 2021

Read More

EPIC GOLD MARKET TO FOLLOW EPIC STOCK MARKET BUBBLE

Most investors are more interested in getting richer than preserving wealth. This is why they will never exit the stock market. As the Dow up 39x in the last 50 years this has been the right strategy....

Egon von Greyerz / January 27, 2021

Read More

GOLD’S PROSECUTORS, DEFENDERS & BITCOIN

Most law graduates share a capacity to argue two-sides of any case, regardless of their own primary conviction. When it comes to gold, my verdict as to its ultimate price direction (upwards) and its h...

Matthew Piepenburg / January 25, 2021

Read More

BIDEN WILL EXTINGUISH THE DOLLAR

If president Biden wants to save the US economy, his first measure should not be to print $trillions of worthless new money but instead tell his secretary of the treasury Janet Yellen to withdraw all...

Egon von Greyerz / January 20, 2021

Read More