AFTER SVB AND CREDIT SUISSE COLLAPSE, BAIL-INS NEXT

Timestamps:

0:00 Wealth Preservation Highlight

0:16 Introductions – Egon von Greyerz Background

3:15 ECB Rising Rates

5:20 High Inflation

9:12 The Looming Recession

15:26 Credit Suisse Collapse

22:00 Protecting Your Assets Now!

22:32 BRICS Gold-backed $

24:26 Dollars, Gold and Wealth Preservation

In this brief (33-minute), yet engaging, conversation with Silver Bullion TV, Matterhorn Asset Management Founder, Egon von Greyerz, addresses the importance of balance and meaning in a global financial backdrop increasingly absent of both.

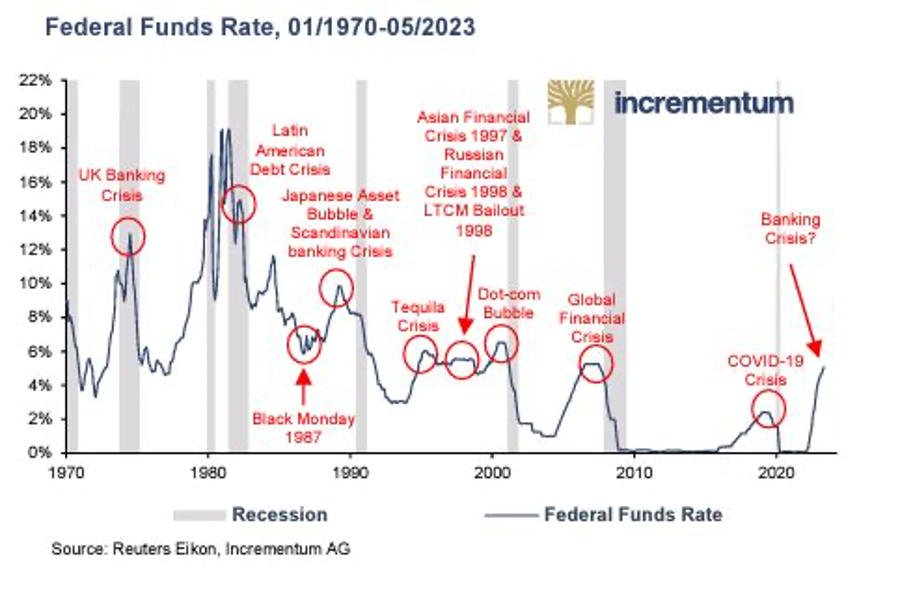

The conversation opens with the ECB’s latest rate hikes in its ever-comical dance to fight an inflationary tide which the central banks alone created. Von Greyerz addresses the fiction of “target 2%.” He sees rates (as well as energy pricing) going higher, which will ultimately add to the inflationary pressures. As rates (and hence the cost of debt) go higher, the need for more synthetic liquidity to cover that debt will end up being inflationary.

Of course, the impact of such poor policies (rising rates and inflation) will affect the man on the street the hardest. This is a gradual but real pain evident across Europe, which is simultaneously (and sadly) suffering from extremely poor leadership. Net result: Citizens will have to pay the recessionary Piper for the financial negligence of their policy makers.

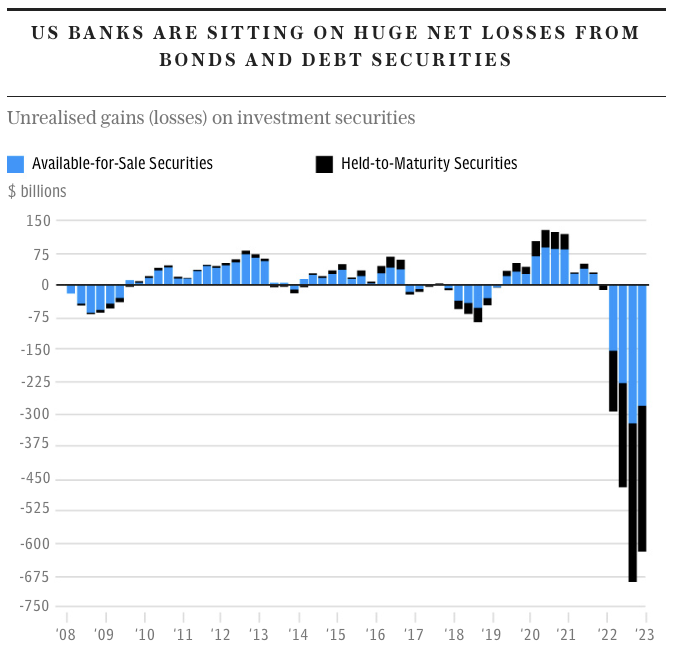

Von Greyerz confirms that banks and policy makers have very few tools left other than empty words to hide embarrassingly poor math, an undeniable embarrassment as evidenced by the recent implosion at Credit Suisse for massive leverage and poor loan underwriting. Unfortunately, such poor banking practices are hardly unique to Credit Suisse. The entire banking system, as argued herein and warned for years, is under extreme pressure. Bail-ins are very likely especially in the US but also in Europe.

As to de-dollarization and the recent headlines as to a gold-backed trading currency among the BRICS, von Greyerz sees the trend away from the USD but is not expecting any complex gold-backed currency in the near or even medium term. The case for gold, however, is rising among central bank reserves. Most importantly, such trends and signs make a far stronger case for informed investors to protect their wealth with physical gold rather than fiat dollars and increasingly unloved sovereign bonds.

As von Greyerz consistently reminds, gold as a wealth preservation asset has never been more important.

AFTER SVB AND CREDIT SUISSE COLLAPSE, BAIL-INS NEXT

“When elephants and central bankers (with wings) fly, don’t hold gold”

This is what Egon von Greyerz recommends in this 25 min. interview with Jan Kneist of Investor Talk.

Egon suggests that they will all fly when: “There are no deficits……, no inflation….., no debasement of currencies ….., strong statesmanship based on real values”!

All very unlikely in the foreseeable future according to Egon. Thus the case for gold and wealth preservation is stronger than ever.

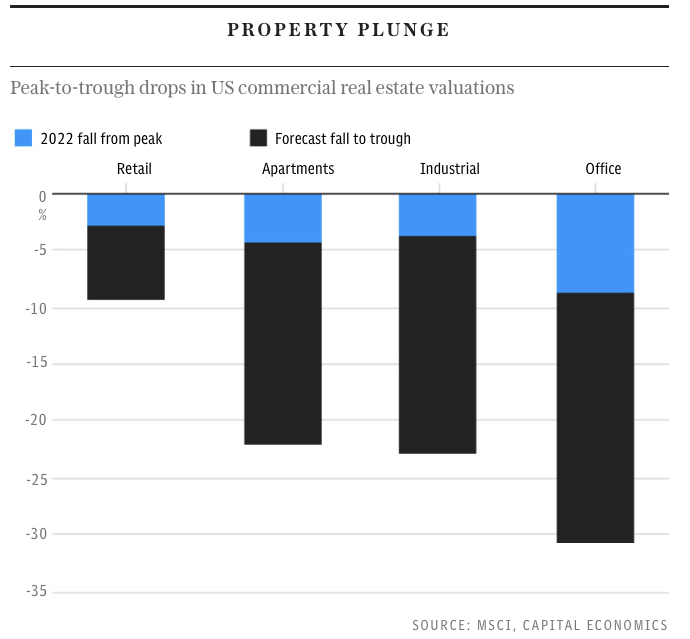

Jan and Egon also discuss increasing pressures on ordinary people with declining food sales in Germany and France due to price increases around 20% and the increasing in housing costs both in Europe and the US, leading to a major increase in evictions. The commercial property sector is also under tremendous pressure in Europe and the US due to higher rates and lower occupancy.

Also credit portfolios are deteriorating rapidly, with a high risk of the banking crisis, which started in mid March, resuming with a vengeance.

The BRICS meeting at the end of August in Johannesburg is much discussed in the media. Egon believes that it is premature to expect a gold backed BRICS currency at the August meeting. What is probable is that the commodity rich BRICS countries will no longer hold the dollar as a reserve asset but instead gold.

The consequences of these events make the case for physical gold as a reserve asset for investors self-evident.

Timestamps:

0:00 Introductions

0:55 Egon’s views on Crypto news

3:05 Inflation will remain high, forcing consumers to save

6:32 Housing and Property Cost increases, USA evictions exceeding pre-pandemic levels

10:20 Payroll employment – The US jobs market is still being equated with the strength of the US economy. a fake?

13:21 According to official figures, the USA has grown much faster than Europe since 2008

15:15 Are Banks Still in Shambles? The US banking crisis is far from over

18:43 A gold-backed BRICS currency is doubtful, the dollar nevertheless continues to lose

24:10 When should you NOT hold gold?

AFTER SVB AND CREDIT SUISSE COLLAPSE, BAIL-INS NEXT

Below we separate the hype from the sad reality of the USD in the face of a new “BRICS currency.”

Net conclusion: The real death of the USD will be domestic not foreign.

The Bell Has Been Tolling for Years

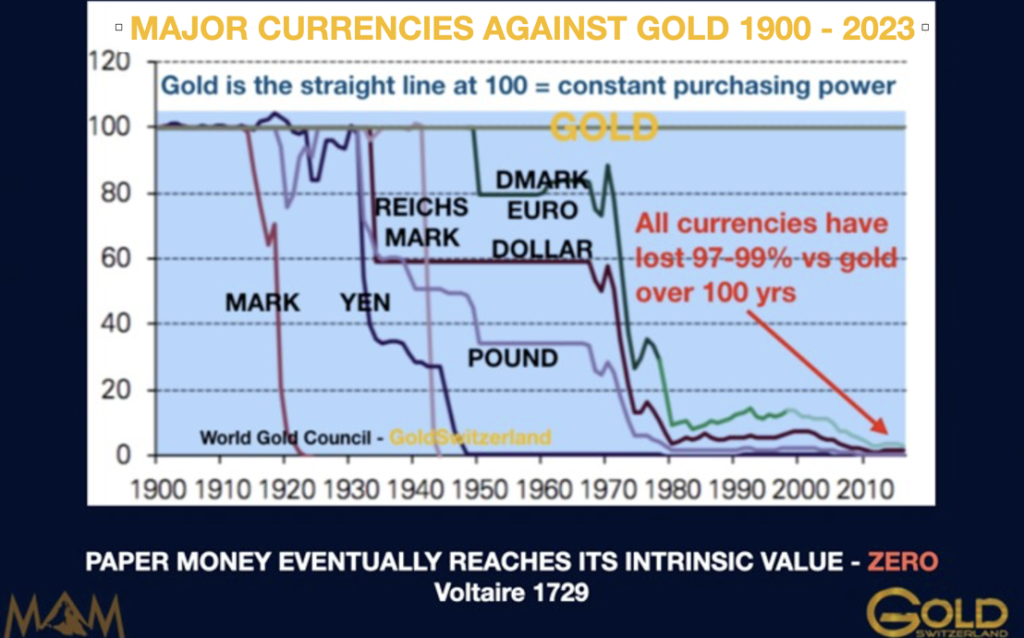

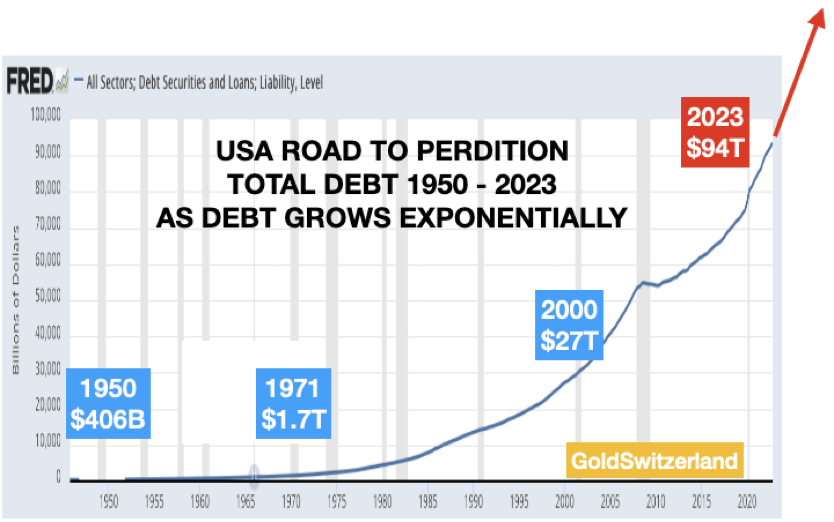

When it comes to the “bell tolling for fiat,” we can all hear its loud chimes, but that bell has been tolling since 1971 (or frankly 1968), when the US leadership decoupled the world reserve currency from its golden chaperone.

Like any teenager throwing a house party, the lack of a parental chaperone leads to lots of crazy events and lots of broken furniture.

The same is true of post-71 politicians and central bankers suddenly freed of a gold-backed chaperone and thus suddenly loaded with drunken power to mouse-click currencies and expand deficits.

And since then, all kinds of things have been breaking, from banks to bonds to currencies.

And now, with all the extreme hype (and, yes, some genuine reality) behind the headlines of a revolutionary gold-backed BRICS trade currency, many are making sensational claims that the World Reserve Currency (i.e., USD) is nearing its end and that fiat money from DC to Tokyo is effectively toast.

Hmmm…

Don’t Bury the Dollar Just Yet

Before we start tossing red roses over the shallow grave of an admittedly grotesque US Greenback in general, or fiat fantasy money in general, let’s all take a deep breath.

