Why is Gold Not Rising?

Many are asking why gold is not rising, as just about every other commodity makes new highs in the backdrop of inflationary tailwinds.

That’s a very fair question.

Some are even saying gold is dead, a silly and “barbarous” old relic of ancient times, ancient math and ancient common sense.

Needless to say, we beg to differ, not because we are Swiss-based gold bugs, but simply…well… let’s explain.

Current Price vs. Current and Future Roles

For those who see history and math as guides rather than “barbarous” and outdated disciplines, their convictions regarding gold’s role, and even price trajectory, do not wane or rise simply due to the paper price of gold.

To some extent, and despite Basel 3, gold remains openly manipulated by a handful of central and bullion banks who are terrified of gold’s shine for no other reason than it embarrasses currencies (and mad monetary experiments) falling deeper into discredit.

But we track the movement of physical gold every day, and can say with blunt clarity that the paper trade in gold has zero to do with the those otherwise “barbarous” forces of the actual supply and demand of this precious metal.

Zero.

In short, the paper price of gold has become a fiction accepted as reality, which is not surprising in a financial landscape (i.e., historically over-valued stocks, negative yielding bonds and central bankers allergic to transparency) which defies every measure of honest price discovery or basic capitalism.

As for the never-ending gold vs. BTC debate, it would be wrong to say Bitcoin hasn’t taken (or continue to take) some market share away from gold, but at less than $1 trillion, BTC is not going to destroy gold’s $10T market share.

In short, the current gold price is a less important topic than its current and future role as historical insurance against mathematically-failing financial and economic systems around the globe.

That said, we are not apologists for the falling gold prices, nor do we doubt that by the end of this decade, gold will price well above $4000 per ounce and greatly reward informed investors playing the long game rather than putting green.

More on that later.

Gold’s Three Roles

For now, let’s consider gold’s historical role as a hedge against: 1) recession risk; 2) market volatility risk; and 3) inflation/currency risk.

- Recession Hedging

As for recessions, gold is like an emotional and mathematical barometer testing the temperature of over-heated monetary expansion.

As such, it moves higher even before policy makers add more inevitable “stimulus” (i.e., mouse-click fiat currencies) into the system.

By the time policy makers officially announce a recession, it’s far too late for most investors to react.

Fortunately, gold acts more quickly, anticipating monetary expansion even before the money printers start churning.

Long before the “COVID recession” of 2020, for example, the writing was already on the wall that markets and central bankers were getting desperate.

By late 2019, debt levels were off the charts, liquidity was drying up, the repo markets were drinking hundreds of billions of Fed dollars per month and an un-official QE to the tune of $60 billion per month was in full-swing.

Then came COVID in March. Markets and GDP were tanking and gold was already on course to see (in dollar terms) a 25% rise in 2020, after a 19% rise in 2019.

In short, as a recession hedge, gold was ahead of the central bankers in protecting investors.

By the way, the Fed’s record for calling recessions and warning investors is 0 for 10…

- Hedging Market Volatility

We all remember March of 2020, when markets puked and gold fell along with it, primarily sold-off as a liquidity source for players facing margin costs which they were forced to pay off with gold holdings.

As in 2008 and 2009, gold initially followed the stock ship below the waterline—though not nearly as far as BTC…

But as mentioned above, gold reacted quickly, anticipating the money printing (and hence dollar debasement) to come, rising steadily for the rest of that fiscal year.

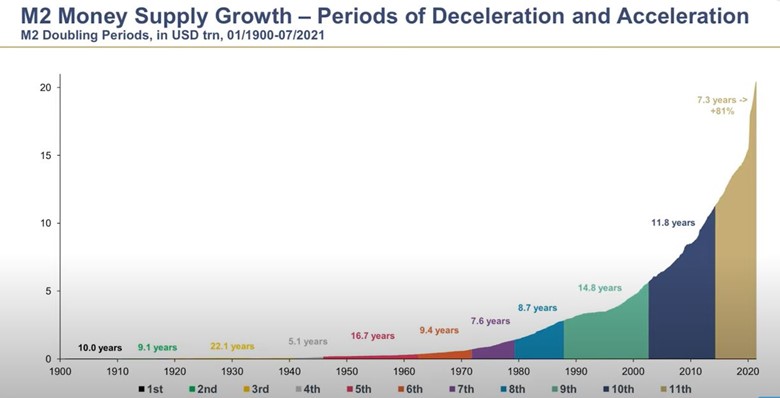

Of course, stocks rose as well, thanks to the unbelievable and historically unprecedented money creation witnessed in 2020—more QE in less than a year than all of the combined QE1-QE4 and “Operation Twist” which we saw from 2009-2015.

