Insights

Egon von Greyerz has built a global reputation as one of the leading voices of precious metal ownership as a critical wealth preservation asset. For decades, he has written and presented internationally on gold topics and themes.

Partner, Matthew Piepenburg, compliments this legacy via an extensive background in risk asset markets - the fractures, risks and signals of which greatly inform his own and shared conviction for precious metal ownership. Together, von Greyerz and Piepenburg are the co-authors of Gold Matters, Real Solutions to Surreal Risks.

A GOLDEN INDICATOR WORTH KNOWING

In this 16-minnute MAMChat, MAM executives Egon von Greyerz and Matthew Piepenburg discuss the critical relationship between rising gold prices and negative real ( inflation-adjusted) yields. Througho...

Egon von Greyerz / February 26, 2021

Watch Now

TOXISCHE BEZIEHUNGEN BEENDEN, ZURÜCK ZUM GOLD

Hier nehmen sich Märkte und Liebe nicht viel: Warum fällt es so schwer, Bekanntes hinter sich zu lassen, wenn es doch eindeutig nicht funktioniert?

Matthew Piepenburg / February 24, 2021

Read More

SISYPHEAN PRINTING WILL KILL DOLLAR & BONDS

Understanding four critical but simple puzzle pieces is all investors will need to take the flood that leads to fortune. Why then will the majority of investors still take the wrong current and lose t...

Egon von Greyerz / February 24, 2021

Read More

L’ARGENT PAPIER EST TOXIQUE, L’ARGENT PHYSIQUE EST L’INVESTISSEMENT DE LA DÉCENNIE

“Tout est poison et rien n’est sans poison ; la dose seule fait que quelque chose n’est pas un poison”. Ces mots ont été prononcés par le célèbre médecin et scientifique suisse Paracelse a...

Egon von Greyerz / February 24, 2021

Read More

THE DEATH OF LOGIC

Just over four years ago, as Bitcoin was making its first big moves in both price and public perception, John Hussman of Hussman Investment Trust penned a lengthy as well as seminal report entitled, “...

Matthew Piepenburg / February 22, 2021

Read More

TOXISCHES PAPIERSILBER & PHYSISCHES SILBER = INVESTMENT DES JAHRZEHNTS

"Alle Dinge sind Gift, und nichts ist ohne Gift, allein die Dosis macht, dass ein Ding kein Gift ist." Diese Worte stammen vom berühmten Schweizer Arzt und Wissenschaftler Paracelsus, der im 16. Jahrh...

Egon von Greyerz / February 17, 2021

Read More

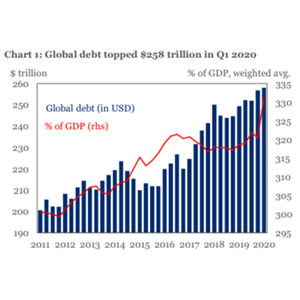

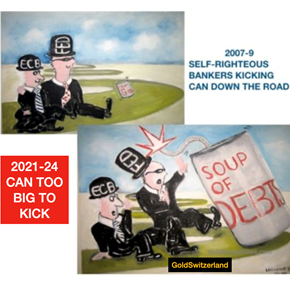

CALLING THE HOLDINGS OF CENTRAL BANKS “ASSETS” IS A TRAVESTY

Akhlys, the Greek goddess of Misery and Poison, is exerting a major influence on the world currently. And sadly the dosage of misery and poison will increase in coming months and years. What is now c...

Egon von Greyerz / February 17, 2021

Read More

SILBER ENGPÄSSE & PAPIERMARKT IGNORANZ

Kryptos sind in aller Munde, Edelmetalle scheinen aus der Mode. Welche Rolle spielt Elon Musk, der die letzte Kaufpanik bei BTC auslöste? Zumindest eine dubiose. Die Märkte sind in eine manische Phase...

Egon von Greyerz / February 17, 2021

Read More

CENTRAL BANKS–SILVER & GOLD’S BEST FRIEND

Matterhorn Asset Management founder, Egon von Greyerz, discusses the current and speculative nature of both Bitcoin and gold ETF’s, observing that neither asset is in fact a genuine store of value. Go...

Egon von Greyerz / February 16, 2021

Watch Now

PHILOSOPHIE DER SCHULDEN, EDELMETALL-MATHEMATIK

Oft sind es die unerwarteten Quellen, die uns Markteinblicke gewähren. Einer der populärsten, ja innig geliebten Harvard-Professoren war beispielsweise kein Ökonom, sondern der brillante (und somit a...

Matthew Piepenburg / February 14, 2021

Read More

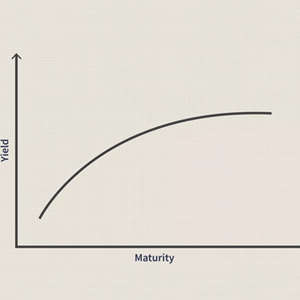

“CONTROLLED” YIELDS ARE CURVING TOWARD GOLD

Regardless of one’s politics, most would agree that extremely complex issues are typically given extremely misleading titles. Not all those of the extreme left, for example, are all that “woke” and no...

Matthew Piepenburg / February 12, 2021

Read More

FROM PITCH FORKS TO TRADING APPS: THE NATIVES ARE GETTING RESTLESS

Mark Twain once quipped that a lie can travel around the world faster than it takes the truth to put its boots on. But now the truth behind years and years of open lies masquerading as fiscal or monet...

Matthew Piepenburg / February 10, 2021

Read More