That is, let’s re-think through this inevitable funeral with a bit more, well, realism, mathematics and even geopolitical common sense before we turn our backs on the USD, and this is coming from an author who has never thought highly of that Dollar, be it fiat, politicized and now weaponized.

So, let’s take a deep breath and engage open, informed and critical minds when it comes to debating many of the still open, un-known and critical issues surrounding the so-called “game changer” event when the BRICS+ nations convene this August in S. Africa.

Needed Context for the “BRICS New Currency” Debate

As made clear literally from Day 1 of the Western sanctions against Putin, the West may have been aiming for Putin’s (or the Ruble’s) chest, but it then shot itself in the foot.

After decades of DC exporting USD inflation from Argentina to Moscow, a large swath of the developing countries of the world who owe greater than $14T in USD-denominated debt were already reeling under the pain of rate-hike gyrations which made their own debt and currency markets flip and flop like a dying fish on the dock.

Needless to say, a 500-basis-point spike in the cost of that debt under Powell didn’t help. In fact, it did little good (or goodwill) for USD friends and enemies alike, from the gilt markets in London to the fruit markets in Santiago.

Adding insult to injury, DC coupled this strong-Dollar policy with a now weaponized-Dollar policy in which a nuclear and economic power like Russia had its FX reserves frozen and access to SDRs and SWIFT transactions blocked.

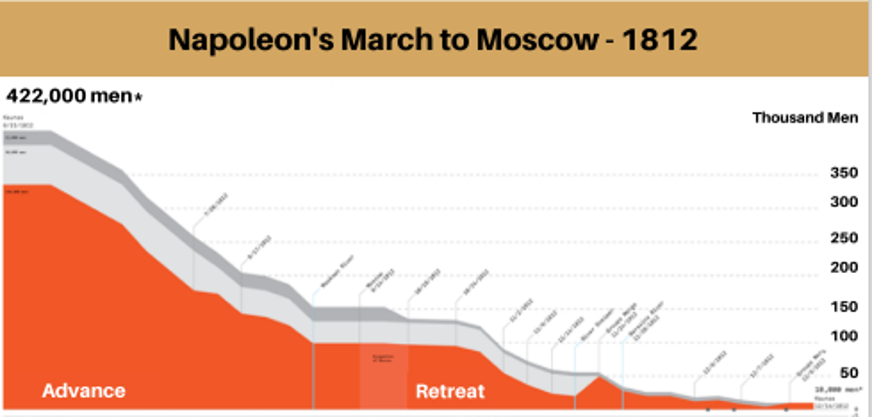

Like Napoleon at Moscow, this was going a step too far…

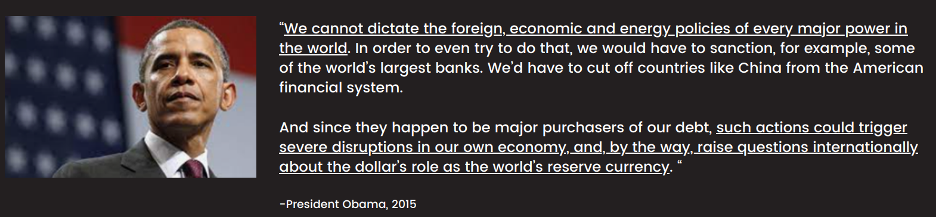

The net result was an obvious and immediate distrust of that once neutral world reserve currency, an outcome which economists like Robert Triffin warned our congress against in 1960, and even John Maynard Keyes warned the world against long before.

Heck, even Obama warned against such weaponization of a reserve currency as recently as 2015.

Thus, and as I (and many others) warned from Day 1 of the sanctions, the distrust for the USD unleashed by the sanctions in early 2022 was “a genie that can never go back in the bottle.”

Or more simply stated, the trend toward de-dollarization was now going to come at greater speed and with greater force.

This force, of course, is now being seen, as well as debated, under the highly symbolic as well as substantive example of the BRICS+ nations seeking to usher in a gold-backed trade currency to move openly away from the USD, a move which some maintain will soon de-throne the USD as a world reserve currency and send its value immediately to the ocean floor.

The Trend Away from the USD Is Clear, But It’s Pace Is Not

For me, the trajectory of this de-dollarization trend is fairly obvious; but the speed and knowable magnitude of these changes are where I take a more realistic (i.e., less sensational) stance.

But before I argue why, let’s agree on what we do know.

The BRICS New Currency Is Very Real

We know, for example, that Russian finance experts like Sergei Glasyev have real motives and sound reasons for planning a new (anti-Dollar) financial system which not only seeks a Eurasian Economic Union for cross boarder trade settlements backed by local currencies and commodities, but to which gold will likely be added as a “backer” to the same.

Glasyev has also made headlines with plans regarding the Moscow World Standard as a far more fair-playing and fair-priced gold exchange alternative to the Western LBMA exchange.

If we take his gold backing plans seriously, we must also take seriously the plan to expand such gold-backed trade currency plans into the Shanghai Cooperation Organization which would make the final tally of BRICS+ nations “going gold” as high as 41 country codes.

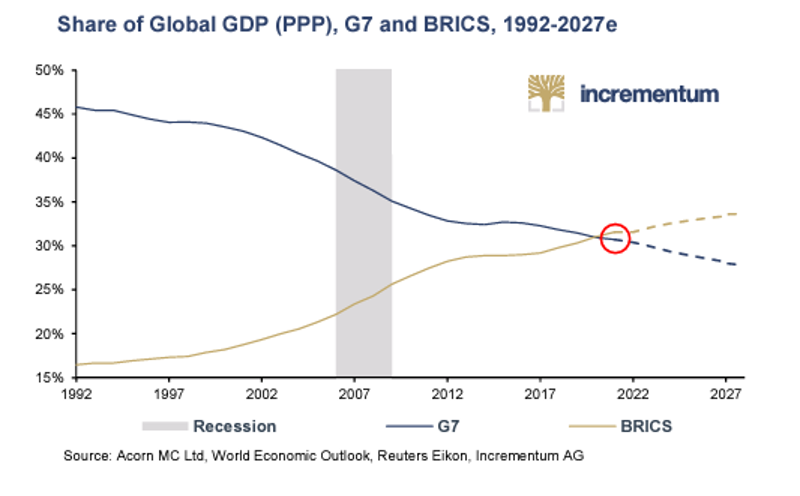

This could ostensibly mean greater than 50% of the world’s population and GDP would be trading in a gold-backed settlement currency outside of the USD, and that, well, matters to both the demand and strength of that Dollar…

China’s Motives Are Also Anti-Dollar

China, moreover, has invested heavily in the Belt & Road Initiative (152 countries) as well as in massive infrastructure projects in Africa and South America, areas of the world that are all too familiar with America’s intentional (or at least cyclical) modus operandi of developing nations enjoying low US rates and cheaper Dollars to create local credit booms which later crash and burn into a local debt crisis whenever those US rates and Dollars rise.

China therefore has a vested interest in protecting its EM investments as well as EM export markets in a currency outside of a USD monopoly.

Meanwhile, as the US is making less and less friends with EM markets, Crown Princes, French Presidents and EU and UK bond markets, China has been busy brokering peace between Saudi Arabia and Iran, as well as building a literal bridge between the latter and Iraq while simultaneously making Yuan-trade deals with Argentina.

Other Reasons to Take the BRICS+ Currency Seriously

Tag on the fact that Brazil, China and Iran are trading outside the USD-denominated SWIFT payment system, and it seems fairly clear that much of the world is leaning toward what Zoltan Poszar described as a “commodity rather that debt-based trade settlement currency” for which Charles Gave (and the BRICS+ nations) see gold as an “essential element” to that global new trend.

Finally, with a strong Greenback making USD energy and other commodity prices painfully (if not fatally) too expensive for large swaths of the globe, it’s no secret to those same large swaths of the globe (including petrodollar nations…) that gold holds its value far better than a USD.

Given this fact, it’s easy to see why BRICS+ nations wish to settle trades in a gold-backed local currency in order to ease the pressure on commodity prices. This gives them the opportunity, as Luke Gromen reminds, to buy time to pay down their other USD-denominated debt obligations.

In addition to the foregoing arguments, the fact that the BRICS+ nations are cloning IMF and World Bank swing loan and “contingency reserve asset” infrastructure programs under their own Asian Monetary Fund and New Development Bank, it becomes more than clear that a new BRICS+ world, trade currency and institutionalized infrastructure is as real as the trend away from a monopolar hegemony of the USD.

In short, and to repeat: There are many, many reasons to both see and trust the obvious and current trend/trajectory away from the USD as warned over a year ago, all of which, no matter what the slope and degree, will be good, very good for gold (see below).

But here’s the rub: The speed, scope, efficiency and ramifications of this trend in general, and the “BRICS August Game Changer” in particular, are far too complex, fluid and unknown to make any immediate (or “sensational”) funeral plans for the USD today.

And here’s a few reasons as to why.

Why the BRICS New Currency Is No Immediate Threat to the USD

First, we have to ask the very preliminary question as to whether the August BRICS summit will even involve an actual announcement of a new, gold-backed trading currency.

So far, all we have to go on is a leak from a Russian embassy in Kenya, not an official communication from the Kremlin or CCP.

Meanwhile, India, a key BRICS member, has openly denied such a new trade currency as a fixed agenda item for this August.

But notwithstanding such media noise, we must also look a bit deeper into the mechanics, economics and politics of a sudden “game-changer” new currency.

The BRICS New Currency: Many Operational Questions Still Open

Mechanically speaking, for example, who will indeed be the issuing entity of this new currency?

The new BRICS Bank?

What will be the actual gold coverage ratio? 10% 15% 20%?

Will BRICS+ member nations/central banks need to deposit their physical gold in a central depository, or will they enjoy (most likely) the flexibility of pledging their domestically-held gold as an accounting-only-unit?

Cohesion Among the Distrusting?

As important, just how much trust and cohesion is there among the BRICS+ nations?

Sure, this collection of nations may trust gold more than they trust each other or the US (which is why such a gold-backed trade currency may work, as it can’t be “inflated away”), but if a BRICS member country wishes to redeem its gold from say, Russia, years down the road, can it realistically assume it will happen?

What if Russia (or any other trade partner) is in a nastier mood tomorrow than they are today?

Basic Math

In addition, there are certain economic/mathematical issues to consider.

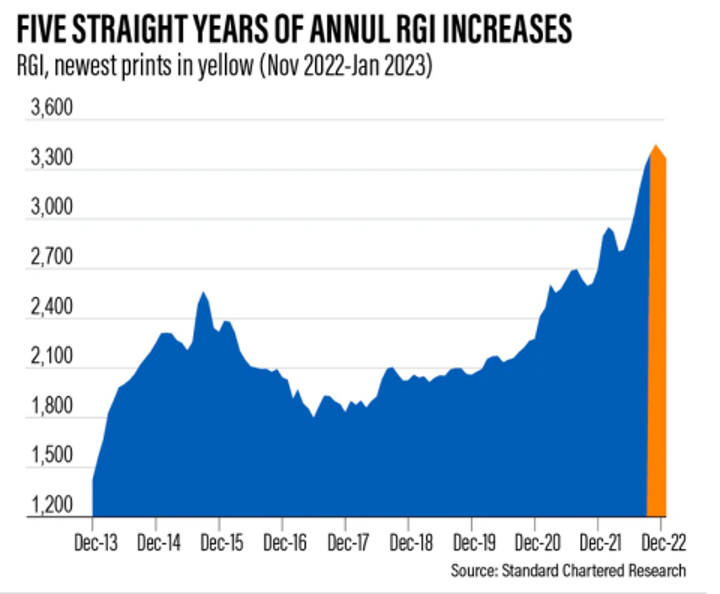

We know, for example, that the collective BRICS+ gold reserve (as of Q1 2023) is just over 5452 tones, valued today at approximately $350B.

Enough, yes to stake a new currency.

But measured against a net global amount of $13T in total physical gold, are the BRICS+ gold reserves enough to make a sizable dent (even at a partial coverage ratio) to tilt the world away from the USD overnight, when the USA, at least officially, has much, much more gold than the BRICS+?

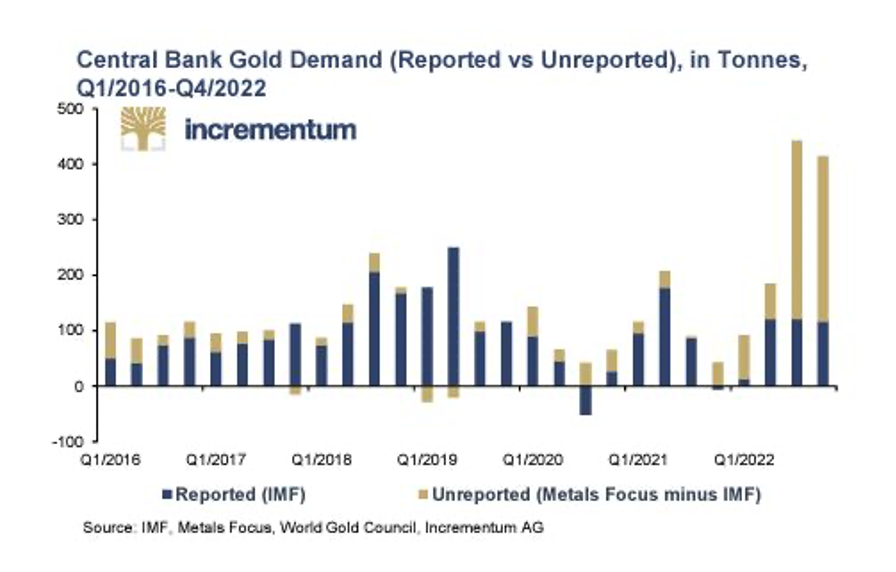

That said, we can’t deny that the actual gold stores in places like Russia and China are far, far higher than officially reported by the World Gold Council.