But thankfully, gold doesn’t just follow stock markets, it hedges them, as the past shows and the future will once again confirm.

Such monetary stimulus creates what von Mises would call a “crack-up boom,” and near-term such liquidity is just wonderful for stocks and bonds.

As we’ve written elsewhere, COVID—and the policy measures which followed– literally saved the securities bubble and made this “boom” even bigger.

But the “boom”-to-volatility to sequence to come from such risk assets reaching price levels which have absolutely nothing to do with valuation will be infinitely more painful (“crack-up”) down the road for those assets than for gold the moment when, not if, this horrific financial system implodes under its own and historically un-matched weight.

In short, gold will zig when the markets zag.

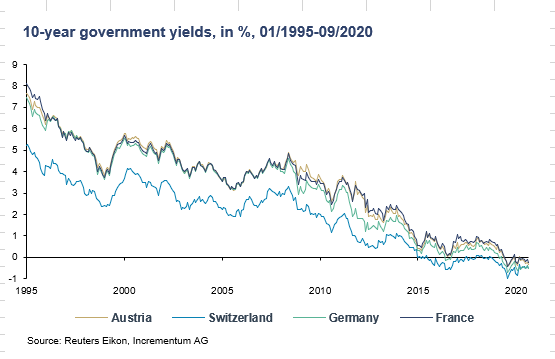

The anti-gold crowd, of course, will smirk and hug their bonds, reminding us all that gold is a yield-less relic while forgetting to confess that the “no yield” of gold is ironically preferrable to over $19 trillion worth of negative yielding sovereign bonds…

- Hedging Inflation & Currency Risk

Which brings us to the big question of the day, why is gold not rising when it should be ripping as a hedge against what is clearly an inflationary new normal?

Fair question.

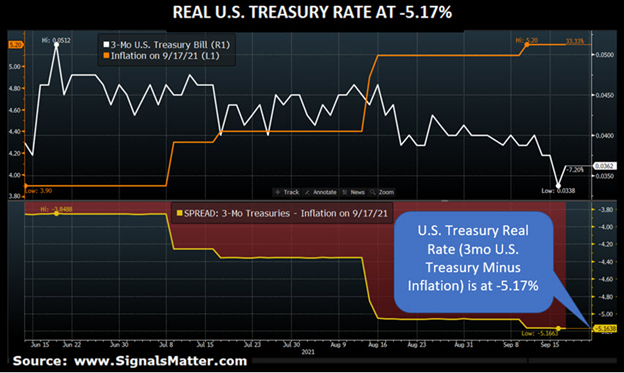

We are asking this ourselves, as real rates (the ideal setting for gold) fall deeper into negative depths with each new day…

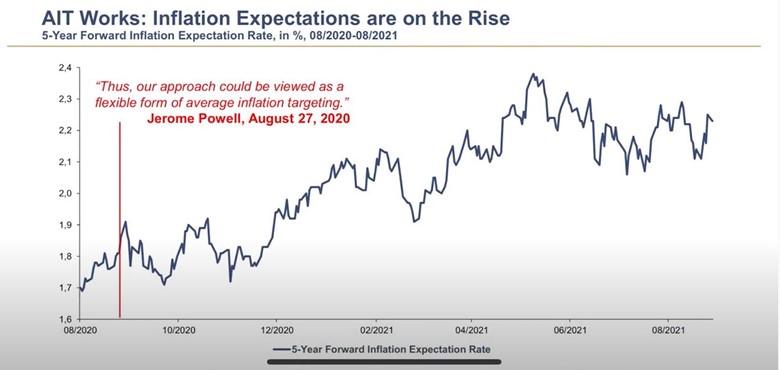

…as inflation, as well as inflation expectations, are on the objective rise:

Last year, for example, gold saw this inflation coming and thus its rising, double-digit price moves reflected the same.

