Articles

Bond Destruction, Banking Waste and the Tilt Toward CBDC

In this extensive and now English-translated, interview with Jan Kneist of Investor Talk, Matterhorn Asset Management principal, Matthew Piepenburg, addresses the critical themes of the ongoing bankin...

Matthew Piepenburg / March 29, 2023

Watch Now

Je T’Accuse: To Bond Killers & Other Villains Destroying Our World

From bond markets to border wars, the world is openly and objectively tilting toward disaster. Many of us already know this, but what can be done? As I look back on just the latest and entirely predi...

Matthew Piepenburg / March 26, 2023

Read More

THIS IS IT! – THE FINANCIAL SYSTEM IS TERMINALLY BROKEN

Anyone who doesn’t see what it happening will soon lose a major part of their assets either through bank failure, currency debasement or the collapse of all bubble assets like stocks, property and bon...

Egon von Greyerz / March 19, 2023

Read More

Silicon Valley Bank Collapse: Just how safe is the banking system? Matthew Piepenburg shares his views.

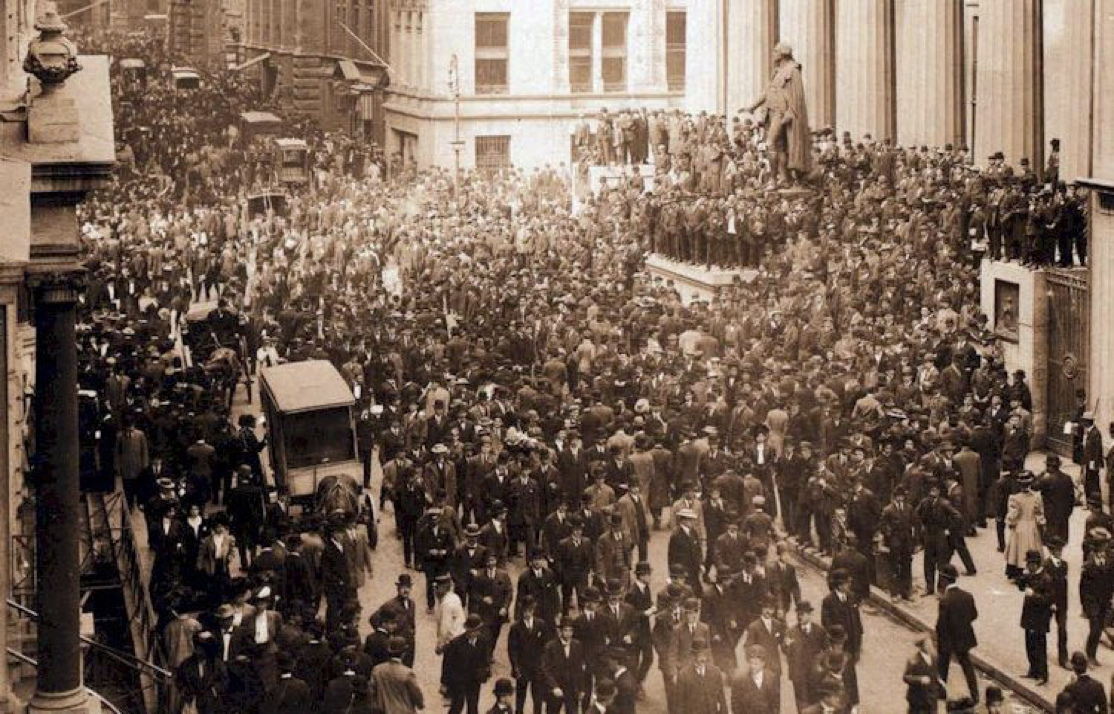

On Wednesday 8th March 2023, Silicon Valley Bank (SVB) announced a loss $1.8B from sale of investment securities. Investors and Depositors got spooked, withdrawing estimated $42B+ in cash within a f...

Matthew Piepenburg / March 15, 2023

Watch NowMaking Common, Golden Sense of the Next Senseless Bank Crisis

Two Failed Banks. The tech-friendly SVB story (i.e. FDIC shutdown) is actually preceded by another failed bank, namely the crypto-friendly Silvergate Capital. Corp, now heading into voluntary liquidat...

Matthew Piepenburg / March 13, 2023

Read More

California Dreaming – Staatsmetapher für eine Scheiternde Nation

Im Folgenden betrachten wir den US-Bundesstaat Kalifornien als Metapher für einen gescheiterten Staat aber auch als Metapher für das Scheitern des amerikanischen Staatenverbunds.

Matthew Piepenburg / March 10, 2023

Read More

California Dreaming—State Metaphor for a Failing Nation

We consider the State of California as the metaphor of a failed state as well as the failing state of the American Union, which is anything but a dream.

Matthew Piepenburg / March 8, 2023

Read More

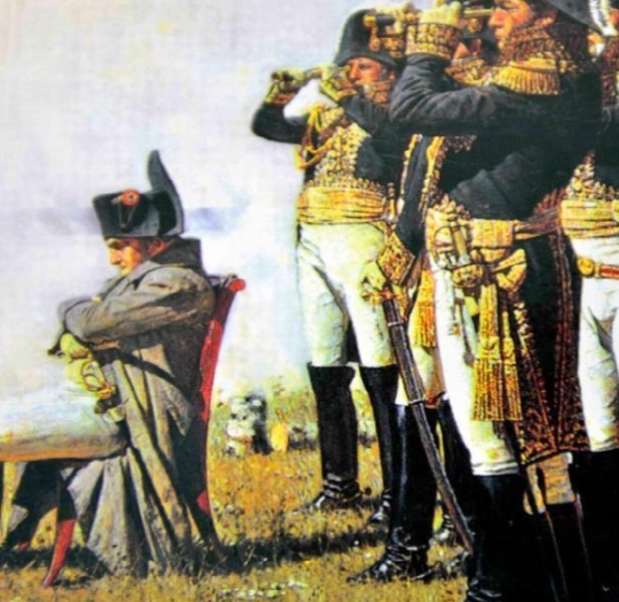

Powell’s Gettysburg Moment, the USD’s Waterloo & Today’s Open Madness

Regardless of what Powell says today, the real play is 3 to 4 moves ahead, which all point toward an inevitably weaker USD and thus an inevitably rising gold price. Powell, of course, is more politic...

Matthew Piepenburg / February 22, 2023

Read More

No Matter How You Turn It, The Global System is Already Doomed: Got Gold?

With inflation ripping and war blazing, many still argue that gold did not do enough. Hmmm… But gold in every currency but the USD (see above) would beg to differ. Furthermore, and as argued so man...

Matthew Piepenburg / February 8, 2023

Read More

Bonds Die, CPI’s Lie & Gold Rises

Most investors, sensing a recession, are doing what most investors typically do in bad times: Make bad choices. Key among these bad choices is the traditional flight to long-dated US Treasuries as a...

Matthew Piepenburg / February 1, 2023

Read More