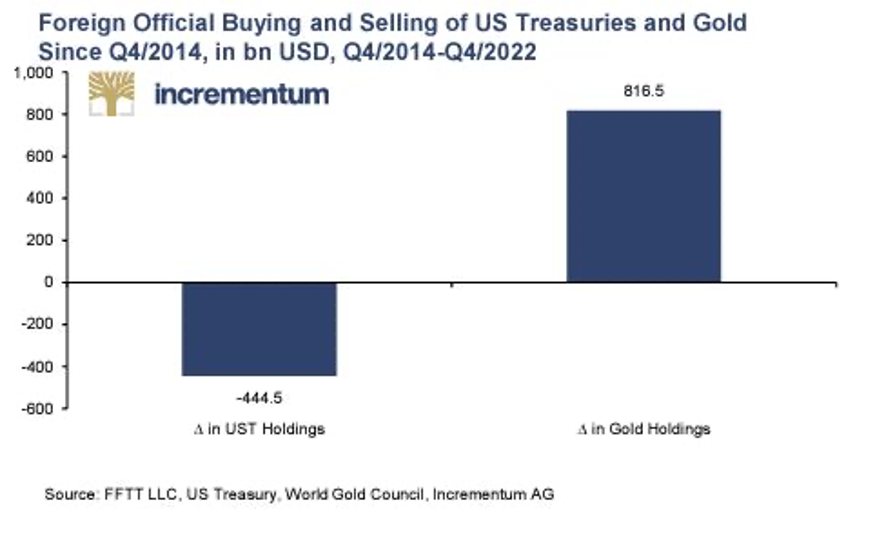

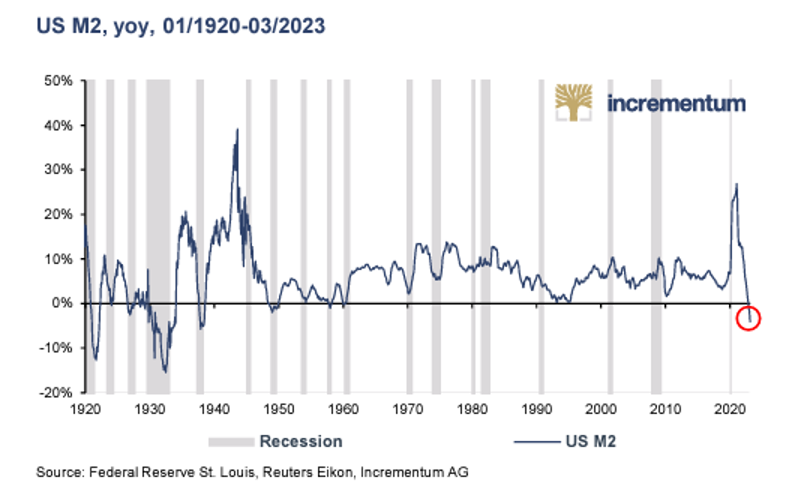

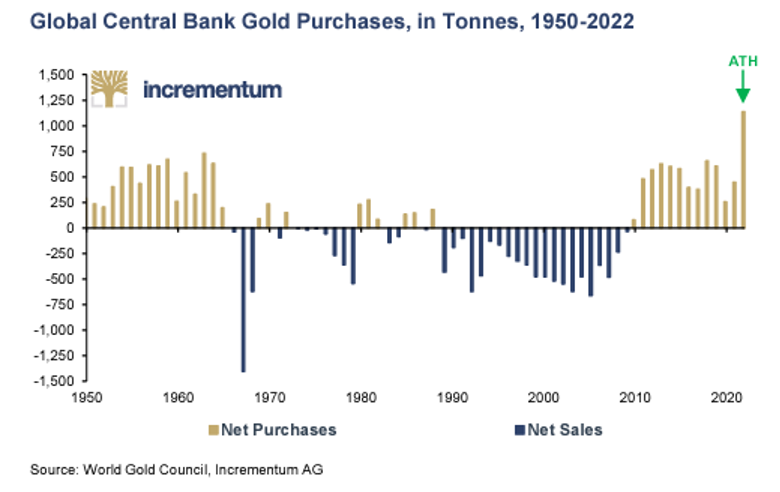

Additionally, the historically unprecedented rate of central bank gold stacking in 2022-23 seems to suggest that the enemies of the USD are indeed “loading their guns” for a reason.

Expecting, however, all of the BRICS+ members to maintain the discipline to continue to purchase and store more physical gold despite the political temptations to redeem the same for later or unexpected domestic spending needs may be a naive assumption in a real world of ever-shifting national behaviors.

Geopolitical Considerations & the BRICS New Currency

Speaking of such shifting behaviors, we also can’t ignore the various pro and con forces within a geopolitical backdrop wherein much of the world, whether it loves or hates the US, still needs its USDs and USTs.

China, for example, may be letting maturities run and even dumping the USTs it now owns at a fast pace (only years away from total UST liquidation), but for now, China needs to keep the USD from growing too weak to buy all the Chinese exports of those American products made, in well…China.

That said, if the trend is indeed a new world of currency wars, rather than currency cooperation, which is a more than fair assumption, then all such liberal economic cooperation/trade arguments fall to the floor.

Nevertheless, with over $30T worth of USDs held by non-US parties in the form of bonds, stocks, and checking accounts, the collective desire (common interest) to keep those USDs alive and at least relatively strong is a major counter-force to the notion that the world and USD are coming to a sudden change this August.

Furthermore, in such an uncertain world of competing currencies as well as national and individual self-interests, the trillions and trillions of off-shored USTs/USDs tangled up within the foreign as well as US banking and derivative markets is important.

Why?

Because any massive dislocation in risk asset (and even currency) markets emanating from South Africa or elsewhere, in August or much later, would more than likely (and ironically) cause a disruption in foreign markets so dramatic that we could easily see a flow into, rather than away from, USDs for the simple (and again ironic) reason that the mean and ugly Greenback is still the best/most-demanded horse in the global fiat slaughter house.

In other words, even if all the BRICS+ plans for a gold-backed trading currency go flawlessly, the time gap between the accepted rise of such a settlement currency and the open fall of the USD is likely to be long, wide and unknown enough to see the USD actually get stronger rather than weaker before we experience any final fall in the USD as a global reserve currency.

The USD: Supremacy (Still) vs. Hegemony (Gone)

So, no, I don’t think that the USD will fall entirely from grace or even supremacy in August of 2023, even if the trend away from its prior hegemony is becoming increasingly undeniable.

It will take more than sensational BRICS headlines to make such a rapid change, but yes, and as the Sam Cooke song says, “change is gonna come.”

My only point is that for now, and for all the reasons cited above, the trajectory and speed of those changes are likely not as sensational as the trajectory and speed of the current headlines.

No Matter What: Gold Wins

The case for gold, of course, does not change just because the debate about the speed and scope of the new BRICS+ trade currency rages today.

No matter what, the very fact that such a gold-backed trade settlement unit will inevitably come to play will be an equally inevitable tailwind for global gold demand and hence global gold pricing in all currencies, including the USD.

The Dollar Will Die from Within, Not from Without

Furthermore, and despite all the hype as well as substance behind the BRICS headlines, I see the evolution of such a gold-backed trade currency as a reaction to, rather than attack upon, the USD, whose real and ultimate threat comes from within, rather than outside, its borders.

The world is losing trust in the USD because US policy makers killed it from within.

Ever since Nixon took the gold chaperone away, politicians and central bankers have been deficit spending like drunken high school seniors in a room filled with beer but absent of parental consent.

The entire world has long known what many Americans are finally seeing from inside their own walls, namely: The US will never, ever be able to put its fiscal house in order.

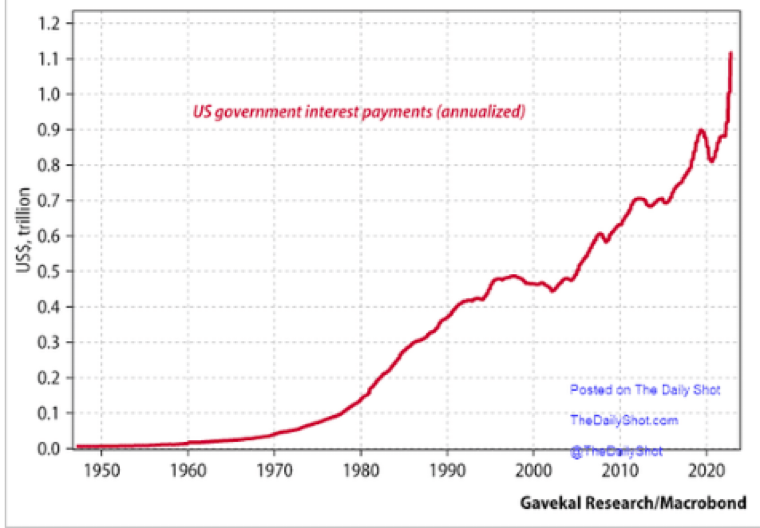

Uncle Sam is simply too far in debt and there’s simply no way out as it approaches a wall of open and obvious fiscal dominance in which fighting inflation will only (and again, ironically) cause more inflation.

Or stated simply, Uncle Sam can’t afford his own ever-increasing and entirely unpayable deficit spending habits without having to resort to trillions and trillions of more mouse-clicked Dollars to keep yields in check and IOUs from defaulting.

And that, far more than a BRICS new currency, is what will put the final rose on a fiat system (and Dollar) that is already openly but slowly dying—first slowly, then all at once.

But I don’t think that day will be August 22.

AFTER SVB AND CREDIT SUISSE COLLAPSE, BAIL-INS NEXT

In this lengthy discussion with Ivor Cummins of Ivor Cummins Science, Matterhorn Asset Management, AG Partner, Matthew Piepenburg, speaks intentionally broadly of the macroeconomic, debt and currency risks to a new yet data-curious audience otherwise less familiar with financial markets and risks. For those just entering such economic topics, Piepenburg covers many, but by no means all, of the core themes now shaping global markets in a common-sense and refreshingly straight-forward manner.

Piepenburg opens with a brief description of his own road to precious metals paved by concerns over rising debt, market, banking and currency risks. The conversation begins with the critical dynamic of unprecedented debt levels “solved” with “mouse click money.” Piepenburg unpacks this fantasy, as well as the dramatic consequences and dangers of such a “solution,” which includes equity melt-ups followed by dramatic melt-downs, all driven by signals from a misunderstood bond market.

He describes the current political landscape of mis-managed policies as one in which nations operate with a “bus-boy’s salary yet Ferrari appetite.” In short, the historical disconnect between global debt and income/productivity levels creates delusionary levels of disfunction across numerous settings, including currency devaluation/debasement, market deformation (in bonds and stocks), social unrest (wealth inequality) and finally: increased centralized controls (i.e., CBDC) at the expense of private rights/freedoms—themes which Piepenburg addresses broadly yet directly and with historical/cyclical evidence as well as personal experience.

Ultimately, Piepenburg advises listeners to never abandon their own judgement, but reminds that each individual is uniquely responsible for informing their that judgement by considering as many facts, cycles and even contrary opinions as possible. In the end, Piepenburg’s own informed opinion boils down to this: Western economies are objectively broke, illiquid and trending within/toward a deflationary recession which will eventually be “saved” at the expense of increasingly mouse-clicked and debased currencies in an inflationary end-game for which physical gold is one obvious antidote.

AFTER SVB AND CREDIT SUISSE COLLAPSE, BAIL-INS NEXT

Will the world experience a catastrophic debt implosion?

Just like the Titan Submersible that recently imploded, the global debt bubble can implode “within just a fraction of a millisecond”. More later in the article.

Are we now in the third circle in Dante’s Inferno?

Dante describes the 9 circles of hell. The 3rd circle is Gluttony which is fitting for a self indulgent Western world with excessive consumption of both material and financial resources.

Each circle represents a gradual increase in evil, culminating at the centre of the earth where Satan is held in bondage. The sinners of each circle are punished for eternity in a fashion fitting their crimes.

Financial markets have also been dominated by gluttony for an extended period. This has led to the biggest asset bubble in history.

But in spite of unprecedented risks in investment markets, for the few investors making the right choice, now is a period of great opportunity not just to preserve wealth but also to enhance it. More later.

END OF THE CURRENT WESTERN EMPIRE

But here we are in the 21st century with the current Western Empire in the final stages of a secular decline which looks very similar to the fall of the Western Roman Empire in the 5th century. Wars, debts, deficits, collapsing currencies, decadence, corruption and socialism – Plus ça change (the more things change, the more they stay the same).

Whether this cycle is the end of a 100, 300 or 2000 year era, only future historians will know the answer to.

WAR DRUMS AND NATO

To diffuse the real reasons for the collapse of the Western economy and the Financial System, there is nothing like starting a war. Leaders love to play real war games although most of them have never been near the front line. A war creates fear in the people and permits the leaders to govern the country irresponsibly, both in relation to the economy and by controlling the people.

So all the Western leaders got together for the NATO meeting in Vilnius, Lithuania last week to listen to Zelensky’s rantings about more money and more weapons in a war that Ukraine is unlikely to ever win. But since this is a proxy war for the real battle between the US and Russia, the West is grudgingly giving in to many of Zelensky’s demands, thus escalating the war to levels which could have catastrophic consequences for the world.

This war could at best lead to 100s of thousands of additional deaths. The Ukrainian people don’t want war, probably more than 10 million of them have left the country and won’t return. Neither the Russian, American or European people want war, only their leaders. When it comes to wars, leaders have ultimate power and also access to money. Although no country has funds available for this war, they all borrow and print to the detriment of the countries and their people.

At best this war will be limited but go on for years at a massive cost of lives and resources. At worst we could have a global and nuclear war with disastrous repercussions.

Western leaders would serve their people much better if they instead sent peace makers and focused on their economies which are on the verge of a major implosion.

Coming back to debt, this is what will finally destroy the West and likely lead to decades of misery.

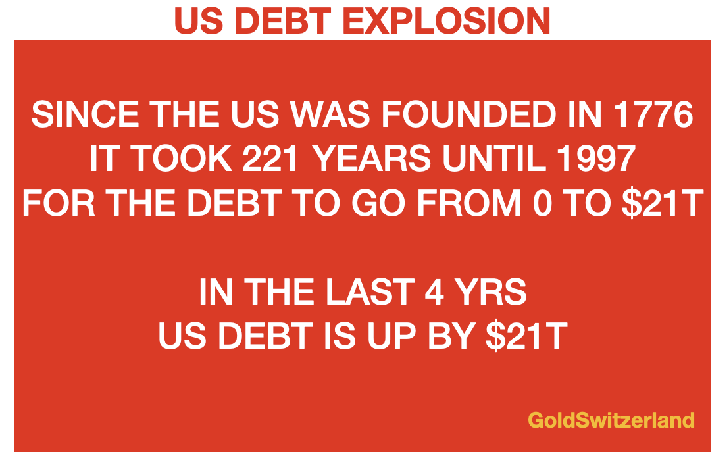

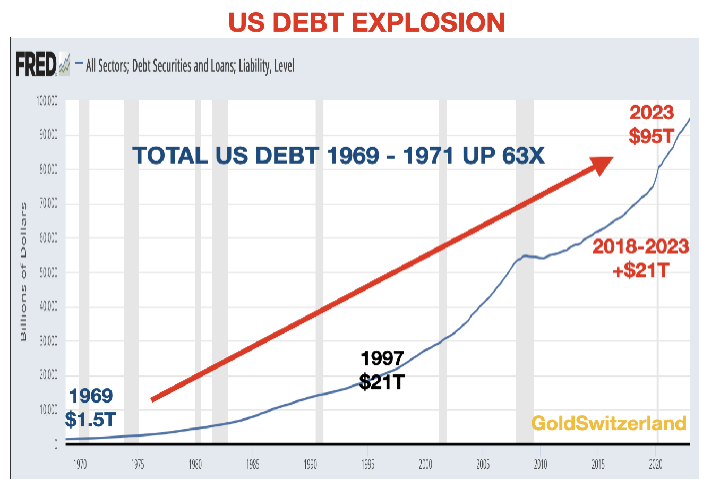

US DEBT UP BY SAME AMOUNT IN LAST 5 YEARS AS THE FIRST 221 YEARS

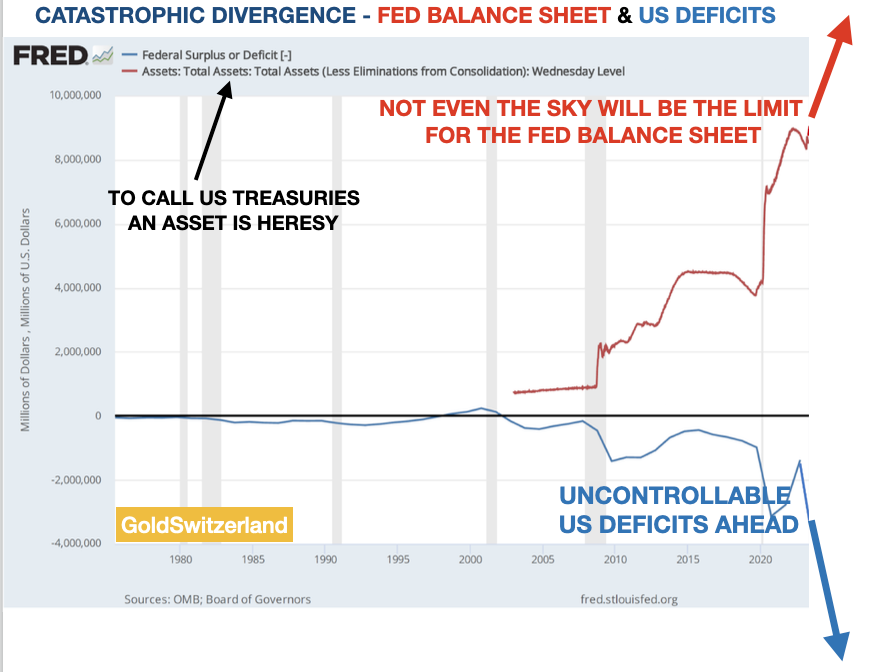

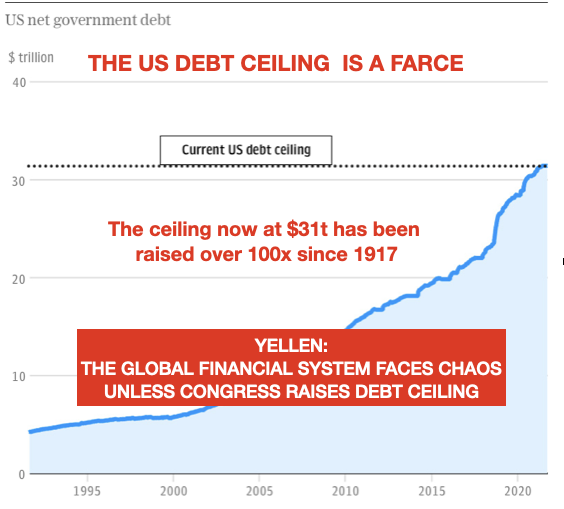

The latest financial crisis started in September 2019 when the US banking system came under serious pressure and the Fed injected major liquidity into the near bankrupt system. Since that time, total US debt has increased by $21 trillion.

Let’s put this into perspective. It took the US 221 years to go from Zero debt in 1776 to $21 trillion in 1997 and just in the last 4 years, debt has gone up by that same $21 trillion.

Now some will argue that it is not the same money today as 200 years ago.

No of course it is not the same money. Because every government destroys the value of their currency by creating unlimited amounts out of thin air to the detriment of savers and pensioners.

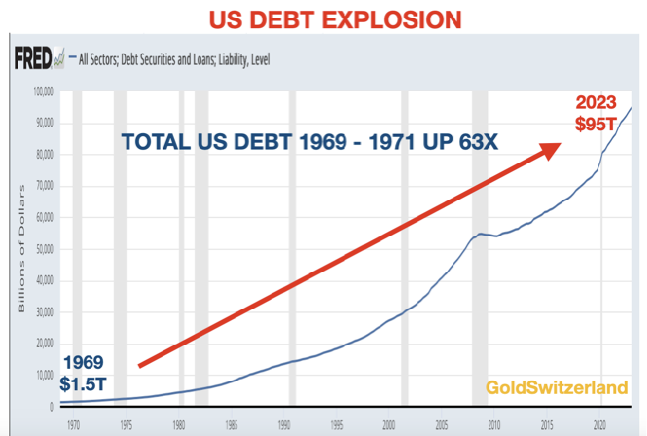

The graph below shows the debt explosion during my working life so far. Up from $1.5 trillion in 1969 to $95T today – a totally mind boggling 63x increase.

To gain power the incumbent government must promise the earth. Once in power they realise that there is no chance of maintaining prosperity without buying votes through chronic deficits and money printing. That’s why there have only been a handful of years since 1930 when US federal debt didn’t go up. Even in the Clinton years debt went up so the surpluses declared were due to false accounting.

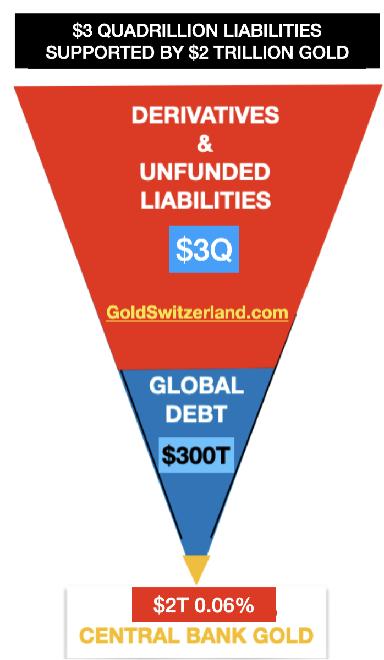

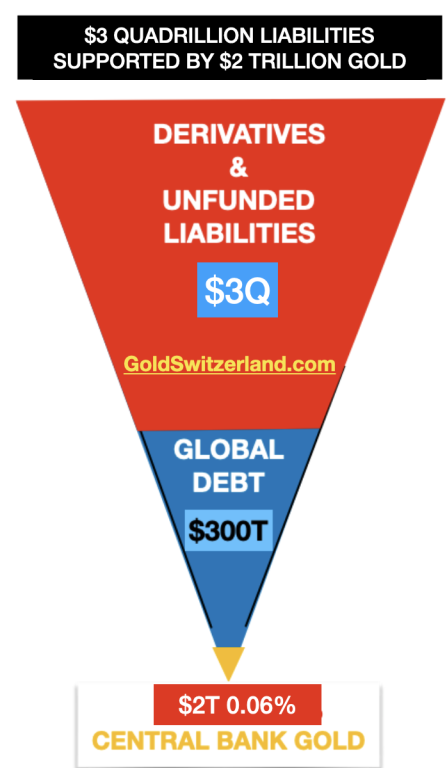

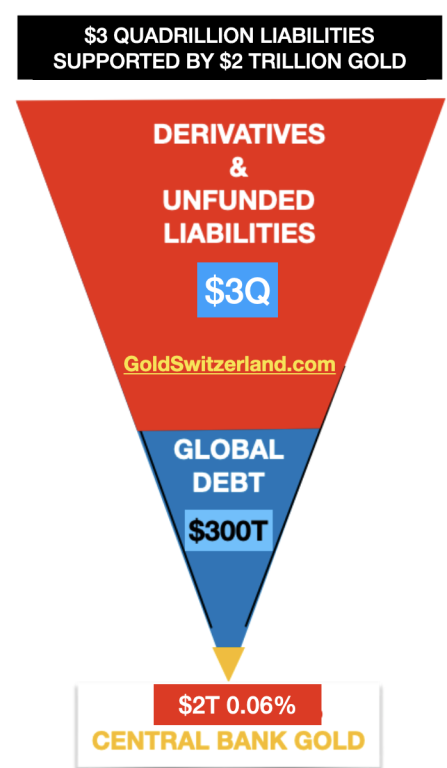

But total US debt of $ 95 trillion is only part of the total liabilities. Add to that unfunded liabilities of Social Security and Medicare of say $150 trillion. Then there are gross derivatives within the banking system and in the shadow banking system of probably $2-2.5 quadrillion. This is a form of credit that can easily blow up when counterparties fail.

A COMING INFERNO

Coming back to Dante’s Inferno, the 9 circles of hell are: 1. Limbo – where there is no god, 2. Lust, 3. Gluttony, 4. Greed, 5. Wrath, 6. Heresy, 7. Violence, 8. Fraud, and 9.Treachery.

Many of the 9 sins in Dante’s Inferno apply to today’s world but maybe Gluttony is one of the more fitting to a self indulgent Western world.

Cerberus, the three-headed beast of hell, guards the gluttons mauling and flaying them for eternity. (Sounds pretty horrible. A more modern version might be the song “Hotel California” by the Eagles – “You can check out any time but you can never leave”.) Also Homer wrote about Cerberus.

What we do know is that in this final phase that probably started in 1913 with the foundation of the Fed and accelerated from 1971 when Nixon closed the gold window we have seen the required excesses or gluttony that inevitably lead to a severe punishment.

We have seen historical bubbles in all asset markets whether in Stocks, Bonds, Property and many others.

We have also seen debt explode, especially since 1971. As always in the final stages of an empire, real growth first slows down and then stops.

THE WORLD HAS REACHED PEAK CHEAP ENERGY

The primary driver of economic growth since the second half of the 1700s has been the discovery and use of energy on an industrial scale, starting with the industrial revolution.

The growth of the economy is not driven by money but by energy.

As Tim Morgan of Surplus Energy Economics states:

“The economy is a surplus energy equation, not a monetary one, and growth in output (and in the global population) since the Industrial Revolution has resulted from the harnessing of ever-greater quantities of energy. But the critical relationship between energy production and the energy cost of extraction is now deteriorating so rapidly that the economy as we have known it for more than two centuries is beginning to unravel.”

The dilemma is that the Energy Cost of Energy is constantly increasing. In 1990 that cost was 2.6% of fossil fuels and is estimated to be 12% in 2025. According to Dr Morgan, with the current Energy Cost of Energy, the real economy as well as prosperity has started to decline and that trend will continue for several decades. Fossil fuels still represent 83% of all energy globally and renewable energy is unlikely to make any significant difference in the next few decades.

So we are now looking at peak cheap energy at a time when asset markets are in bubble territory with debts and deficits at levels which can only result in an implosion.

Again let me emphasise that cheap energy is a prerequisite for economic growth.

PANICKING GOVERNMENTS TAKE IRRATIONAL MEASURES

So, what are governments doing about this? They are clearly aware of the risks and this is why they invent all kinds of events that will enable them to control the people. This includes Covid lockdowns, forced vaccinations, climate control, CBDCs (Central Bank Digital Currencies), wars and unlimited rules, regulations and laws. The US for example now has over 300,000 laws controlling all aspects of daily life and making everyone a likely daily felon.

REVALUATION OF GOLD

I have already in previous articles discussed the seismic shift that will take place from West to East and South based on commodities and manufacturing rather than debt and services. That will be a long process which is just starting: “A DISORDERLY RESET WITH GOLD REVALUED BY MULTIPLES”

Whilst a lot of gold investors are excited about the prospect of a BRICS currency backed by gold, personally I think that is far away. The Tweet by an official at the Russian embassy in Kenya is not quite enough to confirm this.

As I have already written about here , I believe that gold will be the asset of choice for central banks to hold as reserves rather than dollars. Such a move would have a major impact on gold which I wrote about here: “MAJOR REVALUATION OF GOLD AND PRECIOUS METALS IS IMMINENT”.

So with risks facing the Western world of a magnitude never seen before in history, including geopolitical, financial, economic, with the biggest asset and debt bubble in history coming to an end.

It is clearly impossible to predict how this will play out. It is not even worth speculating.

What we do know is that risk is now at a level which makes investment markets extremely dangerous. In the next few years major fortunes will be lost permanently.

ASSET & DEBT EXPLOSION – IMPLOSION

Before we look at how to survive the biggest global asset bubble that has ever existed, let’s first look at the spectacle we have witnessed in the last 54 years. This is a selfish time period and reflects when in 1969 my working life started in banking in Geneva.

This period conveniently coincides with Nixon closing the gold window in 1971. That was the end of sound money and the beginning of a free-for-all bonanza in money printing.

So during my working life since 1969 US total debt has gone up 63X from $1.5 trillion to $95T.

Bubbles always burst, without exception. But we know of course that bubbles can always grow bigger before they burst.

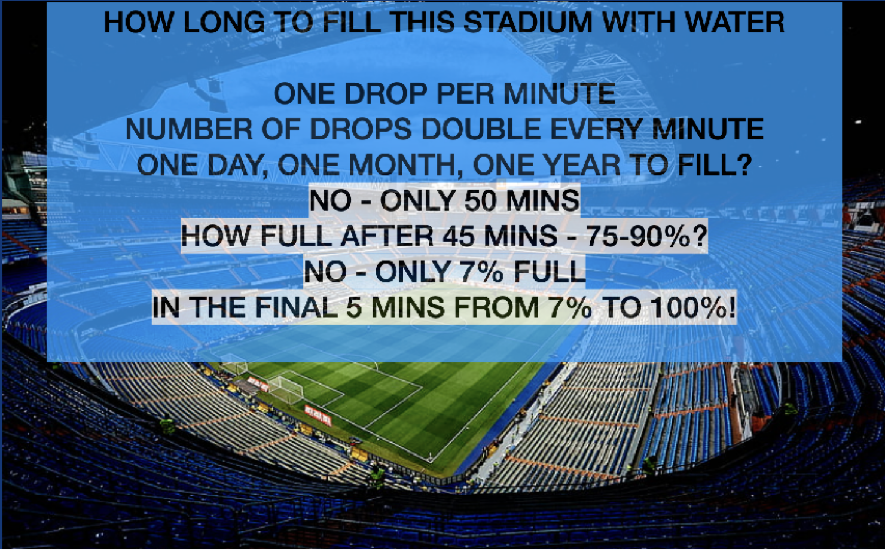

What few people realise is that when a debt bubble explodes or more likely implodes, it could go almost as quickly as the recent implosion of the Titan Submersible.

The pressure on this vessel was remarkable:

A catastrophic implosion is “incredibly quick,” taking place within just a fraction of a millisecond, said Aileen Maria Marty, a former Naval officer and professor at Florida International University.

“The entire thing would have collapsed before the individuals inside would even realise that there was a problem,” she told CNN. “Ultimately, among the many ways in which we can pass, that’s painless.”

I doubt that global debt and the world financial system will implode in a fraction of a millisecond but as I have warned many times, an implosion of the $3 quadrillion of debt and derivatives could happen very, very quickly. It would unroll at such a speed that no central bank would have time to react.

And as I have also pointed out, when the debt implodes, so will all the assets which were inflated by the debt.

So even if it doesn’t happen in milliseconds, it will be too quick to save. We saw this in the middle of March when 4 banks, led by Silicon Valley Bank, collapsed in a matter of a couple of days. And shortly thereafter Credit Suisse imploded too.

As we know, it is impossible to time such an event. But the good thing is that we don’t need to time it.

A MAJOR OPPORTUNITY

Investors must forget about gluttony and greed and stay away from Cerberus’ hell. If they can steer away from the current risks in the system, the opportunities to not just evade disaster but even enhance wealth are considerable.

So forget about short term timing. And forget about greed.

Just avoid the potential implosion of asset markets and safely position yourself for incredible opportunities, whenever they may happen.

Personally, I don’t think things will take too long to unravel but I don’t care about the timing as long as I am sitting right.

My views are not recommendations but only my personal risk assessment.

Firstly I would hardly touch the following assets with a barge pole:

- General stocks, bonds of any kind, corporate or sovereign, currencies, bank deposits, investments in commercial or residential property.

There are of course always exceptions like commodity related stocks, defence stocks and many others.

But remember that in a real bear market, all stocks tend to suffer.

Even for the best companies, profits can halve and P/Es go from 20 to 5. That for example would lead to a decline in the share price of 88%!

When I was at Dixons Plc in the UK during 1973-4 stock market collapse, I experienced a similar decline in our share price although the company was sound financially. From there we built Dixons to the leading electronic retailer in the UK and a FTSE 100 company.

So anyone who believes that a 90% fall can’t happen to good businesses is seriously mistaken.

What not to own is easy but what should we own?

The answer is self-evident as far as I am concerned.

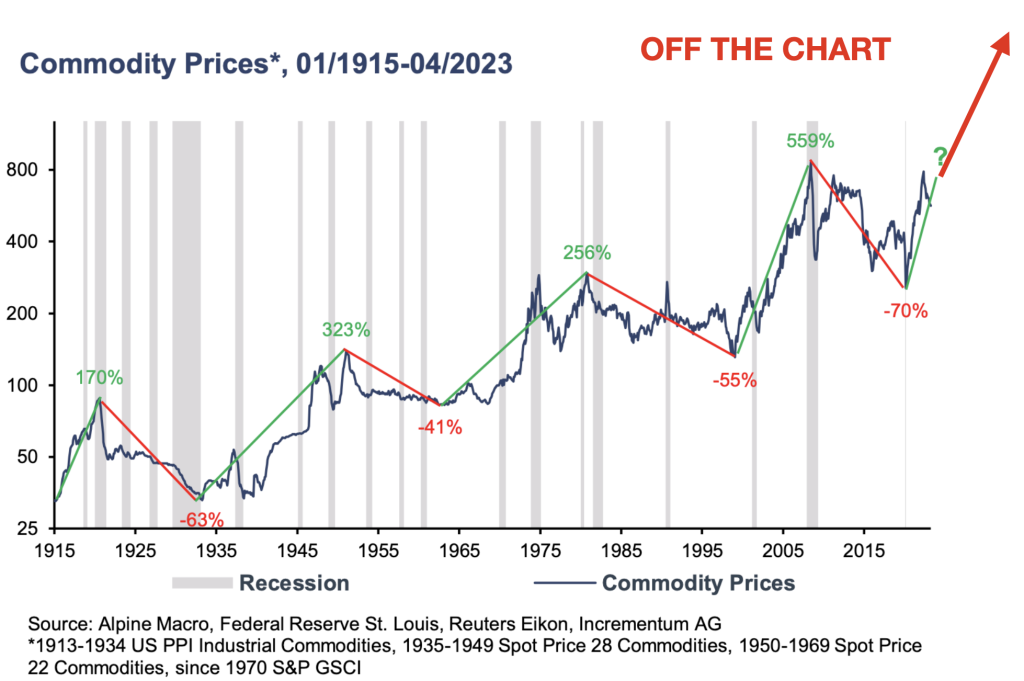

- Commodities started an uptrend in 2020 and have a long way to go.

With gold being the only money which has survived and maintained its purchasing power in the last 5000 years, it is clearly the wealth preservation asset par excellence.

We have mainly stayed away from silver in the last 20 years due to its volatility. It has not been a good metal if you want to sleep well at night. But now with the gold/silver ratio at 80 (meaning silver is relatively cheap vs gold), and with strong industrial demand for solar panels, electricals etc, we are likely to see a decline of the ratio to 30 initially and eventually to 15 or lower. That means silver will go up 3-5x as fast as gold.

But physical gold is the king of metals for wealth preservation purposes and a smaller investment in physical silver should be seen as an investment/speculation with a massive potential.

In addition to yellow gold, black gold – oil – moves very similar to the yellow metal. Thus major price increases in oil are likely.

So owning stocks in good gold and silver companies as well as oil companies is likely to be an excellent investment for a number of years.

But again I must stress that protection against the probably biggest asset implosion in history necessitates holding the majority of investment assets in physical gold and some silver, stored outside the financial system in a very safe jurisdiction and vault.

Preferably the majority of your metals should be stored outside your country of residence. In case of emergency, you should be able to flee to your reserve asset.

A WORLD AT CROSSROADS

What is very clear to me is that the Western world is now at a crossroads. As Brutus said in his speech, the right turn “leads on to fortune” whilst with the wrong turn you end up “in shallows and miseries”.

For anyone who realises the severity of the situation, the choice should be obvious, if not we will “lose our ventures”.

Facing such a momentous risk, protecting our families and stakeholders must be the only option.

AFTER SVB AND CREDIT SUISSE COLLAPSE, BAIL-INS NEXT

It’s time to talk about Powell…

Becoming Powell’s (and the Devil’s) Advocate?

I’ve been thinking, and re-thinking, Powell.

Hmmm.

It’s no secret that in numerous interviews and articles, Jerome Powell has been on my critical mind.

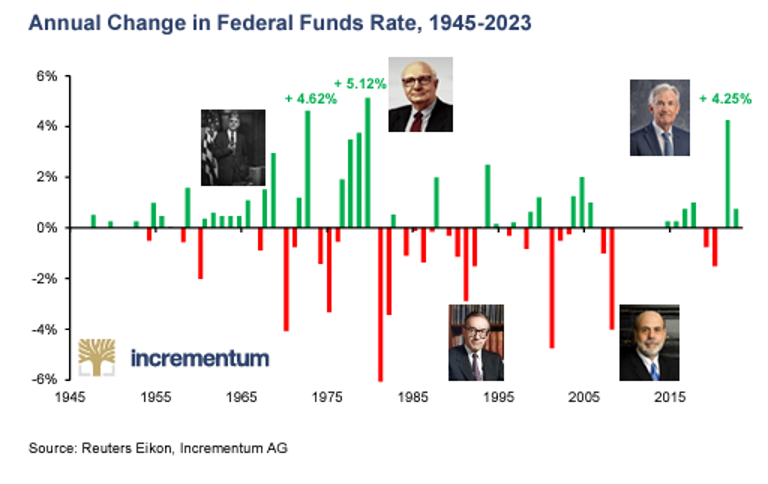

I called him a breathing weapon of mass destruction, and have openly mocked his attempt to be Volcker 2.0 in a USA facing $32T in public debt and climbing.

So, what gives?

Why and what am I re-thinking?

Some Things Can’t be “Re-Thought”

First, let me be clear that there are a lot of criticisms and dis-likes that I have not re-thought.

In fact, I keep a list of stubborn thoughts which probably can’t ever be “re-thought.”

For example, I don’t like centralized anything, be it economies, governments, media cabals, currencies or banks.

Thus, I don’t like the Fed (or ECB etc.) as a concept nor central bankers as a group.

Why?

Because they distort the hell out of natural supply and demand, crush free market price discovery and have effectively killed capitalism while simultaneously and directly creating wealth inequality at levels akin to modern day feudalism.

In fact, my last two books, Rigged to Fail and Gold Matters, spend a great deal of pages underscoring just how rigged the banking system is in general and the Fed in particular.

I’ve equally penned many essays on the open corruption I’ve seen in our so-called financial “elites” and have bluntly said “shame on you” to the entire bunch.

Furthermore, I don’t like Bernanke getting a Nobel Prize for essentially “solving” an historical debt crisis with equally historical levels of new debt, which is then paid for with historically unprecedented levels of inflationary, mouse-click money.

There’s literally nothing noble in that Nobel Prize.

And I don’t like easy money magicians like Janet Yellen who took the Bernanke play-book of ZIRP (Zero Interest Rate Policy) too far and too long in a myopic, career-saving, time-buying, fantasy-narrative to solve every fiscal or monetary addiction/crisis with more synthetic and inflationary liquidity (i.e., QE to the moon).

Nor do I like Yellen saying things like “we may never see another recession in our lifetimes.”