But this year, with real rates still diving and inflation rising, gold is showing single single-digit losses rather than gains.

What gives?

A Key Reason Why Gold Is Not Rising: The Market Still Believes the “Transitory” Meme

Our ultimate opinion boils down to this: We think the market still believes the central bank myth (i.e., propaganda) that the current inflation is indeed, only “transitory.”

We’ve written ad nauseum as to why inflation is anything but “transitory,” yet we can nevertheless respect the deflationists’ argument.

The Deflationists

The deflation camp, for example, rightly argues that recessionary forces, if left alone, are inherently deflationist, and the signs of economic (rather than market) declines are everywhere.

But the key mistake which such deflation (or dis-inflation) narratives make is that these natural forces have not, nor will be, “left alone.”

In other words, deflationists are somehow ignoring the monetary and fiscal elephant in the room.

That is, more, not less, unnatural monetary and fiscal liquidity is entering the system at historically unprecedented levels, levels that are more than enough to quash such otherwise natural deflationary forces.

Stated even more plainly, moderation at the fiscal and monetary level died long ago.

Simple Realism—Inflation as Necessity Rather than Debate

Central banks are desperate to reach higher inflation to inflate their way out of debt without admitting the same.

This is nothing new for fork-tongued policy makers who once “targeted” 2% inflation as a ceiling, but are now effectively “allowing” 2% inflation as the new floor.

Just as Nixon said the closing of the gold window was “transitory” in 1971, or as Bernanke promised that QE would be transitory in 2009, the current lie from on high about “transitory inflation” is no less a lie in 2021 as those other lies were in 1971 or 2009.

Again, we all just kina know this, right?

Furthermore, we just need to be realists rather than dreamers to see the inflation reality now and ahead.

Central bankers, for example, may be dishonest, but they aren’t entirely stupid, just desperate and realistic.

In the U.S., for example, a staggering as well as openly embarrassing $28.5 trillion public (i.e., national) debt level quickly limits one’s options at the White House or the Eccles Building.

Not Many Options Other than Inflation

In this realistic light, let’s consider their options. Policy makers have four tools to address such debt, namely: raise taxes, cut spending, declare bankruptcy, or devalue their currencies through inflation.

The first two are already in play in the U.S., namely political efforts to raise taxes and ‘talk’ of cutting spending, both politically difficult options.

Taking bankruptcy off the table, leaves devaluing the U.S. Dollar as the favored option, which is achieved by deliberately taking real interest rates to extreme negative levels.

Allowing inflation to run while keeping rates low reduces the number of dollars needed to repay the debt.

This hurts regular folks, but as we’ve said so many times, the Fed is not interested in regular folks.

In other words, by decreasing the value of the U.S. Dollar, the U.S. is effectively paying off its current debt with devalued money. There are no permission slips needed from Congress, nor taxpayers.

Given such realism, let us be repeatedly blunt and clear: Unlike gold not rising, inflation is not, nor will it be, “transitory.”

Instead, deliberate inflation is an inherently and deliberately necessary tool used by the same anti-heroes who put us in this debt hole.

More Fed-Speak, Less Honesty

This means the Fed will come up with whatever excuses, words, phrases and lies to justify being more dovish despite publicly flirting with hawkish talk about a Fed taper.

Already, Powell is taking the Fed way beyond its mandate and talking about social and environmental activism, as these are nice phrases to justify, you guessed it: More money creation and more (not “transitory”) inflation.

