Articles

“CONTROLLED” YIELDS ARE CURVING TOWARD GOLD

Regardless of one’s politics, most would agree that extremely complex issues are typically given extremely misleading titles. Not all those of the extreme left, for example, are all that “woke” and no...

Matthew Piepenburg / February 12, 2021

Read More

FROM PITCH FORKS TO TRADING APPS: THE NATIVES ARE GETTING RESTLESS

Mark Twain once quipped that a lie can travel around the world faster than it takes the truth to put its boots on. But now the truth behind years and years of open lies masquerading as fiscal or monet...

Matthew Piepenburg / February 10, 2021

Read More

UN MARCHÉ DE L’OR ÉPIQUE SUCCÉDERA À UNE BULLE BOURSIÈRE ÉPIQUE

La plupart des investisseurs sont davantage intéressés par la possibilité de s’enrichir que par la préservation de leur patrimoine. C’est pourquoi ils continuent d’investir dans le m...

Egon von Greyerz / February 10, 2021

Read More

ENDING TOXIC RELATIONSHIPS, RETURNING TO GOLD

Breaking Up is Hard to Do - In markets, as in love, it’s obviously hard to let go of something familiar yet clearly not working; but as all sober romantics eventually discover: Toxic relationsh...

Matthew Piepenburg / February 8, 2021

Read More

MONUMENTALER AKTIENBLASE FOLGT MONUMENTALER GOLDMARKT

Die meisten Investoren sind eher am Reichwerden interessiert als am Vermögensschutz. Deswegen werden sie auch nie aus dem Aktienmarkt aussteigen. Da der Dow in den letzten 50 Jahren um das 30-fache ge...

Egon von Greyerz / February 5, 2021

Read More

Gold: Anklage und Verteidigung & Bitcoin

Die meisten Juristen eint die Fähigkeit, zwei Seiten eines Falls in Betracht zu ziehen, ungeachtet der ersten persönlichen Einschätzung.

Matthew Piepenburg / February 3, 2021

Read More

THE PHILOSOPHY OF DEBT, THE MATH OF PRECIOUS METALS

Market insights often come from unexpected sources. One of Harvard’s most beloved and popular professors, for example, was not an economist, but the brilliant (and thus controversial) campus philosoph...

Matthew Piepenburg / January 29, 2021

Read More

GOLD’S PROSECUTORS, DEFENDERS & BITCOIN

Most law graduates share a capacity to argue two-sides of any case, regardless of their own primary conviction. When it comes to gold, my verdict as to its ultimate price direction (upwards) and its h...

Matthew Piepenburg / January 25, 2021

Read More

HISTORY REPEATING ITSELF

For anyone inside or outside of the U.S., it goes without saying that things are indeed heating up in the land of the free. President Trump faces an unprecedented second impeachment just days before...

Matthew Piepenburg / January 18, 2021

Read More

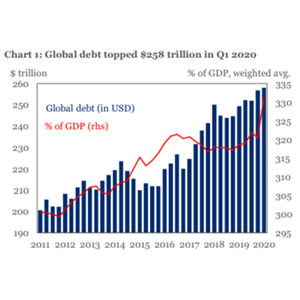

THE FACTS & NUMBERS OF 2020, THE GOLDEN FUTURE OF 2021

As we say goodbye to 2020 and look toward 2021, the key numbers on my screen and mind have nothing to do with dates yet everything to do with this: 14. 14 is the number of trillions by which the aggre...

Matthew Piepenburg / January 6, 2021

Read More

GOLD VS. TWILIGHT ZONES, PERFECT STORMS AND FAIRY TALES

It should and will come as no surprise that fundamentals like valuation basics and sane credit levels have left the building (and securities markets) for some time. Today, we literally invest (i.e. b...

Matthew Piepenburg / January 2, 2021

Read More

SMALL BUSINESS EXTINCTION, WALKING DEAD BONDS & GOLDEN SOLUTIONS

Regardless of one’s views as to the most realistic means of balancing human risk with economic risk, all would agree that COVID has both revealed and accelerated critical (and pre-existing) fissures i...

Matthew Piepenburg / December 23, 2020

Read More