Similarly, I don’t like Powell, around the same time (circa 2019) declaring that there’s no reason not to believe that our bull markets could go on for longer, “perhaps even indefinitely”—when just a year later the markets tanked by greater than 35% (and would have fallen to the ocean floor but for trillions in unlimited QE to “save” the system).

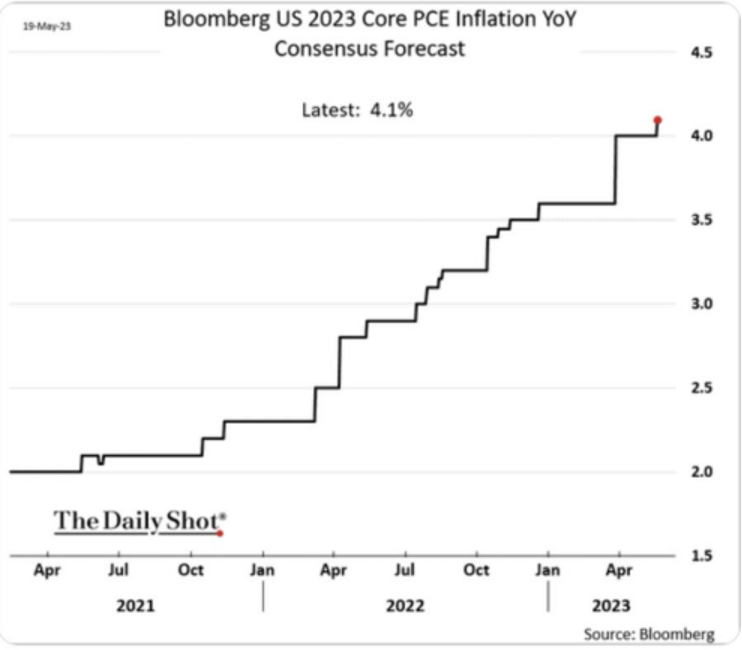

Nor I am a big fan of Powell’s open declaration that inflation was transitory, when we were arguing long before him that inflation was anything but “transitory.”

In short, I don’t like the Fed, and by extension, I can’t declare myself a big “advocate” of Jerome Powell.

So, What Gives?

Why, then, do I find myself playing the devil’s advocate to my own devil, and this includes Jerome Powell?

It’s no secret that I have always seen easy money as a fantasy (criminal) solution to real economic problems.

In the end, such fairytale policies simply create debt bubbles saved by currency bubbles, which like all bubbles, just “pop.”

And when a currency bubble pops (always the last bubble to do so), nations and even reserve currencies, from the Dutch Guilder to the British Pound, equally come to a dramatic end.

And given that every central banker has been openly guilty of this “quantitative” sin since patient-zero Alan Greenspan sold his soul and hard-money graduate thesis to Wall Street in the late 1990’s, I’ve happily lumped Powell into this embarrassing crowd of politicized “data-dependers.”

In short, Powell, like his immediate predecessors, was no Paul Volcker or William Martin, in much the same way that Dan Quayle (as famously declared by Senator Bentsen) was no John Kennedy.

In fact, Martin and Volcker remain semi-iconic for being among the few and the brave Fed Chairs to actually take the punch bowl of easy money away from their spoiled nephews in the trading pits of Wall Street or the re-election seekers in DC.

But this “punch bowl thing” got me to thinking (i.e., re-thinking) about Powell.

Powell Taking Away the Punch Bowl

Yes, I still think Powell’s plan to raise rates into an historical credit bubble and debt cycle will break things, including the economy, markets and banks.

And I still think his public/optic claim of raising rates to fight inflation is an open charade, as he needs inflation to inflate away historical debt yet has the subsequent trick/ability to then mis and under-report otherwise toxic and sticky inflation levels.

But…and this is a big but…, one (or at least myself) has to admit that Powell is the first Fed Chair in a long time to make a genuine effort to, well…take away that punch bowl.

Hard-Money Powell & Needed (Constructive) Destruction?

Yes, Powell’s rate hikes and drying punch bowl are breaking things, as I’ve argued over and over.

But then again, as a follower of Austrian (rather than Keynesian) economics, I confess that some things need breaking.

In fact, it’s a von Mises/Schumpeter concept known as “constructive destruction,” and tanking credit markets can clean out over-levered and debt-soaked markets with SVB-like effect.

I must further confess that Powell, unlike Yellen (the God-Mother of Easy Money) had been a proponent of hard money since he was a junior member of FOMC.

Throughout 2018, for example, Powell had at least tried (quarter after quarter) to forward-guide a tightening of the Fed balance sheet while simultaneously raising rates.

Of course, we all know how badly that ended by year-end. What followed was a 2019 rate “pause” and then a 2020 of unlimited QE…

But I must confess, at least Powell made an attempt at hard money thinking, not easy money thinking, and it’s Powell’s hard-money thinking which has me thinking harder about Powell.

The Death of LIBOR & Now Powell the Savior?

In fact, an equally bemused Libertarian, Tom Luongo, just gave a rather telling interview on KITCO which goes even deeper (see minute 14:20) down this rabbit hole, suggesting that Powell may indeed be trying to make America, well better…

Hmmm…

Luongo, for example, reminds us that the June 30th sunsetting of the London-based LIBOR debt indexing standard for domestically produced USD-denominated debts (think credit cards, mortgages etc.) in favor of the new SOFR index (nod to John Williams) is a major, as well as deliberate, attempt by Powell to save, liquify and repatriate the USD.

Huh?

What does that mean in plain English?

Stated simply, by replacing LIBOR (global-bank-based) with the SOFR (US repo-based) system, this means the USD and US credit markets will be less vulnerable to European bank and credit market failures, which Powell, apparently, foresees.

Thus, if a French or German bank, were to implode under the old LIBOR system, the shock waves of that implosion won’t hit the US system as hard under this brand new SOFR index.

Powell the Anti-Globalist?

In addition, Luongo argues that Powell is quietly at war with the technocrat “one-world-government” types behind the otherwise well-telegraphed “great-reset.”

Luongo bluntly/refreshingly describes this “re-set” as a policy in which globalists (he says communists) in the European Union, IMF, UN and, of course Davos, are effectively aiming to crash the markets (and USD) in order to centralize and “re-set” the entire global system with a clean slate.

Toward that end, my own concerns about Davos, CBDC and more centralization are shared.

Seen in such a light, Powell’s hard money/rate hike policies could thus be interpreted as a direct threat to this globalist agenda, an agenda which, according to Luongo, requires low rates to feed an otherwise bogus/false “green agenda” to justify more global debt.

Fair enough.

Powell, De-Dollarization and the Milkshake Theory

Finally, a valid argument can be made (and Luongo makes it) that by raising rates by over 500 bps since Q1 of 2022, Powell is deliberately trying to crush the leverage (and hence tangled/illiquidity) in USDs held offshore (i.e., the “Euro dollars”).

That is, by raising rates at record speed and at a record slope, it’s much harder for offshore derivative markets to keep levering (and hence tangling up) off-shore USDs on the cheap.

This decline in leverage, complimented by what many believe can lead to a tanking of European sovereign bonds (and spiking yields) can in turn lead to an off shore/European banking and credit crisis.

Such a banking crisis would then create a flow of off-shore money back into USTs as the best horse (or sovereign bond) in the global glue factory, which is yet another nod to Brent Johnson and the milkshake theory.

Thus, and despite all the very real, all too real signs/threats of open de-dollarization, Luongo argues that Powell’s rate hikes are a valid plan to save the USD by soaking up all those off-shore dollars and re-patriate the same back into the UST market.

Summing Up the Devil’s Advocacy

Based on the foregoing, there is at least a case to be made that Powell’s openly hard-money stance since last March is potentially seeking to accomplish three very important goals:

1) Protecting US debtors from cracking and formerly LIBOR-based foreign banking risk;

2) fighting the “good fight” against the globalist technocrats from the IMF to Davos; and…

3) stemming the tide of open de-dollarization by letting EU banks, and hence bonds, implode, which would in turn create a tidal wave of money flows back into the “safe” (safer?) haven of the UST market.

Constructive or Non-Constructive, It’s Still Gonna be Destructive

Whether or not Powell has a method to his madness, and that his own allegedly choregraphed rate-hikes of “constructive destruction” lead to a pro-USD, pro-UST flow of global funds back into the US remains to be seen.

Like Luongo, I do feel that the real test, and signal, for such a flow of capital will come when Japan finally throws in the towel on its insane QE policy (and hence Yield Curve Control).

Once JGB’s lose central bank support, they’ll tank and their yields will spike.

Such a sovereign bond crisis in Japan would spread to a terribly fragile Europe, and the bond spreads between Italian bonds and German bunds would then rip beyond the control of Lagarde’s teetering ECB.

That will be destruction, for sure, but not very “constructive” to the millions of citizens from Berlin to Barcelona who will then suffer for the sins of their central bankers, which include, sorry to say: Jerome Powell.

Gold Favors Man-Made Destruction

Most importantly, and whatever one thinks of Powell (devil or patriot) in particular or central bankers in general, there’s simply no easy answer or solution today for a world already on a fatal debt path which these bankers forged with drunken abandon/policies.

In other words: There’s No Way Out. Or more to the point, the USA is screwed.

Even if Powell’s hawkish “plan” leads to a straw-sucking flow of capital into the USA’s better “milkshake,” the levels of destruction in credit, currency, equity and financial markets which would precede/necessitate such a “flow event” will be catastrophic.

Thus, whether we see a deflationary depression of “constructive destruction,” a globalist “re-set” conveniently blamed on COVID and Putin, or a massive pivot to unprecedented QE (my opinion), the global system will be on its knees and no fiat currency will emerge victorious.

A few investors already know this. An increasing number of BRICS + leaders and Russian finance ministers know this, and an increasing number of central bankers (especially out East) know this.

Which is why they are all buying physical gold at record levels.

They see history and math with clarity, and although history can never be timed with precision, patient preparation for its turning points is all one needs to know.

Got gold?

AFTER SVB AND CREDIT SUISSE COLLAPSE, BAIL-INS NEXT

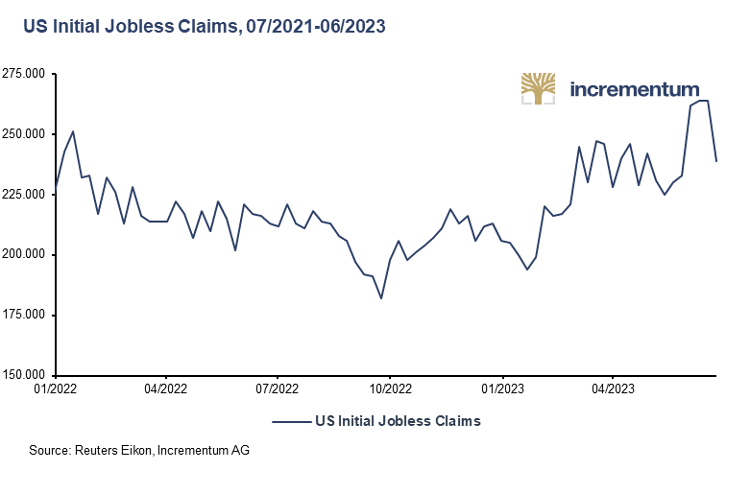

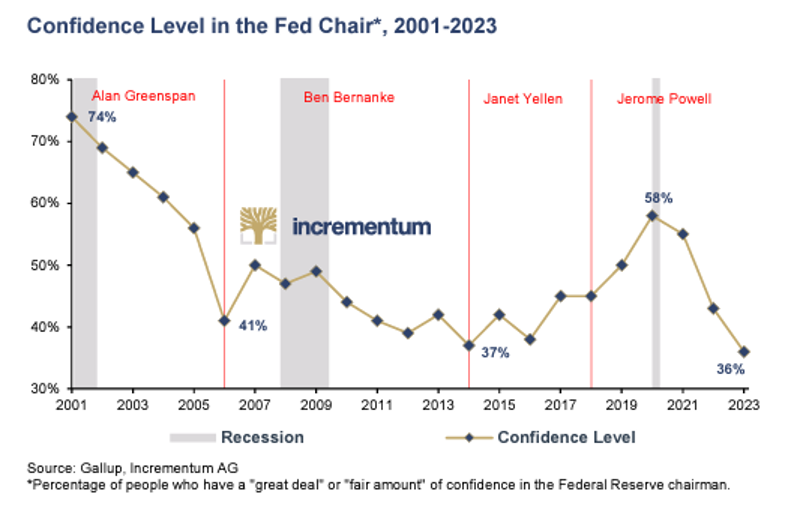

It is considered the most anticipated recession of all time – the one looming in the US. And although countless indicators ranging from the yield curve, the Leading Economic Index (LEI) and PMIs to producer prices and international trade volumes have been pointing to a recession for months, it has not yet materialized in the USA. However, the labor market, which has been more than robust up to now, is now showing the first signs of a slowdown. A labor market which, due to demographic change, is structured completely differently than it was in the 1970s. Initial jobless claims have been on an upward trend since last fall.

Despite this increasingly widespread gloom, it is not too late to ask the question: Which asset classes are now proving to be good investments in a recession, and which are bad? To this end, we have conducted an in-depth analysis.

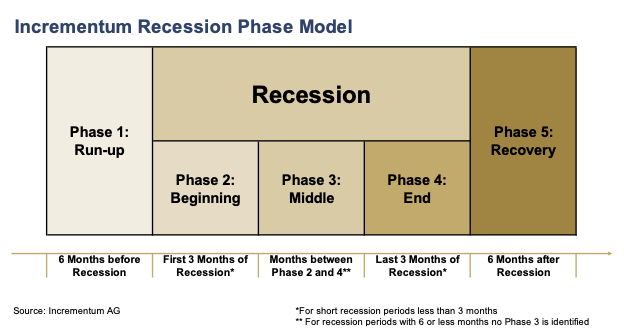

The following analysis does not consider the recession as a uniform block. The Incrementum Recession Phase Model (IRPM) divides a recession into a total of five distinct phases. Dividing a recession into different phases can help reduce the risk of losses and maximize gains. It helps investors develop a balanced investment strategy that takes into account the different phases of a recession. This is because, as will be seen, individual asset classes sometimes exhibit significant differences in performance across the five recession phases. After all, each of the five recession phases has unique characteristics.

- The run-up phase (phase 1) of a recession is characterized by burgeoning volatility on the financial markets. In this phase, the market increasingly starts to price in an impending recession.

- In phase 2, the so-called initial phase, there is a transition between increased uncertainty and the peak of the economic slowdown. In this phase, the slowdown in economic momentum can also be documented for the first time with negative macroeconomic data.

- In the middle phase (phase 3), the negative economic data manifest themselves. It also marks the low and turning point of the recession.

- In phase 4, the final phase, a stabilization of the economy gradually occurs, resulting in a return of optimism on the markets.

- In the fifth and final phase of the recession model, the recovery phase, the economy returns to positive growth figures.

In the case of a short recession, such as in the spring of 2020, there are phases that last less than 3 months, so phase 3 is irrelevant if the recession goes on only 6 months or less. For our model, we chose the NBER’s recession definition, which states that a recession has occurred when there is a significant decline in economic activity that spans the entire economy and lasts longer than a few months. The Federal Reserve also follows this definition.

We know that official recession declarations are always announced with some delay, be it according to the criteria of the National Bureau of Economic Research (NBER) or other alternative definitions such as the technical recession definition of two consecutive quarters of negative GDP growth. It often takes months for the final quarterly GDP numbers to be released. This poses a major challenge to investors, who should always be one step ahead of the actual development. Therefore, it is of great importance to recognize a recession at an early stage in order to position oneself as an investor in the best possible way.

What are the key messages of the Incrementum Recession Phase Model?

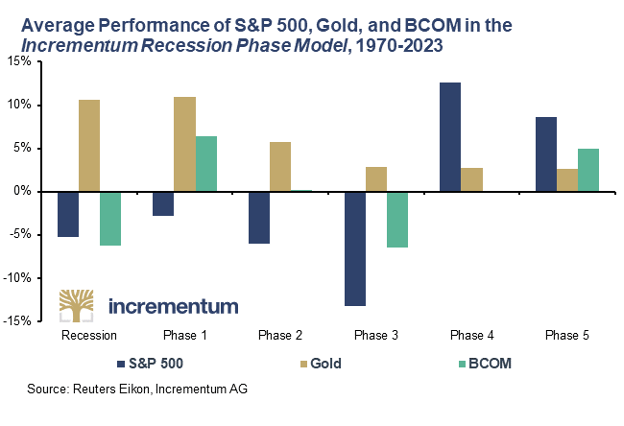

Let’s now look at the performance of the S&P 500 as well as gold and the BCOM index, which tracks commodities, during the last eight recessions since 1970 and broken down into the five recession phases.

Over the entire recession, equities lost an average of 5.3% in value. However, the 2007/2008 Global Financial Crisis is an exception that strongly influences the average. If we look at the median, we see a lower negative performance of -1.6% for equities during a recession.

In the various phases of a recession, equities exhibit significant differences in performance. Particularly in the third phase, the peak of the recession, stocks suffered heavy losses. However, once the last three months of the recession (phase 4) were reached, equities recovered exceptionally well in all eight cases considered. This positive trend even continued in the first months after the recession. Based on the recession phase model, it is therefore advisable to reduce the share of equities in the portfolio at an early stage. Once the peak of the recession has been reached, an increase in the equity share then makes it possible to benefit from the subsequent recovery rally.

Gold, the perfect recession hedge

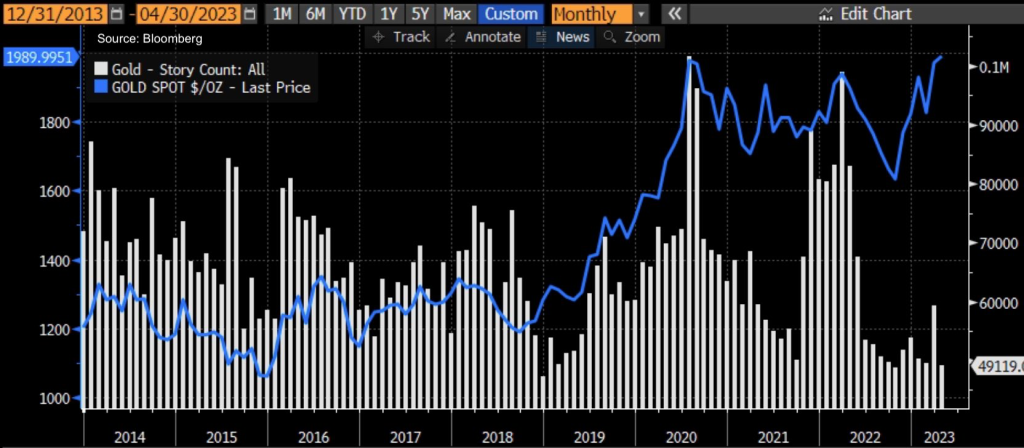

Unsurprisingly, gold has lived up to its reputation as a recession hedge, averaging an impressive 10.6% performance throughout the recession. Most notably, gold has averaged positive performance in all phases of the recession. Gold’s largest price increases are seen in Phases 1 and 2, likely due to the increased uncertainty in the markets during these phases. Another explanation for gold’s strong average performance in Phase 1 is the 120.1% price increase in the initial phase of the recession in 1980, which is an outlier.

In the first three phases of a recession, gold tends to be ahead of equities. It is interesting to note, however, that the tide turns as soon as the first signs of an economic recovery appear, and market uncertainty gradually subsides. In the terminal and recovery phases, equities can often outperform gold. Especially in the early stages of the model, gold manages to act as an ideal recession hedge. It provides excellent diversification, helping to stabilize portfolio performance in times of economic turbulence.

Let us now dive into the world of commodities. The average performance of the BCOM index during a recession since 1970 is -6.3%. This means that commodities perform worse overall than equities in our analysis.

If we look more closely, however, clear differences emerge in each phase of the recession. While commodities show gains in phase 1, the run-up phase, and phase 5, the recovery phase, no clear trend can be identified in phase 2, the initial phase, and phase 4, the final phase. The negative performance therefore mainly occurs in phase 3, the middle phase, when the economy reaches its low point.

Our analysis therefore shows that, from a portfolio perspective, an increased weighting of commodities in the run-up to and recovery phase of a recession is beneficial. This finding is also supported by theoretical considerations suggesting that precious metals, especially gold, are a suitable hedge against uncertainty before the peak of a recession. In addition, energy and base metal commodities prove to be particularly beneficial due to the reflationary effect associated with picking up growth after the peak of a recession.

Finally, we also want to take a look at silver and the mining stocks.

Silver is not a reliable recession hedge, with an average performance of -9.0% throughout the recession. This is probably because silver is perceived much more as a cyclically sensitive industrial metal than as a monetary metal in the midst of the downturn.

Mining stocks also showed a positive performance over the entire recession, but this was only about half as high as that of gold. The significant decline in phase 3, the low point in the recessionary trough, is a major contributor to this.

| Average Asset Performance – Incrementum Recession Phase Model | ||||||

| Asset | Recession* | Phase 1 | Phase 2 | Phase 3 | Phase 4 | Phase 5 |

| Gold | 10.6% | 10.9% | 5.7% | 2.9% | 2.7% | 2.6% |

| Silver | -9.0% | 31.5% | 0.8% | -10.9% | 3.5% | 17.4% |

| Stocks | -5.3% | -2.8% | -6.0% | -13.2% | 12.6% | 8.6% |

| Commodities | -6.3% | 6.4% | 0.2% | -6.5% | -0.2% | 5.0% |

| Mining Stocks | 5.4% | 8.9% | 8.5% | -11.7% | 8.3% | 24.3% |

Conclusion

Our analysis reveals how different assets perform during a recession. It becomes clear that there are significant differences in performance and investors need a strategic approach to succeed in each phase of the recession cycle. What stands out is the brilliant dominance of gold as the ultimate recession hedge, with an average performance of 10.6% and positive performance in every phase of a recession.

On the other hand, equities and commodities show negative performance on average during a recession, with equities performing best in phase 5 at 12.6% and commodities in phase 1 at 6.4%. However, mining stocks show that not all equities post losses during a recession. It is also striking that, with the exception of commodities, all assets are able to gain in phases 4 and 5.

In light of these findings, however, it is also clear that investors need to implement extreme caution and a well-thought-out strategy to successfully navigate the turbulent waters of a recession.

by Ronald-Peter Stöferle, Incrementum AG

AFTER SVB AND CREDIT SUISSE COLLAPSE, BAIL-INS NEXT

The time has now come for the 99.5% of financial assets which are not invested in gold, silver or precious metals mining stocks to grab both the investment and wealth preservation opportunity of a life time.

Making that decision before it is too late is likely to determine your financial and also general wellbeing for the rest of your life!

If you have already joined that exclusive group of 0.5% of global financial assets which are invested in precious metals, you understand what is coming.

But if you belong to the group that neither understands precious metals nor holds any, it might be worthwhile to continue reading.

More about this opportunity later in the article.

FROM A DEBT BASED WEST TO A COMMODITY BASED EAST AND SOUTH

As the Western Empire is breaking up currently, the Eastern & Southern Empire is gaining ever more significance. More than 30 countries want to join the BRICS and many also the SCO (Shanghai Cooperation Organisation). There is also the Eurasian Economic Union (EEU) which exists since 2014 and consists of several ex Soviet Union States.

The enlarged group will consist of more than 40 countries and represent around 2/3 of global population and 1/3 of global GDP. As I have written about in the article “A disorderly reset with gold revalued by multiples”, this is the area which will experience the fastest growth in coming decades as the West gradually declines/collapses under its own deficits and debt burden together with political and moral decay.

The Russian Foreign Minister Lavrov has just announced that Iran will join the SCO on July 4 and that Belarus will also become a full member. There is a virtual SCO meeting on July 4 chaired by India. It seems like more than a coincidence that the meeting takes place on the US Independence Day!

The BRICS meeting in Johannesburg takes place on Aug 22-24 with Macron trying to gatecrash. But he was rejected. Macron is devious and has always tried to ride several horses simultaneously.

But BRICS is not interested in opportunists happy to turn with the wind of success.

At some point, these three groupings might be merged into one, with gold playing a central role. I don’t expect that there will be one gold backed currency at a fixed parity but rather that gold will float at a much higher value than currently with a link to BRICS currencies.

So as the West and especially the US licks its mortal wounds the East is looking forward to the coming feast.

THE DOLLAR IS NO LONGER AS GOOD AS GOLD

There was a time when the US dollar was “As Good as Gold” and until 15 August 1971, sovereign nations could exchange dollars for gold at $35 per ounce.

But sadly most leaders whether of countries or corporations eventually resort to GREED when real money runs out. So this is what Nixon did in 1971 when he closed the gold window.

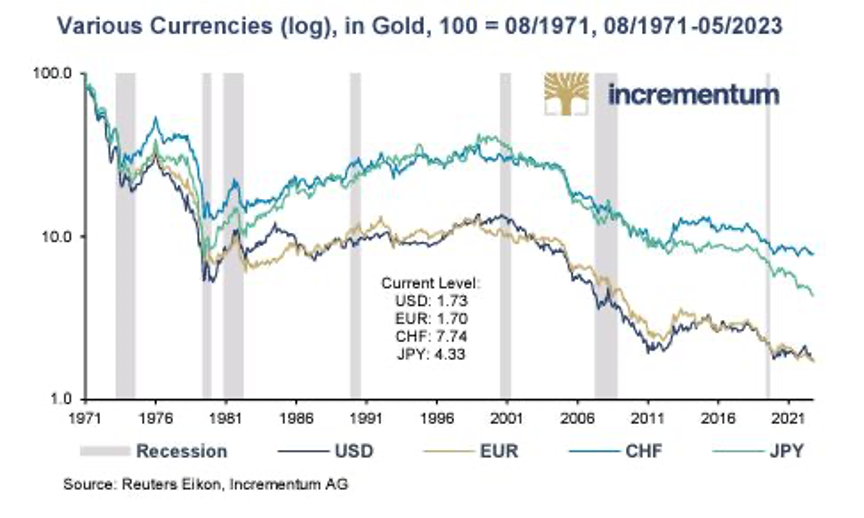

In spite of falling 98% in real terms since 1971, the dollar has remained both the preferred reserve currency and also the currency of choice for global trade.

The two principal reasons why the dollar hasn’t yet died is that virtually all other currencies have declined by similar percentages. Also the astute introduction of the Petrodollar in 1973-4, the brainchild of Nixon’s secretary of state Henry Kissinger, played an important role in convincing Saudi Arabia ( the dominant oil producer at the time) to sell oil in dollars against a package of US weapons and protection.

As the West now sinks in a quagmire of debt, corruption and decadence, the world will experience a tectonic shift away from fiat/fake money with zero intrinsic value to currencies backed by commodities with gold playing a central role.

WHERE HAVE ALL THE STATESMEN GONE

The West has not got one single statesman who can pull it out of the swamp. Many countries are now turning to the right like Italy with Meloni and Spain also probably swinging right in July with the Partido Popular and the far right Vox party. Macron is extremely unpopular and Le Pen now leads the opinion polls with 55%. Scholz in Germany has also failed badly and the Nationalist AfD is now ahead of the ruling social democrats in the polls.

The UK is currently the only major country that is likely to turn to the left at the next election in 2025. No one believes in the weak Sunak and Labour leader Kier Starmer is the clear favourite to win. But sadly he is not a statesman either.

So with a motley crew of weak leaders in Europe, things don’t look any better if we look west to the US. Sadly, the US hasn’t got a leader at all. It seems that Biden has got his strings pulled by an unelected and unaccountable team around him. This is an extremely vulnerable situation for what has been the mightiest country in the world. A major military power without a leader is very dangerous.

As President Eisenhower said in the 1950s:

“In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the military industrial complex. The potential for the disastrous rise of misplaced power exists and will persist. We must never let the weight of this combination endanger our liberties or democratic processes.”

As empires die, weak leaders are the norm and seem a necessary condition to exacerbate the inevitable collapse.

So we can all speculate about the outcome of the current crisis in the West and how it will all end. These situations seldom consist of individual events but are normally processes that take a number of years or even decades.

We must remember that we have already seen half a century of decline since 1971 so we are now likely to experience an acceleration of the process. As I have pointed out above, it is not just the decline of the West which is happening in front of our eyes, but also the emergence of an extremely powerful cooperation of 40 plus countries which will drive a global commodity based expansion on a scale never seen before in history.

Just take Russia. With $85 trillion of natural resource reserves, they will play a major role in this real physical asset expansion as long as the country holds together politically, which I would expect.

Remember that the massive global shift which is about to start is not based on personalities. Leaders are instruments of their time and the right leaders will emerge in most countries to bring about this tectonic shift.

DON’T TOUCH SOVEREIGN DEBT, EVEN WITH A BARGEPOLE

So how will ordinary investors in the West protect and enhance their assets in a world which is on the cusp of major shifts financially, economically and politically?

Well let’s first look at what not to do.

As I have stressed for many years, it is not a matter of maximising returns but minimising risk. After the biggest global asset bubble in history, the everything collapse will be vicious and take down many investments that have been regarded as safe as sovereign debt. See my article “First gradually and then suddenly – the Everything Collapse”.

Take US government bonds or treasuries. For years I have never understood how someone can invest in a “security” which is created by just snapping your fingers. This is how a senior Swedish Riksbank (central bank) official described to a journalist where money comes from. So whether we call it mouse-click money like my good colleague Matt Piepenburg or finger-snapping money, both expressions clearly tell us that we live in a hocus-pocus world where money is unlimited and can be created by snapping your fingers.

Oh yes, we mustn’t forget the additional $2+ quadrillion of quasi debt or liabilities in the form of derivatives. I have argued many times that a big part of these derivatives are likely to become debt as central banks create liquidity to save the financial system from a an implosion of these financial instruments of mass destruction as Warren Buffett calls them.

I have long argued that holding Western sovereign debt is financial suicide. Lately some big names agree with me whether it is Jamie Dimon of JP Morgan- “Don’t touch US bonds”- or Ray Dalio the very successful hedge fund investor – “It would take 500 years to get the money back”. Yes, but what money I wonder??

Firstly, whether it is the Fed or the ECB, their balance sheets are insolvent and no one can ever get real money back. At best it would be another worthless debt/money instrument like CBDC (Central Bank Digital Currency) that would lose 99-100% over 1 to 50 years. Not the best of odds to say the least.

The US 10 year treasury bond peaked in 1981 at just below 16% after a 39 year downtrend it bottomed in 2020 at 0.55%. That was the bottom of the interest and inflation cycle. We will now see higher inflation and rates for decades. But it obviously won’t be a move without major corrections and volatility.

As major central banks are pressing for higher rates, one wonders if they are aware of the consequences. Because in a debt infested world, higher rates mean a high risk of default, both private and sovereign.

But in their normal style, central banks will be behind the curve and realise their misdemeanours once the system has collapsed.

NB: The only buyer of US treasuries will be the Fed as the rest of the world runs away from the US poisonous debt chalice. It’s like passing the parcel when you can only pass it to yourself.

OPPORTUNITIES OF A LIFETIME COMING

So buying anything commodity based will be a clear growth area for decades. In this group is not just commodity businesses but companies that supply the commodity companies with software or hardware.

In addition to the precious metals market whether physical or stocks, we see the potentially most interesting areas being oil and uranium.

We have been in the physical precious metals market for almost 25 years for wealth preservation purposes. During that time gold has gone up 6-12 times in most Western currencies and silver slightly less.

As the premier company for bigger wealth preservation investors in physical gold and silver, outside the financial system, we have had a very exciting journey so far.

But looking at the last 23 years I am very clear that in spite of greater returns in physical gold than most investment classes and much lower risk, the real moves haven’t even started yet.

I have never seen a more obvious situation during my soon 60 years in investment markets.

Although some of the precious metals mining stocks will vastly outperform physical gold and silver, we will stick to what we know best in order to serve our esteemed clients as well as future wealth preservation investors.

In coming years, most investors will lose a major part of their investments and net worth as they hold on to their conventional investments.

For a quarter of a century I have been standing on a soap box, imploring investors to protect their wealth. During that time we have seen The Nasdaq lose 80% in the early 2000s and the financial system being a few minutes from implosion in 2008.

But with the help of finger-snapping $10s of trillions into existence, most markets have remained strong. Still, the (almost) Everything Collapse is hanging over us and this time finger-snapping money into existence is unlikely to help.

WHEN SHOULD YOU NOT HOLD GOLD?

You should not hold gold when:

- There are no deficits and there is a balanced budget

- There is negligible or no inflation

- There is no debasement of currencies

- There is strong statesmanship based on real longterm values

When that day comes, we will also see flying elephants as well as flying central bankers with wings!

But just like Icarus, the son of Daedalus in the Greek mythology, these bankers will crash!

Anyone who has held a major part of his wealth in physical gold, in any country, in this century has achieved an excellent return and still has his gold asset intact. He has also been able to sleep well at night.

Although picking the right precious metals stocks can lead to an opportunity of a lifetime, we will still recommend that investors keep the majority of their funds in physical gold and silver, stored in the right jurisdiction and in the safest vaults with direct access to your metals.

That way investors avoid many risks like:

- Custodial risk, your shares held in a fragile financial system

- Political risk, mines are often in risky countries),

- Fraud, corruption, Doug Casey can tell you about this. Read his book Speculator

- Financial risk, many companies will run out of cash

Still I would advise even the cautious investor to hold some gold and silver stocks or a fund or an index, since the upside is substantial.

NO MAJOR GOLD DISCOVERY FOR YEARS

There has not been a major gold discovery for 4 years.

Major gold discoveries over 1 million ounces:

1990s – 180

2000s – 120

2010 to 2018 – 40

2019 to date – 0

Not only do we have peak oil but also peak gold. So the world is facing a vicious a cycle of increasing energy costs leading to higher costs of extracting precious metals and other commodities.

This confirms that high inflation is here to stay, leading to higher interest rates and very high risk of debt defaults within the private and sovereign sectors.

To hold US dollars is to hand your wealth to the state which is likely to either debase it, lose it, spend it, confiscate it or misappropriate it in any other way.

Why would anyone trust a government like the US which currently is doing all of the above things.

And don’t believe that the Euro will fare better.

The only way to be in control of your own money is to hold it in physical gold outside your country of residence in private vaults.

The trust in the US and the dollar is now coming to an end after the confiscation of all Russian assets. Who would want to hold their assets under the control of a government what can just steal it at will.

So we are not facing a dollar crisis. Instead, the dollar and its issuer is the crisis. No one who is worried about preserving his wealth would ever consider holding it in a crisis currency, controlled by a crisis government.

I find it fascinating that the JP Morgan who has become a joint custodian of the GLD gold ETF is planning to move the gold to Switzerland. This confirms my strong view that Switzerland will further strengthen its position as a major gold hub. Currently 70% of all the gold bars in the world are refined in Switzerland which also have more major private gold vaults than any other country.

Also, as I discussed in a recent article, no central bank will want to hold its reserves in US dollars with to a capricious US government that can steal it at will. The only money that could mantle the role as a reserve asset as the dollar fades away is obviously gold.

TOO LATE TO JUMP ON THE GOLD WAGON?

Nobody should believe that it is too late to jump on the Gold Wagon. It has hardly started yet.

Even if the percentage invested in physical precious metals and precious metals stocks, goes from 0.5% to only 1.5%, there will not be enough metals or stocks available to satisfy a fraction of that increase at current prices for the metals.

So the only way that the increased money flows into metals can be satisfied is through vastly higher prices.

AND AS I HAVE OUTLINED IN THIS ARTICLE, THE SCENE IS NO SET FOR SUCH A MAJOR REVALUATION OF GOLD AND SILVER AND THE WHOLE PRECIOUS METALS SECTOR

AFTER SVB AND CREDIT SUISSE COLLAPSE, BAIL-INS NEXT

We have hardly been the first nor the last to realize that rising rates “break things.”

We’ve all seen the disastrous credit events in the repo crisis of late 2019, the UST debacle in March of 2020, the gilt implosion of October 2022 and, of course, the banking crisis of March, 2023.

And behind, beneath, above and below each of these debacles lies a bemused central banker.

There’s More “Breaking” to Come

But there’s far more “breaking” to come.

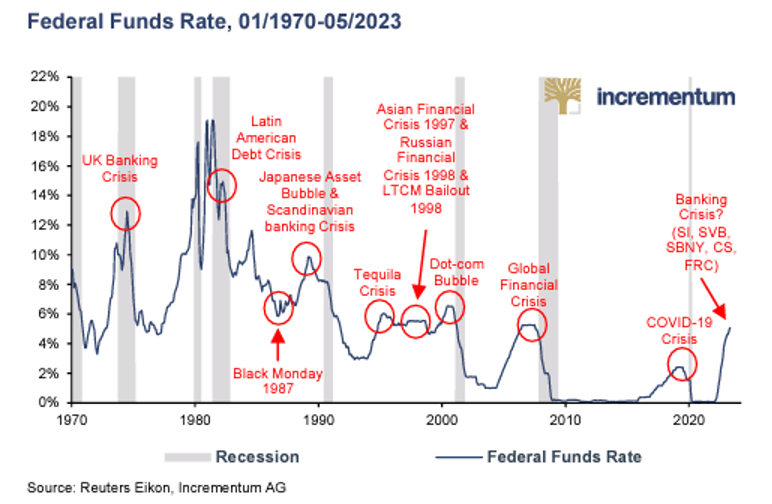

As for recessions, the data is equally (and objectively) abundant that those rising rates (red circles below) tend to correlate directly with recessions, both soft and hard (grey lines below).

Powell can re-define recessions with words, but despite his double speak, he too knows that a recession is already under, or at the very least, directly off, the American bow.

Powell’s Un-Spoken “Plan”?

It has always been my contention that the rate hikes of late have been a public ruse to allegedly “defeat inflation,” when in fact inflation and negative real rates were always part of the unofficial plan to help inflate away portions of Uncle Sam’s openly embarrassing bar tab.

More importantly, Powell’s deeper motive (in my opinion) for the rate hikes of 2022 was done in order to give the Fed something to cut once the mammoth recession they’ve publicly denied becomes, well: mathematically undeniable.

The Past as Prologue

As in 2018, when Powell forward-guided rate hikes simultaneously with QT (Fed balance sheet reduction via UST dumping), the end result was disastrous (remember December 2018 and the days of 10% daily market swings).

This disaster was soon followed by an inevitable/foreseeable rate “pause” and then more QE.

The current pattern is fairly similar.

Although a QT policy of letting the Fed’s reserve of bonds “mature” rather than be dumped into the open market slightly differentiates 2022’s rate hikes from 2018, the end-game of raising rates into an even greater debt bubble will end with even more pain, volatility (and ultimately, QE) than seen in the 2018-2019 debacle/policy.

This pattern is easy to see because the Realpolitik of the bond market is easy to see.

The Bond Market is the Thing

In the most simplistic terms, Uncle Sam survives off debt, which means he survives off of IOUs (i.e., USTs).

If no one buys those IOUs, Uncle Sam falls off his bar stool into a puddle of his own tears as USTs fall further in price and hence yields and rates rise further in interest-expense pain.

And as 2022 reminds, that weaponized USD led to Uncle Sam’s worst fears coming foreseeably true as the world dumped USTs at the same time central banks made historically unprecedented purchases of gold.

The Next Moves Are Fairly Easy to See…

Needless to say, this bond-dumping scares the “H-E- double-toothpicks” out of Uncle Sam and his cadre of corporatist, number-crunching technocrats at the Treasury Dept and FOMC, as even they know what we all know: Someone or some thing has to buy Uncle Sam’s IOUs or it’s game over.

And who do you think that buyer will be?

All together now: “The Federal Reserve.”

And where will the money needed to buy those unloved USTs ultimately come from?

All together now: “An inflationary mouse-clicker at the Eccles Building.”

Pain, then Pleasure for Stocks, But No Way Out for the Dollar