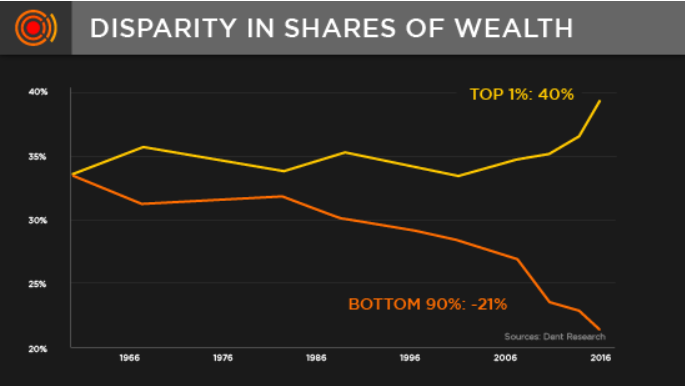

As for me, hearing Powell talk about “labor market inequality” after the Fed has spent years making the top 1% richer at the expense of an increasingly poorer bottom-90% is so rich in hypocrisy that it makes the eyes water.

In this opaque light, the notion of “Fed independence” is a complete and utter fiction.

Instead, the Fed is slowly crossing the line into becoming the direct financier to the entire nation—and the only way it can do this is via monetary expansion and deliberate (as well as much higher) inflation, which is a tax on the poor and bullet to the heart of the U.S. Dollar. Period. Full stop.

It’s All About Debt

Again, this all comes realistically back to debt.

When there’s too much unpayable debt (be it at the zombified corporate level or the embarrassed national level), rising rates becomes fatal.

The Fed has learned since 2018 that even a slight rise in rates kills the debt-saturated markets whose capital gains taxes are about all that Uncle Sam can declare as income in a nation whose GDP was sold to China years ago.

And yet… and yet… the markets somehow wish to believe the fantasy (and Fed-speak) that inflation is only “transitory.”

We strongly think differently.

What’s Ahead? When Will Gold Start Rising?

As blunt realists, we see the Fed perhaps raising rates nominally, but when adjusted by openly deliberate (yet openly denied) inflation, real rates will fall deeper as inflation rises higher.

This is because the simple reality (and choice) of nations with their backs against a debt wall is always the pursuit of inflation by design, not deflation.

As I recently wrote, nothing is real anymore, and all taboos are broken. The Fed, through QE and/or the Repurchase Program, will print more money as fiscal policy rises alongside—a veritable double-whammy for more “liquidity” to come.

This, of course, is crazy and ends badly.

The Fed, along with the White House, have tried since Greenspan to outlaw natural market forces and needed austerity in order to bloat markets, keep their jobs or win re-election.

Since we can never grow or default (?) our way out of the greatest debt hole in our history, the realistic playbook ahead is negative real rates—i.e., inflation rising higher and faster than repressed Treasury yields.

Once this becomes obvious rather than “debated,” gold will rise along side the money supply to levels well above it’s current, yet admittedly, low price.

Slowly, but surely, the $19 trillion in negative-yielding sovereign bonds will see outflows from that discredited asset and hence inflows into the “barbarous” asset: Gold.

For now, we are patient realists rather than apologists, as the market seemingly continues to price gold for only “transitory” inflation.

But once inflationary reality rises above the current “transitory” fantasy, gold will not only surge in price, but serve its far more important role of hedging against undeniable inflation and the equally undeniable (i.e., destructive) impact such inflation will have on global currencies in general and the U.S. Dollar in particular.

Gold: Biding Its Time

Despite such signposts from math, history and Real Politik, gold is currently under attack for not “doing enough.” Gold is rising, but it is not rising quickly enough in the world of insane returns.

Gold investors, however, are not greedy, they are patient, and they hold this physical rather than paper asset for the long game, as previously described.

And as for that long game, the inflation ahead, as well destruction of the currency in your pocket today and tomorrow, means today’s gold price is not nearly as relevant an issue as gold’s role in protecting far-sighted investors from what’s ahead.

In the end, gold’s primary role is acting as insurance for a global financial and currency system already burning to the ground.

But for those naturally asking about price, forecasting and models, as any who worked in a bank know, such models are as complex as they are useless.

We keep things simpler and humbler.

By just tracking monetary growth rates with certain regressions, a realistic price target for gold rising based upon inevitable monetary expansion suggests gold at well past $4000 by the end of this decade.

That may or may not seem sexy enough for those chasing returns today, but when those returns convert into losses too hard to imagine as markets reach new highs, we must genuinely remind you that even with Fed “support,” all bubbles do the same thing: “Pop.”

We are not here to tell you when, as no one can.

We are simply suggesting you prepare, rather than react.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD